Overview

The article titled “Master Your Monthly Payment on a $500K Mortgage: Step-by-Step Guide” is designed to help you navigate the complexities of managing and calculating monthly mortgage payments for a $500,000 mortgage.

We understand how challenging this process can be, and that’s why we provide essential definitions of key mortgage terms and the factors that influence your monthly payments.

Through a detailed step-by-step calculation process, we aim to empower you with the knowledge needed to make informed financial decisions.

Understanding these elements is crucial for optimizing your budgeting and ensuring you feel confident in your choices.

We’re here to support you every step of the way as you embark on this important journey.

Introduction

Navigating the world of mortgages can feel overwhelming, and we know how challenging this can be, especially when considering the substantial financial commitment of a $500,000 loan. Understanding key terms and concepts, such as principal, interest rates, and loan terms, is essential for any prospective homeowner aiming to master their monthly payments. However, with fluctuating interest rates and additional costs like property taxes and insurance, how can buyers ensure they’re making informed decisions that align with their financial goals?

This guide offers a step-by-step approach to demystifying mortgage payments, empowering you to take control of your financial future. We’re here to support you every step of the way, helping you navigate this journey with confidence.

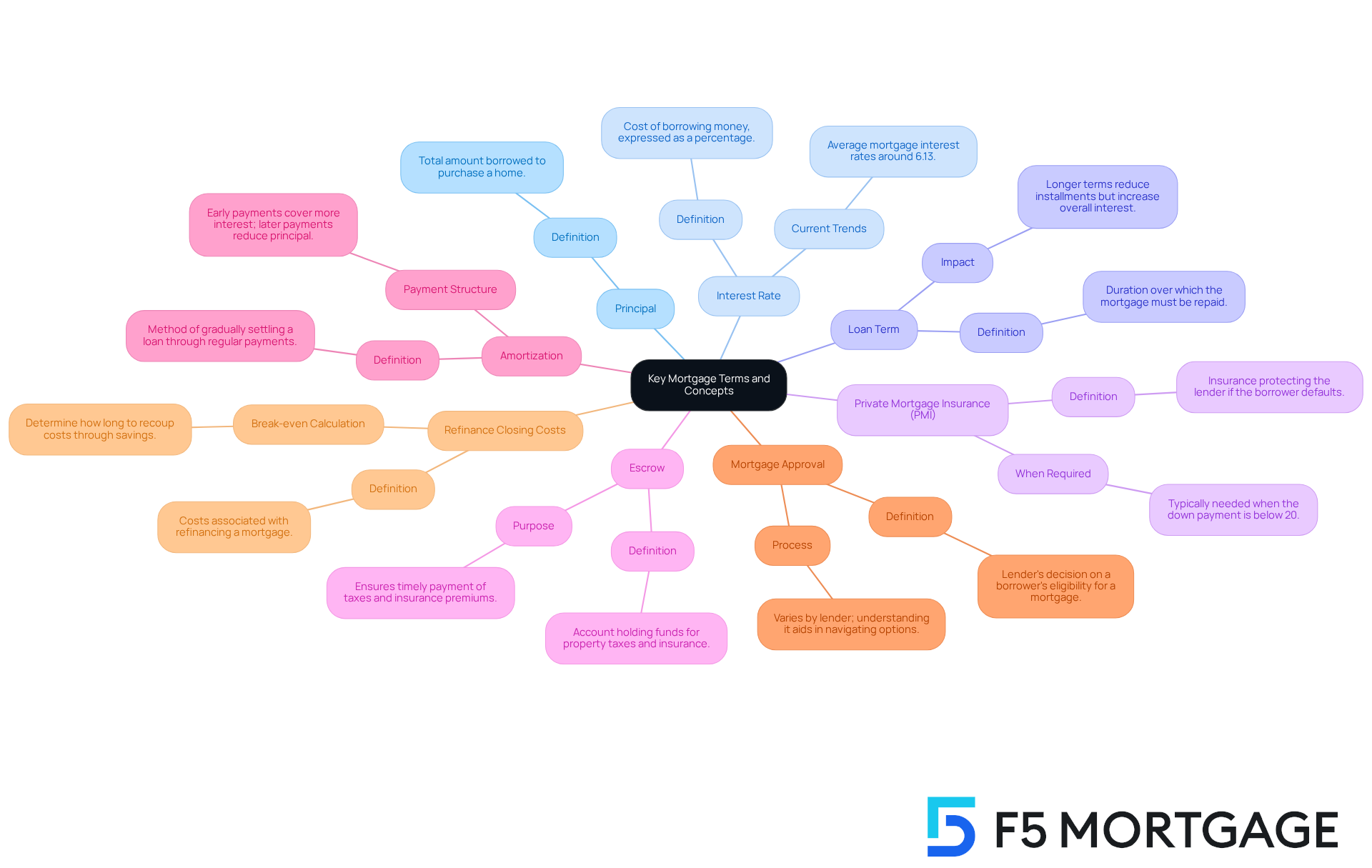

Define Key Mortgage Terms and Concepts

-

Principal: This refers to the total amount borrowed to purchase a home. For instance, if you secure a mortgage of $500,000, the monthly payment on a 500k mortgage would be based on that principal of $500,000. Understanding the principal is crucial, as it forms the basis for and the monthly payment on a 500k mortgage.

-

Interest Rate: This is the cost of borrowing money, expressed as a percentage. Interest charges can be fixed, staying steady throughout the loan duration, or variable, changing according to market conditions. As of 2025, average mortgage interest rates have experienced considerable changes, with recent trends suggesting a decline to approximately 6.13%. This can result in much lower expenses compared to elevated rates, which we know can be a relief.

-

Loan Term: This denotes the duration over which the mortgage must be repaid, typically spanning 15, 20, or 30 years. An extended loan duration typically leads to reduced installments but raises the overall interest paid throughout the loan. Balancing affordability with long-term expenses is essential, and we’re here to support you in making that decision.

-

Private Mortgage Insurance (PMI): PMI is a type of insurance that protects the lender in case the borrower defaults on the loan. It is frequently necessary when the initial deposit is below 20% of the home’s purchase cost. This extra expense can affect monthly expenses, so understanding when PMI is relevant is crucial for budgeting. We know how challenging this can be, and being informed helps you plan better.

-

Escrow: An escrow account is used to hold funds designated for property taxes and insurance premiums. This ensures that these expenses are paid on time, preventing potential penalties or lapses in coverage. Knowing how escrow works can help homeowners manage their overall financial obligations effectively, providing peace of mind.

-

Amortization: This is the method of gradually settling a loan through regular contributions that cover both principal and interest. Grasping amortization is essential for borrowers, as it demonstrates how contributions decrease the loan balance over time. For example, in the early years of a mortgage, a larger portion of the payment goes toward interest, while later payments increasingly reduce the principal. Understanding this can empower you to make informed choices.

-

Mortgage Approval: An approval is a lender’s decision that, based on the financial information you provide, you’re a good candidate for a mortgage. This process can vary from lender to lender, and understanding what it entails can help you navigate your loan options more effectively. We’re here to guide you through this journey.

-

Refinance Closing Costs: When considering refinancing, it’s important to be aware of the associated closing costs, which typically include:

- Application fees: Between $75 and $500

- Origination fees: Between 0.5% and 1.5% of the loan amount

- Credit report fees: Around $35

- Appraisal fees: Usually between $300 and $500, depending on location and property type

- Title search and title insurance: Between 0.5% and 1% of the loan amount

- Discount points: 1% of the loan amount for a 0.25% interest rate reduction

- Attorney fees: $500 or more

- Survey fee: $150 to $400

Calculating your break-even point—determining how long it will take to recoup these costs through savings in monthly payments—can help you make informed decisions about refinancing. To calculate your break-even point, follow these steps: Determine refinancing expenses, calculate your regular savings, and divide your refinancing expenses by your regular savings. For instance, if your refinancing expenses are $4,000 and your savings each month are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months).

By familiarizing yourself with these terms, you can better navigate the complexities of mortgage financing and make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

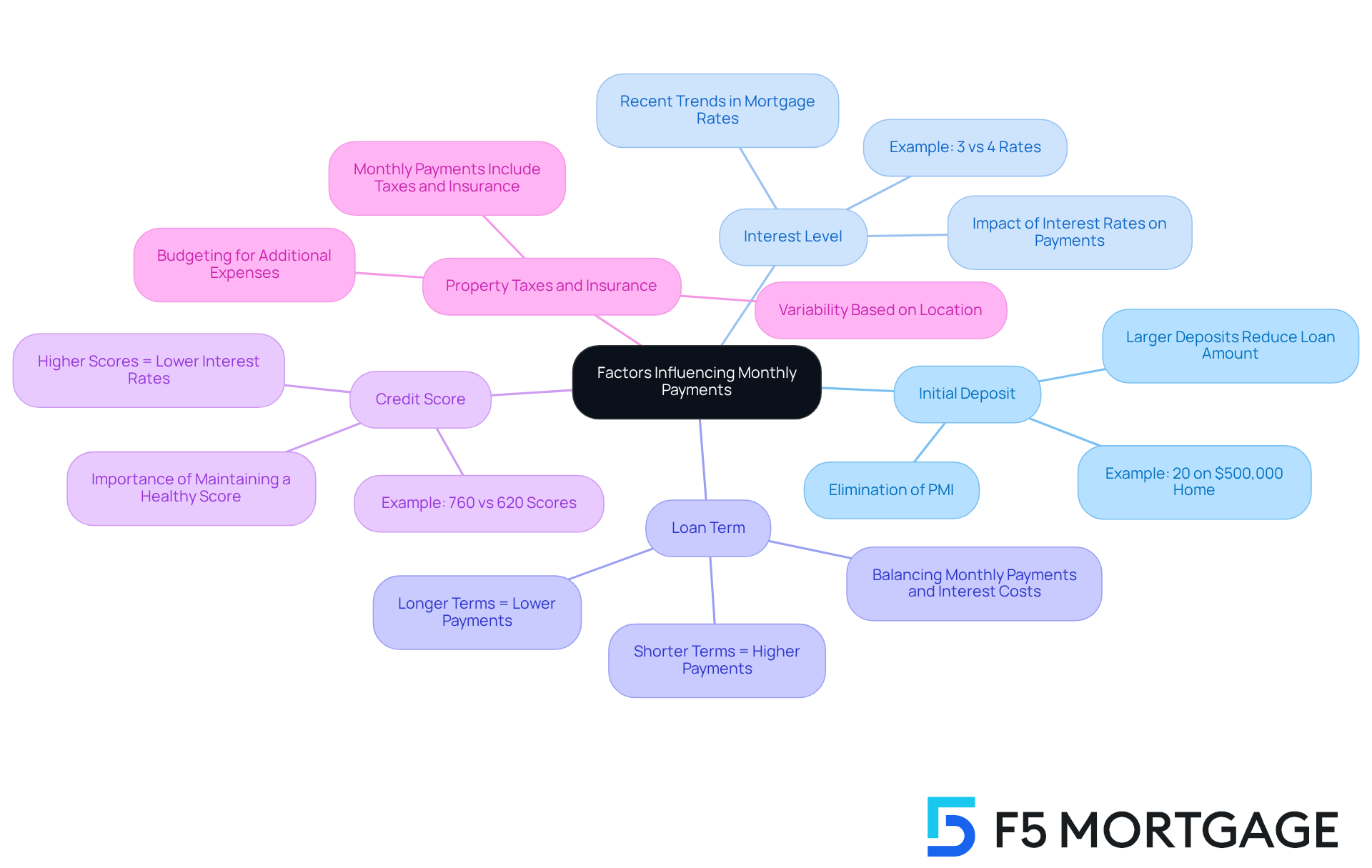

Identify Factors Influencing Monthly Payments

- Initial Deposit: We understand that making a larger initial deposit can feel daunting, but it’s a strategic move that can significantly ease your financial burden. Not only does it decrease the total loan amount, but it may also eliminate private mortgage insurance (PMI), leading to lower ongoing costs. For instance, if you make a 20% deposit on a $500,000 home, that’s $100,000 upfront, reducing your principal to $400,000. This thoughtful step can greatly alleviate the financial strain of the monthly payment on a 500k mortgage.

- Interest Level: The interest level is a key factor that directly affects what you’ll pay each month. A lower interest rate can mean substantial savings. For example, a 3% interest rate on a $500,000 mortgage could result in a monthly payment on 500k mortgage that is hundreds of dollars less than the monthly payment at a 4% rate. With mortgage rates recently reaching their highest levels since late 2022, understanding this relationship is crucial for prospective buyers like you.

- Loan Term: The length of your loan is another important consideration. Shorter loan terms often come with higher monthly payments but lower overall interest costs over time. Conversely, longer terms spread the costs out, lowering your monthly payments but increasing the total interest paid. Finding the right balance is essential for effective budgeting, and we’re here to help you navigate these choices.

- Credit Score: Your plays a significant role in the interest rates available to you, which can greatly impact your monthly payments. For example, a borrower with a credit score of 760 might qualify for a much lower interest rate compared to someone with a score of 620. This difference can lead to considerable savings throughout the life of the loan, highlighting the importance of maintaining a healthy credit score.

- Property Taxes and Insurance: When budgeting for your home, remember that monthly payments often include property taxes and homeowners insurance. These costs can vary widely based on your location and property value. Understanding these additional expenses is vital for accurate budgeting, as they can significantly affect the overall affordability of owning a home. We know how challenging this can be, and we’re here to support you every step of the way.

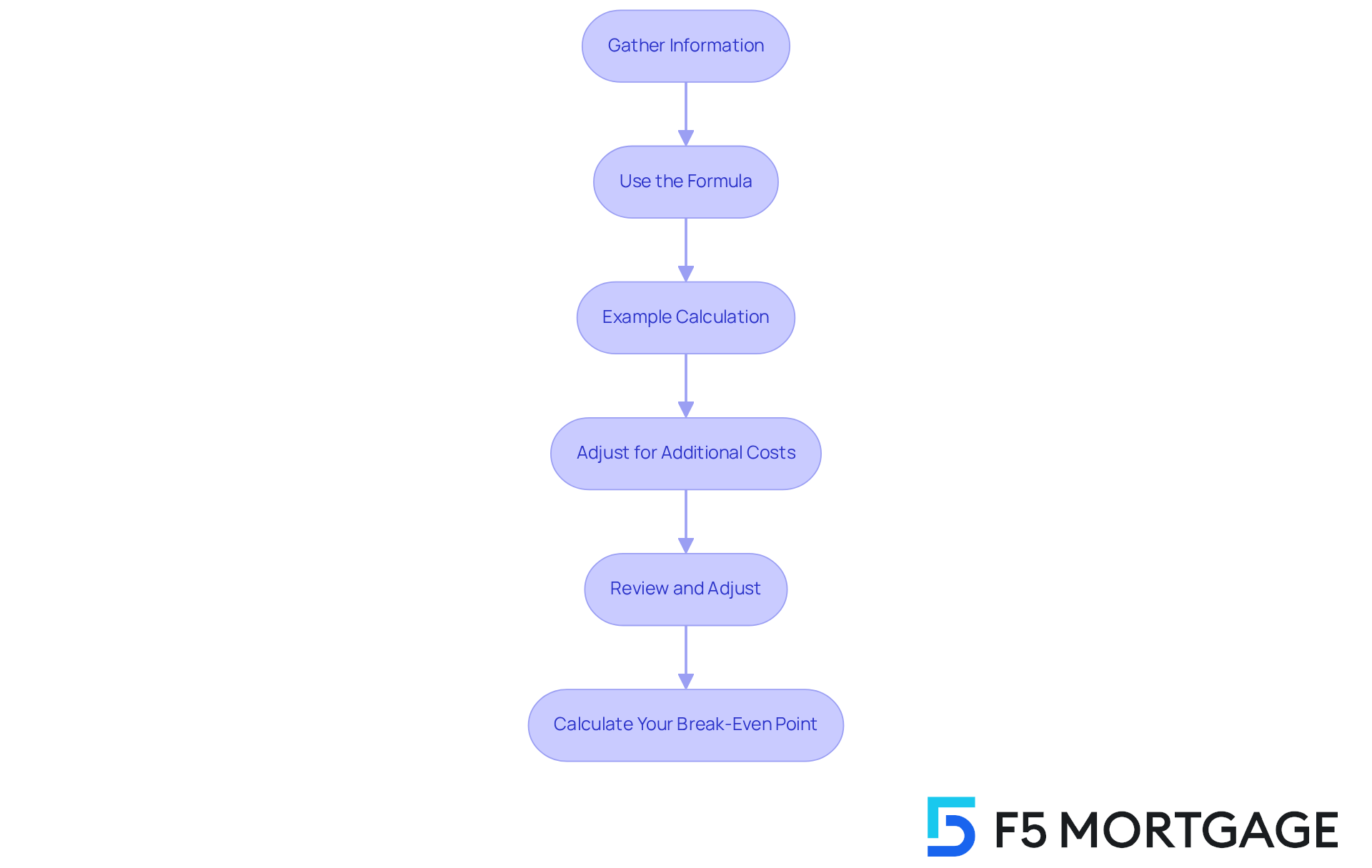

Calculate Your Monthly Payment: A Step-by-Step Guide

-

Gather Information: We know how important it is to have all the at your fingertips. Start by collecting the loan amount (principal), interest percentage, loan term, and any additional costs such as PMI, property taxes, and insurance. This foundational step is crucial in navigating your mortgage journey.

-

Use the Formula: To calculate your monthly mortgage payments, you can apply this simple formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]Where:

- M = total monthly mortgage payment

- P = principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in years multiplied by 12)

-

Example Calculation: Let’s consider a scenario to illustrate this. For a $500,000 mortgage at a 4% interest rate over 30 years:

- P = 500,000

- r = 0.04 / 12 = 0.00333

- n = 30 * 12 = 360

- M = 500,000[0.00333(1 + 0.00333)^360] / [(1 + 0.00333)^360 – 1] = approximately $2,387.08. This example can help you visualize your potential payment.

-

Adjust for Additional Costs: To get a clearer picture of your total recurring charge, it’s important to include any PMI, property taxes, and insurance to the computed mortgage amount. For instance, if PMI is $150, property taxes are $300, and insurance is $100, your overall cost would be $2,387.08 + $150 + $300 + $100 = $2,937.08. This total can help you plan your budget more effectively.

-

Review and Adjust: Regularly evaluating how changes in your down payment or interest levels could affect your monthly payment is essential. For example, a 1% reduction in the interest could save you roughly $200 each month, positively impacting the monthly payment on a 500k mortgage and greatly enhancing your cash flow. Currently, the average 30-year mortgage rate is around 6.13%, which is crucial to factor into your calculations.

-

Calculate Your Break-Even Point: Understanding your break-even point is essential when considering refinancing. Start by assessing your refinancing expenses, including all closing fees and charges. Next, compute your monthly savings by subtracting your new payment from your current one. Finally, divide your refinancing expenses by your regular savings to determine how many months it will take to reach equilibrium. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This examination is vital to ensure that refinancing is reasonable for your financial circumstances. Many satisfied customers, like Alley Cohen, have praised the smooth process and exceptional service provided by F5 Mortgage, reinforcing the value of understanding your break-even point. Remember, we’re here to support you every step of the way.

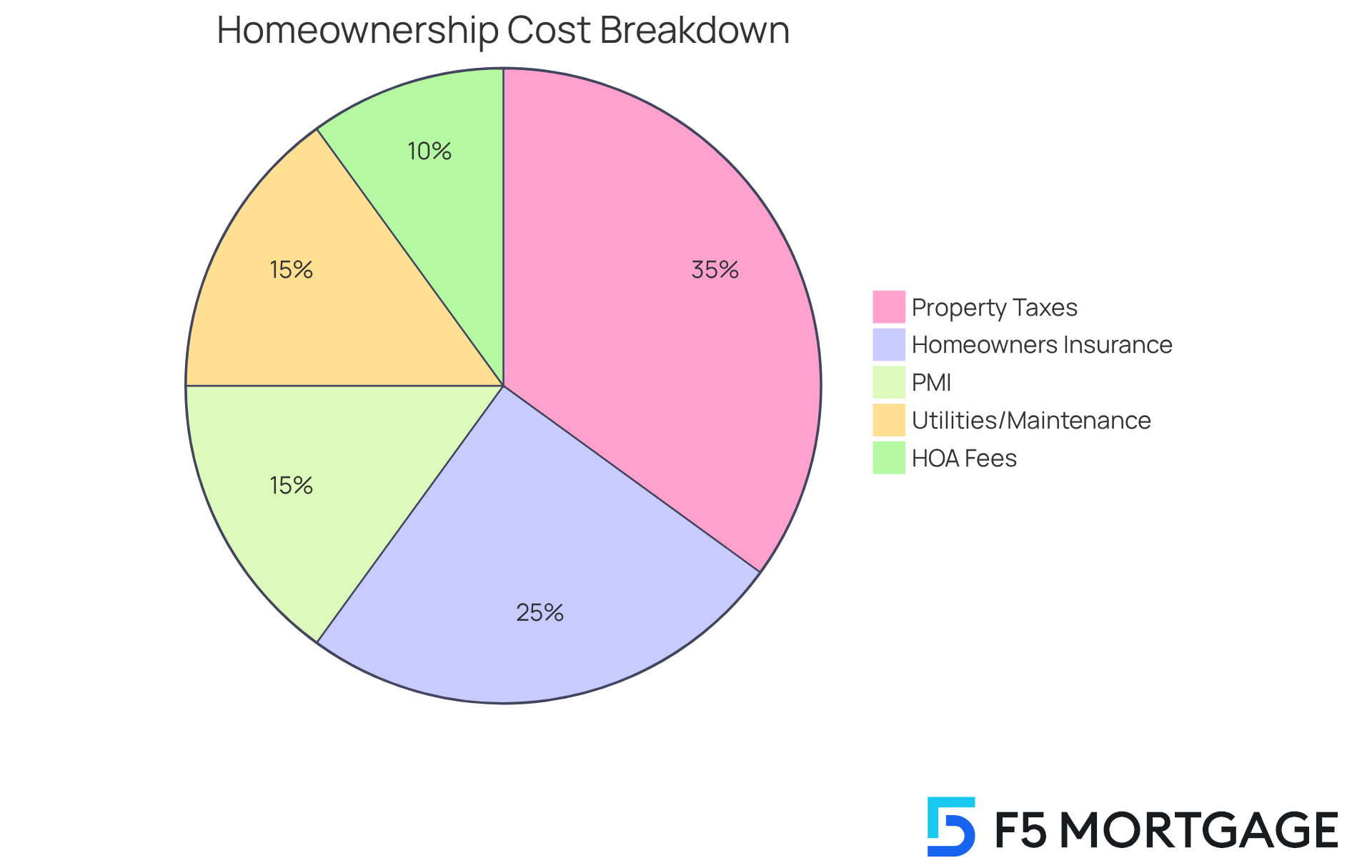

Explore Additional Costs Beyond the Mortgage Payment

- Property Taxes: We know how challenging managing property taxes can be. Typically assessed annually, these taxes can vary significantly based on your location and property value. In 2024, the national average for property taxes reached $4,316, with some areas facing increases due to rising home values. For instance, homeowners in Knox County experienced tax bills reflecting a staggering 50% increase in property value, surpassing the county’s average increase of 40%. Understanding your is crucial for effective budgeting and planning.

- Homeowners Insurance: Homeowners insurance is essential for protecting your cherished property from damages and is often a requirement from lenders. In 2025, the average price of homeowners insurance ranged from $1,000 to $3,000 each year, influenced by factors like coverage levels and geographic location. For example, property owners in New Jersey encounter some of the highest insurance fees, averaging $29,751 annually in total homeownership expenditures. We’re here to help you navigate these costs.

- Private Mortgage Insurance (PMI): If your down payment is below 20%, you may find yourself obligated to pay PMI, which can increase your monthly expenses. PMI rates typically range from 0.3% to 1.5% of the original loan amount annually, significantly impacting your overall budget. Understanding this can help you plan better.

- Homeowners Association (HOA) Fees: If your home is located within a community governed by an HOA, you may encounter monthly or annual fees for maintenance and amenities. These fees can differ greatly, so it’s essential to include them in your total housing expenses. Knowing this in advance can ease your financial planning.

- Utilities and Maintenance: Regular expenses such as electricity, water, and gas, along with routine maintenance, should also be part of your budget. In 2024, homeowners reported that utility expenses had increased for 68% of them, highlighting the necessity to allocate funds for unforeseen repairs and maintenance. Financial planners recommend budgeting for these additional costs to avoid surprises and ensure a smooth homeownership experience. Remember, we’re here to support you every step of the way.

Conclusion

Mastering the intricacies of a $500,000 mortgage is essential for any prospective homeowner. We know how challenging this can be, but by understanding key mortgage terms and concepts, you can navigate your financial obligations with confidence. This knowledge empowers you to make informed decisions regarding your monthly payments, ensuring they align with your long-term financial goals.

Throughout this article, we explored critical factors influencing monthly payments. The importance of:

- The initial deposit

- Interest rates

- Loan terms

- Credit scores

These elements intertwine to affect overall affordability, and understanding them is crucial. Additionally, our step-by-step guide for calculating monthly payments demystified the process, enabling you to grasp your financial commitments better. We also discussed additional costs beyond the mortgage payment, such as:

- Property taxes

- Homeowners insurance

- PMI

Emphasizing the need for comprehensive budgeting.

In conclusion, understanding the complexities of mortgage payments is not just about crunching numbers; it’s about laying a solid foundation for your financial security. Homebuyers are encouraged to delve deeper into their mortgage options, stay informed about market trends, and regularly reassess their financial strategies. By doing so, you can navigate the homebuying journey with confidence and make choices that will lead to lasting peace of mind in your homeownership experience.

Frequently Asked Questions

What is the principal in a mortgage?

The principal refers to the total amount borrowed to purchase a home. For example, if you secure a mortgage of $500,000, the monthly payment is based on that principal amount.

What is an interest rate in the context of a mortgage?

The interest rate is the cost of borrowing money, expressed as a percentage. It can be fixed, remaining steady throughout the loan, or variable, changing with market conditions. As of 2025, average mortgage interest rates have declined to approximately 6.13%.

What does loan term mean in a mortgage?

The loan term is the duration over which the mortgage must be repaid, typically 15, 20, or 30 years. A longer loan term usually results in lower monthly payments but increases the overall interest paid over the life of the loan.

What is Private Mortgage Insurance (PMI)?

PMI is insurance that protects the lender if the borrower defaults on the loan. It is often required when the down payment is less than 20% of the home’s purchase price, which can affect monthly expenses.

What is an escrow account?

An escrow account is used to hold funds for property taxes and insurance premiums, ensuring these expenses are paid on time and avoiding penalties or lapses in coverage.

What does amortization mean?

Amortization is the process of gradually paying off a loan through regular payments that cover both principal and interest. Early payments typically consist of more interest, while later payments reduce the principal more significantly.

What is mortgage approval?

Mortgage approval is a lender’s decision that indicates you are a good candidate for a mortgage based on the financial information you provide. The approval process can vary by lender.

What are refinance closing costs?

Refinance closing costs include various fees such as application fees, origination fees, credit report fees, appraisal fees, title search and insurance, discount points, attorney fees, and survey fees. These costs can range widely based on the loan amount and location.

How can I calculate my break-even point for refinancing?

To calculate your break-even point, determine your refinancing expenses, calculate your monthly savings, and divide the refinancing expenses by the monthly savings. For example, if your expenses are $4,000 and your savings are $100 per month, the break-even point would be 40 months ($4,000 / $100 = 40 months).