Overview

A fixed-rate mortgage (FRM) is a home loan that keeps a consistent interest rate throughout its term, which typically ranges from 10 to 30 years. This feature provides borrowers with predictable monthly payments, allowing families to plan their finances with confidence.

We understand how challenging it can be to navigate fluctuating economic conditions. The stability of an FRM is particularly beneficial during such times, as it helps homeowners budget effectively and protects them against rising interest rates. This assurance makes it a popular choice among new buyers and families seeking long-term financial security.

By choosing a fixed-rate mortgage, you are taking a significant step towards safeguarding your family’s future. We’re here to support you every step of the way, ensuring you feel empowered in your decision-making process.

Introduction

In an often unpredictable housing market, a fixed-rate mortgage stands as a pillar of stability, offering borrowers a consistent interest rate throughout the life of their loan. This financial structure not only simplifies budgeting but also protects homeowners from the ups and downs of market rates. It’s no wonder that many find it an appealing option.

Yet, with so many choices available, you may wonder if a fixed-rate mortgage is the right fit for your financial goals. We understand how challenging this can be. By exploring the nuances of this loan type, you can empower yourself to navigate your home financing journey with confidence. We’re here to support you every step of the way.

Define Fixed-Rate Mortgage

A level-interest home loan (FRM) is a residential loan that provides a stable interest percentage throughout its duration, typically ranging from 10 to 30 years, which leads us to consider what is a fixed rate. This structure ensures that your monthly payments for principal and interest remain constant, offering you predictability and stability in your financial planning. We know how challenging it can be to navigate the mortgage process, and unlike adjustable-rate loans (ARMs), which can fluctuate based on market conditions, what is a fixed rate provides a reliable payment structure.

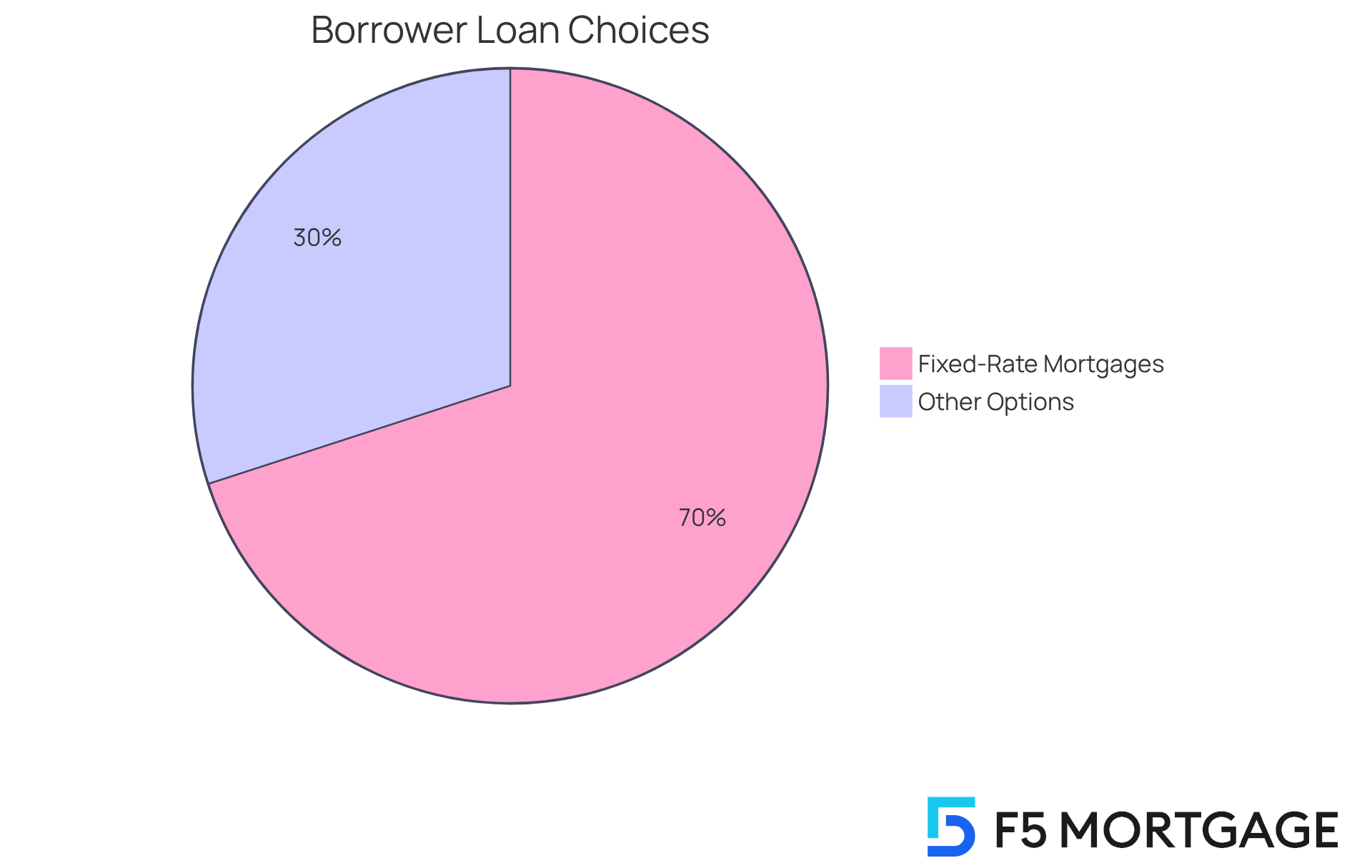

This dependability has made homebuyers increasingly curious about what is a fixed rate option. In fact, around 70% of new loan borrowers chose stable-rate options in 2025. Specialists emphasize that the stability of fixed loans is particularly beneficial in today’s economic climate, where interest rates have recently dropped to a three-year low. This creates a favorable environment for long-term financial strategies.

Imagine securing a stable loan at 6.26%. You can feel confident knowing your , even if market prices increase in the future. This predictability is crucial for families looking to upgrade their homes, as it allows for better budgeting and financial security. We’re here to support you every step of the way, helping you make informed decisions that align with your goals.

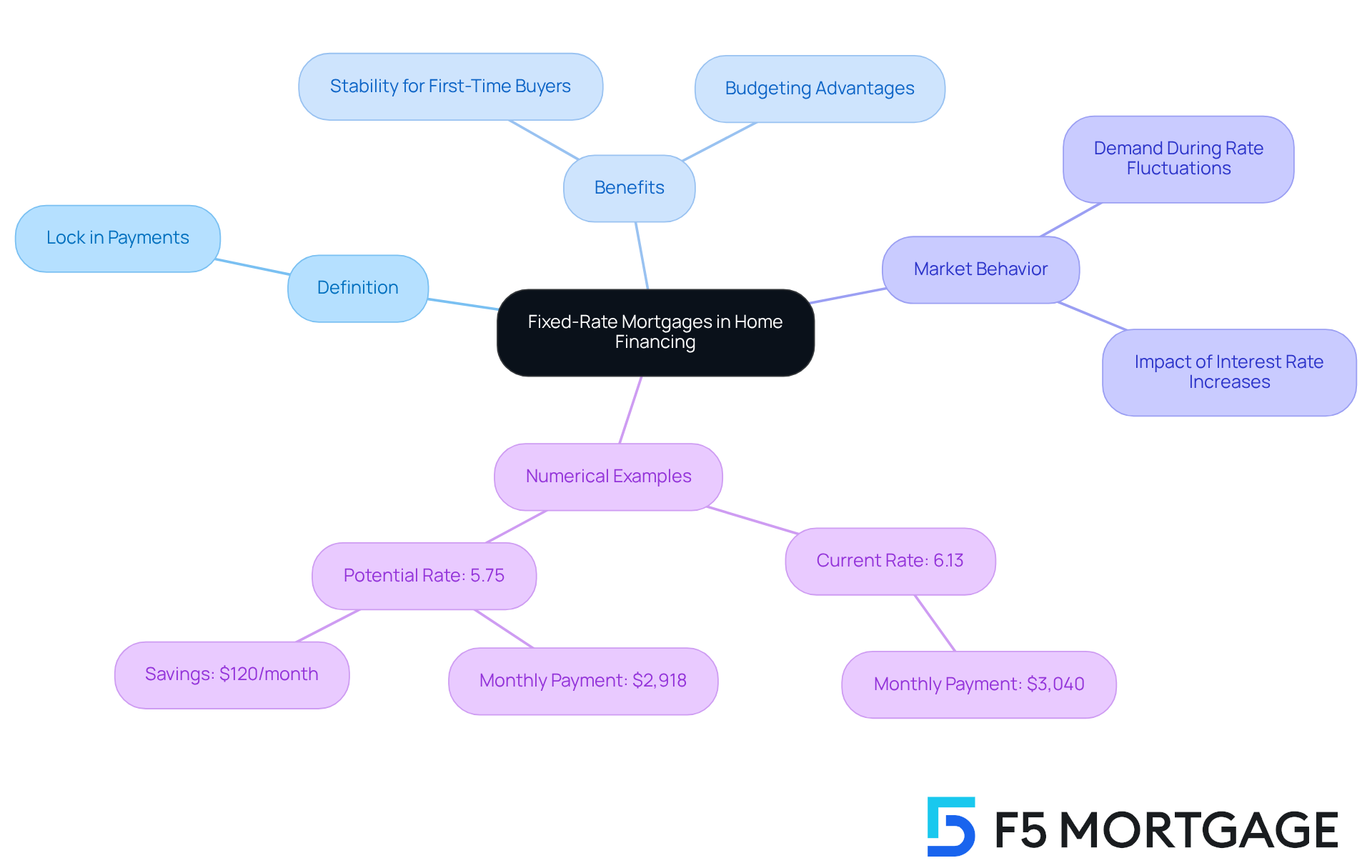

Contextualize Fixed-Rate Mortgages in Home Financing

In home financing, what is a fixed rate? Fixed-rate loans are a vital part of this process in the United States, making up a significant portion of all loan agreements. They are particularly appealing to first-time homebuyers and families seeking long-term financial stability. In a world where interest rates can fluctuate, knowing what is a fixed rate provides the ability to lock in payments for the entire loan term, which offers a remarkable advantage. This stability is invaluable for effective budgeting and financial planning, which is why understanding what is a fixed rate is essential for those looking to buy or refinance their homes, as fixed-rate loans are often the preferred choice.

During times of interest rate fluctuations, the demand for stable loans tends to rise. For example, when rates increase, many potential buyers feel more inclined to understand what is a fixed rate to avoid higher payments down the road. This trend underscores the importance of understanding what is a fixed rate loan as a protective measure against unpredictable market conditions.

For new homeowners, the benefits of stable-interest loans, or what is a fixed rate, are especially clear. They provide a straightforward understanding of what is a fixed rate regarding monthly obligations, which is crucial for those navigating the complexities of homeownership for the first time. With the around 6.13%, a $500,000 loan would result in monthly payments of approximately $3,040. If rates were to drop to 5.75%, this payment could decrease to about $2,918, demonstrating the potential savings and financial relief that stable-interest options can offer.

In summary, understanding what is a fixed rate loan not only enhances financial predictability but also empowers first-time buyers to make informed decisions in an ever-changing economic landscape. We know how challenging this can be, and we’re here to support you every step of the way.

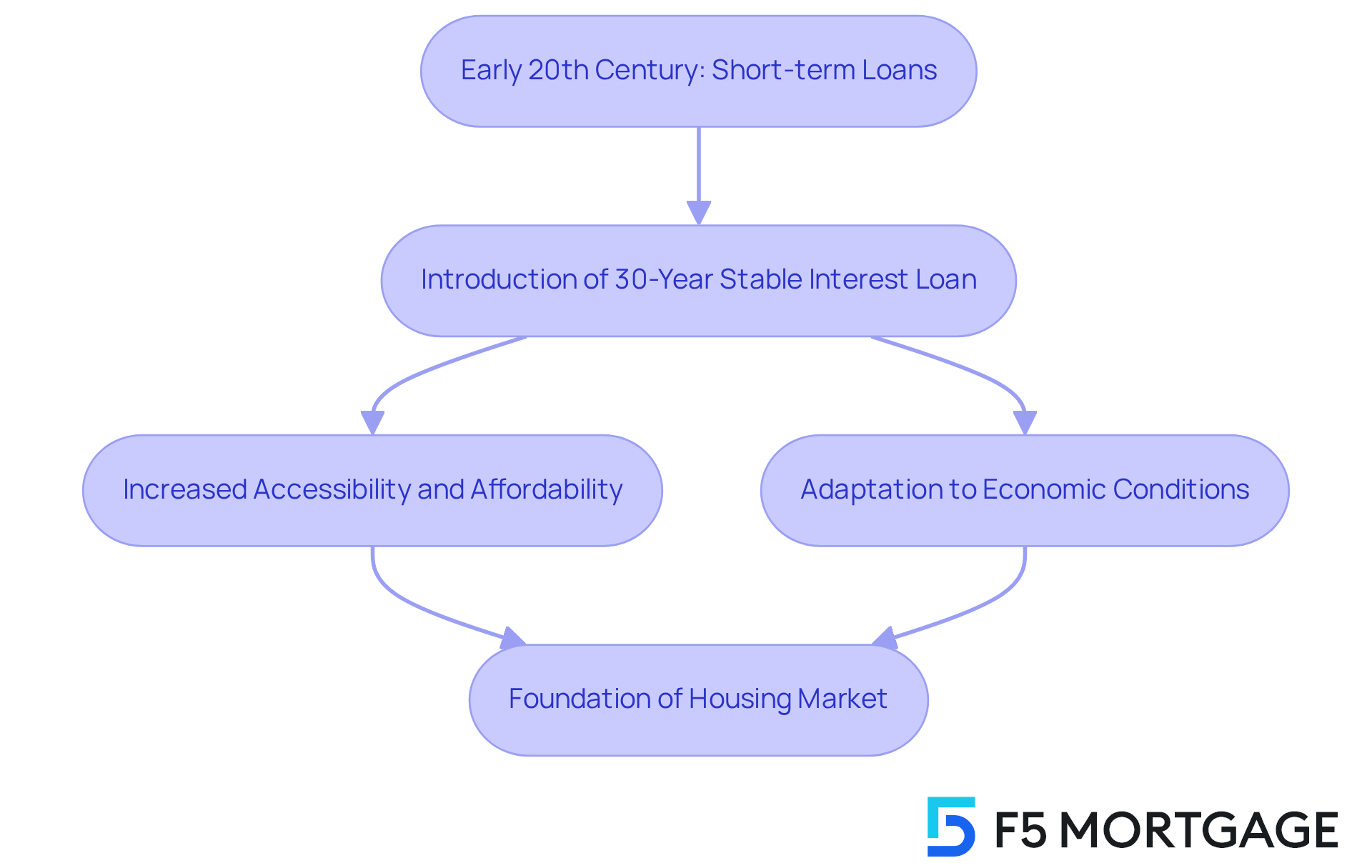

Trace the Evolution of Fixed-Rate Mortgages

The development of stable interest loans has truly been a game changer since their introduction in the early 20th century. Initially, these loans were short-term, often featuring balloon payments, which posed significant risks for borrowers. We understand how daunting this can be. However, the groundbreaking introduction of the 30-year stable interest loan during the Great Depression marked a pivotal shift in home financing.

This innovation allowed families to extend their repayment period while securing a stable interest rate. It made homeownership significantly more accessible and affordable for many. As a result, the 30-year stable interest loan gained widespread acceptance, fundamentally transforming the landscape of home financing.

Over the decades, the concept of what is a fixed rate loan has adapted to various economic conditions and consumer needs. Yet, they have consistently upheld their core principle of providing stability. This lasting reliability has established their position as a foundation of the housing market, contributing to higher homeownership rates across generations. We’re here to as you navigate this important journey.

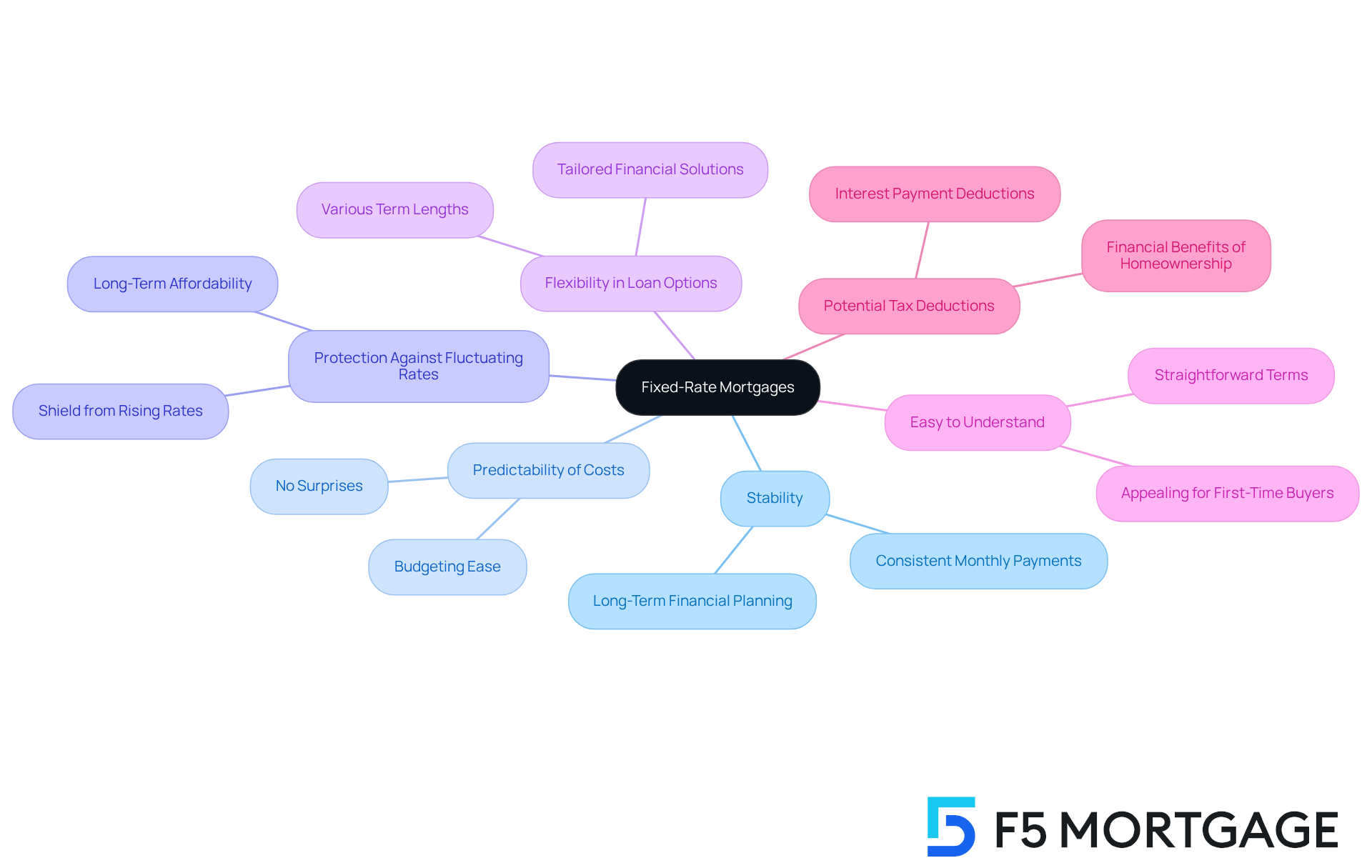

Highlight Key Features and Benefits of Fixed-Rate Mortgages

Families seeking stability often wonder what is a fixed rate, as fixed-rate loans offer essential characteristics and advantages. We know how challenging budgeting can be, and the predictability of monthly costs allows homeowners to plan effectively. A fixed-rate loan provides families with clarity on what is a fixed rate, allowing them to rest assured knowing exactly how much they will owe each month for the duration of the loan.

Moreover, these loans provide protection against fluctuating interest rates, prompting the inquiry of what is a fixed rate. If market rates rise, borrowers with fixed-rate arrangements can better understand what is a fixed rate, as they are shielded from higher payments, ensuring long-term affordability. This security is particularly comforting for families looking to upgrade their homes by understanding what is a fixed rate.

Another significant benefit is the flexibility in loan options, including what is a fixed rate. When considering what is a fixed rate, borrowers can choose from , allowing them to select a duration that aligns with their financial situation and goals. This tailored approach enhances financial independence, making it easier for families to find a loan that suits their budget.

Additionally, understanding what is a fixed rate mortgage—where the terms are straightforward and easy to understand—makes it an appealing choice for first-time homebuyers. We’re here to support you every step of the way in navigating this process. Lastly, with F5 Mortgage, homeowners can enjoy potential tax deductions on interest payments, further amplifying the financial advantages of homeownership.

Conclusion

A fixed-rate mortgage is a cornerstone in home financing, providing you with a stable and predictable payment structure throughout the life of your loan. This type of mortgage not only simplifies financial planning but also offers essential protection against the uncertainties of fluctuating interest rates. By locking in a fixed interest rate, you can confidently navigate your financial commitments, making it an attractive option, especially if you’re a first-time buyer.

We know how challenging the home-buying process can be. Key insights throughout this article highlight the historical evolution of fixed-rate mortgages and their significant role in enhancing homeownership accessibility. The stability they offer allows families like yours to budget effectively, safeguarding you from potential future rate increases. Moreover, the flexibility in loan terms and the straightforward nature of fixed-rate mortgages contribute to their growing popularity among borrowers seeking long-term financial security.

Ultimately, understanding the benefits and features of fixed-rate mortgages empowers you to make informed decisions in your home-buying journey. As the housing market continues to evolve, embracing the predictability of a fixed-rate mortgage can provide peace of mind and a solid foundation for your financial growth. By exploring your options and leveraging the advantages of fixed-rate loans, you can secure a brighter future, ensuring that your dream of homeownership becomes a reality.

Frequently Asked Questions

What is a fixed-rate mortgage (FRM)?

A fixed-rate mortgage (FRM) is a residential loan that maintains a stable interest rate throughout its duration, typically ranging from 10 to 30 years, ensuring that monthly payments for principal and interest remain constant.

How does a fixed-rate mortgage differ from an adjustable-rate mortgage (ARM)?

Unlike adjustable-rate mortgages (ARMs), which can fluctuate based on market conditions, fixed-rate mortgages provide a reliable payment structure, offering predictability and stability in financial planning.

What percentage of new loan borrowers chose fixed-rate options in 2025?

Around 70% of new loan borrowers chose stable-rate options in 2025.

Why is a fixed-rate mortgage considered beneficial in the current economic climate?

The stability of fixed loans is particularly beneficial in today’s economic climate, especially as interest rates have recently dropped to a three-year low, creating a favorable environment for long-term financial strategies.

What is an example of a stable loan interest rate mentioned in the article?

An example of a stable loan interest rate mentioned is 6.26%.

How does predictability in payments benefit families looking to upgrade their homes?

The predictability in payments allows families to budget better and ensures financial security, as they can feel confident that their expenses won’t rise even if market prices increase in the future.