Overview

Navigating the mortgage application process can feel overwhelming, but we’re here to support you every step of the way. This article outlines a four-step process to apply for a mortgage online with confidence.

- First, it’s essential to understand the different mortgage types available to you.

- Next, set clear financial goals that reflect your needs and aspirations.

- Once you have a solid understanding, it’s time to complete the application. Gather all necessary documents to streamline this process.

- Remember, being proactive in following up with your lender can make a significant difference. Finally, maintaining open communication with your lender will help you feel more secure throughout this journey.

Each step is supported by practical advice, enhancing your likelihood of securing favorable mortgage terms. We know how challenging this can be, but with the right approach, you can navigate this process successfully.

Introduction

Navigating the world of mortgages can feel overwhelming, especially with the many options available today. We understand how challenging this can be. Recognizing the different types of mortgages—from fixed-rate to FHA financing—can empower you to make informed decisions that align with your financial goals. But with so much information at hand, how can you confidently approach the online mortgage application process and avoid common pitfalls?

This guide breaks down the essential steps to ensure a smooth application experience. We’re here to support you every step of the way, helping you transform uncertainty into confidence as you embark on your journey toward homeownership.

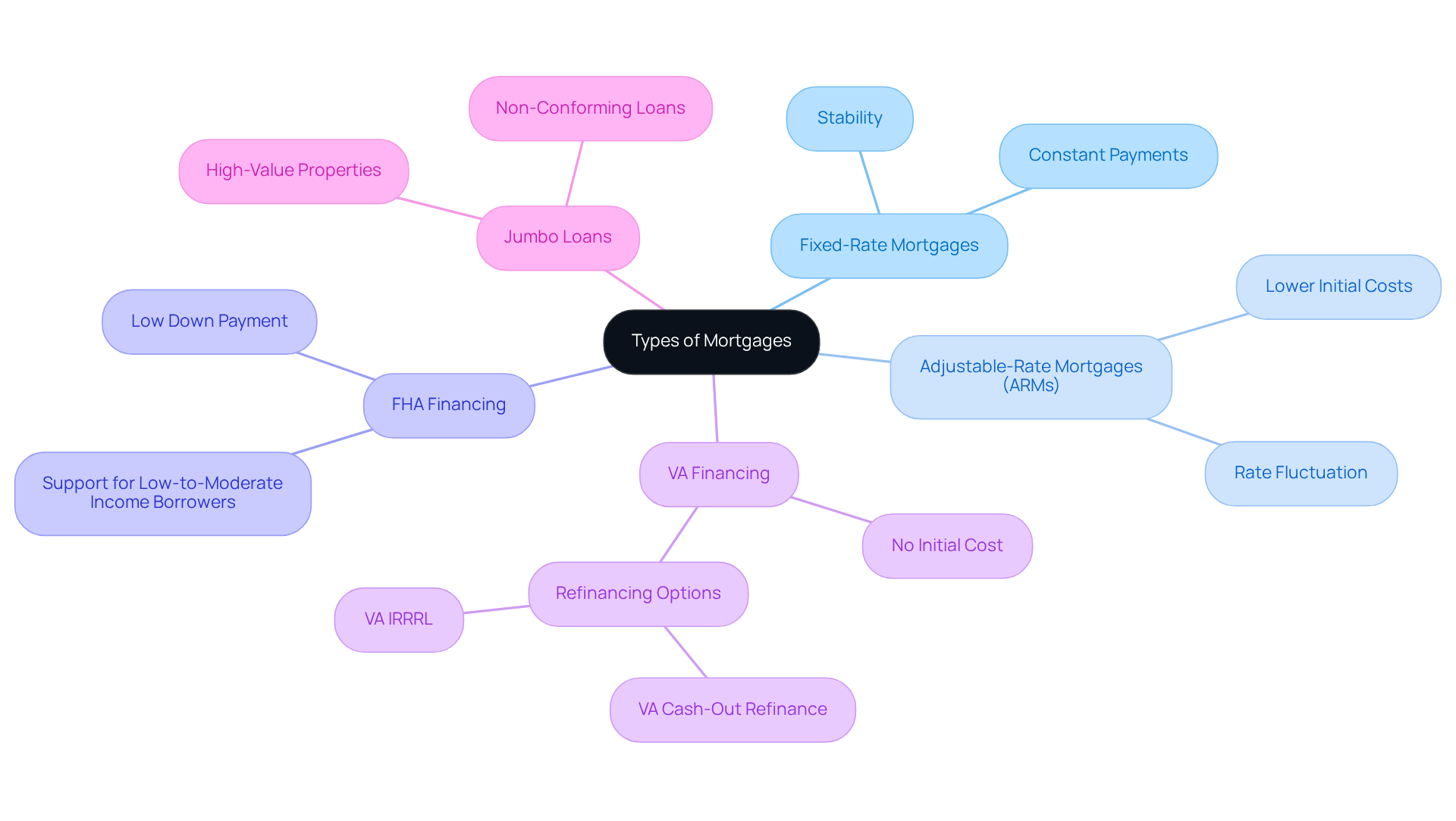

Understand Different Mortgage Types

Before you embark on the journey to apply for mortgage online, we understand how important it is to familiarize yourself with the various types of mortgages available. This knowledge can empower you to make the best choice for your unique situation. Here are some of the most common options:

- Fixed-Rate Mortgages: These loans offer a constant interest rate and monthly payments that remain unchanged, providing you with long-term stability and peace of mind.

- Adjustable-Rate Mortgages (ARMs): With these financial products, your interest rates may fluctuate periodically based on market conditions. This can lead to lower initial costs, but it’s essential to be aware that rates may rise over time.

- FHA Financing: Supported by the Federal Housing Administration, these options are designed with low-to-moderate-income borrowers in mind, requiring reduced minimum upfront contributions to help you achieve homeownership.

- VA Financing: If you’re a veteran or active-duty military personnel, you may find these options particularly beneficial. They often require no initial cost and come with favorable conditions. Plus, once you’ve built equity in your home, you can explore refinancing options like the VA Interest Rate Reduction Refinance Program (IRRRL) to lower your rate and monthly payment, or a VA cash-out refinance for various financial needs. This flexibility makes VA financing a valuable choice for qualified borrowers in California.

- Jumbo Loans: These non-conforming loans exceed the limits set by Fannie Mae and Freddie Mac and are typically used for high-value properties.

Understanding these choices will empower you to select the right loan type that aligns with your financial goals and homeownership aspirations. We’re here to support you every step of the way.

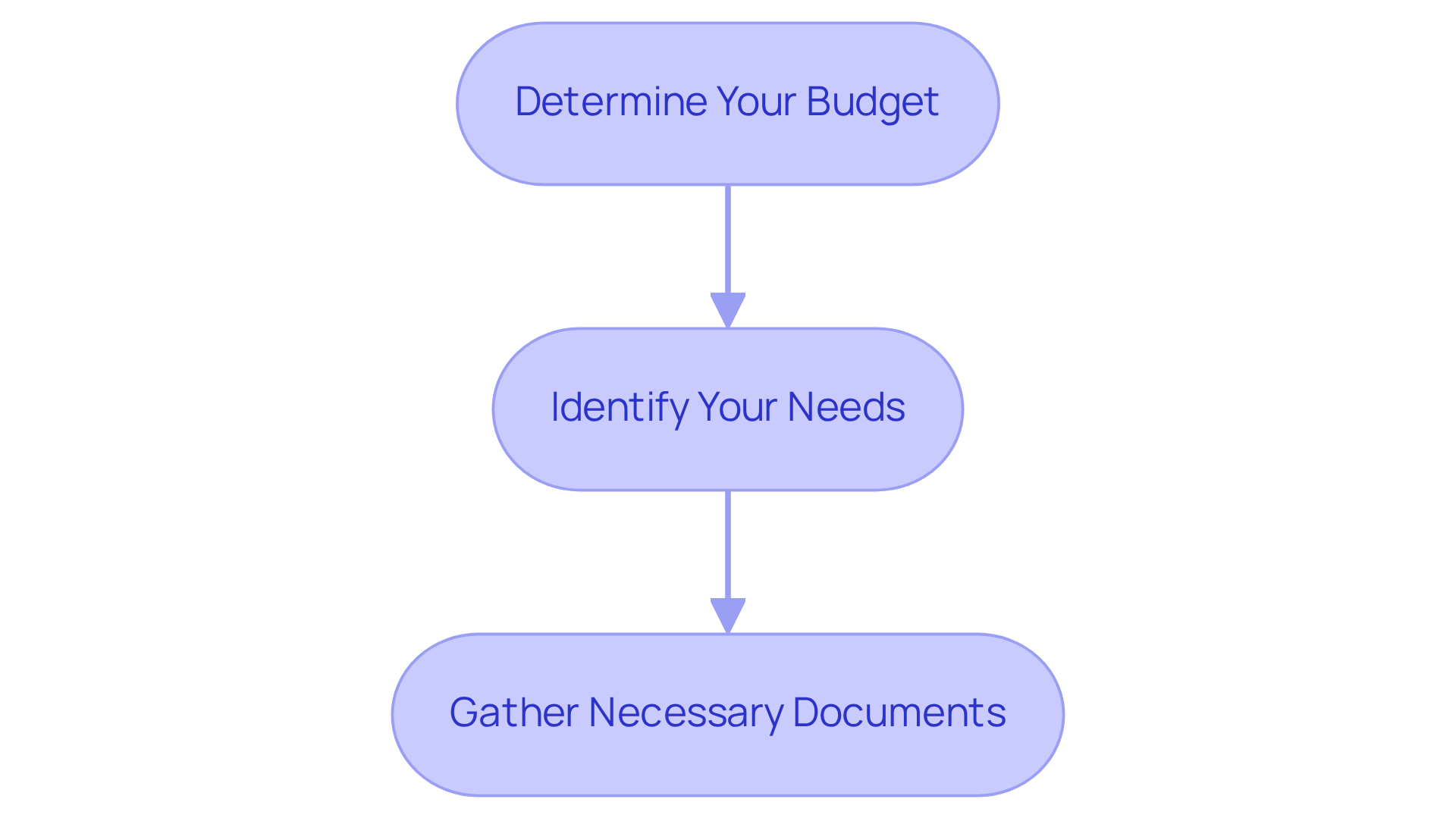

Set Your Mortgage Goals and Gather Necessary Documents

To confidently apply for mortgage online, it’s important to start by setting clear financial objectives. We understand how overwhelming this process can be, so here are essential steps to guide you:

-

Determine Your Budget: Take a moment to assess your financial condition. This will help you figure out how much you can set aside for a down payment and monthly housing expenses. In 2025, the typical down payment for first-time homebuyers is approximately 6%, but aiming for 20% can help you avoid private mortgage insurance (PMI).

-

Identify Your Needs: Clarify the type of home you desire. Consider the key features that matter most to you, such as location, size, and amenities.

-

Gather Necessary Documents: Preparing the following documents will streamline your application process:

- Proof of income (recent pay stubs and tax returns)

- Employment verification

- Bank statements

- Credit history

- Identification (driver’s license and Social Security number)

Having these documents organized will not only facilitate a smoother application process but also enhance your chances of securing favorable mortgage terms. We know how challenging this can be, and financial advisors stress that understanding your budget is essential for effective loan planning. It establishes the foundation for your homeownership journey. By being well-prepared, you can navigate the complexities of loan requests with confidence and clarity. Remember, we’re here to support you every step of the way.

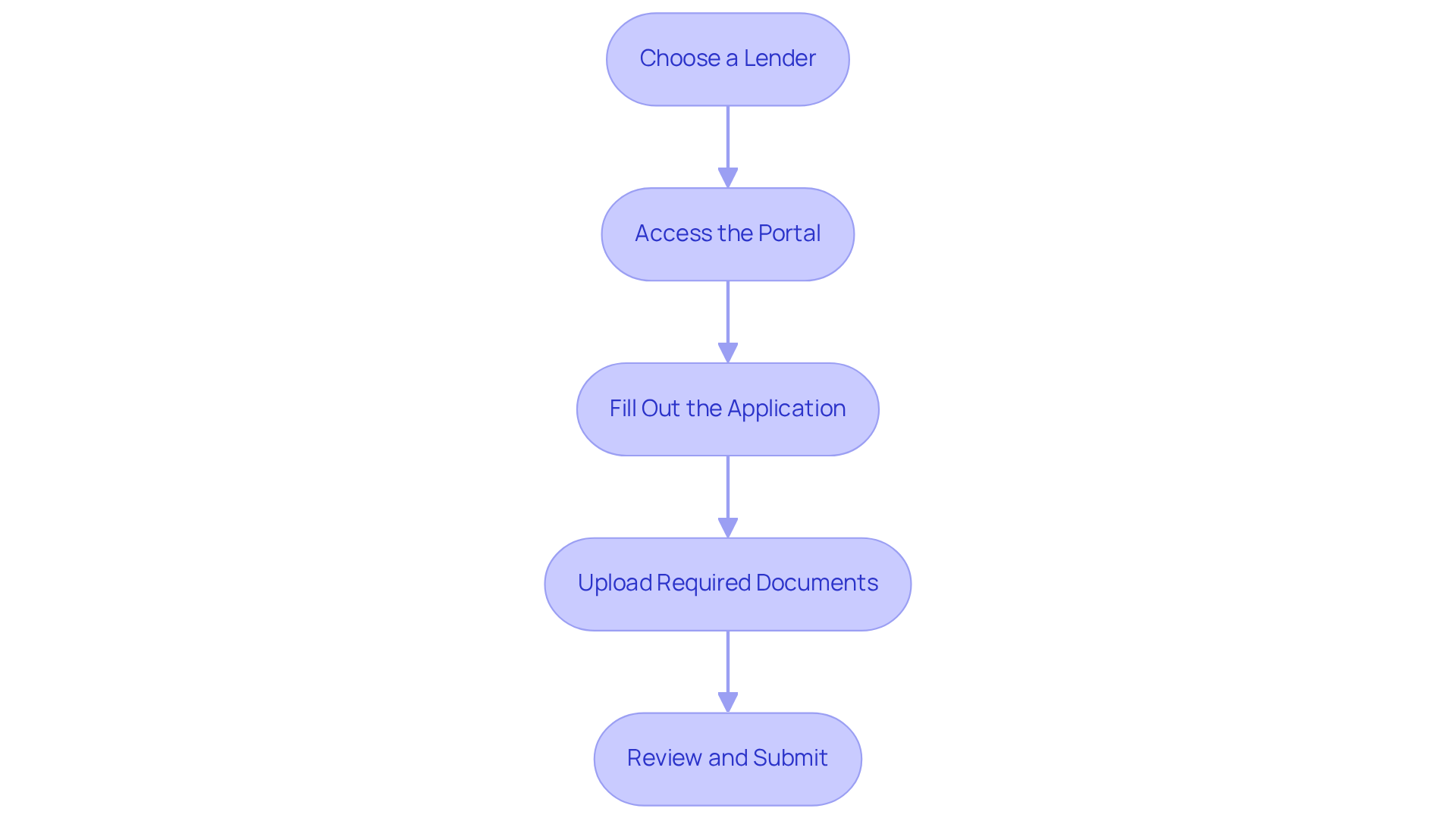

Complete the Online Mortgage Application

Once you have set your objectives and gathered the necessary documents, it’s time to apply for mortgage online. We understand how daunting this process can be, but by following these steps, you can ensure a smooth experience:

-

Choose a Lender: Start by conducting thorough research to find a reputable lender that offers the loan type you need. For instance, F5 Mortgage provides a diverse range of options, including fixed-rate mortgages, FHA financing, VA financing, jumbo mortgages, and nontraditional products tailored for various financial situations. This variety ensures you receive competitive rates and personalized service, even if other lenders have said no.

-

Access the Portal: Next, navigate to the lender’s website and locate the mortgage submission section, which is typically user-friendly and designed for ease of use.

-

Fill Out the Application: Enter your personal information, including:

- Contact details

- Employment and income information

- Financial assets and liabilities

- Desired loan amount and type

-

Upload Required Documents: Attach the documents you collected earlier, such as proof of income, tax returns, and bank statements, to strengthen your request.

-

Review and Submit: Finally, take a moment to carefully examine all details for accuracy before submitting the form. Ensure that all required fields are completed to avoid any delays in processing.

Filling out the form correctly is essential, as it can significantly speed up the approval process. We know how crucial this step is for you. According to industry insights, a well-prepared submission can enhance your position in the housing market, allowing for quicker offers on homes. By choosing a lender like F5 Mortgage, which boasts a customer satisfaction rate of 94% and a quick closing process—most loans finalize in under three weeks—you can navigate the complexities of financing with confidence. Remember, we’re here to support you every step of the way.

Follow Up and Communicate with Your Lender

After submitting your online loan request, we know how essential it is to follow up and keep open lines of communication with your lender. Here’s how you can navigate this process with confidence:

- Check Application Status: Most lenders provide a way to check the status of your application online. Regularly monitoring this can help you stay updated and informed.

- Be Responsive: If your lender requests additional information or documentation, responding promptly is key. This helps avoid delays in processing and shows your commitment.

- Ask Questions: Don’t hesitate to reach out to your lender with any questions or concerns. Clear communication can clarify the process and alleviate uncertainties you may have.

- Stay Informed: Keeping yourself updated on market conditions and interest rates is important, as these can influence your loan terms significantly.

Furthermore, boosting your credit score is crucial for expanding your loan opportunities. Order a copy of your credit report to check for errors or discrepancies. Paying down existing debts can help reduce your debt-to-income ratio. Use credit wisely by avoiding large purchases and making timely payments. By actively engaging with your lender and effectively managing your credit, you can ensure a smoother mortgage application experience and increase your chances of a successful outcome. Remember, we’re here to support you every step of the way.

Conclusion

Applying for a mortgage online can be an empowering journey, especially when you approach it with the right knowledge and preparation. We understand how overwhelming this process can feel, but by familiarizing yourself with the various types of mortgages available, setting clear financial goals, gathering necessary documentation, and maintaining open communication with lenders, you can navigate this experience with confidence.

Throughout this article, we’ve shared key insights on the importance of understanding mortgage types such as:

- fixed-rate

- adjustable-rate

- FHA

- VA

- jumbo loans

Setting a budget and identifying your specific needs are crucial steps in determining the right mortgage for your circumstances. A well-organized application process, including choosing a reputable lender and submitting accurate information, can significantly enhance your chances of approval. Remember, regular communication with lenders and staying informed on market conditions are vital for a smooth experience.

Ultimately, the journey to homeownership begins with informed decisions and proactive steps. By applying the strategies we’ve outlined, you can simplify the mortgage application process and position yourself for long-term financial success. Embrace this opportunity to take control of your homeownership journey. We’re here to support you every step of the way, helping you make informed choices that align with your financial goals.

Frequently Asked Questions

What are the different types of mortgages available?

The main types of mortgages include Fixed-Rate Mortgages, Adjustable-Rate Mortgages (ARMs), FHA Financing, VA Financing, and Jumbo Loans.

What is a Fixed-Rate Mortgage?

A Fixed-Rate Mortgage offers a constant interest rate and monthly payments that remain unchanged, providing long-term stability.

How does an Adjustable-Rate Mortgage (ARM) work?

An Adjustable-Rate Mortgage has interest rates that may fluctuate periodically based on market conditions, which can lead to lower initial costs but may increase over time.

What is FHA Financing?

FHA Financing is supported by the Federal Housing Administration and is designed for low-to-moderate-income borrowers, requiring lower minimum upfront contributions to facilitate homeownership.

Who can benefit from VA Financing?

VA Financing is particularly beneficial for veterans or active-duty military personnel, often requiring no initial cost and offering favorable conditions.

What refinancing options are available for VA Financing?

VA Financing allows for refinancing options such as the VA Interest Rate Reduction Refinance Program (IRRRL) to lower rates and monthly payments, or a VA cash-out refinance for various financial needs.

What are Jumbo Loans?

Jumbo Loans are non-conforming loans that exceed the limits set by Fannie Mae and Freddie Mac and are typically used for high-value properties.