Overview

When it comes to making smart home financing decisions, understanding the Debt Service Coverage Ratio (DSCR) is crucial. This ratio is calculated by dividing the Net Operating Income (NOI) by the total debt obligations. A ratio above 1 indicates that your asset generates sufficient income to cover its financial commitments. We know how challenging this can be, and accurately calculating DSCR can help you assess your loan eligibility and negotiate better financing terms.

Lenders typically prefer a minimum DSCR of 1.25 for investment properties. This means they want to see that you not only meet your financial obligations but also have a buffer to ensure stability. By focusing on this key metric, you can approach your financing decisions with confidence, knowing you have the information you need to make informed choices.

Remember, we’re here to support you every step of the way. Understanding your DSCR is just one part of the journey, but it’s an important one that can lead to favorable outcomes for your family’s financial future.

Introduction

We understand that navigating the financial landscape of home financing can feel overwhelming. Many families share concerns about making informed decisions, especially when it comes to investing in smart homes. In this context, the Debt Service Coverage Ratio (DSCR) stands out as a vital tool. It provides valuable insights into an asset’s ability to generate income that covers its obligations.

As lenders increasingly focus on this ratio to assess risk and determine favorable financing terms, it raises an important question: how can investors effectively use DSCR calculations? By understanding this concept, families can enhance their borrowing potential and secure the best financing options available.

We’re here to support you every step of the way, ensuring you feel empowered in your financial decisions.

Understand Debt Service Coverage Ratio (DSCR) and Its Importance in Home Financing

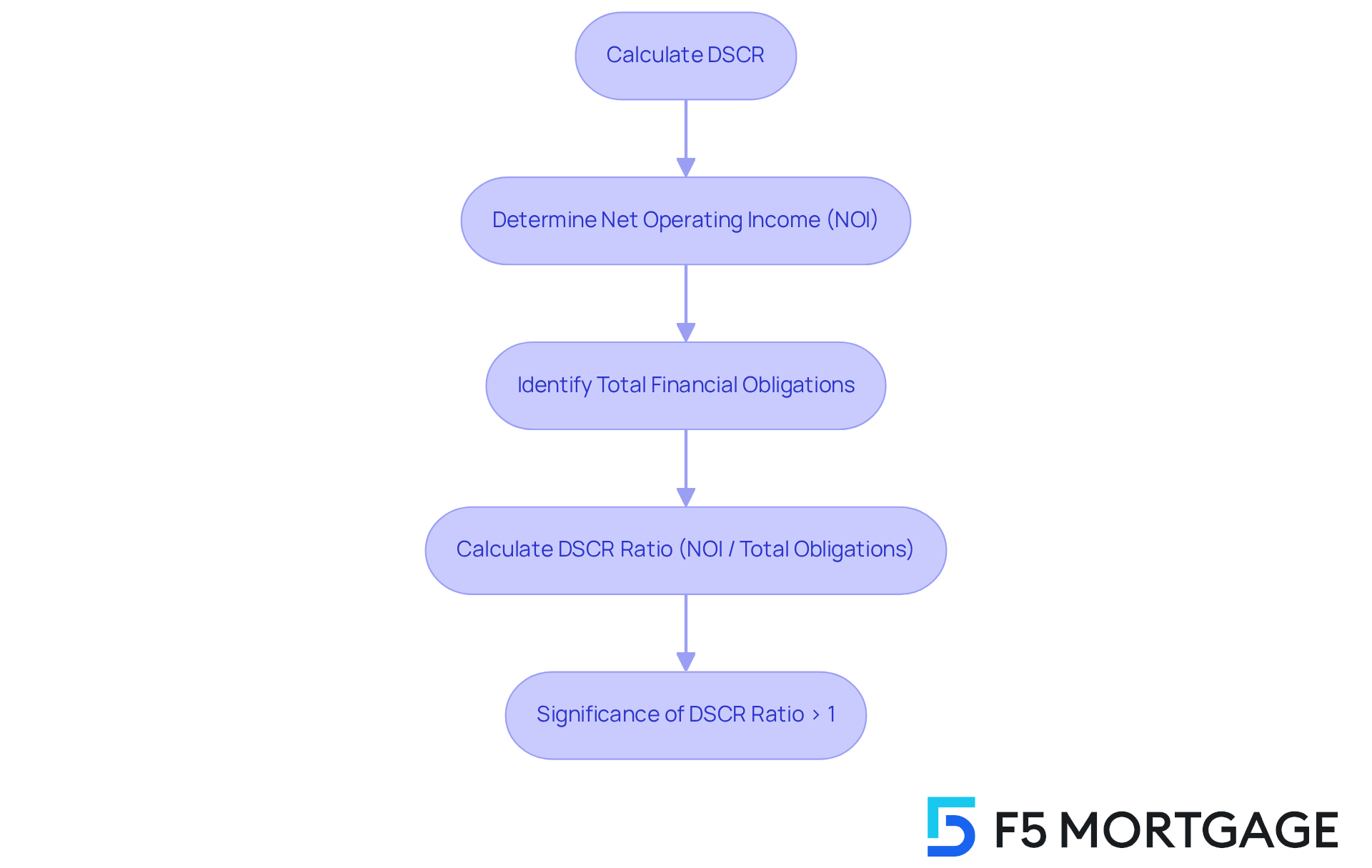

Understanding how to calculate DSCR is crucial for anyone navigating the complexities of financial commitments. This essential measure helps assess how to calculate DSCR, which evaluates an asset’s ability to generate sufficient income to meet its obligations. To understand how to calculate DSCR, we divide the net operating income (NOI) by total financial obligations, which includes all payments due, allowing us to better grasp the financial health of an asset. To understand how to calculate DSCR, note that a ratio greater than 1 indicates that the asset produces more revenue than needed to cover its obligations, which is a reassuring sign for lenders. For instance, if a property shows an NOI of $120,000 against a total debt service of $100,000, knowing how to calculate DSCR will show that the resulting ratio of 1.2 reflects a strong cash flow.

We know how challenging it can be to make informed funding choices, especially when it comes to credit eligibility and interest rates. In recent years, particularly in 2025, the importance of understanding how to calculate DSCR in mortgage lending has become increasingly clear. Lenders are now more vigilant in monitoring how to calculate DSCR to assess risk and determine financing terms. Recent trends indicate that DSCR financing rates generally align with the 5-year Treasury yield, maintaining a historical spread of 2.5% to 4%. This relationship emphasizes how market conditions can shape financing opportunities for real estate investors.

Real estate case studies illustrate how to calculate DSCR and how it impacts borrowing eligibility. For example, the introduction of the 5-8 Program allows investors to qualify based on the income-producing potential of properties with 5 to 8 units, rather than relying solely on personal income. This program simplifies the qualification process, leading to quicker approvals and higher funding limits for larger investments.

Financial specialists emphasize that understanding how to calculate DSCR is vital for navigating the complexities of mortgage lending. As market dynamics shift, we encourage investors to act promptly to secure favorable financing options, particularly amid current economic uncertainties. Understanding how to calculate DSCR is crucial, as the DSCR not only aids in but also significantly influences the overall financing landscape for real estate investments. We’re here to support you every step of the way as you explore your options.

Calculate DSCR: Step-by-Step Formula Breakdown

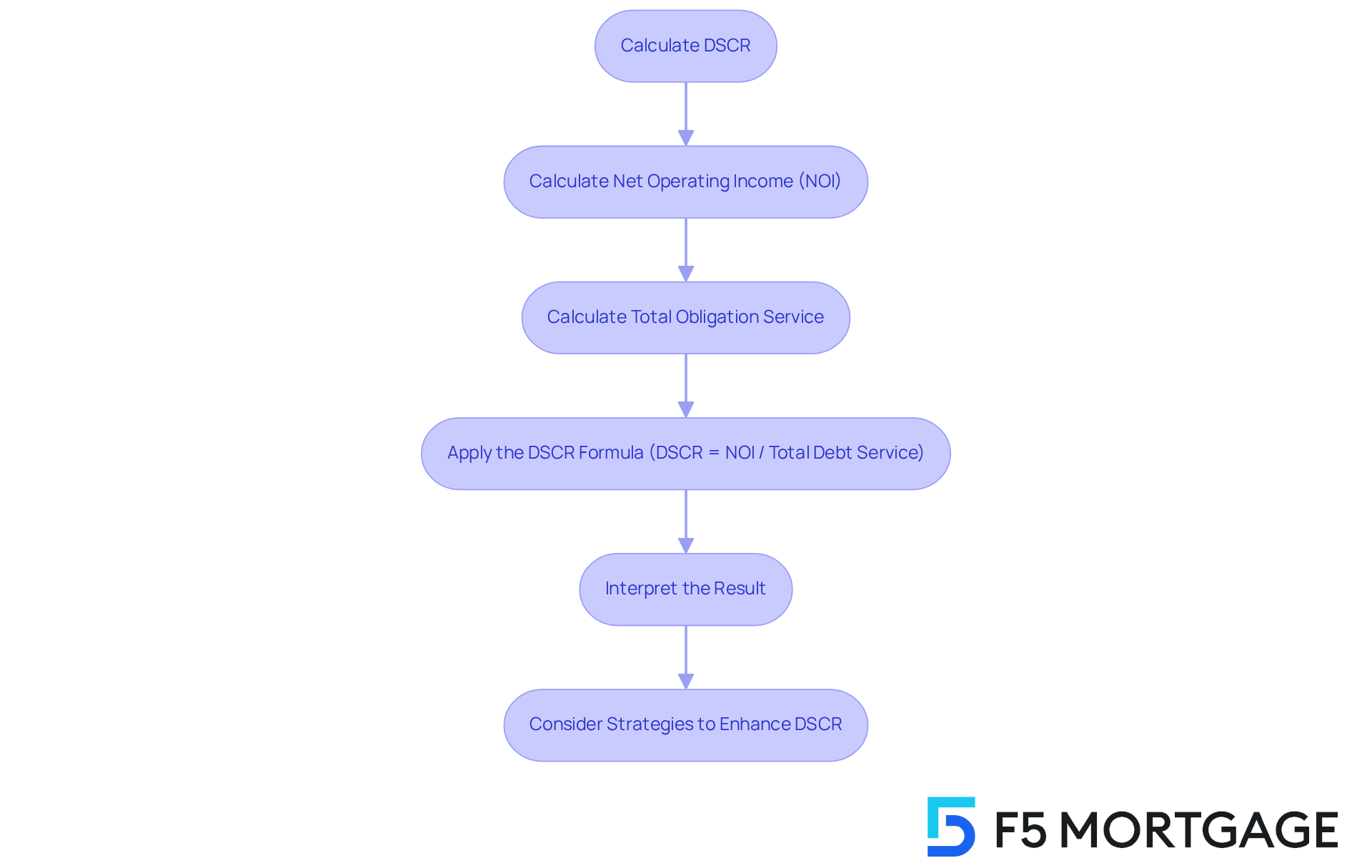

Understanding how to calculate dscr is an important step in managing your finances. Here’s how to navigate this process with confidence:

- Calculate Net Operating Income (NOI): This figure represents the total income generated from your asset after deducting operating expenses. For example, if your property brings in $150,000 in rental income but has $30,000 in operating expenses, your NOI would be $120,000. This is a crucial starting point.

- Calculate Total Obligation Service: This includes all your payment obligations, covering both principal and interest. If your yearly mortgage payment totals $100,000, that amount reflects your total service cost. Understanding this helps you see the .

- To learn how to calculate DSCR, utilize the [[Debt Service Coverage Ratio](https://ipgsf.com/debt-service-coverage-ratio-dscr) Formula](https://f5mortgage.com/loan-programs/dscr-loans/florida), which is simple: DSCR = NOI / Total Debt Service. In our example, this results in a calculation of $120,000 / $100,000 = 1.2. This ratio is a vital indicator of your financial health.

- Interpret the Result: A DSCR of 1.2 means you have $1.20 of income for every $1.00 of debt service, indicating a positive cash flow. Most lenders typically prefer a minimum DSCR of 1.25 for favorable financing terms, with an ideal target closer to 2, reflecting strong financial stability.

We know how challenging it can be to navigate these financial waters, and understanding your Debt-to-Income (DTI) ratio is equally important. Generally, a maximum DTI ratio of 43% is necessary for home financing, whether you’re securing a traditional mortgage or refinancing. A better DTI can lead to more competitive mortgage rates, which are essential for families looking to upgrade their homes.

To enhance your debt service coverage ratio and DTI, consider practical strategies like reducing utility or labor expenses. Additionally, explore refinancing options available in Colorado, such as conventional loans, FHA loans, and VA loans. These can offer favorable terms tailored to your financial situation, helping you move forward with confidence.

Apply Your DSCR Calculation to Home Financing Decisions

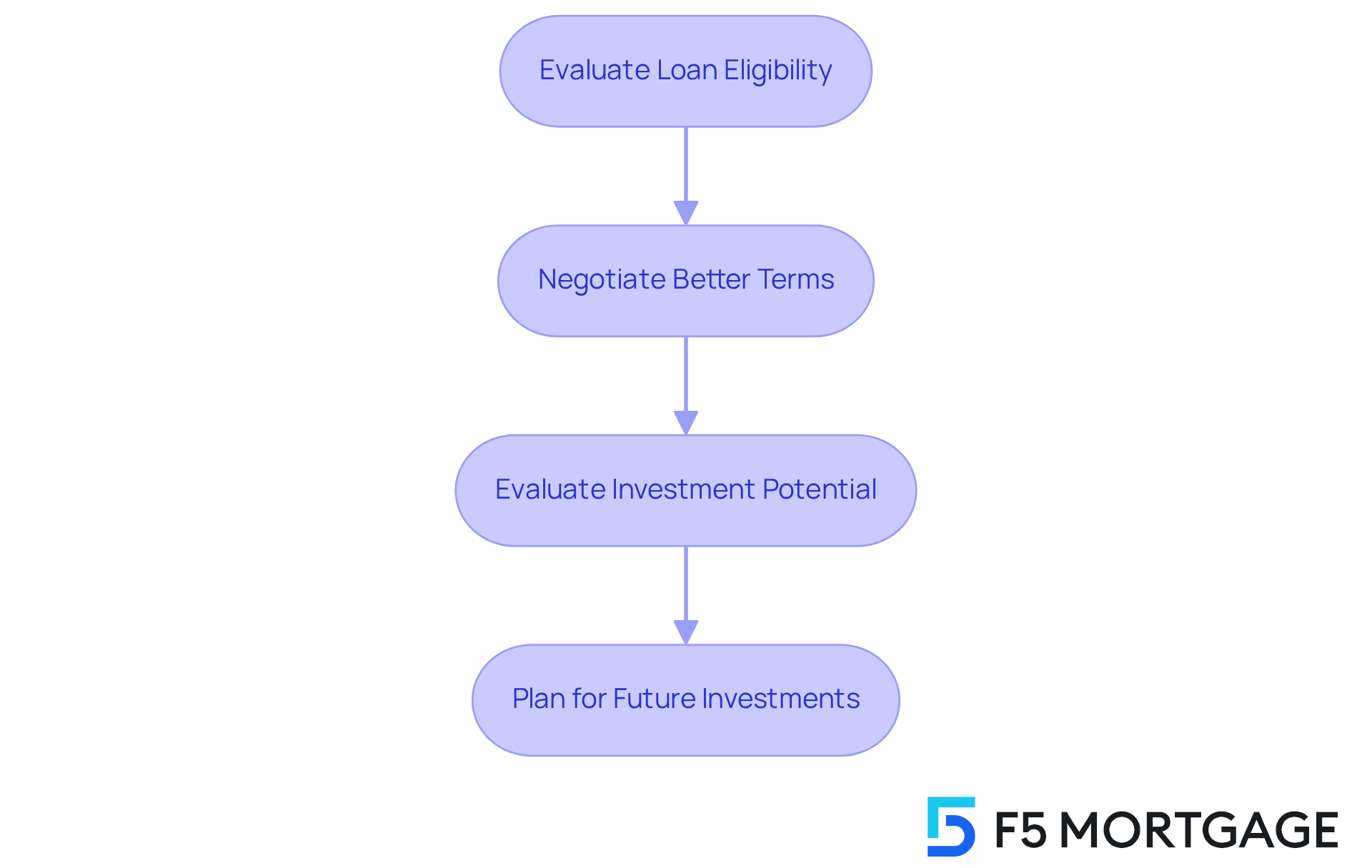

Once you’ve calculated your Debt Service Coverage Ratio (DSCR), you gain a powerful tool for making informed financing decisions that can significantly impact your future:

- Evaluate Loan Eligibility: We know how challenging it can be to secure financing for investment real estate. Lenders typically require a minimum debt service coverage ratio of 1.25, with common ranges between 1.05 and 1.25. If your ratio falls below this threshold, it may be time to explore alternative financing options or consider ways to enhance your property’s income potential. Remember, lender requirements can vary based on your property’s location, and we’re here to support you every step of the way.

- Negotiate Better Terms: Knowing how to calculate DSCR can significantly strengthen your position in negotiations with lenders. This leverage might lead to or more favorable financing conditions, ultimately reducing your total borrowing expenses. Additionally, some loans often do not require personal income verification, making them an appealing choice for families with unique financial situations.

- Evaluate Investment Potential: Knowing how to calculate DSCR is essential for assessing the attractiveness of a real estate asset as an investment. A ratio exceeding 1.5 is frequently seen as a strong indicator of financial stability, enhancing the asset’s appeal to lenders and increasing your chances of securing financing. Properties that qualify for debt service coverage ratio loans include single-family homes, multifamily units, and short-term rentals, all of which need to generate positive cash flow to meet the criteria.

- Plan for Future Investments: Learning how to calculate DSCR can be instrumental in planning for future real estate acquisitions or refinancing options. Maintaining a healthy cash flow is crucial for supporting growth in your real estate portfolio. Let your debt service coverage ratio guide these important decisions, ensuring you’re well-prepared for what lies ahead.

Troubleshoot Common DSCR Calculation Mistakes

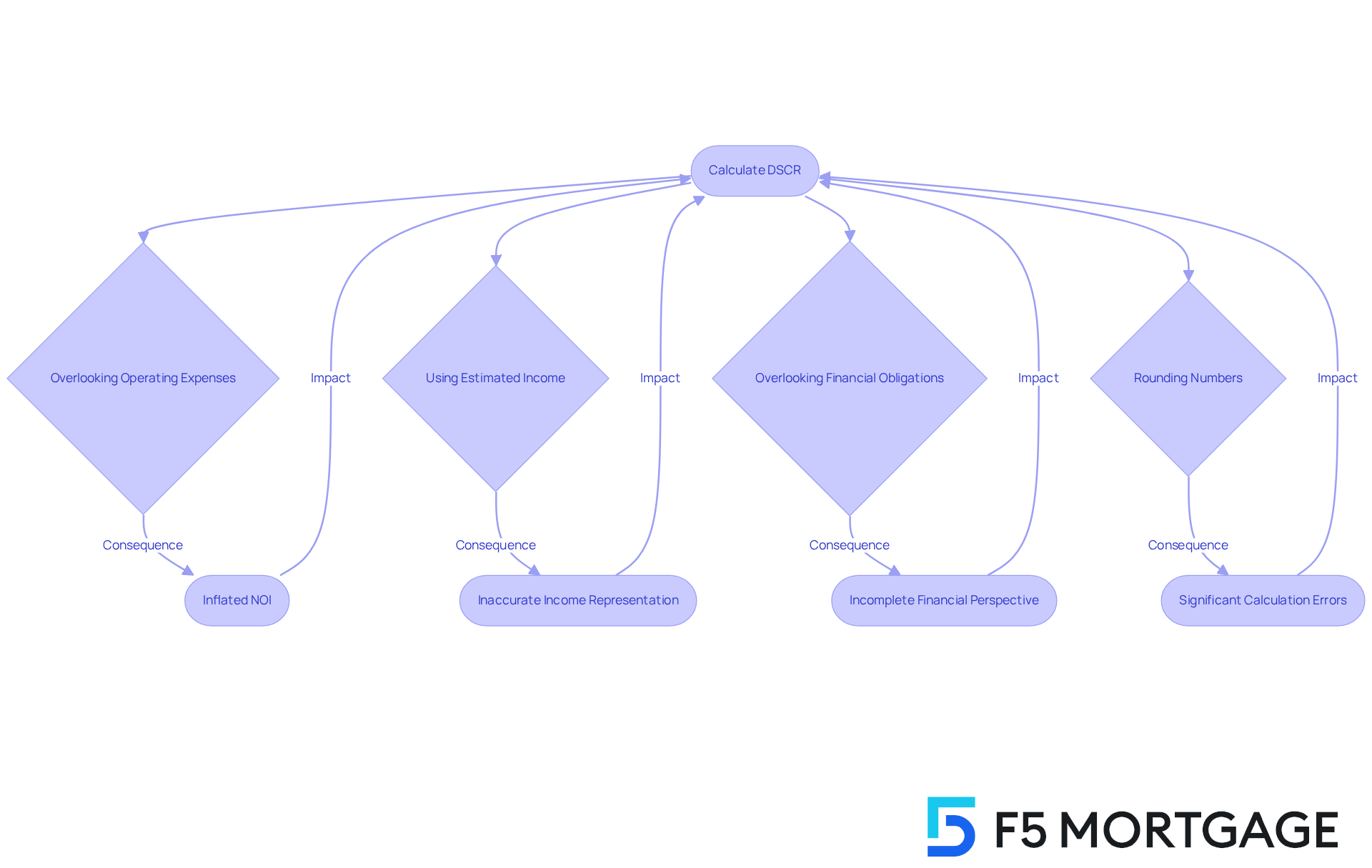

When discussing how to , we know how challenging it can be to navigate the complexities of financial assessments. It’s crucial to avoid common pitfalls that can lead to inaccurate evaluations of your property’s financial health.

- Overlooking Operating Expenses: It’s essential to account for all operating expenses, such as maintenance, property management fees, and vacancy rates. Ignoring these expenses can inflate your Net Operating Income (NOI), resulting in an overly optimistic debt service coverage ratio. A solid coverage ratio is typically greater than 1.5, which signifies a strong capacity to meet financial commitments.

- Using Estimated Income: Always base your calculations on actual rental income rather than projected figures. This practice ensures that you understand how to calculate DSCR so that your debt service coverage ratio reflects the property’s true earning potential, providing a more reliable financial overview. Remember, a DSCR above 1 indicates that the entity generates more income than necessary to meet its financial obligations, suggesting a lower risk of default.

- Overlooking Financial Obligations: Include all financial obligations in your total financial service calculation. This encompasses not only the mortgage but also any other debts related to the asset, ensuring a comprehensive perspective of your financial commitments. Banks often seek a minimum debt service coverage ratio of 1.2:1 for loan approvals, indicating that your income needs to be at least 1.2 times higher than your total debt service.

- Rounding Numbers: Avoid rounding figures too early in your calculations. Even minor discrepancies can lead to significant errors in your final debt service coverage ratio, potentially misrepresenting your property’s financial viability.

By being vigilant about these common mistakes, you can improve how to calculate DSCR accurately. This vigilance ultimately leads to more informed financing decisions and a clearer understanding of your investment’s financial health. We’re here to support you every step of the way, and utilizing tools like Rabbu’s Airbnb Calculator can assist in making more accurate projections, ensuring you account for all relevant factors.

Conclusion

Understanding how to calculate the Debt Service Coverage Ratio (DSCR) is essential for making informed decisions in smart home financing. We know how challenging this can be, and this financial metric serves as a critical indicator of an asset’s ability to generate enough income to meet its obligations. It provides valuable insight for both lenders and investors. By mastering the calculation of DSCR, you can better navigate the complexities of mortgage lending and enhance your financial stability.

This article delves into the step-by-step process of calculating DSCR, emphasizing the importance of accurate figures for Net Operating Income (NOI) and total financial obligations. Maintaining a DSCR above 1.25 is significant for favorable loan terms, and understanding the impact of recent market trends on financing opportunities can be incredibly beneficial. Furthermore, leveraging a strong DSCR can lead to improved negotiation outcomes and investment assessments.

In conclusion, a thorough understanding of DSCR not only aids in evaluating loan eligibility but also empowers you to make strategic financial decisions. By avoiding common calculation mistakes and utilizing the insights provided, you can enhance your chances of securing favorable financing options. Embracing this knowledge positions you to thrive in the ever-evolving landscape of real estate. Remember, we’re here to support you every step of the way, ensuring you’re well-equipped to seize opportunities and mitigate risks in your financial journey.

Frequently Asked Questions

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a financial measure that assesses an asset’s ability to generate sufficient income to meet its financial obligations. It is calculated by dividing the net operating income (NOI) by total financial obligations.

How do you calculate DSCR?

To calculate DSCR, divide the net operating income (NOI) by the total financial obligations, which include all payments due. A ratio greater than 1 indicates that the asset generates more revenue than needed to cover its obligations.

What does a DSCR greater than 1 signify?

A DSCR greater than 1 signifies that the asset produces more revenue than is necessary to cover its financial obligations, which is a positive indicator for lenders.

Why is DSCR important in mortgage lending?

DSCR is important in mortgage lending as it helps lenders assess risk and determine financing terms. It has become increasingly significant in recent years, especially in 2025, as lenders monitor it more closely.

How do market conditions affect DSCR financing rates?

DSCR financing rates generally align with the 5-year Treasury yield, maintaining a historical spread of 2.5% to 4%. This relationship indicates that market conditions can significantly influence financing opportunities for real estate investors.

What is the 5-8 Program related to DSCR?

The 5-8 Program allows investors to qualify for financing based on the income-producing potential of properties with 5 to 8 units, rather than relying solely on personal income. This program simplifies the qualification process and can lead to quicker approvals and higher funding limits for larger investments.

How can understanding DSCR benefit real estate investors?

Understanding DSCR is crucial for real estate investors as it aids in evaluating loan eligibility and significantly influences the overall financing landscape for real estate investments, especially amid economic uncertainties.