Overview

Understanding your monthly mortgage payment can feel overwhelming at times, but we’re here to help. It involves key components like principal, interest, taxes, and insurance, along with a straightforward calculation method. In this article, we break down these elements in detail, providing you with a formula to determine your total payment.

We know how challenging this can be, especially when variations in loan amounts and interest rates can significantly affect your monthly costs. This understanding is crucial for effective financial planning. By equipping yourself with this knowledge, you can make informed decisions that align with your family’s needs and goals.

Our goal is to support you every step of the way, ensuring you feel confident as you navigate the mortgage process.

Introduction

Understanding monthly mortgage payments can often feel like navigating a complex maze of numbers and terms. We know how challenging this can be. With various components like principal, interest, taxes, and insurance at play, the task may seem daunting for many prospective homeowners. However, mastering these elements empowers individuals to take control of their financial future. It also equips them with the knowledge to make informed decisions about their home financing.

What if a slight change in interest rates or down payment could significantly alter monthly obligations? This guide will unravel the intricacies of mortgage calculations. By doing so, we aim to help you confidently navigate your path to homeownership. We’re here to support you every step of the way.

Understand the Components of Your Mortgage Payment

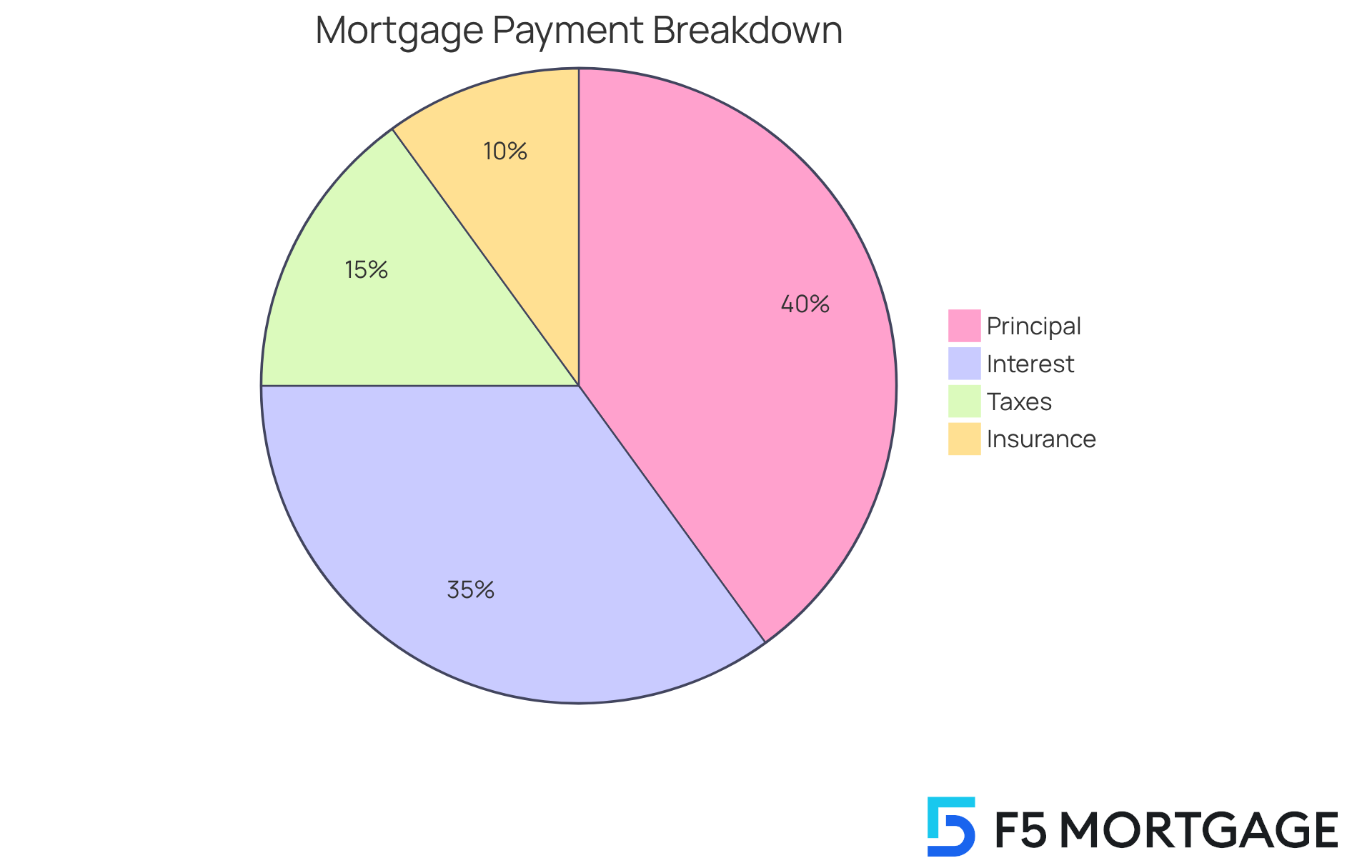

Understanding calculating monthly mortgage payment can feel overwhelming, but we’re here to support you every step of the way. A typical payment comprises several essential components that collectively determine the total amount due each month:

- Principal: This is the amount you borrow from the lender. Each regular installment you make decreases the principal, gradually building your equity in your home.

- Interest: This represents the cost of borrowing the principal, expressed as a percentage. The interest rate significantly impacts your total payment; for instance, a $240,000 mortgage at a 3.5% interest results in a charge of roughly $1,077.71, while the same amount at 6% would rise to around $1,439.

- Taxes: Property taxes are usually included in your monthly payments and can vary based on your property’s assessed value and local tax rates. In 2024, many families faced additional costs, with some paying over $500 monthly in homeowners association fees.

- Insurance: Homeowners insurance protects your property from damages. If your down payment is less than 20%, you may also need private mortgage insurance (PMI), which protects lenders in case of default. The good news is that PMI can be canceled once you achieve at least 20% equity in your home.

We know how challenging this can be, but understanding these elements is crucial for and for grasping how they interact and affect your total loan cost. For example, with a 20% down payment on a U.S. median house price of $410,800, your recurring housing cost would be around $2,195. This illustrates how the size of your contribution directly impacts your ongoing responsibilities. By mastering these components, you can better prepare for the financial responsibilities of homeownership.

Follow These Steps to Calculate Your Monthly Payment

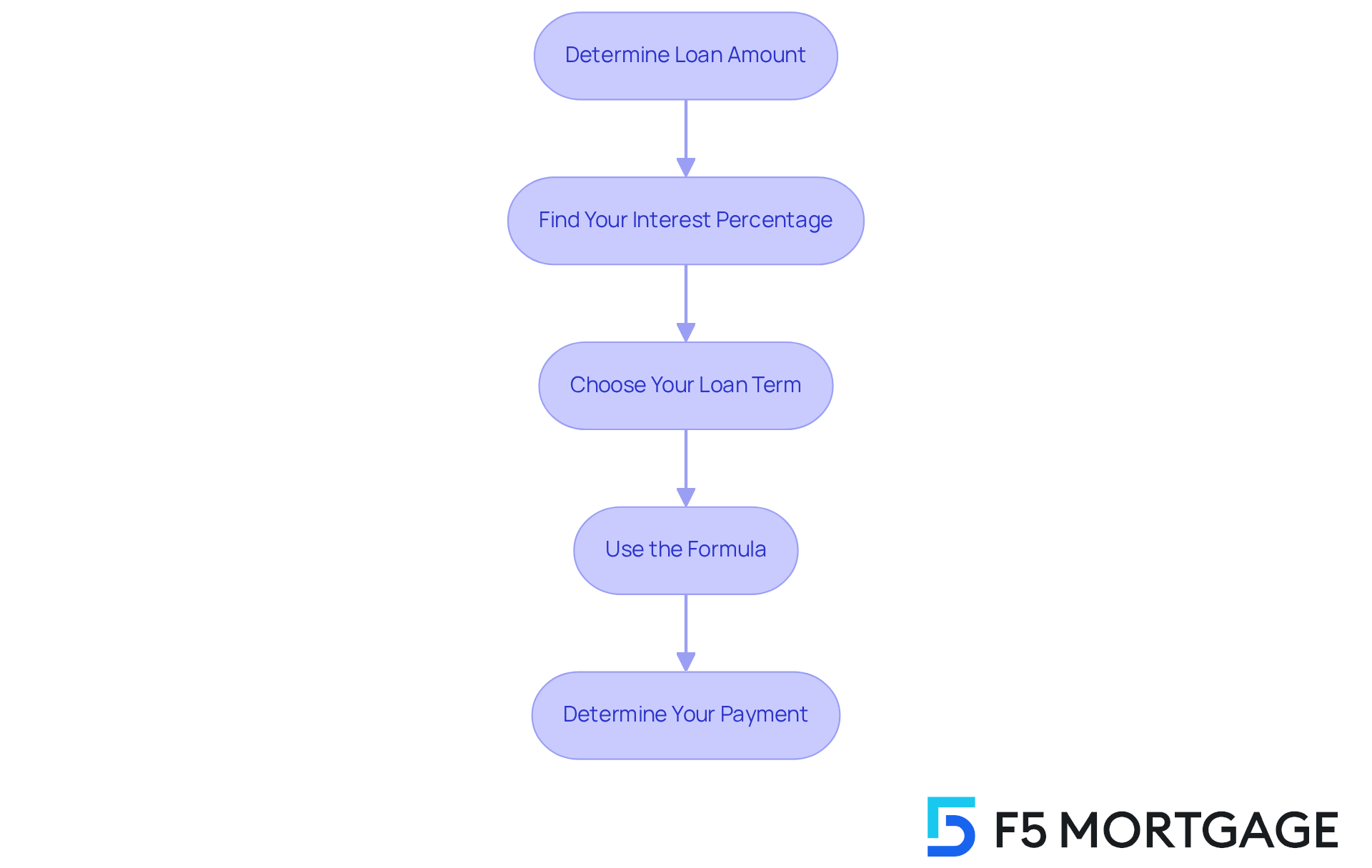

Determining your monthly loan payment may seem overwhelming, but it involves a few straightforward steps for calculating monthly mortgage payment. Here’s how to navigate this process with confidence:

Determine the Loan Amount: Start by identifying the total amount you plan to borrow for your home purchase.

Find Your Interest Percentage: Reach out to your lender to acquire the current yearly interest percentage. As of 2025, average loan interest percentages are fluctuating around 6.5%, but keep in mind that this can vary based on your credit score and market conditions.

Choose Your Loan Term: Common loan terms are 15, 20, or 30 years. Convert this term into months (e.g., a 30-year loan equals 360 months).

Use the Formula: To calculate your monthly payment (M), use the following formula:

M = P [ r(1 + r)^n ] / [ (1 + r)^n – 1]

Where:

- M = total monthly mortgage payment

- P = the loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

Determine Your Payment: Enter your figures to find your regular installment. This calculation, which involves calculating monthly mortgage payment, will give you the principal and interest part of your amount due. Remember to include property taxes, homeowners insurance, and any mortgage insurance for a complete overview of your total costs.

For instance, if you take out $300,000 at a 6.5% interest rate over 30 years, your payment each month would be roughly $1,896. This figure highlights the importance of understanding how various loan amounts and interest levels can significantly impact your monthly budget.

Additionally, it’s crucial to consider home equity requirements. Many lenders require homeowners to maintain at least an 80% home-to-value loan ratio. This means you should have paid down at least 20% of your original loan amount or that your home has increased in value. Furthermore, cash-out home equity loans may have even higher equity requirements. Understanding your debt-to-income (DTI) ratio is also vital; a maximum of 43% DTI is generally necessary for home loans, which can influence your loan costs. An improved DTI can lead to more competitive mortgage prices.

Mortgage professionals emphasize that comparing multiple quotes can lead to substantial savings. Borrowers who shop around can save an average of $3,000 by obtaining five quotes. This method not only helps you secure a better interest rate but also enables you to make informed choices aligned with your financial goals. We’re here to support you every step of the way, and for competitive rates and personalized service that can help you navigate these important aspects of home financing.

Utilize a Mortgage Calculator for Accurate Estimates

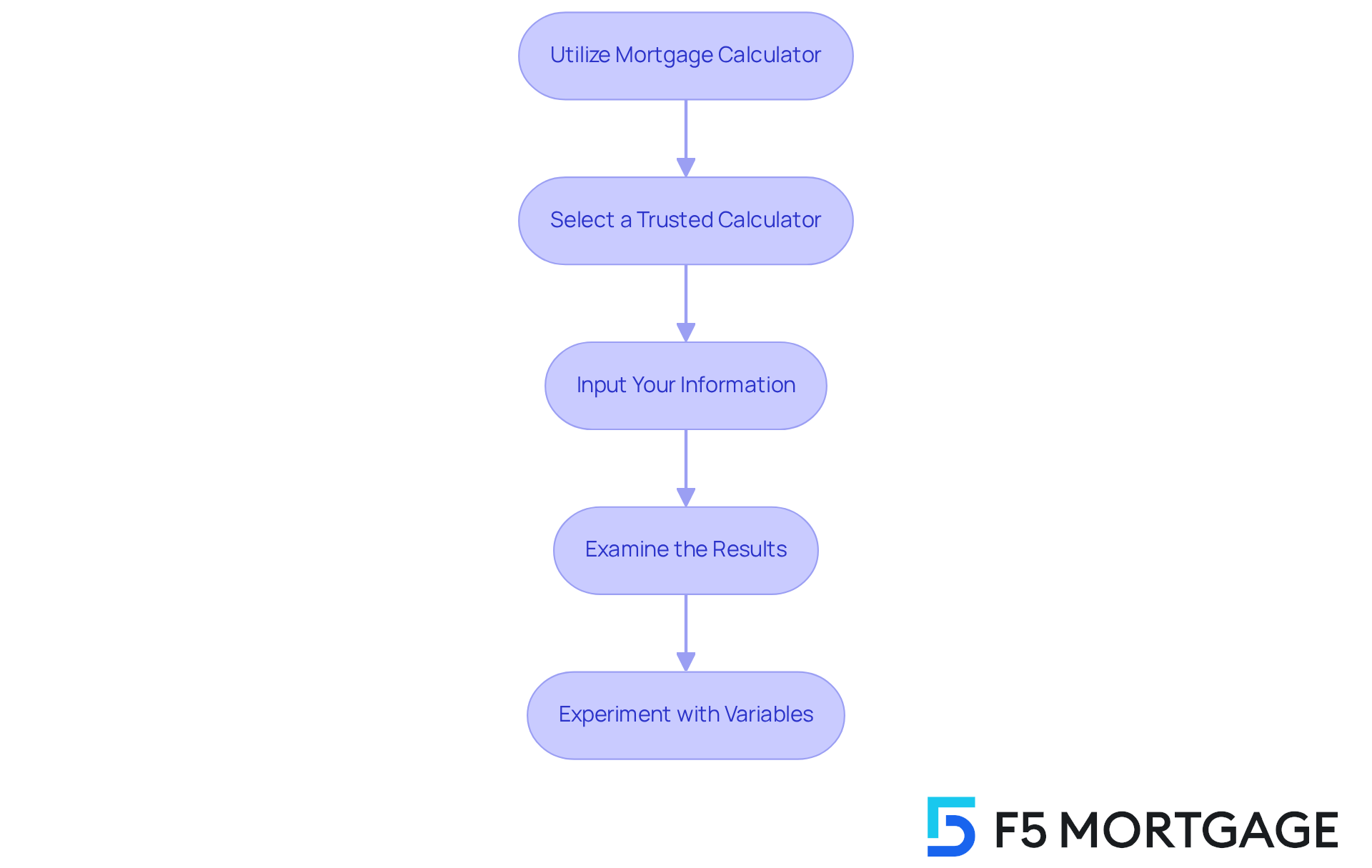

Using an online loan calculator can make a significant difference in calculating monthly mortgage payment, and we understand how important this is for your financial peace of mind. Here’s how to make the most of this valuable tool:

- Select a Trusted Calculator: Choose a user-friendly mortgage calculator from reputable websites. This ensures you have access to accurate and reliable data, which is crucial for your planning.

- Input Your Information: Enter essential details such as the loan amount, interest percentage, loan term, and any additional costs like property taxes and homeowner’s insurance. Providing comprehensive input will yield a more precise estimate, helping you feel more secure in your decisions.

- Examine the Results: The calculator will produce an estimated regular charge that includes principal, interest, taxes, and insurance. Calculating monthly mortgage payment provides you with a complete picture of your financial obligation, allowing you to plan better.

- Experiment with Variables: Adjust various parameters like loan amounts, interest rates, and terms to see how these changes affect your regular payments. This flexibility allows you to explore different scenarios and find the best fit for your budget.

Utilizing a is beneficial for calculating monthly mortgage payment, as it not only saves you time but also enhances your understanding of your financial responsibilities. For instance, a $200,000 loan at a 4% interest rate leads to a payment of roughly $955, while the same loan at 5% raises the payment to around $1,074. These insights are vital for effective budgeting.

Furthermore, loan calculators can help you estimate the total interest paid over the life of the loan, empowering you to make informed decisions. As you navigate the complexities of homeownership, remember that leveraging these calculators can support you in making sound financial choices and avoiding unexpected costs. We’re here to support you every step of the way.

Consider Factors That Influence Your Monthly Payment

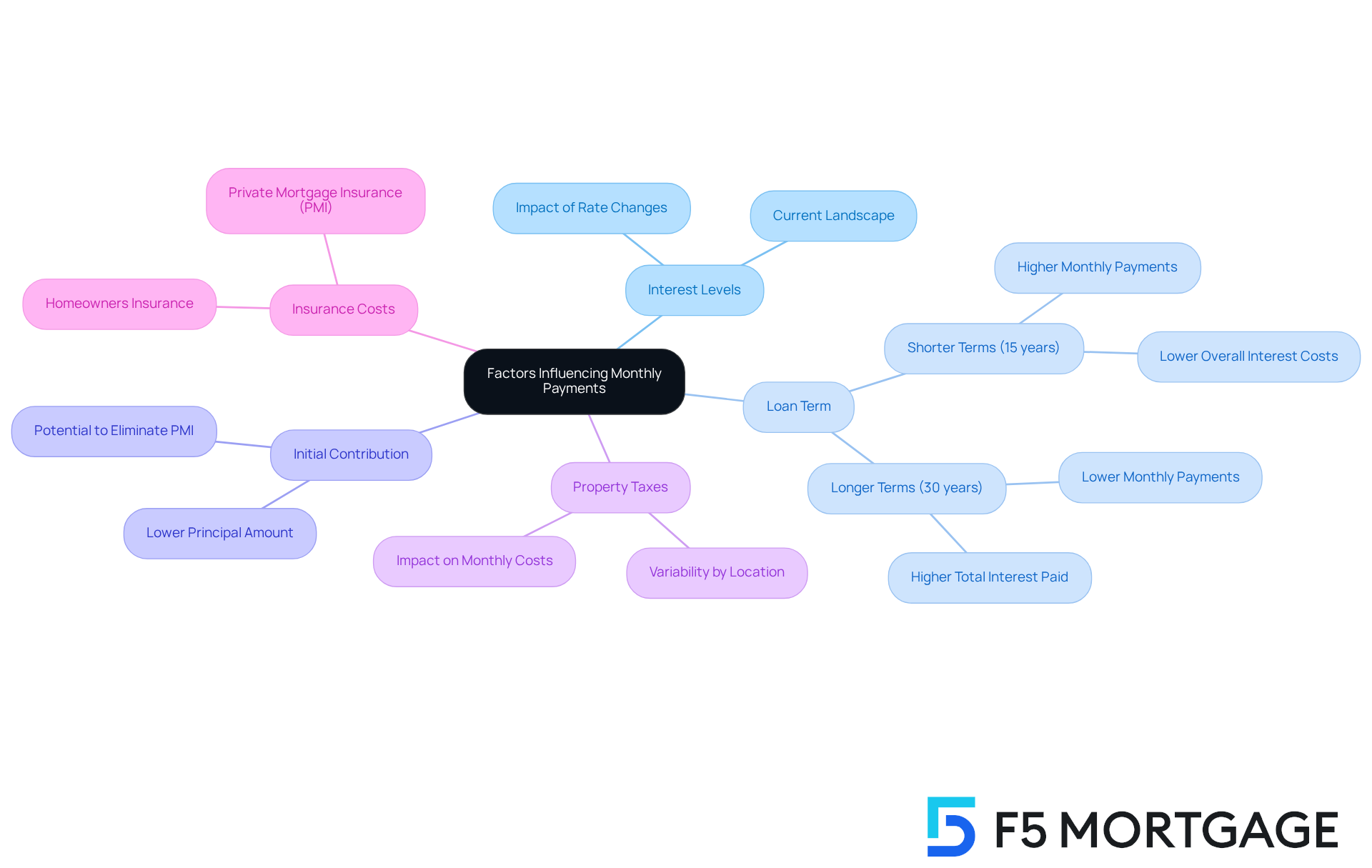

Several key factors can significantly influence your monthly mortgage payment, and understanding them is essential for your financial well-being:

- Interest Levels: The current landscape of interest rates plays a crucial role in shaping your financial obligations. For instance, as of 2025, average loan costs have varied, which can greatly impact your monthly expenses. A decrease in rates can lead to substantial savings, while an increase can raise your costs considerably.

- Loan Term: The length of your loan term is another critical factor to consider. Shorter loan durations, like 15 years, typically result in higher monthly payments but lower overall interest costs throughout the loan’s life. Conversely, a 30-year term spreads costs over a longer period, reducing monthly payments but increasing the total interest paid.

- Initial Contribution: Making a larger initial contribution can significantly reduce the principal amount borrowed. This not only lowers your monthly payments but may also eliminate private mortgage insurance (PMI), further decreasing your overall expenses.

- Property Taxes: Property taxes vary widely by location and can change over time, impacting your monthly costs. It’s important to factor these into your budgeting for homeownership.

- Insurance Costs: Homeowners insurance and PMI can fluctuate based on the property and your financial profile. Understanding your insurance needs is vital, as these expenses contribute to your monthly outgoings.

By thoughtfully evaluating these elements, you can better prepare for your loan obligations and make informed decisions, especially when calculating monthly mortgage payment for your home financing. For example, a minor rise in interest rates can lead to hundreds of dollars in additional payments over the life of a loan, highlighting the importance of securing the best terms possible. We know how challenging this can be, and even a can significantly alter your monthly obligations. Staying informed and proactive in your mortgage planning is crucial, and we’re here to support you every step of the way.

Conclusion

Understanding how to calculate your monthly mortgage payment is essential for anyone looking to buy a home. We know how challenging this can be, and this guide breaks down the intricate components of a mortgage payment, from principal and interest to taxes and insurance. By grasping these elements, prospective homeowners can better prepare for the financial responsibilities that come with homeownership.

This article details a step-by-step approach to calculating monthly payments, emphasizing the importance of knowing your loan amount, interest rate, and loan term. It highlights how various factors, such as interest rates and down payments, can significantly affect your monthly obligations. Additionally, we encourage the use of mortgage calculators to simplify the process and provide accurate estimates, allowing for better financial planning.

Ultimately, being informed about mortgage payment calculations empowers you to make sound financial decisions. As interest rates fluctuate and housing markets evolve, staying proactive and educated about these factors can lead to substantial savings. Embracing this knowledge not only enhances your budgeting capabilities but also ensures a smoother transition into homeownership. We’re here to support you every step of the way.

Frequently Asked Questions

What are the main components of a mortgage payment?

A typical mortgage payment comprises four essential components: principal, interest, taxes, and insurance.

What is the principal in a mortgage payment?

The principal is the amount you borrow from the lender. Each regular installment you make reduces the principal, helping to build your equity in the home.

How does interest affect my mortgage payment?

Interest represents the cost of borrowing the principal and is expressed as a percentage. A higher interest rate increases the total monthly payment. For example, a $240,000 mortgage at 3.5% interest results in a payment of approximately $1,077.71, while the same amount at 6% raises the payment to around $1,439.

Are property taxes included in my mortgage payment?

Yes, property taxes are typically included in monthly mortgage payments and can vary based on the property’s assessed value and local tax rates.

What role does homeowners insurance play in my mortgage payment?

Homeowners insurance protects your property from damages and is included in your mortgage payment. If your down payment is less than 20%, you may also need private mortgage insurance (PMI), which protects lenders in case of default. PMI can be canceled once you achieve at least 20% equity in your home.

How does my down payment affect my monthly housing costs?

The size of your down payment directly impacts your ongoing responsibilities. For instance, with a 20% down payment on a U.S. median house price of $410,800, your recurring housing cost would be around $2,195.

Why is it important to understand the components of a mortgage payment?

Understanding these components is crucial for calculating your monthly mortgage payment and grasping how they interact to affect your total loan cost, which helps in preparing for the financial responsibilities of homeownership.