Overview

Refinancing your mortgage can feel overwhelming, especially when it comes to understanding the associated costs. Typically, these expenses range from 3% to 6% of the new loan amount. This includes fees for loan origination, appraisal, and closing costs. We know how challenging this can be, and it’s crucial to grasp these details fully.

Understanding these costs is just the beginning. It’s important to calculate your break-even point. This will help you determine whether refinancing can lead to significant long-term savings. In favorable market conditions, this could be a smart move for your financial future.

We’re here to support you every step of the way as you navigate these decisions. By taking the time to assess your options, you can make informed choices that align with your family’s needs.

Introduction

We know how challenging the intricacies of mortgage refinancing can be for many homeowners, especially as financial landscapes shift and interest rates fluctuate. This article aims to guide you through the multifaceted world of refinancing, highlighting potential benefits such as:

- Lower monthly payments

- The chance to tap into your home equity

However, alongside these appealing advantages, it’s crucial to navigate the associated costs and complexities with care.

What factors should you consider to ensure that refinancing is a financially sound decision? How can you effectively manage the process to maximize your savings? We’re here to support you every step of the way, helping you make informed choices that align with your financial goals.

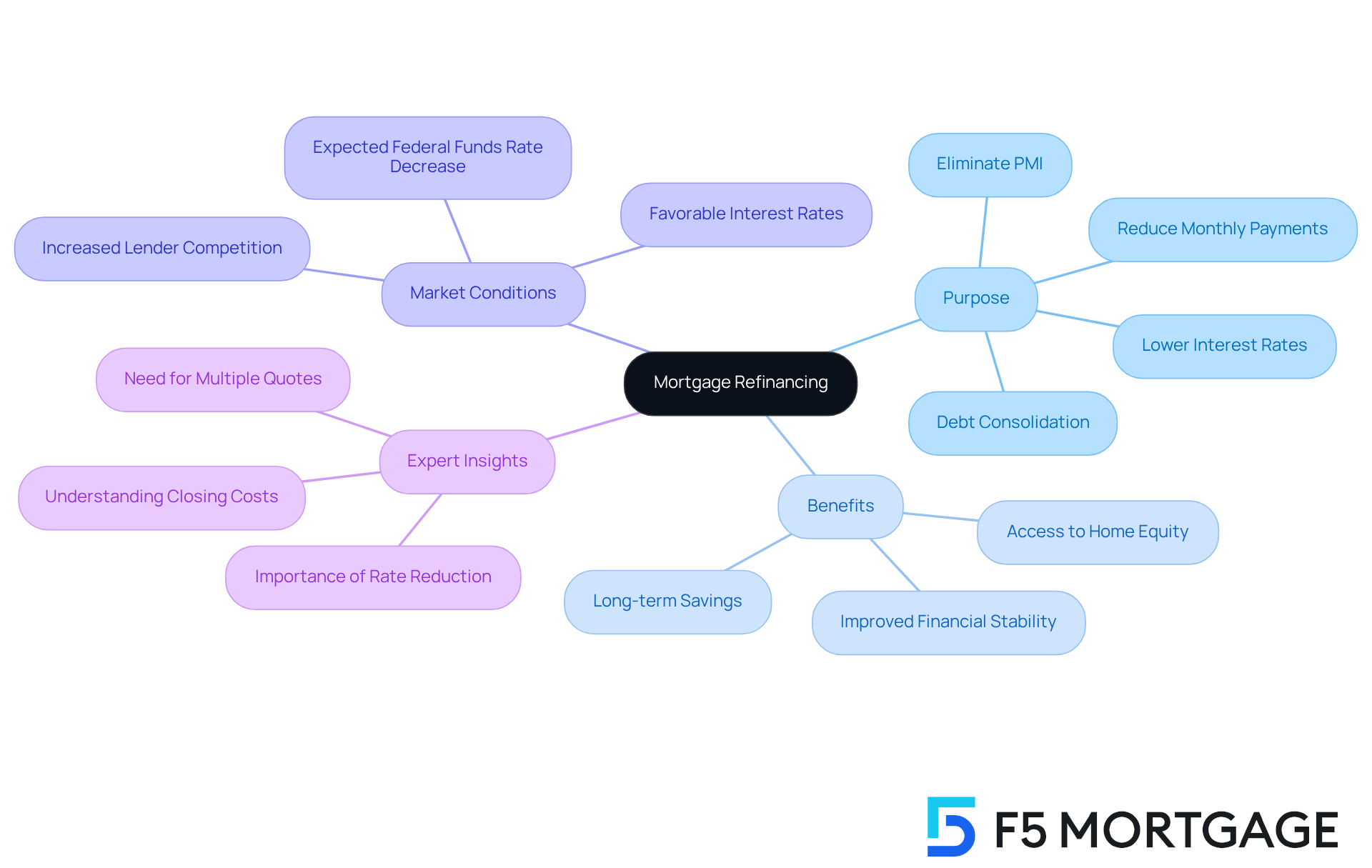

Define Mortgage Refinancing and Its Purpose

Replacing a current financial obligation can feel overwhelming, but it often involves substituting it with a new agreement that has different conditions. Many families consider taking out a new loan to secure a lower interest rate, reduce monthly payments, or manage the cost of refinancing their mortgage, tapping into home equity. Some homeowners may also choose to refinance to change their loan type or term, such as moving from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

In 2025, we know that many homeowners are expected to restructure their loans primarily to reduce the cost of refinancing mortgage. Experts suggest that even a drop of 0.5% to 1% in the cost of refinancing mortgage can make this process worthwhile. For instance, families who refinanced their mortgage in the past year reported significant savings, which outweighed the cost of refinancing mortgage, allowing many to enjoy lower monthly payments that contributed to their overall financial stability.

The benefits of restructuring loans extend beyond the cost of refinancing mortgage; it can also facilitate debt consolidation, allowing families to use their equity to pay off high-interest debts. Additionally, restructuring a loan may provide an opportunity to eliminate private mortgage insurance (PMI) if enough equity has been built up.

As industry analysts have noted, the current market conditions are favorable for restructuring loans, especially due to the cost of refinancing mortgage being impacted by anticipated decreases in the federal funds rate. This environment encourages homeowners to actively explore loan modification options. By obtaining quotes from multiple lenders, families can maximize their savings and ensure they secure the best possible terms.

Ultimately, understanding the goals and potential benefits of restructuring debt is essential for homeowners considering this financial strategy. It can lead to significant long-term savings and improved financial well-being. Remember, we’re here to support you every step of the way.

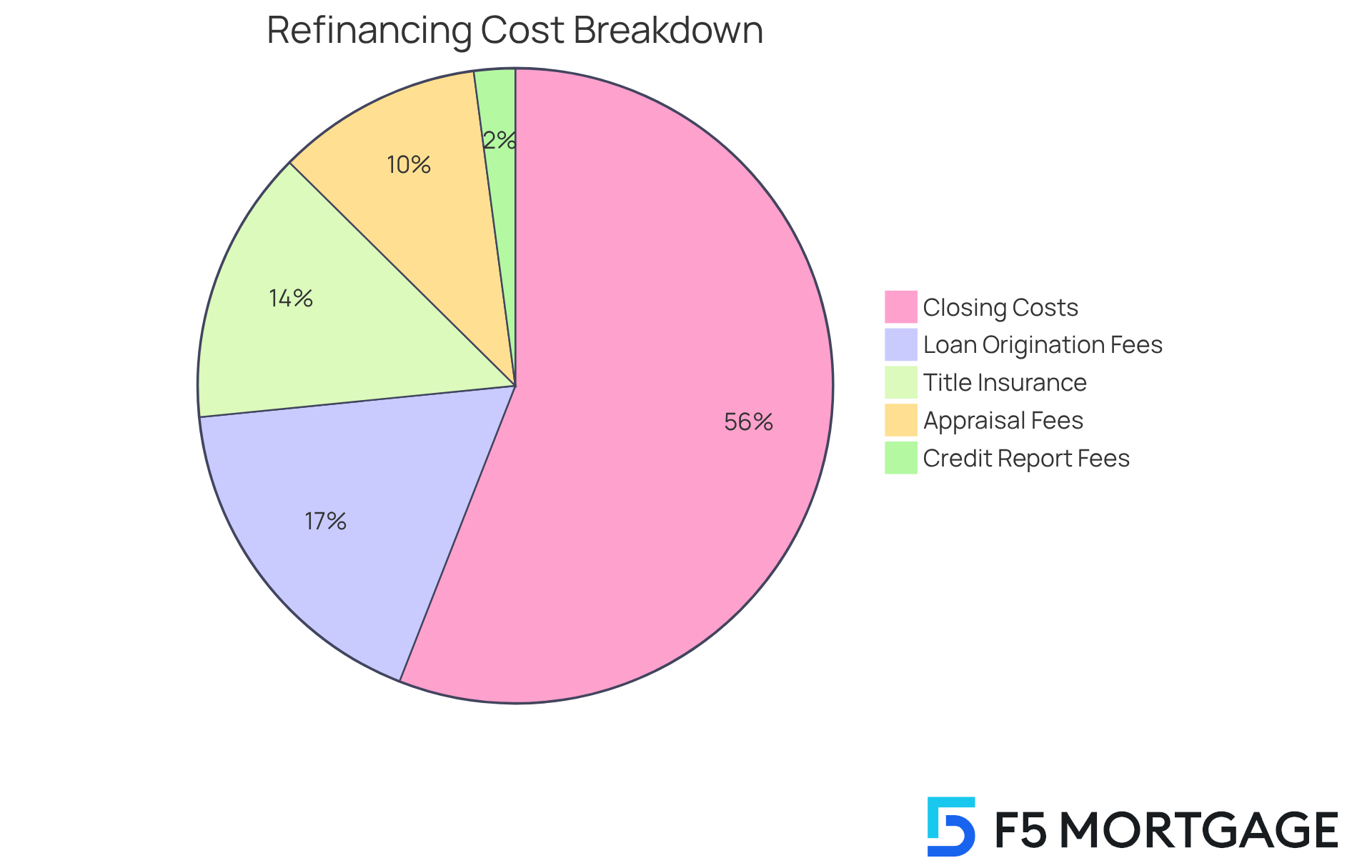

Analyze the Costs Involved in Refinancing a Mortgage

The cost of refinancing a mortgage often involves a range of expenses, typically between 3% to 6% of the new loan amount. We know how challenging this can be, and understanding the cost of refinancing mortgage is vital for evaluating the overall financial impact. Here are some key expenses to consider:

- Loan Origination Fees: These fees, charged by your lender for processing the loan, usually range from 1% to 1.5% of the loan amount. For example, on a $200,000 loan, this could amount to $2,000 to $3,000.

- Appraisal Fees: Required to assess the current value of your home, appraisal fees typically cost between $500 and $1,000, depending on the property’s location and size.

- Credit Report Fees: Lenders may charge for obtaining your credit report, usually around $25 to $30. This fee is essential for evaluating your creditworthiness.

- Title Insurance and Search Fees: Protecting against potential disputes over property ownership, these fees can range from $300 to $2,000, depending on the property’s value and the lender’s requirements.

- Closing Costs: These encompass various administrative fees and taxes, which can add up significantly. On average, closing costs for loan modification can range from $4,000 to $10,000 for a $200,000 mortgage. This highlights the importance of budgeting for these expenses.

By closely examining the cost of refinancing mortgage, homeowners can make informed decisions about whether restructuring their mortgage is financially beneficial, especially when considering potential savings from lower interest rates. Furthermore, it’s crucial to identify the break-even point before making any changes. This is the point at which your monthly savings exceed the initial expenses. To find your break-even point, start by adding all fees associated with restructuring, including origination, application, appraisal, and credit report fees. Then, compare your current monthly payment to your new payment, subtract the difference, and divide the total costs of the new loan by the monthly savings amount. This calculation will help you understand how long it will take to recoup your costs through savings. Remember, we’re here to support you every step of the way.

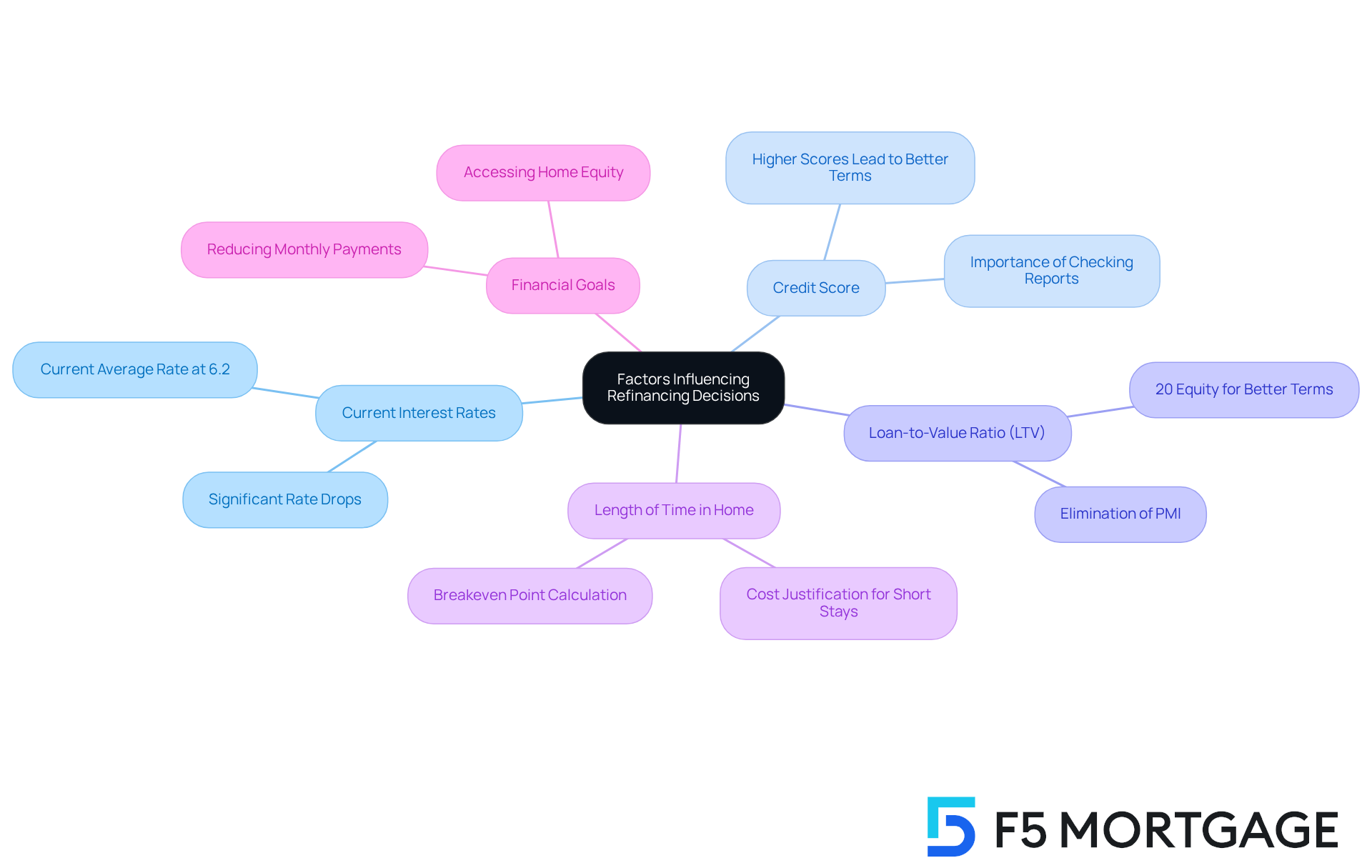

Evaluate Key Factors Influencing the Decision to Refinance

Several key factors can significantly influence your decision to refinance a mortgage, and we know how challenging this can be:

-

Current Interest Rates: When current rates drop significantly below your existing mortgage rate, refinancing can lead to substantial savings. For instance, the typical percentage on a 30-year loan has recently decreased to 6.2%, the lowest in 19 months. This creates a favorable moment for many homeowners to think about restructuring their loans and potentially easing their financial burdens.

-

Credit Score: A higher credit score is essential for obtaining advantageous loan terms. Homeowners with improved credit scores may qualify for lower interest rates, which can significantly reduce monthly payments and overall loan costs. It’s crucial to examine credit reports from prominent agencies to identify and correct any mistakes that could impede your loan options.

-

Loan-to-Value Ratio (LTV): A lower LTV ratio improves your chances of qualifying for better loan options. Homeowners with at least 20% equity in their homes are often presented with more favorable loan terms, including the potential to eliminate private mortgage insurance if their home’s value has increased. This can contribute to your overall financial health.

-

Length of Time in Home: Consider how long you plan to stay in your home. If you anticipate moving soon, the cost of refinancing mortgage—averaging around $5,000—may not be justified by the potential savings. Determining the breakeven point, where savings from restructuring offset the cost of refinancing mortgage, is essential for making a well-informed choice that aligns with your future plans.

-

Financial Goals: Your financial objectives will influence your decision to restructure. Whether you intend to reduce monthly payments, shorten the repayment period, or access home equity for renovations or debt consolidation, comprehending your objectives is crucial. For instance, adjusting to a shorter loan duration, like 15 years, can help you save on interest compared to a 30-year loan.

By evaluating these factors, you can make informed decisions that align with your financial circumstances and long-term goals. Remember, we’re here to support you every step of the way.

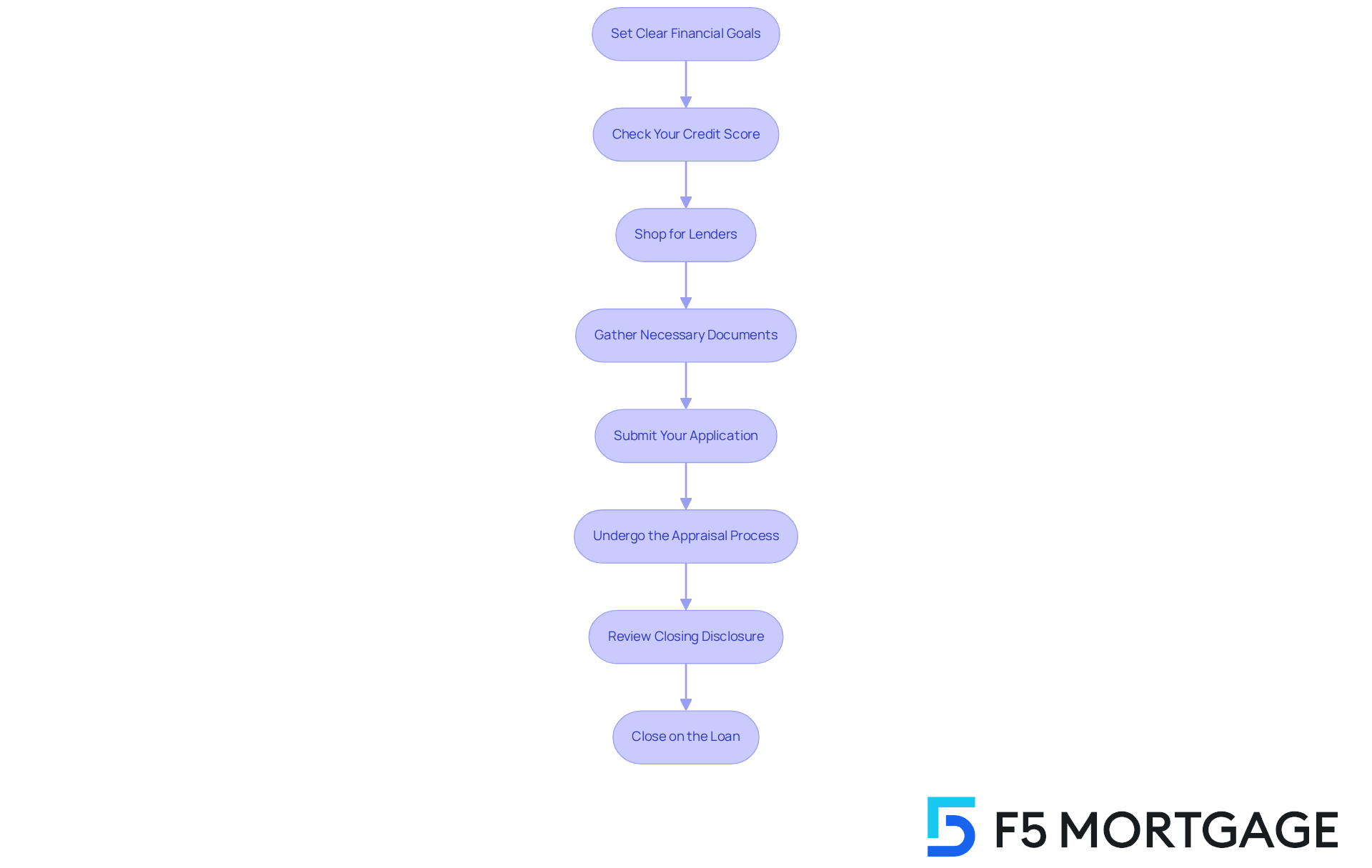

Outline the Step-by-Step Process for Refinancing Your Mortgage

Refinancing a mortgage can feel overwhelming, but it doesn’t have to be. By following these essential steps, homeowners can navigate the process with confidence and clarity.

-

Set Clear Financial Goals: Start by identifying your objectives for restructuring your loan. Whether you aim to reduce monthly payments, access home equity, or consolidate debt, knowing your goals is crucial.

-

Check Your Credit Score: It’s important to obtain your credit report and score to assess your refinancing eligibility. Generally, a score of at least 620 is necessary for traditional loans. Remember, improving your score can lead to better terms.

-

Shop for Lenders: Take the time to explore and compare offers and conditions from various lenders. Engaging with your current lender might streamline the process since they are already familiar with your financial history. If you have a loan of $500,000 or more, even a small reduction of 0.375% can save you significantly. At F5 Mortgage, we utilize user-friendly technology to make this process easier, allowing you to choose what feels right for you without any pressure.

-

Gather Necessary Documents: Prepare essential documents such as proof of income (last two pay stubs, W-2s or 1099s), tax returns, bank statements, and your current mortgage statement. Having these ready can help speed up your application.

-

Submit Your Application: Once you’ve chosen a lender, complete the application, ensuring that all required documentation is included to avoid any delays.

-

Undergo the Appraisal Process: Be prepared for an appraisal to determine your home’s current value. This step is vital for the lender’s assessment, and appraisal fees typically range from $300 to $500.

-

Review Closing Disclosure: Before finalizing your loan, take the time to carefully review the closing disclosure. Understanding all associated costs, including appraisal fees, is crucial for transparency in the loan restructuring process.

-

Close on the Loan: Finally, sign the necessary documents to complete the refinancing process. Most loans can finalize in under three weeks, so it’s important to act swiftly, especially if conditions are favorable. At F5 Mortgage, we are committed to a quick closing procedure, ensuring you can move forward without unnecessary delays.

By following these steps, you can create a smoother loan adjustment experience, potentially saving thousands each year and reducing the cost of refinancing mortgage, particularly if your current loans have interest rates above 7%. Additionally, being mindful of the timing of refinancing in relation to the cost of refinancing mortgage and interest rate movements can maximize your savings. Remember, we understand how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Refinancing a mortgage can be a powerful opportunity for homeowners to improve their financial situation. By securing better loan terms, lowering monthly payments, or accessing home equity, you can take significant steps towards financial health. While the process may seem complex, understanding its costs and benefits can lead to meaningful savings.

In this article, we explored key considerations, such as the various costs associated with refinancing, including:

- loan origination fees

- appraisal fees

- closing costs

We also highlighted factors that influence your decision to refinance, like:

- current interest rates

- credit scores

- your individual financial goals

By carefully evaluating these elements, you can find the best time to refinance and ensure it aligns with your long-term objectives.

Ultimately, the journey of refinancing is not just about immediate savings. It’s about making informed decisions that pave the way for lasting financial stability. Engaging in this process with the right knowledge and preparation empowers you to take control of your financial future. As market conditions change, staying informed about current trends and opportunities in mortgage refinancing is essential for maximizing your potential benefits. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing is the process of replacing an existing mortgage with a new loan that has different conditions, often to secure a lower interest rate, reduce monthly payments, or access home equity.

Why do homeowners choose to refinance their mortgages?

Homeowners may refinance to obtain a lower interest rate, reduce their monthly payments, change their loan type or term (e.g., from an adjustable-rate mortgage to a fixed-rate mortgage), or consolidate debt using their home equity.

What are the expected trends in mortgage refinancing for 2025?

In 2025, many homeowners are expected to restructure their loans primarily to reduce the cost of refinancing. Even a small decrease of 0.5% to 1% in refinancing costs can make the process worthwhile.

What are the potential savings from refinancing?

Families who refinanced their mortgage in the past year reported significant savings that outweighed the costs of refinancing, resulting in lower monthly payments and improved financial stability.

How can refinancing help with debt consolidation?

Refinancing can facilitate debt consolidation by allowing families to use their home equity to pay off high-interest debts.

Can refinancing eliminate private mortgage insurance (PMI)?

Yes, restructuring a loan may provide an opportunity to eliminate PMI if the homeowner has built up enough equity in their home.

What market conditions are favorable for refinancing?

Current market conditions, including anticipated decreases in the federal funds rate, are favorable for loan restructuring, encouraging homeowners to explore loan modification options.

How can homeowners maximize their savings when refinancing?

Homeowners can maximize their savings by obtaining quotes from multiple lenders to ensure they secure the best possible terms for their new mortgage.

Why is it important for homeowners to understand the goals of refinancing?

Understanding the goals and potential benefits of restructuring debt is essential as it can lead to significant long-term savings and improved financial well-being for homeowners.