Overview

Finding the right local loan officer can feel overwhelming, but it’s an essential step in navigating the mortgage process. This guide is here to help you understand the importance of loan officers and how they can support you through this journey.

Start by researching potential loan officers. Look for those with experience, strong communication skills, and positive customer reviews. We know how challenging this can be, and taking these steps will empower you to make informed decisions about your financing options.

As you evaluate your choices, consider reaching out to loan officers directly. Ask them questions to gauge their responsiveness and willingness to help. Remember, this is about finding someone who understands your needs and can guide you effectively.

Ultimately, choosing the right loan officer can make all the difference in your mortgage experience. We’re here to support you every step of the way, ensuring you feel confident in your decisions and secure in your financing options.

Introduction

Navigating the complex world of mortgages can feel overwhelming, and finding the right loan officer is often a significant part of that journey. These dedicated professionals act as essential guides in the financing process, helping you understand your options and streamline your applications. We know how challenging this can be, which is why this article offers a comprehensive step-by-step guide to locating local loan officers. Our goal is to ensure you are equipped with the knowledge necessary to make informed choices.

But what criteria should you consider when evaluating potential candidates? How can you ensure you are making the best decision for your financial future? We’re here to support you every step of the way.

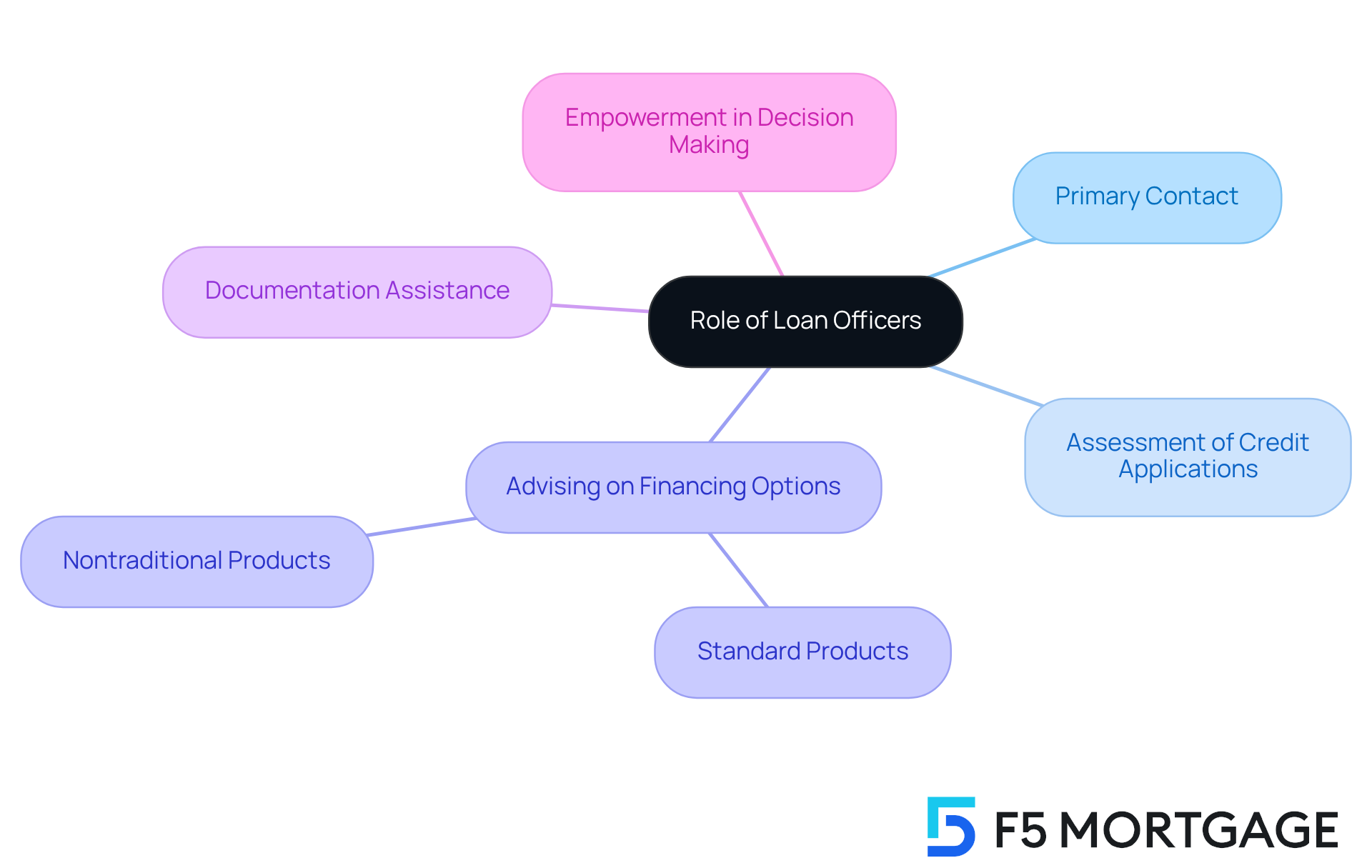

Understand the Role of Loan Officers

Loan officers near me are your primary point of contact between you and lenders. Loan officers near me play a vital role in your journey by assessing credit applications and advising you on the best financing options available. Understanding the can be overwhelming, but loan officers near me are available to assist you every step of the way.

They evaluate your financial circumstances and help you comprehend various credit options with the assistance of loan officers near me, including both standard and nontraditional products offered by F5 Mortgage. This guidance ensures that all required documentation is submitted smoothly, making the process less stressful for you.

Recognizing the value a mortgage specialist brings to your home purchasing or refinancing experience is essential. By exploring the different financing options available, you can feel empowered and supported in making informed decisions for your future.

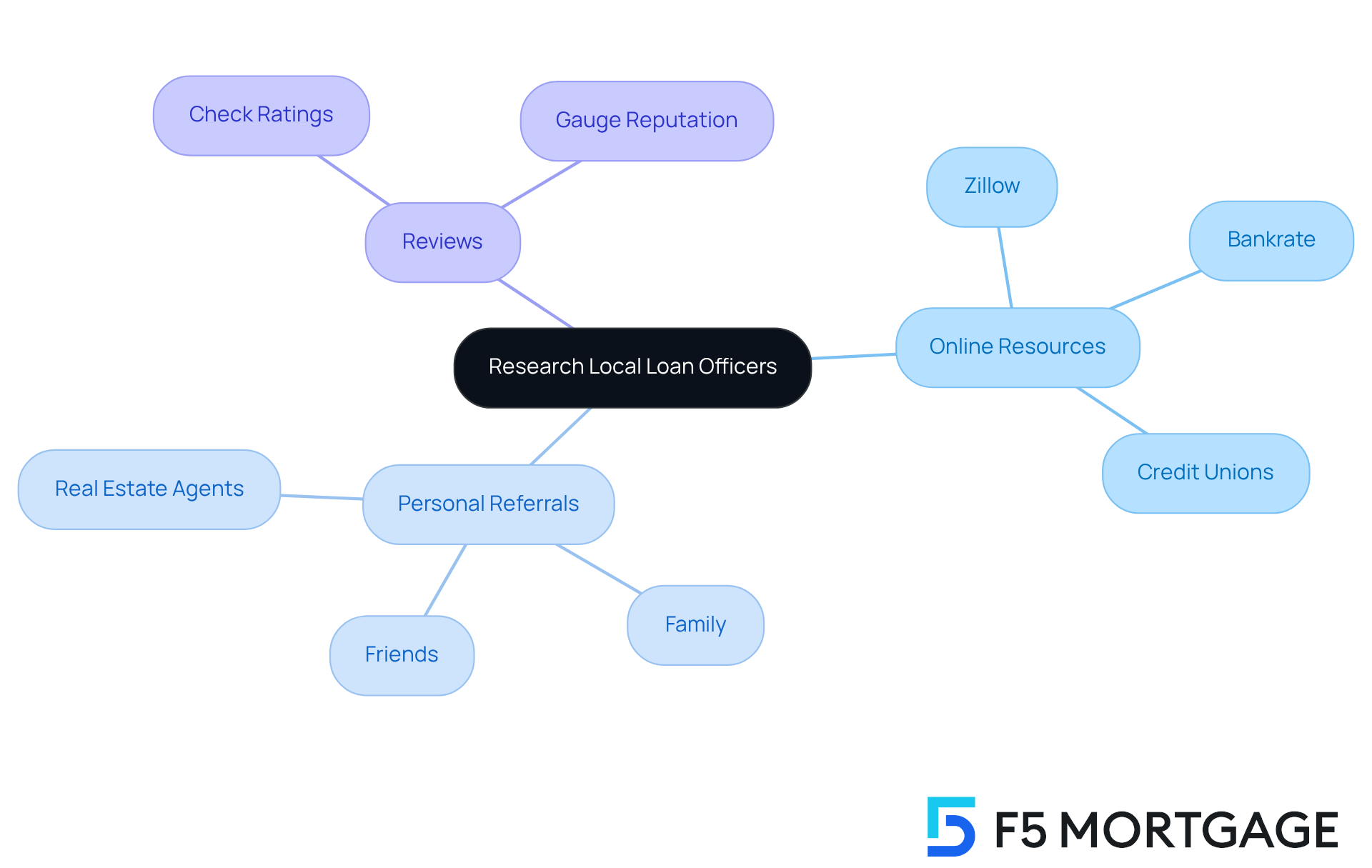

Research Local Loan Officers

Finding loan officers near me can feel overwhelming, but you’re not alone in this journey. Start by exploring online resources like mortgage brokerage sites, local bank directories, and real estate platforms. Websites such as Zillow, Bankrate, and nearby credit unions often showcase listings of loan officers near me who can assist you.

We know how important it is to find someone you can trust. Consider reaching out to friends, family, or real estate agents who have had positive experiences; their referrals can lead you to loan officers near me. As you gather potential candidates, take the time to check their online reviews and ratings. This step will help you gauge their reputation and the quality of service they provide.

Remember, you’re taking an important step towards securing your financial future, and we’re here to support you every step of the way. Make a list of your top choices, and don’t hesitate to ask questions when you connect with them. Your in this process are what matter most.

Evaluate Loan Officers Based on Key Criteria

When assessing , we know how challenging this can be. Consider the following criteria to help you make an informed decision:

- Experience: Seek professionals with a proven track record in the industry. Their experience can provide you with the confidence you need.

- Communication Skills: Choose someone who communicates clearly and promptly. You deserve to have someone who listens and responds to your concerns.

- Understanding of Lending Options: Ensure they are well-versed in various financing choices, including FHA, VA, and conventional mortgages. This knowledge can empower you to make the best choice for your family.

- Customer Reviews: Check online reviews and testimonials to gauge past client satisfaction. Real stories from other families can guide your decision.

- Availability: Confirm that the financing officer can accommodate your schedule and is reachable when you require assistance. You need loan officers near me who are there for you when it matters.

Additionally, comparing rates, costs, and terms among different lenders is crucial to ensure they align with your needs. F5 Mortgage not only provides competitive rates but also delivers personalized service designed for families enhancing their homes. We’re here to support you every step of the way, ensuring a smoother and more supportive financing process.

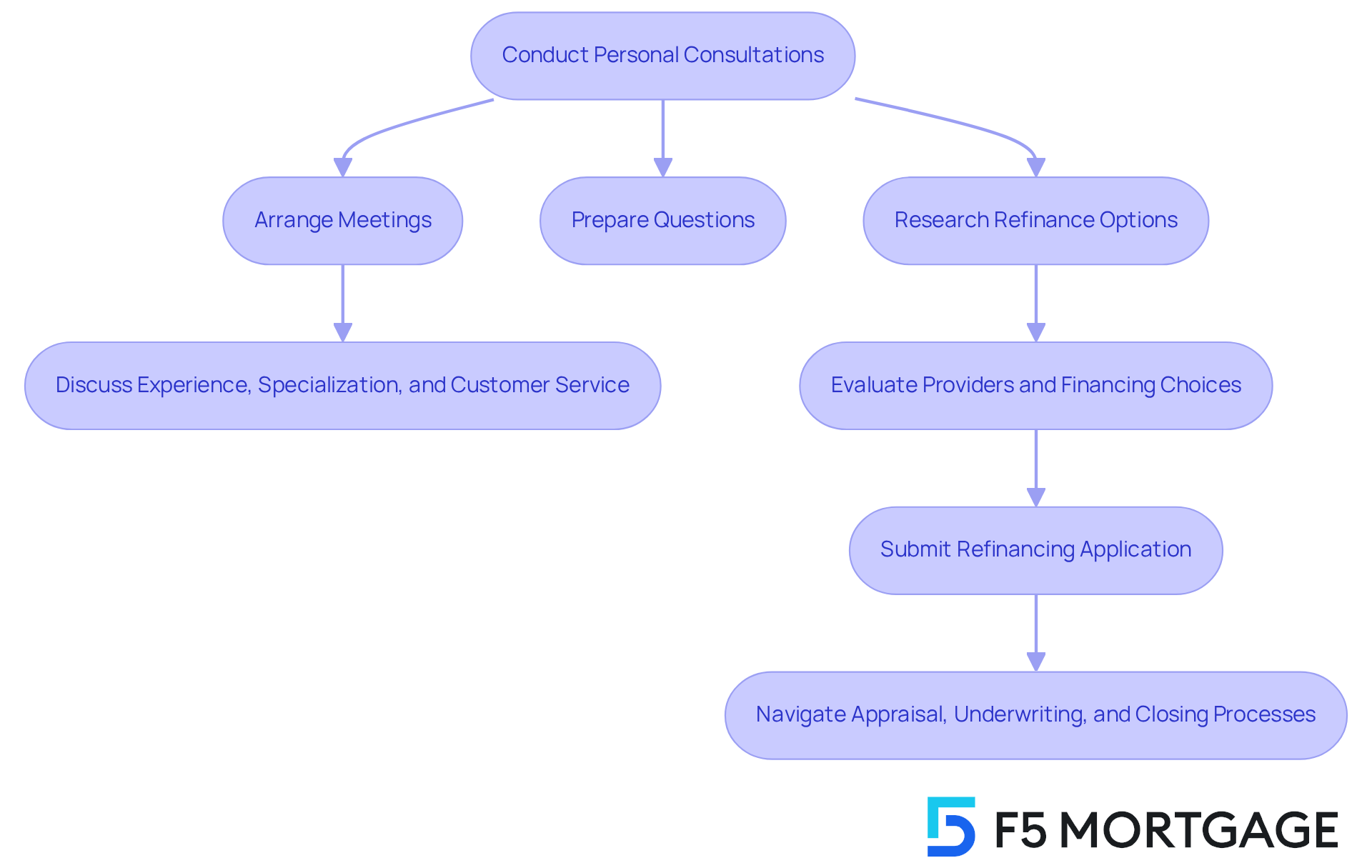

Conduct Personal Consultations with Loan Officers

Arrange meetings with your selected financial officers. During these important discussions, we encourage you to inquire about:

- Their experience

- The types of financing they specialize in

- Their approach to customer service

Prepare a thoughtful list of questions regarding your financial situation and the borrowing process. Pay close attention to how they respond and whether they take the time to address your concerns thoroughly.

Additionally, it’s beneficial to research your refinance options before these consultations. Consider evaluating various providers and financing choices to find the most favorable rates and conditions that suit your needs. After selecting a lender, you will need to submit a refinancing application, which includes information about your property and necessary financial documents. This interaction will help you gauge their expertise and comfort level as you . Remember, we know how challenging this can be, and we’re here to support you every step of the way.

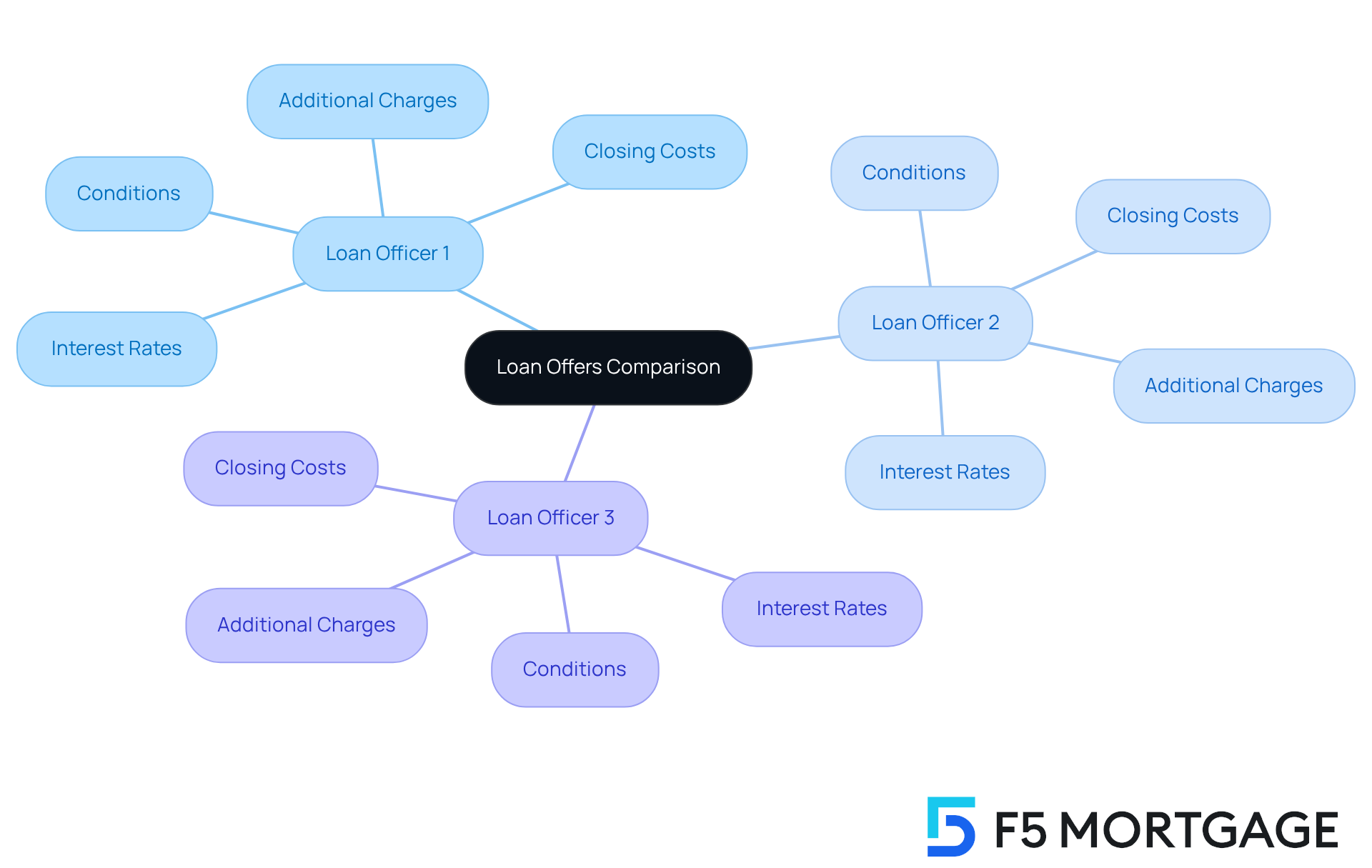

Compare Offers and Terms from Different Loan Officers

Once you’ve gathered financing estimates from various representatives, it’s essential to evaluate them thoughtfully. Focus on key elements such as:

- Interest rates

- Conditions

- Closing costs

- Any additional charges

A comparison chart can be a helpful tool to visualize these differences clearly.

Pay special attention to the Annual Percentage Rate (APR), as it reflects the overall cost of borrowing over time. We understand how overwhelming this process can feel, so don’t hesitate to ask financial officers to clarify any terms or conditions that are unclear. Remember, this thorough comparison is crucial in helping you choose the loan that best aligns with your financial situation.

We’re here to , ensuring you feel confident in your decisions.

Conclusion

Finding local loan officers is a crucial step in navigating the mortgage process. We know how challenging this can be, and ensuring that individuals receive the support and guidance they need is essential for making informed financial decisions. Understanding the role of loan officers, researching potential candidates, and evaluating their qualifications are all vital aspects of this journey. By taking the time to connect with the right professionals, borrowers can feel empowered to choose the best financing options available to them.

This article emphasizes the importance of thorough research and personal consultations when selecting loan officers. Key criteria such as experience, communication skills, and customer reviews play a significant role in determining the right fit for each individual’s needs. Moreover, comparing offers and understanding the terms of different loans can lead to more favorable financial outcomes. By following these steps, borrowers can approach the mortgage process with confidence and clarity.

Ultimately, securing the right loan officer can significantly impact one’s financial future. It is essential to gather information, ask pertinent questions, and compare various options. With the right support, navigating the complexities of financing can transform from a daunting task into an empowering experience. This journey paves the way for homeownership and financial stability, and we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of loan officers?

Loan officers are the primary point of contact between you and lenders. They assess credit applications, advise on financing options, and assist you throughout the mortgage process, ensuring that all required documentation is submitted smoothly.

How do loan officers help with the mortgage process?

Loan officers evaluate your financial circumstances, help you understand various credit options, and provide guidance on both standard and nontraditional products. Their support aims to make the mortgage process less stressful for you.

Why is it important to recognize the value of a mortgage specialist?

Recognizing the value of a mortgage specialist is essential as they empower and support you in exploring different financing options, helping you make informed decisions for your future when purchasing or refinancing a home.

How can I find loan officers near me?

You can find loan officers by exploring online resources such as mortgage brokerage sites, local bank directories, and real estate platforms like Zillow and Bankrate. Additionally, nearby credit unions often have listings of loan officers.

What should I consider when choosing a loan officer?

Consider reaching out to friends, family, or real estate agents for referrals based on their positive experiences. Additionally, check online reviews and ratings of potential loan officers to gauge their reputation and the quality of service they provide.

What steps should I take when connecting with loan officers?

Make a list of your top choices of loan officers and don’t hesitate to ask questions when you connect with them. Your comfort and confidence in the process are crucial as you work towards securing your financial future.