Overview

Navigating the mortgage process can feel overwhelming, especially for families looking to make informed decisions about homeownership. This article focuses on how to effectively use a mortgage payment calculator in Texas, helping you estimate monthly loan payments and understand the financial commitment involved in buying a home.

We know how challenging this can be, and that’s why we highlight essential components such as:

- Principal

- Interest rate

- Loan term

- Property taxes

- Homeowners insurance

Accurately inputting this information is crucial for achieving reliable estimates. By doing so, you can better grasp the total financial commitment that comes with homeownership.

Remember, you’re not alone in this journey. We’re here to support you every step of the way, empowering you to make informed choices that align with your family’s needs and financial goals.

Introduction

Navigating the complex world of home financing can feel overwhelming, especially for first-time buyers in Texas. We understand how challenging this can be. That’s why a mortgage payment calculator is such a vital tool—it empowers you to estimate your monthly payments and make informed financial decisions.

However, many potential homeowners may wonder: how can you ensure you are using this calculator effectively to avoid hidden costs and miscalculations? This guide delves into the essentials of mastering the mortgage payment calculator, offering insights that can lead to a smoother and more confident home-buying experience.

We’re here to support you every step of the way.

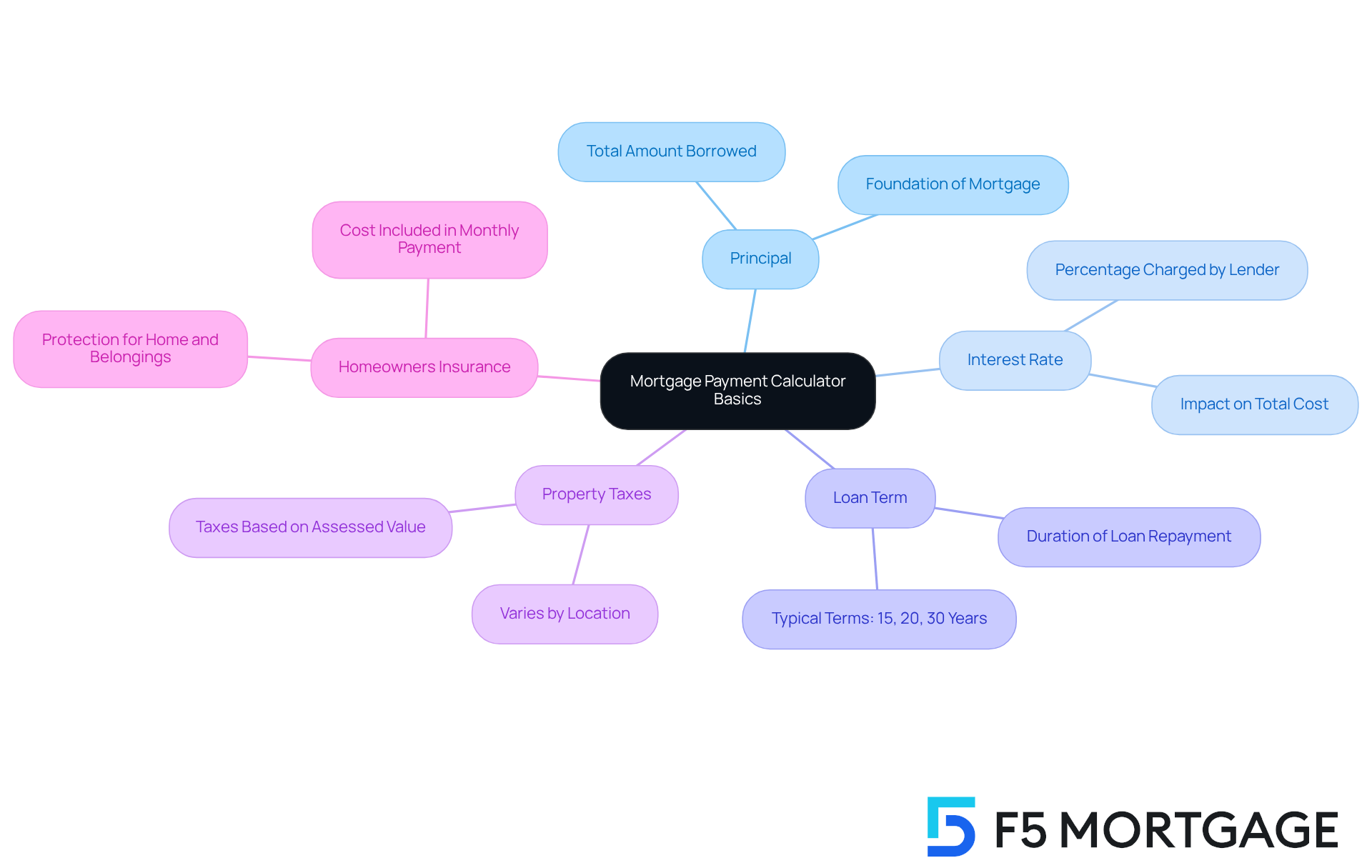

Understand the Mortgage Payment Calculator Basics

A [mortgage payment calculator Texas](https://f5mortgage.com/9-essential-features-of-a-florida-mortgage-calculator) is an essential tool for estimating your monthly loan payments, helping you make informed financial choices with confidence. At F5, we understand how daunting the lending experience can be, and we strive to transform it by leveraging technology to provide competitive rates without the pressure of aggressive sales tactics. Here are the key components you will encounter:

- Principal: This is the total amount borrowed to purchase your home, forming the foundation of your mortgage.

- Interest Rate: The percentage charged by the lender for borrowing the funds, significantly impacting your total cost.

- Loan Term: The duration over which the loan will be repaid, typically lasting 15, 20, or 30 years, which affects both your regular payments and total interest paid.

- Property Taxes: Taxes levied by the government based on the property’s assessed value, varying widely by location.

- Homeowners Insurance: This insurance protects your home and belongings, and its cost is usually included in your monthly payment.

Understanding these elements is crucial for accurately entering information into the and for interpreting the results. For instance, a recent study revealed that many homebuyers use loan cost estimators to visualize their financial situations, aiding them in budgeting effectively. By grasping how these factors interact, you can better prepare for the financial responsibilities of homeownership.

Industry experts highlight the importance of understanding these components: “Homebuyers often face much more than just a loan payment; hidden costs can average $18,000 annually.” This underscores the value of using a mortgage payment calculator Texas to account for all potential expenses, ensuring a comprehensive view of your financial commitment. Ultimately, by utilizing these tools—especially through F5 Mortgage’s transparent and customer-focused approach—you can navigate the complexities of home buying with confidence.

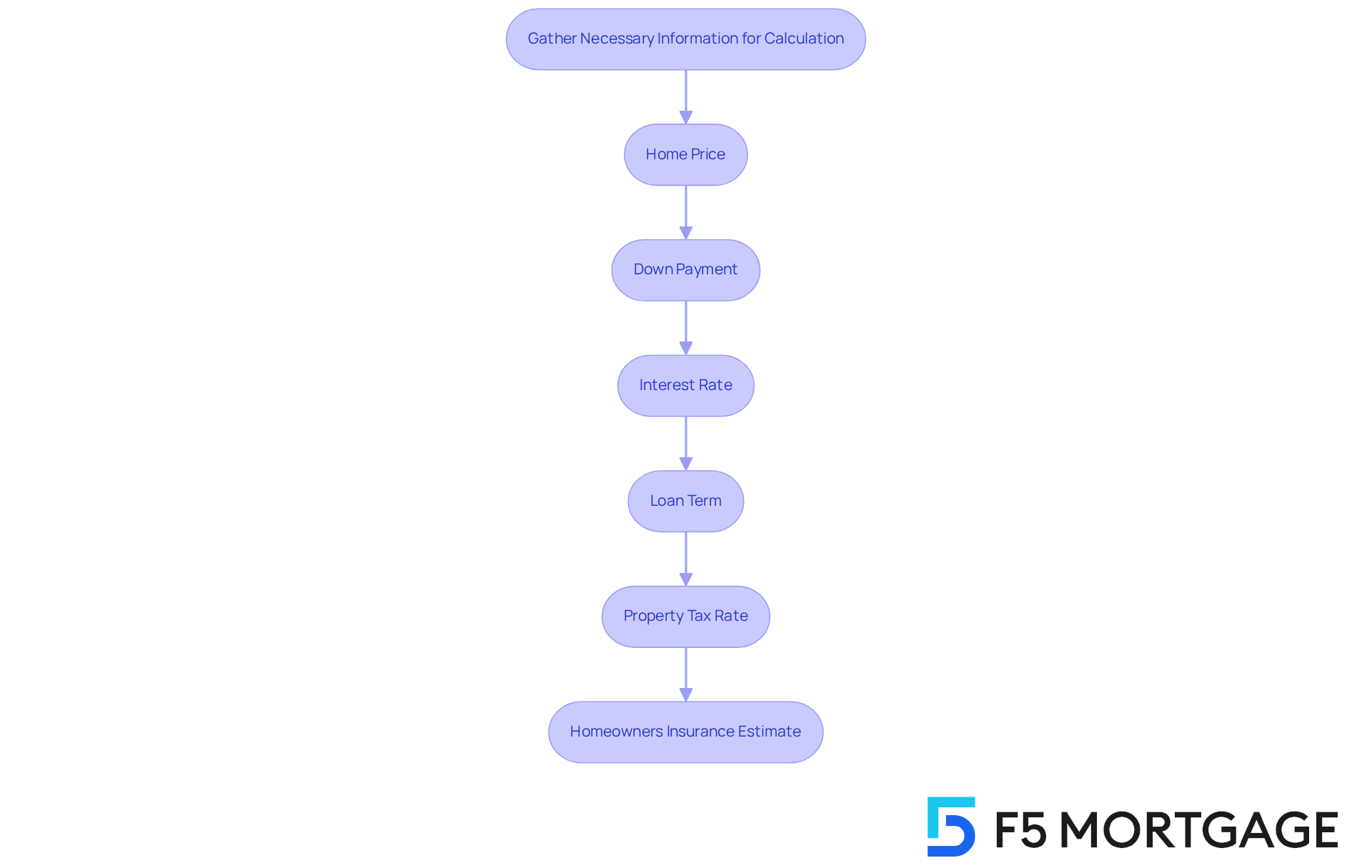

Gather Necessary Information for Calculation

To effectively use the mortgage payment calculator, we know how crucial it is to gather the following information:

- Home Price: Start by determining the purchase price of the home you are considering.

- Down Payment: Identify the amount you plan to pay upfront, as this will influence the principal loan amount. In Texas, when utilizing a mortgage payment calculator Texas, the average down payment is usually about 20%, but this can change depending on your personal situation. Additionally, consider exploring down payment assistance programs offered by F5 Mortgage, like the My Choice Texas Home program, which provides up to 5% for down payment and closing support. For a broader perspective, compare this with programs in California and Florida, such as the MyHome Assistance Program from CalHFA and the Florida Assist Second Mortgage Program.

- Interest Rate: Research current loan rates in Texas through a mortgage payment calculator Texas, which are approximately 6.5% as of September 2025. Experts suggest that rates may approach 6% later in the year, making it essential for accurate calculations.

- Loan Term: Decide on the length of the loan you prefer, such as 15 or 30 years. An extended duration can help keep your monthly costs lower, allowing more funds for home enhancement projects or increasing your savings. On the other hand, a shorter term means you’ll settle your loan sooner and build equity in your home more quickly.

- Property Tax Rate: Investigate local property tax rates, which can vary significantly across Texas, and utilize a mortgage payment calculator Texas for accurate financial assessments.

- Homeowners Insurance Estimate: Obtain quotes from various insurance providers to estimate this cost accurately.

Having this information ready will not only simplify the calculation process but also improve the precision of your loan cost estimates. As Steven Glick, a director of loan sales, emphasizes, “Locking in now at mid-6% could save thousands annually while rates are declining.” This proactive approach can significantly benefit first-time homebuyers navigating the Texas housing market. We’re here to support you every step of the way.

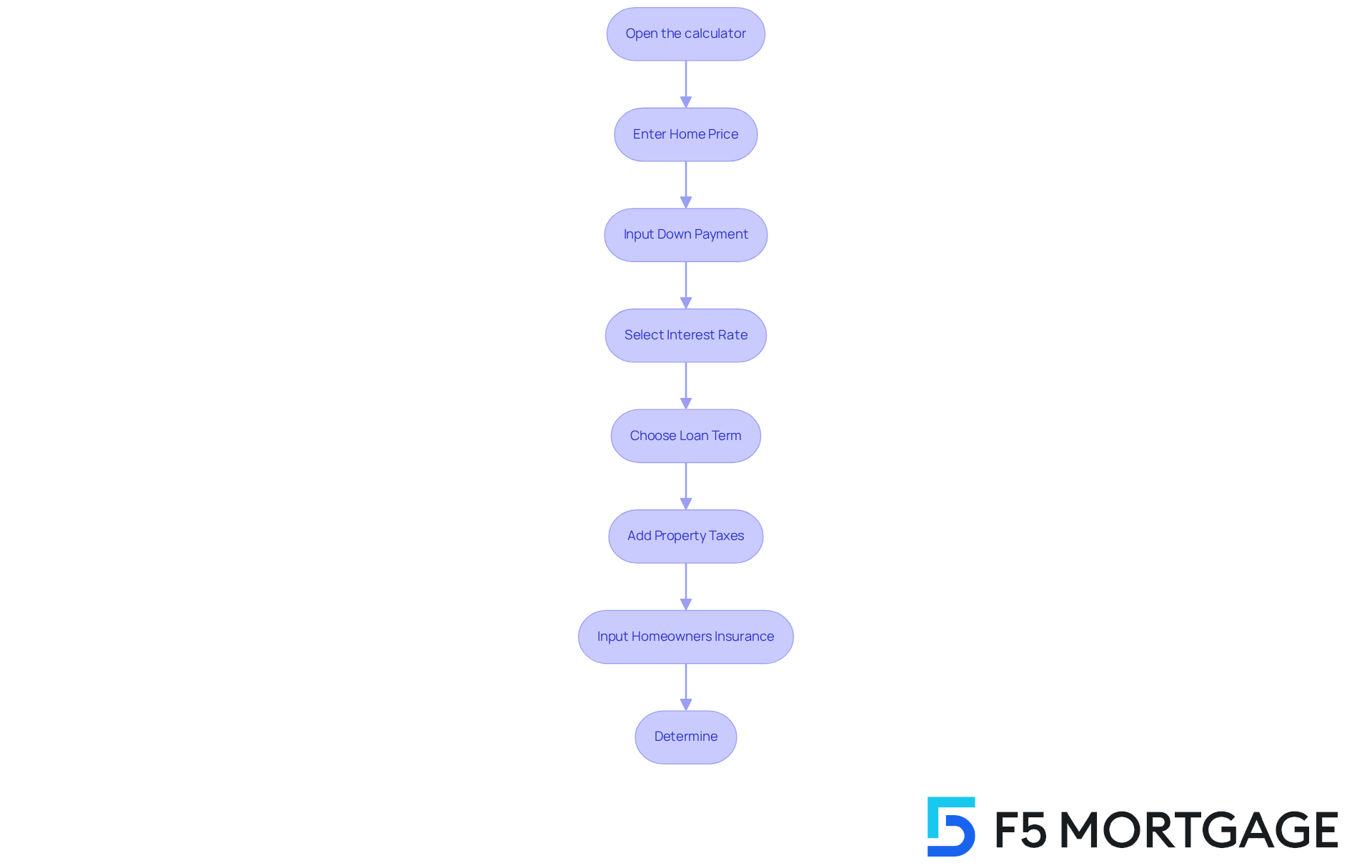

Input Data into the Calculator

We understand that navigating the mortgage process can feel overwhelming. To help you, here’s a simple guide to input your data into the mortgage payment calculator:

- Open the mortgage payment calculator Texas: Start by accessing a reliable loan cost calculator online. This is your first step towards clarity.

- Enter Home Price: Input the total price of the home you wish to purchase. Knowing this figure is crucial for your calculations.

- Input Down Payment: Enter the amount you plan to pay upfront. This will automatically adjust the principal, providing you with a clearer picture when using a mortgage payment calculator Texas.

- Select Interest Rate: Input the interest rate you found during your research. It’s important to use the most accurate rate available to you.

- Choose Loan Term: Select the duration of the loan from the dropdown menu. This decision has a significant impact on the results you would see from a mortgage payment calculator Texas.

- Add Property Taxes: Enter the estimated annual property tax amount. This will help you understand the full cost of homeownership.

- Input Homeowners Insurance: Add the estimated annual insurance cost. This is an essential part of your budgeting.

- Determine: Finally, click the calculate button to generate your estimated recurring charge.

Remember, ensuring all figures are accurate when using a mortgage payment calculator Texas is vital to receive the most reliable estimate. We’re here to as you embark on this important journey.

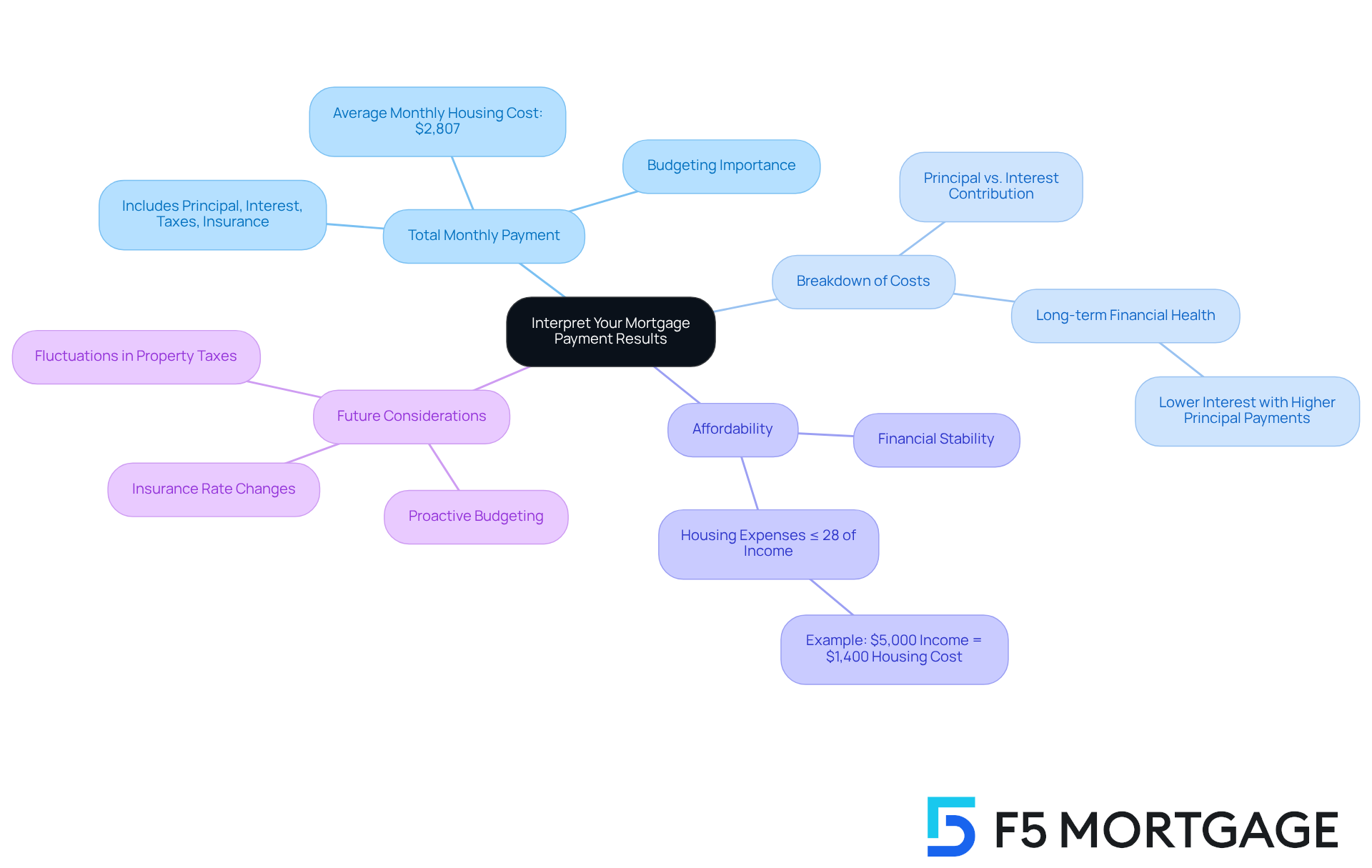

Interpret Your Mortgage Payment Results

Once you have utilized a mortgage payment calculator Texas to calculate your estimated monthly mortgage payment, it’s crucial to interpret the results effectively by considering a few key aspects that can truly make a difference for you and your family.

- Total Monthly Payment: This includes the total of principal, interest, property taxes, and insurance. It’s essential to ensure that this total fits comfortably within your budget. We know how challenging this can be, especially as recent data shows that the has reached a record high of $2,807. Careful budgeting is more important than ever, especially when using a mortgage payment calculator Texas.

- Breakdown of Costs: Take a moment to analyze how much of your contribution goes to principal versus interest. A larger principal contribution can significantly decrease your loan balance over time, leading to lower interest paid in the long term. According to Bob Broeksmit, CEO of the Mortgage Bankers Association, understanding this breakdown is vital for your long-term financial health.

- Affordability: Evaluate your projected cost against your monthly income to determine manageability. Financial specialists frequently advise that housing expenses should not exceed 28% of your total income each month. For instance, if your monthly income is $5,000, aim for a total housing cost of no more than $1,400. Many families in Texas find that following this guideline, along with a mortgage payment calculator Texas, helps maintain financial stability.

- Future Considerations: Be mindful of potential fluctuations in property taxes or insurance rates that could impact your payment in the future. Staying informed about these changes can help you avoid surprises down the line. As Kimberly Freutel, a Redfin Premier agent, advises, being proactive about potential increases can safeguard your budget.

By understanding these components, you can make more informed decisions regarding your loan options, ensuring that your financial commitments align with your long-term goals. Furthermore, consider the experiences of families who have effectively managed these calculations to find a loan that suits their needs. Their journeys can offer practical insights into the process, reminding you that you’re not alone in this journey.

Troubleshoot Common Calculator Issues

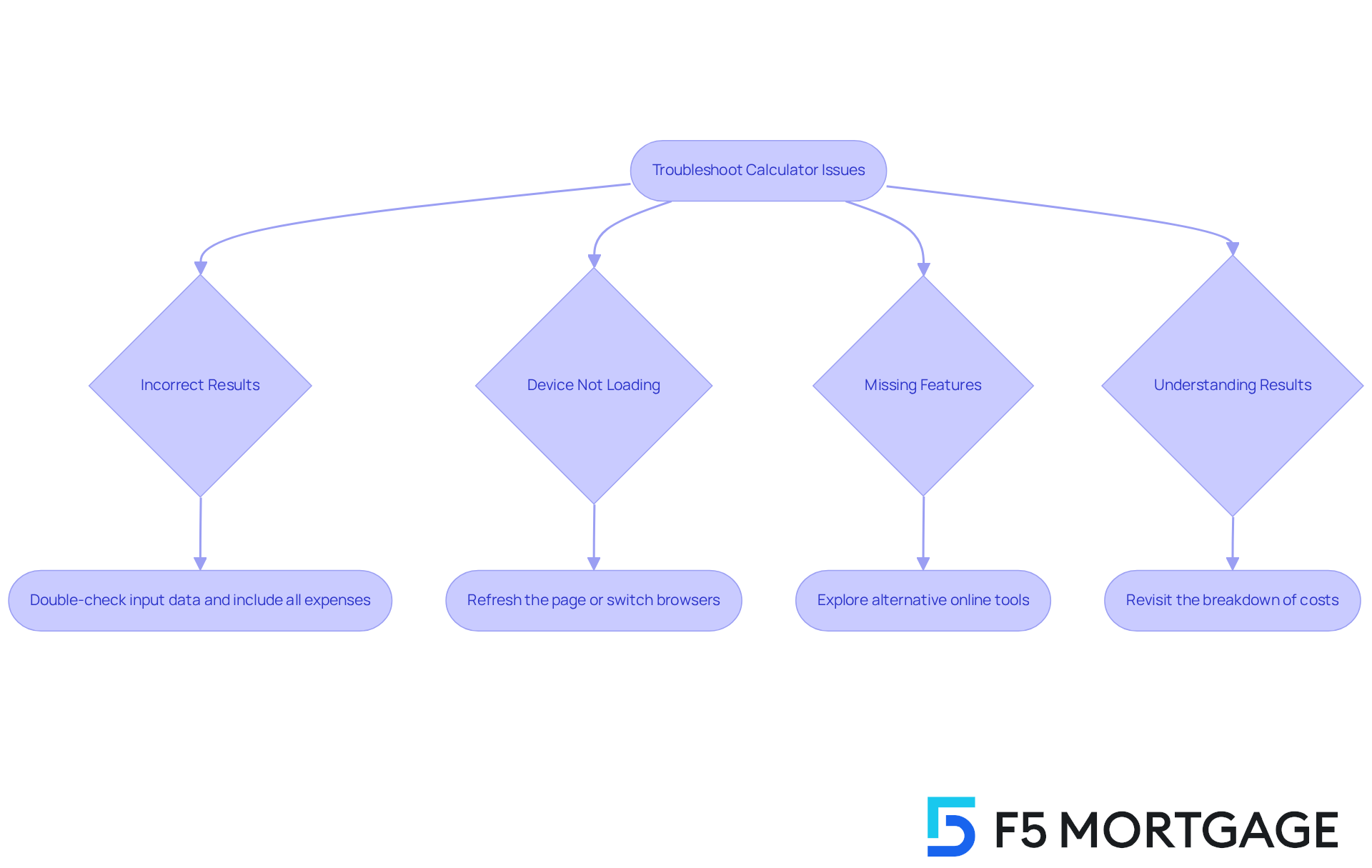

When utilizing a loan cost estimator, we understand that you may encounter some common challenges. Here are some helpful troubleshooting tips to support you:

- Incorrect Results: It’s essential to ensure that all input data is accurate. Please double-check the home price, initial deposit, interest rate, and any other relevant figures. Many individuals often overlook their total housing expenses by not factoring in property taxes, insurance, and housing insurance, which can lead to unrealistic expectations. For example, Freddie Mac estimates that borrowers pay between $30 to $70 a month for private mortgage insurance (PMI) for every $100,000 borrowed, which can significantly impact your monthly payments.

- Device Not Loading: If your device fails to load, try refreshing the page or switching to a different browser. Technical glitches can often be resolved with these simple steps, and we want to ensure you have a smooth experience.

- Missing Features: If your device doesn’t provide certain features you need, consider exploring alternative online tools that offer a more comprehensive range of options. Some devices might only calculate principal and interest fees, overlooking other crucial expenses that matter to you.

- Understanding Results: If the results seem confusing, take a moment to revisit the breakdown of costs. Understanding each component—such as principal, interest, property taxes, and insurance—is vital for . Remember, as a loan officer points out, “the financing estimation tool only offers an approximation,” so discussing your situation with a lender can provide a clearer understanding of your financial responsibilities.

By following these steps, you can effectively troubleshoot common issues and enhance your experience with mortgage payment calculator Texas. This will lead to more informed financial decisions, and we’re here to support you every step of the way.

Conclusion

Mastering the mortgage payment calculator in Texas is a vital step for homebuyers looking to navigate the complexities of home financing. We understand how overwhelming this process can be, but by grasping the essential components—like principal, interest rates, loan terms, property taxes, and homeowners insurance—you can make informed decisions that align with your financial goals. This comprehensive approach not only demystifies the borrowing process but also empowers you to take control of your financial future.

In this guide, we’ve shared key insights on:

- Gathering the necessary information

- Inputting data accurately

- Interpreting results

- Troubleshooting common issues

Each step is crucial for ensuring that the mortgage payment calculator provides reliable estimates. By paying attention to the breakdown of costs and understanding how various factors influence your overall payments, you can better assess your affordability and plan confidently.

Ultimately, using the mortgage payment calculator in Texas goes beyond just crunching numbers; it’s about fostering financial literacy and building confidence in your home buying journey. As the housing market evolves, staying informed and proactive will help you navigate potential challenges and seize opportunities. Embrace the power of this tool, and take that first step toward achieving your homeownership dreams with clarity and assurance.

Frequently Asked Questions

What is a mortgage payment calculator and why is it important?

A mortgage payment calculator is a tool used to estimate monthly loan payments, helping homebuyers make informed financial decisions. It simplifies the lending experience by providing insights into various costs associated with homeownership.

What key components are involved in calculating mortgage payments?

The key components include: – Principal: The total amount borrowed to purchase the home. – Interest Rate: The percentage charged by the lender for borrowing funds. – Loan Term: The duration over which the loan will be repaid, typically 15, 20, or 30 years. – Property Taxes: Taxes based on the property’s assessed value. – Homeowners Insurance: Insurance that protects the home and belongings.

How does the down payment affect the mortgage calculation?

The down payment is the amount paid upfront when purchasing a home, influencing the principal loan amount. In Texas, the average down payment is about 20%, but this can vary based on personal circumstances.

What are some down payment assistance programs available in Texas?

One notable program is the My Choice Texas Home program, which offers up to 5% for down payment and closing support. It’s beneficial to explore various programs, including those available in other states like California and Florida.

What should I consider when determining the interest rate for my mortgage?

Research current loan rates in Texas, which are approximately 6.5% as of September 2025. It’s important to stay informed as rates may fluctuate, and locking in a lower rate could save significant amounts over time.

How does the loan term impact my mortgage payments?

The loan term affects both monthly payments and total interest paid. A longer term typically results in lower monthly payments but more interest paid over time, while a shorter term means higher payments but quicker equity buildup.

Why is it important to understand local property tax rates?

Property tax rates can vary significantly across Texas, impacting overall housing costs. Understanding these rates is crucial for accurate financial assessments when using a mortgage payment calculator.

How can I estimate homeowners insurance costs?

To estimate homeowners insurance costs, obtain quotes from various insurance providers. This will help you include an accurate figure in your mortgage payment calculations.

What should I do to ensure accurate calculations using the mortgage payment calculator?

Gather necessary information such as home price, down payment, interest rate, loan term, property tax rate, and homeowners insurance estimates. Having this information ready will improve the precision of your loan cost estimates.