Overview

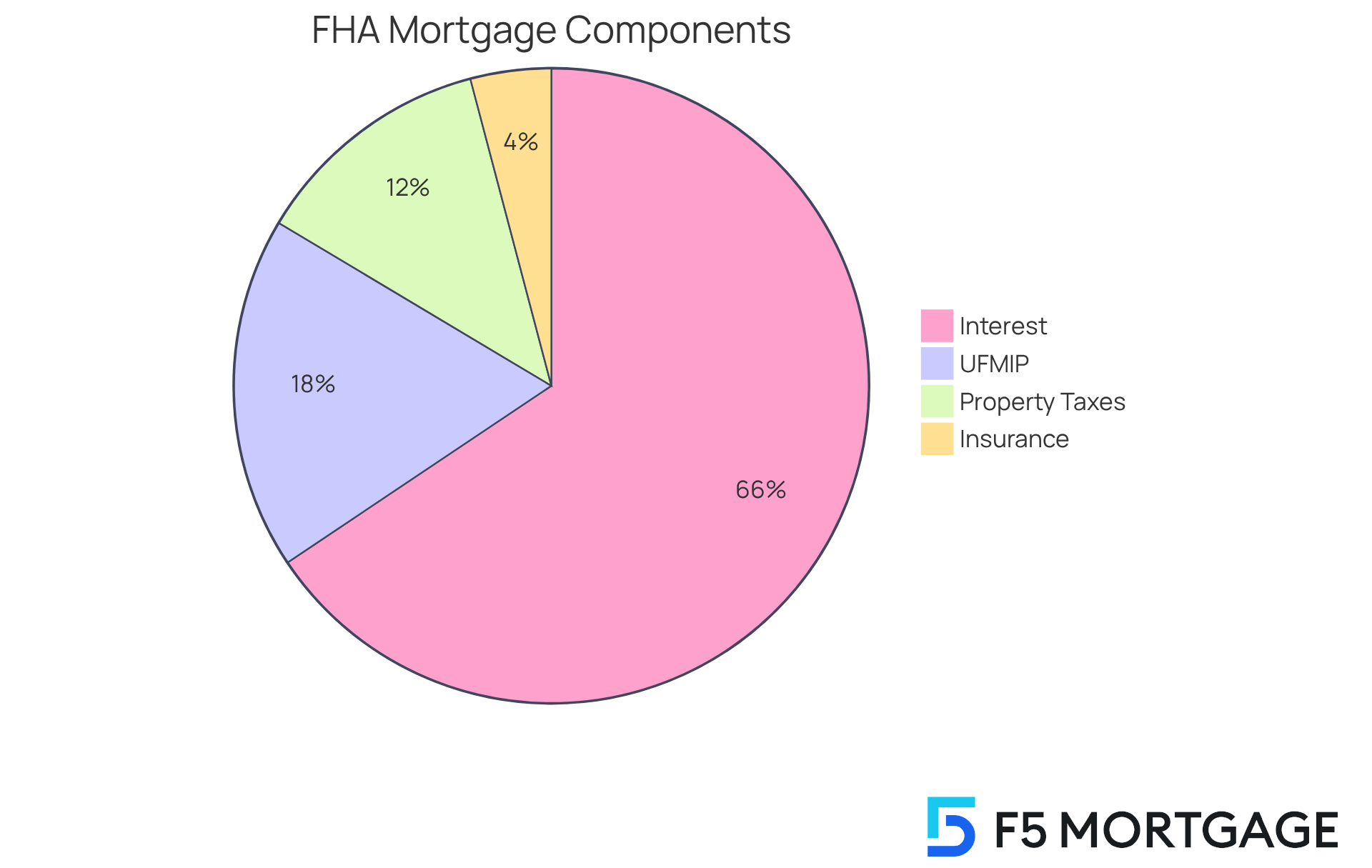

Navigating the complexities of mortgage financing can be daunting, especially when it comes to understanding the Upfront Mortgage Insurance Premium (UFMIP). We know how challenging this can be, and we’re here to support you every step of the way. UFMIP, currently set at 1.75% of the loan amount, serves as a protective measure for lenders against borrower defaults. However, it’s important to recognize how this impacts you as a borrower.

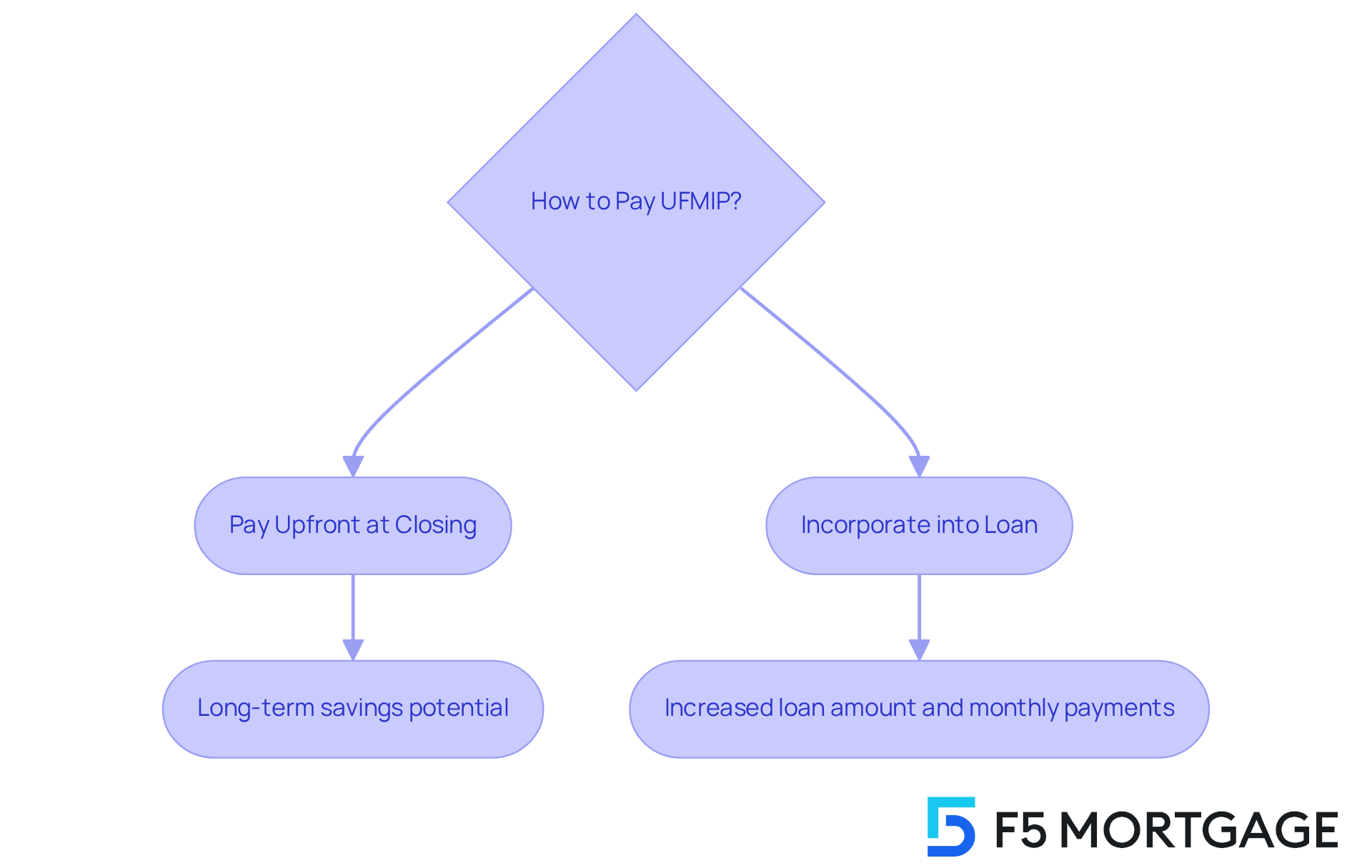

The good news is that UFMIP offers various payment strategies, allowing you to choose what best fits your financial situation. You can opt to pay it upfront or roll it into the loan. Each choice can significantly affect your overall financial planning and monthly payments. By understanding these options, you can make a more informed decision that aligns with your needs.

We encourage you to explore these payment strategies further, as they can empower you to take control of your mortgage journey. Remember, you’re not alone in this process, and there are resources available to help you make the best choice for your family.

Introduction

Navigating the FHA mortgage landscape can feel overwhelming, especially when it comes to understanding the intricacies of Upfront Mortgage Insurance Premium (UFMIP). We know how challenging this can be, and that’s why it’s essential to pay attention to this often-overlooked fee, set at 1.75% of the loan amount. This fee can significantly shape your financial journey, influencing both your initial costs and long-term payments.

So, what’s the best approach? Should you pay the UFMIP upfront or roll the cost into your mortgage? By exploring the purpose, implications, and various payment options of UFMIP, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way, helping to ease your path to homeownership.

Define Upfront Mortgage Insurance Premium (UFMIP)

The ufmip, or Upfront Mortgage Insurance Premium, is an important fee that many individuals encounter when securing an FHA mortgage. Currently set at 1.75% of the principal amount, this fee can significantly impact your financial planning. For instance, on a $300,000 mortgage, the upfront mortgage insurance premium would total $5,250. This premium acts as a safeguard for lenders against borrower defaults, providing a financial cushion that helps mitigate potential losses.

Understanding how to is crucial. Borrowers have the option to pay the upfront mortgage insurance premium in cash at closing or to roll it into the total loan amount. This choice can influence the overall cost of the mortgage over time. We know how challenging this can be, and it’s essential to consider how this insurance affects not only your initial expenses but also your monthly payments and long-term financial strategies.

For families thinking about cash-out refinancing to tap into home equity for improvements or other expenses, recognizing the role of this insurance in your overall financial strategy is vital. Many individuals opt to include the ufmip in their financing, which allows them to manage their initial expenses more effectively while still benefiting from FHA funding.

Additionally, it’s important for families to be aware of FHA loan limits, especially when considering multi-unit properties. These limits can influence your choices regarding payment options, and understanding them can empower you to make informed decisions. We’re here to support you every step of the way as you navigate this process.

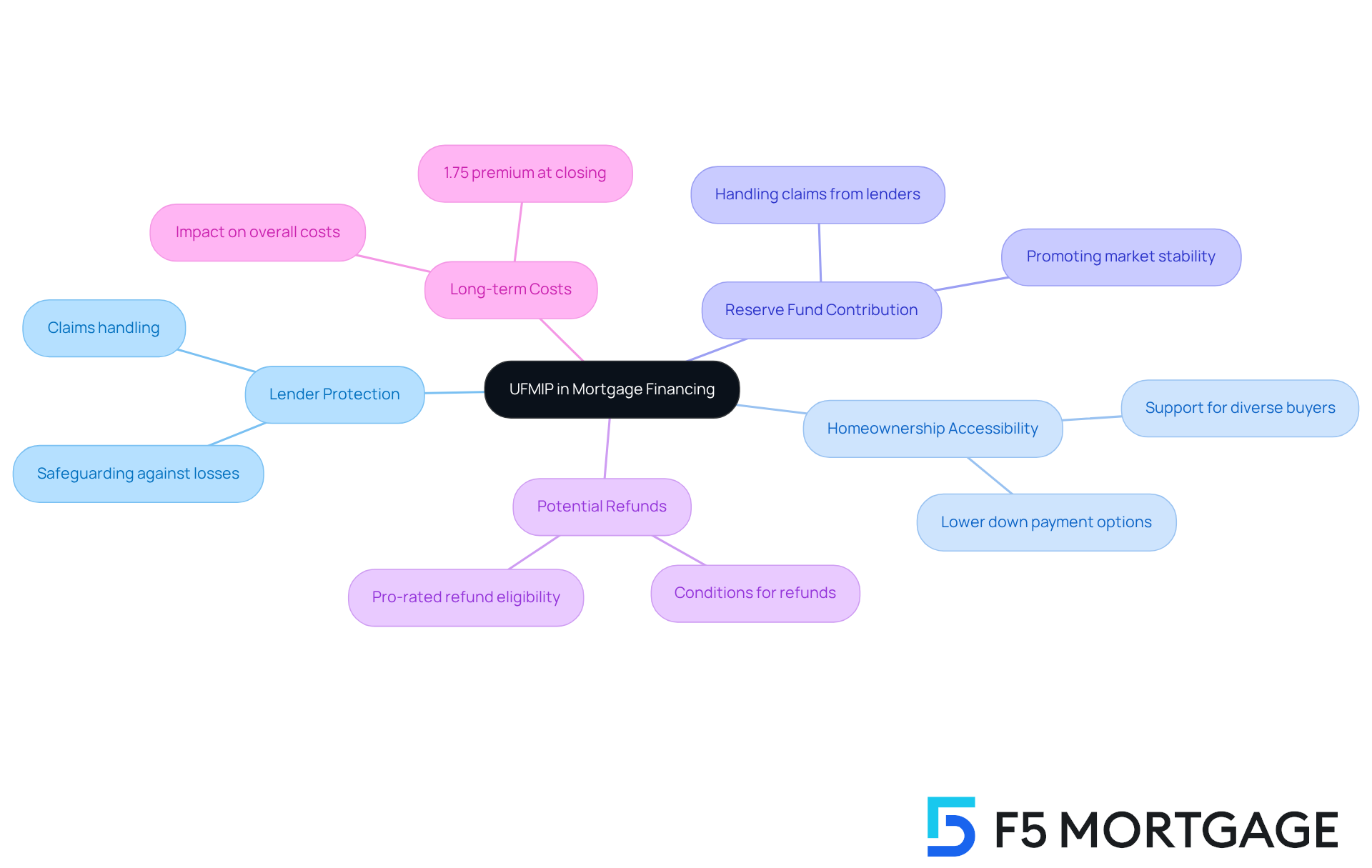

Explain the Purpose of UFMIP in Mortgage Financing

The ufmip is crucial for safeguarding lenders against potential losses from borrower defaults. We understand how daunting the mortgage process can be, and by mandating this upfront premium, the Federal Housing Administration (FHA) introduces the ufmip to open doors to . This change makes homeownership more attainable for many families, easing the journey into your new home.

This program also contributes to a reserve fund, ufmip, which is designed to handle claims from lenders when individuals face difficulties meeting their mortgage obligations. This protective mechanism not only secures lenders but also promotes stability in the housing market, encouraging lending through ufmip to a diverse range of buyers.

For instance, if you sell your home within the first five to seven years and meet certain criteria, you may qualify for a pro-rated refund on your mortgage insurance premium. This potential refund can significantly alleviate financial pressure, making it easier for families to enter the housing market. Moreover, if your down payment is less than 10%, the ufmip remains necessary for the duration of your FHA mortgage, highlighting the long-term impact of this premium on your overall costs.

As of 2025, the ufmip is approximately 1.75% of the total loan amount, payable at closing. Understanding this financial aspect is key for those considering a loan. By providing lenders with a safety net, this program fosters a more robust lending environment, ultimately benefiting both lenders and borrowers in the context of ufmip. Remember, we’re here to support you every step of the way.

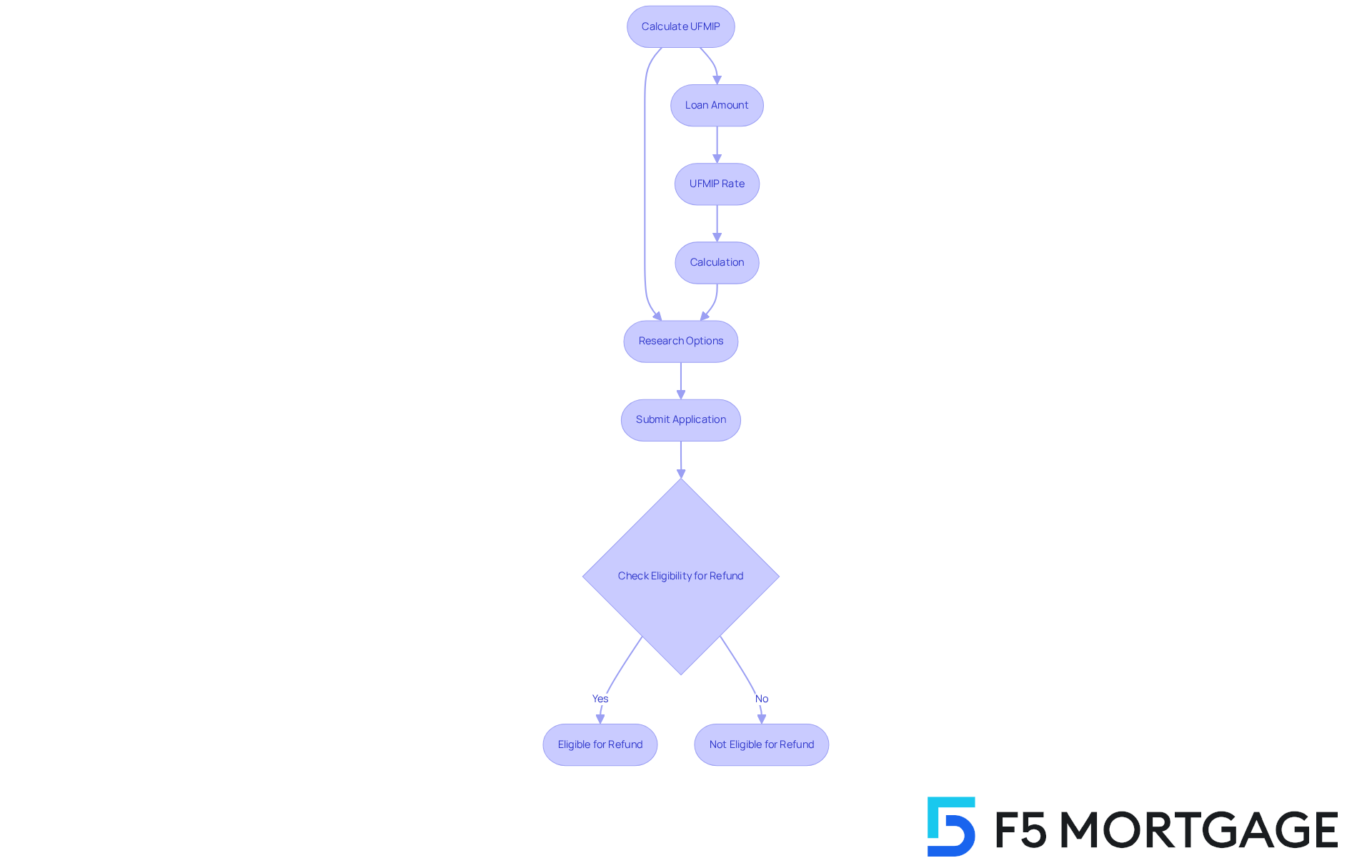

Calculate UFMIP: Understanding the Cost Implications

Calculating the initial mortgage insurance premium can feel overwhelming, but it’s a straightforward process. To determine the fee, simply multiply the base borrowing sum by 1.75%. For instance, if you’re securing a loan of $400,000, the calculation would look like this:

- Loan Amount: $400,000

- UFMIP Rate: 1.75% (or 0.0175)

- Calculation: $400,000 x 0.0175 = $7,000

Therefore, the UFMIP for a $400,000 loan amounts to $7,000. Understanding this expense is crucial, as it can significantly influence your overall borrowing amount and monthly installments. If the upfront mortgage insurance premium is included in your mortgage, it will raise the principal amount, leading to larger monthly payments throughout the financing period. This is especially important for individuals in 2025, as the impact of UFMIP expenses can vary according to the size of the mortgage and your personal financial situation.

When considering refinancing, it’s essential to research your options and submit an application with your lender. If you’re refinancing into another FHA product within three years, you may qualify for a refund of your upfront mortgage insurance premium (MIP). To be eligible for this refund, you must have a current FHA mortgage that closed less than three years ago and be up-to-date on your mortgage payments. This refund can help cover the mortgage insurance premium of your new FHA refinance loan, making the refinancing process more economical.

Given the current competitive mortgage rates in Colorado, now is a wonderful time to explore refinancing options with F5 Mortgage. We understand how challenging this can be, and comprehending both the costs associated with the (UFMIP) and the possibility of MIP refunds is essential for those seeking to enhance their mortgage financing and achieve their financial goals. We’re here to support you every step of the way.

Outline UFMIP Payment Options and Strategies

When it comes to paying the ufmip, we understand that borrowers face important decisions. Here are a couple of options to consider:

- Paying Upfront at Closing: This option allows you to pay the upfront mortgage insurance premium in cash at the time of closing. While this requires a larger initial investment, it can lead to by reducing your overall debt and the interest paid throughout the life of the loan.

- Incorporating the Mortgage Insurance Premium into the Loan: Alternatively, you can choose to roll the premium into your mortgage. This means the fee is included in the total financing amount, making initial expenses more manageable. However, keep in mind that this option increases your overall loan amount, resulting in higher monthly payments and more interest over time.

Strategies: We know how challenging this can be, so take a moment to consider your financial situation carefully. If you have the funds available and can manage to pay the upfront mortgage insurance, it might be beneficial in the long term. On the other hand, if cash flow is a concern, financing the ufmip could offer immediate relief. Just be mindful of the long-term implications on your mortgage costs. We’re here to support you every step of the way.

Conclusion

Understanding the Upfront Mortgage Insurance Premium (UFMIP) is crucial for anyone navigating the FHA mortgage landscape. We know how challenging this can be, and this fee, currently at 1.75% of the loan amount, plays a pivotal role in safeguarding lenders while making homeownership more accessible for borrowers. By comprehending the implications of UFMIP, you can better prepare for your financial commitments and make informed decisions regarding your mortgage options.

Throughout this discussion, we highlighted key insights, including:

- The significance of UFMIP in protecting lenders against defaults

- The various payment strategies available

- The potential for refunds under certain conditions

The ability to either pay the UFMIP upfront or roll it into the mortgage amount offers flexibility, yet each choice carries its own long-term financial consequences. Additionally, understanding FHA loan limits and how they relate to UFMIP can empower you to make sound financial decisions.

Ultimately, grasping the intricacies of UFMIP is not just about managing immediate costs; it is about positioning yourself for long-term financial success in the housing market. As the landscape of mortgage financing continues to evolve, staying informed about UFMIP and its implications can lead to more strategic financial planning. For those considering an FHA mortgage, taking the time to evaluate payment options and understanding the broader impact of UFMIP can pave the way for a smoother path to homeownership.

Frequently Asked Questions

What is Upfront Mortgage Insurance Premium (UFMIP)?

UFMIP, or Upfront Mortgage Insurance Premium, is a fee associated with securing an FHA mortgage. It is currently set at 1.75% of the principal amount of the mortgage.

How much would UFMIP cost on a $300,000 mortgage?

On a $300,000 mortgage, the UFMIP would total $5,250.

Why is UFMIP charged?

UFMIP acts as a safeguard for lenders against borrower defaults, providing a financial cushion that helps mitigate potential losses.

How can borrowers manage the UFMIP cost?

Borrowers can choose to pay the UFMIP in cash at closing or roll it into the total loan amount, which can influence the overall cost of the mortgage over time.

How does UFMIP affect monthly payments and financial planning?

UFMIP impacts initial expenses, monthly payments, and long-term financial strategies, making it crucial for borrowers to consider when planning their finances.

What should families know about cash-out refinancing and UFMIP?

Families considering cash-out refinancing to access home equity should recognize the role of UFMIP in their overall financial strategy, as many opt to include it in their financing to manage initial expenses effectively.

Why are FHA loan limits important?

FHA loan limits are important because they can influence payment options, especially for families considering multi-unit properties, and understanding these limits can empower informed decision-making.