Overview

Navigating the process of upgrading your home can feel overwhelming, especially when it comes to understanding FHA credit score requirements. We know how challenging this can be, and we’re here to support you every step of the way.

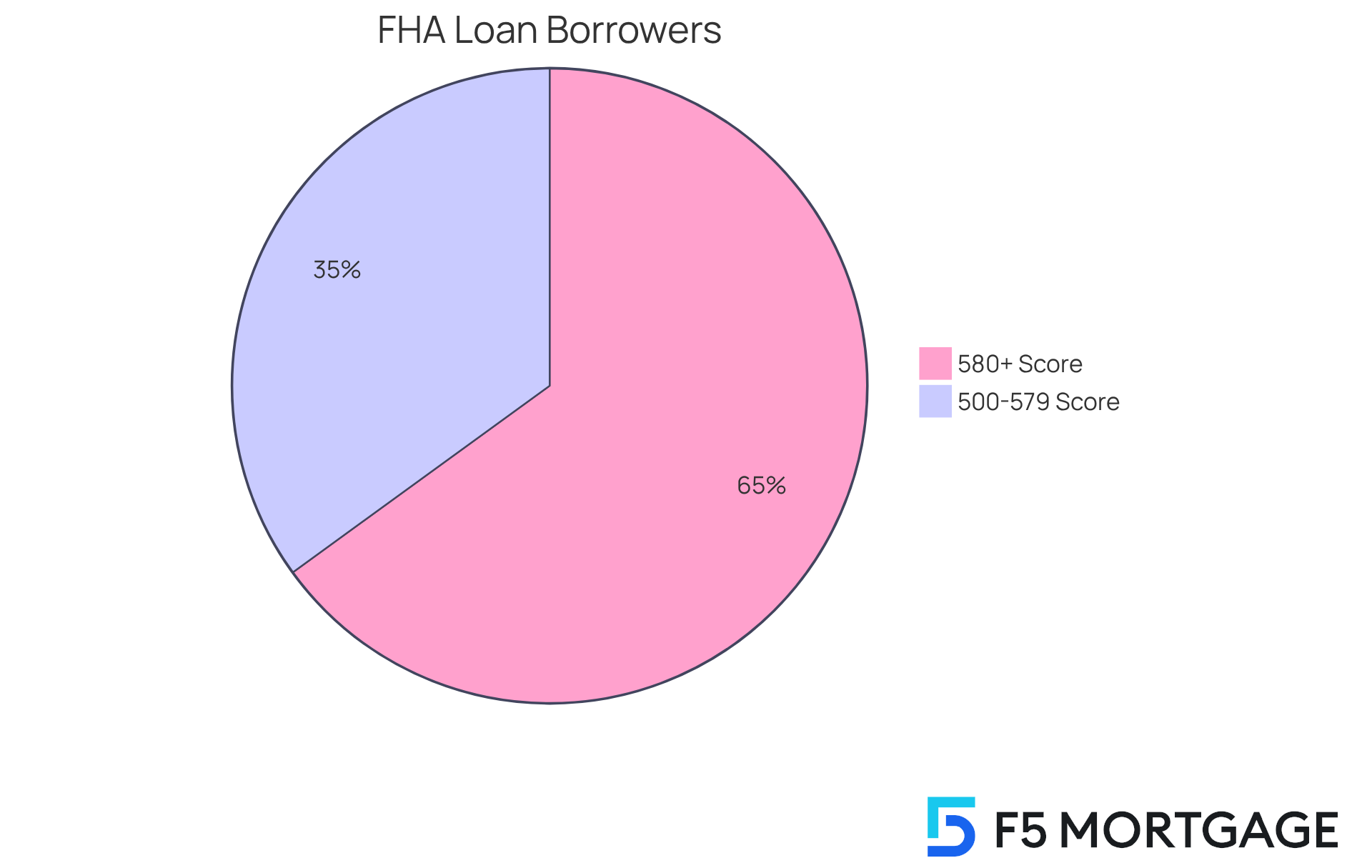

To qualify for an FHA loan with a lower down payment of 3.5%, a minimum credit score of 580 is typically required. If your score falls between 500 and 579, a higher down payment will be necessary. This highlights the importance of maintaining a strong credit profile, as it can significantly influence the terms of your loan.

By focusing on your credit health, you can secure more favorable loan conditions, making your dream home more attainable. Remember, every small step you take towards improving your credit can lead to greater opportunities in your home-buying journey.

Introduction

Understanding the complexities of FHA loans is essential for anyone looking to upgrade their home or enter the housing market for the first time. We know how challenging this can be. With their low down payment requirements and accessibility, FHA mortgages have become a lifeline for many aspiring homeowners, particularly those who may not meet traditional lending criteria. However, we also recognize that the pivotal role of credit scores in determining eligibility can create a daunting barrier for potential borrowers.

What strategies can individuals employ to navigate these requirements and enhance their chances of securing an FHA loan? We’re here to support you every step of the way.

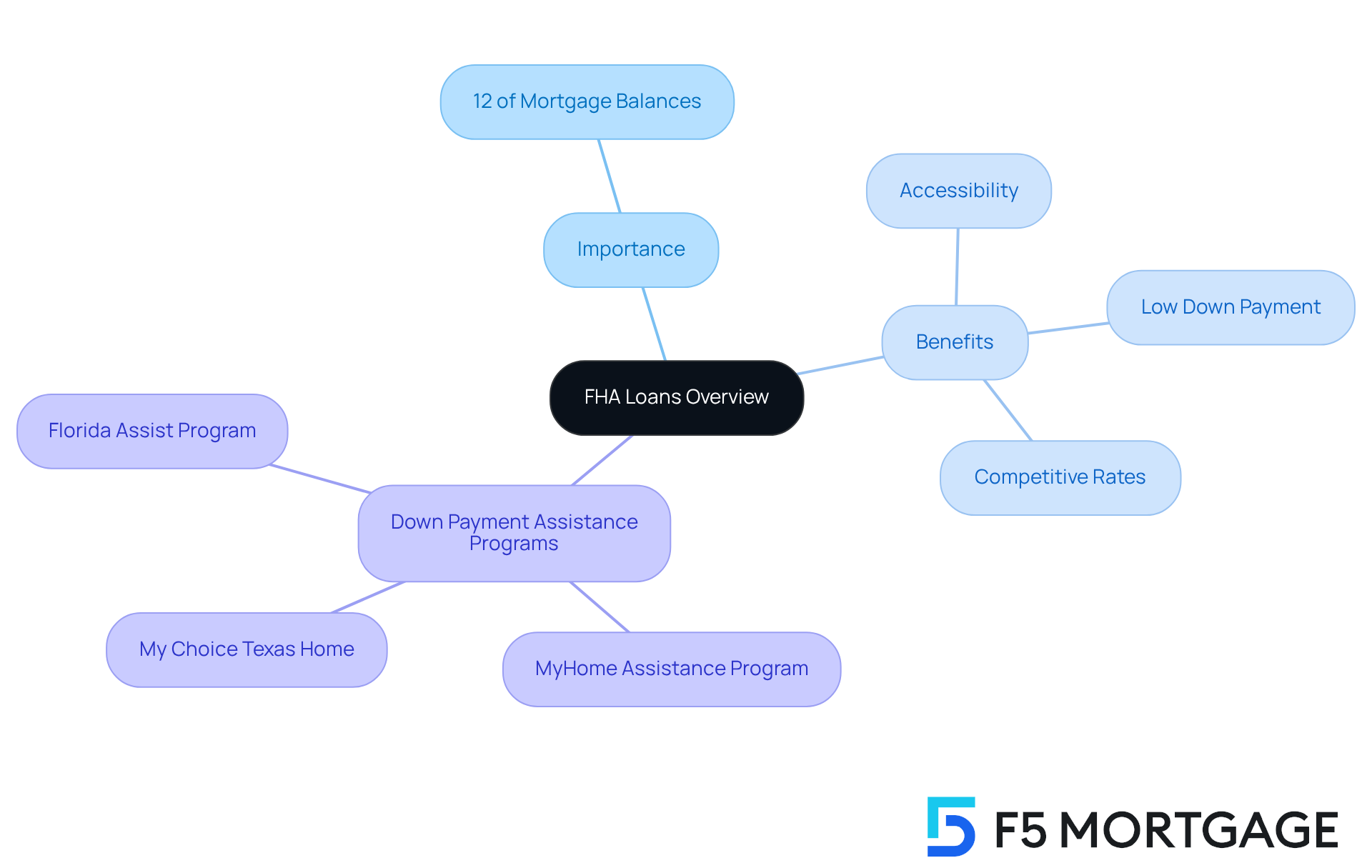

Overview of FHA Loans and Their Importance

FHA mortgages, backed by the Federal Housing Administration, have been instrumental in promoting homeownership for Americans since 1934. These financial products are designed to assist individuals who may struggle to qualify for traditional financing due to FHA credit score requirements or limited savings. One of the most significant benefits of FHA mortgages is their accessibility; they enable first-time homebuyers and those with unique financial situations to secure financing with as little as 3.5% down. This lower down payment requirement greatly reduces the barrier to entry for many families eager to upgrade their homes or purchase for the first time.

In 2025, FHA financing accounted for around 12% of total mortgage balances, underscoring their vital role in the housing market. They offer competitive interest rates and lower closing costs, making them a compelling option for families. Experts suggest that FHA mortgages are particularly beneficial for first-time homebuyers, as they provide a pathway to homeownership that might otherwise seem out of reach. Moreover, understanding the mortgage approval process is crucial; an approval indicates that a lender views you as a suitable candidate for a mortgage based on your financial information, which must meet FHA credit score requirements to obtain FHA financing.

Alongside FHA financing, families can explore various down payment assistance programs available through F5 Mortgage. For example:

- The MyHome Assistance Program in California offers up to 3% of the home’s purchase price.

- Texas provides the My Choice Texas Home program, which includes up to 5% for down payment and closing assistance.

- Florida also features several programs, such as the Florida Assist Second Mortgage Program, which can offer up to $10,000 for upfront costs.

Understanding these benefits and challenges is vital for effectively , especially for those considering upgrading their homes. The ongoing support from FHA financing and down payment assistance programs continues to empower families, ensuring that the dream of homeownership remains within reach.

FHA Credit Score Requirements Explained

Navigating the world of FHA loans can feel overwhelming, especially when it comes to understanding FHA credit score requirements. To qualify for an FHA loan, borrowers must adhere to the FHA credit score requirements, typically needing a minimum rating of 580 to secure the standard down payment of 3.5%. But don’t worry—if your rating falls between 500 and 579, you can still qualify under the FHA credit score requirements, although this will require a higher down payment of at least 10%.

We know how challenging this can be, and it’s important to recognize that many lenders may set stricter evaluation thresholds, often requiring ratings above 600. This reflects their approach to managing risk, which can add to your concerns. Additionally, factors like your debt-to-income (DTI) ratio—ideally 43% or lower—and a stable employment history for at least two years are significant in meeting the FHA credit score requirements.

Looking ahead to 2025, a considerable number of borrowers with ratings under 580 are expected to seek FHA financing. This highlights the program’s commitment to being accessible for individuals with less-than-perfect financial histories. Understanding the is crucial for prospective borrowers. It empowers you to assess your readiness for an FHA mortgage and navigate the lending landscape with confidence. Remember, we’re here to support you every step of the way.

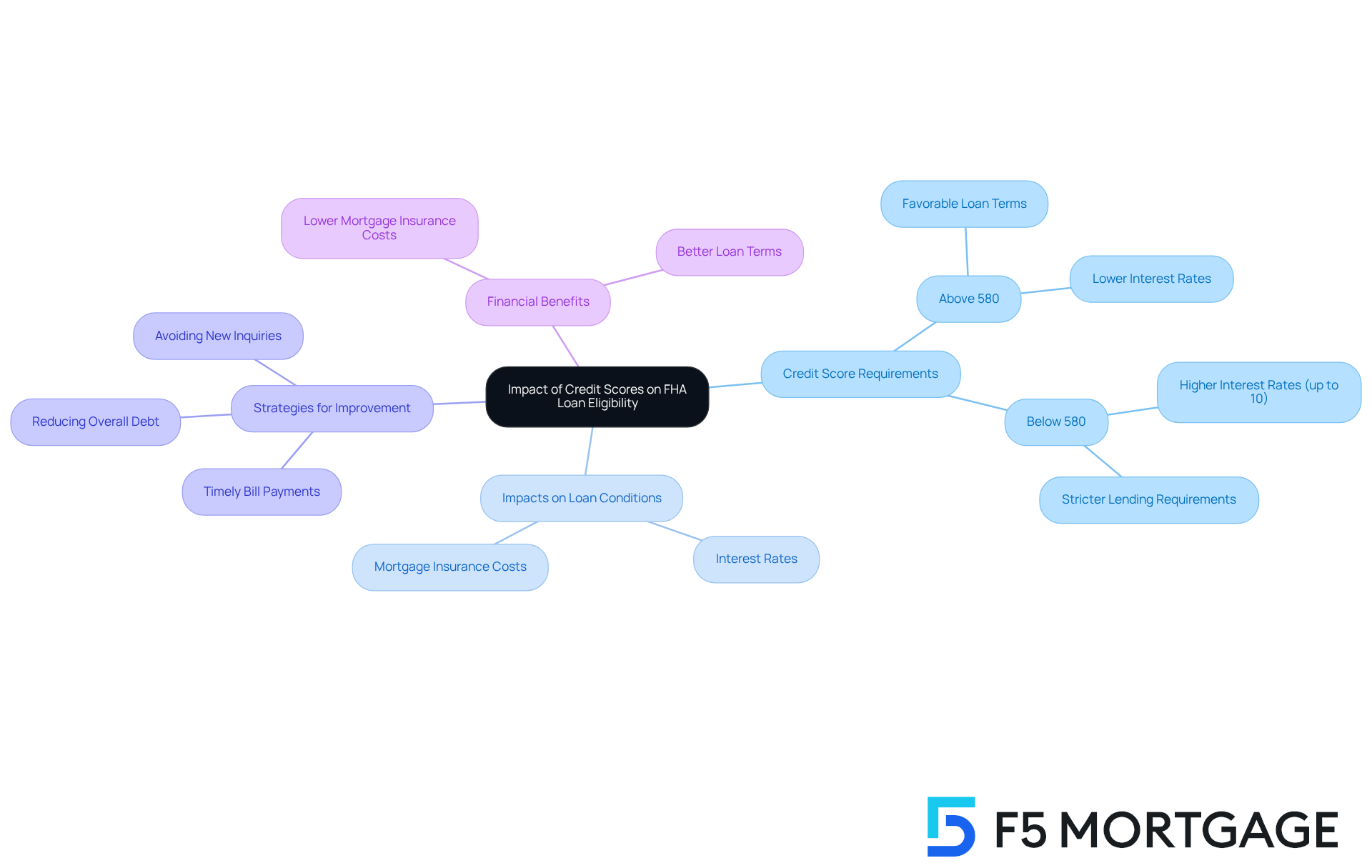

Impact of Credit Scores on FHA Loan Eligibility

Understanding the is vital when it comes to FHA mortgage eligibility and financing conditions. We know how challenging this can be, but an elevated credit rating can significantly boost your chances of approval. Not only does it improve the likelihood of getting approved, but it can also lead to better interest rates and lower mortgage insurance costs.

For instance, borrowers with ratings above 580 typically enjoy more favorable borrowing terms. In contrast, those with ratings below this threshold may face higher interest rates—sometimes reaching 10%—and stricter lending requirements. Lenders assess credit ratings to gauge the risk of lending to a borrower, making it essential to maintain a positive credit status if you’re considering an FHA mortgage.

It’s wise to regularly review your financial reports for any errors and take proactive steps to enhance your ratings. By doing so, you can improve your loan conditions and enjoy a smoother mortgage experience. Financial advisors often highlight the importance of:

- Timely bill payments

- Reducing overall debt

- Avoiding new inquiries

as key strategies for maintaining a strong financial rating.

As Tyler Oswald wisely notes, ‘Having a strong financial rating will assist you in getting one step nearer to obtaining the home you’ve always desired.’ Many borrowers have successfully improved their scores to satisfy the FHA credit score requirements for financing. By addressing negative factors on their financial reports and demonstrating fiscal responsibility, they have transitioned from being viewed as high-risk candidates to securing advantageous borrowing terms.

This proactive approach not only opens doors to FHA financing but also enhances overall financial stability, making the dream of homeownership more attainable. In 2025, the average mortgage insurance costs for FHA mortgages vary significantly based on borrowing ratings, underscoring the financial benefits of having a robust credit profile.

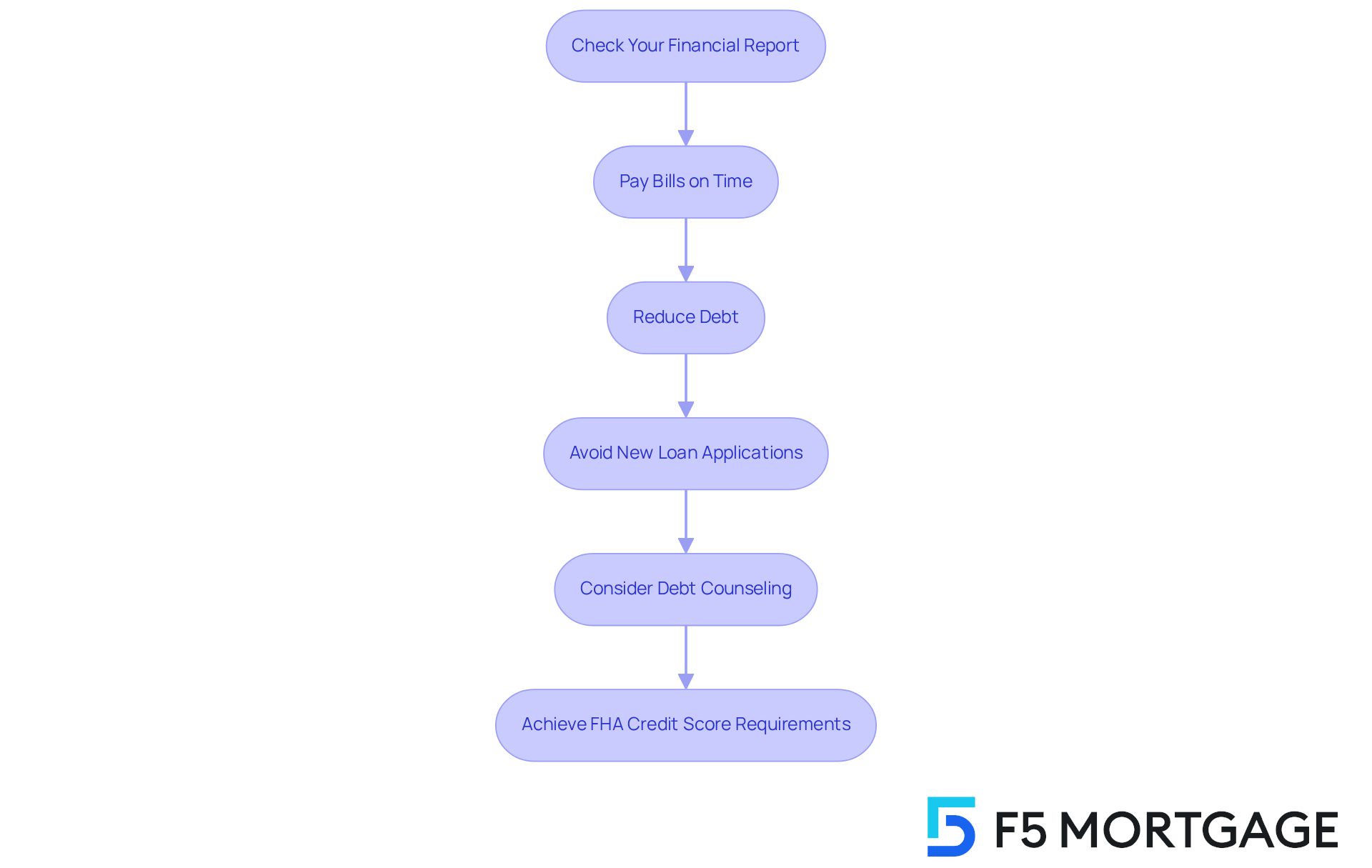

Steps to Improve Your Credit Score for FHA Loans

Enhancing your rating is a proactive step that can significantly increase your chances of meeting the FHA credit score requirements to qualify for an FHA loan. We understand how daunting this process can be, but there are effective strategies you can follow:

- Check Your Financial Report: Start by obtaining a free copy of your financial report from the three major bureaus at AnnualCreditReport.com. Regularly check it for mistakes and you find. This simple act can lead to a more accurate assessment. As Equifax reminds us, “You should frequently examine items on your report, such as personal information, accounts, collections, bankruptcies, and inquiries.”

- Pay Bills on Time: One of the most impactful ways to improve your financial rating is by paying your bills on time. Setting up reminders or automatic payments can help you avoid missing deadlines, which is crucial for maintaining a positive payment history.

- Reduce Debt: Aim to lower your credit card balances and overall debt. Keeping your utilization ratio under 30%—the amount of borrowed funds compared to your total credit limit—can positively influence your rating and demonstrate responsible financial management.

- Avoid New Loan Applications: Each time you apply for new financing, a hard inquiry appears on your report, which can temporarily lower your rating. It’s wise to limit new applications while you focus on improving your financial profile to prevent unnecessary declines.

- Consider Debt Counseling: If managing your debt feels overwhelming, seeking help from a counseling service can provide you with personalized strategies to enhance your financial well-being and borrowing profile.

By following these steps, you can work towards achieving a financial rating that satisfies FHA credit score requirements, ultimately paving the way for a successful mortgage application. Many borrowers have shared their success stories of significantly increasing their credit scores before applying for FHA loans, often seeing improvements within just a few months by diligently implementing these strategies that meet FHA credit score requirements. Remember, we’re here to support you every step of the way.

Conclusion

FHA loans serve as a vital pathway to homeownership, especially for those who encounter difficulties in securing traditional financing. By grasping and meeting the FHA credit score requirements, prospective borrowers can open doors that make purchasing or upgrading a home more achievable. These loans not only lower the entry barrier with minimal down payments but also offer essential support for first-time homebuyers and those with unique financial situations.

It’s important to recognize the significance of maintaining a strong credit profile, as credit scores directly impact loan eligibility and borrowing terms. With a minimum score of 580 needed for favorable conditions, it becomes evident that proactive measures—like timely bill payments, reducing debt, and regularly reviewing financial reports—are vital strategies for potential FHA borrowers. Furthermore, the existence of down payment assistance programs enhances the accessibility of FHA financing.

Ultimately, the importance of understanding FHA credit score requirements cannot be emphasized enough. As individuals take control of their financial health and strive to improve their credit ratings, they not only set themselves up for better mortgage conditions but also contribute to their long-term financial stability. By embracing these strategies and resources, families can empower themselves to realize their dream of homeownership, ensuring that the pathway to a new home remains open for everyone.

Frequently Asked Questions

What are FHA loans?

FHA loans are mortgages backed by the Federal Housing Administration that help individuals who may struggle to qualify for traditional financing due to credit score requirements or limited savings.

Who can benefit from FHA loans?

FHA loans are particularly beneficial for first-time homebuyers and individuals with unique financial situations, allowing them to secure financing with as little as 3.5% down.

What is the significance of the down payment requirement for FHA loans?

The lower down payment requirement of 3.5% significantly reduces the barrier to entry for many families looking to purchase their first home or upgrade their current living situation.

What percentage of total mortgage balances did FHA financing account for in 2025?

In 2025, FHA financing accounted for around 12% of total mortgage balances, highlighting its vital role in the housing market.

What are some benefits of FHA mortgages?

FHA mortgages offer competitive interest rates and lower closing costs, making them an attractive option for families seeking homeownership.

What is the importance of understanding the mortgage approval process?

Understanding the mortgage approval process is crucial, as it indicates that a lender views you as a suitable candidate for a mortgage based on your financial information, which must meet FHA credit score requirements.

What down payment assistance programs are available alongside FHA financing?

Various down payment assistance programs include: – The MyHome Assistance Program in California, offering up to 3% of the home’s purchase price. – The My Choice Texas Home program in Texas, providing up to 5% for down payment and closing assistance. – The Florida Assist Second Mortgage Program in Florida, which can offer up to $10,000 for upfront costs.

How do FHA loans and down payment assistance programs empower families?

FHA loans and down payment assistance programs help families navigate the mortgage landscape, making the dream of homeownership more accessible and achievable.