Overview

Navigating the world of mortgages can feel overwhelming, but we’re here to support you every step of the way. This article offers a comprehensive step-by-step guide to mastering a $250,000 mortgage payment, breaking down its key components—Principal, Interest, Taxes, and Insurance (PITI). Understanding these elements is crucial for assessing your financial readiness and ensuring you can meet your monthly obligations.

We know how challenging this can be, especially when considering the additional costs of homeownership. By detailing calculations and emphasizing the importance of these components, we aim to empower you to effectively navigate the responsibilities that come with owning a home. Remember, you are not alone in this journey; with the right knowledge and preparation, you can confidently manage your mortgage and create a stable home for your family.

Introduction

Understanding the intricacies of a mortgage payment is essential for anyone stepping into the world of homeownership. We know how challenging this can be. With components like principal, interest, taxes, and insurance, navigating these financial waters can feel daunting. This guide breaks down the elements of a $250,000 mortgage payment, equipping you with the tools to calculate your payments and prepare for additional costs that come with owning a home.

However, as homebuyers face fluctuating interest rates and varying property taxes, how can you ensure you are financially ready to take on this significant commitment? We’re here to support you every step of the way.

Understand Mortgage Payment Components

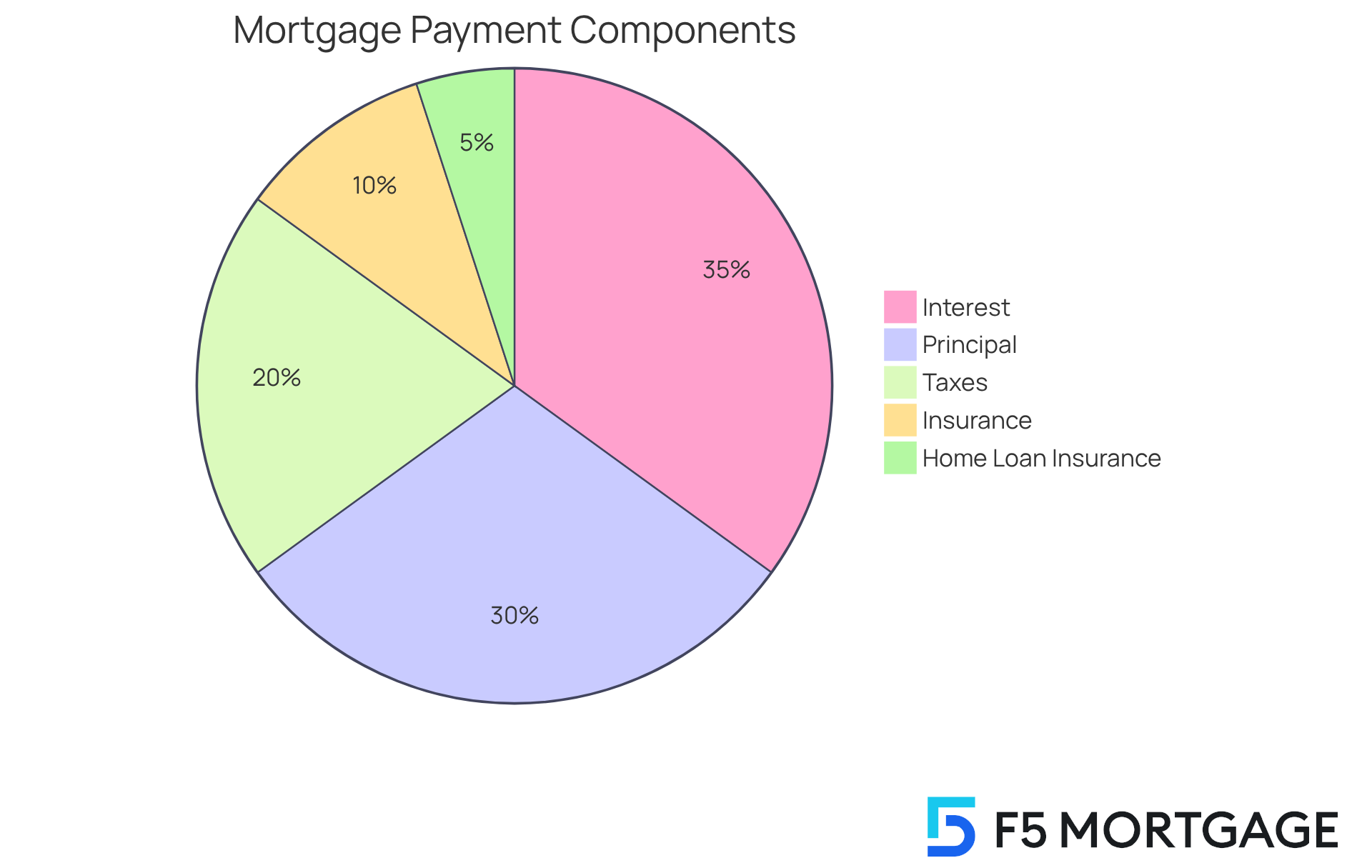

Understanding your is crucial for navigating the journey of homeownership. Typically, these payments consist of several key components, often summarized by the acronym PITI: Principal, Interest, Taxes, and Insurance. By grasping these elements, you can predict your regular obligations and plan for the expenses that come with owning a home.

- Principal: This represents the amount borrowed from the lender to purchase your property. Each regular installment you make reduces this principal amount, ultimately building your home equity.

- Interest: This is the cost of borrowing the principal, expressed as a percentage. As you pay down the principal, the interest portion decreases over time, reflecting the diminishing balance owed.

- Taxes: Property taxes, assessed by local governments, can vary significantly based on location. These taxes are often included in your regular payments through an escrow account, ensuring timely remittance and helping you avoid fines.

- Insurance: Homeowners insurance protects you against damages to your property and is typically required by lenders. Like taxes, insurance premiums can also be included in your regular costs through escrow, providing peace of mind.

- Home Loan Insurance: If your down payment is below 20%, you may need to cover private mortgage insurance (PMI). This protects the lender in case of default, adding an extra expense to your monthly payment.

In 2025, the median cost for U.S. homebuyers reached $2,259, highlighting the importance of understanding these components. For example, if you have a $250,000 loan at a 6.75% interest rate, your 250k mortgage payment might be around $1,600 each month, including PITI. Additionally, the typical recurring obligation for a $636,100 home is approximately $3,301, illustrating how the loan amount influences your monthly costs.

As financial specialist Ben Luthi wisely notes, ‘Grasping the components of your loan expense can assist you in making knowledgeable choices regarding your financial future.’ By understanding these components, you can better prepare for the financial responsibilities of homeownership. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Calculate Your Monthly Payment Step-by-Step

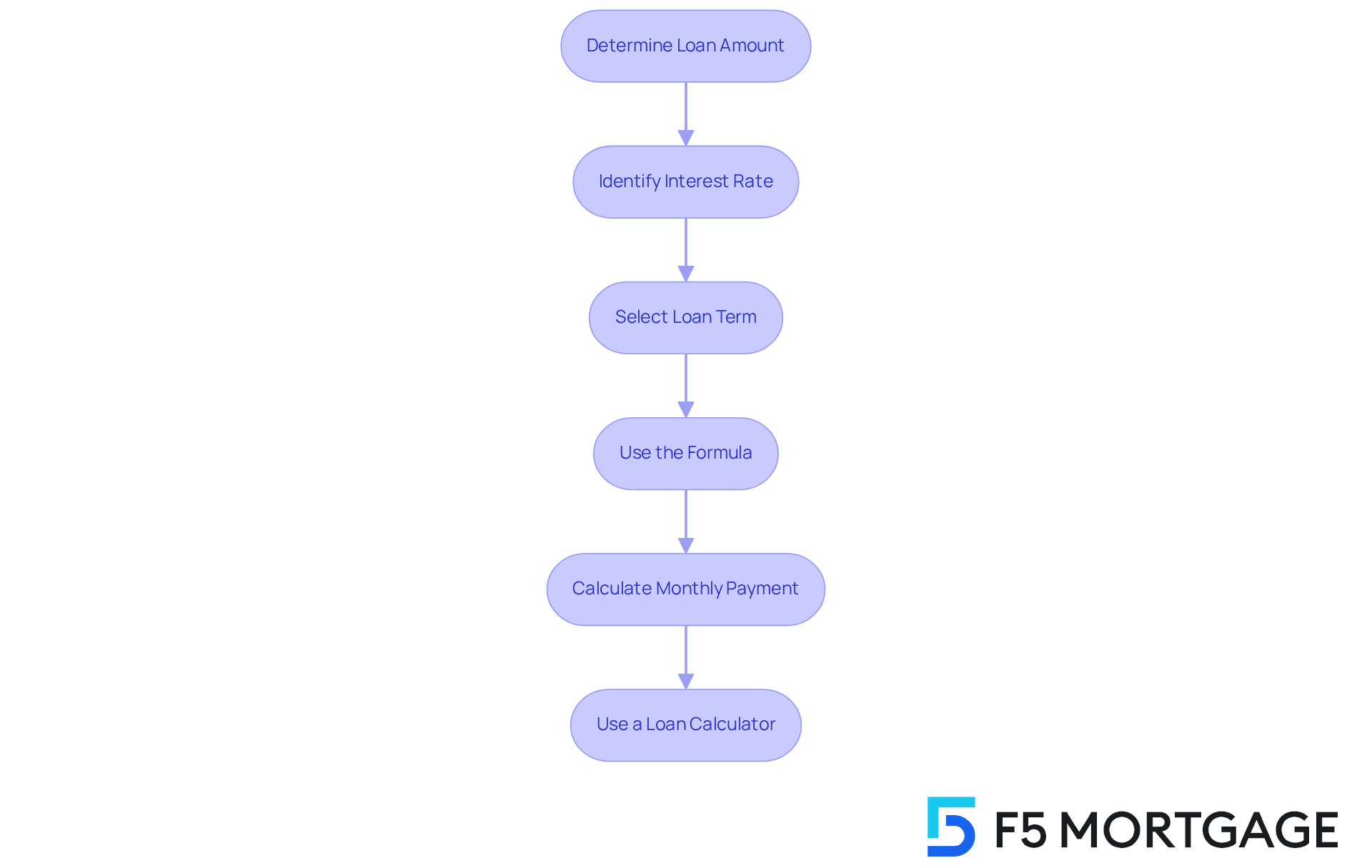

Determining your regular loan installment is a straightforward process that can help you understand your financial obligations. We know how challenging this can be, so here’s a step-by-step guide to assist you:

-

Determine the Loan Amount: This is simply the purchase price of the home minus your initial contribution.

-

Identify the Interest Rate: This refers to the annual percentage rate (APR) offered by your lender.

-

Select the Loan Term: Common terms are 15, 20, or 30 years.

-

Use the Formula: To calculate your monthly payment (M), use the following formula:

M = P [ r(1 + r)^n ] / [ (1 + r)^n - 1]Where:

- M = total monthly mortgage payment

- P = the loan principal (amount borrowed)

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

-

Calculate: Plug in your numbers to find your monthly payment. For example, for a $250,000 loan at a 4% interest rate over 30 years:

- P = 250,000

- r = 0.04 / 12 = 0.00333

- n = 30 * 12 = 360

- M = 250,000 [0.00333(1 + 0.00333)^360] / [(1 + 0.00333)^360 – 1]

- M ≈ $1,193.54

-

Use a : Alternatively, you can utilize online loan calculators for quick calculations.

Understanding these calculations is essential, especially as many families navigate the complexities of housing financing. By mastering these steps, you can make informed choices about your loan options and better prepare for your financial future. Additionally, it’s important to recognize the limitations of these calculations, as they may not account for all variables in your financial situation. Remember, many lenders require property owners to maintain a minimum of an 80% loan-to-value ratio, meaning you should have reduced at least 20% of your initial loan amount or your property should have appreciated in value. A maximum of a 43% debt-to-income (DTI) ratio is typically needed for housing loans, which can influence your loan rates and overall affordability. We’re here to support you every step of the way.

Account for Additional Homeownership Costs

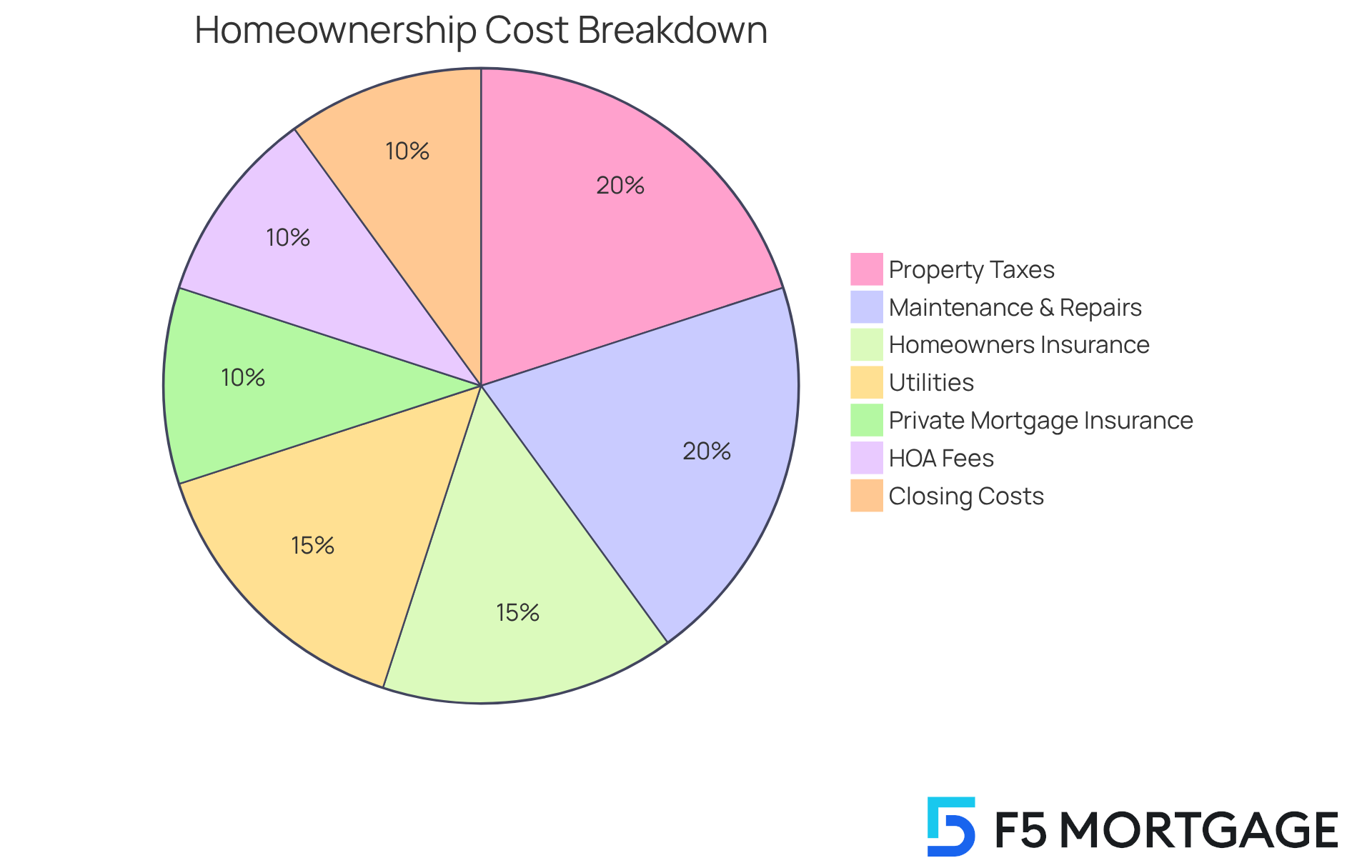

When planning your , it’s important to consider not just your 250k mortgage payment but also several additional costs that can impact your financial well-being. We know how challenging this can be, so let’s break it down together:

- Property Taxes: These can vary widely based on location and are typically assessed annually. Understanding your local tax rates can help you prepare.

- Homeowners Insurance: This protects your home and belongings, and it’s often required by lenders. It’s a crucial safeguard for your investment.

- Private Mortgage Insurance (PMI): If your down payment is below 20%, you might have to pay PMI, which can increase your monthly costs. Knowing this in advance can help you plan better.

- Homeowners Association (HOA) Fees: If you live in a community with an HOA, you may need to pay monthly or annual fees for community maintenance and amenities. It’s essential to factor these into your budget.

- Maintenance and Repairs: Allocate funds for continuous upkeep and unforeseen repairs, which can average 1% to 4% of your property’s value each year. Setting aside money for these expenses can prevent future stress.

- Utilities: Monthly costs for electricity, water, gas, and internet should also be included in your financial planning. These everyday expenses can add up.

- Closing Costs: These are one-time fees incurred during the purchase of a home, typically ranging from 2% to 5% of the loan amount. Being aware of these costs ahead of time can help you avoid surprises.

By accounting for these additional costs, you can create a more accurate budget that considers your 250k mortgage payment and avoids financial strain. Remember, we’re here to support you every step of the way in this journey.

Assess Your Financial Readiness for a $250K Mortgage

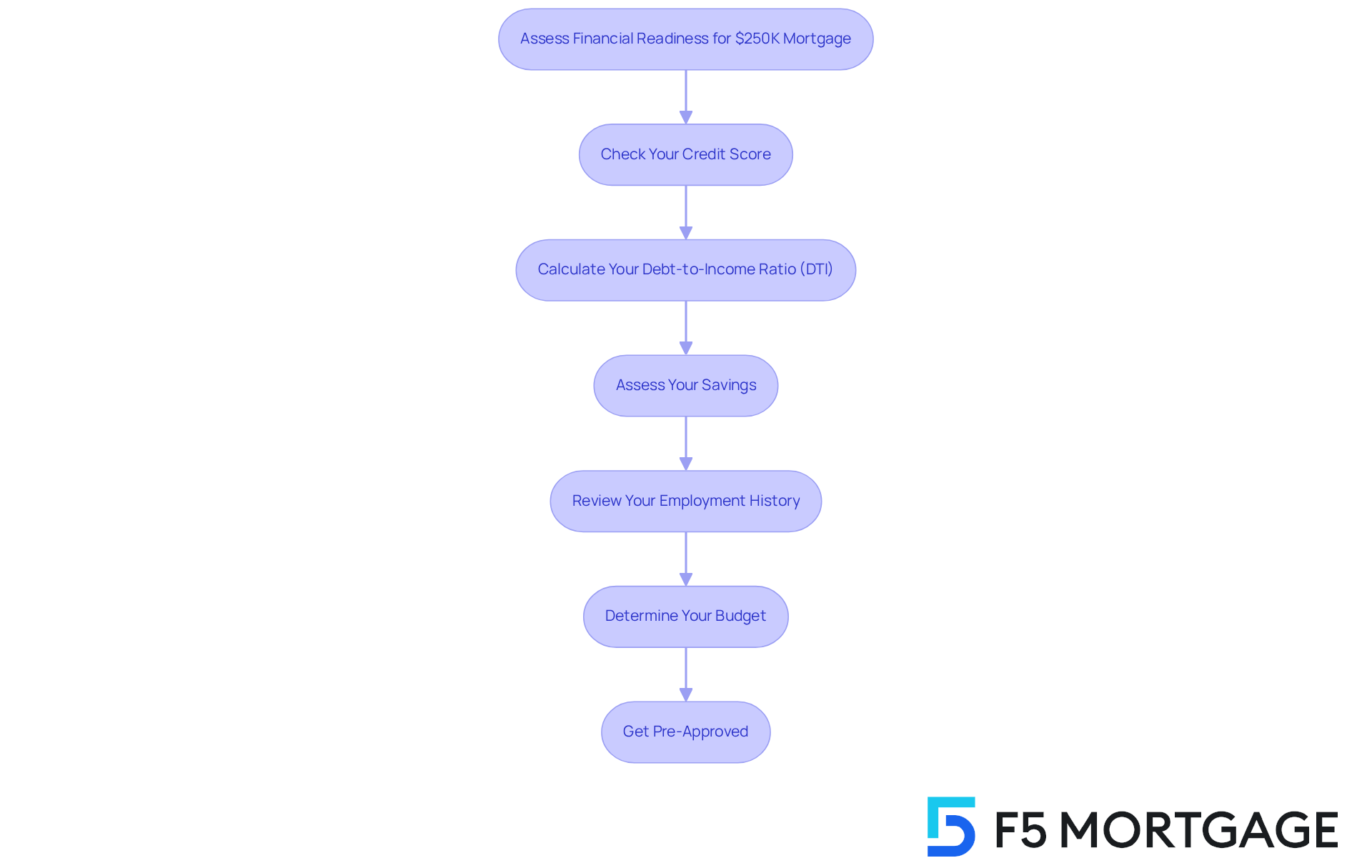

Assessing your financial readiness for a 250k mortgage payment can feel overwhelming, but we’re here to support you every step of the way. Consider these important steps:

- Check Your Credit Score: Your credit score plays a crucial role in determining loan rates. Aim for a score of 700 or higher, as this can significantly enhance your chances of securing favorable terms. If your score falls between 750 and 850, you’re likely to qualify for the best interest rates. Remember, scores range from 300 to 850, with higher scores indicating better creditworthiness.

- Calculate Your Debt-to-Income Ratio (DTI): This ratio compares your monthly obligations to your gross monthly income. As of 2025, most lenders prefer a DTI of 36% or lower, while the current average DTI ratio for mortgage approval is around 30%. This indicates a manageable level of debt relative to your income, which is essential for your financial health.

- Assess Your Savings: It’s vital to ensure you have adequate savings for a down payment, which typically varies from 3% to 20% of the property cost. Don’t forget to account for closing costs and other expenses related to acquiring a property. Consider exploring down payment assistance programs available through F5 Mortgage. For instance, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price, while Texas has the My Choice Texas Home program, providing up to 5% for down payment and closing support. In Florida, programs like the Florida Assist Second Mortgage Program can offer up to $10,000 for upfront costs. These initiatives can greatly improve your financial preparedness by reducing the amount you need to save for an initial deposit.

- Review Your Employment History: A stable employment background can positively influence your loan application. Lenders generally look for at least two years of consistent income, demonstrating your reliability and commitment.

- Determine your budget by calculating how much you can comfortably afford for a monthly housing payment, especially regarding a 250k mortgage payment, without jeopardizing your financial stability. Remember to consider your other financial obligations and lifestyle needs.

- Get Pre-Approved: Securing pre-approval for a loan can clarify how much you can borrow and signal to sellers that you are a serious buyer. This step can streamline the and enhance your negotiating power, making it a critical part of your journey.

By thoroughly assessing your financial readiness, you can approach the home-buying process with confidence and clarity. Recognizing the significance of your credit score, which should ideally remain above 700, can lead to improved loan conditions and a more streamlined approval process. For instance, borrowers with scores between 750 and 850 typically qualify for the best interest rates, while those below 580 may face significant challenges in securing a mortgage. Additionally, maintaining a credit utilization ratio below 30% and ensuring a positive payment history are crucial for managing your credit effectively. Be mindful of frequent applications for new credit, as this can negatively impact your credit score.

Conclusion

Understanding the intricacies of a $250K mortgage payment is essential for any prospective homeowner. We know how challenging this can be, and this guide has illuminated the core components—Principal, Interest, Taxes, and Insurance—collectively known as PITI. These elements form the foundation of your monthly obligations. Grasping these components not only equips you with the knowledge needed to manage your finances effectively but also empowers you to make informed decisions regarding your homeownership journey.

Throughout this article, we’ve outlined the key steps to calculating your mortgage payment. It’s important to understand not just the payment itself, but also the additional costs associated with homeownership, such as property taxes, homeowners insurance, and maintenance expenses. Furthermore, assessing your financial readiness, including credit scores and debt-to-income ratios, is crucial for ensuring a smooth home-buying experience.

Ultimately, taking the time to master these concepts can significantly impact your financial stability and success in homeownership. By being proactive in budgeting for all related expenses and understanding the mortgage payment structure, you can navigate your financial commitments with confidence. For anyone considering a mortgage, this knowledge serves as a powerful tool to facilitate a more secure and rewarding homeownership experience.

Frequently Asked Questions

What are the main components of a mortgage payment?

The main components of a mortgage payment are summarized by the acronym PITI: Principal, Interest, Taxes, and Insurance.

What does the principal component of a mortgage payment represent?

The principal represents the amount borrowed from the lender to purchase the property. Each regular payment reduces this principal amount, building your home equity.

How does interest affect mortgage payments?

Interest is the cost of borrowing the principal, expressed as a percentage. As the principal is paid down, the interest portion of the payment decreases over time.

What role do property taxes play in mortgage payments?

Property taxes, assessed by local governments, can vary based on location and are often included in regular mortgage payments through an escrow account to ensure timely payment.

Why is homeowners insurance included in mortgage payments?

Homeowners insurance protects against damages to the property and is typically required by lenders. Insurance premiums can also be included in regular costs through escrow.

What is private mortgage insurance (PMI) and when is it required?

Private mortgage insurance (PMI) is required if your down payment is below 20%. It protects the lender in case of default and adds an extra expense to your monthly payment.

What was the median cost for U.S. homebuyers in 2025?

In 2025, the median cost for U.S. homebuyers reached $2,259.

How much might a $250,000 mortgage payment be at a 6.75% interest rate?

A $250,000 mortgage payment at a 6.75% interest rate might be around $1,600 each month, including PITI.

What is the typical recurring obligation for a $636,100 home?

The typical recurring obligation for a $636,100 home is approximately $3,301.

How can understanding mortgage payment components help homeowners?

Grasping the components of mortgage payments can assist homeowners in making informed choices regarding their financial future and better prepare them for the responsibilities of homeownership.