Overview

Calculating your $300,000 mortgage monthly payment can feel overwhelming, but we’re here to support you every step of the way. It’s important to consider various factors, including the principal amount, interest rate, loan term, and additional costs like property taxes and insurance. We know how challenging this can be, and that’s why this article outlines a step-by-step approach tailored for families like yours.

By using a payment formula and online calculators, you can accurately determine your monthly obligations. This will empower you to budget effectively for homeownership and ease some of the stress that comes with it. Remember, understanding these details is crucial in making informed decisions for your family’s future. Let’s take this journey together, ensuring you feel confident in your financial choices.

Introduction

Understanding the intricacies of a mortgage can feel overwhelming, especially when considering a significant loan like a $300,000 mortgage. We know how challenging this can be. With various components such as interest rates, loan terms, and additional costs, navigating this financial landscape requires careful attention.

This article offers a step-by-step guide to calculating your monthly mortgage payment, empowering you to make informed decisions about your home financing.

But how can you ensure that you are fully prepared for the total financial commitment that comes with homeownership, beyond just the monthly payment? We’re here to support you every step of the way.

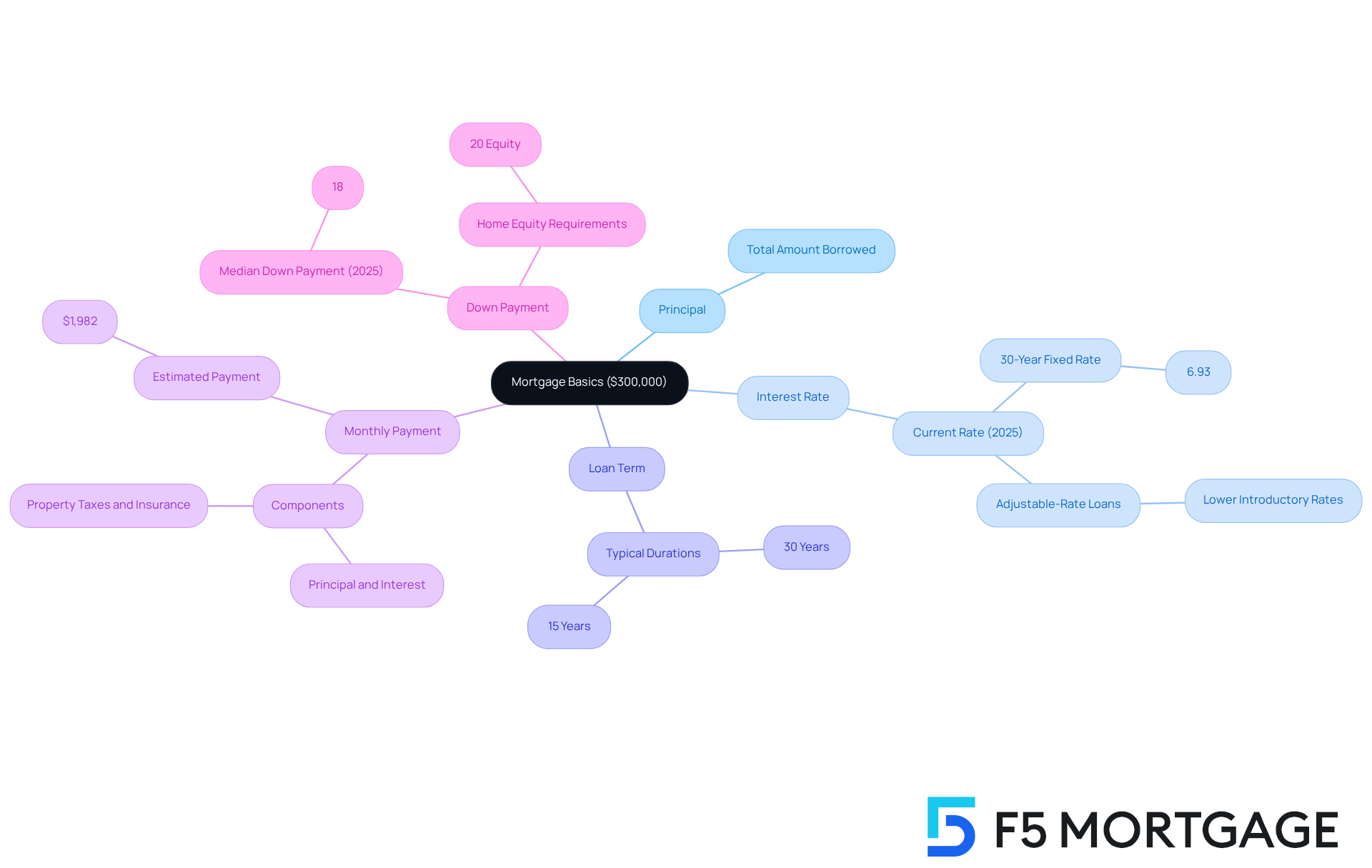

Understand Your 300k Mortgage Basics

A home loan is a specialized financial product designed to help you acquire real estate, with the property itself serving as collateral. If you’re considering a $300,000 mortgage, it’s essential to understand some key components that can feel overwhelming at first:

- Principal: This is the total amount you borrow, which in this case is $300,000.

- Interest Rate: This represents the cost of borrowing, expressed as a percentage. Interest rates can vary based on factors like your credit score, the type of loan, and current market conditions. As of 2025, the typical interest rate for a 30-year fixed loan is about 6.93%. If you’re thinking about adjustable-rate loans (ARMs), keep in mind that they often start with lower introductory rates, which can be beneficial if you plan to move or refinance within a few years.

- Loan Term: This is the duration over which you will repay the loan, usually 15 or 30 years. The term you choose can greatly affect your monthly payments and the total interest paid over the life of the loan.

- Monthly Payment: This includes both principal and interest, and may also cover property taxes and insurance, depending on your lender’s requirements. Understanding how these elements work together is vital for managing your loan effectively. Additionally, many lenders require homeowners to maintain a certain level of equity, often at least 20%, which can influence your loan options and approval process.

For example, if you secure a 30-year fixed-rate loan at an interest rate of 6.93%, your estimated monthly payment for principal and interest alone would be around $1,982. This calculation highlights the importance of understanding your loan components, as they directly impact your financial planning and homeownership journey. Financial advisors emphasize that a solid understanding of these factors can empower borrowers to make informed decisions and navigate the complexities of financing with confidence.

Moreover, in 2025, the median down payment for a house in the United States is approximately 18%. This is crucial for families considering a $300,000 mortgage monthly payment, as it directly relates to home equity requirements. We know how challenging this can be, but we’re here to as you embark on this important journey.

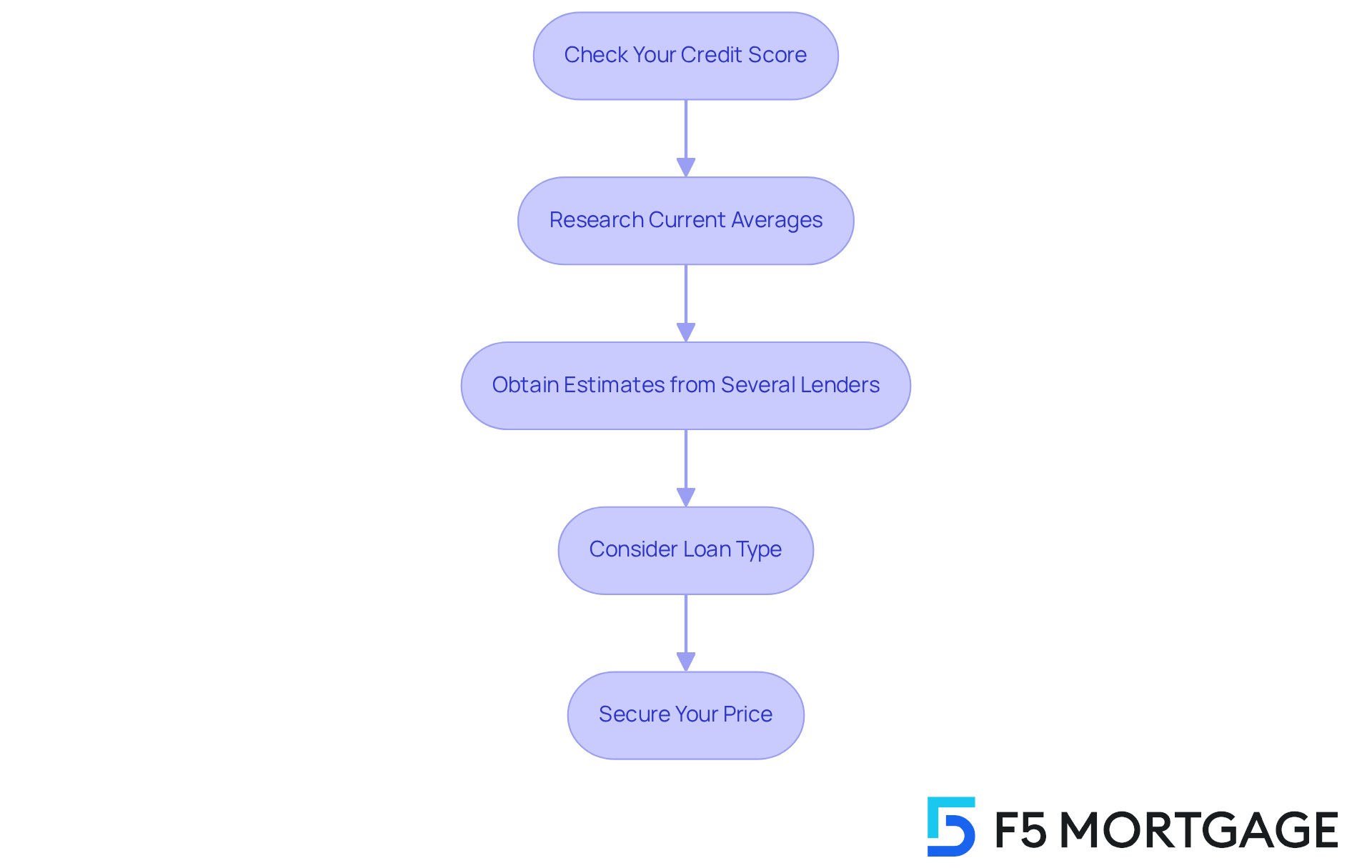

Determine Your Interest Rate

To determine your interest rate, follow these essential steps:

- Check Your Credit Score: We know how crucial your credit score is in determining your interest level. Typically, higher scores lead to . For instance, a score of 760-850 can secure an average refinance APR of approximately 6.726%, while a FICO score of 800 achieves a loan cost of 6.644% as of July 16, 2025. Scores below 640 may encounter charges surpassing 7.769%. Understanding this can feel overwhelming, but we’re here to support you every step of the way.

- Research Current Averages: Take a moment to utilize online resources or consult with mortgage brokers to find the current average costs for a $300,000 home loan, particularly the 300k mortgage monthly payment. As of mid-August 2025, the average 30-year mortgage percentage is approximately 6.72%, aligning with the figure reported by Freddie Mac as of July 10, 2025. A favorable percentage is considered to be 6.77% or below. Knowing these averages can empower you in your decision-making.

- Obtain Estimates from Several Lenders: We encourage you to reach out to different lenders, including F5 Mortgage, which partners with over two dozen leading lenders to ensure you receive competitive offers tailored to your needs. This comparison is vital in helping you recognize the best prices and conditions available. Remember, the average homebuyer can lose about $300 annually by not shopping around for mortgages, highlighting the importance of obtaining multiple quotes.

- Consider Loan Type: Various loan categories, such as FHA, VA, or conventional loans, can offer differing terms. For example, FHA loans may allow purchases with credit scores as low as 500 with a 10% down payment, making them a viable option for first-time buyers. It’s essential to choose a loan type that aligns with your financial situation, and we’re here to guide you through these options.

- Secure Your Price: Once you find a beneficial price, think about securing it to protect against potential future hikes. Given the current market instability, securing a price can provide reassurance as values fluctuate. F5 Mortgage can assist you in navigating this process, ensuring you secure the best possible deal.

By adhering to these steps and utilizing the tailored service provided by F5 Mortgage, you can successfully maneuver through the loan landscape to secure a favorable interest rate for your 300k mortgage monthly payment.

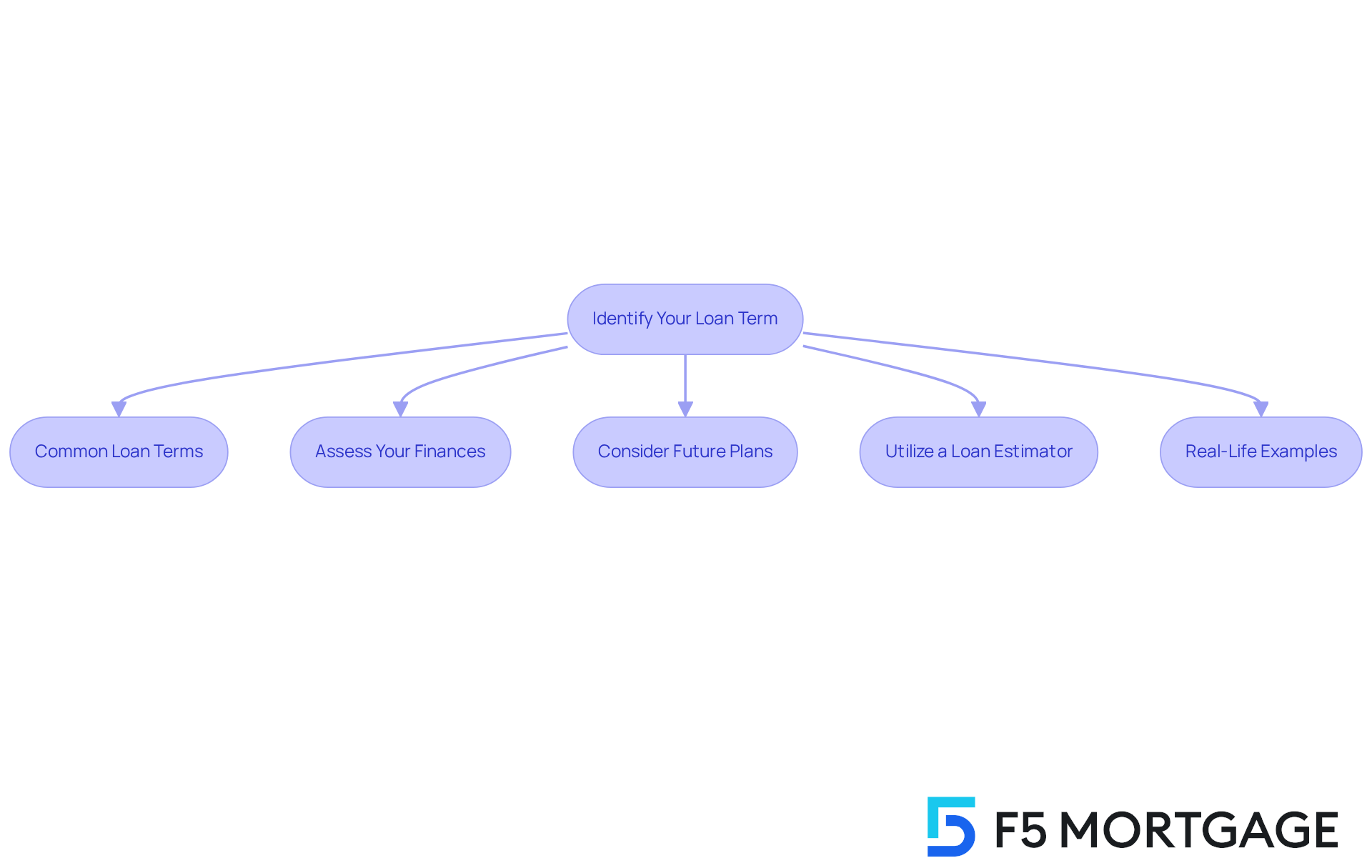

Identify Your Loan Term

Selecting the right loan term is a crucial step in your financial journey. We know how challenging this can be, so here’s how to find the best fit for your needs:

- Common Loan Terms: The two most prevalent options are 15 and 30 years. A 30-year loan typically offers lower monthly payments, resulting in a 300k mortgage monthly payment that is more manageable for many homeowners. However, it does result in higher total interest costs over time. Conversely, a 15-year loan comes with higher monthly payments but significantly reduces the overall interest paid, allowing you to build equity more quickly.

- Assess Your Finances: Take a moment to carefully review your monthly budget. Understanding how much you can comfortably allocate towards loan payments is essential in deciding whether a shorter or longer term aligns better with your financial situation.

- Consider Future Plans: Think about your plans for the future. If you expect to stay in your home for many years, a 30-year loan might be advantageous due to its potential to result in a lower 300k mortgage monthly payment. However, if you anticipate moving within a few years, a 15-year loan could save you money in interest costs.

- Utilize a : Online loan calculators can be invaluable tools. They allow you to see how different loan terms affect your monthly payments and total interest expenses. This insight can help you visualize the financial implications of each option, making the decision process clearer.

- Real-Life Examples: For instance, on a $300,000 loan at an interest rate of 6.7%, a 30-year term results in an average monthly payment of about $1,940, whereas a 15-year term would necessitate a 300k mortgage monthly payment of around $2,200. This difference underscores the importance of aligning your choice with your budget and financial goals.

By considering these factors, you can make a more informed decision that truly fits your financial landscape. Remember, we’re here to support you every step of the way.

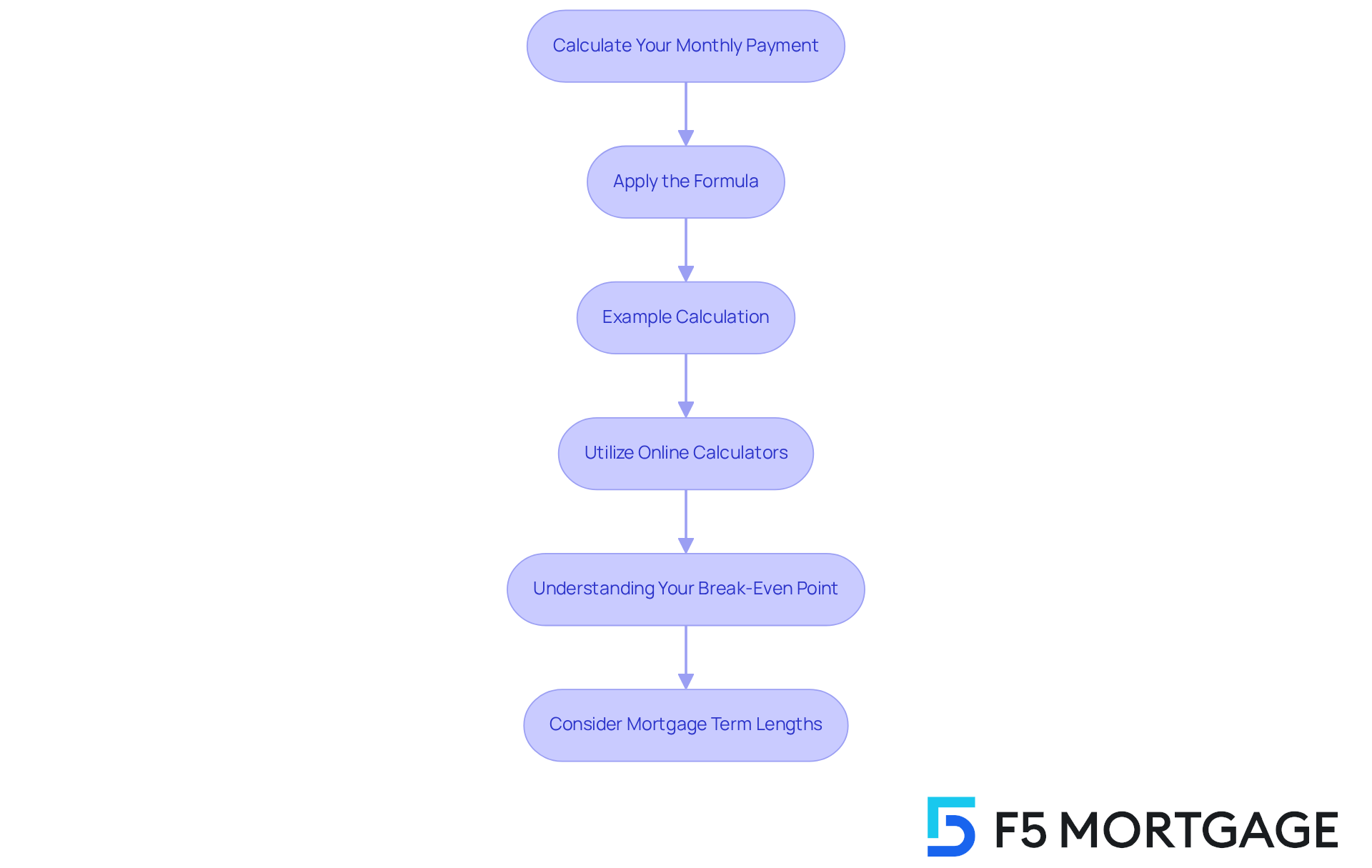

Calculate Your Monthly Payment

Determining your 300k mortgage monthly payment can feel daunting, but we are here to assist you every step of the way. Follow these simple steps to make the process easier:

Apply the Formula: The formula for calculating your monthly payment (M) is:

M = P × (r(1 + r)^n) / ((1 + r)^n – 1)

Where:

- P = principal loan amount ($300,000)

- r = monthly interest rate (annual rate divided by 12)

- n = total number of payments (loan term in months)

Example Calculation: For an interest rate of 4% (0.04), the monthly interest rate becomes 0.04/12 = 0.00333. For a 30-year loan, n = 30 × 12 = 360 months.

By substituting these values into the formula, we find:

M = 300,000 × (0.00333(1 + 0.00333)^360) / ((1 + 0.00333)^360 – 1)

This calculation will provide your monthly payment amount, approximately $1,432.25.

Utilize Online Calculators: For a more straightforward approach, consider using online mortgage calculators. Websites such as Rate.com and Bankrate offer intuitive tools that allow you to perform these calculations quickly and efficiently, helping you budget effectively.

Understanding Your Break-Even Point: Calculating your break-even point can assist you in figuring out how long it will take to recover the costs of refinancing through savings in regular installments or interest rates. To calculate your break-even point, follow these steps:

- Determine refinancing costs, including all closing fees and expenses associated with refinancing.

- Determine your savings each month by subtracting your new payment from your existing payment.

- Divide your refinancing expenses by your savings each month to determine how many months it will take to reach breakeven. For instance, if your refinancing expenses are $4,000 and your savings each month are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months).

Consider Mortgage Term Lengths: It’s also important to understand the implications of different mortgage term lengths. An extended duration might result in reduced installments but can lead to paying more interest throughout the lifespan of the loan. On the other hand, a shorter duration usually results in increased monthly costs but reduced total interest paid. Assessing these choices can assist you in making a more knowledgeable decision regarding your loan.

By comprehending these calculations and employing available resources, you can gain better insight into your loan payments and make informed financial decisions. We know how challenging this can be, but with the right tools and knowledge, you can .

Consider Additional Homeownership Costs

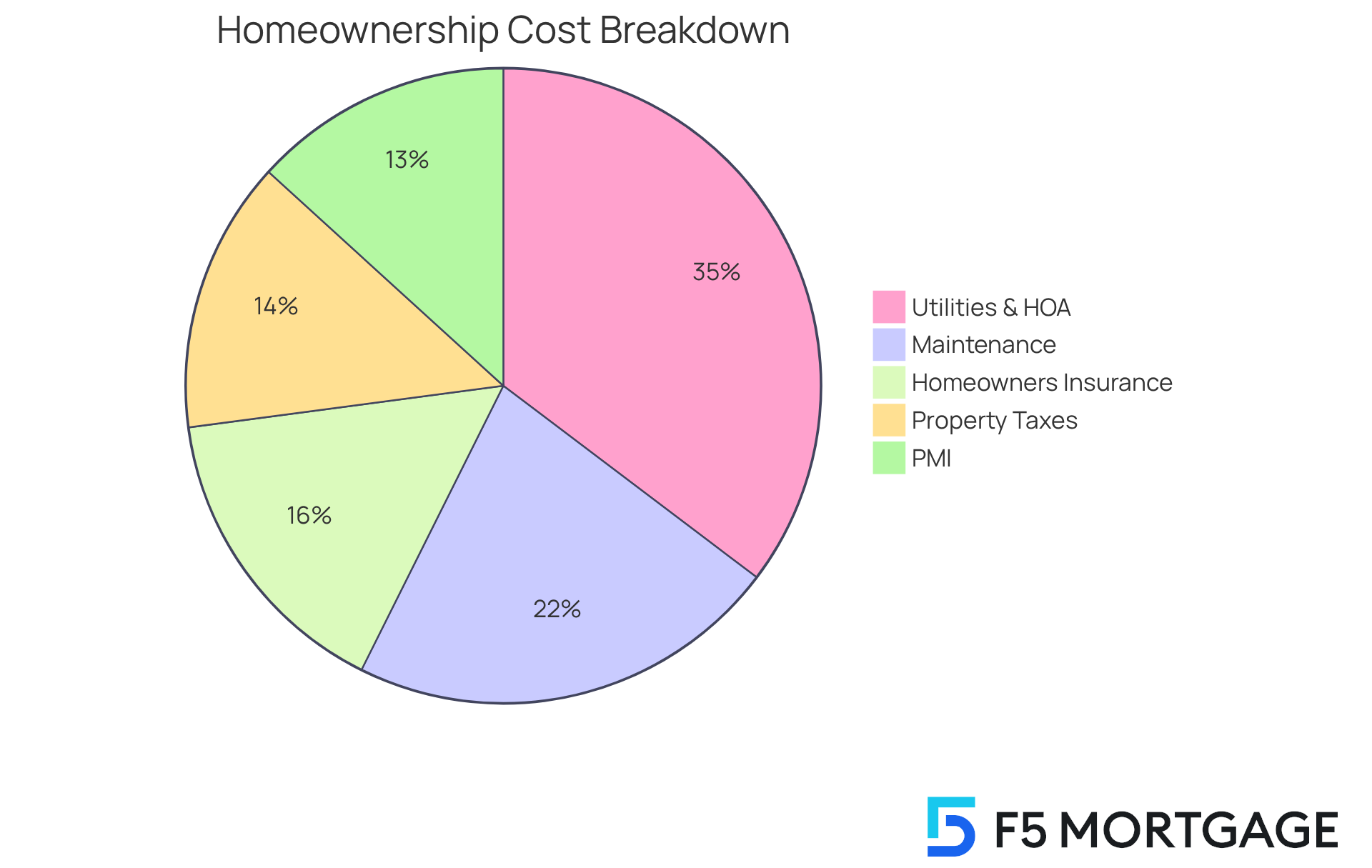

When budgeting for your , we know how crucial it is to account for several additional costs that can significantly affect your payments. Understanding these expenses can help you feel more secure in your financial planning.

- Property Taxes: These can vary widely based on your location and are a major component of your monthly expenses. In 2025, the average property tax paid across the U.S. was approximately $1,889 annually, translating to about $157 per month. Investigating local tax levels is essential to precisely assess this cost.

- Homeowners Insurance: Protecting your home and belongings is vital. The average annual homeowners insurance cost for a $300,000 dwelling is around $2,110, which is about $176 per month, similar to a 300k mortgage monthly payment for homeowners with good credit. However, homeowners with poor credit pay an average of $3,620 for insurance, highlighting the significant difference based on credit scores. We recommend obtaining quotes from multiple insurers to secure the best rate, as costs can vary significantly based on factors like location and home features.

- Private Mortgage Insurance (PMI): If your down payment is below 20%, you might need to pay PMI. This can increase your payment by an extra $100 to $200, depending on your loan amount and credit score. Being aware of this can help you plan better.

- Maintenance and Repairs: It’s wise to budget for ongoing maintenance and unexpected repairs, which can average about 1% of your home’s value annually. For a $300,000 home, the 300k mortgage monthly payment equates to approximately $250 per month. Experts recommend saving about 1% to 4% of your home’s value for unexpected expenses, ensuring you’re prepared for any necessary upkeep.

- Utilities and HOA Fees: Don’t overlook monthly utility bills and any homeowners association fees, which can vary widely. On average, utility costs can range from $150 to $300 per month, while HOA fees can add another $100 to $500, depending on the community.

By factoring in these additional expenses, you can create a more accurate budget that reflects the true cost of homeownership, helping you avoid financial surprises down the road. As Linda Bell, a home lending expert at Bankrate, emphasizes, “You should save about 1% to 4% of your home’s value” for unexpected expenses. Additionally, it’s important to be aware that hidden costs of homeownership can exceed $21,000 annually, making comprehensive budgeting essential. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of a $300,000 mortgage can significantly empower you on your financial journey. We know how challenging this can be, but grasping essential components such as principal, interest rates, loan terms, and additional costs can help you make informed decisions that align with your financial goals. This knowledge not only simplifies the mortgage process but also enhances your confidence in navigating the complexities of homeownership.

The article outlines a systematic approach to calculating a mortgage payment. It emphasizes the importance of determining the interest rate, selecting an appropriate loan term, and accounting for various additional costs associated with homeownership. Each step—utilizing mortgage calculators, considering property taxes, homeowners insurance, and maintenance fees—plays a crucial role in creating a comprehensive budget that reflects the true financial commitment of owning a home.

Ultimately, being well-informed about these factors can lead to better financial planning and a more secure homeownership experience. As your journey to homeownership unfolds, it’s essential to seek guidance and support. We’re here to support you every step of the way, ensuring that every decision made is rooted in thorough understanding and careful consideration. Embracing this proactive approach not only prepares you for the responsibilities of owning a home but also sets the foundation for a successful financial future.

Frequently Asked Questions

What is a mortgage and how does it work?

A mortgage is a specialized financial product that helps you acquire real estate, with the property itself serving as collateral. The borrower takes a loan amount, which must be repaid over time, typically with interest.

What are the key components of a $300,000 mortgage?

The key components include the principal (the total amount borrowed, which is $300,000), the interest rate (the cost of borrowing expressed as a percentage), the loan term (the duration for repayment, usually 15 or 30 years), and the monthly payment (which includes principal, interest, and may also cover property taxes and insurance).

What is the typical interest rate for a 30-year fixed mortgage in 2025?

As of 2025, the typical interest rate for a 30-year fixed mortgage is about 6.93%.

How does the loan term affect monthly payments?

The loan term significantly affects monthly payments; a longer term typically results in lower monthly payments but higher total interest paid over the life of the loan.

What is the estimated monthly payment for a $300,000 mortgage at a 6.93% interest rate?

The estimated monthly payment for principal and interest alone would be around $1,982.

What is the median down payment for a house in the United States in 2025?

The median down payment for a house in the United States in 2025 is approximately 18%.

How can I determine my interest rate for a mortgage?

To determine your interest rate, check your credit score, research current averages, obtain estimates from several lenders, consider the loan type, and secure your price once you find a favorable rate.

How does my credit score affect my mortgage interest rate?

Generally, higher credit scores lead to lower interest rates. For example, a score of 760-850 can secure an average refinance APR of about 6.726%, while scores below 640 may face rates exceeding 7.769%.

Why is it important to obtain estimates from multiple lenders?

Obtaining estimates from multiple lenders is crucial because it allows you to compare offers and find the best prices and conditions available, potentially saving you money over time.

What types of loans can I choose from when getting a mortgage?

You can choose from various loan types, including FHA, VA, or conventional loans, which offer different terms and requirements. For example, FHA loans may allow purchases with lower credit scores and smaller down payments.