Overview

If you’re looking to secure a mortgage with bad credit, we understand how challenging this can be. It’s important to focus on improving your credit score, and there are specialized loan options available, like FHA, VA, and USDA financing, that can help.

Start by taking practical steps to enhance your credit rating. This includes:

- Correcting any inaccuracies in your credit reports

- Managing your debts effectively

These actions can make a significant difference.

Additionally, there are accessible mortgage programs tailored for those with lower credit scores. By exploring these options, you can increase your chances of approval and move closer to your dream of homeownership. Remember, we’re here to support you every step of the way.

Introduction

Navigating the mortgage landscape can feel daunting, especially for those with a credit score below 580. Lenders often impose higher interest rates or even outright rejections, leaving many feeling discouraged. However, we know how challenging this can be, and understanding the nuances of bad credit can truly open doors to homeownership that once seemed closed.

What strategies can individuals employ to improve their creditworthiness and secure a mortgage despite their financial history? This guide delves into actionable steps and resources designed to empower you. We’re here to support you every step of the way as you overcome the challenges of bad credit and work toward achieving your dream of owning a home.

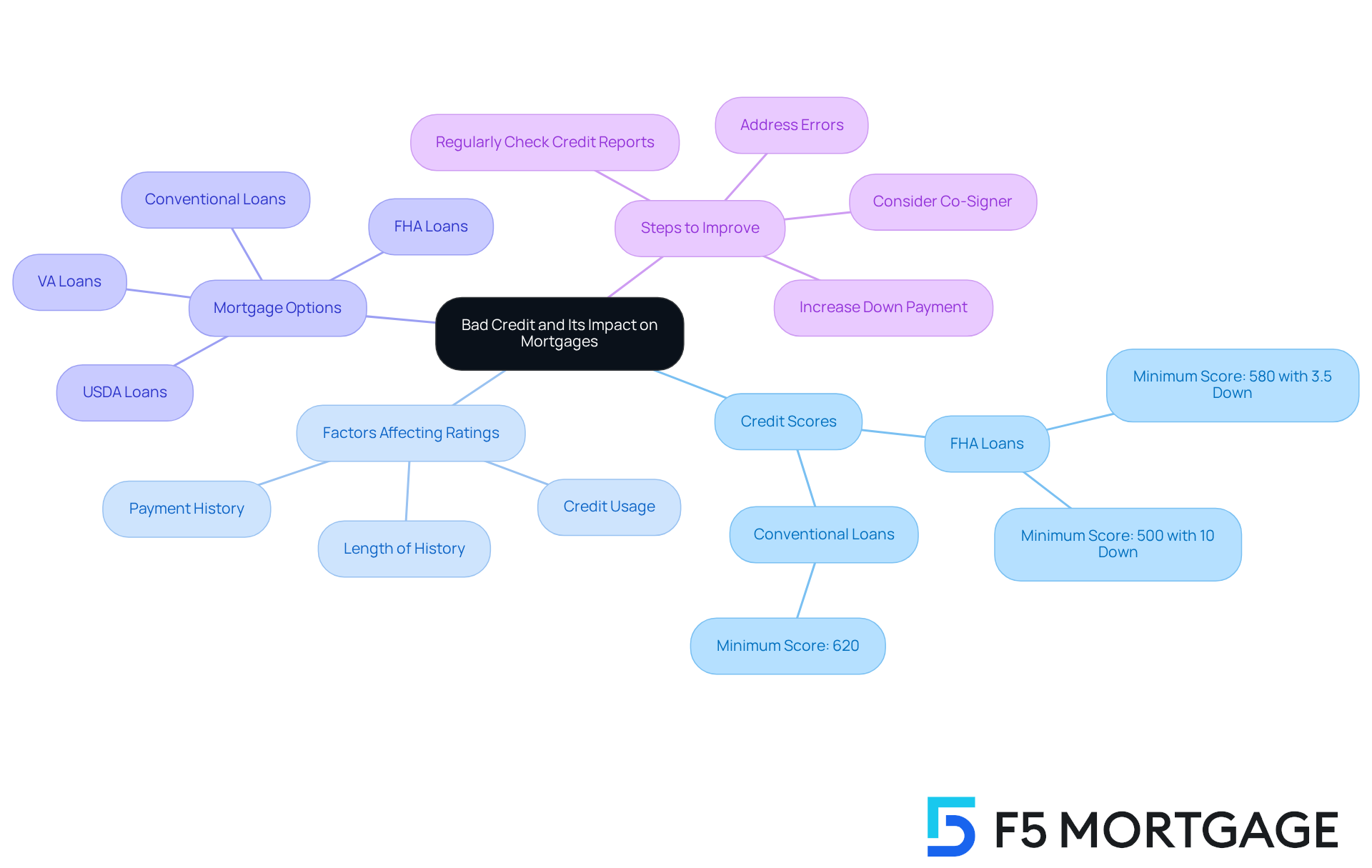

Understand Bad Credit and Its Impact on Mortgages

A rating under 580 is often seen as a sign of poor financial standing, which can significantly limit your options for a mortgage for bad credit. We understand how concerning this can be, as lenders typically view low ratings as indicators of greater risk. This often leads to higher interest rates or even rejection of loan applications. In 2025, the minimum rating for FHA loans is set at 580 with a 3.5% down payment, while conventional loans generally require a minimum rating of 620.

Understanding your financial rating and its impact on loan eligibility is crucial in your home purchasing journey. Regularly reviewing your financial report for errors is essential, as approximately 34% of Americans have outdated or incorrect information that could hinder their loan opportunities. Key factors that affect your rating include:

- Your payment history

- How you use available credit

- The length of your financial history

By familiarizing yourself with these components, you can take proactive steps to improve your financial standing before applying for a home loan. This can ultimately enhance your chances of securing favorable financing terms. Additionally, exploring unique loan programs, such as FHA, VA, and USDA offerings through F5 Mortgage, can provide more accessible options for individuals looking for a mortgage for bad credit. We’re here to support you every step of the way in achieving homeownership with tailored solutions that meet your needs.

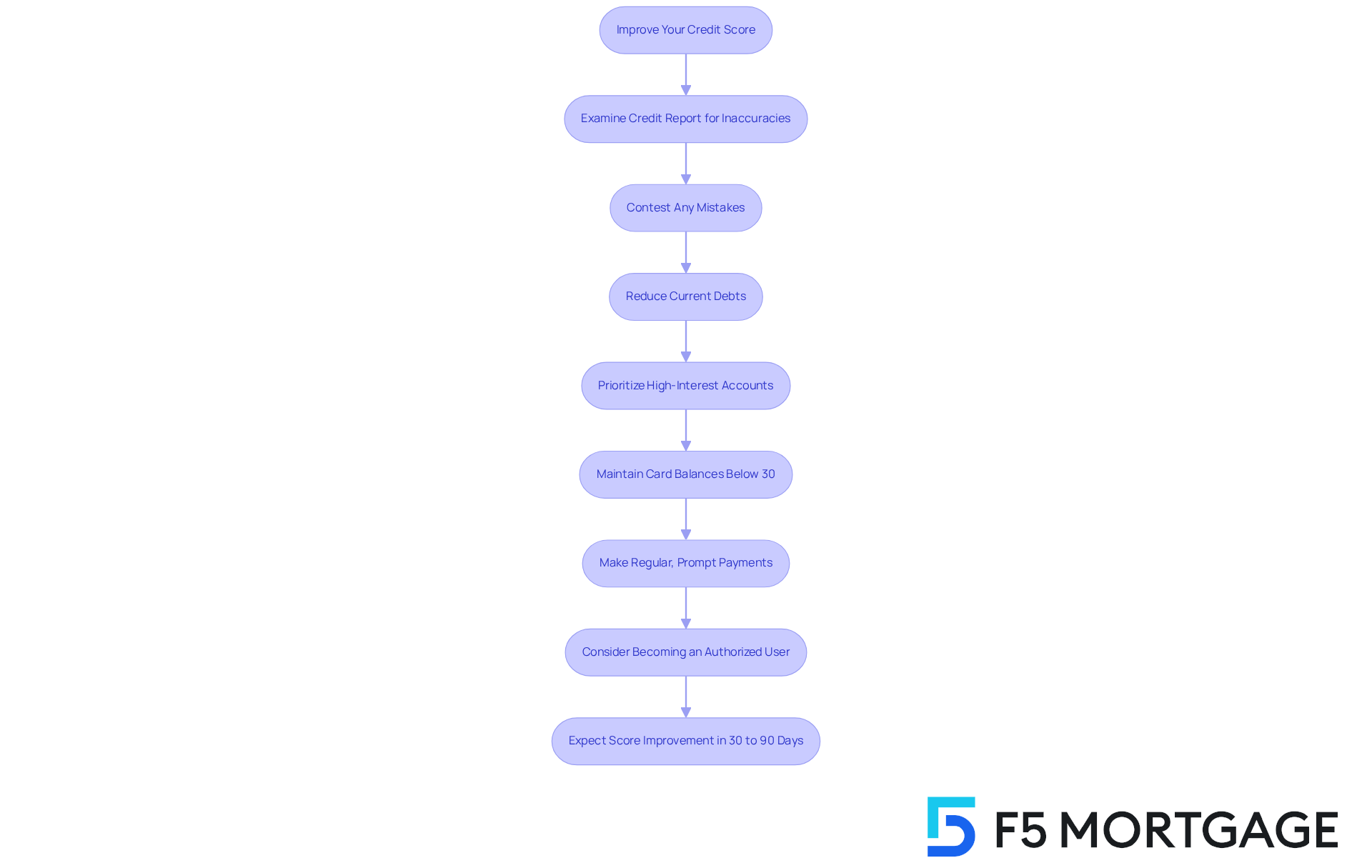

Improve Your Credit Score Before Applying

We understand how challenging it can be to improve your rating before applying for a mortgage for bad credit. Start by examining your credit report for inaccuracies and contesting any mistakes you discover. This proactive approach can significantly influence your rating, as even minor discrepancies can diminish your creditworthiness.

Focus on reducing current debts, prioritizing accounts with high interest first. This strategy can enhance your utilization ratio—a crucial element in your rating. Aim to keep your card balances below 30% of your total limit. For example, if you have a $5,000 limit, try to maintain a balance of no more than $1,500.

Regular, prompt payments are essential. Making payments on time can positively affect your rating, as payment history comprises a substantial part of your overall evaluation. Furthermore, consider becoming an authorized user on a responsible individual’s card. This can help you benefit from their favorable financial history, potentially enhancing your rating.

On average, individuals can see improvements in their scores within 30 to 90 days by implementing these strategies. If you need to contest inaccuracies on your report, you can accomplish this by reaching out to the bureaus directly and supplying documentation to support your assertion. By taking these steps, you can position yourself as a more appealing candidate for lenders, thereby enhancing your chances of obtaining a mortgage for bad credit with favorable financing conditions.

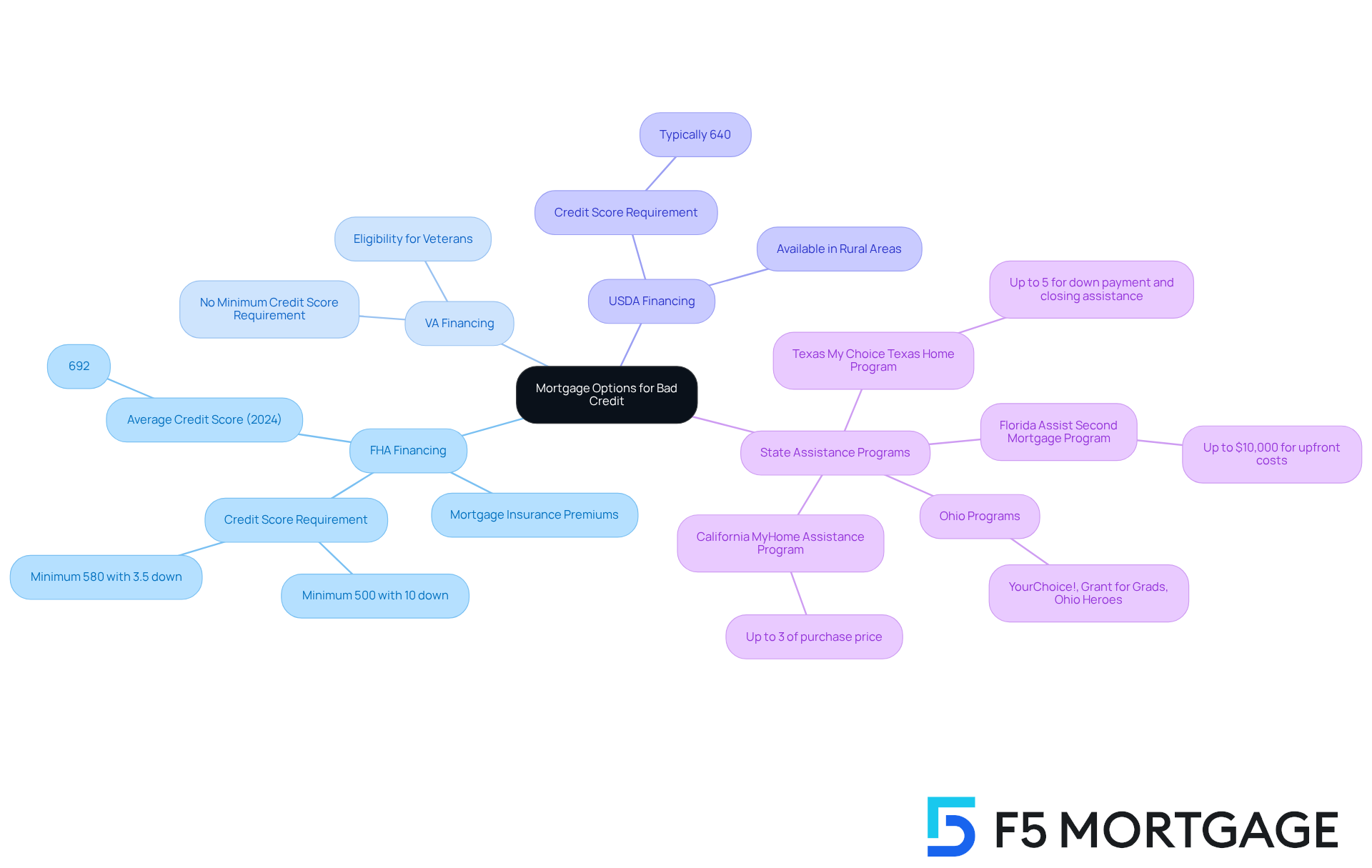

Explore Mortgage Options for Bad Credit

If you’re facing challenges due to a poor financial history, know that there are several mortgage for bad credit options available to help you achieve your dream of homeownership. FHA financing is a particularly viable choice, allowing credit scores as low as 500 with a 10% down payment, or 580 with just 3.5% down. This flexibility makes FHA financing especially appealing for those looking for a mortgage for bad credit.

Additionally, VA financing, available to veterans, does not impose a minimum credit score requirement. This means qualified borrowers can secure funding without the pressure of stringent standards. For low-income buyers in rural areas, USDA financing provides favorable conditions, further expanding your options for a mortgage for bad credit.

To effectively navigate these choices, it’s essential to conduct thorough research and consult with a knowledgeable financial advisor. This can significantly improve your chances of finding the best financing option tailored to your unique financial situation. Moreover, exploring down payment assistance programs can offer vital support for families looking to upgrade their homes.

For instance, California’s MyHome Assistance Program provides up to 3% of the home’s purchase price, while Texas offers the My Choice Texas Home program, which includes up to 5% for down payment and closing assistance. Florida has various options, such as the Florida Assist Second Mortgage Program, which can provide up to $10,000 for upfront costs. In Ohio, programs like YourChoice!, Grant for Grads, and Ohio Heroes are well-regarded, each with specific eligibility criteria and financial support for homebuyers.

Remember, utilizing resources like a home affordability calculator can also help you estimate your budget and borrowing capacity. We know how challenging this process can be, but we’re here to support you every step of the way.

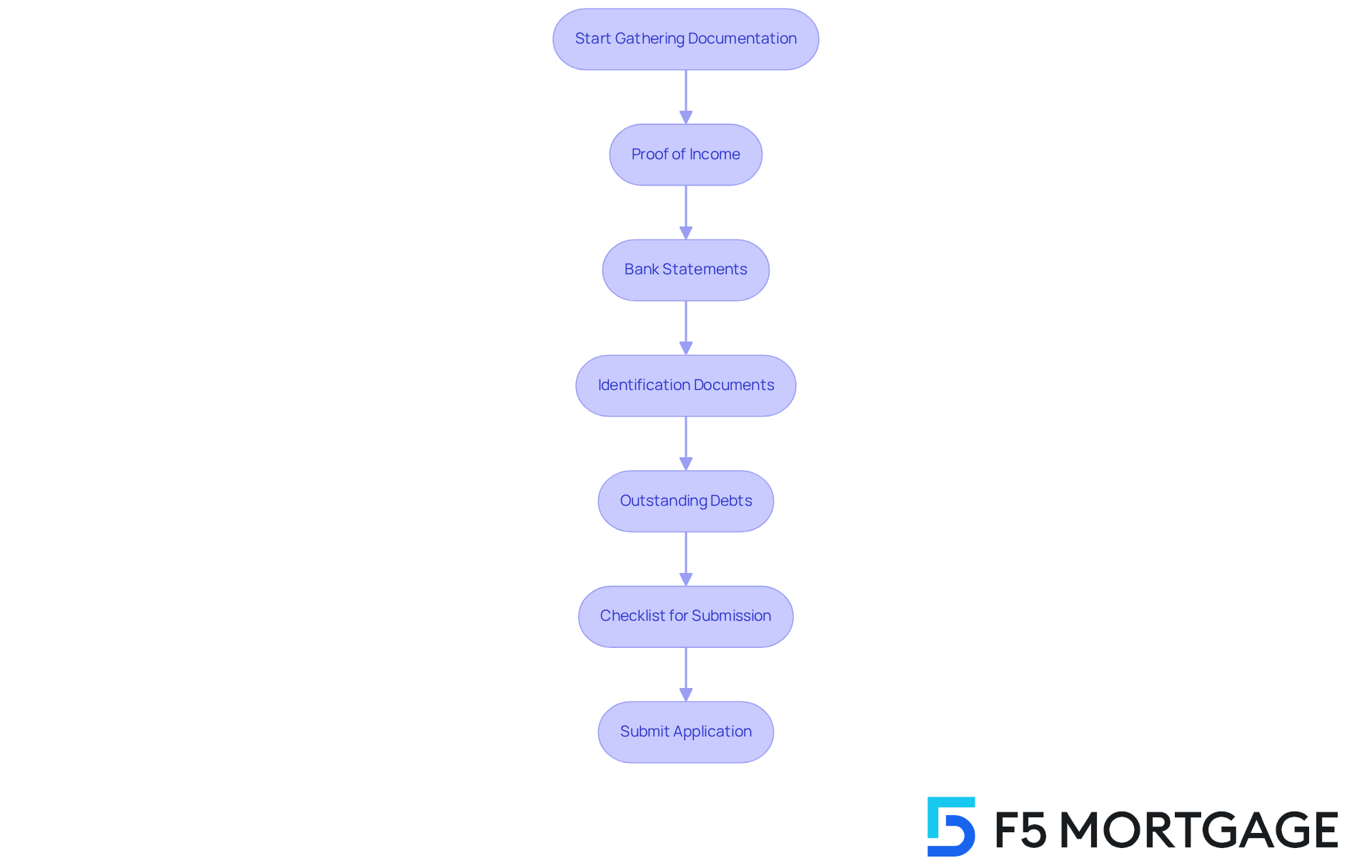

Gather Required Documentation for Your Application

When seeking a loan, we know how challenging this can be. It’s essential to gather a comprehensive set of documents to support your application. Key items typically required include:

- Proof of income, such as recent pay stubs and tax returns

- Bank statements that reflect your financial stability

- Identification documents, like a driver’s license or Social Security card

- Documentation of any outstanding debts, including card statements and loan agreements

Organizing these documents in advance can significantly expedite the application process. Studies show that disorganized submissions are a common cause of delays, with many applicants facing setbacks due to missing or improperly labeled documents. By creating a checklist and confirming that all documents are finished and clearly marked, you can present a compelling case to lenders. This showcases your preparedness and dedication to the financing process.

For individuals with reduced ratings, it is especially vital to be thorough in your documentation when seeking a mortgage for bad credit. In these cases, lenders often scrutinize applications for a mortgage for bad credit more closely. Providing thorough and accurate information can enhance your chances of approval. Remember, a not only reflects your financial responsibility but also helps build trust with potential lenders. We’re here to support you every step of the way.

Apply for Your Mortgage with Confidence

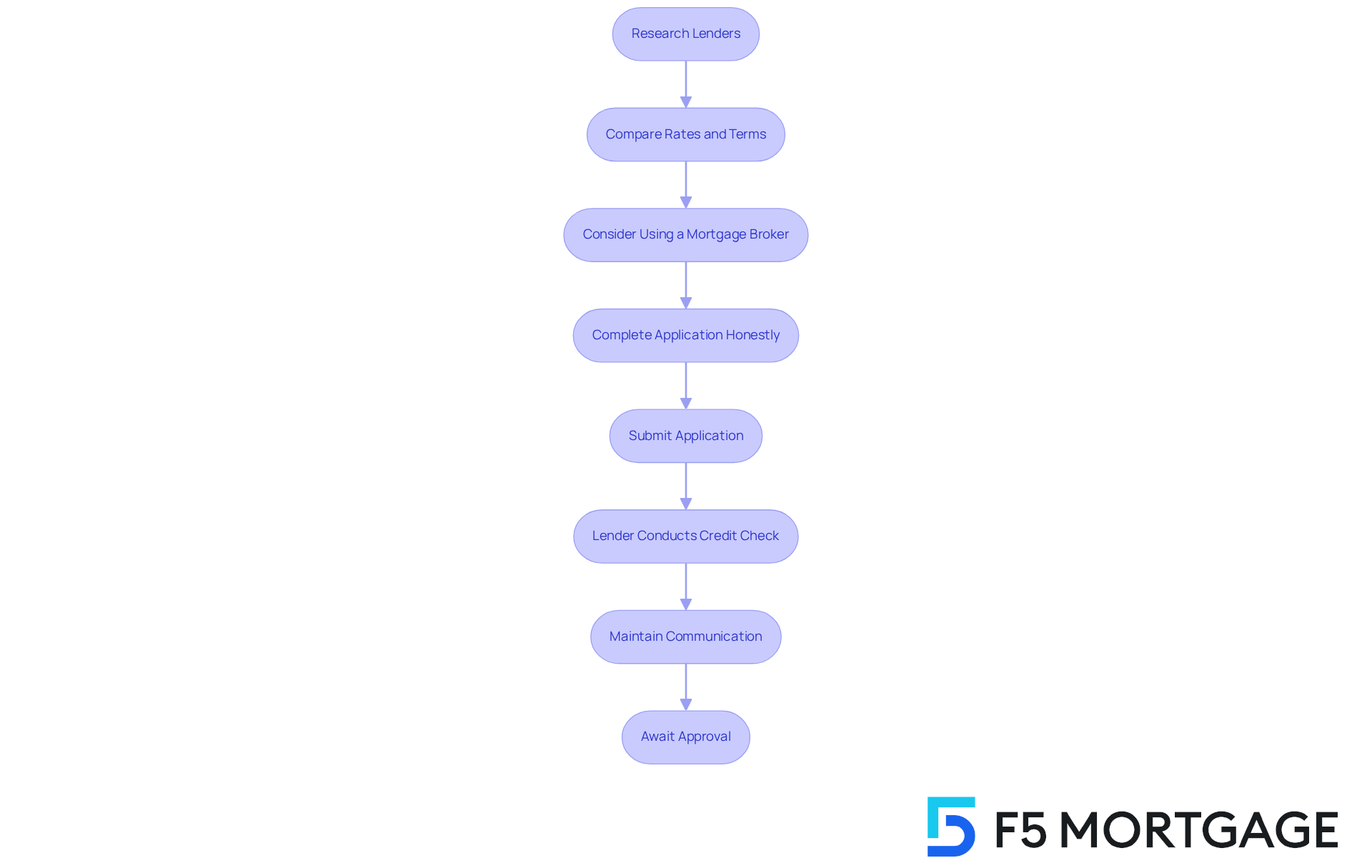

We know how challenging the mortgage process can be, but enhancing your rating and gathering the necessary paperwork is just the beginning. The next step is to apply for your loan. Start by researching various lenders and comparing their rates and terms. Utilizing a mortgage broker can be especially advantageous, particularly if you are looking for a mortgage for bad credit, as they focus on identifying the optimal choices suited to your financial circumstances.

When completing your application, it’s crucial to be honest and thorough; discrepancies can lead to significant delays or even denials. Most lenders require a minimum rating score of 620 for a conventional loan, so understanding this can help set realistic expectations. Once your application is submitted, expect the lender to conduct a credit check and verify your financial information. Maintaining open lines of communication with your lender throughout the process is vital. This proactive approach enables you to tackle any inquiries or issues quickly, ultimately simplifying your loan application experience.

Remember, the average loan approval rate stands at approximately 81%, but being well-prepared can significantly enhance your chances of success. Additionally, consider the down payment assistance programs available through F5 Mortgage, such as:

- Florida’s FL Assist and the Homeownership Loan Program, which offer up to $10,000 in support

- Michigan’s MI Home Loan program, providing $10,000 loans for first-time homebuyers

Clients have commended F5 Mortgage for their outstanding service, with one mentioning, ‘They assisted me greatly throughout the journey,’ making the loan process easier and more attainable.

By exploring these options and leveraging the personalized service offered by F5 Mortgage, you can navigate the mortgage landscape with confidence. We’re here to support you every step of the way.

Conclusion

Securing a mortgage with bad credit can feel overwhelming, but we understand how important this journey is for you. By grasping the process and taking proactive steps, you can significantly enhance your chances of success. Start by understanding credit ratings and how they influence your mortgage options. Familiarizing yourself with the factors affecting credit scores and exploring specialized loan programs can help pave the way to homeownership, even in the face of financial challenges.

One key strategy is to improve your credit score before applying. Explore various mortgage options designed for those with bad credit. Gather the necessary documentation to support your loan applications meticulously. Programs like FHA, VA, and USDA loans, along with down payment assistance, offer viable pathways for potential homeowners. Each step you take to enhance your financial standing and prepare documentation not only increases your likelihood of approval but also positions you as a responsible borrower in the eyes of lenders.

Ultimately, your journey to securing a mortgage with bad credit is not merely about overcoming obstacles; it’s about seizing opportunities and making informed decisions. By leveraging available resources, conducting thorough research, and maintaining open communication with lenders, you can confidently navigate the mortgage application process. Embracing this proactive approach can transform your aspirations of homeownership into reality. Remember, with determination and the right strategies, achieving a stable future is within reach, and we’re here to support you every step of the way.

Frequently Asked Questions

What is considered bad credit for mortgage eligibility?

A credit rating under 580 is often seen as a sign of poor financial standing, which can significantly limit mortgage options. FHA loans require a minimum rating of 580 with a 3.5% down payment, while conventional loans generally require a minimum rating of 620.

How does bad credit impact mortgage options?

Lenders typically view low credit ratings as indicators of greater risk, which can lead to higher interest rates or even rejection of loan applications.

What factors affect my credit rating?

Key factors that affect your credit rating include your payment history, how you use available credit, and the length of your financial history.

How can I improve my credit score before applying for a mortgage?

To improve your credit score, examine your credit report for inaccuracies and contest any mistakes. Reduce current debts, prioritize high-interest accounts, keep card balances below 30% of your total limit, and make payments on time. Additionally, consider becoming an authorized user on a responsible individual’s credit card.

How quickly can I see improvements in my credit score?

Individuals can typically see improvements in their credit scores within 30 to 90 days by implementing strategies to improve their creditworthiness.

What unique loan programs are available for individuals with bad credit?

Unique loan programs such as FHA, VA, and USDA offerings can provide more accessible mortgage options for individuals with bad credit.