Overview

Navigating the mortgage refinancing process can feel overwhelming, but we’re here to support you every step of the way. This article focuses on how to effectively use a refi mortgage calculator, ensuring you can make informed decisions that lead to significant financial benefits.

- First, gather the necessary loan information. Understanding your current mortgage details is crucial.

- Next, input your data into the calculator; this step is vital for analyzing potential savings.

- As you explore your options, remember that informed decision-making can lead to lower monthly payments and reduced overall interest costs.

We know how challenging this can be, but taking these steps can empower you. By utilizing the calculator, you can visualize your financial future and make choices that align with your goals. Embrace this opportunity to enhance your financial well-being.

Introduction

Navigating the world of mortgage refinancing can feel overwhelming for homeowners. We understand how challenging it can be to make sense of complex financial decisions. That’s where a refi mortgage calculator comes in—a powerful tool designed to simplify the process. This calculator can reveal opportunities for lower interest rates, reduced monthly payments, and improved loan terms.

As you explore these options, critical questions may arise:

- How can you ensure that the potential savings outweigh the costs?

- What factors should you consider to maximize your benefits?

This article will guide you through the essential steps and considerations for mastering the refi mortgage calculator. Our goal is to empower you to make informed financial choices that align with your long-term goals.

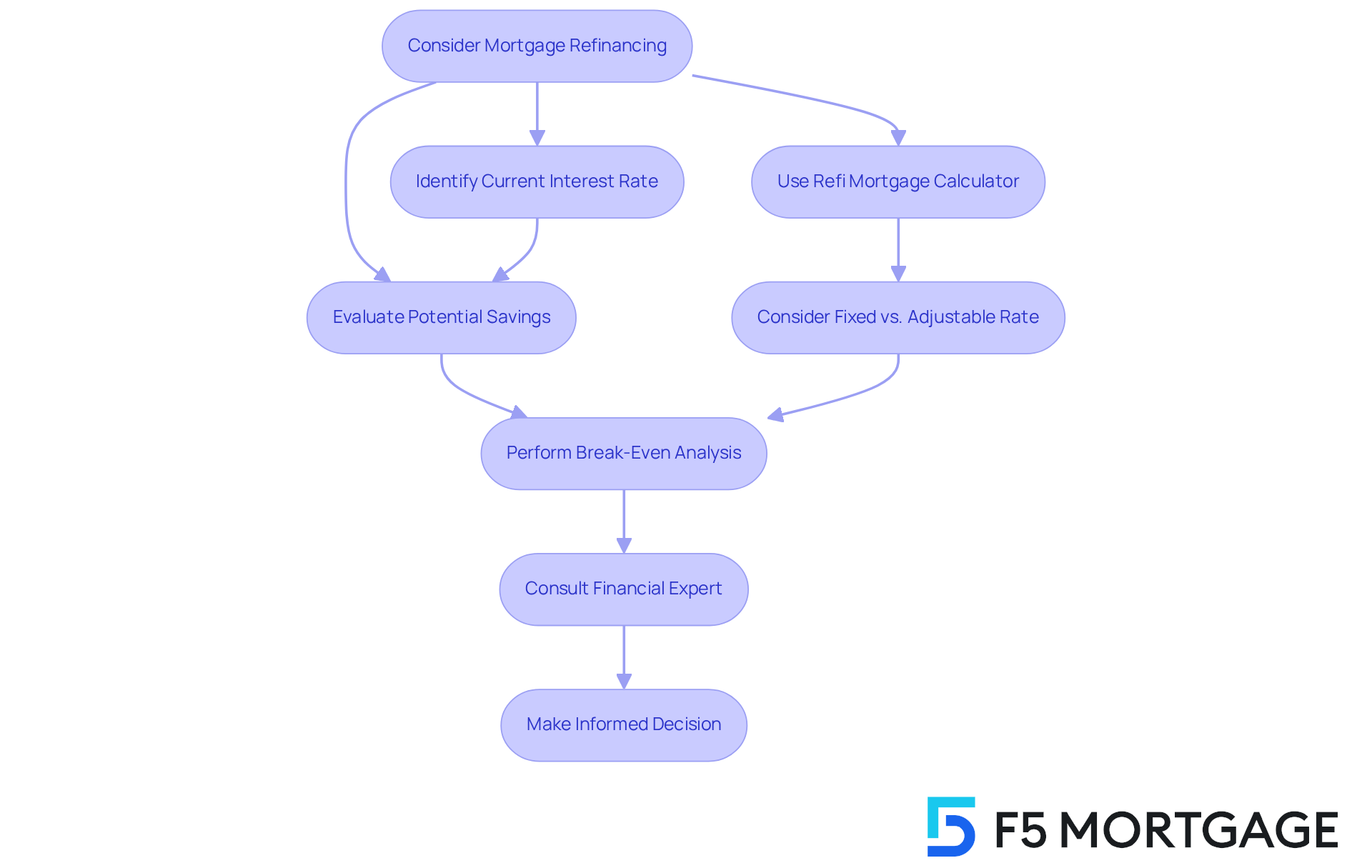

Understand Mortgage Refinancing Basics

Home loan restructuring can be a valuable option for many homeowners facing financial challenges. By utilizing a refi mortgage calculator to substitute your existing loan with a new one, you may secure a lower cost of borrowing, reduce monthly payments, or even adjust the loan duration to better fit your needs. This process can lead to significant advantages, such as , access to cash through home equity, and the opportunity to use a refi mortgage calculator to switch from an adjustable-rate loan to a more stable fixed-rate option.

In 2025, this could be especially beneficial for homeowners with existing rates above 7%. By utilizing a refi mortgage calculator and switching to rates under 6%, you may discover substantial savings. For instance, refinancing into a 15-year loan can save you thousands in interest while allowing you to build equity more quickly.

We understand that navigating these options can feel overwhelming. That’s why specialists emphasize the importance of performing a break-even analysis. This analysis compares the actual expenses of restructuring your loan with the potential savings, helping you determine how long it will take for the monthly savings to exceed the closing costs associated with the new loan. If you plan to stay in your home for more than a year and your current interest rate is at least 0.5% above current figures, utilizing a refi mortgage calculator and consulting with a financial expert about restructuring your loan could be a wise decision.

Real-world examples show the tangible benefits of refinancing: homeowners who took action when rates peaked at 7% or higher have successfully transitioned to lower rates, resulting in reduced monthly payments and overall interest costs. As the loan landscape continues to evolve, understanding these fundamentals will empower you to make informed choices about refinancing, enhancing your financial situation. Remember, we’re here to support you every step of the way.

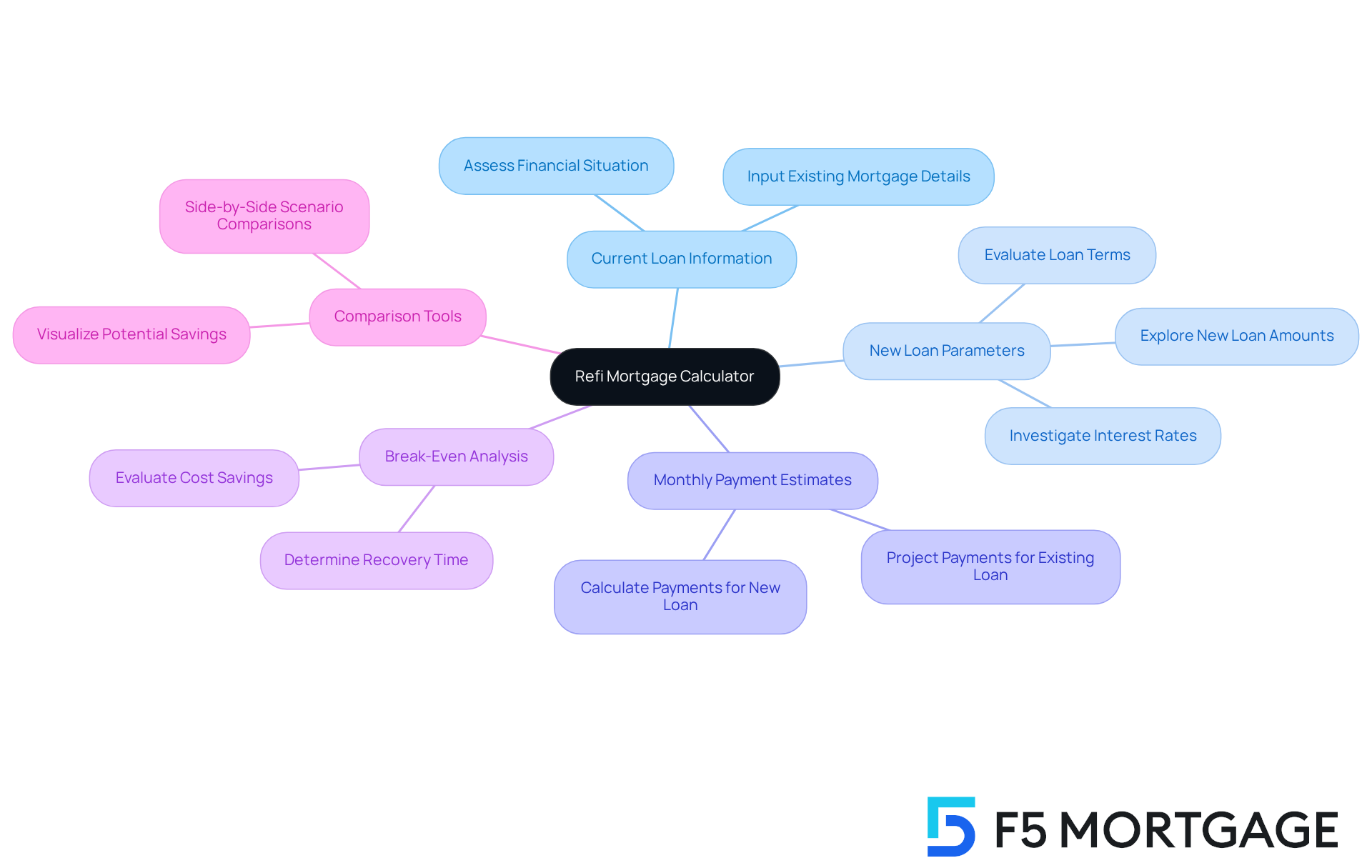

Explore Features of a Refi Mortgage Calculator

A refi mortgage calculator is a valuable ally for homeowners looking to enhance their loan terms. We understand how overwhelming this process can be, and these calculators are designed to simplify it for you. Key features typically include:

- Current Loan Information: You can input your existing mortgage details, such as balance, interest rate, and remaining term, giving you a clear picture of your current financial situation.

- New Loan Parameters: The calculator allows you to explore potential new loan amounts, interest rates, and terms, enabling you to investigate various options for loan modification.

- Monthly Payment Estimates: It computes projected monthly payments for both your existing and new loans, helping you understand the financial implications of making changes.

- Break-Even Analysis: This feature shows how long it will take to recover costs through savings, helping you make informed decisions. With typical , grasping this analysis is crucial for evaluating the financial benefits of mortgage modification.

- Comparison Tools: Many calculators provide side-by-side comparisons of multiple scenarios, allowing you to visualize potential savings and select the best option.

In 2025, these calculators have become increasingly sophisticated, featuring user-friendly interfaces and advanced algorithms to deliver accurate estimates. Experts highlight the importance of using tools such as the refi mortgage calculator, as they empower homeowners to make strategic financial choices. For instance, a recent study revealed that homeowners utilizing a refinance calculator could save an average of $90 each month and $1,077 annually after restructuring their loans, underscoring the tangible benefits of informed decision-making.

Real-life stories demonstrate the effectiveness of these calculators. One homeowner, after entering their existing loan information and exploring restructuring options, discovered that switching to a lower interest rate could save them thousands over the life of their loan. This practical application emphasizes the crucial role refinance loan calculators play in navigating the complexities of financing. Additionally, refinancing with F5 Mortgage provides dedicated support throughout the process, ensuring that you are never alone on your refinancing journey. Remember, consulting a tax or financial advisor for specific information regarding laws and your unique financial situation is always a wise step to ensure the best outcomes.

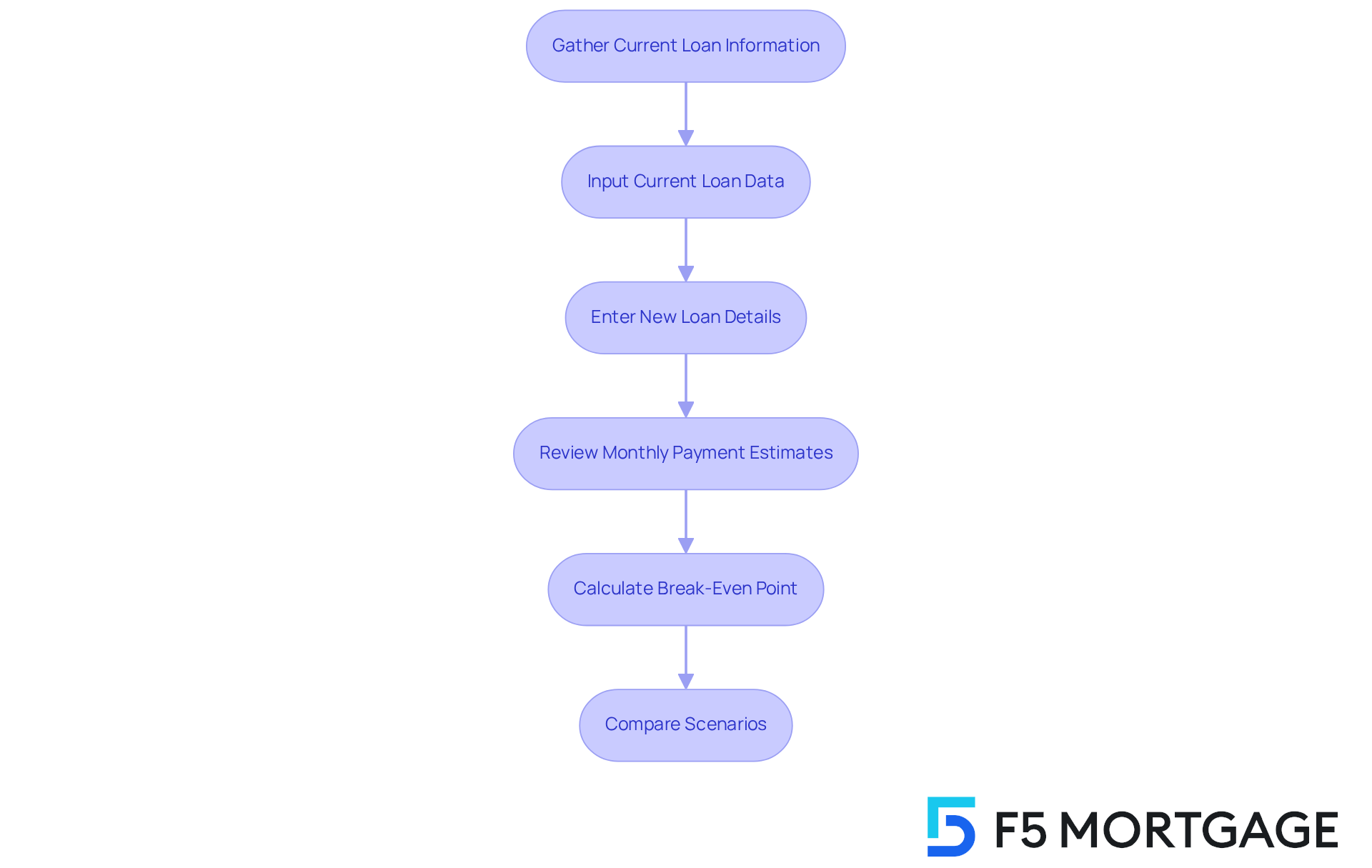

Follow Steps to Use the Refi Mortgage Calculator

To effectively utilize a refinance mortgage calculator, we know how important it is to follow these steps with care:

- Gather Current Loan Information: Start by collecting essential details about your existing loan, such as the balance, financing cost, and remaining term. This foundational data is crucial for accurate calculations.

- Input Current Loan Data: Enter your current mortgage information into the calculator. This will serve as a baseline for , helping you see where you stand.

- Enter New Loan Details: Input the details of the new loan you are considering, including potential amounts, interest rates, and terms. This enables you to examine different loan restructuring scenarios that could better fit your needs.

- Review Monthly Payment Estimates: Analyze the estimated monthly payments for both your current mortgage and the potential new loans. This comparison will assist you in grasping the financial consequences of restructuring your loan, giving you a clearer picture of what to expect.

- Calculate Break-Even Point: Use the calculator to determine how long it will take to recover any costs associated with restructuring, such as appraisal and closing fees. Knowing the break-even point is essential for making informed decisions. For instance, if your loan restructuring costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This knowledge can empower you to move forward confidently.

- Compare Scenarios: If the calculator provides comparison features, use them to assess various loan options side by side. This can reveal the most advantageous choice based on your financial goals, ensuring you make the best decision for your family.

Experts stress that precisely collecting loan information is essential to prevent common errors when utilizing calculators. For instance, failing to consider all expenses related to the loan restructuring can result in misleading estimates. By adhering to these steps and using the refi mortgage calculator, homeowners can make more educated choices regarding loan modification and possibly save considerably on their mortgage payments. Remember, we’re here to support you every step of the way as you navigate this process.

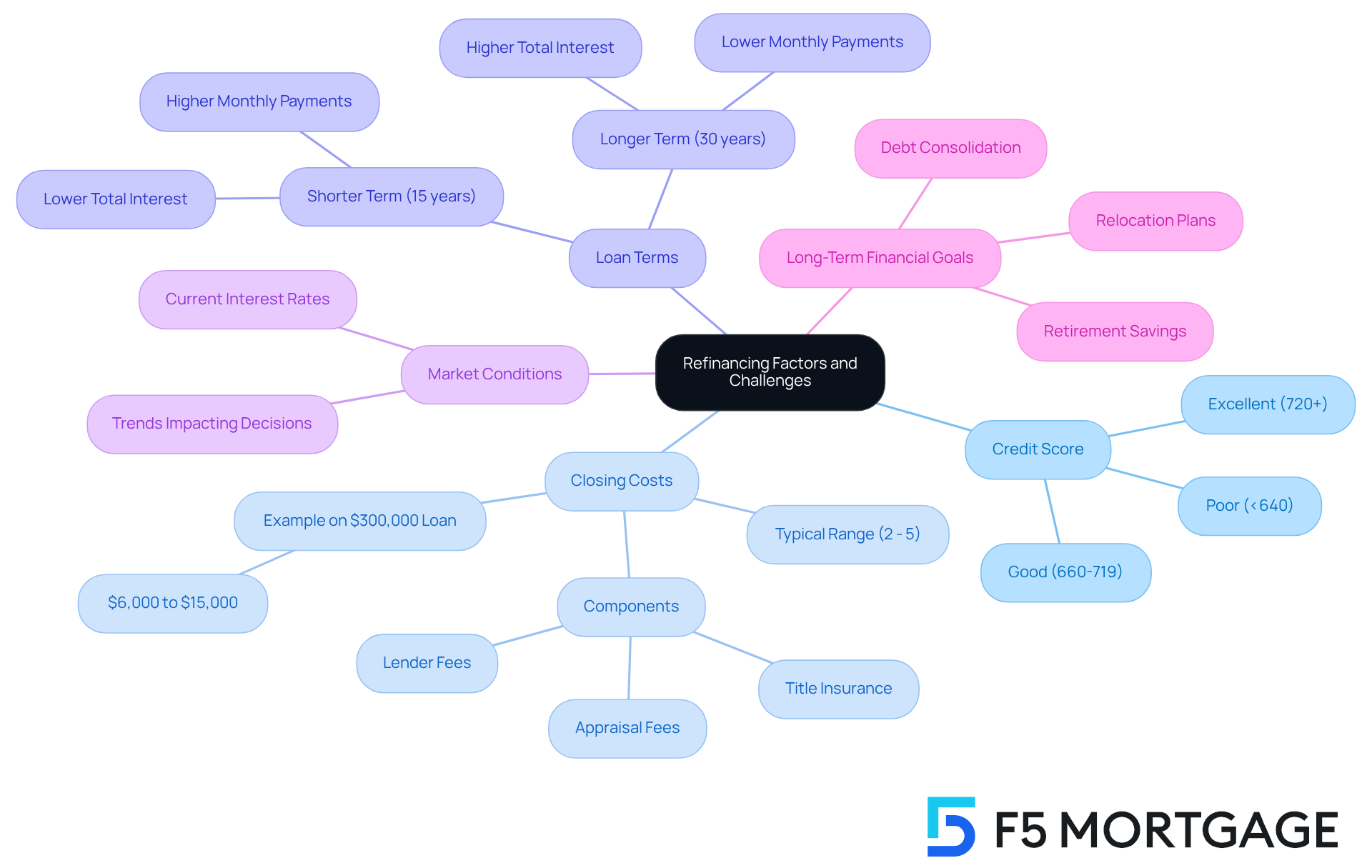

Consider Key Factors and Challenges in Refinancing

When considering refinancing, we know how challenging it can be to navigate the process using a . It’s crucial to keep the following factors and challenges in mind:

- Credit Score: A higher credit score can significantly influence the interest rates available to you. For instance, borrowers with excellent credit (720 and above) typically secure the best rates, while those with scores below 640 may face significantly higher rates. Checking your credit score before applying is essential to ensure you qualify for favorable terms.

- Closing Costs: Understanding the fees associated with refinancing is vital. Closing costs generally range from 2% to 5% of the loan amount, which can translate to thousands of dollars. For example, on a $300,000 loan, closing expenses could range from $6,000 to $15,000. These costs can include lender fees, title insurance, and appraisal fees—often overlooked but can add up quickly.

- Loan Terms: Evaluate whether a shorter loan term aligns with your financial goals. Although a 15-year mortgage might involve greater monthly payments, it can save you thousands in costs over the duration of the loan. Conversely, lengthening the term can reduce monthly payments but raise the overall cost paid.

- Market Conditions: Staying updated on current interest levels and market trends is crucial, as these elements can greatly influence your decision to restructure your loan. For example, if your existing mortgage rate exceeds 7.5%, obtaining a new loan may be advantageous, particularly if you can achieve a lower rate.

- Long-Term Financial Goals: Consider how restructuring your loan aligns with your long-term financial objectives, such as paying off debt or saving for retirement. If you intend to relocate within five years, adjusting your mortgage might not be beneficial due to the time required to recover initial expenses. As financial advisor Greg McBride notes, if you can reduce your mortgage rate by half to three-quarters of a percentage point, it may be worth exploring refinancing options.

By carefully assessing these factors, homeowners can utilize a refi mortgage calculator to make informed decisions that align with their financial aspirations. Remember, we’re here to support you every step of the way.

Conclusion

Using a refinance mortgage calculator can truly enhance the financial well-being of homeowners looking to restructure their loans. This helpful tool simplifies the refinancing process and empowers individuals to make informed decisions, potentially leading to lower monthly payments and significant savings over time. By understanding the complexities of mortgage refinancing and leveraging these calculators, homeowners can navigate their financial landscape with confidence.

We understand how overwhelming this process can be, which is why we’ve outlined essential steps for effectively using a refinance mortgage calculator. From gathering current loan information to evaluating potential new loan scenarios, each step is designed to guide you. Key insights include:

- The importance of conducting a break-even analysis

- Recognizing the impact of credit scores and closing costs

- Considering your unique financial goals and market conditions

Each of these factors plays a crucial role in determining whether refinancing is a viable and beneficial option for you.

Ultimately, approaching the journey of refinancing requires careful consideration and strategic planning. We encourage homeowners to take advantage of the tools available, consult with financial professionals, and remain proactive in managing their mortgage options. By doing so, you can unlock the potential for significant savings and align your mortgage choices with your long-term financial aspirations. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing involves restructuring an existing home loan by replacing it with a new one, often to secure better borrowing terms such as lower interest rates, reduced monthly payments, or altered loan durations.

How can refinancing benefit homeowners?

Refinancing can lead to significant advantages, including potential savings on loan payments, access to cash through home equity, and the ability to switch from an adjustable-rate loan to a more stable fixed-rate option.

When might refinancing be particularly beneficial?

Refinancing may be especially beneficial in 2025 for homeowners with existing rates above 7%, as they could potentially save money by switching to rates under 6%.

What is a refi mortgage calculator?

A refi mortgage calculator is a tool that helps homeowners evaluate the financial implications of refinancing by estimating potential savings and costs associated with a new loan.

What is a break-even analysis in refinancing?

A break-even analysis compares the costs of restructuring a loan with the potential savings to determine how long it will take for monthly savings to surpass the closing costs of the new loan.

When should a homeowner consider refinancing?

Homeowners should consider refinancing if they plan to stay in their home for more than a year and their current interest rate is at least 0.5% higher than current market rates.

What real-world benefits have homeowners experienced from refinancing?

Homeowners who refinanced when rates peaked at 7% or higher have successfully transitioned to lower rates, resulting in reduced monthly payments and overall interest costs.

How can homeowners get support during the refinancing process?

Homeowners can seek assistance from financial experts who can guide them through the refinancing process and help them make informed decisions.