Overview

Navigating the process of assuming a VA loan can feel overwhelming, but we’re here to support you every step of the way. Typically, this process takes about 45 to 60 days, depending on the lender’s processing times and how complete your documentation is.

We understand how important it is to have everything in order, and you can help expedite this timeline by ensuring that all required documents are submitted accurately and on time. Remember, the assumption process is generally quicker than applying for a new mortgage, making it a more attractive option for many buyers.

By taking these proactive steps, you can ease some of the stress associated with the loan assumption process. We know how challenging this can be, but with the right preparation, you can move forward with confidence.

Introduction

Navigating the complexities of home financing can be daunting, especially when it comes to assuming a VA loan. We understand how challenging this can be. This unique option allows buyers to take over an existing mortgage, often at a more favorable interest rate than what’s currently available. By understanding the key steps and benefits of this process, potential homeowners can unlock significant savings and streamline their path to ownership.

However, the timeline for assuming a VA loan can vary widely. This raises an important question: how long does it really take to complete this transaction, and what factors can influence the duration? We’re here to support you every step of the way.

Understand VA Loan Assumptions

When considering a VA mortgage transfer, many buyers wonder how long does it take to assume a VA loan, including its interest rate and outstanding balance. This can be particularly beneficial if the original terms include a lower interest rate than what is currently available in the market. To qualify for a VA loan transfer, buyers need to meet specific lender requirements, including creditworthiness and income verification. Understanding these fundamentals is essential, as they can lead to significant savings and a smoother home-buying experience.

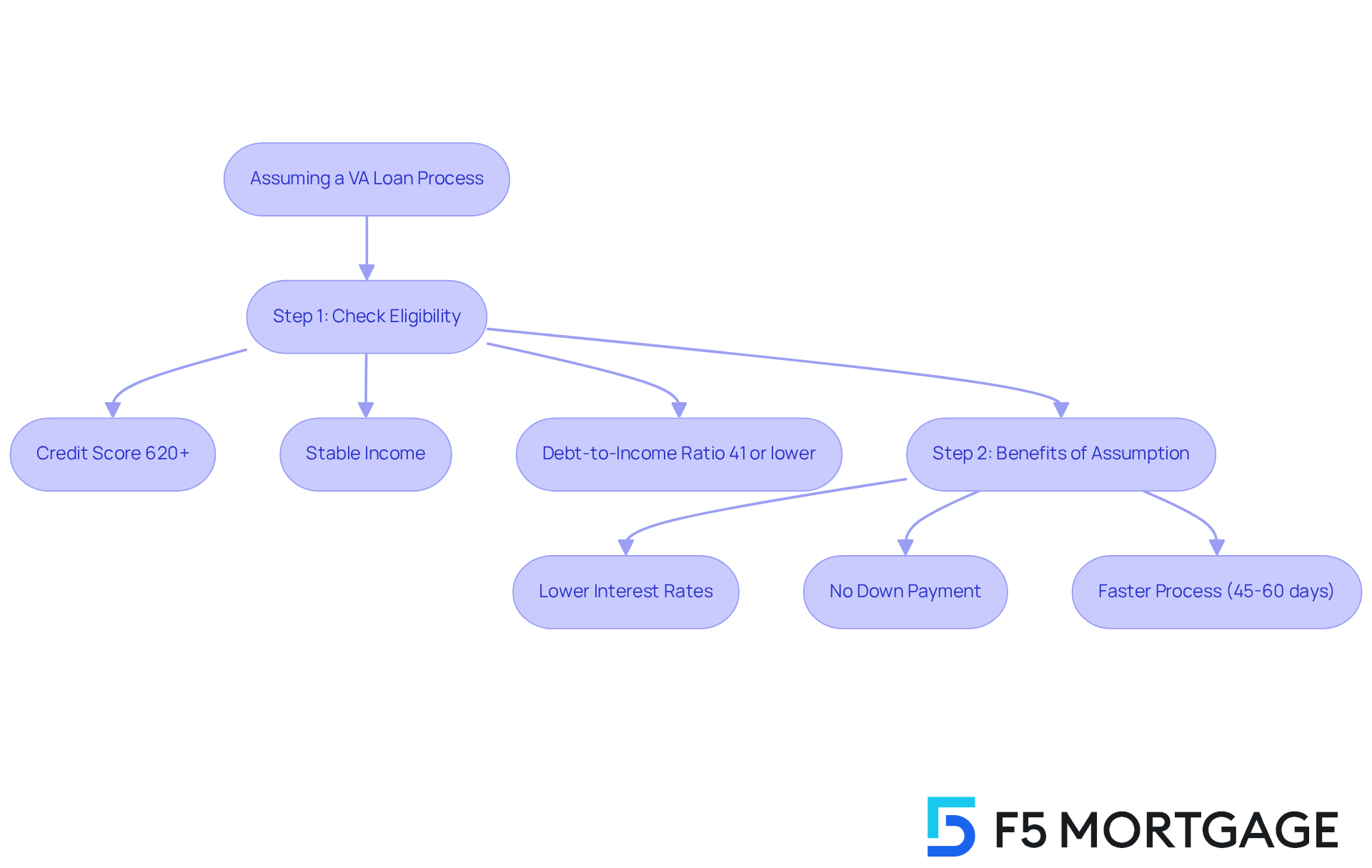

Key Benefits of VA Loan Assumptions

- Lower Interest Rates: Buyers can enjoy interest rates that are often more favorable than those in the current market. Approximately 84% of VA homeowners benefit from mortgage rates under 5%, making this an appealing option for families looking to upgrade their homes and save money.

- Streamlined Process: In terms of how long does it take to assume a VA loan, the assumption process can be quicker than applying for a new mortgage, typically taking just 45-60 days. This efficiency aligns with F5 Mortgage’s commitment to providing fast and flexible mortgage solutions, including options like the VA Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinance, which can further enhance affordability and access to home equity.

- No Down Payment: Many VA financial products do not require a down payment, making it easier for buyers to enter the housing market. This feature empowers families to achieve homeownership without the stress of upfront costs.

Eligibility Criteria

- Buyers do not need to be veterans to assume a VA loan, but they must meet the lender’s criteria for credit and income. Generally, this means having a credit score of 620 or higher, stable income, and a debt-to-income ratio of 41% or lower. Additionally, the VA Funding Fee for taking over a mortgage is only 0.5% of the mortgage balance, which can be included in the mortgage, further enhancing affordability.

Experts point out that when considering how long does it take to assume a VA loan, it can significantly lower monthly payments, especially if the current financing was secured at a lower rate. This not only makes homeownership more accessible but also allows buyers to bypass some standard lending requirements, ultimately improving their financial situation. However, it’s important to be aware that VA homeowners risk losing their VA benefit entitlement if the mortgage is assumed by a civilian without a substitution of entitlement. While for VA assumption agreements, they may be covered by the assumer. Chris Birk, Vice President of Mortgage Insight, emphasizes, “Assuming a VA mortgage can be a huge advantage if the existing financing was taken out at a lower rate since it will reduce the monthly payments and total interest paid over the life of the financing.

Follow the Steps to Assume a VA Loan

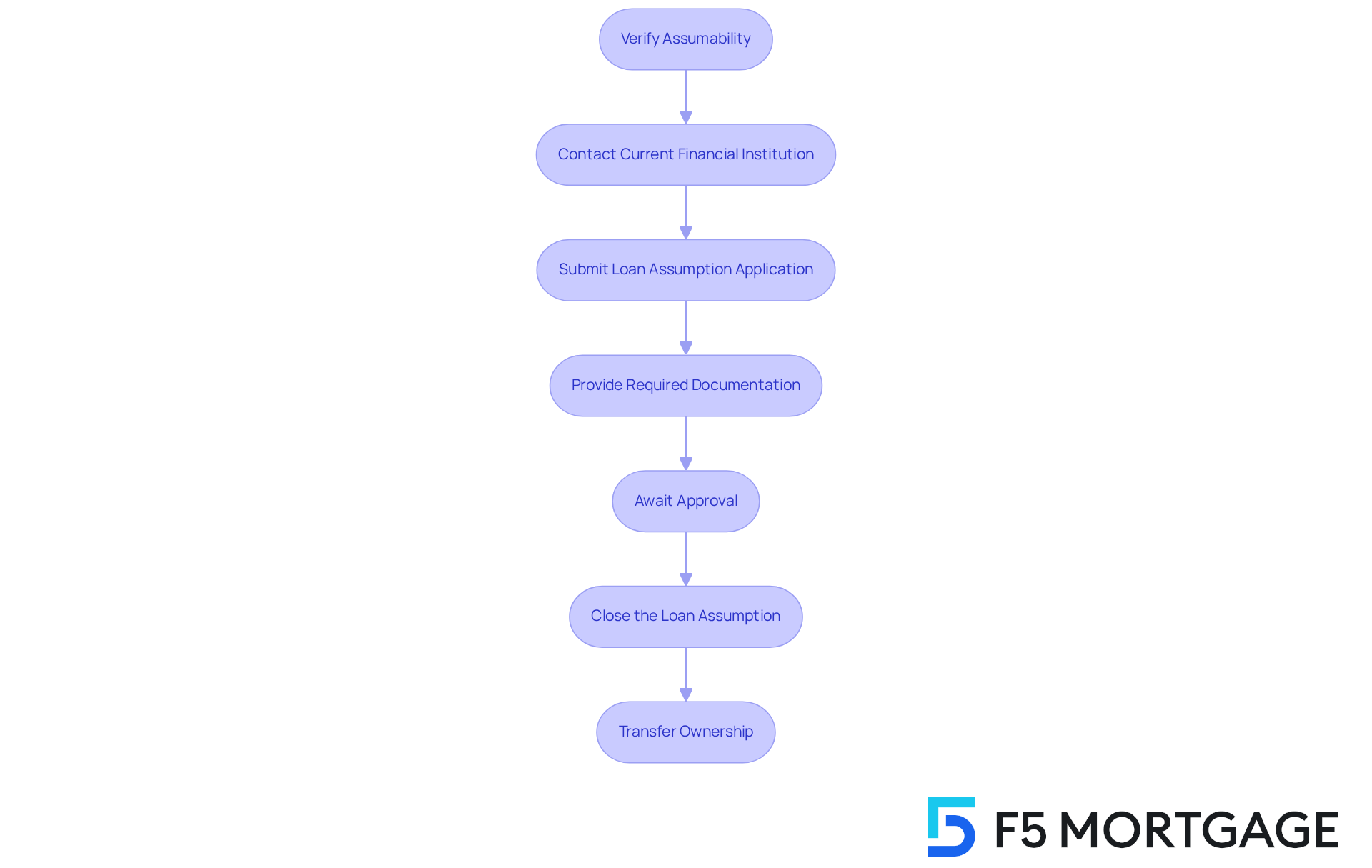

To successfully assume a VA loan, follow these essential steps:

- Verify Assumability: We know how challenging this can be, so start by . Not all credits qualify, and it’s crucial to check with the current provider.

- Contact the Current Financial Institution: Reach out to the provider to express your intention to assume the loan. They will provide specific instructions and requirements tailored to your situation, guiding you through the process.

- Submit a Loan Assumption Application: Complete the necessary application forms supplied by the financial institution. This typically includes personal information and financial details, ensuring they have everything they need to assist you.

- Provide Required Documentation: Gather and submit all necessary documents, such as proof of income and credit history. We understand that this can feel overwhelming, but having organized records can speed up the procedure.

- Await Approval: The financial institution will review your application and documentation. The question of how long does it take to assume a VA loan can be answered by noting that this process can take anywhere from 30 to 60 days, depending on the lender’s workload and the intricacy of the financing. We’re here to support you every step of the way.

- Close the Loan Assumption: Once approved, you will need to sign the assumption agreement and any other closing documents. Be ready to cover relevant charges, such as the VA funding fee, which is generally about 0.5% of the amount borrowed. Assuming a lower-rate VA financing option can save you money on monthly payments compared to applying for a new mortgage.

- Transfer Ownership: After closing, the financing will be officially transferred to you, and you will assume responsibility for the mortgage payments. This efficient procedure enables you to take advantage of possibly lower interest rates and decreased closing expenses compared to acquiring a new credit. Furthermore, if the purchaser is not a Veteran, the seller’s entitlement can stay linked to the assumed financing until payoff, which may restrict the seller’s capacity to utilize a new VA mortgage. Remember, you’re not alone in this process; we’re here to help you navigate it with confidence.

Identify Factors Affecting the Timeline

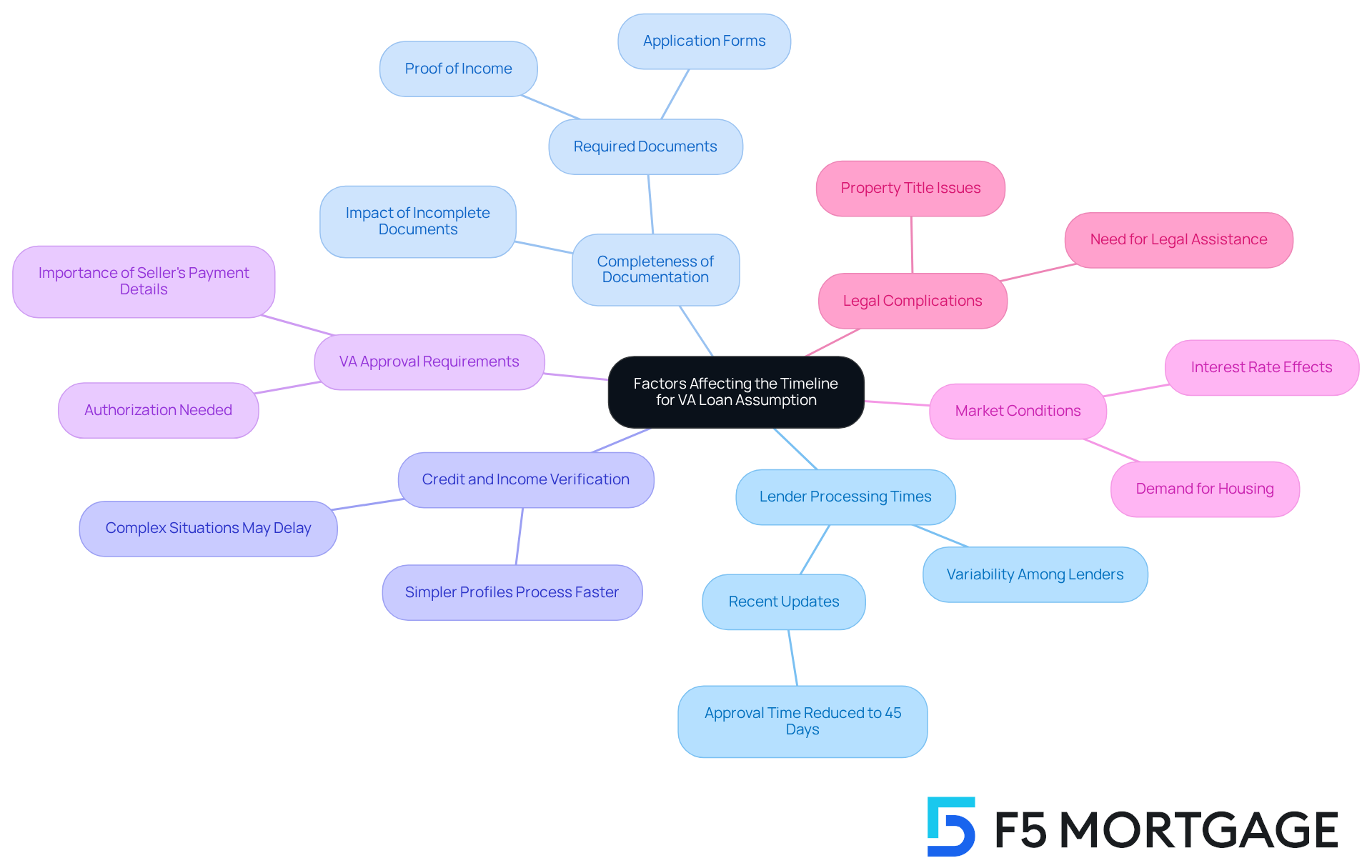

Several factors can significantly influence the timeline, and we understand how long does it take to assume a VA loan is important for you. Here’s what you need to know:

- Lender Processing Times: Processing times can vary widely among lenders. The time frame for how long it takes to assume a VA loan can vary, with some completing the process in as little as 30 days, while others may take up to 90 days or more. This variability often stems from each lender’s operational efficiency and current workload. Recent updates have notably shortened the average approval timeframe for VA financing transfers from 90-120 days to only 45 days, according to VA Circular 26-23-27.

- Completeness of Documentation: We know how challenging it can be when documentation is incomplete or incorrect, which is a frequent reason for delays in the VA financing assumption procedure. Ensuring that all required documents are submitted accurately and in full can expedite the timeline considerably. Additionally, buyers should be prepared to cover any difference between the purchase price and the remaining principal when taking over a VA mortgage.

- Credit and Income Verification: The duration for verifying a buyer’s creditworthiness and income can differ based on the complexity of the buyer’s financial situation. Buyers with straightforward financial profiles may experience quicker verification, while those with more intricate circumstances could face extended timelines. A strong credit history is crucial to streamline this procedure, and we’re here to support you every step of the way.

- VA Approval Requirements: In some cases, the VA must authorize the loan transfer, which can add extra time to the procedure. Understanding the can help manage expectations. Moreover, possessing up-to-date payment details from the seller can greatly accelerate the transition.

- Market Conditions: External factors like elevated demand for housing or a backlog of applications can also hinder the transition. As interest rates climb, the attractiveness of assumable VA options grows, potentially resulting in greater application volumes.

- Legal Complications: Legal issues can emerge during the VA mortgage transfer, particularly regarding property title matters or ongoing legal actions associated with the property or financing terms. These complications may require legal assistance and can prolong the timeline.

By understanding these elements, you can more effectively manage the VA financing transfer and better assess how long does it take to assume a VA loan for completion. Remember, we’re here to help you navigate this process with confidence.

Prepare Required Documentation

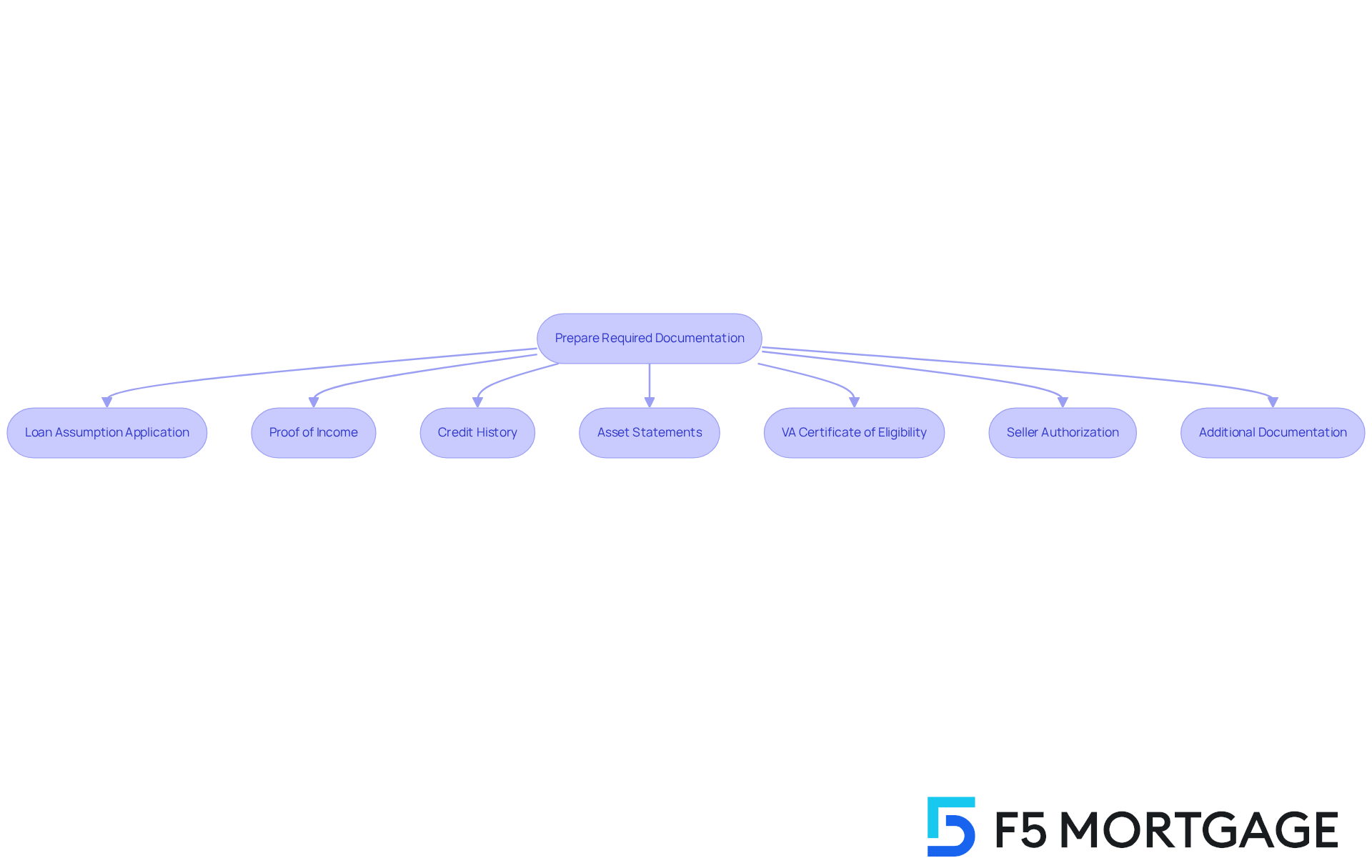

To facilitate a seamless VA loan assumption process, we understand how long does it take to assume a VA loan and the importance of gathering the necessary documentation. Here’s what you’ll need:

- Loan Assumption Application: Begin by completing the refinancing application form provided by F5 Mortgage. Be sure to include details such as Social Security numbers, bank statements, tax returns, and pay stubs.

- Proof of Income: It’s essential to include recent pay stubs, W-2 forms, and tax returns from the past two years to demonstrate your financial capability.

- Credit History: Providing a credit report is crucial. F5 Mortgage may obtain this directly to assess your creditworthiness.

- Asset Statements: Submit your bank statements and other asset documentation to showcase your financial stability.

- VA Certificate of Eligibility: If applicable, include this document to confirm your eligibility for VA benefits.

- Seller Authorization: Make sure to obtain a signed consent from the current loan holder, allowing the transfer of the loan.

- Additional Documentation: Depending on F5 Mortgage’s requirements, you may need to provide further documents, such as proof of employment or a letter addressing any credit issues.

Thorough preparation of these documents is vital. We know how challenging this can be, and may occur during the transition. For instance, ensuring that all financial statements are current and accurately reflect your situation can prevent delays. Case studies suggest that applicants who carefully prepare their documentation often encounter a smoother approval procedure. This highlights the significance of thoroughness in this crucial step.

Additionally, be aware that closing costs will apply when assuming a VA loan. These can include fees such as the assumption fee and other related costs. Consulting with F5 Mortgage professionals can provide valuable insights into how long does it take to assume a VA loan and help you avoid common pitfalls in the refinancing application process. We’re here to support you every step of the way.

Conclusion

Understanding the timeline and process for assuming a VA loan can truly be a game changer for prospective homebuyers. This guide highlights how advantageous it can be to take over an existing VA mortgage, especially with the potential for lower interest rates and reduced closing costs. By grasping the essential steps involved, buyers can navigate the assumption process with confidence and clarity.

Key insights reveal the streamlined nature of the VA loan assumption, which can typically be completed in 45 to 60 days, depending on various factors such as lender processing times and the completeness of documentation. The benefits of assuming a VA loan—such as no down payment requirements and the possibility of significant savings on monthly payments—make it an appealing option for many families. Additionally, understanding the eligibility criteria and preparing the necessary documentation can further simplify the process and help avoid common pitfalls.

In conclusion, the VA loan assumption process offers a unique opportunity for buyers to step into homeownership with favorable terms. By taking proactive steps and being well-informed about the requirements and potential challenges, individuals can leverage this option to achieve their homeownership goals. We know how challenging this can be, and embracing this knowledge not only empowers buyers but also highlights the importance of making informed financial decisions in today’s housing market.

Frequently Asked Questions

What is a VA loan assumption?

A VA loan assumption is the process of transferring the existing VA mortgage from the original borrower to a new buyer, allowing the buyer to take over the loan’s interest rate and outstanding balance.

How long does it typically take to assume a VA loan?

The assumption process for a VA loan typically takes about 45-60 days, which is generally quicker than applying for a new mortgage.

What are the key benefits of assuming a VA loan?

Key benefits include lower interest rates, a streamlined process, and no down payment requirement, making it easier for buyers to enter the housing market.

Do buyers need to be veterans to assume a VA loan?

No, buyers do not need to be veterans to assume a VA loan, but they must meet the lender’s criteria for credit and income.

What are the eligibility criteria for assuming a VA loan?

Buyers typically need a credit score of 620 or higher, stable income, and a debt-to-income ratio of 41% or lower. Additionally, there is a VA Funding Fee of 0.5% of the mortgage balance, which can be included in the mortgage.

What risks are associated with assuming a VA loan?

If the mortgage is assumed by a civilian without a substitution of entitlement, the original VA homeowner risks losing their VA benefit entitlement.

Are appraisals necessary for VA loan assumption agreements?

Appraisals are not necessary for VA loan assumption agreements, although they may be covered by the person assuming the loan.

How can assuming a VA loan impact monthly payments?

Assuming a VA loan can significantly lower monthly payments, especially if the existing financing was secured at a lower interest rate, making homeownership more accessible.