Overview

When considering how expensive a home you can afford, it’s important to first assess your financial situation. We know how challenging this can be, so let’s break it down into manageable steps.

Start by calculating your debt-to-income ratio; this is a crucial factor in understanding your financial health. Aim to maintain a debt-to-income ratio below 36%, which can help you feel more secure in your decisions.

Next, establish a realistic home budget. This means budgeting housing costs to around 28% of your income. By doing this, you can ensure that your monthly expenses remain manageable.

Finally, explore various mortgage options that align with your financial capabilities and long-term plans. Selecting the right mortgage type is essential for your peace of mind.

These four key steps are designed to empower you on your journey toward homeownership. Remember, we’re here to support you every step of the way as you navigate this important decision.

Introduction

Determining how much home you can afford is a pivotal step in the journey toward homeownership. We know how challenging this can be, often feeling like navigating a maze of financial intricacies. By understanding your personal finances, calculating debt-to-income ratios, and establishing a realistic budget, you can unveil the opportunities available to you in the housing market.

However, with fluctuating mortgage options and varying lender requirements, you may wonder: how can you ensure that your decisions align with your financial capabilities? It’s essential to approach this process with care and insight. We’re here to support you every step of the way, helping you avoid potential pitfalls while empowering you to make informed choices.

Understand Your Financial Situation

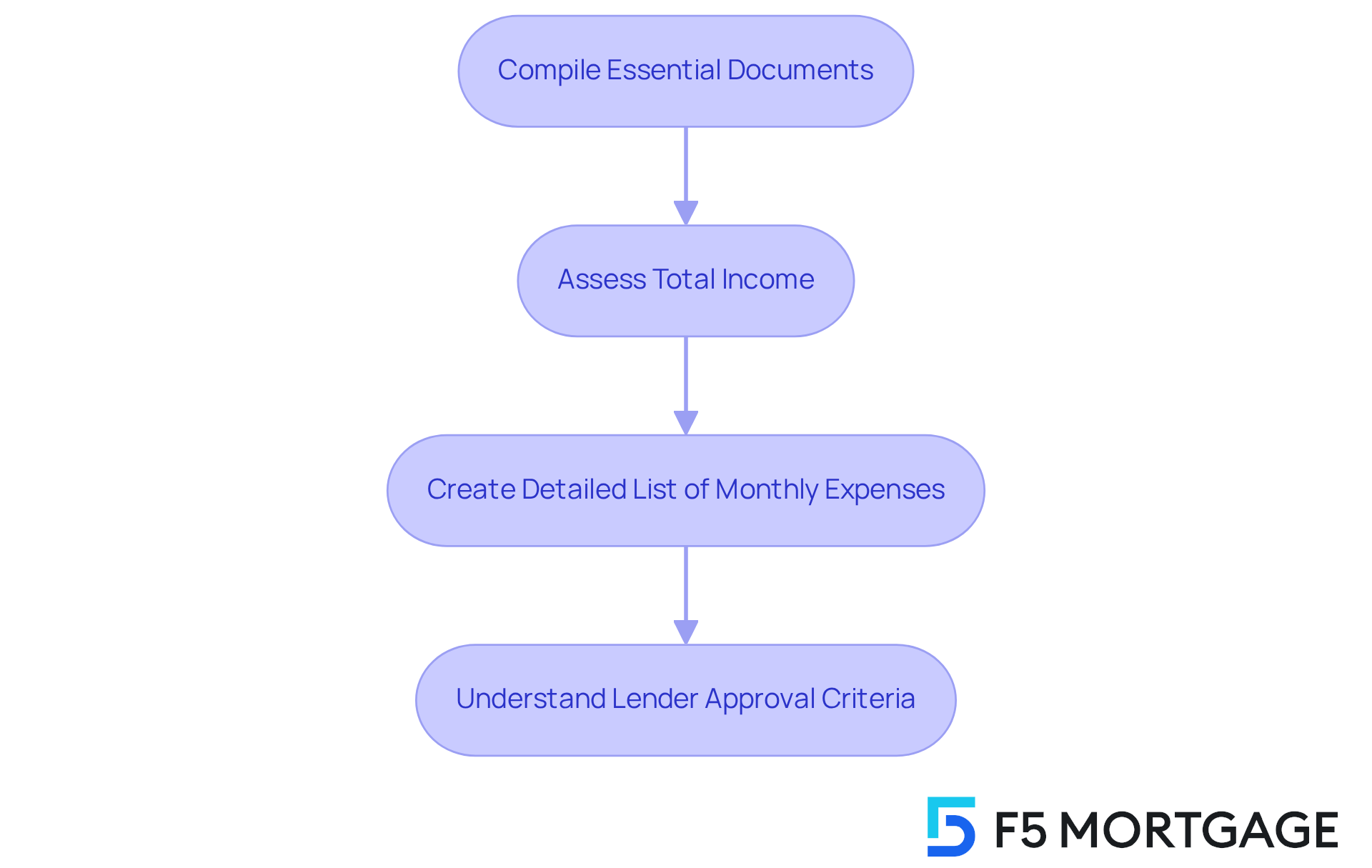

We understand how challenging it can be to navigate the mortgage process. Start by compiling essential monetary documents, such as pay stubs, bank statements, and tax returns. These documents are crucial for lenders to confirm your earnings and evaluate your financial stability. Take a moment to assess your total income for the month by examining your bank accounts and billing statements. Don’t forget to include any bonuses or extra income sources to obtain a clear understanding of your earnings.

Next, create a detailed list of your monthly expenses. This should encompass debts like credit cards, student loans, and car payments. Having this thorough overview will illuminate your economic landscape, helping you determine how expensive of a home you can afford. Investment consultants stress the significance of collecting these documents early in the loan process. By doing so, you not only enable smoother applications but also gain insight into how expensive of a home you can afford and the opportunities available in the housing market.

It’s also important to understand that an approval is a lender’s decision based on your financial information. This indicates that you are a good candidate for a mortgage. Consider your savings for emergencies and down payments. A good rule of thumb is to have three months of earnings saved. We’re here to as you prepare for this significant journey.

Calculate Your Debt-to-Income Ratio

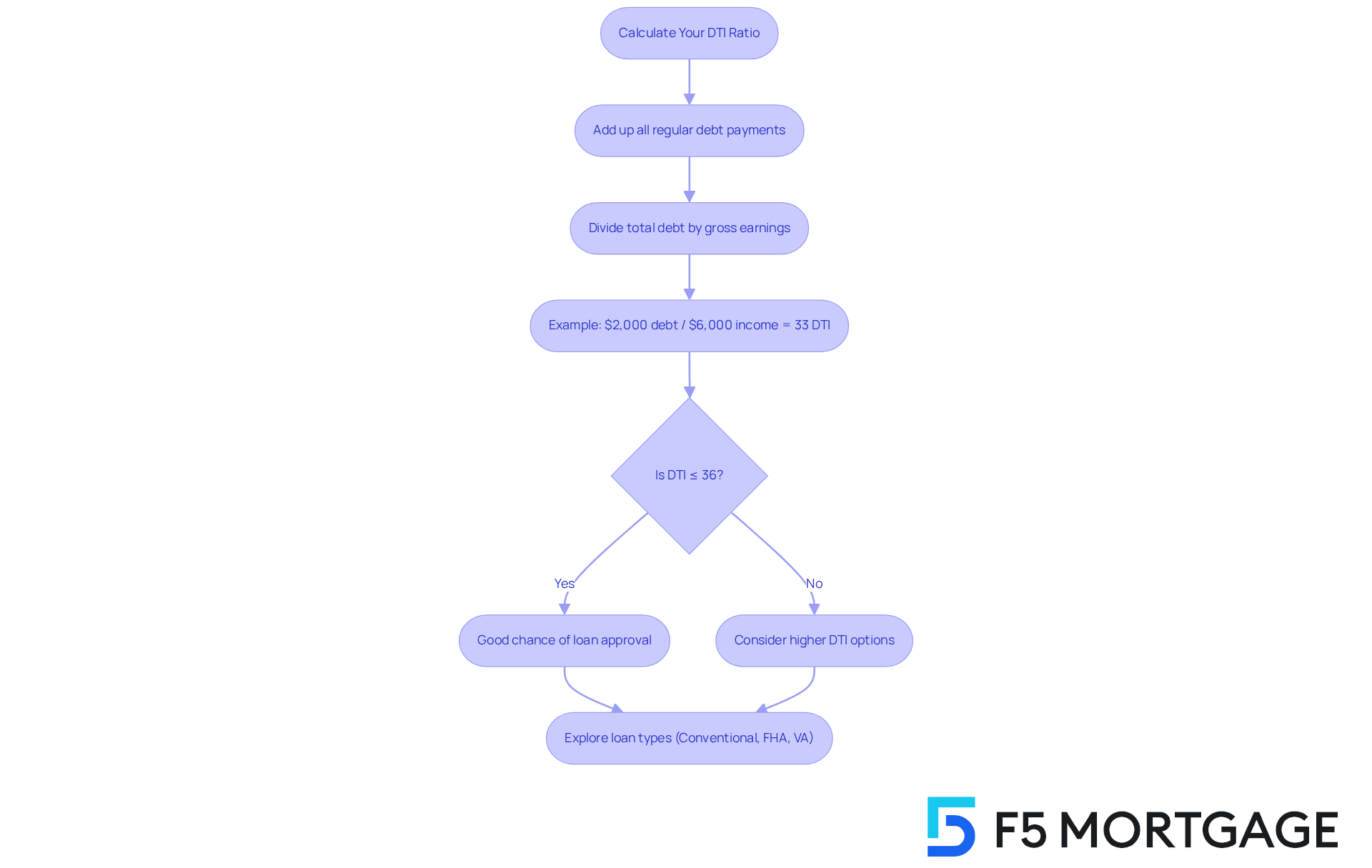

Understanding your debt-to-income (DTI) ratio is crucial, especially when navigating the mortgage process. To calculate your DTI, simply add up all your regular debt payments and divide that total by your gross earnings. For example, if your total monthly debts are $2,000 and your gross monthly income is $6,000, your DTI ratio would be 33% (2000/6000). We know how challenging this can be, and it’s important to recognize that . This threshold suggests a stronger financial profile, which can significantly enhance your chances of loan approval.

However, some lenders may be more flexible, accepting higher DTI ratios, especially for FHA or VA loans. In certain situations, these loans can allow DTI ratios to reach up to 50%. An improved DTI can lead to more competitive loan rates, making it essential to understand your DTI when figuring out how expensive of a home you can afford.

In Colorado, a maximum DTI ratio of 43% is typically required for home loans. This makes it vital to carefully evaluate your financial situation. We’re here to support you every step of the way. F5 Mortgage can assist you in exploring refinancing options, including:

- Conventional loans

- FHA loans

- VA loans

These options may offer more favorable DTI requirements. Together, we can help you secure competitive financing rates tailored to your unique needs.

Establish a Realistic Home Budget

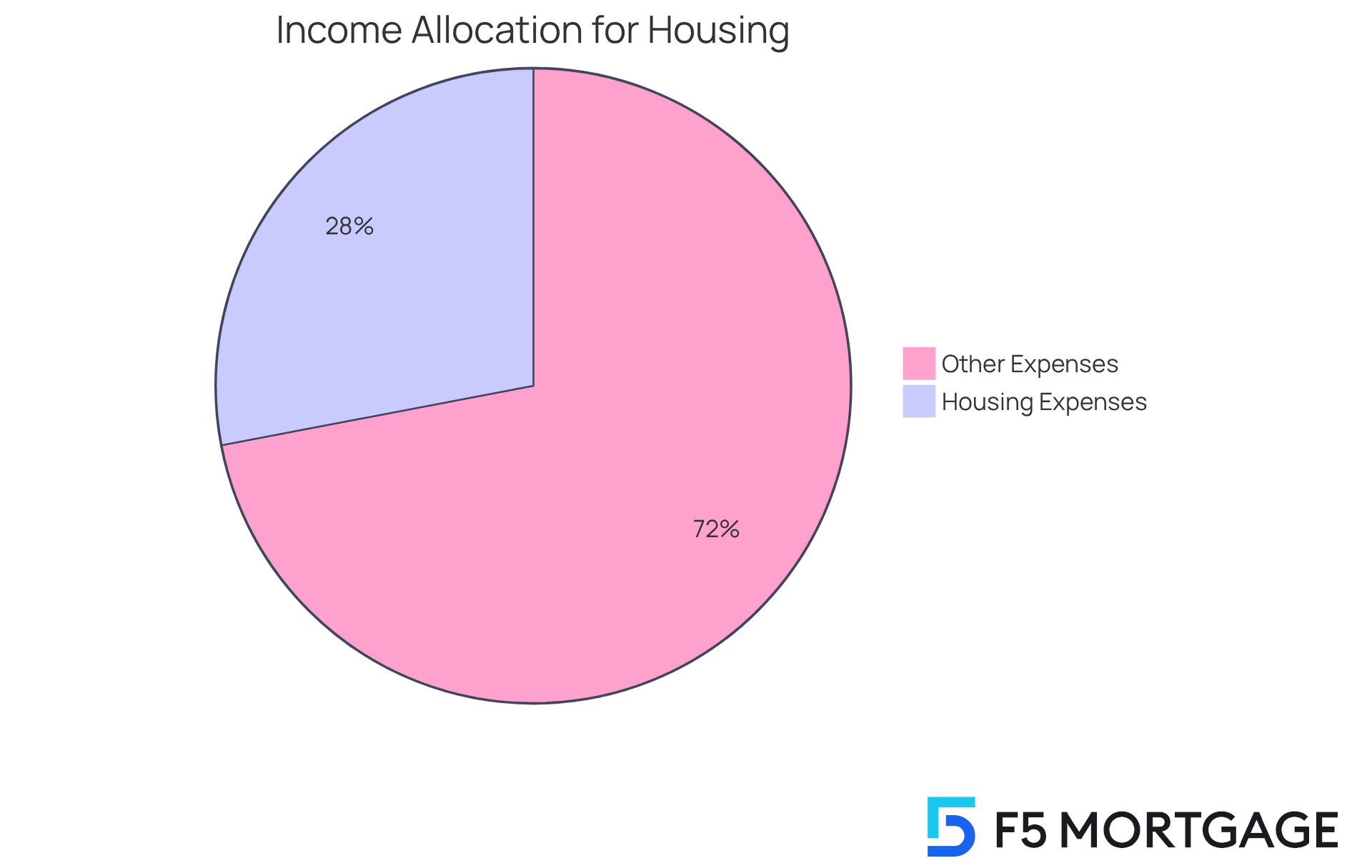

Begin by assessing how much you can comfortably set aside for your housing payment each month to determine how expensive of a home you can afford. We understand how overwhelming this can feel, so a commonly suggested guideline to determine how expensive of a home you can afford is to of your total monthly earnings. This percentage encompasses not just your loan principal and interest, but also property taxes, homeowners insurance, and maintenance costs. For example, if your monthly earnings are $6,000, aim for a mortgage payment that does not exceed $1,680, which represents 28% of your income. By adopting this budgeting strategy, you can alleviate financial pressure and ensure you manage your new home expenses effectively.

Families who successfully control their housing expenses within this 28% threshold often highlight the importance of budgeting and financial education, leading to significant savings. Experts agree that maintaining housing costs at or below this level fosters a more sustainable economic future, especially in light of rising living expenses. By following these guidelines, you can craft a realistic budget that aligns with your homeownership aspirations and answers the question of how expensive of a home you can afford while protecting your financial well-being. Remember, we’re here to support you every step of the way.

Explore Mortgage Options and Terms

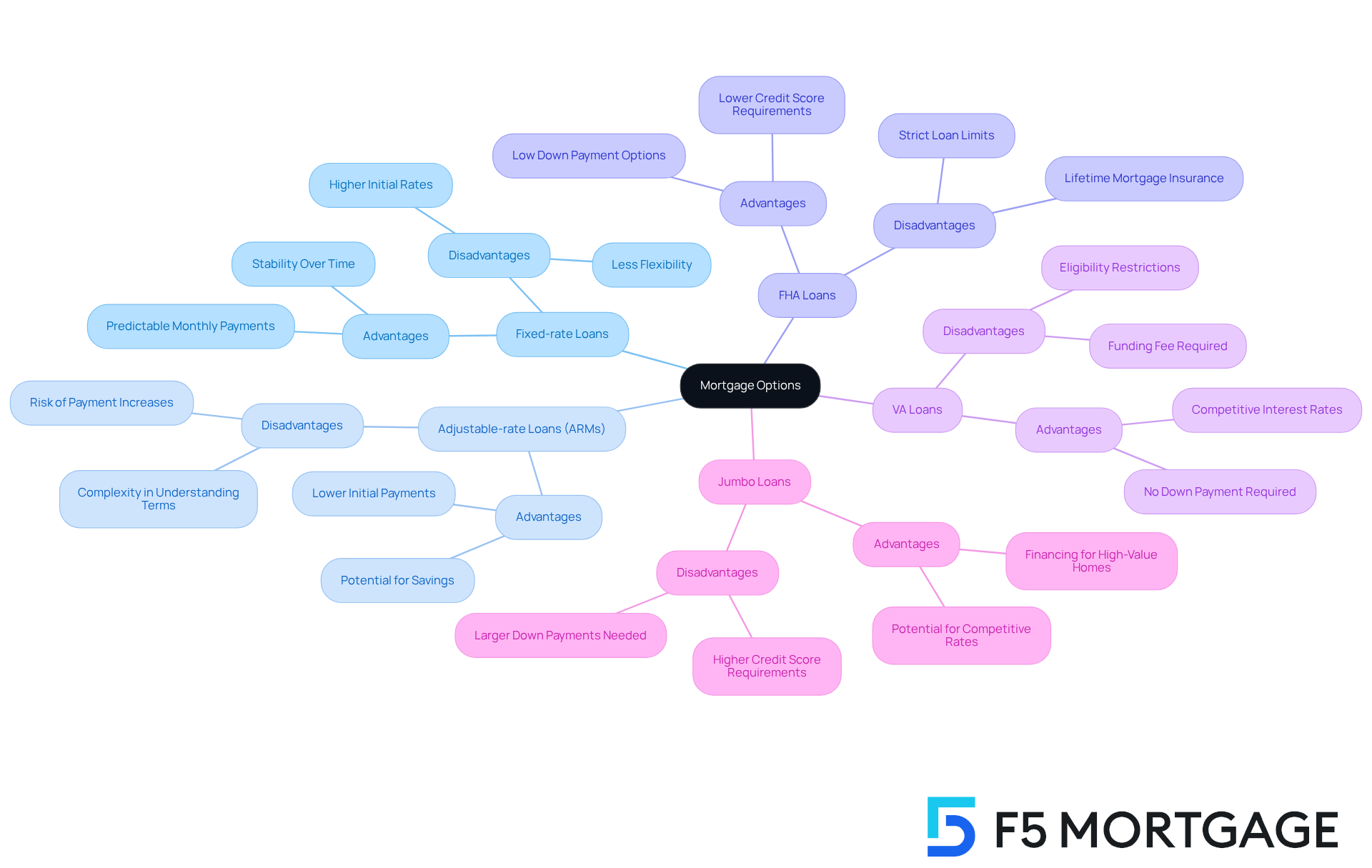

When contemplating a home loan, we know how challenging this can be. It’s essential to explore various types, including:

Each type has distinct advantages and disadvantages. Fixed-rate home loans are perfect for individuals intending to reside in their houses for an extended period. They provide that stay steady during the loan duration. Approximately 92% of U.S. households with loans choose fixed rates, reflecting a strong preference for this stability, especially among lower-income families who value predictability and the option to refinance if rates decline.

On the other hand, adjustable-rate loans (ARMs) can be attractive for families planning to relocate within a few years. ARMs typically start with lower initial payments, which can be advantageous for those looking to maximize their budget in the short term. However, it’s crucial to consider the potential for rate adjustments that could lead to higher payments later on. In fact, the median initial borrowing amount for ARMs is $207,913, compared to $167,323 for fixed-rate loans, indicating that ARMs are often associated with larger loans.

We’re here to support you every step of the way. Consulting with a loan advisor can provide valuable insights into these options, helping you navigate the complexities of financing. Brokers can assist in comparing rates and terms from various lenders, ensuring you find the best match for your monetary circumstances. As you evaluate your choices, think about how expensive of a home you can afford, as well as your long-term plans and financial capabilities, since these factors will significantly influence the most suitable mortgage type for your needs.

Conclusion

Determining how expensive of a home one can afford is a multifaceted process that requires a deep understanding of personal finances. We know how challenging this can be, but by assessing your financial situation, calculating debt-to-income ratios, establishing realistic budgets, and exploring various mortgage options, you can make informed decisions that align with your long-term financial goals.

It’s important to compile financial documents to gain a clear picture of your income and expenses. Maintaining a debt-to-income ratio that meets lender expectations is essential. Establishing a budget that keeps housing costs below 28% of your total income is crucial for ensuring financial stability. Additionally, understanding the different types of mortgage options available can help you choose the best fit for your individual circumstances.

Ultimately, embarking on the journey to homeownership requires careful planning and informed decision-making. Taking the time to evaluate your finances and explore available resources can pave the way for a successful and sustainable home purchase. Engaging with financial advisors and mortgage professionals can further enhance this process, ensuring that every step you take leads toward a secure and fulfilling homeownership experience. We’re here to support you every step of the way.

Frequently Asked Questions

What documents should I compile to understand my financial situation before applying for a mortgage?

You should compile essential monetary documents such as pay stubs, bank statements, and tax returns. These documents are crucial for lenders to confirm your earnings and evaluate your financial stability.

How can I assess my total income for the month?

You can assess your total income by examining your bank accounts and billing statements. Be sure to include any bonuses or extra income sources for a clear understanding of your earnings.

What should I include in my list of monthly expenses?

Your list of monthly expenses should encompass debts such as credit cards, student loans, and car payments. This thorough overview will help you determine how expensive of a home you can afford.

Why is it important to collect financial documents early in the loan process?

Collecting financial documents early in the loan process enables smoother applications and provides insight into how expensive of a home you can afford and the opportunities available in the housing market.

What does mortgage approval indicate?

Mortgage approval is a lender’s decision based on your financial information, indicating that you are a good candidate for a mortgage.

How much should I save for emergencies and down payments?

A good rule of thumb is to have three months of earnings saved for emergencies and down payments.

How can I get support during the mortgage application process?

You can receive support throughout the mortgage application process from professionals who can guide you as you prepare for this significant journey.