Overview

Navigating the home equity loan process can feel overwhelming, especially for individuals with a credit score of 580. We understand how challenging this can be. This article outlines the requirements and challenges you may face when securing such financing.

While a score of 580 might lead to higher interest rates and limited options, there is hope. By understanding lender requirements and gathering necessary documentation, you can improve your chances of approval. It’s essential to proactively address potential challenges that may arise.

We’re here to support you every step of the way. With the right knowledge and preparation, you can navigate this process with confidence and find the best solutions for your financial needs.

Introduction

Navigating the complexities of home equity loans can feel overwhelming, especially for those with a credit score of 580, often seen as ‘fair.’ We understand how this score can significantly impact your loan options, interest rates, and overall borrowing capacity. By grasping the essential requirements and exploring strategies to strengthen your application, you can find a pathway to secure the funds you need for home improvements or debt consolidation.

But how can you, as a borrower with a lower credit score, effectively maneuver through the application process? What steps can you take to enhance your chances of approval? We’re here to support you every step of the way, providing guidance and insights to help you feel more confident in your journey.

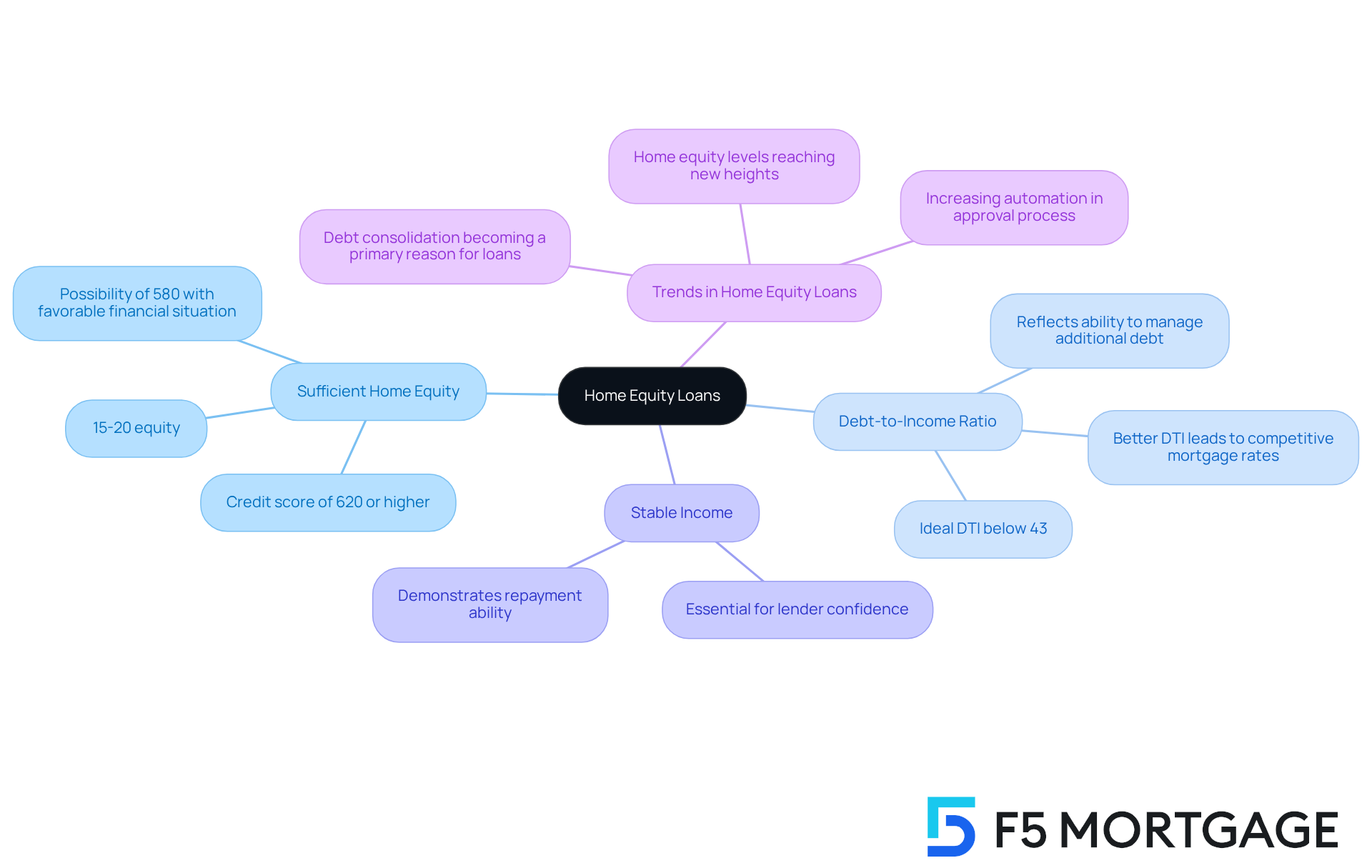

Understand Home Equity Loans and Their Requirements

Equity financing is a valuable tool that enables property owners to tap into the worth of their assets. This value is calculated as the difference between your property’s current market value and the remaining mortgage balance. If you’re considering a home equity loan, it’s important to understand what lenders typically require:

- Sufficient Home Equity: Most lenders look for at least 15-20% equity in your home. This ensures that you have a stake in your property, which is crucial for your financial security. While a of 620 or higher is preferred, some lenders may accept a home equity loan of 580, particularly if your overall financial situation, including income and debt levels, is favorable.

- Debt-to-Income Ratio: A lower debt-to-income (DTI) ratio, usually below 43%, is ideal. This reflects your ability to manage additional debt, and a better DTI can lead to more competitive mortgage rates—something that can really benefit families looking to improve their homes.

- Stable Income: Demonstrating a stable income is essential, as it shows lenders that you can repay the debt responsibly.

Understanding these requirements is key for property owners who want to navigate the equity loan process with confidence. We know how challenging this can be, but recent trends show that lenders are increasingly automating functions to speed up the approval process, which can significantly enhance your experience.

Moreover, with property equity levels reaching new heights, many homeowners are exploring these options to secure funds for various needs, such as debt consolidation or home improvements. We’re here to support you every step of the way as you consider your options.

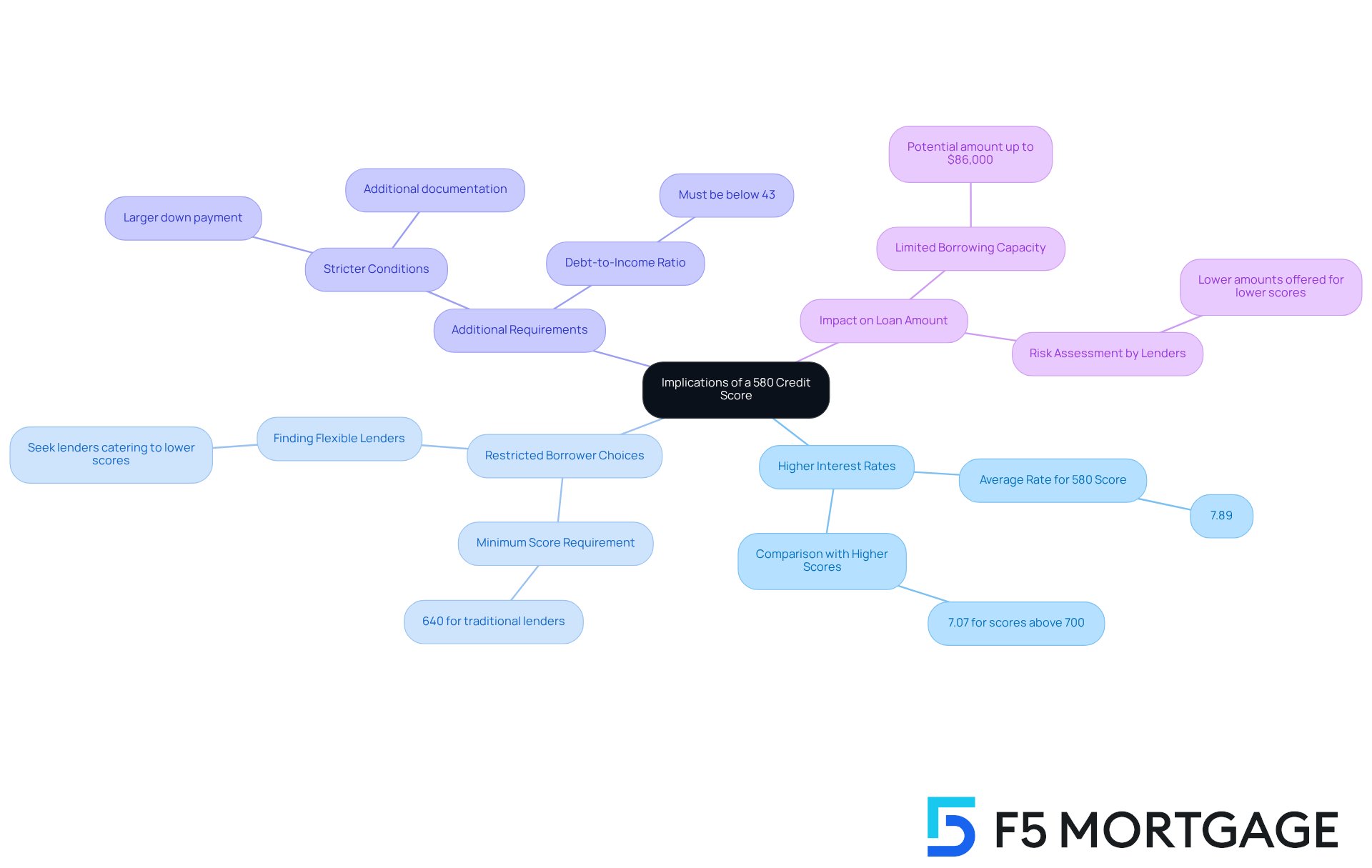

Recognize the Implications of a 580 Credit Score

A home equity loan credit score of 580 is categorized as ‘fair’ and can significantly impact your ability to secure a home equity line of credit. Understanding the implications of this rating is essential, especially when navigating your options. Here are some key points to consider:

- Higher Interest Rates: We know how challenging it can be to face higher interest rates. Borrowers with lower credit scores often encounter rates that can increase the overall cost of the loan. For instance, the average mortgage rate for someone with a home equity loan credit score 580 is approximately 7.89%, compared to 7.07% for those with scores above 700. This difference can lead to higher monthly payments and more interest paid over time.

- Restricted Borrower Choices: Many traditional lenders set a minimum credit score of 640 for home equity financing, which can limit your access to funding. It’s crucial to seek financial institutions that cater to individuals with lower credit ratings, as they may offer more flexible options. At F5 Mortgage, we pride ourselves on being a client-centric lender, ready to help you navigate these choices with understanding and care.

- Potential for Additional Requirements: Lenders might require stricter conditions, such as a larger down payment or additional documentation, to manage their risk. This could mean demonstrating a stable income or keeping a debt-to-income (DTI) ratio below 43% to qualify. However, we’re here to support you every step of the way, and with our knowledge of various down payment assistance programs, we can help you explore options that may ease these requirements.

Impact on Loan Amount: If your home equity loan credit score is 580, your borrowing capacity may be limited compared to those with higher ratings. Lenders often assess risk based on creditworthiness, which could result in lower amounts being offered. Depending on the equity in your property, possible sums could reach up to $86,000. F5 Mortgage is dedicated to helping you maximize your borrowing potential through tailored solutions and unwavering support.

Understanding these implications is crucial as you navigate the equity financing process with a home equity loan credit score 580. With F5 Mortgage by your side, you can prepare effectively and explore , ensuring a smoother path to homeownership.

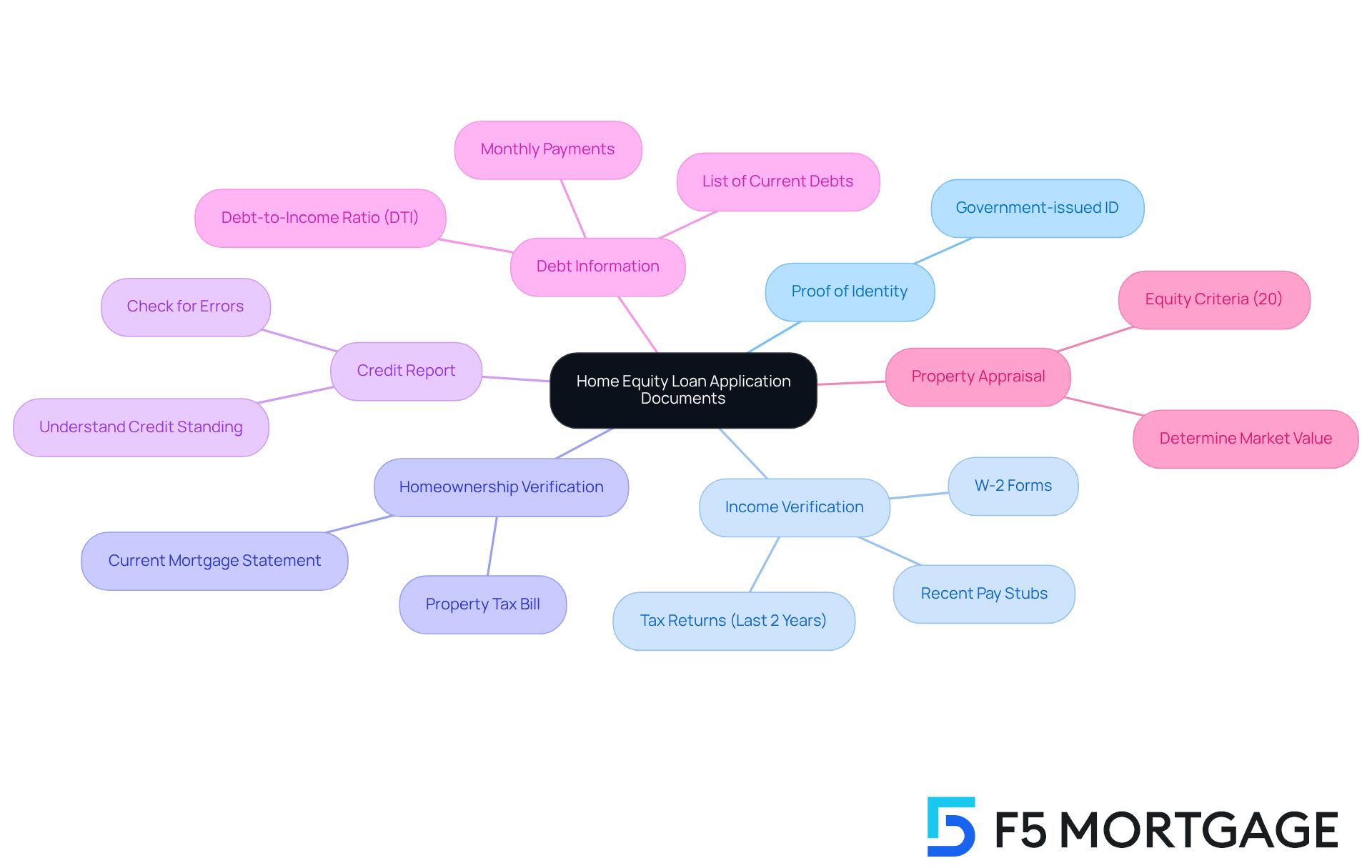

Prepare Your Application: Gather Necessary Documentation

To enhance your chances of approval for a home equity loan, we understand that gathering the right documentation can feel overwhelming. Here are some key documents you’ll want to prepare:

- Proof of Identity: A government-issued ID, such as a driver’s license or passport, helps verify who you are.

- Income Verification: Recent pay stubs, W-2 forms, or tax returns from the last two years will show your financial stability.

- Homeownership Verification: Your current mortgage statement and property tax bill confirm your ownership status.

- Credit Report: Obtaining a copy of your credit report allows you to check for errors and understand your credit standing.

- Debt Information: A list of your current debts and monthly payments is essential to calculate your debt-to-income (DTI) ratio. Ideally, this should be below 43% to qualify for competitive mortgage rates.

- Property Appraisal: Some lenders may require a recent appraisal to determine the current market value of your property. This ensures you meet the essential equity criteria, usually at least 20% equity in your residence.

Having these documents ready can significantly accelerate the application process. It not only demonstrates your preparedness but also reassures financial institutions of your commitment. We’re here to support you every step of the way, ultimately enhancing your chances of obtaining a .

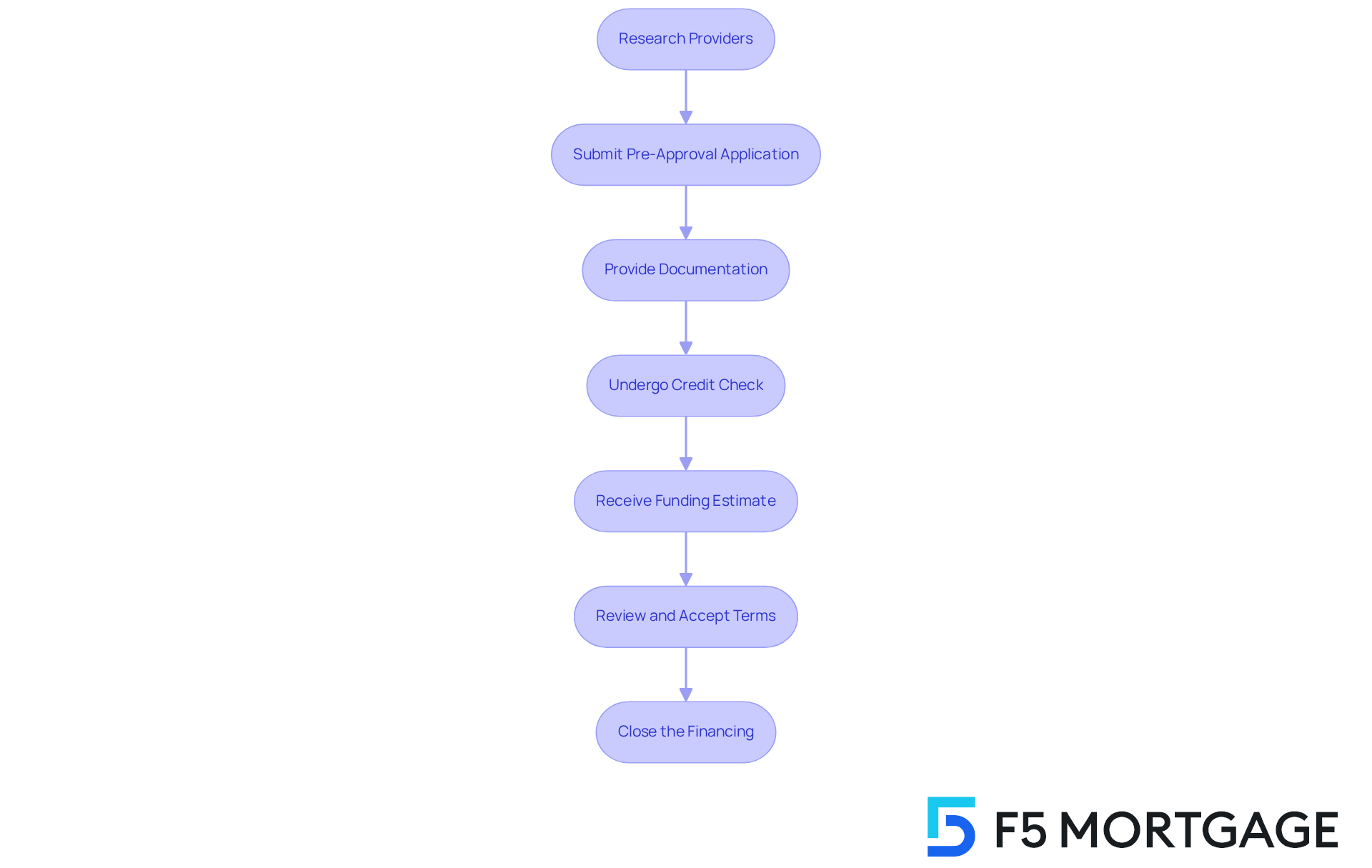

Navigate the Application Process: Step-by-Step Instructions

Navigating the home equity loan application process with a home equity loan credit score of 580 can feel daunting, but we’re here to support you every step of the way. By following these essential steps, you can simplify your application procedure and increase your chances of obtaining an equity line, even with a reduced credit rating.

- Research providers that specifically accept applications for home equity loans from borrowers with a credit score of 580. Remember, not all financial institutions have the same criteria, so it’s important to find those that are open to collaborating with you.

- Submit Pre-Approval Application: Next, complete a pre-approval application with your chosen financial institution. This step is crucial, as it will give you an estimate of how much you may be eligible to borrow, helping you plan your financial needs effectively.

- Provide Documentation: Gather and submit the necessary documentation, including proof of income, homeowners insurance declaration, property tax statements, and any other required financial documents. This information is vital for the financial institution to evaluate your application accurately.

- Undergo Credit Check: Be prepared for the that the financial institution will conduct to assess your creditworthiness. This phase is important, as it will influence the conditions of your financing.

- Receive Funding Estimate: After reviewing your application, the lender will provide a funding estimate. This document will detail the suggested terms, interest rate, and related fees, allowing you to understand the financial implications of your borrowing.

- Review and Accept Terms: Take the time to carefully examine the financing estimate. If you have any questions or need clarification, don’t hesitate to reach out to the lender. Once you feel confident and satisfied with the terms, you can proceed to accept the offer.

- Close the Financing: Finally, attend the closing meeting to sign the necessary documents and complete the financing. This step marks the official conclusion of the financing process.

By following these steps, you can approach the home equity loan application process with confidence, knowing that support is available to help you through it.

Troubleshoot Common Challenges in the Application Process

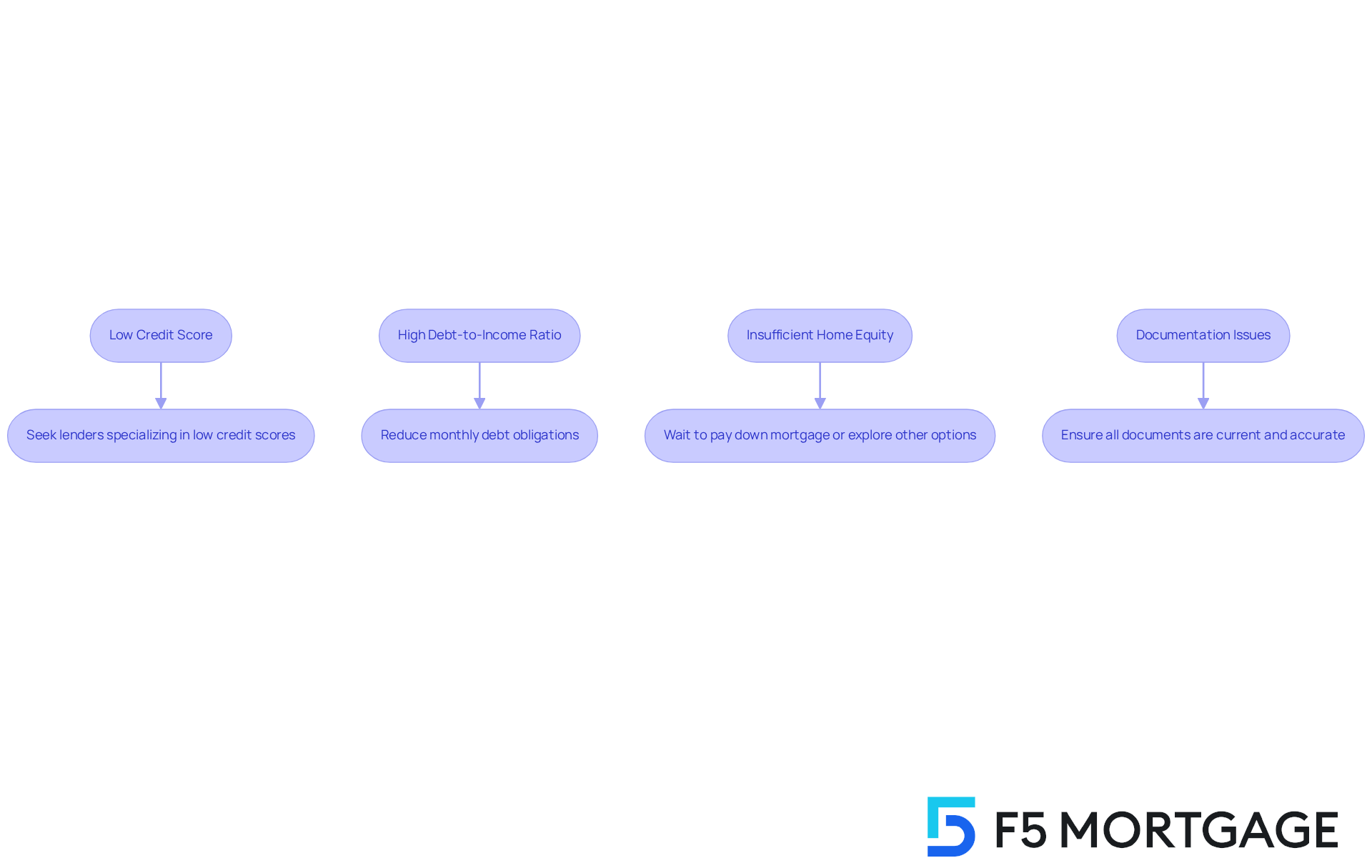

Navigating the home equity loan credit score 580 financing application process can be challenging, especially for those facing lower credit ratings. We understand how daunting this can feel, but there are effective strategies to help you overcome these obstacles:

- Challenge: Low Credit Score

Solution: Seek out lenders who specialize in providing loans to borrowers with lower credit scores. These lenders often have tailored programs that can accommodate your financial situation, increasing your chances of approval. - Challenge: High Debt-to-Income Ratio

Solution: Before applying, consider working on reducing your monthly debt obligations. This might involve paying down existing debts or considering a smaller loan amount that better aligns with your income. - Challenge: Insufficient Home Equity

Solution: If your home equity is below the required threshold, it may be wise to wait until you have paid down more of your mortgage. Alternatively, explore other financing options that may be available to you. - Challenge: Documentation Issues

Solution: Ensure that all your documents are current and accurate. Fill out a refinancing application with your chosen lender, such as F5 Mortgage, and be prepared to provide details like Social Security numbers, bank statements, tax returns, and pay stubs. Take the time to double-check for any missing information before submission, as incomplete applications can lead to delays or denials.

By anticipating these challenges and preparing solutions, you can navigate the application process more effectively. Remember, we’re here to support you every step of the way, increasing your chances of securing a home equity loan credit score 580.

Conclusion

Navigating the home equity loan process with a credit score of 580 can be daunting, but understanding the requirements and implications empowers you to make informed decisions. This guide highlights essential steps to help you recognize the importance of sufficient home equity and a manageable debt-to-income ratio. We’ll walk you through preparing necessary documentation and addressing common obstacles.

Key insights reveal the significance of seeking lenders who accommodate lower credit scores, along with the potential for higher interest rates. By gathering the right documentation and understanding the application process, you can enhance your chances of approval and secure the funds needed for home improvements or debt consolidation.

Ultimately, approaching the home equity loan process with a proactive mindset and the right support can lead to successful outcomes. Embracing these strategies aids in overcoming immediate challenges and fosters long-term financial stability. As you explore your options, remember that seeking tailored solutions that cater to your unique circumstances will ensure a smoother path toward achieving your financial goals. We’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows property owners to borrow against the value of their home, calculated as the difference between the property’s current market value and the remaining mortgage balance.

What are the typical requirements for obtaining a home equity loan?

Most lenders require at least 15-20% equity in the home, a credit score of 620 or higher (though some may accept 580), a debt-to-income ratio below 43%, and proof of stable income.

How does a credit score of 580 affect home equity loan options?

A credit score of 580 is considered ‘fair’ and can lead to higher interest rates, restricted borrower choices, and potentially additional requirements from lenders.

What are the implications of having a lower credit score for a home equity loan?

Borrowers with a credit score of 580 may face higher interest rates (approximately 7.89%), limited access to traditional lenders, stricter conditions, and a potentially lower borrowing capacity.

What is the average mortgage rate for borrowers with a credit score above 700?

The average mortgage rate for those with scores above 700 is approximately 7.07%.

Can borrowers with a credit score of 580 still secure a home equity loan?

Yes, borrowers can still secure a loan, but they may need to seek lenders that cater to individuals with lower credit ratings and may face stricter lending conditions.

How much can someone with a credit score of 580 potentially borrow?

Depending on the equity in their property, borrowers with a credit score of 580 could potentially secure sums up to $86,000.

What support can F5 Mortgage provide for individuals with lower credit scores?

F5 Mortgage offers tailored solutions and support for navigating the equity financing process, including assistance with down payment programs and understanding lending options.