Overview

Refinancing debt can be a transformative step for many families, as it involves replacing an existing loan with a new one that often comes with better terms. Imagine enjoying lower interest rates and improved cash flow; these changes can significantly enhance your financial management.

In this article, we explore the many benefits of refinancing, including:

- Debt consolidation

- The opportunity to access home equity

We understand how challenging navigating this process can be, so we also outline the eligibility criteria and the essential steps to help you successfully move forward.

Introduction

Refinancing debt offers a unique opportunity for individuals who are looking to enhance their financial stability. We understand how challenging this can be, and with the potential to lower interest rates, improve cash flow, and consolidate high-interest obligations, it’s important to grasp the intricacies of refinancing. This understanding can significantly impact your financial future.

However, navigating the various options and eligibility criteria can feel daunting. What if the right choice is just a few steps away? By exploring the benefits and processes of refinancing, you not only demystify this financial strategy but also empower yourself to take control of your economic well-being.

Understand Refinancing and Its Benefits for Debt Management

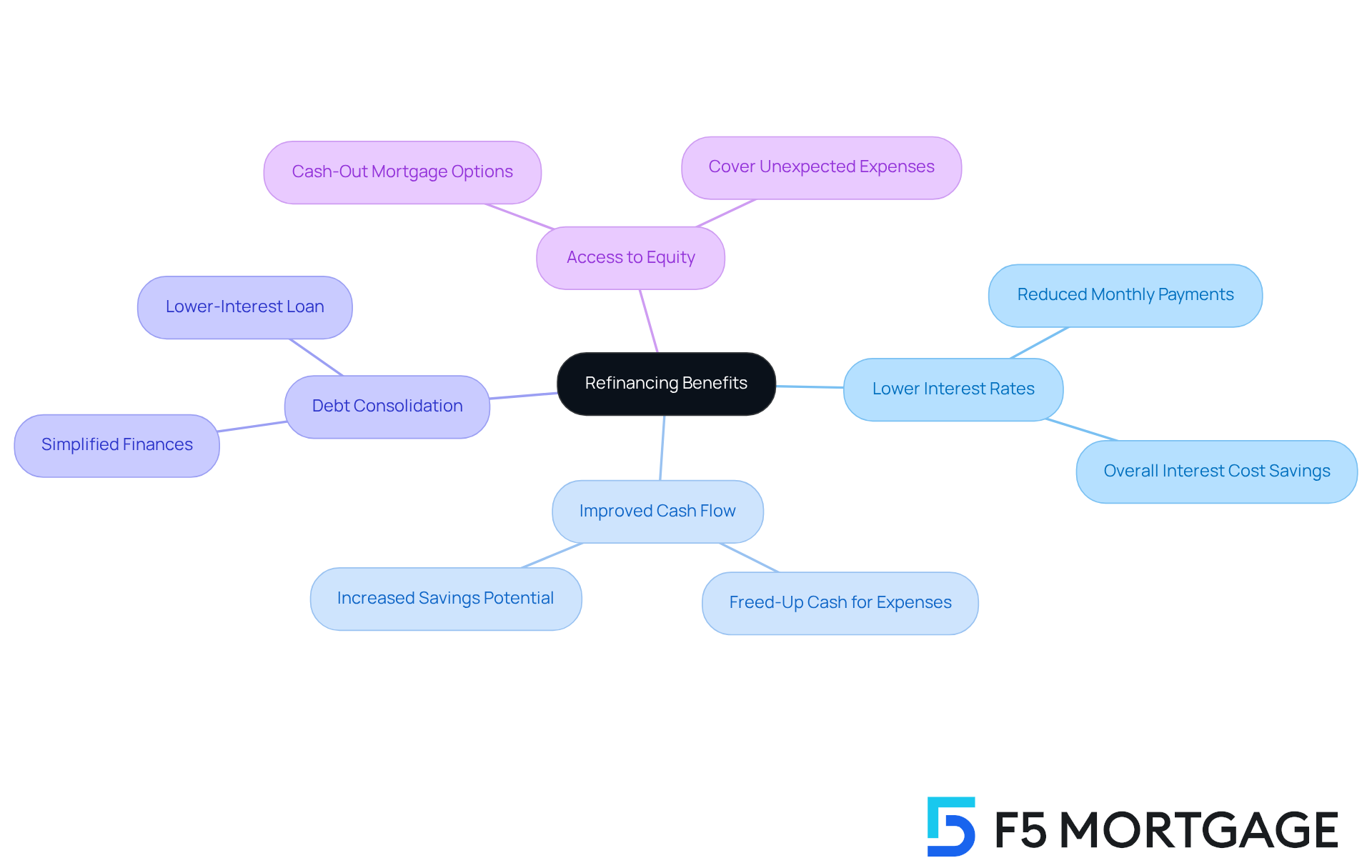

Refinancing can feel like a daunting process, but it’s a valuable opportunity to replace an existing loan with a new one that often comes with better terms. Understanding the is essential for managing your financial future effectively. Here’s how it can help:

- Lower Interest Rates: By refinancing, you may secure a lower interest rate. This can lead to reduced monthly payments and overall interest costs, providing you with some much-needed relief.

- Improved Cash Flow: With lower payments, you can free up cash for other important expenses or even for savings, giving you more financial flexibility.

- Debt Consolidation: You can refinance debt to consolidate high-interest debts into a single, lower-interest loan. This simplifies your finances and makes it easier to manage your payments.

- Access to Equity: If your home has increased in value, a cash-out mortgage can provide you with access to cash. This can be a lifeline to refinance debt or cover unexpected expenses.

We know how challenging navigating these financial decisions can be. By recognizing these advantages, you’re taking the first step toward a more secure financial future through loan restructuring. Remember, we’re here to support you every step of the way.

Explore Different Refinancing Options: Cash-Out vs. Term Refinance

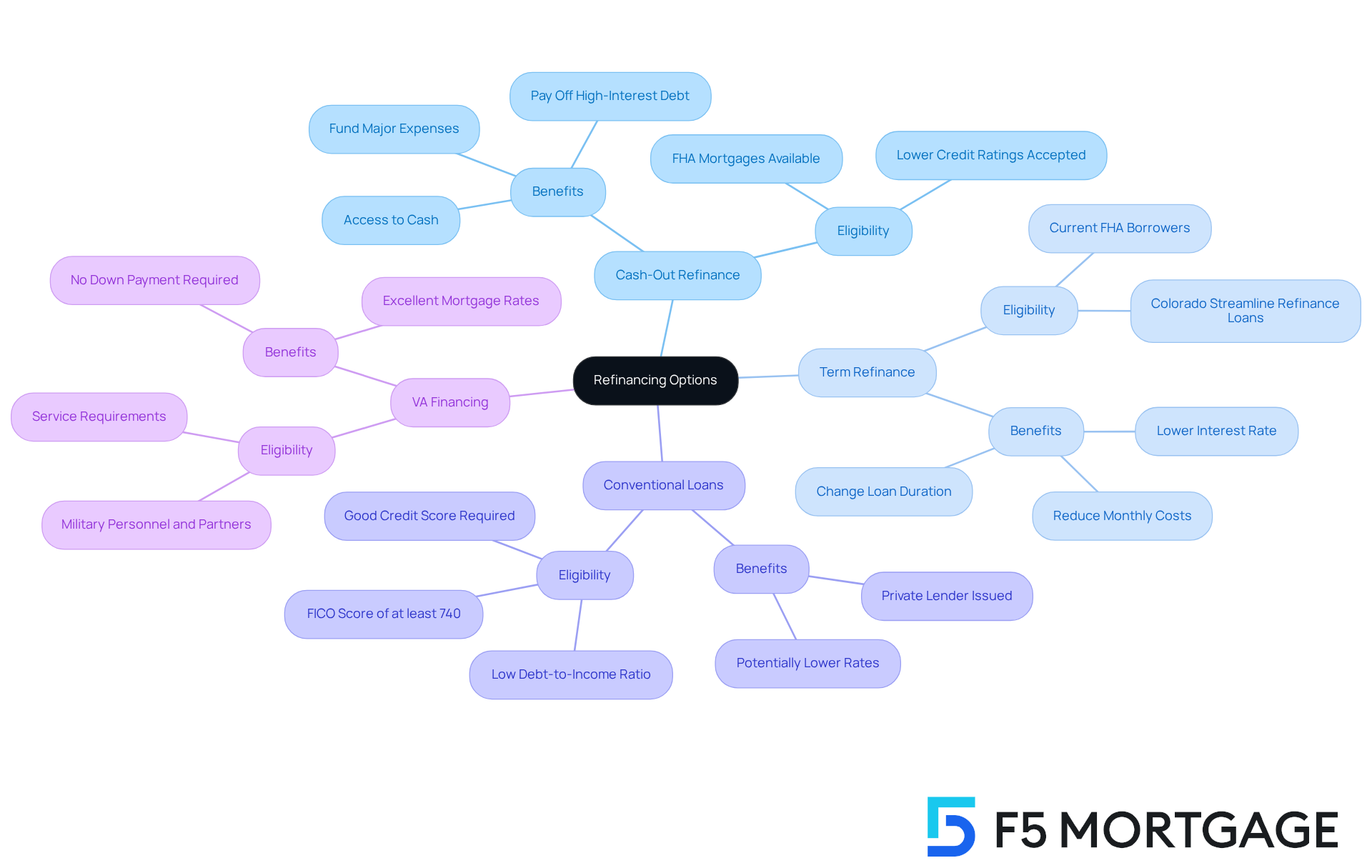

When considering , we understand how overwhelming the options can be. Let’s explore the various alternatives available to you:

- Cash-Out Refinance: This option allows you to refinance for more than you owe on your current mortgage, taking the difference in cash. This can be a lifeline to refinance debt for paying off high-interest obligations or funding major expenses. In Colorado, this can be especially advantageous with alternatives such as FHA mortgages, which are accessible to homeowners with lower credit ratings, making it easier to qualify for cash-out funding.

- Term Refinance: This involves refinancing your existing mortgage to a new loan with a different term, typically aimed at lowering your interest rate or changing the duration of your loan. This choice is ideal for individuals looking to reduce their monthly costs without withdrawing cash. For instance, Colorado Streamline Refinance Loans enable current FHA borrowers to refinance swiftly and easily, often leading to reduced monthly payments.

- Conventional Loans: These traditional mortgages are issued by private lenders and come with stricter eligibility requirements. To qualify, you typically need a good credit score and a low debt-to-income (DTI) ratio. The most favorable rates are available to those with a FICO score of at least 740.

- VA Financing: Accessible to military personnel and their partners, VA financing offers excellent mortgage rates and a straightforward application process. Eligibility is based on specific service requirements, and these loans often do not require a down payment.

We know how challenging this can be, so it’s crucial to assess your financial condition and objectives to determine how to refinance debt in a way that aligns best with your needs. F5 Mortgage is here to support you every step of the way, helping you navigate these options to find the best solution for your family’s financial future.

Determine Your Eligibility for Debt Consolidation Through Refinancing

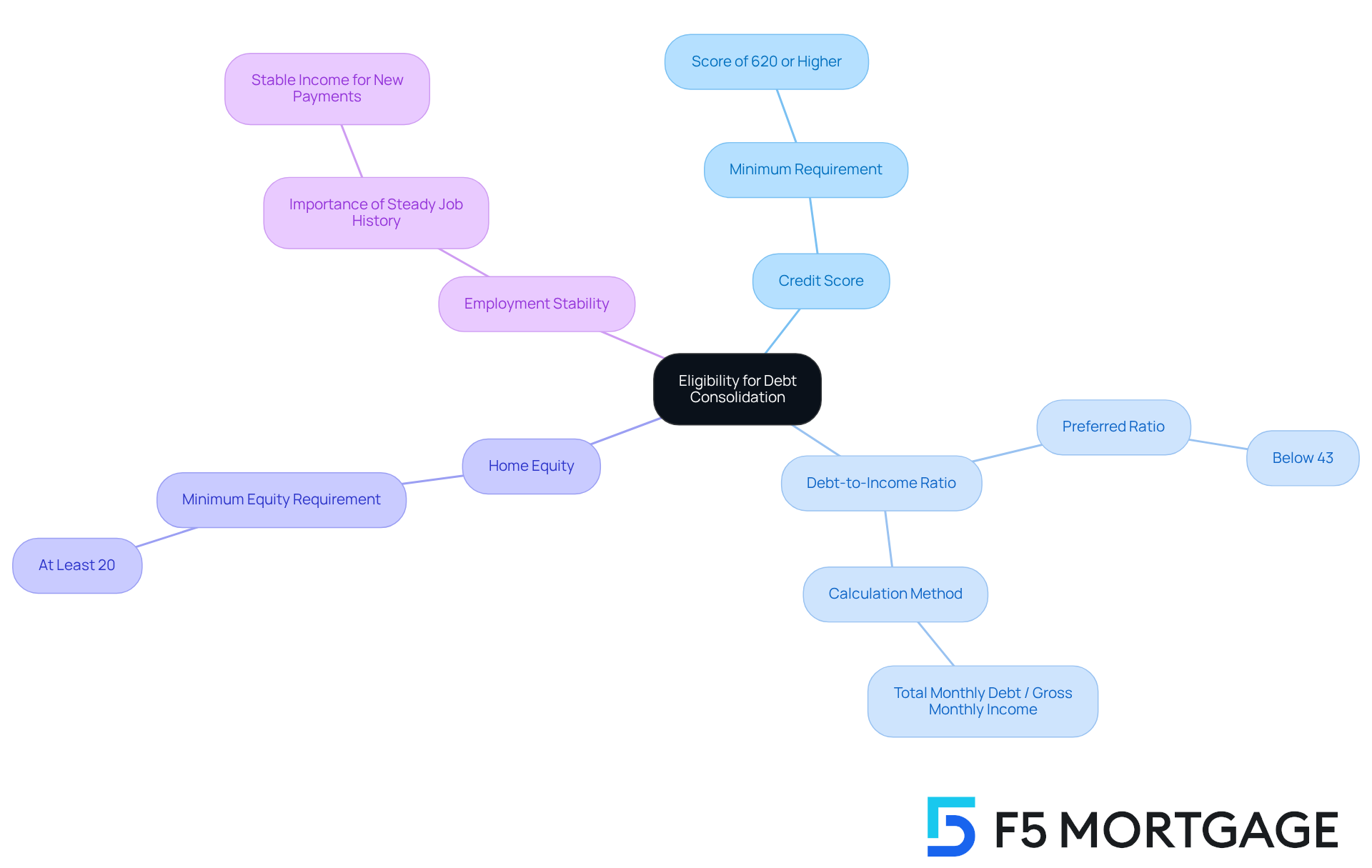

To determine your eligibility for debt consolidation through refinancing, let’s consider some important factors together:

- Credit Score: We know how crucial a higher credit score can be. Typically, a score of 620 or higher qualifies you for better rates, which is a common minimum requirement for conventional loan programs.

- Debt-to-Income Ratio: Lenders often prefer a debt-to-income ratio below 43%. To calculate yours, divide your total monthly debt expenses by your gross monthly income. Understanding this is essential for qualifying for .

- Home Equity: It’s important to ensure you have sufficient equity in your home. Lenders usually require at least 20% equity for cash-out loan transactions, especially when accessing funds to refinance debt or for significant expenses.

- Employment Stability: A steady job history can greatly enhance your application. Lenders seek stable income to ensure you can handle new payments, which is vital for all kinds of loan options.

Reviewing these criteria can help you evaluate your eligibility before moving forward with the loan modification. By comprehending these factors, you will be better equipped to manage the loan modification process efficiently and make informed choices regarding your financial future. Remember, we’re here to support you every step of the way.

Prepare for the Refinancing Process: Documentation and Steps to Follow

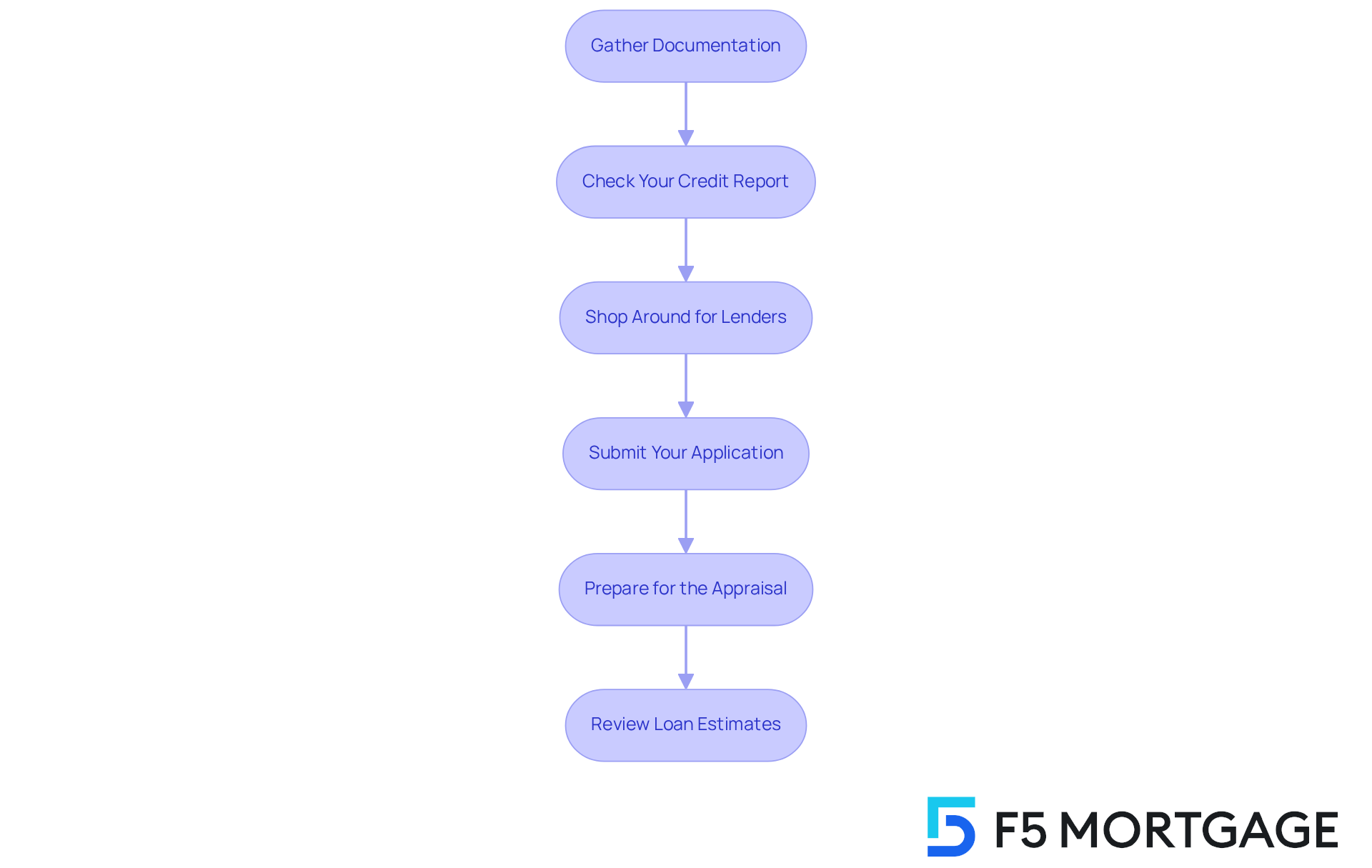

Preparing for the process to refinance debt can feel overwhelming. We know how challenging this can be, but by following these steps, you can navigate it more smoothly and position yourself for success.

- Gather Documentation: Start by collecting the necessary documents, including recent pay stubs, tax returns for the last two years, bank statements, your current mortgage statement, and proof of homeowners insurance. Having these ready will make the process easier.

- Check Your Credit Report: Take a moment to review your credit report for any errors. Addressing issues now can help improve your score, which is crucial when you refinance debt.

- Shop Around for Lenders: Don’t settle for the first offer. Compare rates and terms from multiple lenders to find the best deal that suits your needs.

- Submit Your Application: Once you’ve chosen a lender, complete the application process. Be sure to provide all required documentation to avoid delays.

- Prepare for the Appraisal: The lender will likely require an appraisal to determine your home’s value. Make sure your home is presentable and accessible for the appraiser.

- Review Loan Estimates: After receiving loan estimates, take the time to compare them carefully. Understanding the costs involved will empower you to .

By following these steps, you can streamline the process to refinance debt. Remember, we’re here to support you every step of the way.

Conclusion

Refinancing debt offers you a strategic opportunity to reshape your financial commitments and enhance your monetary stability. By replacing existing loans with new ones that provide better terms, you can significantly lower interest rates, improve cash flow, and simplify your financial landscape. Embracing the refinancing process is a proactive step towards achieving a more secure financial future.

In this guide, we’ve explored key aspects of refinancing, including various options like cash-out and term refinancing, as well as the eligibility criteria necessary for successful debt consolidation. Understanding these elements empowers you to make informed decisions, ensuring that your refinancing efforts align with your financial goals.

Ultimately, refinancing is not just about securing lower payments; it’s about taking control of your financial destiny. By assessing your personal circumstances, gathering the necessary documentation, and exploring the best refinancing options, you can pave the way for a brighter financial future. Taking action today can lead to lasting benefits, so consider how refinancing can transform your financial life for the better.

Frequently Asked Questions

What is refinancing?

Refinancing is the process of replacing an existing loan with a new one that often comes with better terms, such as lower interest rates.

What are the benefits of refinancing?

The benefits of refinancing include securing lower interest rates, improving cash flow, consolidating debt, and accessing equity from increased home value.

How can refinancing lower my monthly payments?

By refinancing to a lower interest rate, you can reduce your monthly payments and overall interest costs, providing financial relief.

How does refinancing improve cash flow?

With lower monthly payments from refinancing, you can free up cash for other important expenses or savings, enhancing your financial flexibility.

What is debt consolidation through refinancing?

Debt consolidation through refinancing involves combining high-interest debts into a single, lower-interest loan, simplifying your finances and making payments easier to manage.

What is a cash-out mortgage?

A cash-out mortgage allows you to access cash from your home’s increased value, which can be used to refinance debt or cover unexpected expenses.