Overview

Navigating the process of securing a home equity loan can feel overwhelming, but we’re here to support you every step of the way. This article outlines five simple steps to help you secure a quick home equity loan:

- First, it’s essential to understand what home equity is.

- Next, assessing your property value will give you a clearer picture of your financial options.

- Checking your credit scores is also crucial, as it directly impacts your loan eligibility.

- Once you’re informed, it’s time to apply for the loan.

- Finally, successfully closing the loan is the last step in this journey.

Each of these steps is supported by practical advice and statistics, emphasizing the importance of preparation and informed decision-making. We know how challenging this can be, but with the right knowledge and support, you can navigate the loan process effectively.

Introduction

Navigating the world of home equity loans can feel overwhelming for many property owners, especially when time is of the essence. We understand how challenging this can be. With the potential to unlock significant funds tied up in your home’s value, grasping the process is crucial for making informed financial decisions. This guide offers a straightforward approach to securing a quick home equity loan, outlining essential steps that can empower you to access the capital you need.

Yet, with fluctuating market conditions and varying lender requirements, how can you ensure that you are making the best choice for your financial future? We’re here to support you every step of the way.

Understand Home Equity Loans

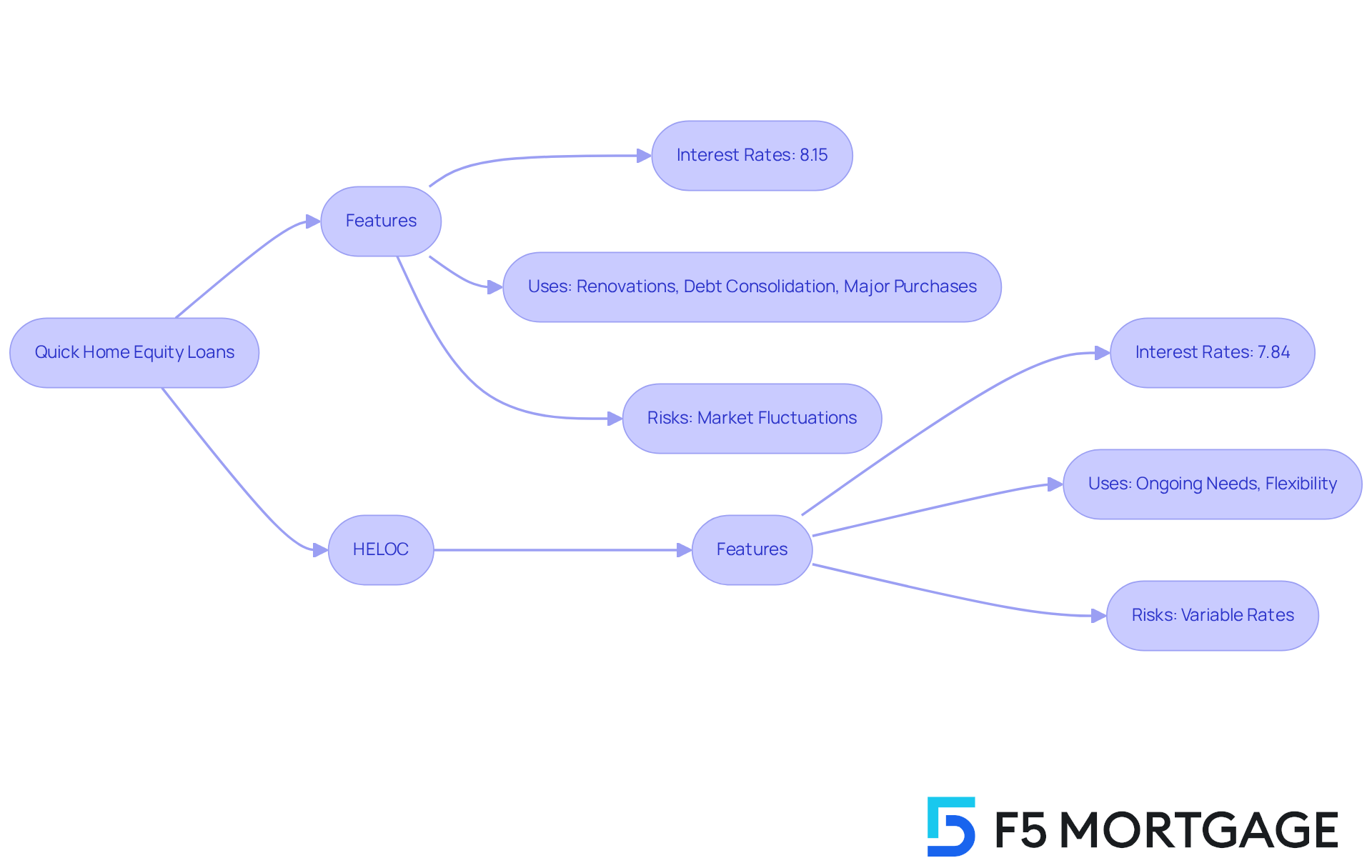

Quick home equity loans enable property owners to access the value built up in their assets, providing funds for various needs such as renovations, debt consolidation, or major purchases. These financial agreements use the property as security, offering a lump sum with set repayment conditions. In contrast, a property value line of credit (HELOC) provides a revolving line of credit that can be accessed as needed, usually with variable interest rates.

As of 2025, average interest rates for residential property financing are approximately 8.15%, while HELOC rates are slightly lower at around 7.84%. Understanding these rates is crucial because they can significantly impact the overall cost of borrowing. We know how challenging this can be, so financial advisors recommend assessing your financial situation and comparing offers from multiple lenders to secure the best possible rate.

Real-world instances demonstrate the usefulness of property-based financing. For example, property owners frequently utilize them to finance renovations that enhance value or combine high-interest debt, resulting in significant savings over time. However, it is essential to acknowledge the risks linked to borrowing against property value. Market fluctuations can influence the worth of your residence and, as a result, your financial stake.

In summary, while both home collateral products and quick home equity loans offer valuable monetary choices, they serve different functions. Home value loans provide stability with fixed payments, making them suitable for one-time expenses, whereas HELOCs offer flexibility for ongoing needs. As you consider these options, remember to borrow with purpose, and ensure that your financial decisions align with your long-term goals. We’re here to every step of the way.

Assess Your Home Equity

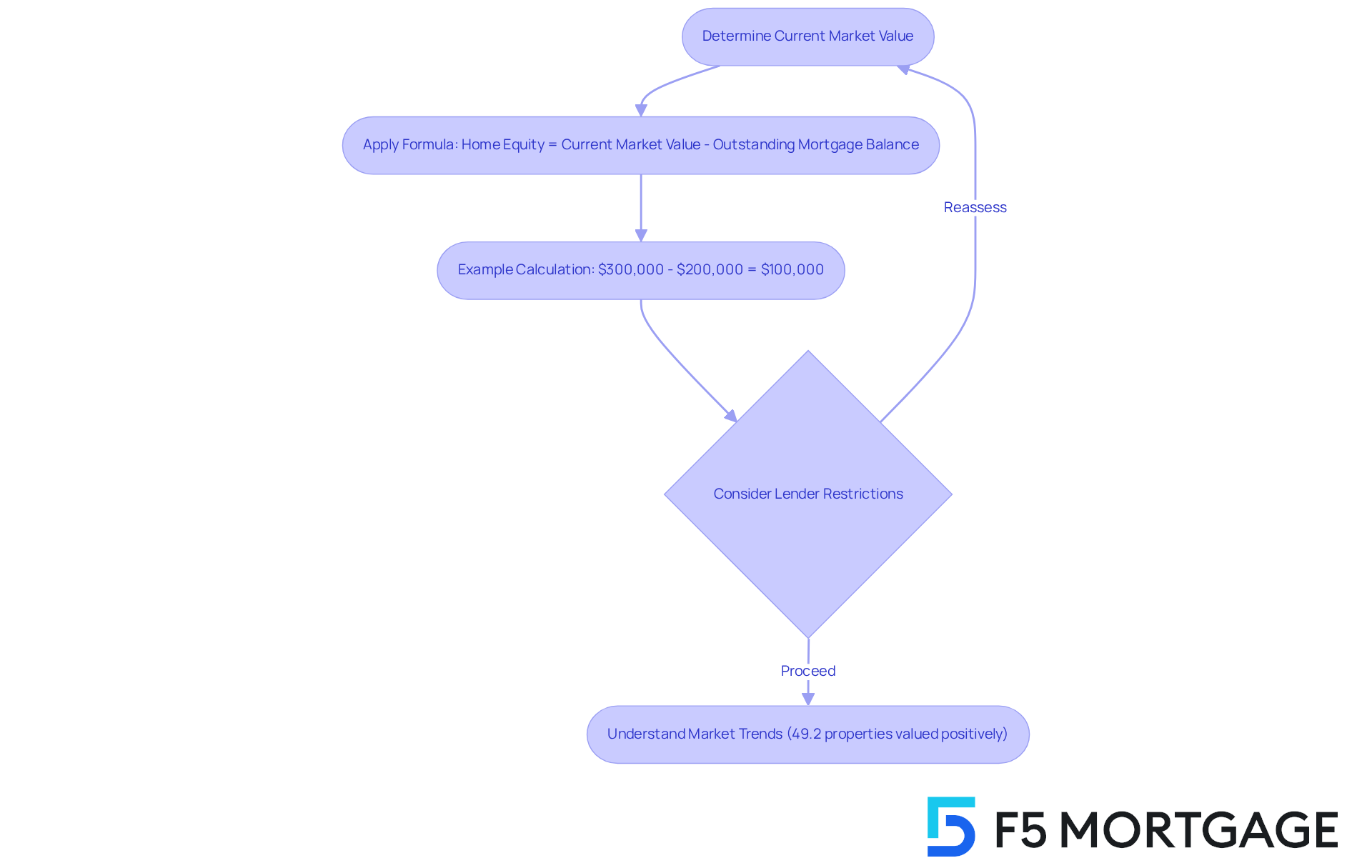

To evaluate your property value, we know how important it is to start by finding your residence’s current market worth. You can achieve this through online real estate platforms, hiring a professional appraiser, or consulting with a . Once you have the market value, you can apply the following formula:

Home Equity = Current Market Value – Outstanding Mortgage Balance

For instance, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your home equity would be $100,000. This sum indicates the highest you could possibly obtain through a quick home equity loan borrowing arrangement. However, lenders may set their own borrowing restrictions based on personal standards, which can be a source of concern for many.

As of 2025, around 49.2% of U.S. mortgaged residential properties are categorized as valuable, indicating their loan balances are less than half of their estimated market values. This trend emphasizes the increasing wealth among property owners. In fact, the average mortgage holder currently has $315,000 in available residential value, an increase of $129,000 since the pandemic started.

Understanding how to determine your property value is vital for utilizing it effectively for your financial needs. We’re here to support you every step of the way as you navigate this process.

Check Your Credit Score

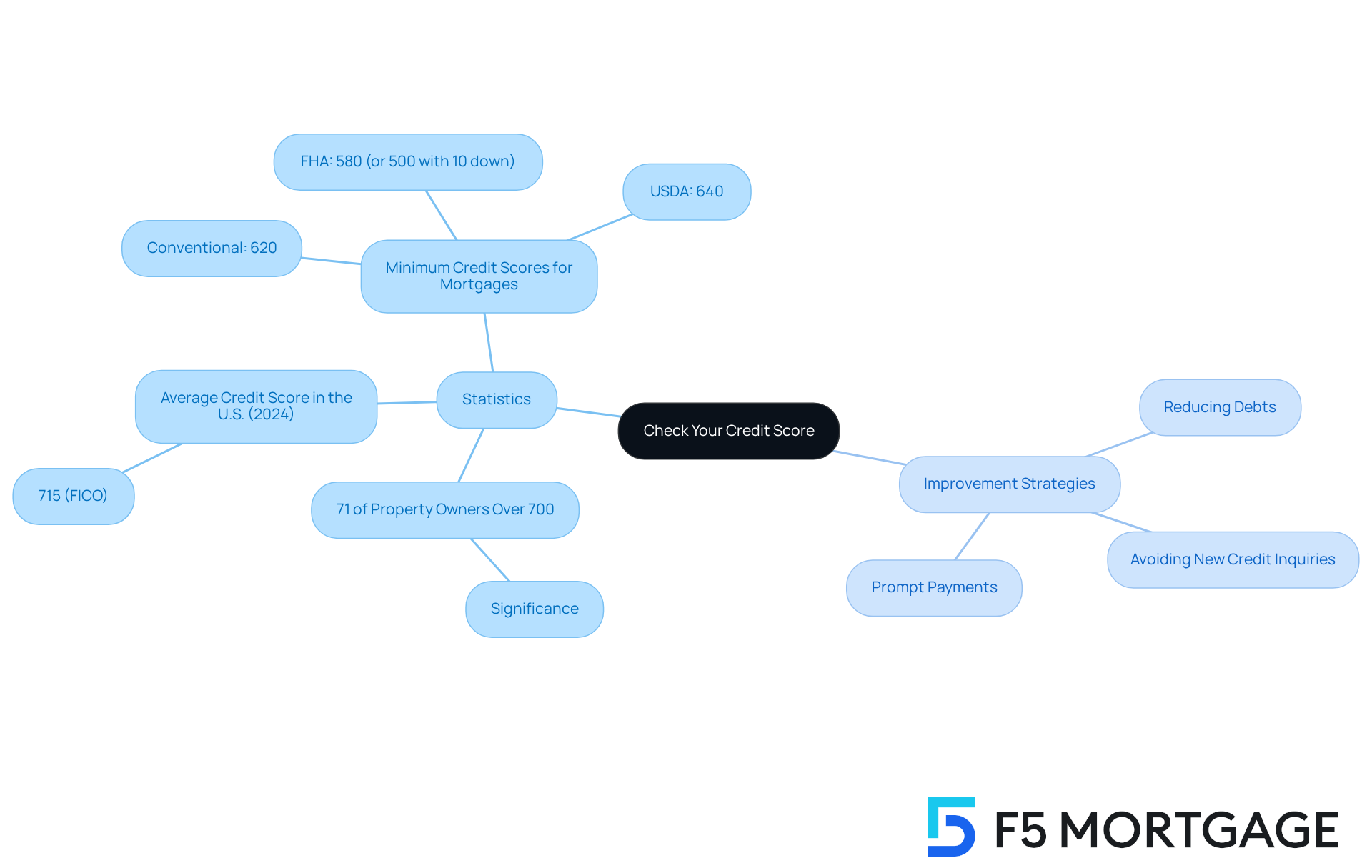

Before applying for a home equity line of credit, we know how crucial it is to check your credit score. You can easily obtain a from major bureaus like Experian, TransUnion, and Equifax. It’s essential to review these reports for any discrepancies or negative marks that could impact your score.

As of 2025, around 71% of property owners possess credit scores exceeding 700, which is typically regarded as good. This can lead to more advantageous financing conditions. If your score falls below this threshold, don’t worry—there are several effective strategies to improve it. Financial specialists suggest:

- Reducing current debts

- Ensuring prompt payments

- Steering clear of new credit inquiries before applying for funding

For example, numerous homeowners have successfully improved their scores by focusing on these aspects. This not only boosts their creditworthiness but also elevates their likelihood of obtaining more favorable financing terms. Remember, we’re here to support you every step of the way as you navigate this process.

Apply for the Home Equity Loan

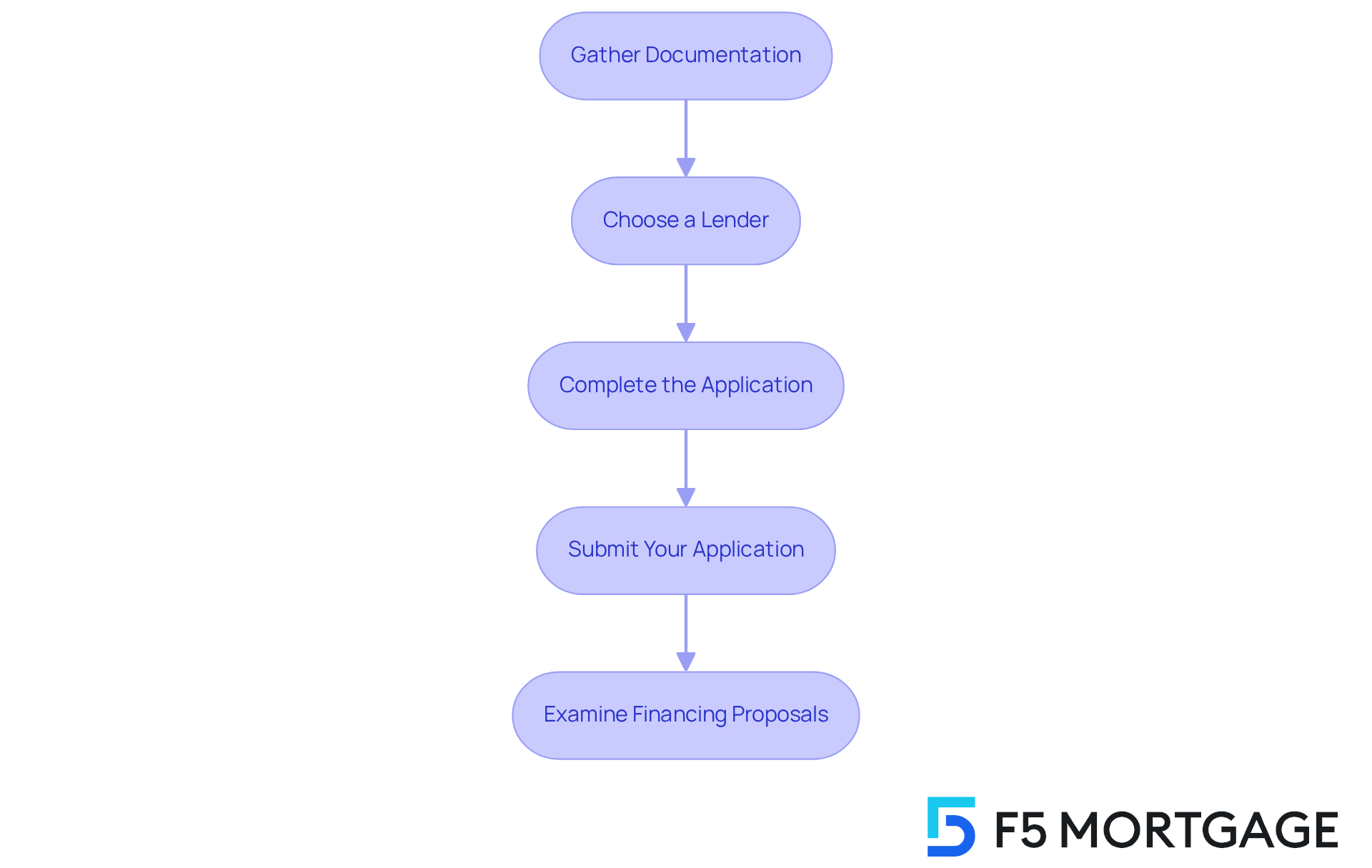

To secure a home equity loan efficiently, follow these essential steps:

- Gather Documentation: We know how challenging this can be, so start by collecting key documents such as proof of income, recent tax returns, and details about your existing mortgage. This preparation is essential, as lenders usually demand detailed monetary information to evaluate your application.

- Choose a Lender: Research various lenders to identify those offering competitive rates and favorable terms. Choosing F5 Mortgage can provide you with a quick home equity loan along with customized service and expert assistance, ensuring a seamless mortgage experience tailored to your unique economic circumstances.

- Complete the Application: Accurately fill out the lender’s application form, ensuring you provide detailed information about your financial situation and the purpose of the funds. This step is vital for a smooth approval process, and at F5 Mortgage, we’re here to support you every step of the way with clear communication.

- Submit Your Application: After completing the application, submit it along with the required documentation. Be prepared for the lender to conduct a credit check and potentially appraise your home to verify its value. Our team at F5 Mortgage is here to assist you, making the process as seamless as possible.

- Examine Financing Proposals: Once your application is approved, carefully examine the financing proposals. Compare interest rates, fees, and terms to make an informed decision that aligns with your financial goals. With our 5-star reviews and commitment to client satisfaction, you can trust that F5 Mortgage will provide you with exceptional options and support.

Statistics show that property owners with a minimum of 15% to 20% stake in their residences are more likely to obtain advantageous financing conditions, especially pertinent in the current market where property values have increased considerably. Furthermore, comprehending the documentation needed—such as W-2 forms, bank statements, and proof of property insurance—can simplify the process. We understand that 53% of property owners reported feeling assured in their against their assets. By adhering to these steps and selecting F5 Mortgage, you can traverse the property financing landscape with increased ease and assurance, especially when seeking a quick home equity loan.

Close the Loan Successfully

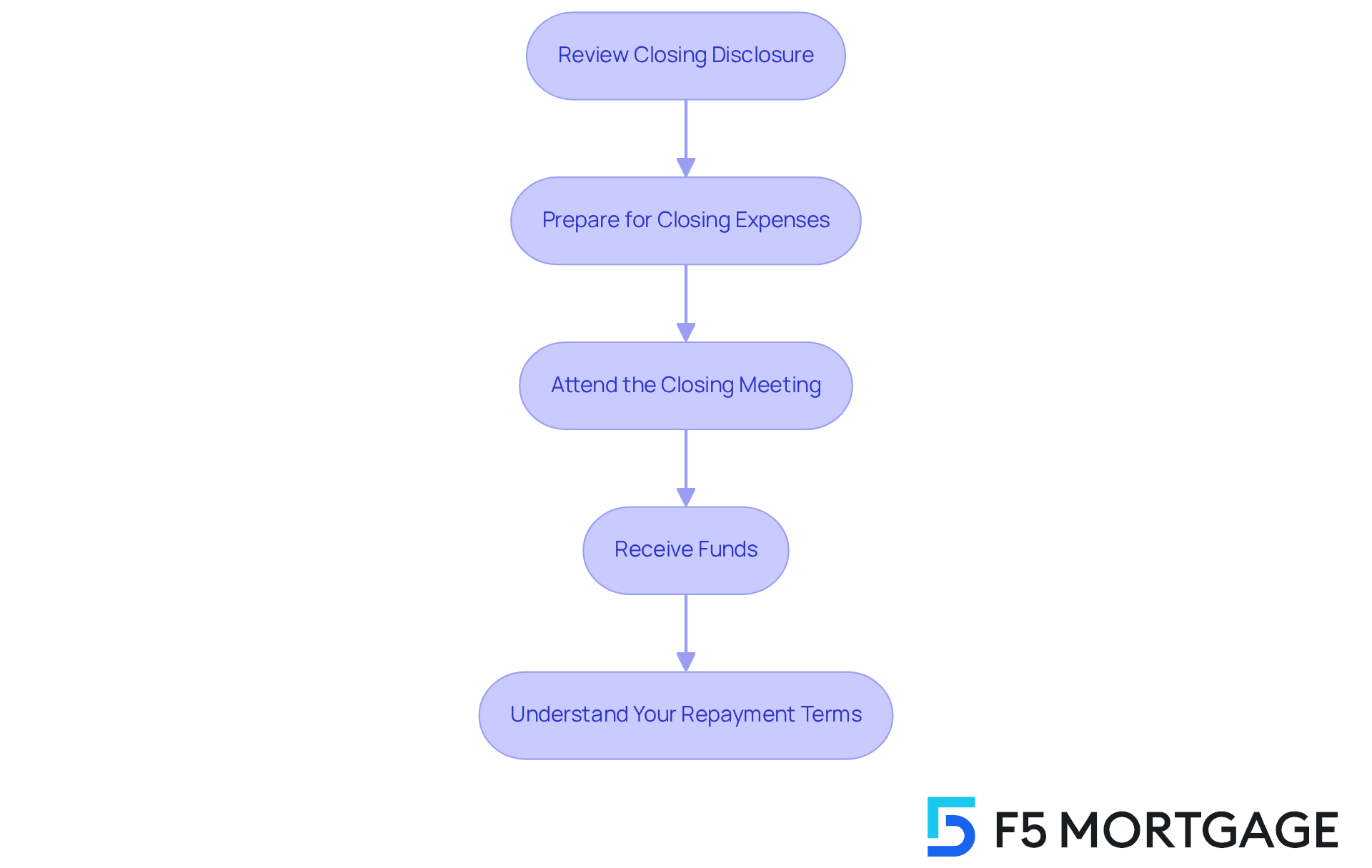

Closing a quick home equity loan involves several essential steps that can feel overwhelming. We understand how challenging this can be, but by following these guidelines, you can navigate the process with confidence and clarity.

- Review Closing Disclosure: A few days before closing, you will receive a Closing Disclosure outlining the financing terms and related expenses. It is crucial to review this document thoroughly to ensure all information aligns with your expectations. Take your time with this step—it’s important to feel secure in what you’re signing.

- Prepare for Closing Expenses: Be aware of the different closing fees that may occur, which generally range from 2% to 5% of the borrowed amount. Common expenses include appraisal fees (averaging $350), title insurance (costing between $1,000 and $4,000), and legal fees, which can vary from $100 to $300 per hour. Understanding these costs upfront can help you and avoid surprises.

- Attend the Closing Meeting: On the day of closing, you will meet with the lender or a closing agent to sign the necessary documents. Ensure you bring valid identification and any required funds to facilitate the process smoothly. Remember, this is a significant step—don’t hesitate to ask questions if anything is unclear.

- Receive Funds: After signing the documents, the lender will disburse the loan funds, which you can utilize as planned for your home improvement or other financial needs. This moment can be exciting, as it opens the door to new possibilities for your home.

- Understand Your Repayment Terms: It is vital to comprehend the repayment schedule, including any potential penalties for late payments. Being informed about these terms will help you manage your finances effectively and avoid future complications. We’re here to support you every step of the way, ensuring you feel equipped to handle your responsibilities.

By following these steps and being aware of the associated costs, you can approach the closing process for a quick home equity loan with a sense of empowerment and clarity.

Conclusion

Securing a quick home equity loan can be a straightforward process when approached with the right knowledge and preparation. We know how challenging this can be, but by understanding the fundamentals of home equity loans, assessing your property value, checking your credit score, and following a structured application and closing process, homeowners can effectively leverage their equity for financial needs. This comprehensive approach not only demystifies the borrowing process but also empowers you to make informed decisions aligned with your financial goals.

Key insights from this guide highlight the importance of:

- Accurately assessing home equity

- Maintaining a good credit score

- Carefully reviewing loan terms

By gathering the necessary documentation, selecting a suitable lender, and understanding the closing process, you can navigate potential hurdles with confidence. Moreover, recognizing the differences between a home equity loan and a HELOC allows for better financial planning tailored to your specific needs.

Ultimately, the journey toward securing a home equity loan is not just about accessing funds; it’s about making strategic financial choices that can lead to significant benefits, whether it’s funding home improvements or consolidating debt. By taking proactive steps and seeking expert guidance throughout the process, you can unlock the potential of your property equity, paving the way for a more secure financial future.

Frequently Asked Questions

What are home equity loans and how do they work?

Home equity loans allow property owners to access the value built up in their assets, providing a lump sum of funds for various needs such as renovations, debt consolidation, or major purchases. These loans use the property as security and have set repayment conditions.

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit that property owners can access as needed, usually with variable interest rates. It offers flexibility for ongoing financial needs compared to a one-time loan.

What are the average interest rates for home equity loans and HELOCs as of 2025?

As of 2025, the average interest rate for residential property financing is approximately 8.15%, while HELOC rates are slightly lower at around 7.84%.

Why is it important to understand interest rates when considering home equity financing?

Understanding interest rates is crucial because they can significantly impact the overall cost of borrowing, affecting how much you will ultimately pay back over time.

How can property-based financing be useful for homeowners?

Homeowners often use property-based financing to finance renovations that enhance property value or to consolidate high-interest debt, which can lead to significant savings over time.

What risks are associated with borrowing against property value?

The risks include market fluctuations that can influence the worth of your residence and, consequently, your financial stake in the property.

How can I assess my home equity?

To assess your home equity, start by determining your residence’s current market value through online real estate platforms, hiring a professional appraiser, or consulting with a real estate agent. Then, use the formula: Home Equity = Current Market Value – Outstanding Mortgage Balance.

What percentage of U.S. mortgaged residential properties are considered valuable as of 2025?

As of 2025, around 49.2% of U.S. mortgaged residential properties are categorized as valuable, meaning their loan balances are less than half of their estimated market values.

What is the average available residential value for mortgage holders currently?

The average mortgage holder currently has $315,000 in available residential value, which has increased by $129,000 since the pandemic started.

What should I consider when deciding to borrow against my home equity?

When deciding to borrow against your home equity, consider borrowing with purpose and ensure that your financial decisions align with your long-term goals.