Overview

Navigating home loan approval can feel overwhelming, but we’re here to guide you through it with five essential steps.

- Obtaining pre-qualification sets a solid foundation, allowing you to understand your budget and options.

- Securing mortgage pre-approval gives you a clearer picture of what you can afford, boosting your confidence as you move forward.

- Completing the full application is the next step, and it’s crucial to be thorough. We know how challenging this can be, but timely communication with your lender can make a significant difference.

- As you navigate the underwriting process, remember that this is where your application is carefully reviewed. Understanding the requirements during this phase enhances your chances of success.

- Finalizing approval for closing is the culmination of your efforts.

Each step we’ve outlined is supported by practical advice and insights, emphasizing the importance of preparation and communication. By following these steps, you’ll not only increase your chances of a successful loan approval but also feel more empowered throughout the process. We’re here to support you every step of the way.

Introduction

Navigating the home loan approval process can often feel like traversing a complex maze, filled with intricate steps and potential pitfalls. We know how challenging this can be. Understanding the nuances of pre-qualification, pre-approval, and the finalization stages can significantly streamline your journey to homeownership. This guide offers a clear roadmap, empowering you with essential strategies to enhance your chances of securing a favorable loan.

However, with so many variables at play, what are the critical steps that can make or break a successful home loan application? We’re here to support you every step of the way.

Obtain Pre-Qualification for Your Home Loan

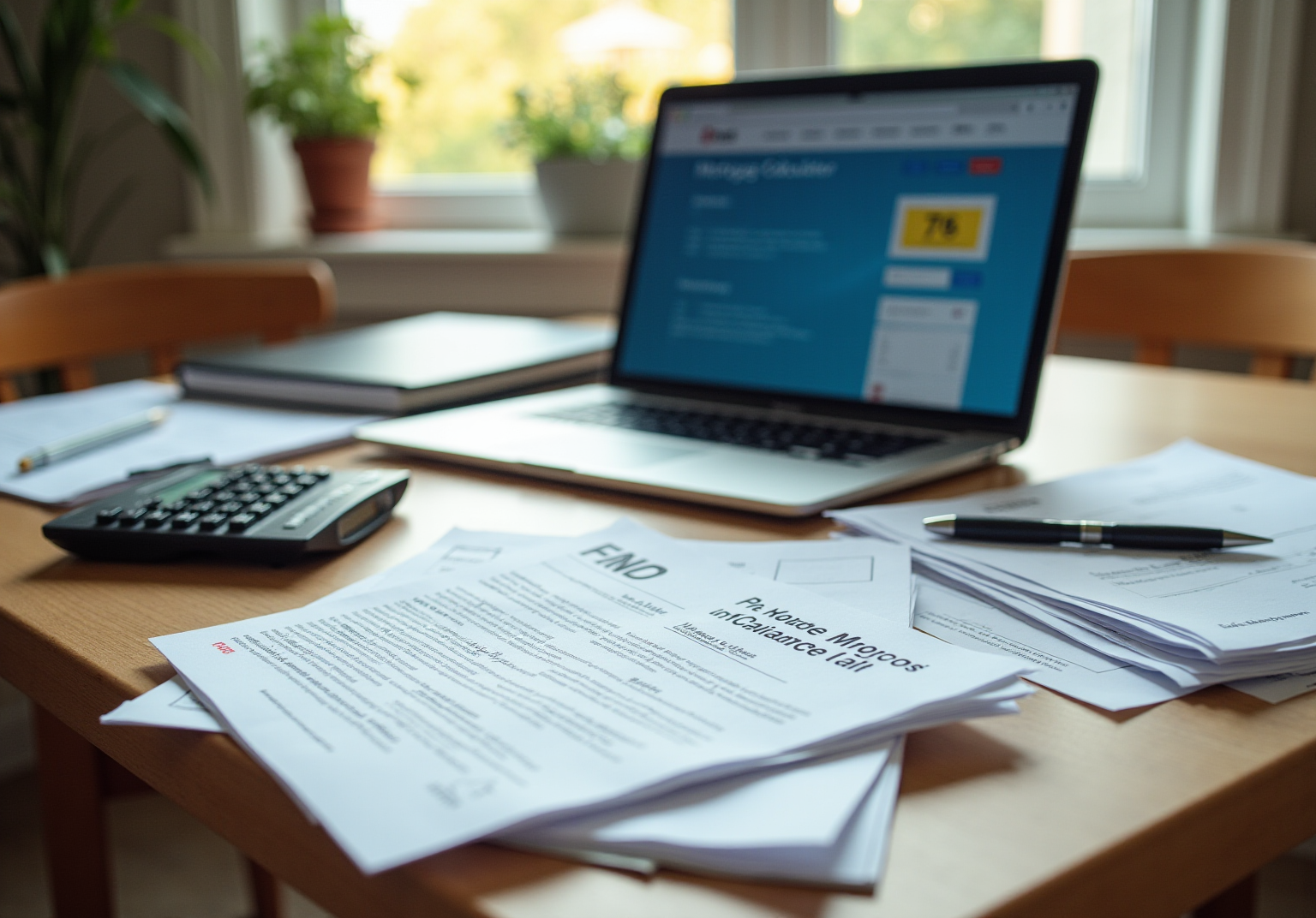

To obtain pre-qualification for your home loan, follow these essential steps:

- Gather Financial Information: We know how challenging this can be, so start by collecting your income details, monthly debts, and assets. This includes recent pay stubs, bank statements, and any other relevant financial documents. Having this information prepared can significantly accelerate the procedure and ease your worries.

- Contact a Loan Advisor: Reach out to a loan advisor, such as F5 Mortgage, who can provide expert guidance throughout the pre-qualification phase. At F5 Mortgage, we’re here to support you every step of the way. We leverage user-friendly technology to simplify the process, ensuring a stress-free experience. Our brokers play a vital role in assisting clients navigate the intricacies of financing and understanding the significance of having a local specialist. Additionally, we can connect you with top realtors in your area to further support your homebuying journey.

- Submit Your Information: Once you’ve gathered your financial details, provide them to the broker. They will analyze this information to estimate how much you can borrow, which is a vital step in establishing your homebuying budget. Remember, home loan approval typically involves a soft credit check that does not impact your credit score, allowing you to proceed with confidence.

- Receive a Pre-Qualification Letter: After reviewing your information, you will receive a pre-qualification letter indicating the estimated loan amount you may qualify for. This letter not only reflects your borrowing capacity but also serves as a when making offers on homes, showing sellers that you are a serious buyer. It’s important to remember that prequalification is not a substitute for preapproval, which may be required in competitive markets.

In 2025, the loan pre-qualification procedure has become progressively efficient, with numerous brokers capable of issuing pre-qualification letters within an hour. This efficiency is crucial in a competitive housing market, where being prepared can make a significant difference. Additionally, the trend shows that 41% of recent buyers began their home search online, highlighting the importance of digital tools in the homebuying journey. By utilizing the knowledge of a loan broker at F5 Finance and comprehending the pre-qualification procedure, you can place yourself advantageously in the market.

Secure Mortgage Pre-Approval

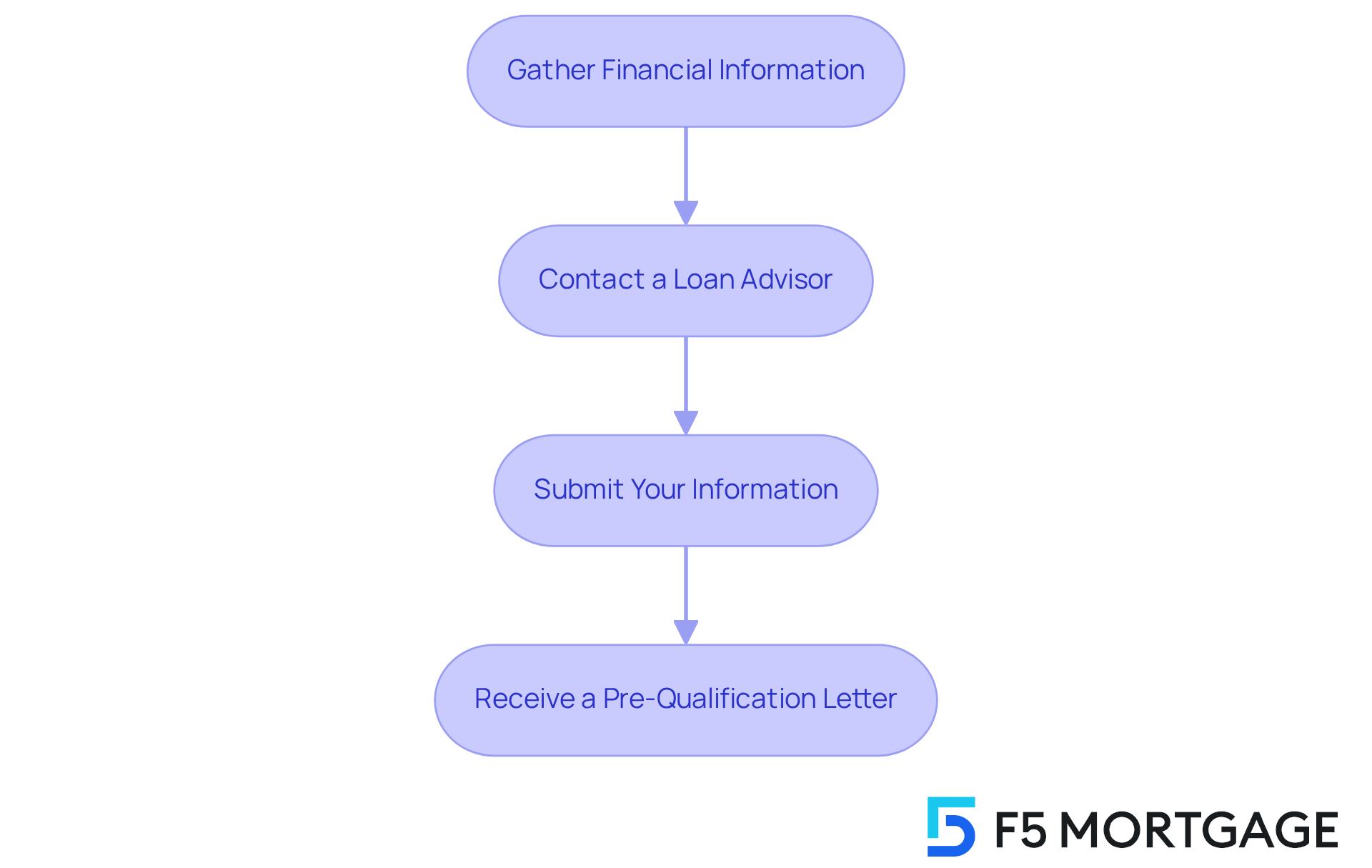

Securing mortgage pre-approval can feel overwhelming, but we’re here to guide you through the essential steps with care and understanding:

- Choose a Lender: Begin by selecting a lender or loan broker. F5 Mortgage offers a diverse range of loan options tailored to meet your specific needs, ensuring you find the right fit for your situation.

- Complete the Application: Fill out the pre-approval application, providing comprehensive details about your financial situation, including income, debts, and assets. We know how challenging this can be, but providing accurate information is crucial.

- Submit Required Documents: Gather necessary documentation such as W-2 forms, recent pay stubs, and bank statements to verify your financial status. This step is vital in helping the lender understand your unique circumstances.

- Financial Assessment: The lender will perform a financial assessment to evaluate your creditworthiness. It’s essential to ensure your financial report is precise and current, as preserving a high score greatly influences your home loan approval and its conditions.

- Receive Pre-Approval Letter: If approved, you will receive a pre-approval letter indicating the loan amount you are eligible for, typically valid for 60 to 90 days. This letter is vital in a competitive market, as it demonstrates to sellers that you are a serious buyer with financing lined up.

Understanding the is also important. Pre-qualification provides a general estimate of what you might be able to borrow based on self-reported information, while pre-approval involves a thorough review of your financial documents and credit history, resulting in a more accurate assessment.

The advantages of securing home loan approval are substantial. It not only enhances your homebuyer profile but also allows you to narrow down your house-hunting list to a specific price range, helping you avoid disappointment. In competitive markets, having a pre-approval letter can give you a significant edge, signaling to sellers that you are financially prepared and serious about purchasing a home. For families looking to upgrade their homes, securing pre-approval can streamline the buying process and increase the likelihood of a successful purchase.

Complete Your Full Mortgage Application

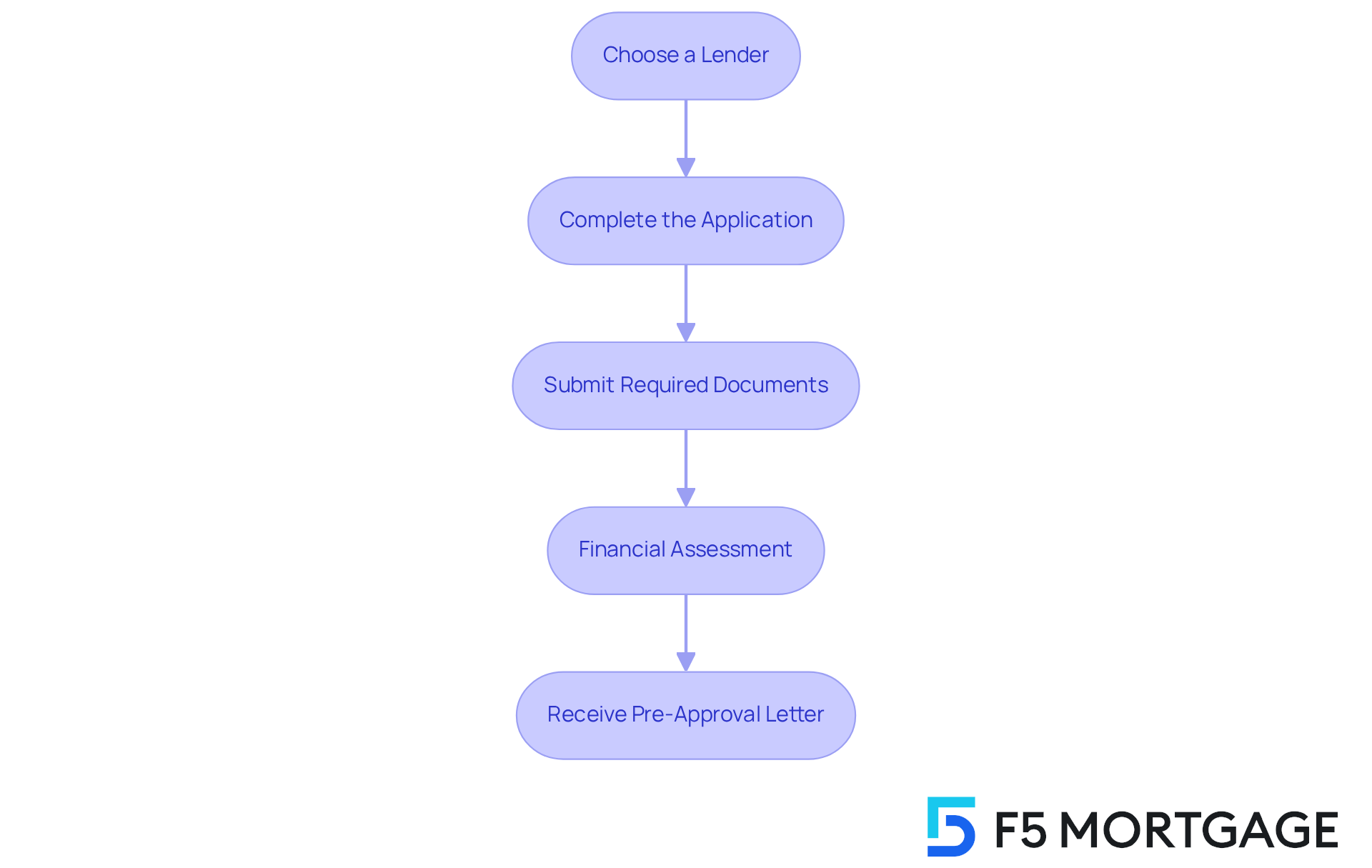

Completing your full mortgage application for home loan approval can feel overwhelming, but we’re here to support you every step of the way. By following these essential steps, you can navigate the process with confidence and ease.

- Gather Additional Documentation: Beyond the initial pre-approval documents, you may need to provide tax returns, proof of additional income, and comprehensive details about your debts. This additional information is crucial for a complete assessment of your financial situation. We know how challenging this can be, so remember that a maximum of 43% is typically required for home financing. Understanding the specific DTI requirements for various types of financing—like conventional options, which often require a lower DTI, and FHA options, which may have more lenient DTI criteria—is essential.

- Fill Out the Application Form: Carefully complete the loan application form provided by your lender. Accuracy is paramount; any discrepancies can lead to processing delays or complications in your approval. Ensure that all information is complete to avoid common mistakes.

- Review Financing Options: Collaborate with your broker to examine various financing alternatives customized to your requirements. Discuss interest rates, terms, and any government-backed mortgage requirements that may apply, such as home inspections. F5 Mortgage offers various refinancing options, including conventional loans and FHA loans, each with different DTI requirements and benefits.

- Submit the Application: After ensuring all information is accurate and complete, submit your application along with the required documentation to your lender. This submission is a crucial step in the approval procedure.

- Follow Up: Maintain regular communication with your lender to monitor the status of your application. A Customer Advocate may assist you during the underwriting process, providing guidance and answering questions about your application and the next steps.

By following these steps, you can avoid common errors that often obstruct loan applications, such as incomplete documentation or inaccuracies in your application form. On average, a complete loan application may require around 10 to 15 documents, including proof of income, credit history, and property details. Being proactive and organized will significantly improve your chances of a successful loan approval.

Navigate the Underwriting Process

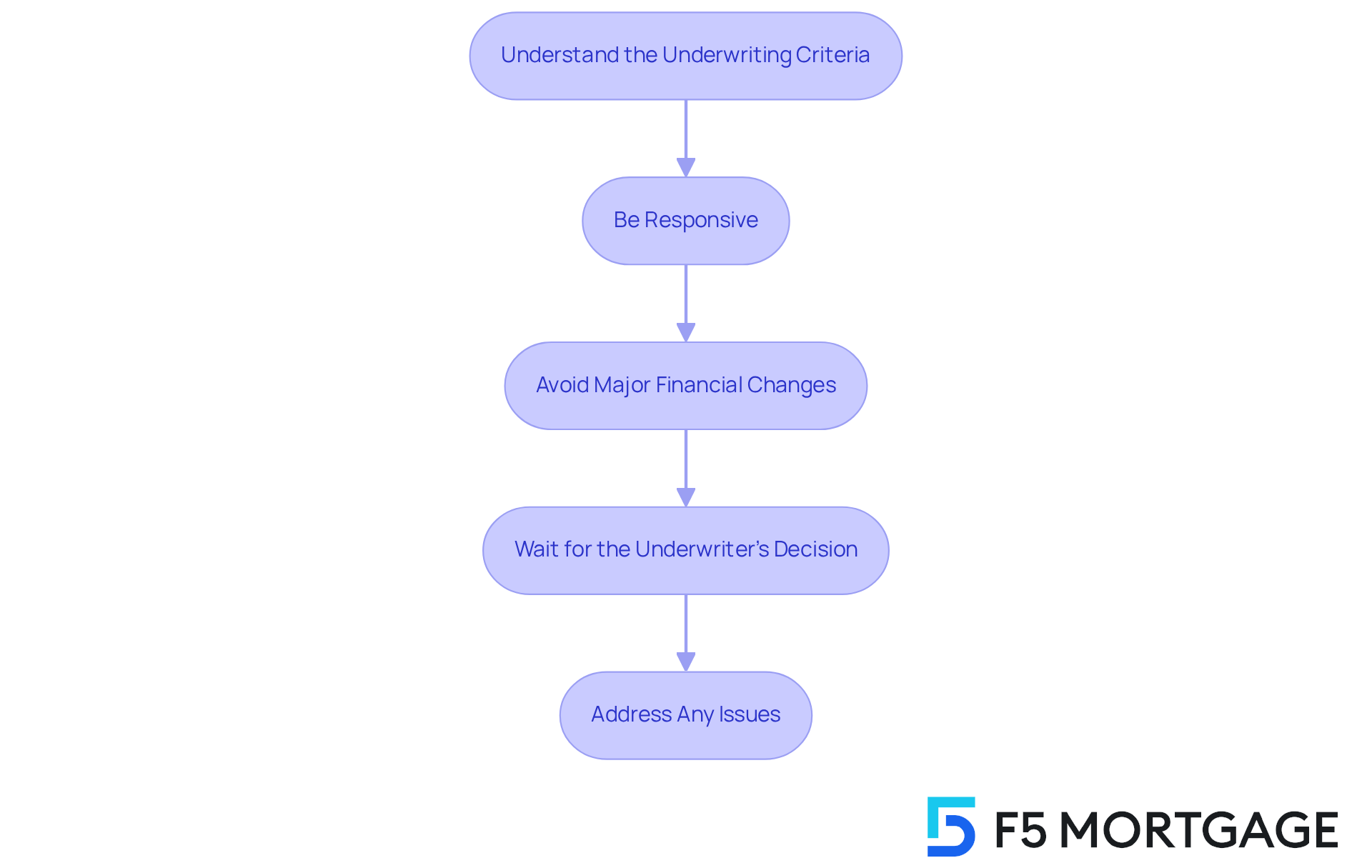

Navigating the underwriting process is essential for securing home loan approval, especially with F5 Mortgage‘s commitment to a technology-driven, consumer-centric approach. We know how challenging this can be, so here are five key steps to help you through this critical phase:

- Understand the : Familiarize yourself with the key factors assessed by underwriters, such as your credit score, income stability, and debt-to-income ratio. As of 2024, nearly 38 percent of prospective homeowners mistakenly think that only individuals with outstanding financial histories can obtain a mortgage. This statistic underscores the importance of understanding diverse credit profiles. Many borrowers with varying credit histories can still qualify for loans, especially with F5 Mortgage’s focus on providing tailored solutions and competitive rates.

- Be Responsive: Timely communication is crucial. Respond promptly to any requests from your lender for additional documentation or clarification. A proactive approach can significantly simplify the procedure, as underwriting can take anywhere from 7 to 14 days, depending on the complexity of your application. F5 Mortgage emphasizes a no-pressure service, ensuring you feel supported throughout this phase.

- Avoid Major Financial Changes: During the underwriting phase, refrain from making significant purchases or changing jobs. Such actions can disrupt your financial stability and potentially jeopardize your approval. Maintaining a consistent financial profile is vital, especially since lenders assess risk based on your credit history and debt levels when considering home loan approval.

- Wait for the Underwriter’s Decision: The underwriting procedure can extend over several days to weeks. Patience is key; stay in touch with your lender for updates. Understanding that lenders typically advertise a 30 to 45-day turn time for loan processing can help set realistic expectations. F5 Mortgage aims to revitalize the loan process, making it as efficient as possible for you through innovative technology that enhances the underwriting experience.

- Address Any Issues: If the underwriter identifies concerns, collaborate with your loan broker to resolve them swiftly. Many clients face challenges during underwriting, and addressing these issues promptly can help maintain the momentum of your loan application. It’s important to note that the average rejection rate for home loan applications grew to almost 21 percent in 2024, highlighting the need for diligence in this undertaking. With F5 Mortgage’s innovative approach and technology-driven solutions, you can navigate these challenges with confidence.

By following these steps, you can navigate the underwriting procedure more effectively, increasing your chances of obtaining home loan approval. We’re here to support you every step of the way.

Finalize Approval and Prepare for Closing

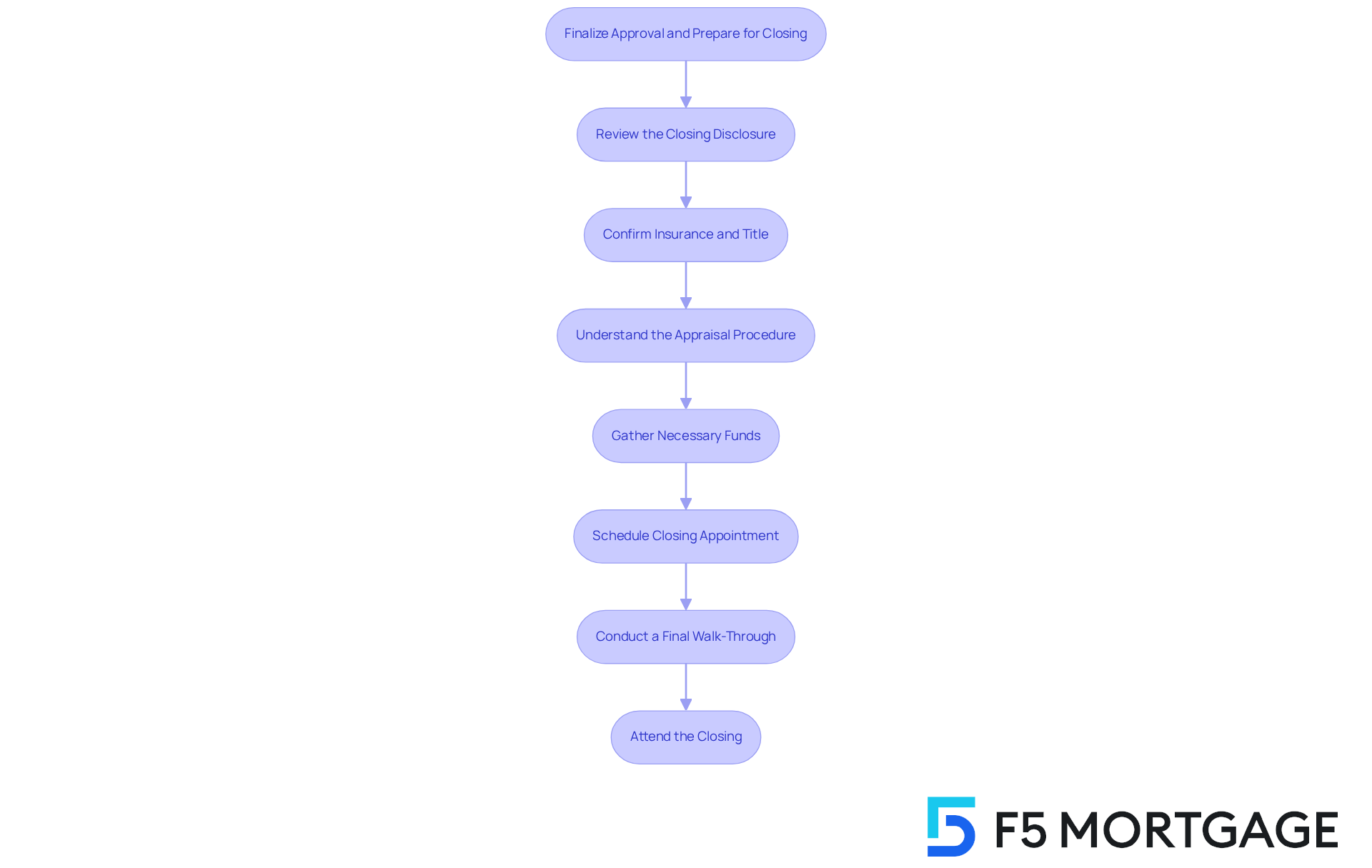

To finalize approval and prepare for closing, let’s walk through these essential steps together:

- Review the Closing Disclosure: This document is crucial as it outlines the final terms of your home loan approval, including the interest rate, monthly payments, and closing costs. We know how overwhelming this can feel, so it’s important to allocate time to review this document thoroughly. Typically, buyers receive it at least three business days before closing, giving you a chance to understand every detail.

- Confirm Insurance and Title: Ensure that you have homeowners insurance in place, which is often a requirement from lenders. Additionally, verify that a title search has been completed to confirm the property’s legal status, which is necessary for home loan approval. This step protects you from potential legal issues regarding ownership related to home loan approval. Consider scheduling a home inspection to identify any hidden issues with the property before finalizing the purchase. A typical home inspection will cover essential elements such as structural components, heating and cooling systems, and appliances, helping you avoid costly surprises later. Remember, attending the inspection allows you to ask questions and gain insights from the inspector about any red flags.

- Understand the Appraisal Procedure: An is a necessary component of purchasing a home that safeguards both you and your lender from overexpending on a property. As part of the home loan approval process, your mortgage company will order the appraisal, which is conducted by an independent third party. The appraisal typically costs between $250 and $600, depending on the property type and location. If the appraised value is lower than your purchase price, you may need to negotiate with the seller or bring additional funds for your home loan approval.

- Gather the necessary funds required for home loan approval, which may include your down payment and various closing costs. Buyers should expect to pay between 2% to 6% of the purchase price in closing costs, which are typically covered by both buyers and sellers, with sellers usually having their costs deducted from the sale proceeds. Having these funds readily available is essential for ensuring a smooth home loan approval process.

- Schedule the closing appointment for your home loan approval: Coordinate with your lender and real estate agent to set a closing date and time. The closing process usually takes 30 to 60 days from the acceptance of your offer, so early scheduling can help avoid last-minute complications related to home loan approval.

- Conduct a Final Walk-Through: Before closing, it’s advisable to conduct a final walk-through of the property to ensure it is in the agreed-upon condition and that any repairs have been completed.

- Attend the Closing: On closing day, review all documents carefully, sign where required, and ensure you receive copies of everything for your home loan approval. Expect to spend at least two hours at the closing meeting, where you will finalize the transaction and receive the keys to your new home. This is a significant milestone, marking the transition from prospective buyer to homeowner. Remember, we’re here to support you every step of the way.

Conclusion

Successfully navigating the home loan approval process is essential for those dreaming of homeownership. We understand how challenging this can be, and by following the outlined steps—from obtaining pre-qualification and securing mortgage pre-approval to completing the full application and finalizing approval—you can significantly enhance your chances of a smooth and successful transaction.

- Gathering accurate financial information

- Choosing the right lender

- Maintaining clear communication throughout the underwriting process

Each step, including completing necessary documentation and understanding the appraisal and closing procedures, plays a vital role in ensuring that the home loan approval process is efficient and effective. We’re here to support you every step of the way, and utilizing the expertise of loan advisors, like those at F5 Mortgage, can further streamline your journey.

Being well-prepared cannot be overstated. By actively engaging in the home loan approval process and adhering to best practices, you can position yourself favorably in a competitive market. This proactive approach not only facilitates a smoother transaction but also empowers you to make informed decisions, ultimately leading to a successful home purchase. Embrace this journey with confidence, and take the necessary steps to turn your homeownership dreams into reality.

Frequently Asked Questions

What is the first step to obtain pre-qualification for a home loan?

The first step is to gather your financial information, including income details, monthly debts, and assets, along with relevant financial documents like pay stubs and bank statements.

How can a loan advisor assist in the pre-qualification process?

A loan advisor, such as those at F5 Mortgage, can provide expert guidance, simplify the pre-qualification process using user-friendly technology, and help navigate the complexities of financing.

What should I do after gathering my financial details for pre-qualification?

After gathering your financial details, you should submit this information to your broker, who will analyze it to estimate how much you can borrow.

What is a pre-qualification letter, and why is it important?

A pre-qualification letter indicates the estimated loan amount you may qualify for and serves as a persuasive tool when making offers on homes, showing sellers that you are a serious buyer.

How has the pre-qualification process changed in 2025?

The pre-qualification process has become more efficient, with many brokers able to issue pre-qualification letters within an hour, which is crucial in a competitive housing market.

What is the difference between pre-qualification and pre-approval?

Pre-qualification provides a general estimate of what you might be able to borrow based on self-reported information, while pre-approval involves a thorough review of your financial documents and credit history for a more accurate assessment.

What steps are involved in securing mortgage pre-approval?

The steps include choosing a lender, completing the pre-approval application, submitting required documents, undergoing a financial assessment, and receiving a pre-approval letter.

What documents are typically required for mortgage pre-approval?

Required documents usually include W-2 forms, recent pay stubs, and bank statements to verify your financial status.

How long is a pre-approval letter typically valid?

A pre-approval letter is typically valid for 60 to 90 days.

Why is having a pre-approval letter beneficial in a competitive market?

A pre-approval letter demonstrates to sellers that you are a serious buyer with financing lined up, which can give you a significant edge in negotiations.