Overview

This article is here to support families with bad credit as they explore the steps to refinance their mortgage and upgrade their homes, even in the face of financial challenges. We understand how daunting this can be, and it’s important to recognize the various refinancing options available, such as FHA and VA loans. Improving your credit score is a crucial step, and we’ll guide you through effectively navigating the application process. By doing so, you can unlock better loan terms and achieve more favorable financial outcomes.

As we delve deeper, let’s acknowledge the hurdles you may be experiencing. It’s not just about numbers; it’s about your home and your family’s future. We’re here to walk you through the solutions with compassion and understanding. Remember, you’re not alone in this journey. Together, we can explore the options that best suit your needs and empower you to take control of your financial situation.

Take a moment to consider these actionable steps:

- Evaluate your current financial standing and identify areas for improvement.

- Research the refinancing options available to you.

- Reach out for assistance—whether that’s from a financial advisor or a trusted friend.

Each step you take brings you closer to your goal of refinancing and enhancing your home.

We know how challenging this can be, but with the right information and support, you can navigate these waters successfully. Let’s embark on this journey together, ensuring that your home remains a place of comfort and security for you and your loved ones.

Introduction

Navigating the world of mortgage refinancing can be particularly daunting for families grappling with bad credit. We understand how challenging this can be. With the potential to lower monthly payments and improve loan terms, refinancing presents a valuable opportunity for homeowners seeking financial relief.

However, the path is fraught with challenges, from stringent lender requirements to the complexities of credit scores. How can families effectively maneuver through these obstacles to secure a more favorable mortgage? We’re here to support you every step of the way.

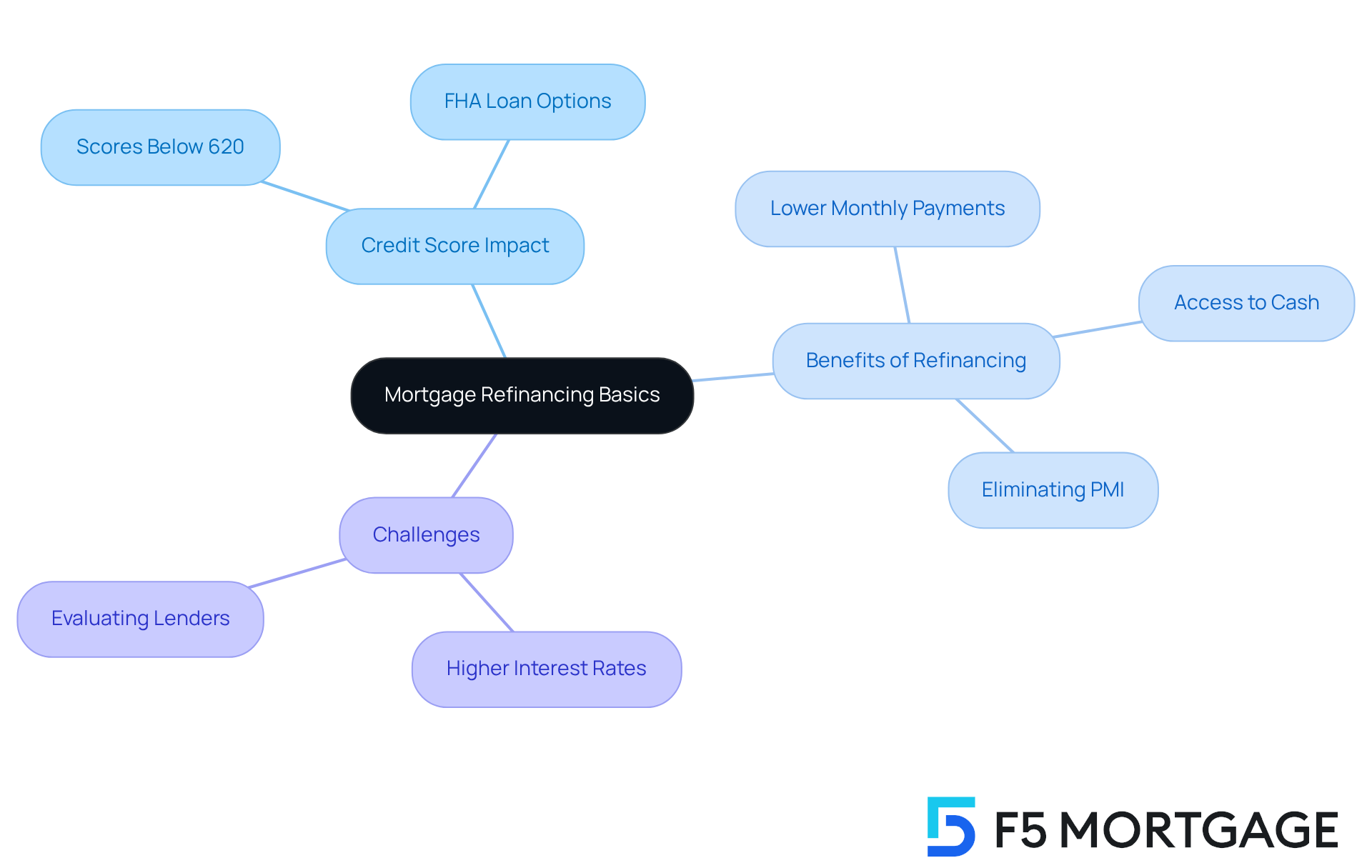

Understand Mortgage Refinancing Basics for Bad Credit

Mortgage restructuring involves replacing your current mortgage with a new one, often to secure a lower interest rate or modify the financing terms. We understand how overwhelming this process can feel, especially for families looking to refinance mortgage bad credit while facing credit challenges. Here are some key points to consider:

-

Credit Score Impact: If your credit score is below 620, it may be classified as ‘bad credit,’ which can limit your refinancing options. Many lenders require a minimum score of 620 for standard mortgages. However, FHA options might allow for restructuring with scores as low as 500, provided certain criteria are met.

-

Benefits of Refinancing: Refinancing can lead to lower monthly payments, access to cash through your home equity, and improved loan terms. For instance, consolidating high-interest debt into your mortgage could save you money in the long run. Plus, once you achieve 20% equity, refinancing can help you eliminate private mortgage insurance (PMI).

-

Challenges: Families may face higher interest rates and stricter qualification standards due to their financial situation. It’s crucial to evaluate different lenders, as some may offer more flexible terms for those looking to refinance mortgage bad credit. For example, portfolio lenders often cater to smaller borrowers, providing more adaptable options.

By understanding these fundamentals, we hope you feel more empowered to navigate the loan modification landscape. Evaluate your eligibility carefully, and remember, we’re here to support you every step of the way as you make informed choices that align with your financial goals.

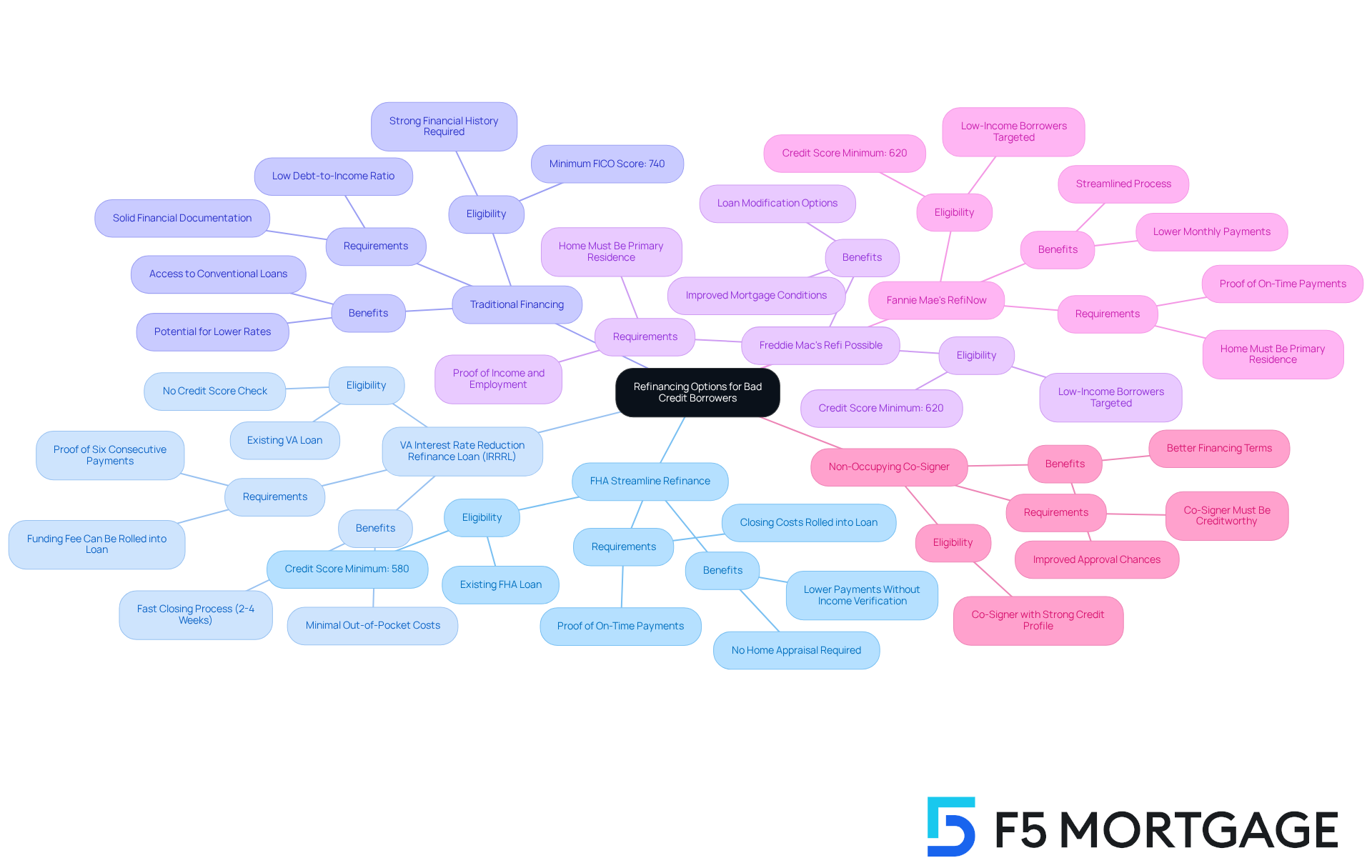

Explore Available Refinancing Options for Bad Credit Borrowers

Families facing challenges with bad credit have several refinancing options to explore:

-

FHA Streamline Refinance: This program is designed specifically for homeowners with existing FHA loans. It allows for refinancing with minimal documentation and no credit score requirement. This streamlined procedure makes it attainable for those who have faced difficulties with loans in the past. In Colorado, FHA refinancing options are available, typically requiring a minimum rating of 580 and more flexible DTI criteria.

-

VA Interest Rate Reduction Refinance Loan (IRRRL): This option is tailored for veterans, offering a streamlined process to lower interest rates without requiring a credit score check. The simplicity and effectiveness of this program allow veterans to swiftly obtain improved financing conditions. It’s important to note that the VA funding fee, usually around 0.5%, can be included in the mortgage, minimizing upfront costs.

-

Traditional Financing: While traditional financing often comes with more stringent eligibility criteria, families with a strong financial history can still explore refinancing alternatives. If individuals have a minimum FICO score of 740, they may qualify for the most advantageous mortgage rates. This option is worth investigating if their financial situation has improved. However, it’s crucial to recognize that traditional loans require a solid financial history and a low DTI.

-

Freddie Mac’s Refi Possible: This program targets low-income borrowers, allowing loan modification with a rating as low as 620. It provides an opportunity for families to refinance mortgage bad credit and secure better mortgage conditions, even in the face of financial difficulties.

-

Fannie Mae’s RefiNow: Similar to Freddie Mac’s program, RefiNow assists borrowers with lower scores and income levels, helping families enhance their financial circumstances through more favorable terms.

-

Non-Occupying Co-Signer: Families can improve their chances of approval and secure better terms by applying with a co-signer who has a stronger credit profile. This strategy can significantly enhance the overall financing conditions, making refinancing more attainable.

By evaluating these options, families can find a refinance mortgage bad credit solution that aligns with their financial situations. This could potentially lead to reduced monthly payments and improved financial terms. For instance, even a small decrease in interest rates can result in substantial savings over the life of the loan. Therefore, it’s beneficial to explore these options together.

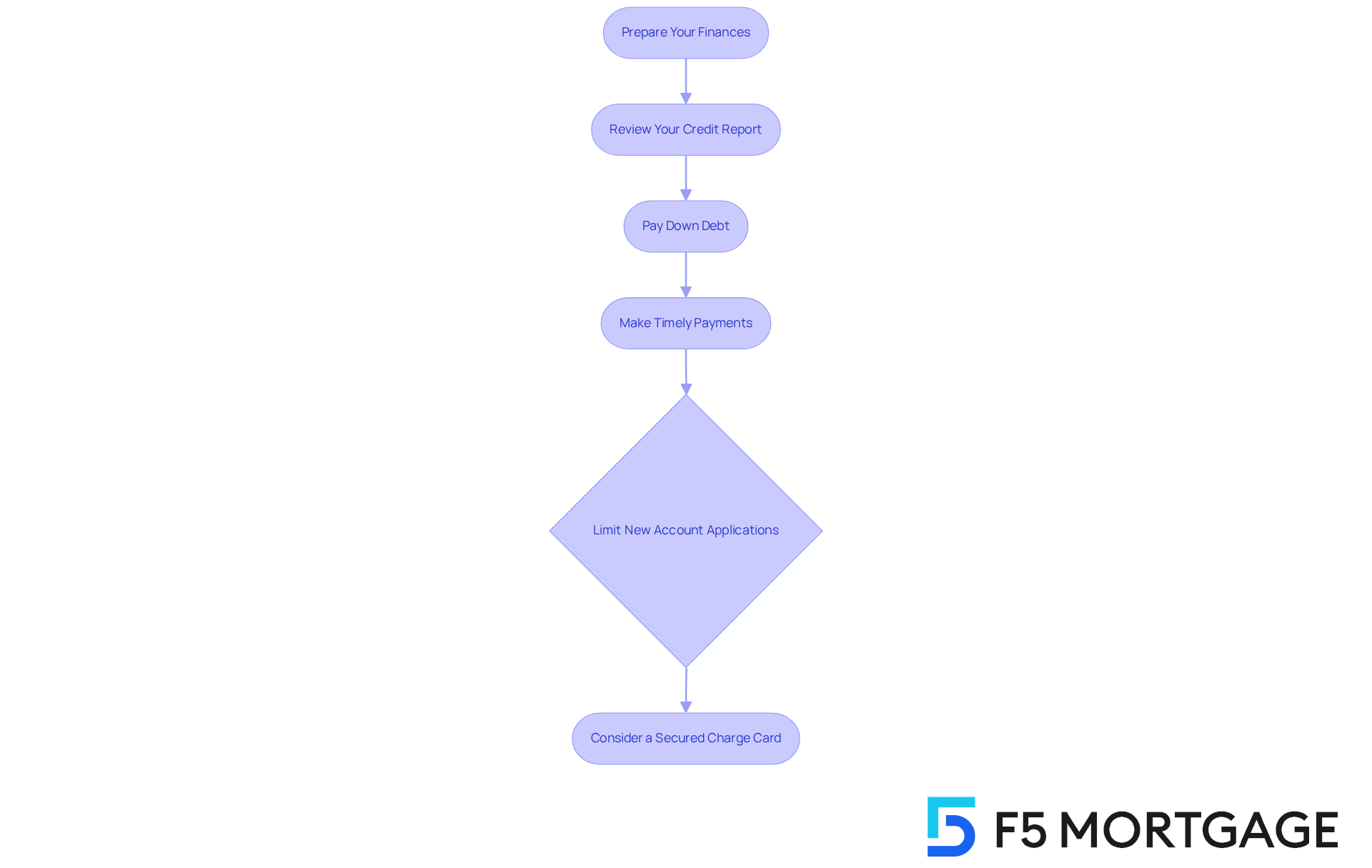

Prepare Your Finances and Improve Your Credit Score

To enhance your chances of successful refinance mortgage bad credit, we understand how important it is to take the right steps. Here are some thoughtful actions you can consider:

-

Review Your Credit Report: Start by obtaining a free copy of your credit report from the three major credit bureaus. Thoroughly examine it for mistakes, and don’t hesitate to contest any discrepancies that may be adversely impacting your results. Fixing these errors can potentially boost your score by 50 to 100 points within a couple of months.

-

Pay Down Debt: Focus on reducing outstanding debts, especially high-interest credit cards. To meet the requirements for a loan modification, it is essential to have a lower debt-to-income (DTI) ratio, ideally under 43%, especially for those looking to refinance mortgage bad credit. Families that have successfully reduced debt often report enhanced loan restructuring results.

-

Make Timely Payments: Ensure all bills, including utilities and charge cards, are settled punctually. A steady payment record is an important element in enhancing your rating, which lenders take into account when evaluating your application for a loan modification.

-

Limit New Account Applications: Avoid applying for new accounts before refinancing. Numerous inquiries can diminish your borrowing rating, making it more challenging to obtain favorable terms.

-

Consider a Secured Charge Card: If your rating is very low, using a secured charge card responsibly can assist in restoring your standing over time. This strategy enables you to showcase responsible borrowing practices, which can positively impact your financial profile.

By adhering to these steps, families can enhance their financial profiles and increase their chances of securing advantageous loan terms, which is especially important when looking to refinance mortgage bad credit. We know how challenging this can be, but with careful planning and action, you can navigate this process successfully.

Navigate the Refinancing Application Process Effectively

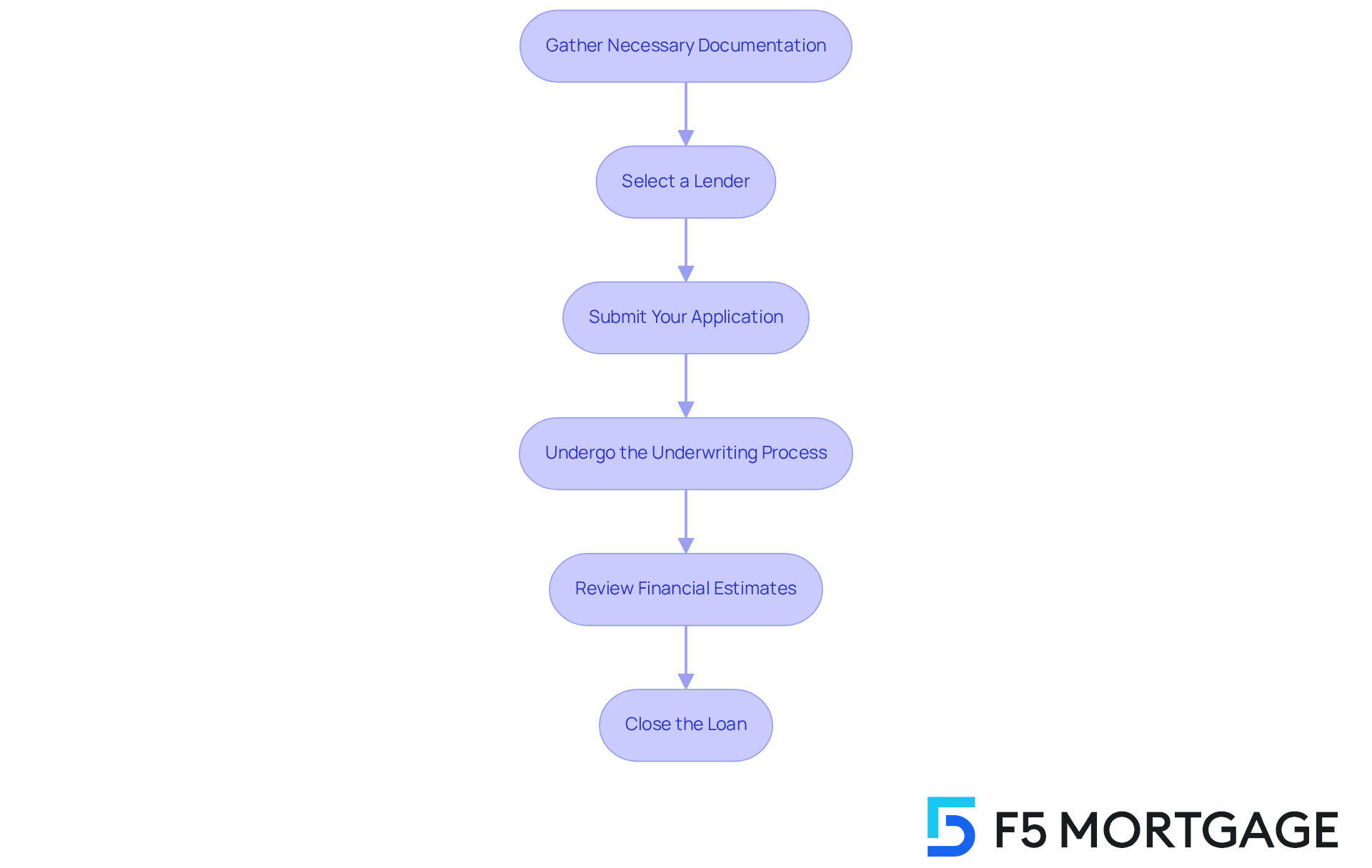

Navigating the refinance mortgage bad credit application process can feel overwhelming, especially for families. We understand how challenging this can be, but by following these key steps, you can significantly improve your chances of success.

-

Gather Necessary Documentation: Start by preparing essential documents such as pay stubs, tax returns, bank statements, and details about your current mortgage. Having these ready can streamline the application process and ease your worries.

-

Select a Lender: Take the time to investigate and assess lenders who offer favorable conditions for individuals with poor financial history. Both traditional banks and online lenders provide different options. Consider their rates, fees, and customer reviews to find the best fit for your needs.

-

Submit Your Application: When you complete your application, ensure that all required information and documentation are included. Incomplete applications can lead to delays or denials, adding to your stress.

-

Undergo the Underwriting Process: Be prepared for the lender to assess your financial situation, which typically includes a credit check and a home appraisal. Understanding this process can help you anticipate what to expect and reduce any anxiety.

-

Review Financial Estimates: Once approved, carefully examine the financial estimate provided by the lender. Pay close attention to interest rates, fees, and terms to ensure they align with your financial goals and needs.

-

Close the Loan: If you’re satisfied with the terms, proceed to close the loan. Make sure you understand all closing costs and obligations before signing, as this is a crucial step in securing your future.

By following these steps, families can effectively navigate the refinance mortgage bad credit process and achieve the best possible outcome for their home upgrade. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the landscape of mortgage refinancing with bad credit can feel overwhelming for families, but understanding the available options and steps can empower them to make informed decisions. We know how challenging this can be, and by recognizing the significance of credit scores, the various refinancing programs, and the necessary financial preparations, families can enhance their chances of securing favorable loan terms that align with their goals.

Key points to consider include:

- Assessing credit scores

- Exploring specialized refinancing options like FHA Streamline and VA IRRRL

- Taking proactive measures to improve financial health

Families are encouraged to review their credit reports, reduce debt, and gather essential documentation to facilitate a smoother application process. Each of these steps contributes to a more favorable refinancing outcome, potentially leading to lower monthly payments and better financial stability.

Ultimately, the journey towards refinancing with bad credit is not insurmountable. By taking strategic actions and leveraging available resources, families can transform their financial situations and achieve their homeownership aspirations. Embracing this opportunity to upgrade homes while actively working to improve credit scores can lead to long-term benefits. It’s essential for families to stay informed and engaged throughout the refinancing process, and we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing involves replacing your current mortgage with a new one, often to secure a lower interest rate or modify the financing terms.

How does bad credit affect mortgage refinancing options?

If your credit score is below 620, it may be classified as ‘bad credit,’ which can limit your refinancing options. Many lenders require a minimum score of 620 for standard mortgages, but FHA options may allow refinancing with scores as low as 500 under certain criteria.

What are the benefits of refinancing a mortgage?

Benefits of refinancing include lower monthly payments, access to cash through home equity, improved loan terms, and the potential to eliminate private mortgage insurance (PMI) once you achieve 20% equity.

What challenges might families face when refinancing with bad credit?

Families may encounter higher interest rates and stricter qualification standards due to their financial situation. It is important to evaluate different lenders, as some may offer more flexible terms for those with bad credit.

What type of lenders might be more accommodating for refinancing with bad credit?

Portfolio lenders often cater to smaller borrowers and may provide more adaptable options for refinancing, making them a potential choice for those with bad credit.

How can I prepare for the mortgage refinancing process?

Carefully evaluate your eligibility and explore different lenders to find the best options that align with your financial goals.