Overview

We know how challenging it can be for homebuyers to manage closing costs. Fortunately, there are several options available to help alleviate this financial burden. Assistance programs and negotiating seller concessions can make a significant difference.

Consider exploring local funding initiatives that may be available in your area. Discussing cost reductions with lenders can also lead to more manageable expenses. Additionally, financing closing costs into the mortgage is a practical solution that many buyers find helpful.

These strategies empower you to successfully complete your home purchase. Remember, we’re here to support you every step of the way as you navigate this process.

Introduction

Navigating the intricacies of closing costs can feel overwhelming for homebuyers. These expenses can accumulate to a significant percentage of a property’s purchase price, raising a critical concern: what if I can’t afford closing costs? We understand how challenging this can be. This article explores various options available to manage these financial obligations, from assistance programs to negotiating seller concessions.

It’s crucial to address these costs, as overlooking them could jeopardize your dream of homeownership. Together, we can explore effective strategies to ease this burden and ensure a smooth transition into your new home.

Define Closing Costs: What They Are and Why They Matter

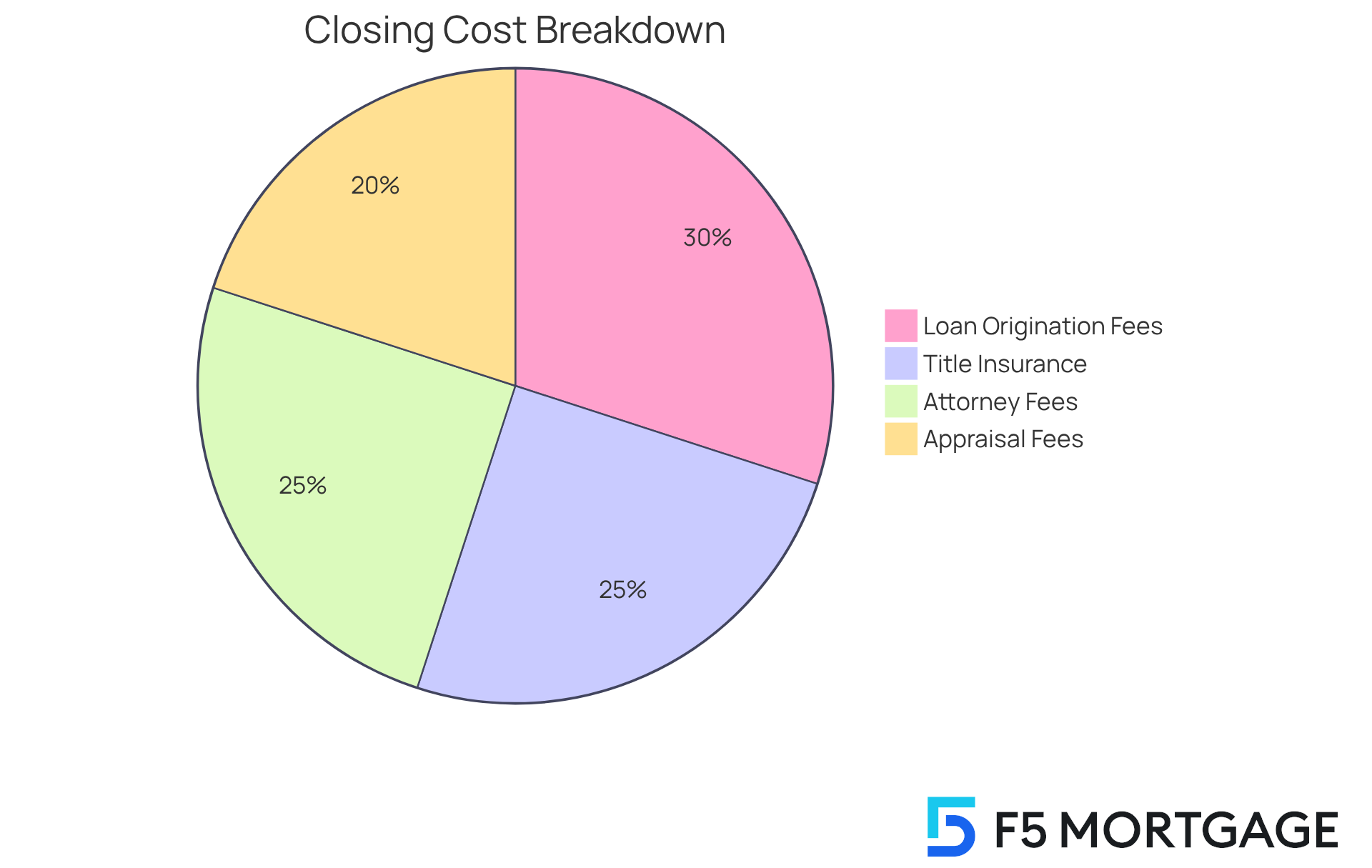

Closing charges represent the various payments and expenditures that homebuyers and sellers encounter during the final stages of a real estate transaction. Typically, these expenses range from 2% to 5% of the home’s purchase price and can include:

- Loan origination fees

- Title insurance

- Appraisal fees

- Attorney fees

We know how challenging this can be, and understanding these costs is crucial for homebuyers, particularly when they wonder what if I can’t afford closing costs, as these signify a significant financial obligation beyond just the down payment.

It’s important to remember that closing expenses can vary based on location, lender, and the specifics of the transaction. This variability makes it essential for buyers to plan accordingly and seek clarity on what these charges entail, especially considering what if I can’t afford closing costs before moving forward with a purchase. When searching for lenders, evaluating rates and conditions is vital, as this can greatly impact your total expenses, including final fees.

At F5 Mortgage, we’re here to support you every step of the way. We offer , making us a valuable option for homebuyers looking to minimize their financial commitments. By understanding your closing charges and exploring your options, you can take confident steps toward your new home.

Explore Options for Managing Closing Costs: Assistance Programs and Seller Concessions

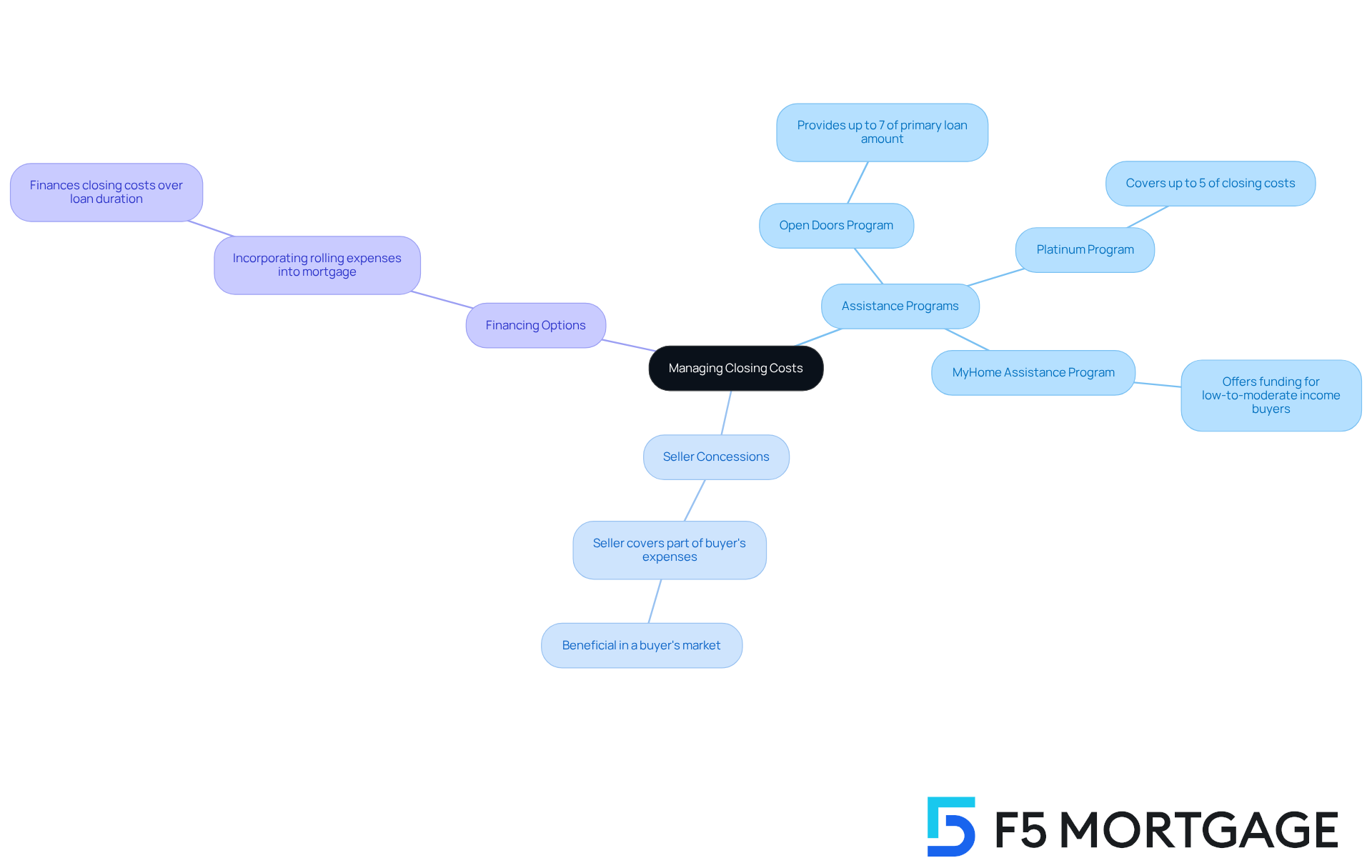

Navigating the expenses associated with finalizing a home purchase can feel overwhelming, leading to questions like what if I can’t afford closing costs, but there are multiple choices available that can significantly ease this financial burden for homebuyers. We understand how challenging this can be, and that’s why support initiatives—often provided by local or municipal authorities—can offer funding or low-interest loans to help with these final costs.

For instance, in California, the Golden State Finance Authority’s Open Doors program provides up to 7% of the primary loan amount for expenses at the end of a transaction, while the Platinum Program covers up to 5%. Moreover, F5 Mortgage is here to guide you through various down payment assistance programs tailored to your location, ensuring you find the best support options available. It’s important to keep in mind that most of these programs are designed for individuals with low-to-moderate incomes, and one concern might be, what if I can’t afford closing costs, as specific income limits that may vary by county impact eligibility.

Another effective strategy is negotiating seller concessions, where the seller agrees to cover a portion of the buyer’s expenses. This can be especially beneficial in a buyer’s market, where sellers might be more willing to negotiate to finalize the sale. Additionally, buyers should consider incorporating rolling expenses into their mortgage to address the question of what if I can’t afford closing costs, allowing them to finance these costs over the loan’s duration and reducing the immediate cash requirement at closing.

With programs like the MyHome Assistance Program in California and similar initiatives in Texas and Florida, homebuyers can unlock opportunities for , and we’re here to support you every step of the way.

Understand the Implications of Inability to Pay Closing Costs: Risks and Consequences

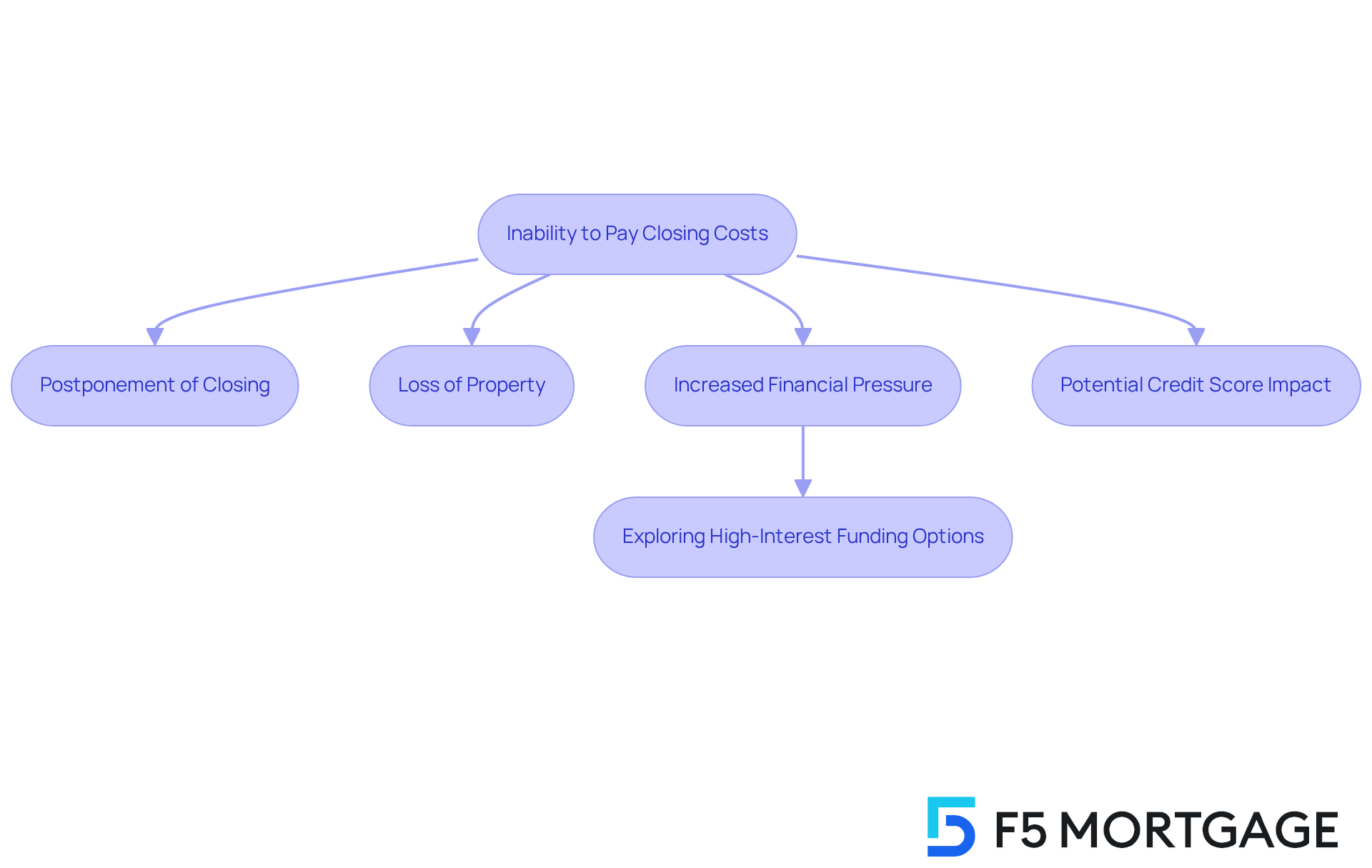

Neglecting to cover settlement expenses can lead to significant consequences for home purchasers. We know how challenging this can be. If a purchaser is unable to manage these expenses, they might wonder what if I can’t afford closing costs, which may postpone or even obstruct the closing procedure, resulting in possible loss of the property and any earnest funds submitted. Furthermore, purchasers may encounter greater financial pressure if they are compelled to explore different funding options at elevated interest rates.

Understanding your is essential. It offers insight into your loan amount, interest rate, and monthly payments, which can assist you in preparing for these expenses. In certain situations, purchasers might need to pull out from the transaction entirely, which can adversely affect their credit score and future borrowing ability.

Consequently, it is crucial for potential homeowners to evaluate their financial circumstances thoroughly, particularly in terms of what if I can’t afford closing costs. Consider all available alternatives, including negotiating with sellers for repairs or enhancements, to ensure you can fulfill your payment obligations. Remember, we’re here to support you every step of the way.

Additional Strategies for Reducing Closing Costs

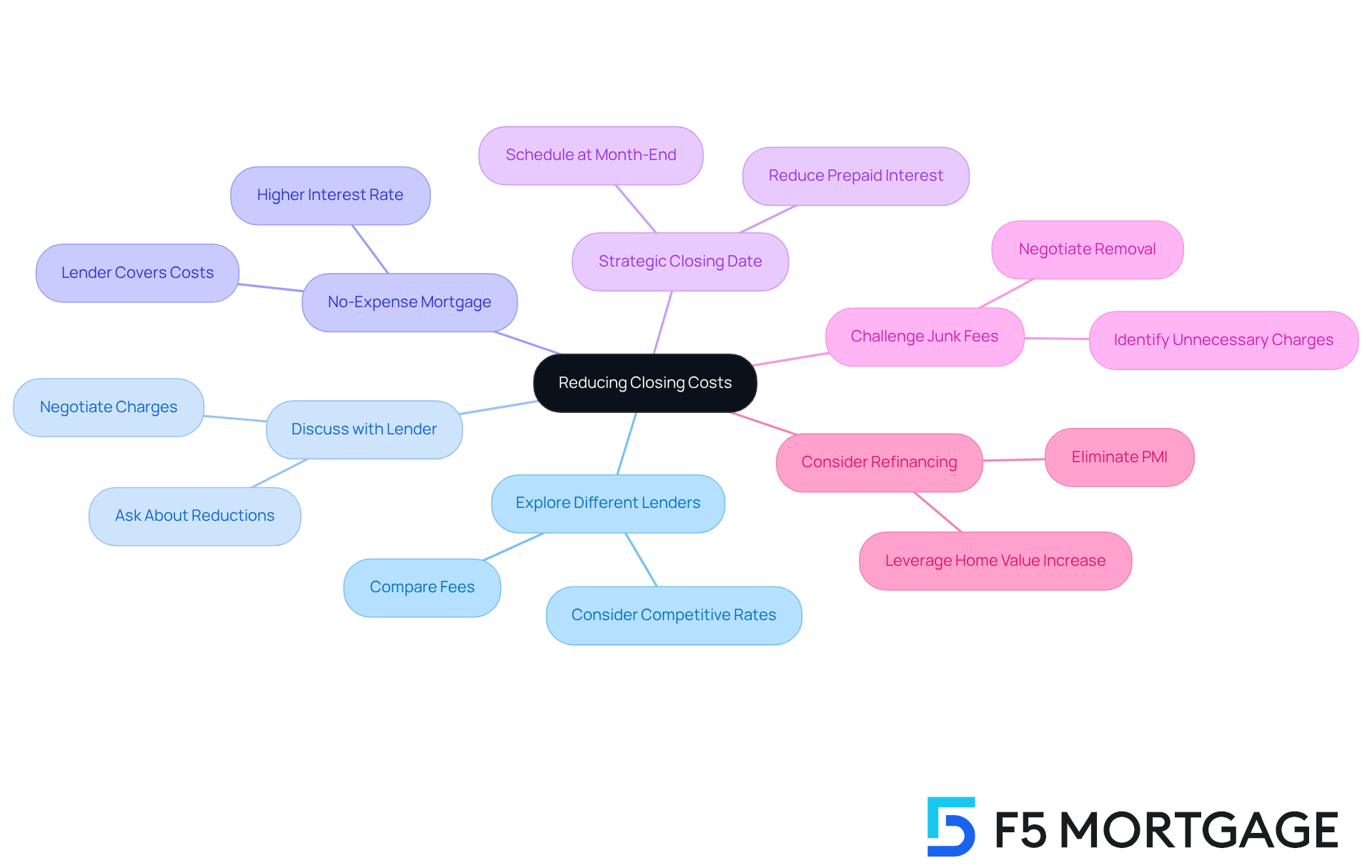

We understand that navigating settlement costs can be challenging, and you might be wondering what if I can’t afford closing costs, but there are several strategies you can employ to lower your expenses effectively. One of the most impactful methods is to explore different lenders and compare their fees, as these can vary significantly between institutions. For instance, consider F5 Mortgage, which provides competitive rates and personalized service tailored to your needs.

It’s also beneficial to have an open discussion with your lender about what if I can’t afford closing costs and how to reduce specific charges. You might even explore a , considering what if I can’t afford closing costs, where the lender covers the costs in exchange for a slightly higher interest rate. Additionally, timing your closing date strategically can make a difference; for example, scheduling it at the end of the month could reduce the total amount of prepaid interest due at settlement.

Moreover, be vigilant about potential ‘junk fees’ that may appear in your closing cost estimates. Don’t hesitate to challenge any unnecessary charges that could inflate your costs. If you purchased your home with a conventional loan and put down less than 20%, refinancing could be a wise choice. With the significant appreciation of homes in California, you may be able to leverage your home’s increased value to achieve a new, lower loan-to-value (LTV) ratio, which can lead to substantial savings by eliminating private mortgage insurance (PMI).

We’re here to support you every step of the way as you navigate these options and make informed decisions for your financial future.

Conclusion

Understanding and managing closing costs is a vital part of the home-buying journey, especially for those who may feel anxious about affordability. These expenses, which can range from 2% to 5% of the home’s purchase price, include various essential fees for completing a real estate transaction. By recognizing the significance of these costs and exploring available options, potential homeowners can feel more empowered to navigate their financial commitments.

Key strategies for addressing closing costs start with:

- Seeking financial assistance programs

- Negotiating seller concessions

- Exploring different lender options

Programs like the Golden State Finance Authority’s Open Doors program and MyHome Assistance Program offer valuable resources for eligible homebuyers. By understanding these alternatives and engaging in open discussions with lenders, buyers can significantly lighten their financial burdens. Moreover, being proactive in identifying and challenging unnecessary fees can lead to meaningful savings.

Ultimately, taking the time to assess financial circumstances and explore all available resources is crucial for anyone wondering about their ability to afford closing costs. The journey to homeownership should not be overshadowed by financial uncertainties. By leveraging assistance programs, negotiating effectively, and staying informed about potential savings, aspiring homeowners can move forward confidently in their pursuit of a new home.

Frequently Asked Questions

What are closing costs in a real estate transaction?

Closing costs are various payments and expenditures that homebuyers and sellers encounter during the final stages of a real estate transaction. They typically range from 2% to 5% of the home’s purchase price.

What types of expenses are included in closing costs?

Closing costs can include loan origination fees, title insurance, appraisal fees, and attorney fees.

Why is it important for homebuyers to understand closing costs?

Understanding closing costs is crucial for homebuyers because these expenses represent a significant financial obligation beyond just the down payment.

How do closing costs vary?

Closing costs can vary based on location, lender, and the specifics of the transaction, making it essential for buyers to plan accordingly.

What should buyers do if they are concerned about affording closing costs?

Buyers should seek clarity on what the closing charges entail and explore their options with lenders to evaluate rates and conditions, which can impact total expenses.

How can F5 Mortgage assist homebuyers with closing costs?

F5 Mortgage offers competitive rates and personalized service, helping homebuyers minimize their financial commitments and understand their closing charges.