Overview

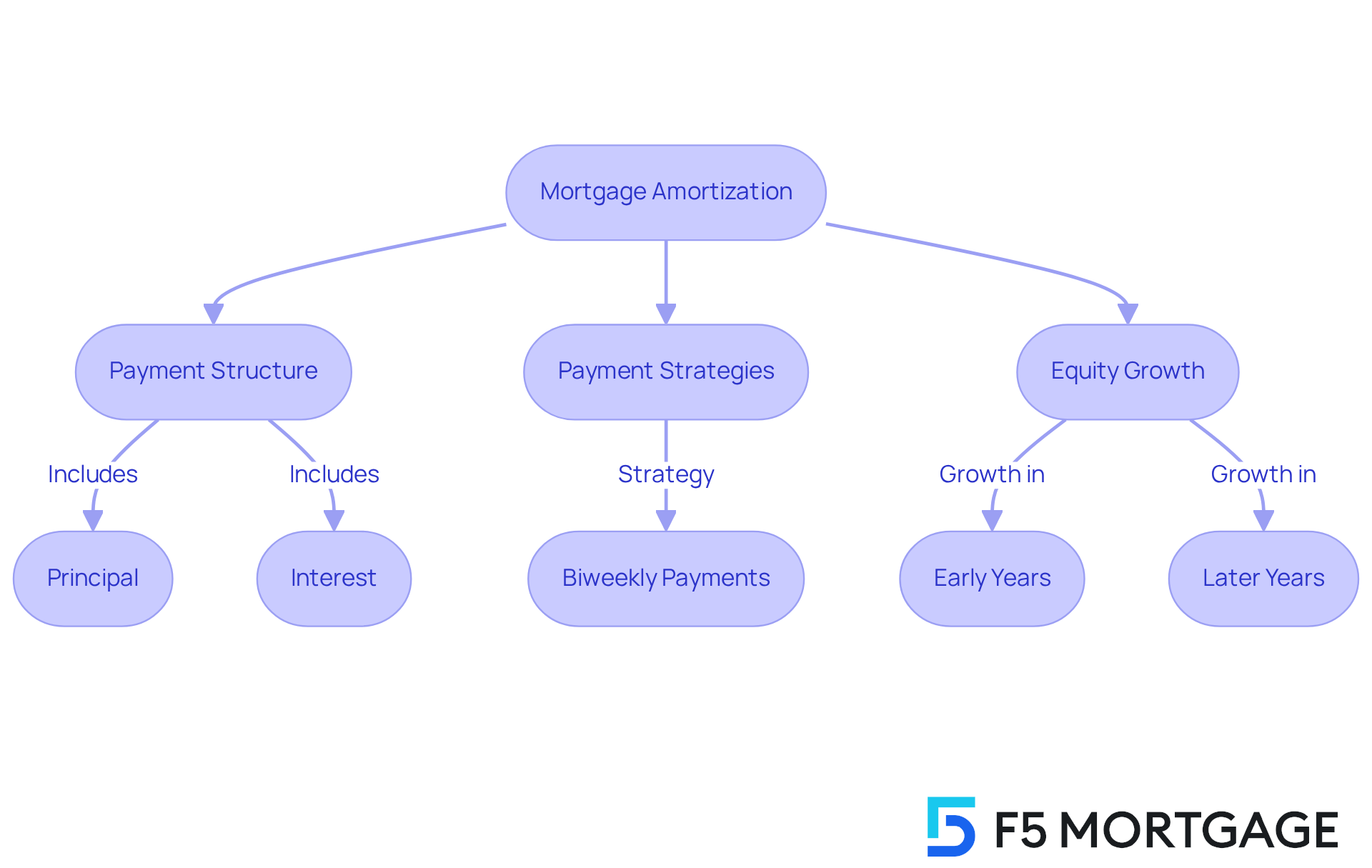

Mortgage amortization is a vital process for families looking to upgrade their homes. We understand how challenging this can be, as it involves systematically repaying home loans through regular payments that gradually reduce the principal over time. This process not only impacts overall costs but also influences equity growth.

By grasping this concept, families can make informed financial decisions. For instance, opting for biweekly payments or refinancing can lead to significant savings and quicker loan repayment. We’re here to support you every step of the way, helping you align these choices with your long-term financial goals.

Remember, understanding mortgage amortization empowers you to take control of your financial future. Explore these options and see how they can work for you!

Introduction

Understanding the intricacies of mortgage amortization is essential for families aspiring to upgrade their homes and make informed financial decisions. We know how challenging this can be. This process not only dictates how monthly payments are structured but also significantly influences the total cost of homeownership and the speed at which equity is built. However, navigating the various strategies and choices available can feel overwhelming.

For instance, consider the implications of:

- Shorter amortization periods

- Longer amortization periods

- Potential savings from making extra payments

How can families leverage this knowledge to enhance their financial well-being while achieving their homeownership dreams? We’re here to support you every step of the way.

Define Mortgage Amortization and Its Importance

Amortization mortgage is an essential process for repaying your home debt through regular, equal contributions over a specified term. Each payment consists of two parts: principal and interest. At the beginning, a larger portion of your payment goes toward interest, but as time goes on, more of your installment is applied to the principal. This shift is crucial for homeowners, as it directly impacts the total cost paid over the life of the loan and the pace at which you build equity in your home.

For families looking to upgrade their homes, understanding amortization mortgage is vital for making informed financial decisions. For instance, consider a 30-year fixed-rate home loan of $100,000 at a rate of 7.75%. This results in of approximately $716.41. Acknowledging not just the monthly payment, but also how much of it contributes to equity versus the cost of borrowing, is significant.

Moreover, the advantages of understanding amortization go beyond simple calculations. Homeowners who grasp this concept can strategically manage their expenses. For example, making biweekly payments instead of monthly ones means you’ll make 26 payments a year, allowing you to reduce your principal more quickly and lower your overall financing costs. This strategy can lead to substantial savings over time, enabling families to pay off their loans sooner than usual.

Additionally, comprehending how the amortization mortgage influences home equity is essential. In the early years of a mortgage, equity tends to grow slowly due to higher interest costs. However, as you continue to make payments, your equity increases at a faster rate, providing you with greater financial flexibility. This knowledge empowers families to make decisions that align with their long-term financial goals, such as refinancing for a shorter repayment period to reduce total interest, even if it means higher monthly payments.

In summary, a solid understanding of amortization mortgage equips families with the tools they need to navigate the complexities of home financing. This ensures you choose mortgage options that align with your financial aspirations and enhance your overall wealth-building strategy. We know how challenging this can be, and we’re here to support you every step of the way.

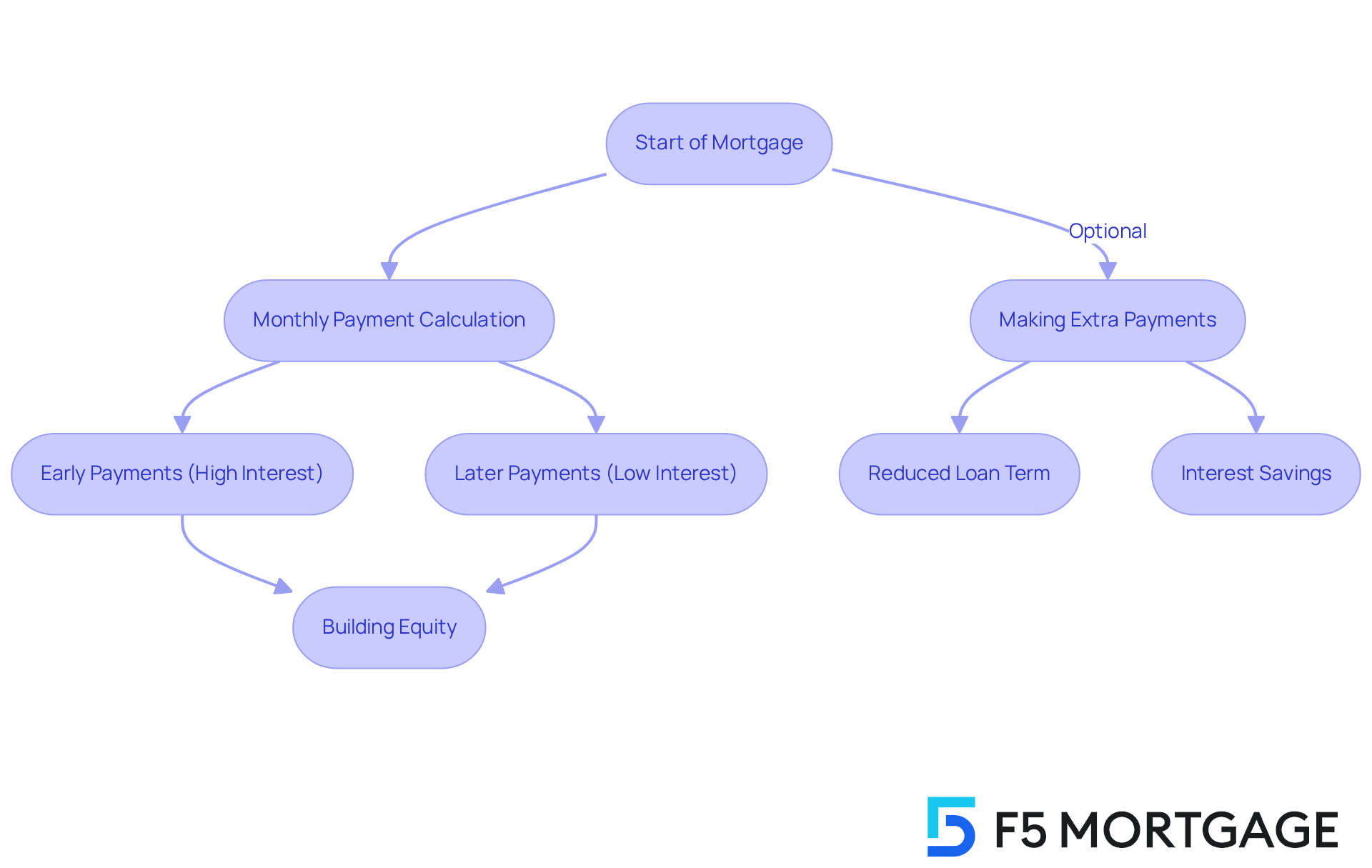

Explain How Mortgage Amortization Works

Understanding amortization mortgage is crucial for your financial journey, even though it can feel overwhelming. This process of amortization mortgage involves distributing the total amount borrowed over a specified term, typically ranging from 15 to 30 years. Each monthly installment in an amortization mortgage is determined by a formula that considers the principal sum, interest rate, and duration. In the early stages of an amortization mortgage, a significant portion of each payment goes toward fees, while a smaller amount reduces the principal balance. As time goes on, the principal of your amortization mortgage decreases, leading to a reduction in the fee portion of your payment. This shift indicates that an amortization mortgage allows you to gradually build equity in your home.

For instance, if you take out an amortization mortgage with a 30-year fixed rate of $400,000 at a 6.5% interest rate, you may end up paying over $510,000 in total. We understand how important it is for families to grasp this breakdown, as it highlights the impact of making extra payments. By contributing an additional $100 each month to the principal, you could pay off your loan approximately 38 months earlier and save nearly $63,917 in interest costs.

Financial advisors often remind us that while your overall loan payment remains consistent, the amortization mortgage influences how it’s divided between principal and interest over time. Knowing this can empower families to make informed decisions about their financing strategies. We’re here to support you every step of the way as you work toward improving your financial well-being and .

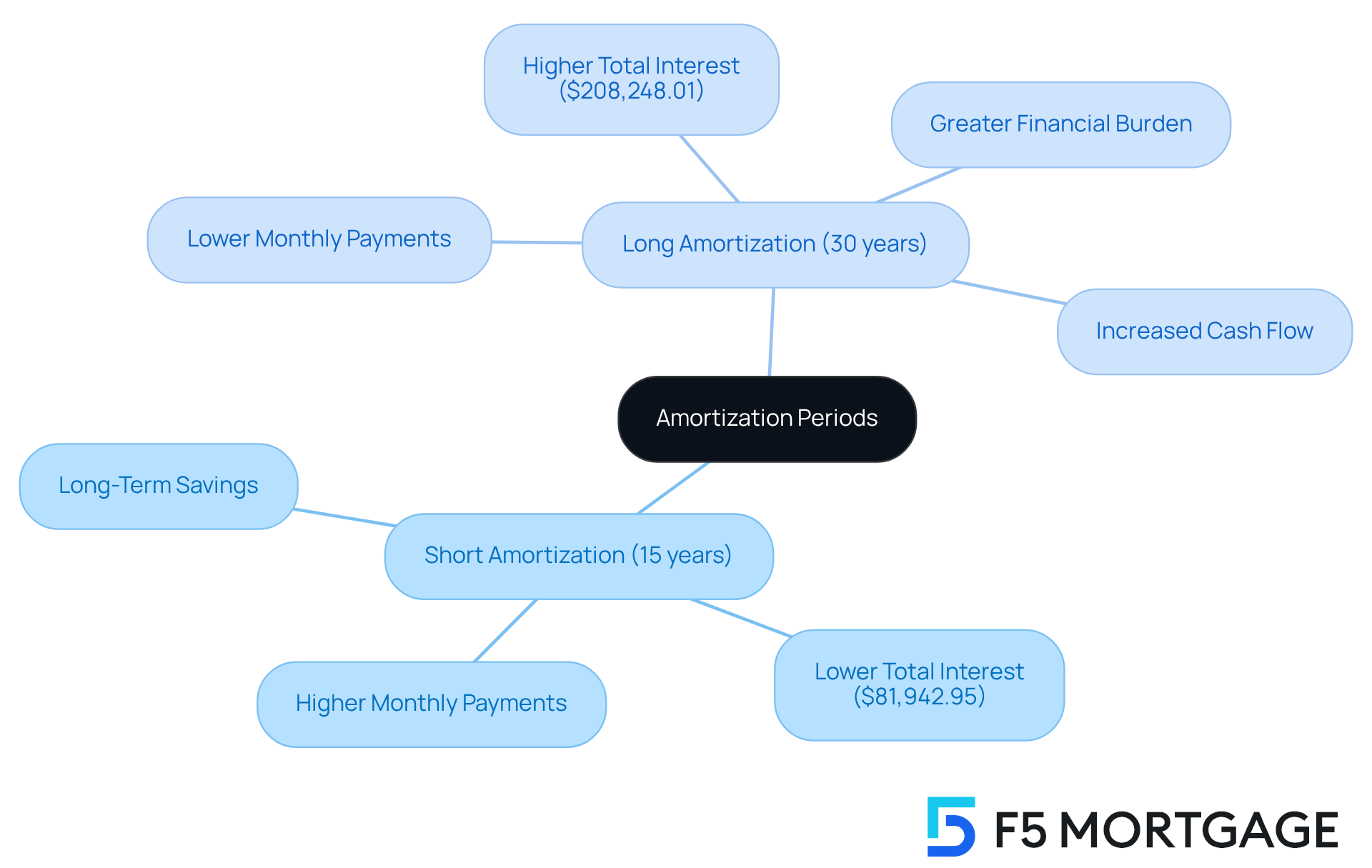

Discuss Amortization Periods: Short vs. Long

The amortization mortgage durations for loans typically span from 15 to 30 years, with each choice carrying its own financial implications. We understand how challenging this can be. A shorter amortization mortgage duration, such as 15 years, results in higher monthly payments, but it significantly reduces the total expense incurred over the life of the loan. For instance, a 15-year mortgage might come with a total interest cost of around $81,942.95, starkly contrasting with a 30-year mortgage that can accumulate over $208,248.01 in interest. This difference highlights the potential savings for families who can manage the increased monthly costs associated with shorter terms.

Conversely, an amortization mortgage with a longer period, like 30 years, lowers monthly payments, making homeownership more accessible for families on tighter budgets. This option can enhance cash flow, allowing families to qualify for larger loans. However, it also leads to higher overall expenses, which can become a significant financial burden over time. For example, families opting for a 30-year mortgage might incur an additional CAD 260,000 in costs over five years compared to a shorter term.

Mortgage experts emphasize the importance of aligning the choice of amortization mortgage period with individual financial situations and long-term goals. Penelope Graham notes that while extended amortization mortgage durations reduce monthly costs, they lead to greater overall interest charges. Families must carefully evaluate their current financial capabilities against their future plans. For instance, a family planning to stay in their home for many years may find a shorter amortization period advantageous for long-term savings, while those prioritizing lower monthly payments might prefer a longer term.

Ultimately, the decision between short and long periods for an amortization mortgage should be guided by a thorough understanding of how these choices impact overall financial health and homeownership aspirations. At F5, we’re here to support you every step of the way. Families can explore quick and adaptable financing solutions tailored to their needs, ensuring they achieve homeownership with exceptional service and competitive rates. Additionally, F5 Mortgage offers a no-obligation quote and boasts a 4.9 rating from over 300 reviews, reflecting high customer satisfaction. Understanding the approval process is also essential, as it helps families identify their financing options and advantages, empowering them to make informed choices regarding their funding strategy.

Outline Strategies to Reduce Your Amortization Period

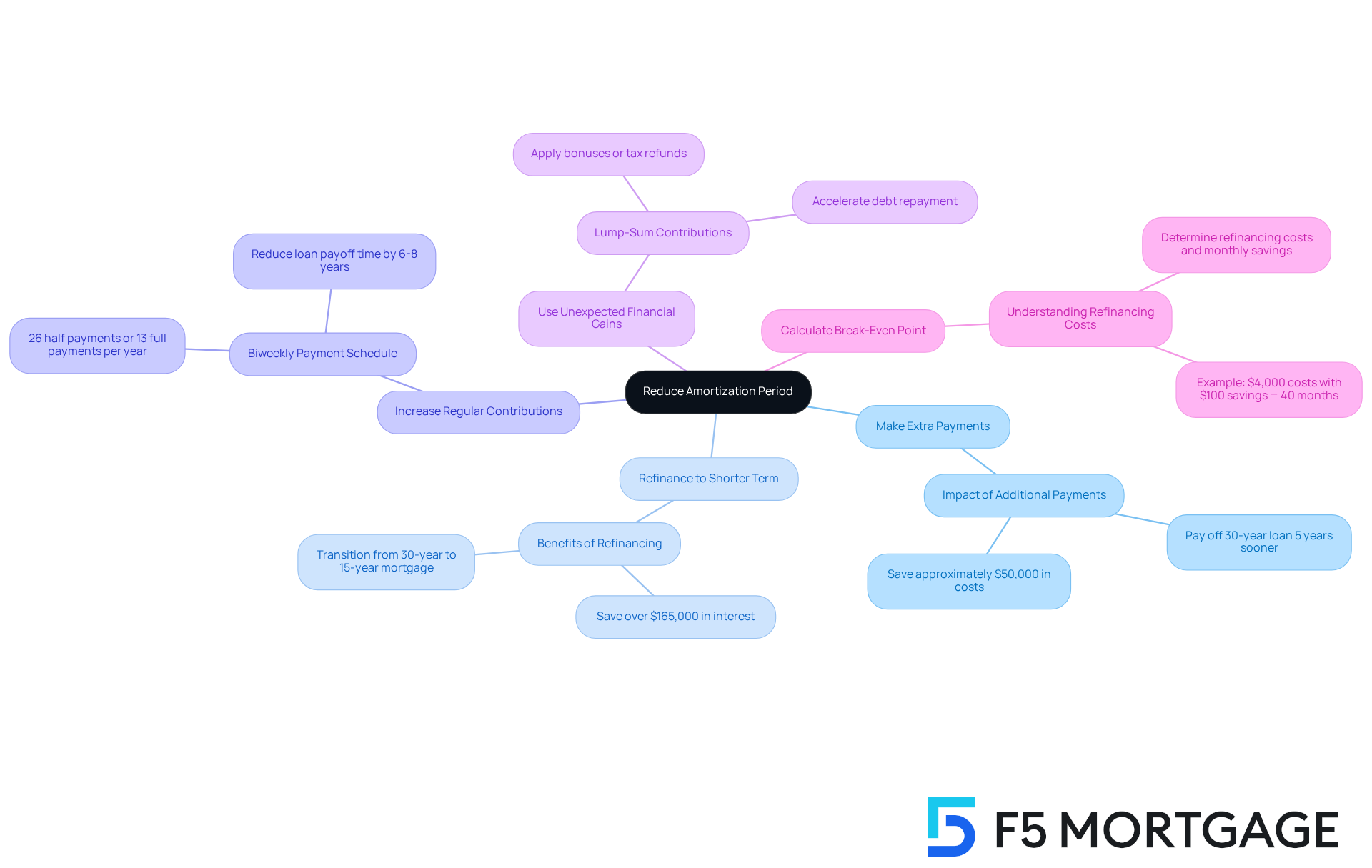

To effectively reduce your mortgage amortization period, consider implementing these compassionate strategies:

- Make Extra Payments: We understand how daunting a mortgage can feel. Allocating extra funds toward your principal can significantly reduce your term and lower overall financing costs on your amortization mortgage. For instance, making just one additional payment annually on an amortization mortgage can lead to paying off a 30-year loan nearly five years sooner, saving homeowners about $50,000 in costs.

- If current rates are favorable, refinancing to a shorter term can not only decrease your rate but also lessen the total cost paid over the life of the amortization mortgage. Transitioning from a 30-year loan to a 15-year amortization mortgage can , helping them attain homeownership more quickly. Given the recent decline in mortgage rates in Colorado, now is an excellent time to explore refinancing options with F5 Mortgage, where you can benefit from streamlined processes and competitive rates tailored to your needs.

- Increase Regular Contributions: We know how challenging it can be to manage monthly payments. Opting for a biweekly contribution schedule instead of the typical monthly contributions leads to 26 half contributions or 13 full contributions each year. This method can reduce the amortization mortgage loan payoff time by 6 to 8 years, providing substantial savings on interest. As financial specialist Ben Geier observes, “A biweekly loan repayment schedule can save you time and money.”

- Consider using unexpected financial gains, like bonuses or tax refunds, to make lump-sum contributions toward your amortization mortgage. This approach can significantly reduce your principal balance, accelerate debt repayment through an amortization mortgage, and help combat lifestyle inflation by redirecting extra income toward financial goals. For example, applying a bonus towards your mortgage can greatly ease your debt without impacting your regular budget.

- Calculate Your Break-Even Point: Understanding the duration required to recover the expenses of refinancing through savings in monthly charges is essential. To calculate your break-even point, determine your refinancing costs, calculate your monthly savings by subtracting your new monthly payment from your current one, and divide your refinancing costs by your monthly savings. For instance, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This analysis helps ensure that refinancing makes financial sense for your situation.

By adopting these strategies, families can navigate the complexities of amortization mortgage financing more efficiently and work towards achieving their homeownership aspirations sooner. We’re here to support you every step of the way, especially with the dedicated assistance and competitive options available through F5 Mortgage.

Conclusion

Understanding mortgage amortization is essential for families looking to upgrade their homes. It lays the groundwork for making informed financial decisions. By grasping how amortization works, families can better manage their mortgage payments, build equity, and ultimately secure their financial future. We know how challenging this can be, but knowledge of this process not only enhances awareness of monthly obligations but also empowers families to explore strategies that can lead to significant savings over time.

Key insights from the article highlight the importance of recognizing how each payment is divided between principal and interest. Understanding the implications of choosing between short and long amortization periods is vital. Moreover, effective strategies to reduce the overall amortization period can make a real difference. Families can save substantial amounts in interest costs through methods such as:

- making extra payments

- refinancing

- opting for biweekly payment schedules

These strategies provide a pathway to financial flexibility and the homeownership aspirations that many families hold dear.

Ultimately, the journey of understanding and mastering mortgage amortization is a vital step toward achieving long-term financial goals. Families are encouraged to take proactive measures—whether through further education on mortgage options or consulting with financial experts—to ensure they are making the best choices for their unique situations. By doing so, they can enhance their financial well-being and secure a brighter future in their homes. We’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage amortization?

Mortgage amortization is the process of repaying home debt through regular, equal payments over a specified term, consisting of both principal and interest.

How does the payment structure change over the life of a mortgage?

At the beginning of the mortgage, a larger portion of the payment goes toward interest, but over time, more of the payment is applied to the principal.

Why is understanding mortgage amortization important for homeowners?

Understanding mortgage amortization is crucial for homeowners as it impacts the total cost paid over the life of the loan and the rate at which they build equity in their home.

Can you provide an example of a mortgage payment?

For a 30-year fixed-rate home loan of $100,000 at a rate of 7.75%, the monthly payment would be approximately $716.41.

How can homeowners manage their expenses related to amortization?

Homeowners can manage expenses by making biweekly payments instead of monthly ones, which allows them to make 26 payments a year and reduce the principal more quickly, ultimately lowering overall financing costs.

How does amortization affect home equity over time?

In the early years of a mortgage, equity grows slowly due to higher interest costs, but as payments continue, equity increases at a faster rate, providing greater financial flexibility.

What financial strategies can families consider based on their understanding of amortization?

Families can consider refinancing for a shorter repayment period to reduce total interest, even if it results in higher monthly payments, aligning with their long-term financial goals.

How does a solid understanding of amortization benefit families?

A solid understanding of amortization equips families with the knowledge to navigate home financing complexities and choose mortgage options that align with their financial aspirations and wealth-building strategies.