Overview

The VA mortgage loan calculator is an invaluable resource for veterans and active-duty service members, guiding them in estimating their monthly payments and overall financial obligations when using VA financing for home upgrades.

We understand how challenging this can be, and this tool offers clarity by allowing users to input key financial details. By doing so, they can uncover potential costs, empowering them to make informed decisions.

This simplification of the home purchasing process ultimately fosters successful homeownership experiences, and we’re here to support you every step of the way.

Introduction

Embarking on the journey to homeownership can feel overwhelming, especially for veterans and active-duty service members who are navigating the complexities of financing. We understand how challenging this can be, and that’s why a VA mortgage loan calculator becomes an essential ally in this process. This powerful tool provides clarity on monthly payments and overall costs, helping you gain a deeper understanding of your financial commitments.

Imagine exploring various scenarios that impact your budget with ease. By leveraging this calculator, you can simplify the buying process and maximize the benefits of VA financing. Let’s take this journey together, ensuring you feel supported every step of the way.

Define VA Mortgage Loan Calculator

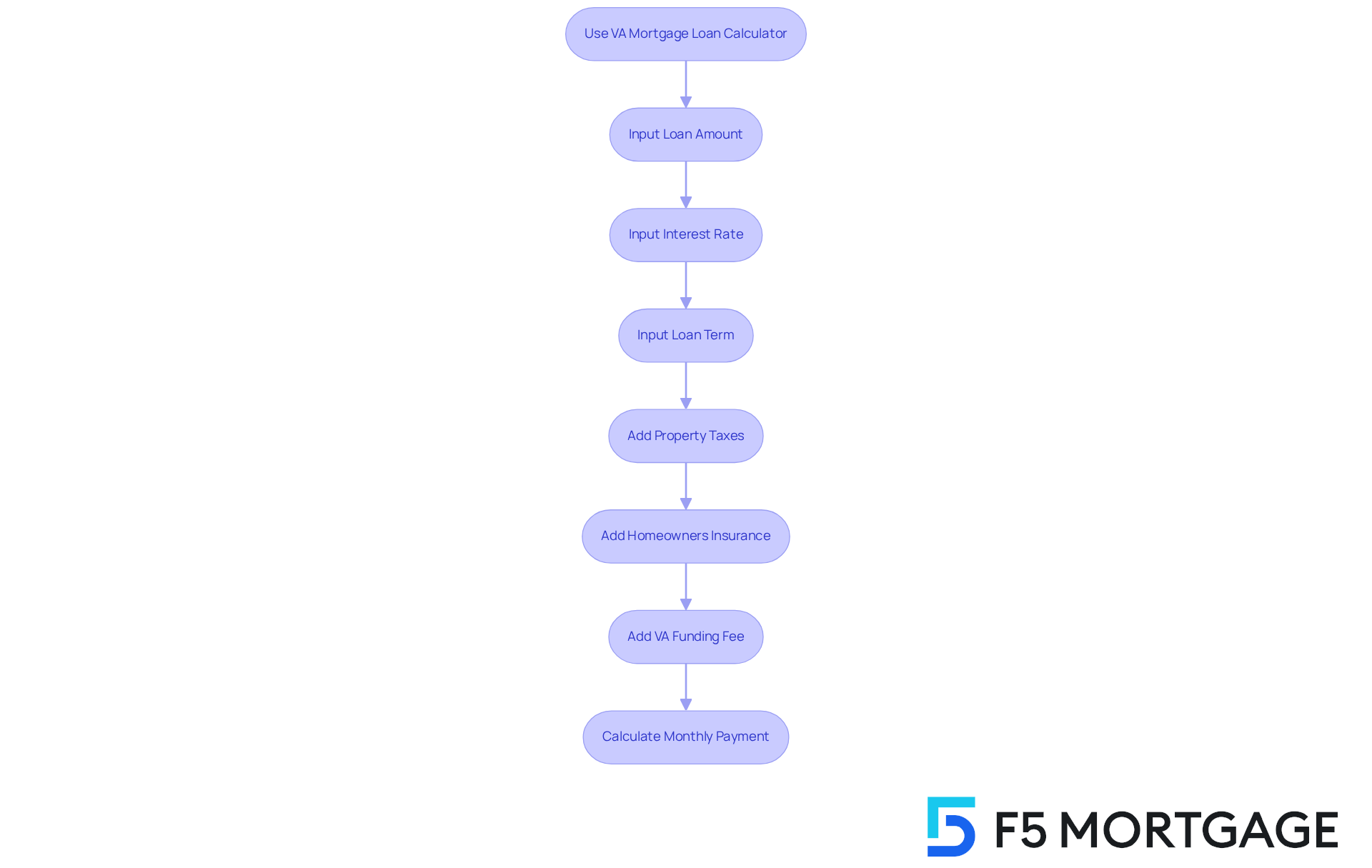

A VA financing estimator is a valuable financial tool designed specifically for veterans and active-duty service members. It helps them approximate their monthly payments when utilizing a VA program. By considering various elements—such as the amount borrowed, interest rate, loan term, property taxes, homeowners insurance, and the VA funding fee—users can use a VA mortgage loan calculator to gain crucial insights into their potential financial obligations. This understanding facilitates better budgeting for homeownership, which we know can be a challenging journey.

Current usage statistics reveal that VA mortgage financing tools are gaining popularity among veterans. Many are turning to these resources to manage the complexities of home funding. For example, imagine a veteran purchasing a home priced at $500,000. This scenario results in a loan amount of $510,750 after including a VA funding fee of $10,750. With this estimator, they can clearly see their , which may total around $3,159.74.

Real-world examples highlight the effectiveness of these tools. Veterans have shared their experiences using them to compare different financing scenarios, assess how varying interest rates impact their budgets, and understand the influence of additional costs like property taxes and insurance. Experts emphasize that the use of a VA mortgage loan calculator not only simplifies the home purchasing process but also empowers veterans to make informed financial decisions. This ultimately leads to more successful homeownership experiences.

By grasping their possible monthly expenses and overall loan costs, veterans can approach home buying with enhanced confidence. Understanding the effects of various loan term lengths is also essential. A longer term can help maintain lower monthly payments, freeing up cash for home improvement projects or savings. Conversely, a shorter term allows homeowners to settle their loans sooner, incur less interest, and build equity more quickly in their homes. This information is crucial for families aiming to enhance their residences and prepare for loan approval with F5 Mortgage. We’re here to support you every step of the way.

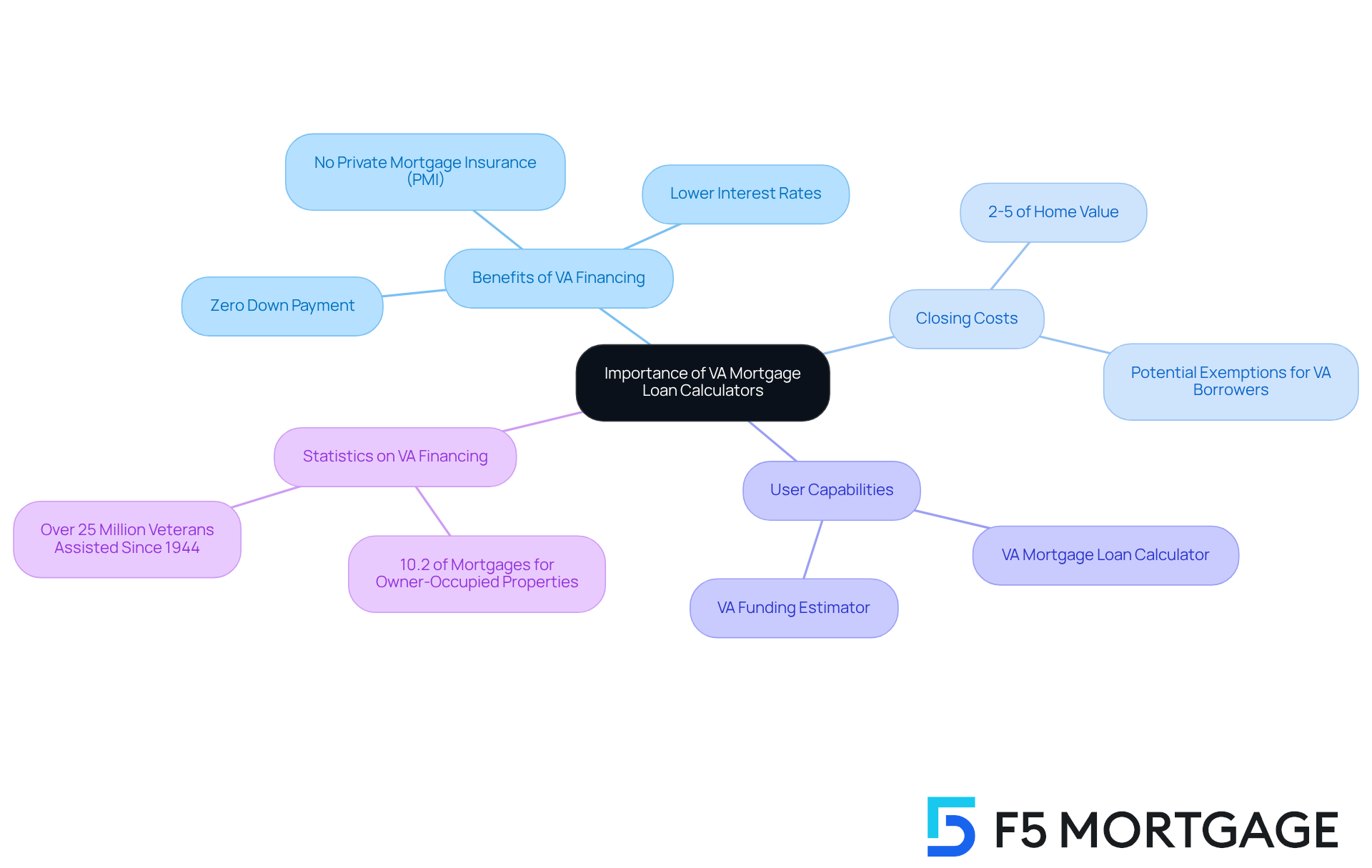

Contextualize the Importance of VA Mortgage Loan Calculators

VA financing tools serve as vital supports for veterans and active-duty service members as they navigate the complexities of home funding. These resources highlight the unique benefits of VA financing, such as the absence of a down payment and the elimination of private insurance. This clarity allows users to understand how these advantages impact their monthly expenses.

It’s essential to consider closing costs, which can range from 2% to 5% of the home’s value. These costs can significantly influence overall affordability. By utilizing a VA mortgage loan calculator, prospective homebuyers can assess their financial situation, explore various financing options, and feel more confident in their purchasing decisions.

For example, a first-time buyer using a VA funding estimator can quickly see how a zero down payment affects their monthly budget compared to traditional mortgages that require substantial initial costs. A 3% down payment on a $200,000 home, for instance, would amount to $6,000. Expert insights reveal that these tools not only simplify the decision-making process but also empower veterans to make informed choices about their home financing.

In fact, more than 10% of all financing for one- to four-family owner-occupied properties is utilized by veterans through VA programs for home purchases. This statistic underscores the in fostering homeownership among military families. We know how challenging this can be, and we’re here to support you every step of the way.

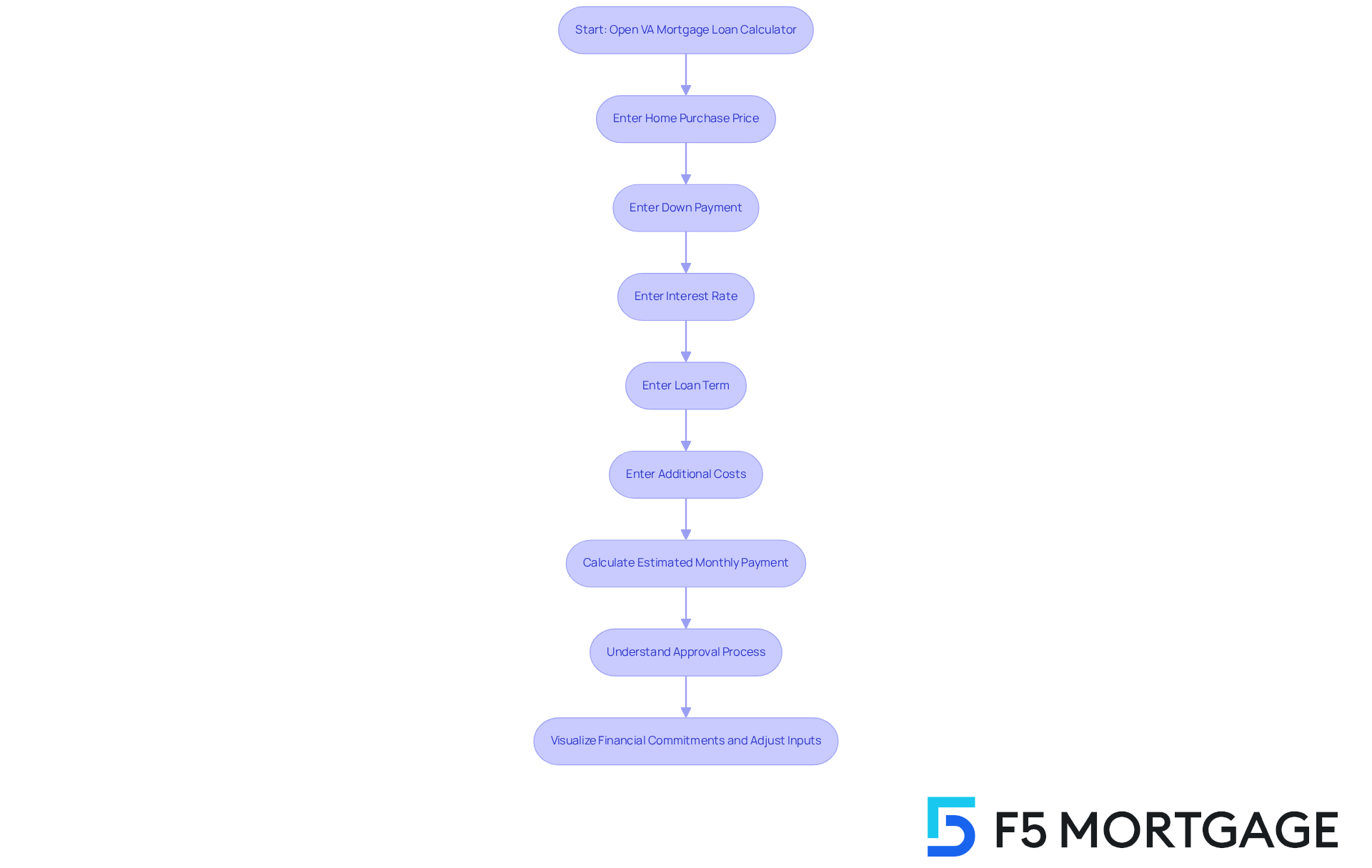

Explain How VA Mortgage Loan Calculators Work

The VA mortgage loan calculator is an essential tool that helps you assess your monthly costs and understand your financial responsibilities. We know how challenging it can be to navigate these waters. Typically, the VA mortgage loan calculator requires you to input key financial details, including:

- The home’s purchase price

- Any down payment

- The interest rate

- The loan term

- Additional costs like property taxes and homeowners insurance

Once you enter this information, the calculator processes the data to provide an estimated monthly payment.

Understanding the approval process is crucial when utilizing the VA mortgage loan calculator. Approval means that a lender has reviewed your financial information and determined that you are a suitable candidate for a mortgage. This process usually gives you an estimate of your borrowing capacity, interest rate, and potential monthly payment, which can vary among lenders. You might hear terms like ‘preapproval‘ or ‘prequalification,’ and knowing your approval status can empower you to make more informed estimates with the tool.

Advanced calculators, like the VA mortgage loan calculator, offer even more features, providing a thorough analysis of total interest paid over the life of the loan, the impact of the VA funding fee—which typically ranges from 0.5% to 3.3%—and amortization plans. This capability allows you to visualize your financial commitments clearly. You can experiment with different scenarios by adjusting inputs, such as increasing your down payment or changing the interest rate, to see how these adjustments affect your .

Many users share positive experiences with VA financing tools, highlighting their user-friendly nature and the valuable insights they provide. On average, individuals spend about 10 to 15 minutes using these tools, which is just the right amount of time to explore various scenarios and gain a clearer understanding of their potential financial obligations. This interactive approach not only supports financial planning but also boosts your confidence in making informed decisions about home ownership.

Identify Key Features of VA Mortgage Loan Calculators

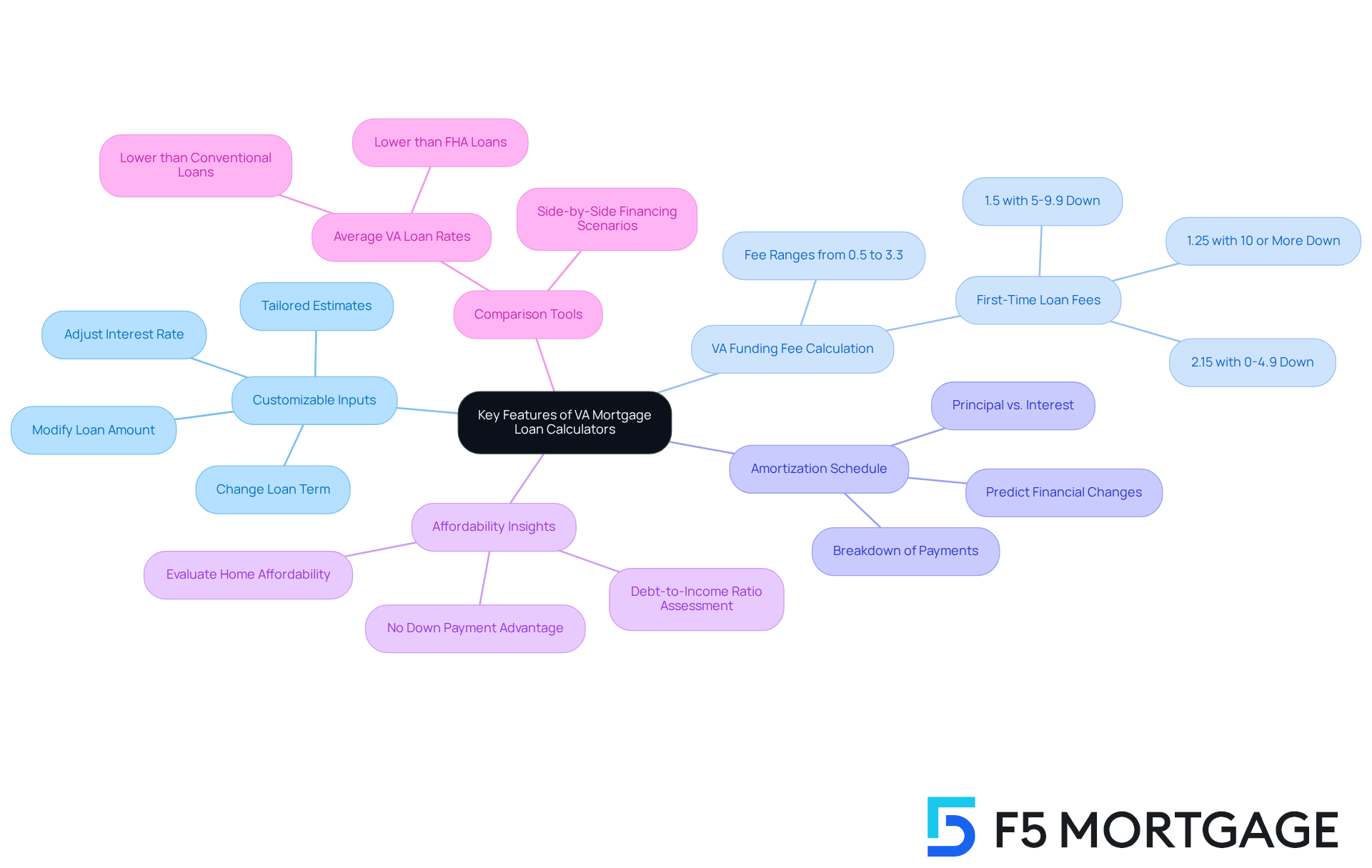

Navigating the world of [VA mortgage loan calculators](https://f5mortgage.com/7-benefits-of-va-streamline-refinance-for-veterans) can feel overwhelming, but understanding their key features can empower you in the process.

- Customizable Inputs: You have the ability to modify variables such as loan amount, interest rate, and loan term. This flexibility allows you to see how adjustments affect your monthly payments. It’s essential for tailoring estimates to your personal financial circumstances, reflecting F5 Mortgage’s commitment to providing customizable financing options.

- VA Funding Fee Calculation: Many tools automatically include the VA funding fee, which can vary from 0.5% to 3.3% based on your down payment and credit type. For first-time VA purchase financing, the funding fee is 2.15% with 0%-4.9% down, 1.5% with 5%-9.9%, and 1.25% with 10% or more. This inclusion helps you gain a clearer understanding of total costs when utilizing the VA mortgage loan calculator, ensuring you are well-informed.

- Amortization Schedule: Some calculators provide comprehensive amortization schedules, showing how your contributions are distributed between principal and interest throughout the loan’s term. This feature can assist you in predicting changes in your financial arrangement over time.

- Affordability Insights: Advanced calculators may evaluate how much home you can afford based on your income and debt-to-income ratio. This empowers you to make sound financial decisions. Notably, VA financing often requires no down payment, which is a significant advantage for many borrowers, especially first-time home purchasers.

- Comparison Tools: You can compare different financing scenarios side by side, helping you make informed choices about your financial options. Understanding that are typically lower than those for conventional and FHA loans can further guide you in your decision-making process.

These features collectively empower veterans and service members to confidently navigate the mortgage landscape by utilizing a VA mortgage loan calculator. F5 Mortgage is here to support you every step of the way, providing full-service assistance and ensuring tailored financing solutions that meet your unique needs.

Conclusion

Understanding the VA mortgage loan calculator is essential for veterans and active-duty service members who want to make informed decisions about home financing. This powerful tool not only simplifies the home buying process but also enhances financial literacy. It enables users to accurately estimate their monthly payments and overall loan costs. By leveraging the unique benefits of VA financing—such as no down payments and the absence of private insurance—veterans can navigate their homeownership journey with greater confidence.

Throughout this article, we shared key insights about how the VA mortgage loan calculator functions, its essential features, and the importance of understanding costs like the VA funding fee and closing expenses. Real-world examples illustrated how veterans can effectively use the calculator to assess various financing scenarios. By comparing loan terms, they can make informed choices that align with their financial goals. The emphasis on customizable inputs and affordability insights further underscores the value of these calculators in empowering users to tailor their mortgage estimates to their specific situations.

Ultimately, the significance of utilizing a VA mortgage loan calculator cannot be overstated. It serves as a vital resource for veterans seeking to enhance their home financing experience. By embracing these tools, veterans can take proactive steps toward successful homeownership. This ensures they are well-prepared to manage their financial commitments. We know how challenging this journey can be, but leveraging the capabilities of a VA mortgage loan calculator will undoubtedly pave the way for more informed decisions and a brighter financial future.

Frequently Asked Questions

What is a VA mortgage loan calculator?

A VA mortgage loan calculator is a financial tool designed for veterans and active-duty service members to estimate their monthly payments when using a VA loan program. It takes into account factors such as the loan amount, interest rate, loan term, property taxes, homeowners insurance, and the VA funding fee.

Why is a VA mortgage loan calculator important for veterans?

It helps veterans understand their potential financial obligations, facilitating better budgeting for homeownership. This tool simplifies the home purchasing process and empowers veterans to make informed financial decisions.

How does the VA mortgage loan calculator work?

Users input details such as the amount borrowed, interest rate, loan term, and additional costs like property taxes and insurance to estimate their monthly payments and overall loan costs.

Can you provide an example of how a VA mortgage loan calculator is used?

For instance, if a veteran buys a home priced at $500,000, the loan amount could be $510,750 after including a VA funding fee. Using the calculator, they might see their estimated monthly payments total around $3,159.74.

What benefits do veterans gain from using a VA mortgage loan calculator?

Veterans can compare different financing scenarios, assess how varying interest rates affect their budgets, and understand additional costs, leading to enhanced confidence in their home buying process.

How does the loan term affect monthly payments?

A longer loan term typically results in lower monthly payments, allowing more cash for other expenses, while a shorter term leads to quicker loan payoff, less interest paid, and faster equity building in the home.