Overview

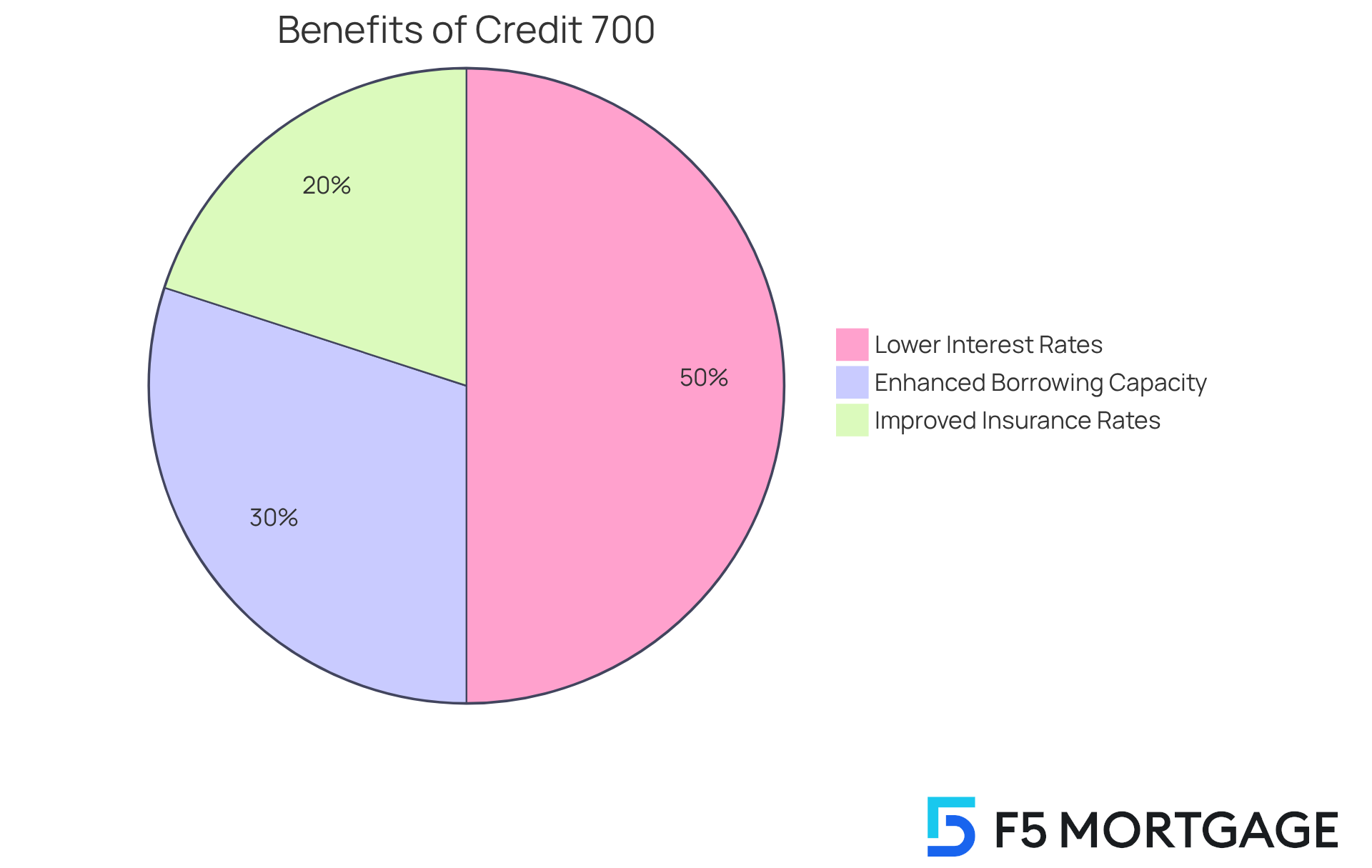

Achieving and maintaining a credit score of 700 is essential for families seeking favorable financial opportunities. We know how challenging this can be, but a good credit score signifies trustworthiness to lenders. This can lead to lower interest rates, enhanced borrowing capacity, and improved insurance premiums.

To help you on this journey, we outline practical steps that can make a difference:

- Timely bill payments are crucial, as they show lenders you are responsible.

- Maintaining low credit utilization is another key factor.

- Utilizing credit monitoring tools can empower you to stay informed about your credit status.

By following these steps, you can improve your financial health and sustain your credit score over time. Remember, we’re here to support you every step of the way.

Introduction

Achieving a credit score of 700 is often seen as a significant financial milestone, unlocking a world of opportunities for families. This includes lower interest rates on loans and better insurance premiums. This desirable rating not only reflects trustworthiness in the eyes of lenders but also opens the door to substantial savings and improved financial stability.

However, we know how challenging this journey can be. Many families wonder: what practical steps can they take to navigate the complexities of credit management? It’s essential to ensure that their financial future remains bright. Together, we can explore effective strategies that empower families to take control of their credit and thrive.

Understand the 700 Credit Score: Definition and Importance

A rating of credit 700 is typically regarded as ‘good’ on the FICO scale, which spans from 300 to 850. This rating suggests that you are a trustworthy borrower, qualifying you for advantageous loan conditions and interest rates. Achieving a credit 700 can create pathways to numerous financial prospects, such as improved mortgage rates, reduced insurance costs, and simpler approval for charge cards. We know how challenging it can be to navigate these financial waters, so understanding the elements that influence this score—such as payment history, utilization of resources, and duration of borrowing history—is vital for households seeking to and obtain improved mortgage choices.

Key Benefits of a 700 Credit Score

- Lower Interest Rates: Lenders often offer lower rates to borrowers with higher credit scores, which can save families thousands over the life of a loan. For instance, borrowers with a rating between 700 and 759 may see rates around 6.948%, while those with ratings below 640 can face rates significantly higher than 7.769%. By comparing rates, costs, and terms from various lenders, households can ensure they are getting the best deal possible. F5 Mortgage is known for offering competitive rates and personalized service, making the process easier.

- Enhanced Borrowing Capacity: A favorable financial rating can raise the sum you qualify to borrow, simplifying the process of buying a home or refinancing a current mortgage. This heightened borrowing ability can be especially advantageous for households aiming to improve their living conditions. For self-employed borrowers, understanding options like bank statement loans, where income is calculated based on business cash flow, can further enhance borrowing potential.

- Improved Insurance Rates: Numerous insurance providers utilize financial ratings to establish premiums, so a higher rating can result in reduced expenses. This can free up additional funds for families to allocate towards savings or other expenses.

Furthermore, it is crucial to acknowledge the difficulties related to reduced borrowing ratings. For instance, individuals with reduced ratings may encounter greater security deposits when leasing or may be obligated to provide advance payments for utilities. By recognizing the significance of attaining and sustaining a credit 700 rating, households can make knowledgeable financial choices and strive diligently towards this objective. This effort ultimately improves their mortgage alternatives and overall financial well-being.

As Peter Warden, a mortgage and finance expert, notes, “Comparison shopping for your mortgage can make a huge difference.” This highlights the necessity for households to actively participate in enhancing their financial ratings to achieve the most favorable economic results. Remember, we’re here to support you every step of the way.

Implement Strategies to Improve Your Credit Score

Enhancing your financial rating requires a thoughtful approach. We understand how overwhelming this process can seem, but there are effective strategies that families can implement to improve their financial health.

- Pay Your Bills on Time

Timely payments are the most significant factor affecting your credit score, making up about 35% of the . As Lee mentions, ‘The single most crucial element in the FICO calculation is whether you make your dues on time.’ Setting up automatic payments or reminders can help ensure you never miss a due date. Remember, every late payment can lead to a substantial reduction in your score, and we know how important it is to maintain a positive financial standing. - Reduce Credit Card Balances

Aim to keep your credit utilization ratio below 30%. For instance, if you have a limit of $10,000, your total card balances should not exceed $3,000. Experts recommend maintaining this ratio between 10% and 30% for optimal scoring. Reducing outstanding debt can significantly enhance your rating, as managing utilization is crucial for a healthy financial profile. Effective management of borrowing utilization involves reducing existing balances and using multiple cards to avoid maxing out any single account. - Avoid Opening New Credit Accounts

Each time you apply for credit, a hard inquiry is made on your report, which can temporarily lower your score. We encourage you to limit new applications to when they are essential, as this helps preserve your financial health. It’s important to be tactical about when to request new financing since the seriousness of inquiries can influence your rating. - Diversify Your Credit Mix

Having a mix of credit types—such as credit cards, auto loans, and installment loans—can positively impact your score. However, only take on new financial obligations if you can manage them responsibly. A varied loan portfolio showcases your capability to handle different kinds of debt, which can improve your financial reliability. - Regularly Check Your Credit Report

Obtain free copies of your credit report from the three major bureaus (Experian, TransUnion, and Equifax) and review them for errors. Challenging inaccuracies is essential, as they can adversely impact your results. Regularly monitoring your credit report allows you to stay informed about your financial status and take corrective measures when needed.

By adopting these strategies, families can take proactive steps toward enhancing their financial ratings and achieving the desired credit 700 benchmark. Successful case studies show that consistent on-time payments and efficient financial management can lead to substantial improvements in ratings over time. We’re here to support you every step of the way.

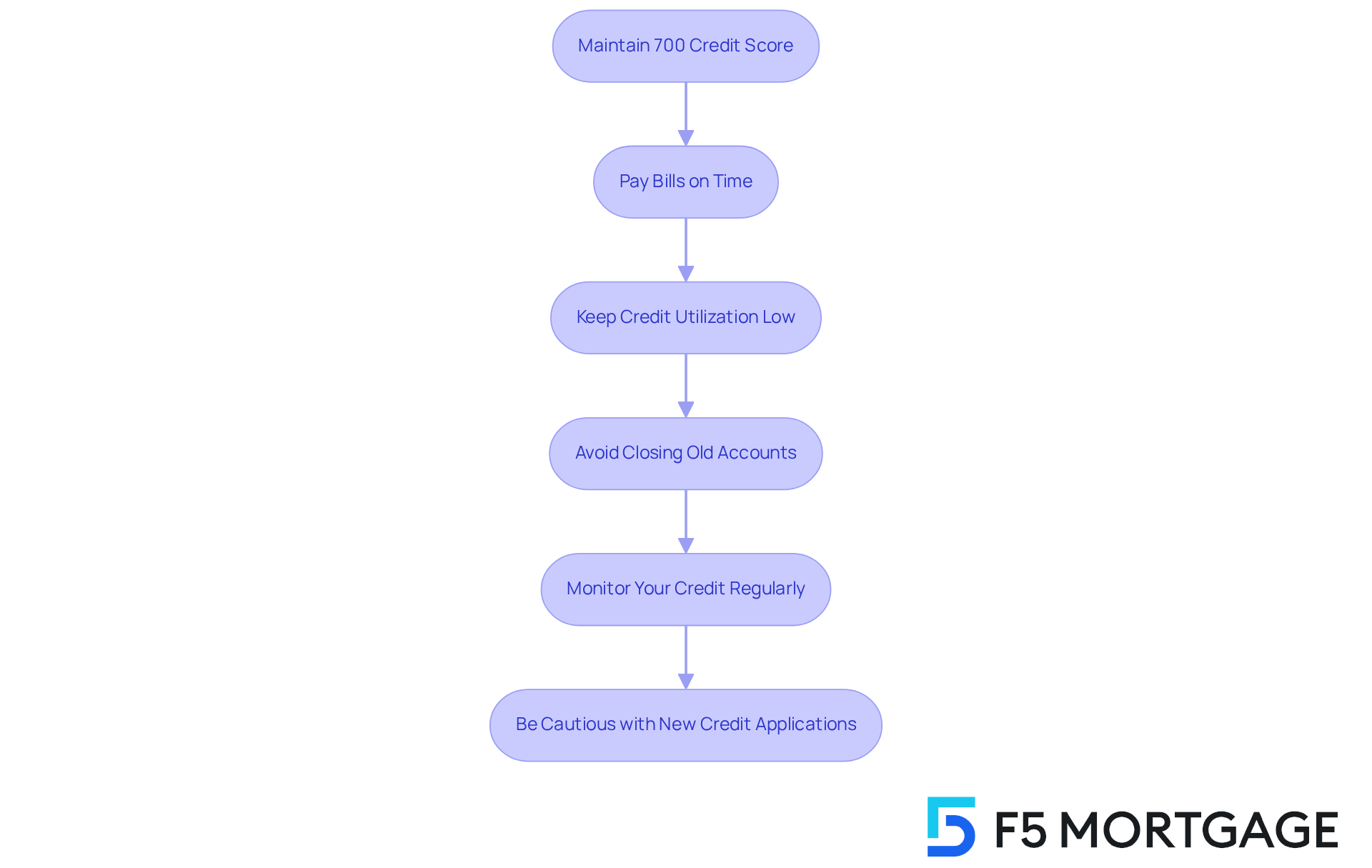

Maintain Your 700 Credit Score: Best Practices for Longevity

Sustaining a requires continuous dedication and wise financial practices. We understand how challenging this can be, but following essential practices can help ensure your score remains high:

- Continue Paying Bills on Time

Establish a routine of paying all bills by their due dates. Setting up automatic transfers for regular costs can assist in avoiding late fees, which can greatly affect your rating. Remember, according to the FICO scoring model, payment history constitutes 35 percent of your score, making timely payments essential. - Keep Credit Utilization Low

Regularly monitor your credit utilization ratio, aiming to keep it below 30%—ideally under 10% for optimal scoring. For example, if you possess $10,000 in accessible funds, your overall card balances should not surpass $3,000. Families who maintain low utilization ratios often experience improved ratings and access to advantageous loan conditions. As Nicole Dieker wisely suggests, “Maintain your utilization ratio low by using less than 30 percent of your available funds.” - Avoid Closing Old Accounts

The length of your credit history plays a crucial role in your score. Maintaining older accounts, even if they are not actively utilized, helps preserve a longer average financial history, which lenders prefer. Closing old accounts can reduce your financial history and adversely impact your rating. Nicole Dieker recommends, “Don’t close old accounts; instead, use your old cards as evidence of a lengthy and responsible financial history.” - Monitor Your Credit Regularly

Utilize credit monitoring services to keep track of your score and receive alerts for any changes. Regular checks can help you identify potential issues early, allowing for timely corrections. - Be Cautious with New Credit Applications

Limit new credit applications to necessary instances. Each application leads to a hard inquiry, which can temporarily reduce your rating. Spacing out applications by three to six months can help mitigate this impact. A study by Experian discovered that users with a utilization rate below 30% were more likely to have higher ratings.

By following these best practices, families can maintain their credit 700 rating and continue to enjoy the financial advantages associated with good standing, such as lower interest rates and improved loan options. Remember, we’re here to support you every step of the way.

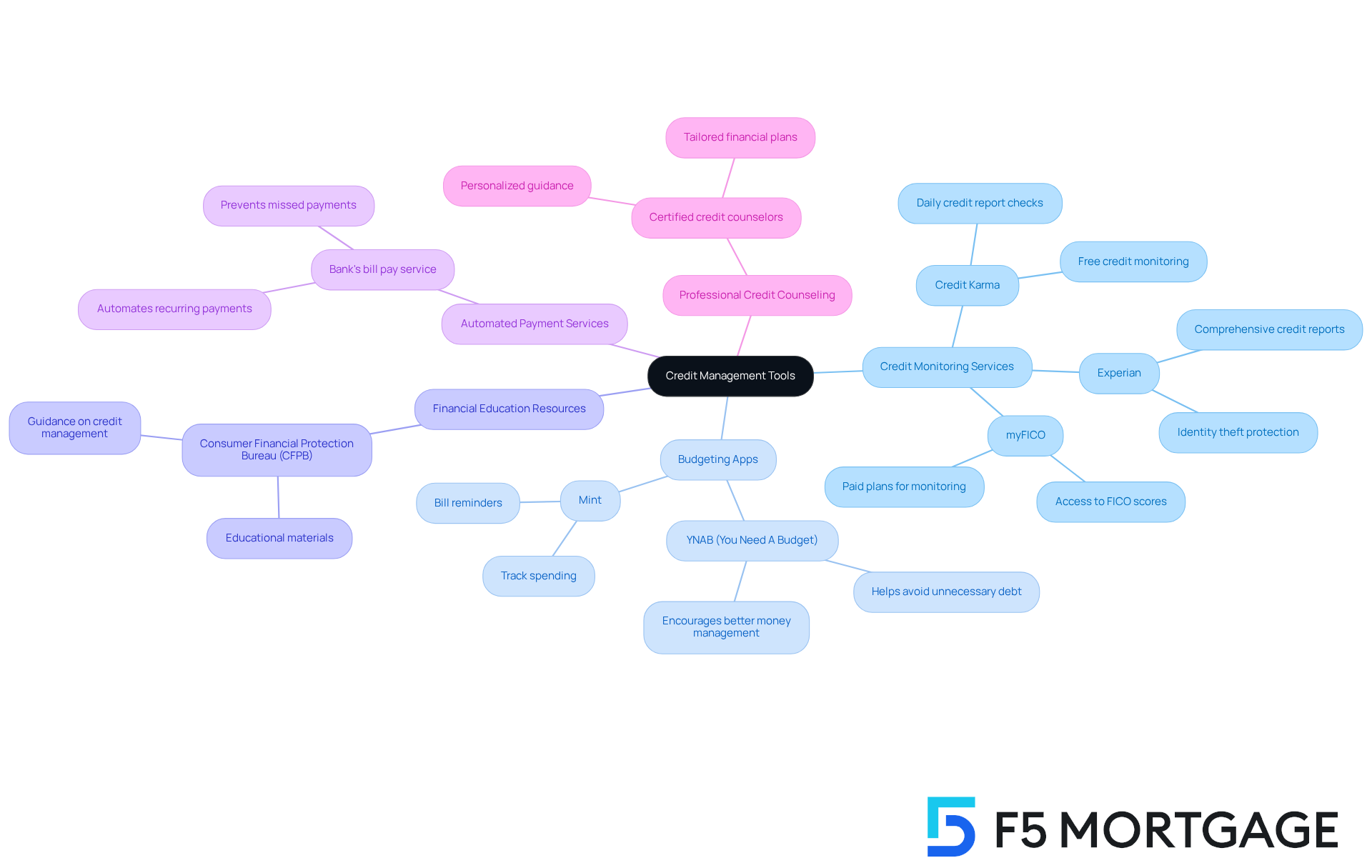

Utilize Tools and Resources for Credit Management

To effectively and work towards achieving or maintaining a credit 700 score, we understand how important it is to have the right tools and resources at your disposal. Here are some supportive options to consider:

- Credit Monitoring Services

Services such as Credit Karma, Experian, and myFICO provide free access to your credit score and report, along with alerts for any changes. These tools keep you updated about your financial status, allowing you to take prompt action to resolve any issues. Recently, FICO reported that the nation’s average rating has dropped to 715, highlighting the importance of staying attentive to your financial health. - Budgeting Apps

Apps like Mint and YNAB (You Need A Budget) can be invaluable for tracking spending and managing finances. They help families stay organized, ensuring bills are paid on time and unnecessary debt is avoided. Research shows that households using budgeting applications often see significant improvements in their financial ratings, helping them achieve a credit 700 by encouraging better money management practices. As financial expert David Bach reminds us, “What determines your wealth is not how much you make but how much you keep of what you make.” - Financial Education Resources

Websites like the Consumer Financial Protection Bureau (CFPB) offer essential information on credit management. They provide guidance for improving your credit 700 rating and understanding financial reports, empowering families with the knowledge needed to make informed monetary choices. Building positive money habits, such as budgeting and automating savings, is crucial for achieving financial success. - Automated Payment Services

Using your bank’s bill pay service to automate payments for recurring bills can truly be a game changer. This ensures that you never miss a bill, which is vital for maintaining a favorable credit 700 rating and avoiding late fees. The risk of missing payments can be exacerbated by data breaches, making monitoring services even more important. - Professional Credit Counseling

If you find yourself struggling with credit management, seeking help from a certified credit counselor can be a wise choice. These experts provide personalized guidance and plans tailored to your unique financial situation, assisting you in navigating the complexities of financial oversight. A case study on the impact of financial monitoring on ratings illustrates how proactive management can lead to improved financial outcomes.

By leveraging these tools and resources, families can take proactive steps in managing their credit. Remember, we’re here to support you every step of the way as you work towards improved scores and better financial opportunities.

Conclusion

Achieving a credit score of 700 is a significant milestone for families. It represents a robust financial standing that opens doors to favorable loan conditions and lower interest rates. This score reflects trustworthiness in the eyes of lenders and enhances overall financial well-being. It enables families to make informed decisions that positively impact their lives.

In this guide, we’ve outlined various strategies to help families improve and maintain their credit scores. Key practices include:

- Timely bill payments

- Reducing credit card balances

- Regularly monitoring credit reports

By implementing these strategies, families can enhance their credit profiles and secure better financial opportunities, such as lower mortgage rates and improved insurance premiums.

The journey to achieving and maintaining a credit score of 700 requires commitment and proactive management. Utilizing tools like credit monitoring services and budgeting apps can further support families in this endeavor. As families take these steps toward financial literacy and responsibility, they not only improve their credit scores but also pave the way for a more secure financial future. Embracing these practices is essential for long-term success, ensuring that families can enjoy the benefits that come with a strong credit rating.

Frequently Asked Questions

What is a 700 credit score and why is it important?

A 700 credit score is considered ‘good’ on the FICO scale, which ranges from 300 to 850. This score indicates that you are a trustworthy borrower, enabling you to qualify for better loan conditions and interest rates, leading to various financial opportunities.

What are the benefits of having a 700 credit score?

The benefits include lower interest rates on loans, enhanced borrowing capacity, and improved insurance rates. Borrowers with a score between 700 and 759 may see significantly lower rates compared to those with lower scores, which can save money over the life of a loan.

How does a 700 credit score affect loan interest rates?

Lenders typically offer lower interest rates to borrowers with higher credit scores. For example, borrowers with scores between 700 and 759 may receive rates around 6.948%, while those with scores below 640 might face rates higher than 7.769%.

Can a 700 credit score improve borrowing capacity?

Yes, a favorable credit score can increase the amount you qualify to borrow, making it easier to buy a home or refinance a mortgage. This is particularly beneficial for households looking to enhance their living conditions.

How does a 700 credit score impact insurance premiums?

Many insurance providers use credit scores to determine premiums, so having a higher score can lead to lower insurance costs, allowing families to save money for other expenses.

What challenges do individuals with lower credit scores face?

Individuals with lower credit scores may encounter higher security deposits when renting, and they might be required to make advance payments for utilities. Understanding the importance of maintaining a good credit score can help households make informed financial decisions.

What should households do to improve their credit score?

Households should actively participate in improving their credit ratings by understanding the factors that influence their scores, such as payment history and credit utilization, to achieve better financial outcomes.