Overview

In today’s financial landscape, many families face the challenge of deciding between home equity loans and home equity lines of credit (HELOCs). We understand how overwhelming this decision can be, and we’re here to support you every step of the way.

Home equity loans offer a lump sum with fixed payments, making them ideal for significant expenses like home renovations or debt consolidation. On the other hand, HELOCs provide flexible borrowing options for ongoing costs, but they come with variable interest rates.

It’s essential to evaluate your specific situation carefully. Consider your financial needs and how each option aligns with your goals. By taking the time to weigh these factors, you can make a choice that best suits your family’s unique circumstances. Remember, we’re here to guide you through this process and help you find the right solution.

Introduction

Homeownership often represents a significant financial asset, and we know how challenging it can be for families to navigate this landscape. Many remain uncertain about how to effectively leverage their property’s value. By exploring the nuances of home equity loans and HELOCs, homeowners can unlock the potential of their investments for various financial needs, from renovations to education expenses.

However, with the distinct advantages and drawbacks of each option, families may wonder: how can they determine which path aligns best with their financial goals and circumstances? Understanding these critical differences is essential for making informed decisions that could impact their financial well-being for years to come. We’re here to support you every step of the way as you explore these options.

Understanding Home Equity Loans and HELOCs

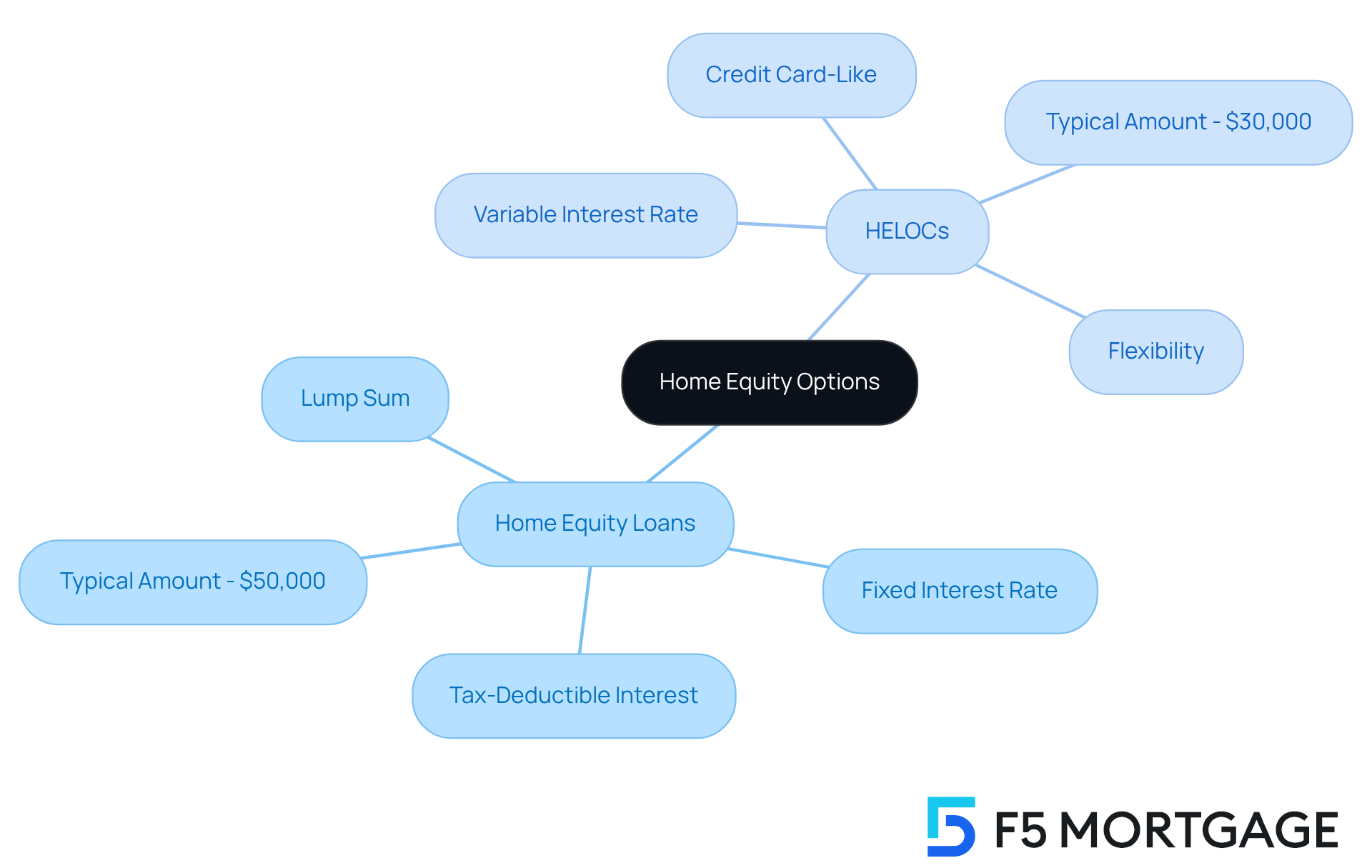

Homeowners often consider home equity vs HELOC as two common ways to tap into the value of their properties. We understand how important it is to make the most of your home’s equity. A property value loan provides a lump sum that is paid back over a set duration, usually at a stable interest rate. Borrowers receive a one-time payment and make regular monthly payments until the debt is fully repaid. Importantly, interest on home collateral loans may be tax-deductible if used for home improvements, offering potential financial benefits.

In contrast, a HELOC functions similarly to a credit card, enabling homeowners to withdraw against their ownership value as needed, up to a predetermined limit. However, it’s important to note that HELOCs generally have variable interest rates, which can fluctuate and impact your monthly payments. As of 2025, the typical amount for property-backed loans is roughly $50,000, whereas HELOCs average about $30,000. This distinction highlights that families often use residential value loans for significant, one-time expenses, like major property renovations or debt consolidation, while HELOCs are more suited for ongoing projects or unexpected costs. Yet, families should also consider that HELOCs may come with ongoing charges, such as annual fees or per-use fees, which could affect their overall cost.

Alongside these options, California homeowners might also explore rate-and-term financing as a way to access their home equity. This approach can help lower monthly mortgage expenses by replacing a current mortgage with one that offers a more favorable interest rate or varying term duration. This can be particularly beneficial during periods of declining interest rates, allowing families to save money on their overall borrowing.

For instance, imagine a family using a property value loan to fund a kitchen renovation, enjoying consistent monthly payments and a fixed interest rate. Alternatively, another family might choose a HELOC to finance a series of smaller home improvements over time, enjoying the flexibility to borrow as needed. Financial consultants often emphasize the differences in home equity vs HELOC, noting that property value loans offer stability with fixed payments, while HELOCs provide flexibility but come with the risk of variable rates.

Ultimately, understanding the distinctions of home equity vs HELOC is crucial for families considering using their property value for various financial needs, such as renovations, education expenses, or debt consolidation. It’s essential to take personal financial circumstances, including income, debts, and cash flow, into account when choosing between a property value loan, a HELOC, or a rate-and-term refinance. We’re here to support you every step of the way, empowering you to make informed decisions that align with your financial goals.

Pros and Cons of Home Equity Loans and HELOCs

When considering financial solutions, families often face the challenge of choosing between home equity vs HELOC. Both options, when considering home equity vs HELOC, come with unique benefits and drawbacks that deserve careful evaluation to find the best fit for your financial needs.

Home Equity Loans:

- Pros:

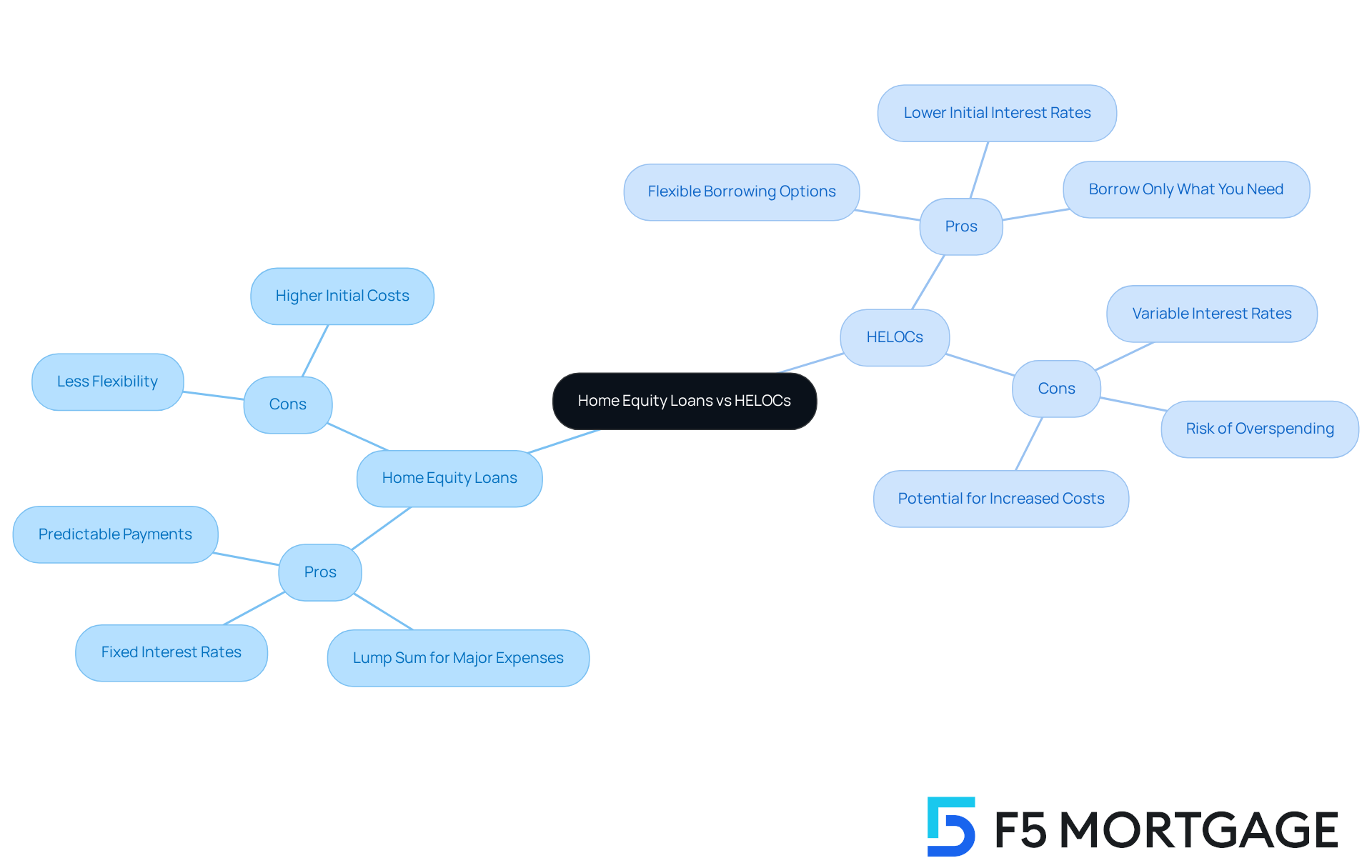

- Fixed interest rates provide predictable monthly payments, simplifying budgeting for families.

- These loans are ideal for significant, one-time expenses, such as home renovations or debt consolidation, offering a lump sum that can be accessed right away.

- The fixed repayment terms make financial planning easier, allowing borrowers to know exactly when their debt will be paid off.

- Cons:

- Home equity loans are less flexible; once the loan is closed, accessing additional funds requires taking out a new loan.

- They often come with higher initial costs, including closing fees that can range from 2% to 5% of the borrowed amount, which might deter some borrowers.

HELOCs:

- Pros:

- HELOCs offer flexible borrowing options, allowing homeowners to withdraw funds as needed during the draw period, typically lasting 10 years. This flexibility is especially beneficial for ongoing expenses, such as repairs or education costs.

- They often feature lower initial interest rates compared to home equity loans, making them an attractive choice for those looking to minimize upfront costs.

- Homeowners can borrow only what they need, which helps manage expenses over time and can reduce interest payments.

- Cons:

- The variable interest rates associated with HELOCs may result in fluctuating monthly payments, making it difficult to predict future costs.

- There is a risk of overspending due to easy access to credit, which can lead to financial strain if not managed carefully.

- If interest rates rise significantly, the overall cost of borrowing could increase, potentially resulting in higher payments than expected.

Consider real-life scenarios: families have successfully utilized HELOCs for renovations, enabling them to finance projects gradually while only covering interest on the amounts withdrawn. However, financial experts remind us that the flexibility of HELOCs can lead to overspending if discipline is not maintained.

As we look ahead to 2025, the average closing costs for property-backed financing and HELOCs remain competitive. Yet, it’s essential for borrowers to compare options to find the best rates and terms. By understanding these factors, families can make informed decisions that align with their financial goals. Remember, we’re here to support you every step of the way.

Choosing the Right Option: When to Use Home Equity Loans vs. HELOCs

Choosing between home equity vs HELOC can feel overwhelming, as it truly depends on your personal financial situation and specific needs.

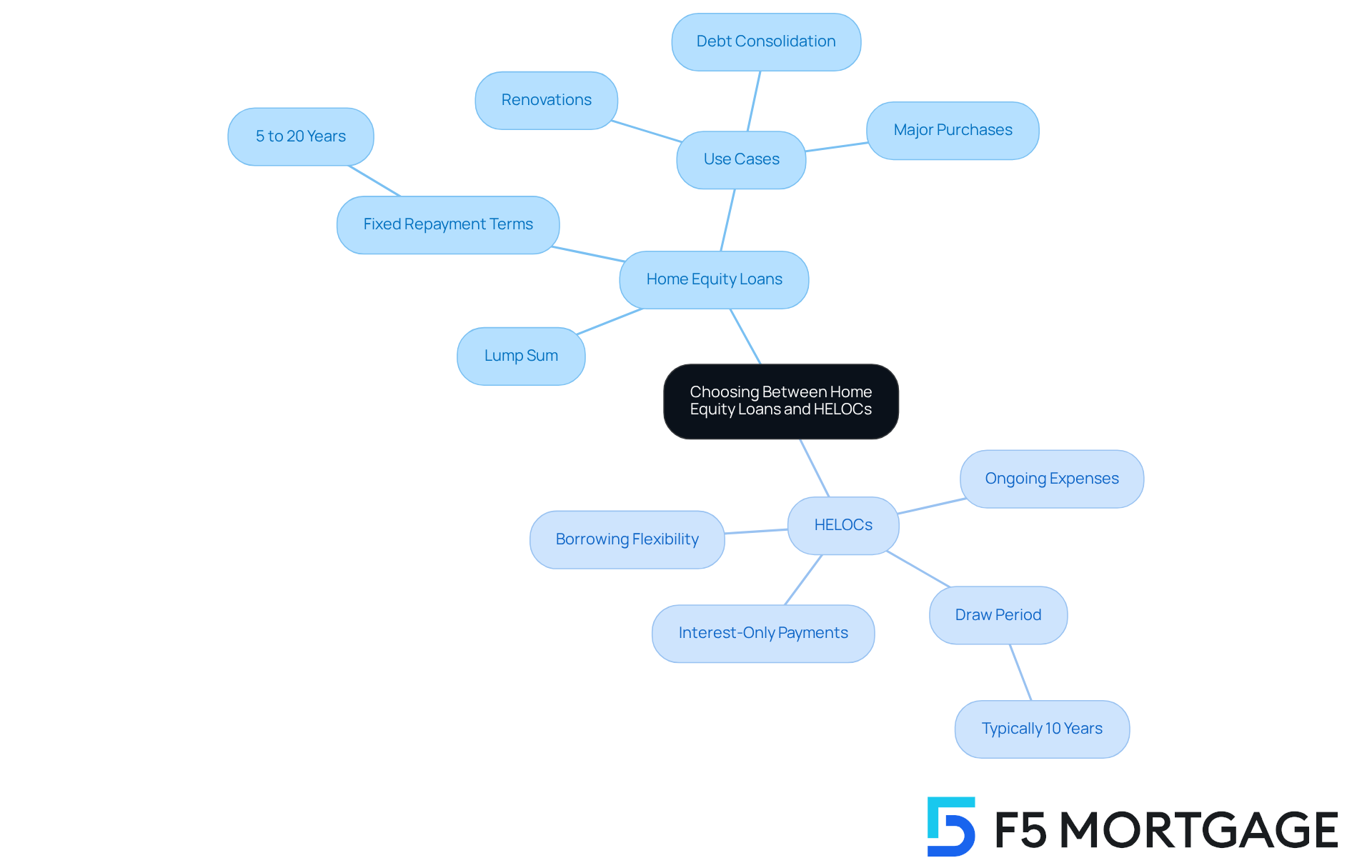

Property Equity Loans can be a wonderful solution for families who need a significant lump sum for important reasons, such as major renovations or consolidating high-interest debt. With fixed repayment terms typically ranging from 5 to 20 years, these loans offer predictable monthly payments, which can simplify budgeting for families over time. For instance, if a household is considering a significant kitchen renovation, opting for a property value financing option allows them to secure the necessary funds in advance, enabling them to handle the project without added financial stress.

On the other hand, HELOCs are ideal for those who anticipate ongoing expenses or desire borrowing flexibility. Imagine a family planning a series of renovations over several months; a HELOC can be advantageous as it permits them to access funds gradually as needed, rather than incurring a large debt all at once. During the initial draw period, usually lasting around 10 years, borrowers can make interest-only payments, providing them with additional financial breathing room.

Ultimately, the choice between home equity vs HELOC should reflect your family’s financial situation, your comfort with managing variable payments, and your specific borrowing needs. We know how challenging this can be, and engaging with a mortgage expert can offer valuable insights, ensuring you make informed decisions tailored to your unique circumstances. We’re here to support you every step of the way.

Current Market Trends and Interest Rates

As of September 2025, we understand how important it is for families to navigate the environment for residential asset borrowing, particularly in terms of home equity vs HELOC, especially with the significant interest trends at play. Currently, home equity loan averages hover around 8.22%, while HELOC averages are slightly lower at roughly 8.10%. This small difference in costs can greatly influence a family’s choice regarding home equity vs HELOC when deciding which funding option to pursue.

Market conditions, particularly the Federal Reserve’s monetary policy, are crucial in shaping these figures. The Federal Reserve has maintained its benchmark level at 4.25% to 4.50%, fostering a stable borrowing environment. However, families should remain vigilant, as fluctuations can lead to increased borrowing costs. With over 47% of mortgaged residential properties considered asset-rich in Q2 2025 and property values having surged 142% nationwide since 2020, many families are in a favorable position to utilize their property assets.

Understanding when to borrow is essential for maximizing savings. If families anticipate an increase in interest rates, acting sooner rather than later may be beneficial. Additionally, potential tax benefits from home equity loans, especially when used for home improvements, should not be overlooked. By comparing prices, expenses, and conditions, families can ensure they find the most suitable option for their needs in the context of home equity vs HELOC.

Working with F5 Mortgage can provide access to competitive rates and personalized service, making the process smoother. Consulting with a mortgage expert offers tailored advice, helping families navigate the complexities of the current market and make informed decisions that align with their financial goals. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding the differences between home equity loans and HELOCs is essential for families looking to leverage their property’s value. We know how challenging this decision can be. Each option presents distinct advantages and challenges, making it crucial to align the choice with your specific financial needs and circumstances. By assessing the nature of your expenses—whether they are substantial one-time costs or ongoing projects—you can make informed decisions that best serve your financial goals.

This article highlights key aspects of both home equity loans and HELOCs. It emphasizes the stability of fixed-rate loans versus the flexibility offered by variable-rate HELOCs. Important factors such as interest rates, repayment terms, and potential fees are discussed, providing a comprehensive overview for families navigating these borrowing options. The current market trends and interest rates further underscore the importance of timely decision-making, particularly as economic conditions evolve.

Ultimately, the choice between a home equity loan and a HELOC should reflect your personal financial situation and future plans. Engaging with mortgage experts can provide invaluable insights tailored to your individual needs. We’re here to support you every step of the way, ensuring you choose the most advantageous option. The significance of understanding these financial tools cannot be overstated, as making the right choice can lead to substantial savings and improved financial stability.

Frequently Asked Questions

What are home equity loans and HELOCs?

Home equity loans provide a lump sum that is paid back over a set duration with a stable interest rate, while HELOCs allow homeowners to withdraw against their equity as needed, similar to a credit card, up to a predetermined limit.

How does a home equity loan work?

A home equity loan involves receiving a one-time payment that is repaid through regular monthly payments until the debt is fully paid off. The interest may be tax-deductible if used for home improvements.

What is a HELOC and how does it differ from a home equity loan?

A HELOC (Home Equity Line of Credit) allows homeowners to borrow against their equity as needed, with variable interest rates that can fluctuate, whereas a home equity loan has fixed payments and a fixed interest rate.

What are the typical amounts for home equity loans and HELOCs?

As of 2025, the typical amount for home equity loans is roughly $50,000, while HELOCs average about $30,000.

When are home equity loans typically used?

Home equity loans are often used for significant, one-time expenses such as major property renovations or debt consolidation.

When are HELOCs more appropriate?

HELOCs are more suited for ongoing projects or unexpected costs due to their flexibility in borrowing as needed.

Are there any additional costs associated with HELOCs?

Yes, HELOCs may come with ongoing charges such as annual fees or per-use fees, which can affect their overall cost.

What is rate-and-term financing?

Rate-and-term financing allows homeowners to access their home equity by replacing their current mortgage with one that offers a more favorable interest rate or varying term duration, potentially lowering monthly mortgage expenses.

How can personal financial circumstances affect the choice between a home equity loan and a HELOC?

Personal financial circumstances, including income, debts, and cash flow, should be considered when choosing between a home equity loan, a HELOC, or a rate-and-term refinance to ensure alignment with financial goals.

What is the importance of understanding the differences between home equity loans and HELOCs?

Understanding the distinctions is crucial for families considering using their property value for financial needs such as renovations, education expenses, or debt consolidation, allowing them to make informed decisions.