Overview

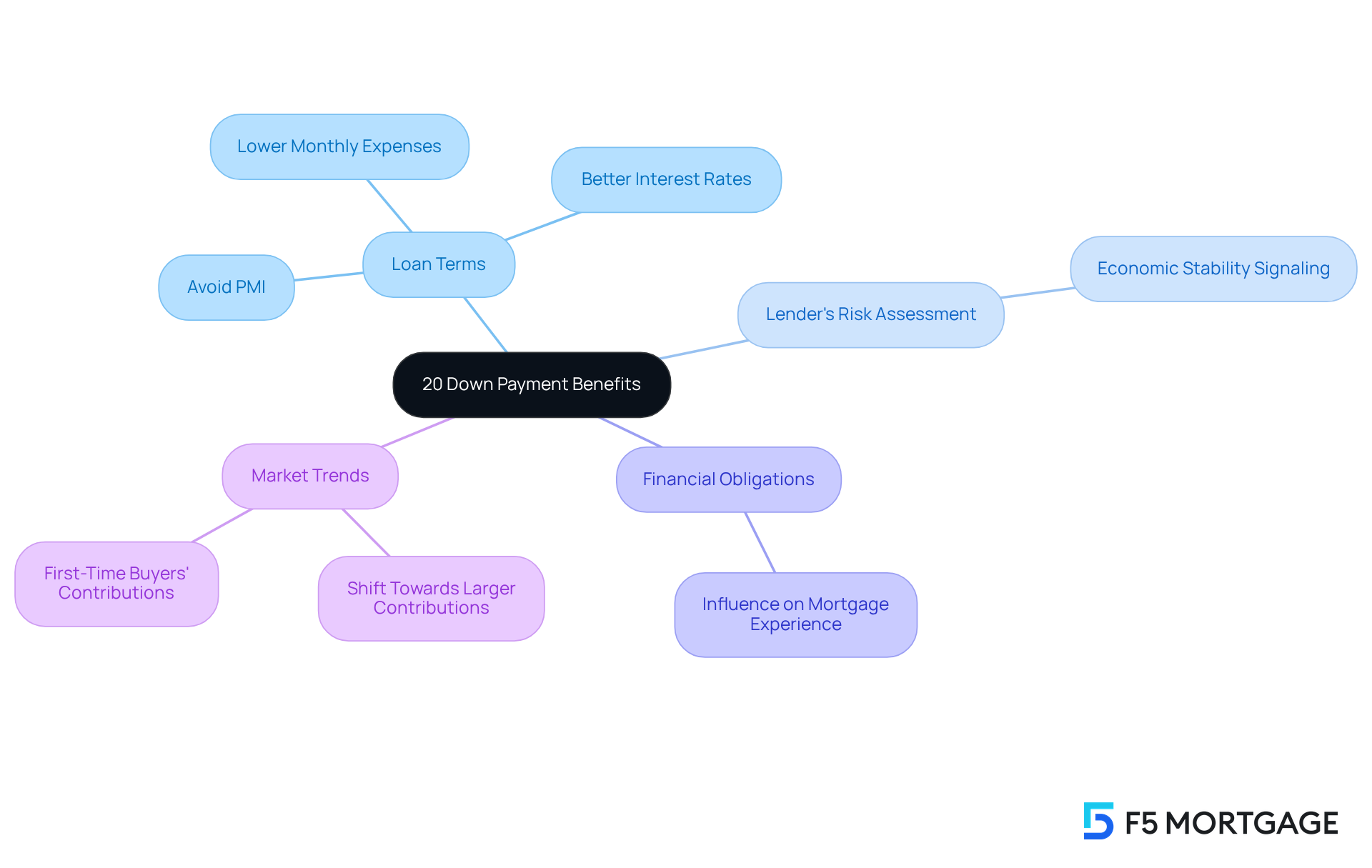

We understand how important it is to feel secure when making a significant investment like buying a home. Having a large house down payment of at least 20% can offer you substantial benefits. Not only does it provide financial security, but it also leads to lower monthly payments and helps you avoid private mortgage insurance (PMI).

Imagine the peace of mind that comes with knowing you’ve made a strong financial choice. A substantial down payment enhances your loan terms, reduces overall borrowing costs, and signals economic stability to lenders. This can make homeownership not just a dream, but a reality that feels attainable and manageable.

We’re here to support you every step of the way as you navigate this process. By focusing on the advantages of a larger down payment, we hope to empower you to make informed decisions that align with your financial goals.

Introduction

Navigating the complex world of home buying can feel overwhelming. We understand how daunting it is, especially when considering the financial implications of down payments. A significant contribution—typically at least 20%—not only opens doors to better loan terms but also enhances long-term financial security for homeowners. Yet, many potential buyers struggle with saving such a substantial amount. It’s natural to wonder if the benefits truly outweigh the hurdles.

So, what strategies can aspiring homeowners employ to reach this benchmark? Together, we can explore practical steps that will empower you to secure a more favorable mortgage experience. Remember, we’re here to support you every step of the way.

Define a Large Down Payment: Understanding the 20% Benchmark

When considering a home purchase, we know how challenging it can be to navigate the financial landscape. Having a large house down payment (at least 20%) has benefits such as playing a significant role in the loan sector. This threshold is not just a number; it can lead to more favorable loan terms. For example, having a large house down payment (at least 20%) has benefits such as the ability to avoid private mortgage insurance (PMI), which is an extra cost that protects lenders in case of default.

This 20% benchmark serves as a vital indicator of a lender’s risk assessment. When you can offer a significant down payment, having a large house down payment (at least 20%) has benefits such as , which in turn lowers the lender’s perceived risk. Having a large house down payment (at least 20%) has benefits such as better interest rates and more advantageous loan conditions, which make homeownership more attainable.

Understanding the implications of this benchmark is essential for potential homebuyers. It directly influences your financial obligations and overall mortgage experience. In 2024, the median initial contribution for U.S. home purchasers was 18%, reflecting a trend towards larger contributions. However, first-time buyers typically contributed only 8%. FHA loans offer low initial cost options, making homeownership more accessible, especially with their flexible credit criteria.

Looking ahead to 2025, many homebuyers are expected to meet this standard, indicating a shift towards increased economic security in home purchasing. As Diane Hughes, Executive Vice President and Director of Mortgage Lending, noted, ‘Having a large house down payment (at least 20%) has benefits such as reducing your monthly loan expense and qualifying for improved rates or conditions.’

Furthermore, comprehending the loan approval process is crucial. It involves a lender evaluating your economic information to determine your eligibility for a loan. This understanding can greatly influence your borrowing choices, empowering you to make informed decisions every step of the way.

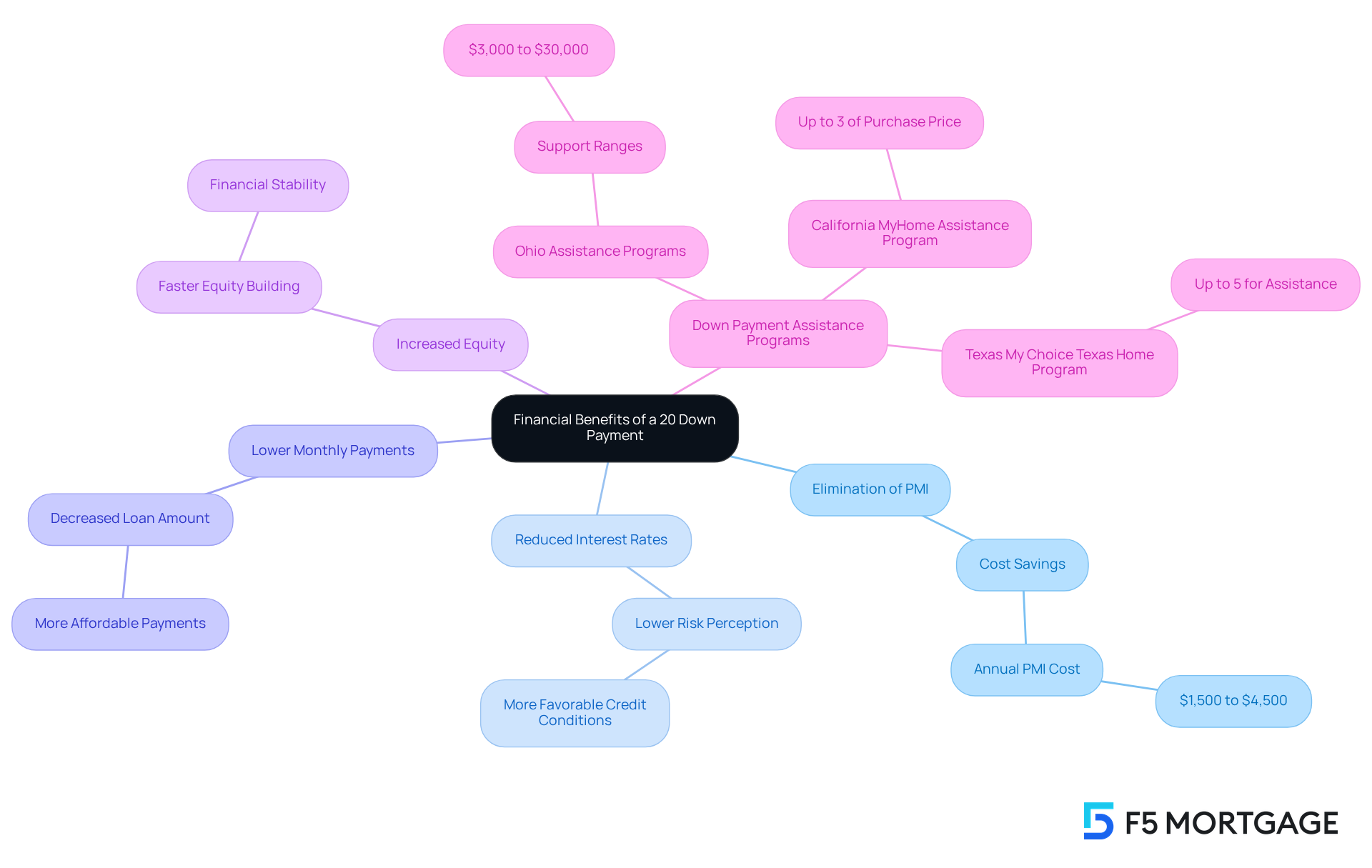

Explore the Financial Benefits of a 20% Down Payment

Having a large house down payment (at least 20%) has benefits such as providing substantial financial advantages for homebuyers. We understand how daunting this process can be, and having a large house down payment (at least 20%) has benefits such as eliminating private mortgage insurance (PMI). This insurance can significantly increase monthly payments, costing between 0.5% and 1.5% of the loan amount annually. For example, on a $300,000 mortgage, this could mean an additional $1,500 to $4,500 each year. By avoiding PMI, homeowners can ease their monthly financial burden.

Additionally, having a large house down payment (at least 20%) has benefits such as leading to reduced interest rates. Lenders view borrowers who can provide significant upfront contributions as less risky, which can translate into more favorable credit conditions. For instance, having a large house down payment (at least 20%) has benefits such as qualifying for interest rates that are substantially lower than those available to borrowers with smaller contributions. This decrease in interest rates not only lowers monthly costs but also reduces the overall interest paid throughout the life of the loan.

Moreover, a 20% deposit decreases the total loan amount, leading to reduced monthly installments and a quicker path to building equity in the home. This economic strategy enhances affordability, and having a large house down payment (at least 20%) has benefits such as providing homeowners with increased equity from the start, which sets the stage for future financial stability and flexibility.

However, we know how challenging it can be for many first-time homebuyers to save for a down deposit. In Ohio, down deposit assistance programs can provide support ranging from a few thousand dollars to over $30,000, either as loans or grants, helping to alleviate some of the financial pressure. Eligibility for these programs often depends on factors such as income level, credit score, and the type of home being purchased. For example, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price, while Texas’s My Choice Texas Home program provides up to 5% for down payment assistance and closing support.

Postponing the purchase to save for a 20% deposit can delay the benefits of homeownership, as renters miss out on the opportunity to build equity while they save. We’re here to support you every step of the way, ensuring you have the to make informed decisions.

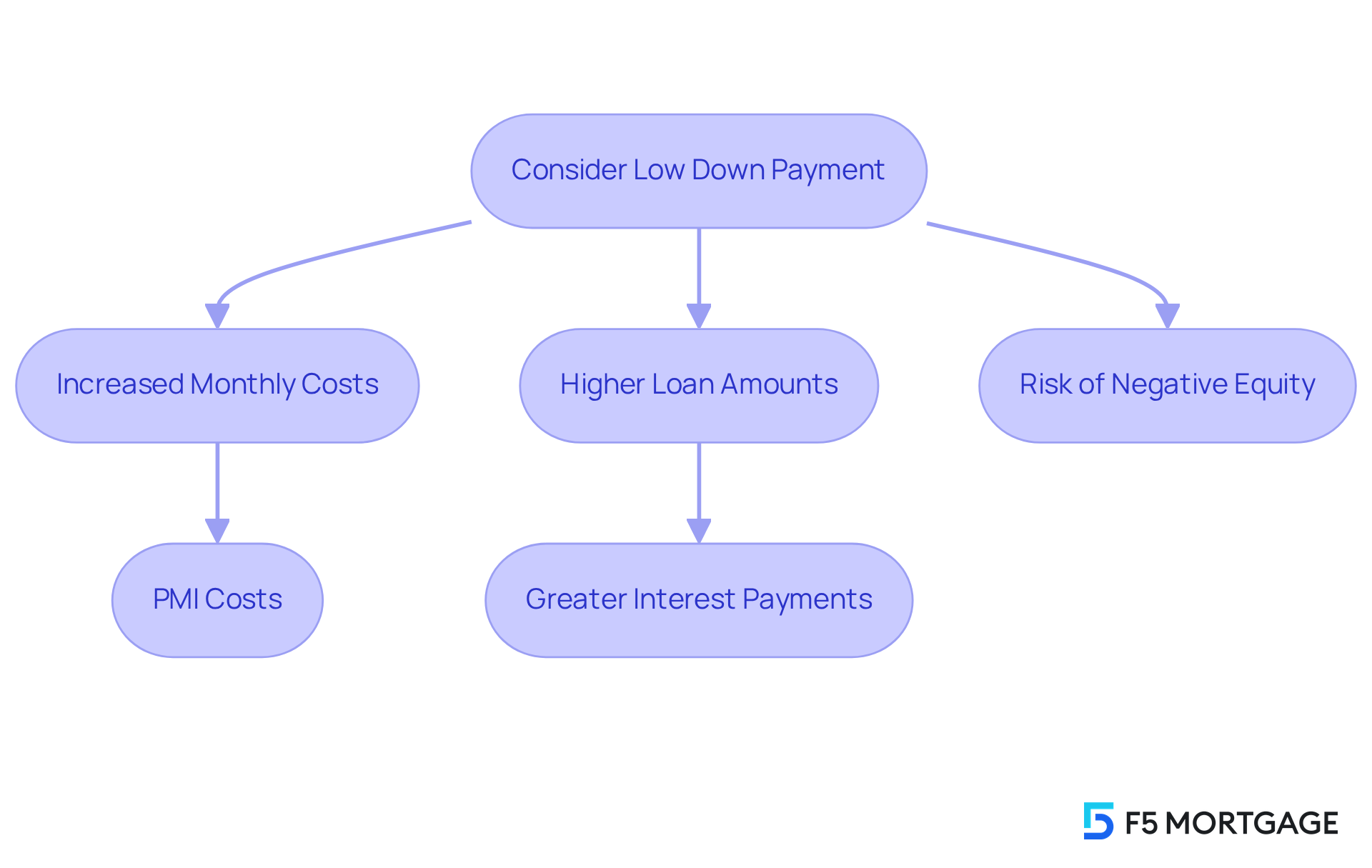

Examine the Risks of Low Down Payments: What Homebuyers Should Consider

Choosing a low initial contribution may seem appealing at first, especially when considering the reduced upfront expenses. However, it’s important to recognize the considerable financial dangers that come with this choice. One major concern is the necessity of private insurance for loans, which can add a significant amount to your monthly costs. For instance, PMI expenses can range from $30 to $70 per $100,000 borrowed, leading to an average monthly charge of $90 to $210 for a $300,000 loan with less than 20% down. This additional cost can put pressure on a homeowner’s finances, particularly when combined with a larger borrowed amount due to a smaller initial contribution.

Moreover, larger loan amounts mean higher monthly mortgage payments and increased interest over the life of the loan, further limiting your financial flexibility. If property values decrease, borrowers with minimal upfront contributions face the risk of negative equity, making refinancing or selling the home more complicated and potentially resulting in a loss. Having a large house down payment (at least 20%) has benefits such as significantly reducing the need for PMI and enhancing financial security, even though it is not mandatory.

We know how can be. It’s crucial for homebuyers to carefully assess these risks in relation to their financial situations and long-term goals before committing to a smaller initial investment. We’re here to support you every step of the way as you navigate this important journey.

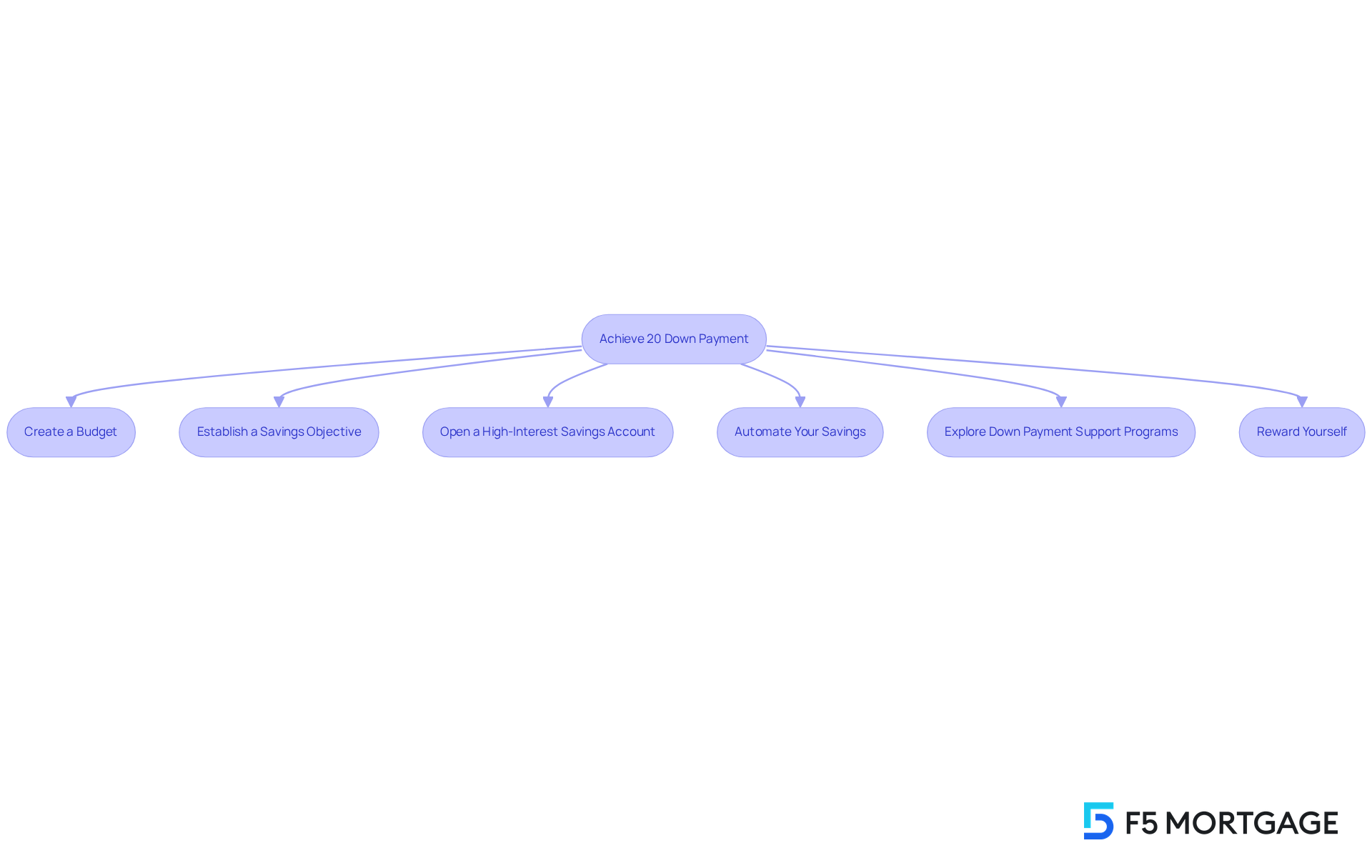

Identify Strategies for Achieving a 20% Down Payment: Tips and Resources

Reaching a 20% deposit necessitates careful planning and consistent saving. We know how challenging this can be, but there are several effective strategies to help you reach this goal:

- Create a Budget: Develop a comprehensive budget that emphasizes your savings for the initial deposit. Identify discretionary spending areas where you can cut back, such as dining out or subscription services.

- Establish a Savings Objective: Determine the precise sum required for a 20% deposit based on your desired home price. Establish a realistic timeline for achieving this goal to keep yourself accountable.

- Open a High-Interest Savings Account: Consider opening a dedicated savings account that offers a higher interest rate than traditional accounts. This can significantly enhance your savings over time, allowing your money to grow more effectively.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This ‘set it and forget it’ approach ensures consistent contributions without the temptation to spend the funds elsewhere.

- Explore Down Payment Support Programs: Investigate local and state initiatives that offer aid for down payments. In Ohio, programs like YourChoice!, Grant for Grads, and Ohio Heroes offer valuable support tailored to various situations. Eligibility criteria for these programs may vary, often based on income levels and first-time homebuyer status. In California, F5 Mortgage can guide you through programs such as the Golden State Finance Authority’s Open Doors program, which provides up to 7% of the primary loan amount toward closing costs.

- Reward Yourself: To stay motivated, consider rewarding yourself for every milestone reached in your savings journey. For example, if your goal is to save $30,000, treat yourself to a nice meal for every $5,000 saved. This can help maintain your motivation throughout the process.

By applying these strategies, prospective homebuyers can strive for attaining the financial stability that accompanies a significant upfront contribution. Statistics indicate that a typical for first-time purchasers is around 8%, while repeat buyers often contribute 19%. Having a large house down payment (at least 20%) has benefits such as helping to avoid private mortgage insurance (PMI) and securing better interest rates, which ultimately leads to substantial savings over the life of the loan. Additionally, setting up a separate savings account for the down payment can help avoid spending the funds on other expenses, reinforcing financial discipline. In summary, understanding the available assistance programs and setting clear savings goals are crucial steps in the journey to homeownership.

Conclusion

Having a significant down payment of at least 20% can profoundly influence your homebuying experience. This substantial investment offers numerous financial advantages that go beyond mere numbers. Not only does it facilitate access to better loan terms, but it also enhances your financial security. By making this upfront commitment, you can avoid the pitfalls of private mortgage insurance and enjoy lower monthly payments. We know how challenging this can be, but the importance of this investment cannot be overstated. It lays the foundation for a more stable and economically sound homeownership journey.

Throughout our discussion, we’ve explored various benefits of a large down payment. From reduced interest rates to increased equity and financial flexibility, these advantages can significantly impact your financial future. A 20% contribution mitigates risks associated with low down payments, such as high insurance costs and the potential for negative equity. We’re here to support you every step of the way, and we’ve provided practical strategies to help you achieve this goal, empowering you to take control of your financial future.

Ultimately, the journey to homeownership should be approached with careful planning and informed decision-making. By prioritizing a larger down payment, you can unlock a pathway to financial stability and long-term success in your home investment. As the landscape of homebuying continues to evolve, embracing the importance of a substantial down payment will remain a critical step toward achieving lasting economic security.

Frequently Asked Questions

What is considered a large down payment for a home purchase?

A large down payment is typically defined as at least 20% of the home’s purchase price.

What are the benefits of making a 20% down payment?

Making a 20% down payment can lead to more favorable loan terms, including the ability to avoid private mortgage insurance (PMI), better interest rates, and more advantageous loan conditions.

How does a large down payment affect a lender’s risk assessment?

A significant down payment signals economic stability to lenders, which lowers their perceived risk and can result in better loan terms for the borrower.

What was the median down payment for U.S. home purchasers in 2024?

The median initial contribution for U.S. home purchasers in 2024 was 18%.

How do first-time homebuyers’ down payment contributions compare to the median?

First-time homebuyers typically contributed only 8%, which is lower than the median down payment.

What role do FHA loans play in home purchasing?

FHA loans offer low initial cost options and flexible credit criteria, making homeownership more accessible for many buyers.

What is the expected trend for down payments in 2025?

Many homebuyers are expected to meet the 20% down payment standard in 2025, indicating a shift towards increased economic security in home purchasing.

Why is understanding the loan approval process important for homebuyers?

Understanding the loan approval process helps homebuyers know how lenders evaluate their financial information, which can influence their borrowing choices and empower them to make informed decisions.