Overview

This article is dedicated to helping families manage their $1 million mortgage monthly payment effectively. We understand how daunting this can be, and it’s essential to grasp key mortgage terms, the factors that influence payments, and the calculation process involved. By familiarizing yourself with concepts like principal, interest rates, and loan terms, you can make informed financial decisions.

Strategic planning regarding credit scores and down payments is also crucial. We’re here to support you every step of the way, empowering you to navigate the mortgage landscape with confidence. With the right knowledge and preparation, you can turn this challenge into an opportunity for your family’s future.

Introduction

Navigating the complexities of a $1 million mortgage can feel overwhelming, especially for families eager to secure their dream home. We understand how challenging this can be. Grasping key mortgage terms and concepts is vital for effective financial management, as it empowers you to make informed decisions that can significantly impact your monthly payments.

With fluctuating interest rates, varying loan terms, and additional costs like property taxes and insurance, how can you ensure you are fully prepared for the financial responsibilities that come with such a substantial investment?

This guide delves into the critical factors influencing mortgage payments and provides a step-by-step approach to mastering the art of mortgage management, ensuring you feel supported every step of the way.

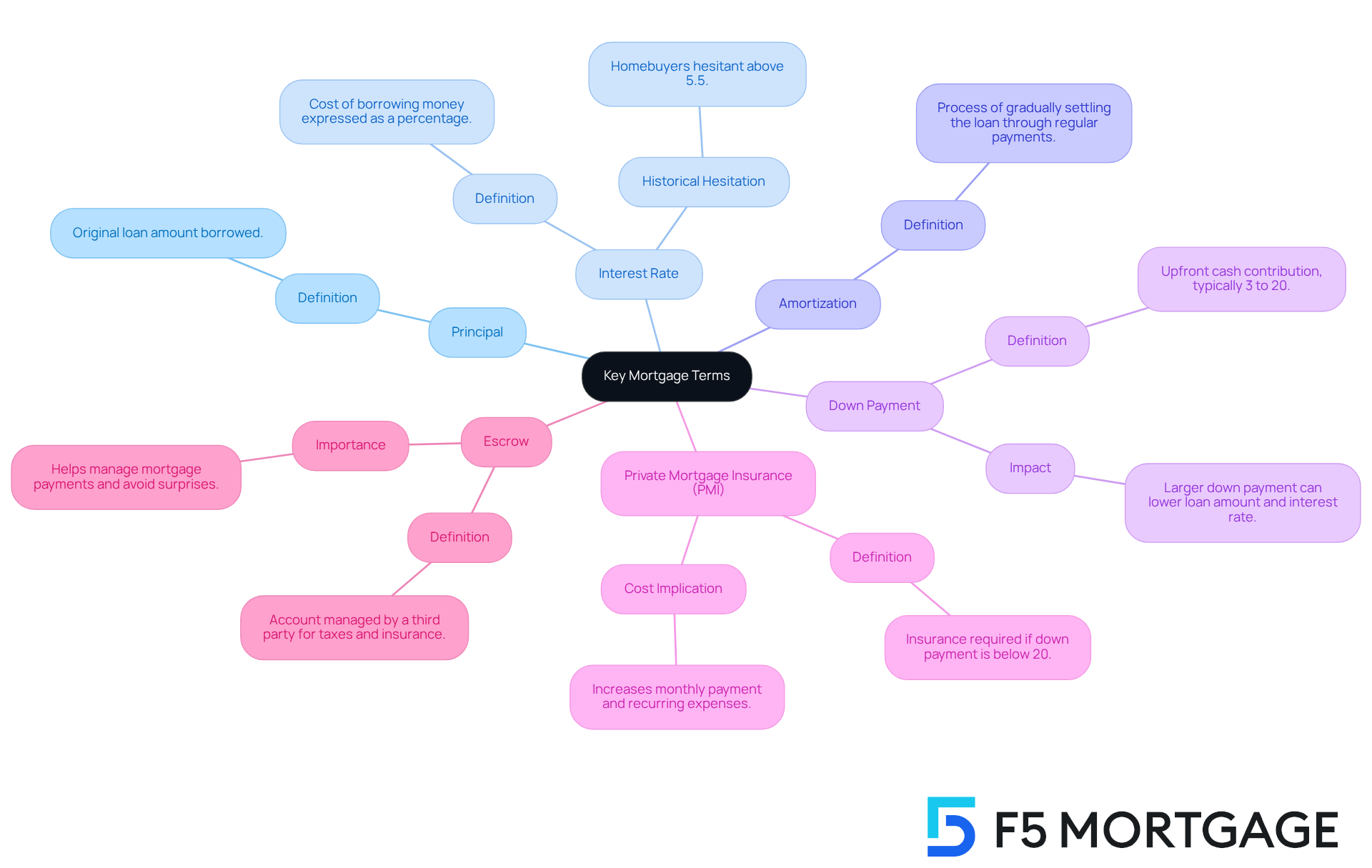

Define Key Mortgage Terms and Concepts

To effectively manage your $1 million mortgage monthly payment, we understand how crucial it is to grasp the following key terms:

- Principal: This is the original loan amount borrowed, serving as the foundation for your mortgage calculations.

- Interest Rate: This percentage represents the cost of borrowing money from the lender, directly influencing your $1 million dollar mortgage monthly payment. Many prospective homebuyers feel hesitant when percentages surpass 5.5%, which is considered historically typical. At F5 Mortgage, we’re here to help you secure competitive rates that can lead to a favorable deal.

- Amortization: This refers to the process of gradually settling your loan through regular installments, such as a $1 million dollar mortgage monthly payment, where each payment reduces both the principal and interest over time. Understanding amortization is essential, as it allows you to see how your $1 million dollar mortgage monthly payment contributions shift from primarily interest to principal as the loan progresses.

- Down Payment: This upfront cash contribution typically ranges from 3% to 20% of the home’s price. A larger upfront contribution can decrease your loan amount and potentially lower your interest rate, making homeownership more attainable.

- Private Mortgage Insurance (PMI): Necessary when your deposit is below 20%, PMI protects the lender in the event of default, which can increase your $1 million dollar mortgage monthly payment and your recurring expenses.

- Escrow: This account is managed by a third party to hold funds for property taxes and insurance, ensuring these obligations are met on your behalf. is critical for managing the $1 million dollar mortgage monthly payment and avoiding surprises in your mortgage journey.

Additionally, calculating your break-even point when refinancing is essential. This involves assessing your refinancing expenses, calculating your savings each month, and dividing the costs by the savings to discover how long it will take to recover those expenses. For instance, if your refinancing expenses are $4,000 and your savings each month are $100, your break-even point would be 40 months. At F5 Mortgage, we provide personalized service to help you navigate these calculations effectively.

By becoming acquainted with these terms and understanding the importance of evaluating lenders like F5 Mortgage, you can approach the financing process with enhanced assurance and clarity. This ultimately leads to more informed financial choices, and remember, we’re here to support you every step of the way.

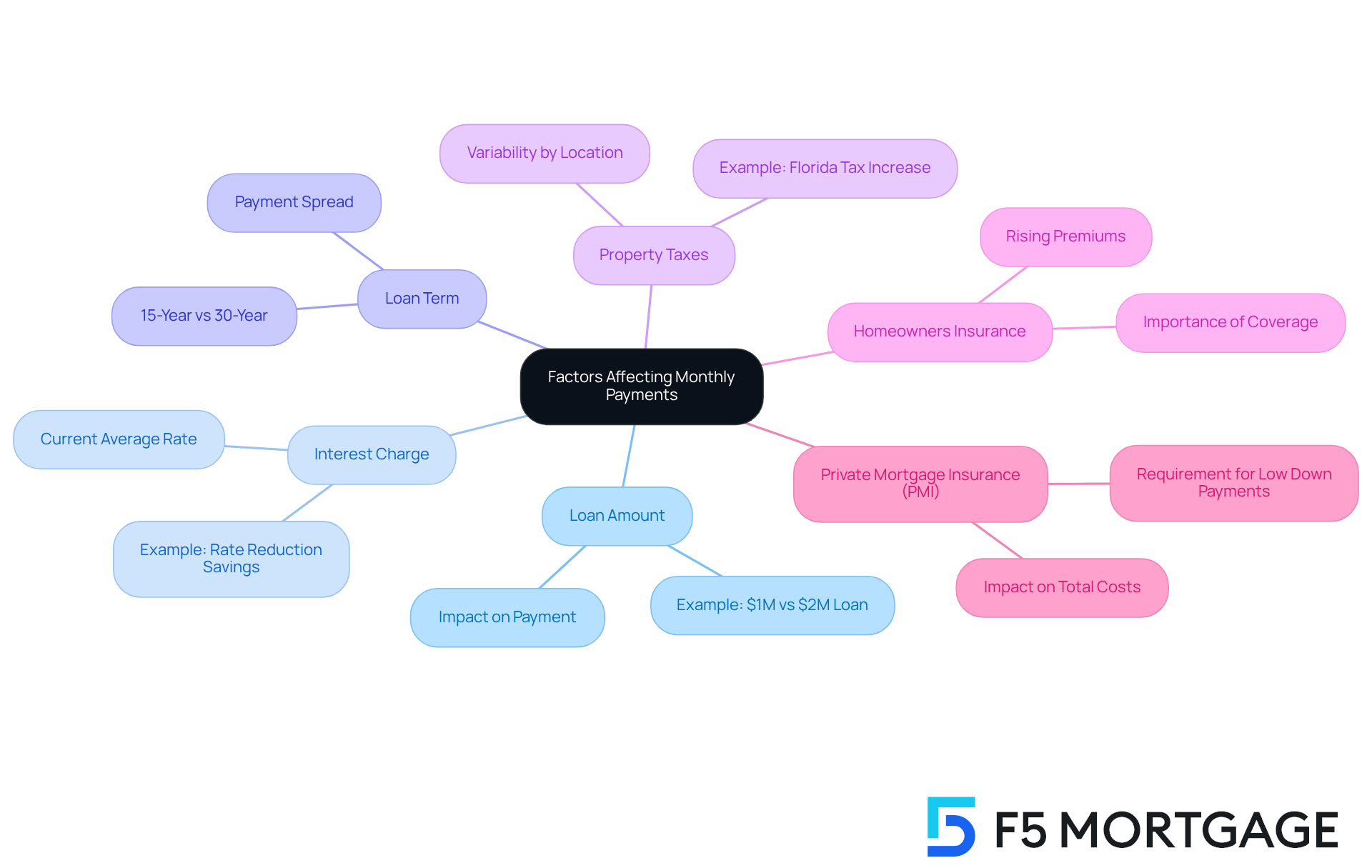

Analyze Factors Affecting Monthly Payments

Understanding your monthly mortgage payment can feel overwhelming, but several key factors can help simplify this process for you:

- Loan Amount: The total amount borrowed has a direct impact on your monthly payment. Larger loans naturally lead to higher payments. For example, if you take out a loan, the $1 million dollar mortgage monthly payment at a 6.5% interest rate over 30 years would be roughly $6,320. In contrast, a $2 million loan at the same interest rate would result in a cost of approximately $12,640.

- Interest Charge: The interest charge plays a crucial role in your recurring fee. As of September 2025, the average percentage for a 30-year mortgage is around 6.72%. Even a small reduction in the interest rate can significantly lower your monthly costs, making homeownership more achievable. For instance, by lowering the rate from 7% to 6.5% on a $400,000 loan, borrowers can save about $200 each month.

- Loan Term: The length of your loan, typically either 15 or 30 years, also influences your monthly installments. While extended terms generally result in , they also increase the overall interest paid over the life of the loan. For example, a 30-year term spreads out the payments, making them more manageable compared to a 15-year term.

- Property Taxes: These taxes are often included in your monthly dues and can vary widely based on your location. For instance, property taxes in Florida have surged nearly 50% over the past five years, placing additional financial pressure on homeowners.

- Homeowners Insurance: This insurance is essential for protecting your home and is typically part of your monthly payment. However, rising premiums, influenced by factors such as natural disasters, can further increase your expenses.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, PMI will be added to your monthly payment, raising your total costs.

By understanding these factors, you can better estimate your monthly expenses and effectively manage your budget. We know how challenging this can be, and we’re here to support you every step of the way, ensuring you’re prepared for the financial responsibilities of homeownership.

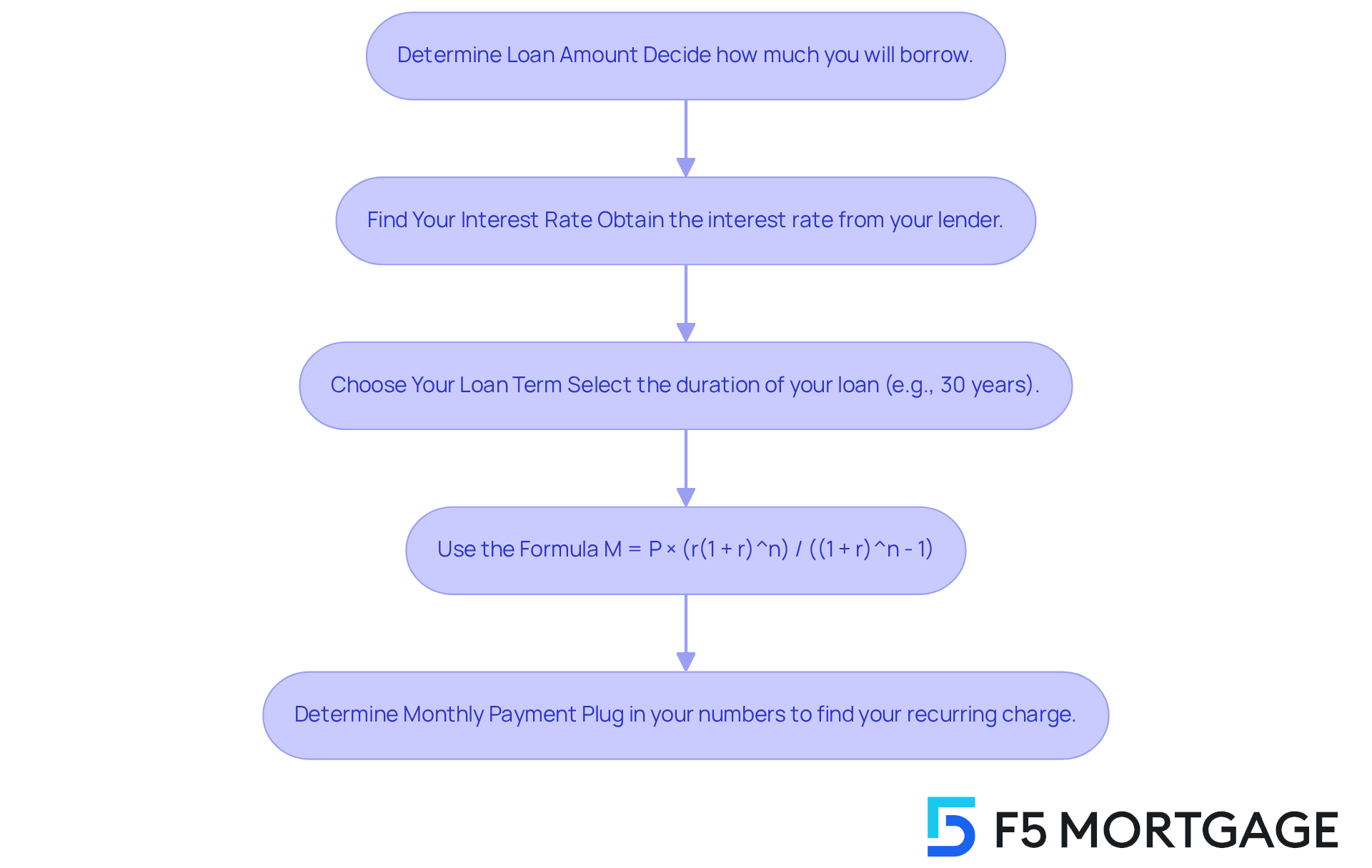

Calculate Your Monthly Payment: Step-by-Step Guide

Understanding your recurring mortgage cost is essential for grasping your financial responsibilities. We know how challenging this can be, so let’s walk through the steps together to determine your payment:

-

Determine the Loan Amount: Decide how much you will borrow.

-

Find Your Interest Rate: Obtain the interest rate from your lender.

-

Choose Your Loan Term: Select the duration of your loan (e.g., 30 years). A longer term can help keep your monthly expenses lower, allowing you to allocate funds for home renovations or savings. On the other hand, a shorter term means you’ll pay off your mortgage sooner, incur less interest, and build equity in your home faster.

-

Use the Formula: The formula for calculating your monthly payment (M) is:

M = P × (r(1 + r)^n) / ((1 + r)^n - 1)Where:

- M = monthly payment

- P = loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in years multiplied by 12)

-

Determine: Plug in your numbers to find your recurring charge.

For example, if you borrow $1,000,000 at a 4% interest rate for 30 years:

- P = 1,000,000

- r = 0.04 / 12 = 0.00333

- n = 30 × 12 = 360

Using the formula, your monthly payment would be approximately $4,774.15. This calculation is vital for families to comprehend their financial obligations and effectively plan their budgets.

Looking ahead to 2025, the typical expense associated with a $1 million dollar mortgage monthly payment can vary significantly based on interest rates and loan conditions. For instance, with a 6.90% interest rate, your $1 million dollar mortgage monthly payment might rise to around $6,550, highlighting the importance of securing favorable terms. As financial experts often remind us, “the more you borrow, the more you pay each month,” underscoring the necessity for careful planning and calculation. Additionally, it’s important to recognize that factors like property taxes and insurance can also influence your overall monthly responsibilities, making it essential to factor these elements into your financial planning.

By choosing F5 Mortgage, you can access quick and flexible financing solutions that empower you to achieve homeownership with exceptional service and competitive rates. Our satisfied clients frequently share their positive experiences, reinforcing our commitment to helping families like yours navigate the financing process with ease.

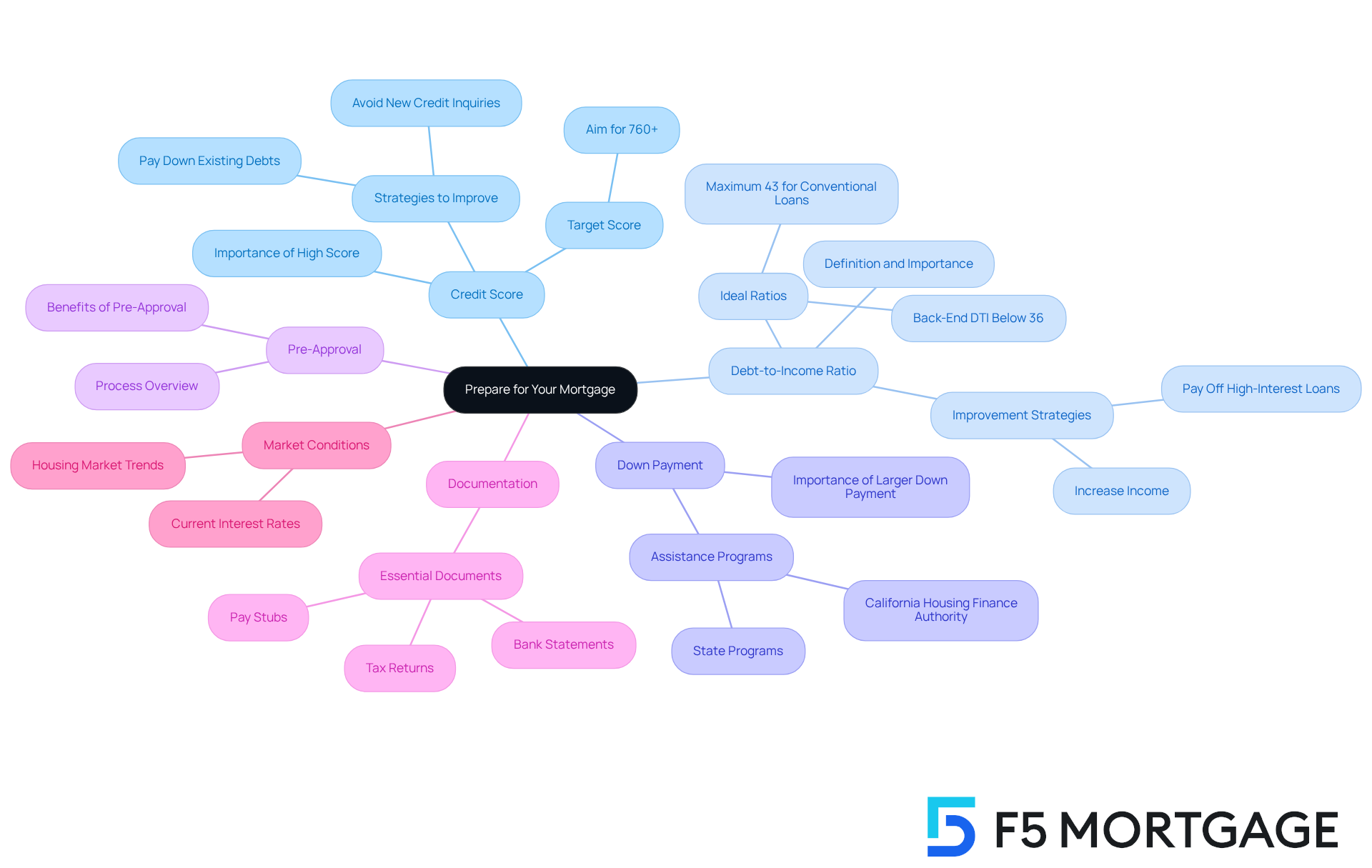

Prepare for Your Mortgage: Key Considerations and Challenges

When preparing for your mortgage, we understand how overwhelming it can feel. Here are some key points to consider:

- Credit Score: A higher credit score is crucial for securing better interest rates. Aim for a score of at least 760 to access the most favorable terms. Regularly check your score and take proactive steps to improve it, such as paying down existing debts and avoiding new credit inquiries.

- Debt-to-Income Ratio: This ratio is an essential element in loan approval, indicating your capacity to handle regular expenses. Most lenders prefer a back-end DTI ratio below 36%, with a maximum of 43% for conventional loans. Reducing your DTI can significantly enhance your chances of approval and lead to better rates. Strategies such as paying off high-interest loans or increasing your income can help improve this ratio.

- Down Payment: Assess how much you can afford to contribute upfront. A bigger initial deposit not only reduces your monthly costs but can also remove private mortgage insurance (PMI), making your financing more manageable over time. F5 Mortgage offers comprehensive down payment assistance programs, including options from the California Housing Finance Authority and other state programs, which can provide significant support for homebuyers. Consider looking into specific case studies or testimonials from families who have benefited from these programs to understand their impact better.

- Pre-Approval: Securing pre-approval for a home loan clarifies your budget and strengthens your negotiating position when making an offer. This process involves a thorough review of your financial situation, including your credit score and DTI ratio.

- Documentation: Prepare essential documents such as tax returns, pay stubs, and bank statements. Having these ready can streamline the application process and reduce delays.

- Market Conditions: Stay informed about current interest rates and housing market trends. Understanding these factors can help you make and potentially save thousands over the life of your loan.

By addressing these considerations, we hope you can navigate the mortgage process with greater confidence. Remember, we’re here to support you every step of the way, especially with the assistance options available through F5 Mortgage.

Conclusion

Understanding the intricacies of managing a $1 million mortgage monthly payment is vital for any family looking to secure their financial future. We know how challenging this can be, and this guide emphasizes the importance of grasping key mortgage terms and concepts. By analyzing factors that affect monthly payments and effectively calculating your recurring costs, families can approach homeownership with greater confidence and clarity.

Throughout this article, we explored critical factors such as:

- Loan amount

- Interest rates

- Loan terms

- Property taxes

- Homeowners insurance

Each of these components plays a significant role in determining monthly payments and overall financial obligations. Additionally, we highlighted the importance of:

- Credit scores

- Debt-to-income ratios

- Pre-approval processes

Underscoring how these factors can influence your mortgage experience.

Ultimately, navigating the mortgage landscape requires careful planning and a thorough understanding of the financial responsibilities involved. By utilizing the insights and resources provided, families can make informed decisions that lead to successful homeownership. We’re here to support you every step of the way, so it’s essential to stay proactive and seek assistance from trusted mortgage professionals, like F5 Mortgage, to ensure the best possible outcomes in this significant financial journey.

Frequently Asked Questions

What is the principal in a mortgage?

The principal is the original loan amount borrowed, which serves as the foundation for mortgage calculations.

How does the interest rate affect my mortgage payment?

The interest rate is the percentage that represents the cost of borrowing money from the lender. It directly influences your monthly mortgage payment, and many homebuyers feel hesitant when rates exceed 5.5%, which is historically typical.

What is amortization in relation to a mortgage?

Amortization is the process of gradually settling your loan through regular installments. Each payment reduces both the principal and interest over time, with contributions shifting from primarily interest to principal as the loan progresses.

What is a down payment and how does it impact my mortgage?

A down payment is the upfront cash contribution typically ranging from 3% to 20% of the home’s price. A larger down payment can decrease your loan amount and potentially lower your interest rate, making homeownership more attainable.

What is Private Mortgage Insurance (PMI)?

PMI is necessary when your down payment is below 20%. It protects the lender in the event of default and can increase your monthly mortgage payment and recurring expenses.

What is an escrow account?

An escrow account is managed by a third party to hold funds for property taxes and insurance, ensuring these obligations are met on your behalf. Understanding escrow accounts is critical for managing your mortgage payment and avoiding surprises.

How do I calculate the break-even point when refinancing?

To calculate the break-even point, assess your refinancing expenses, calculate your monthly savings, and divide the costs by the savings. For example, if refinancing costs $4,000 and your savings are $100 per month, your break-even point would be 40 months.

Why is it important to understand mortgage terms and evaluate lenders?

Understanding key mortgage terms and evaluating lenders helps you approach the financing process with assurance and clarity, leading to more informed financial choices.