Overview

Absolutely, you can purchase land with a VA loan! However, it’s important to understand that the land must be intended for building your primary residence. VA financing is not available for land purchases on their own. We know how challenging this can be, so it’s essential to plan ahead. You’ll need to combine the land purchase with construction financing. Working with a lender experienced in VA loans is crucial; they can help you navigate the specific requirements and ensure a successful acquisition. Remember, we’re here to support you every step of the way.

Introduction

Navigating the world of homeownership can feel particularly daunting for veterans and active-duty service members. We understand how overwhelming it is, especially when it comes to grasping the nuances of VA loans. These unique financial products not only open doors for home purchases but also raise an important question: can they be used to buy land?

In this article, we will explore the essential steps and considerations for leveraging VA loans to acquire land, highlighting the significant benefits available to eligible borrowers. As the housing market continues to evolve, understanding the intricacies of land purchases with VA financing becomes crucial.

What challenges might arise, and how can you effectively overcome them? We’re here to support you every step of the way.

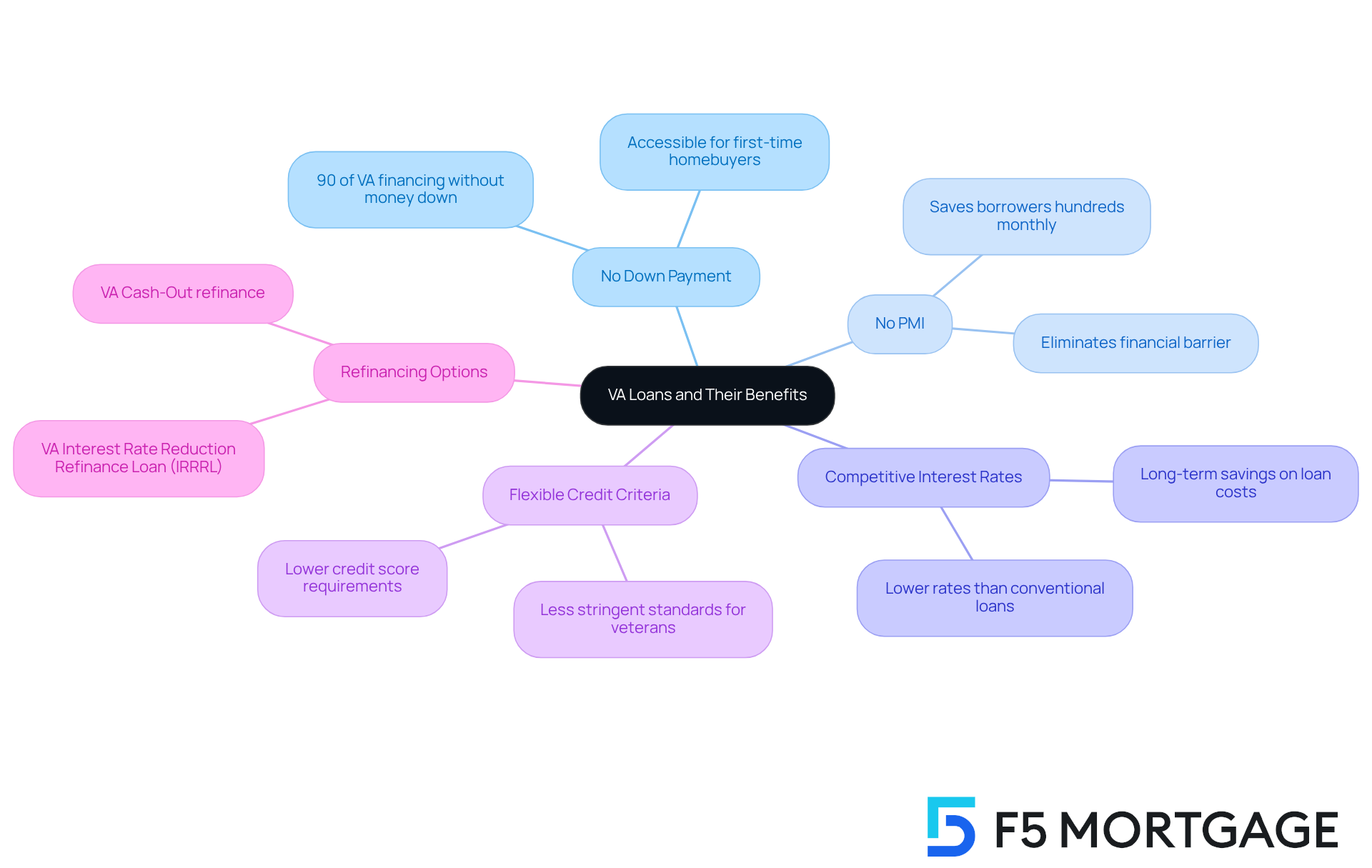

Understand VA Loans and Their Benefits

VA financing presents a wonderful opportunity for veterans, active-duty service personnel, and certain members of the National Guard and Reserves. One of the most remarkable features of VA programs is that they typically require no down payment. This significantly enhances access to homeownership, allowing families to step into the housing market without the heavy financial burden of a large upfront payment. In fact, around 90% of conventional VA purchase financing is provided without any money down.

Moreover, VA financing eliminates the need for private mortgage insurance (PMI). This cost can accumulate considerably over time, presenting a real challenge for many borrowers. By removing this requirement, VA loans offer substantial savings. These financial products also come with competitive interest rates and flexible credit criteria, making them an appealing option for many families.

For instance, veterans with lower credit ratings may still find themselves eligible, as lenders often have less stringent standards compared to traditional financing. Once you’ve built up some equity in your home, you have the option to [refinance a VA mortgage](https://mortgagemark.com/loan-programs/government-home-loan/va-home-loan) through programs like the VA Interest Rate Reduction Refinance Loan (IRRRL) or a VA cash-out option. This can further enhance your financial flexibility.

Understanding these advantages is crucial for anyone considering a VA mortgage to determine if they can buy land with a VA loan. In today’s housing market, where affordability remains a pressing issue, we know how challenging this can be. We’re here to support you every step of the way as you explore the .

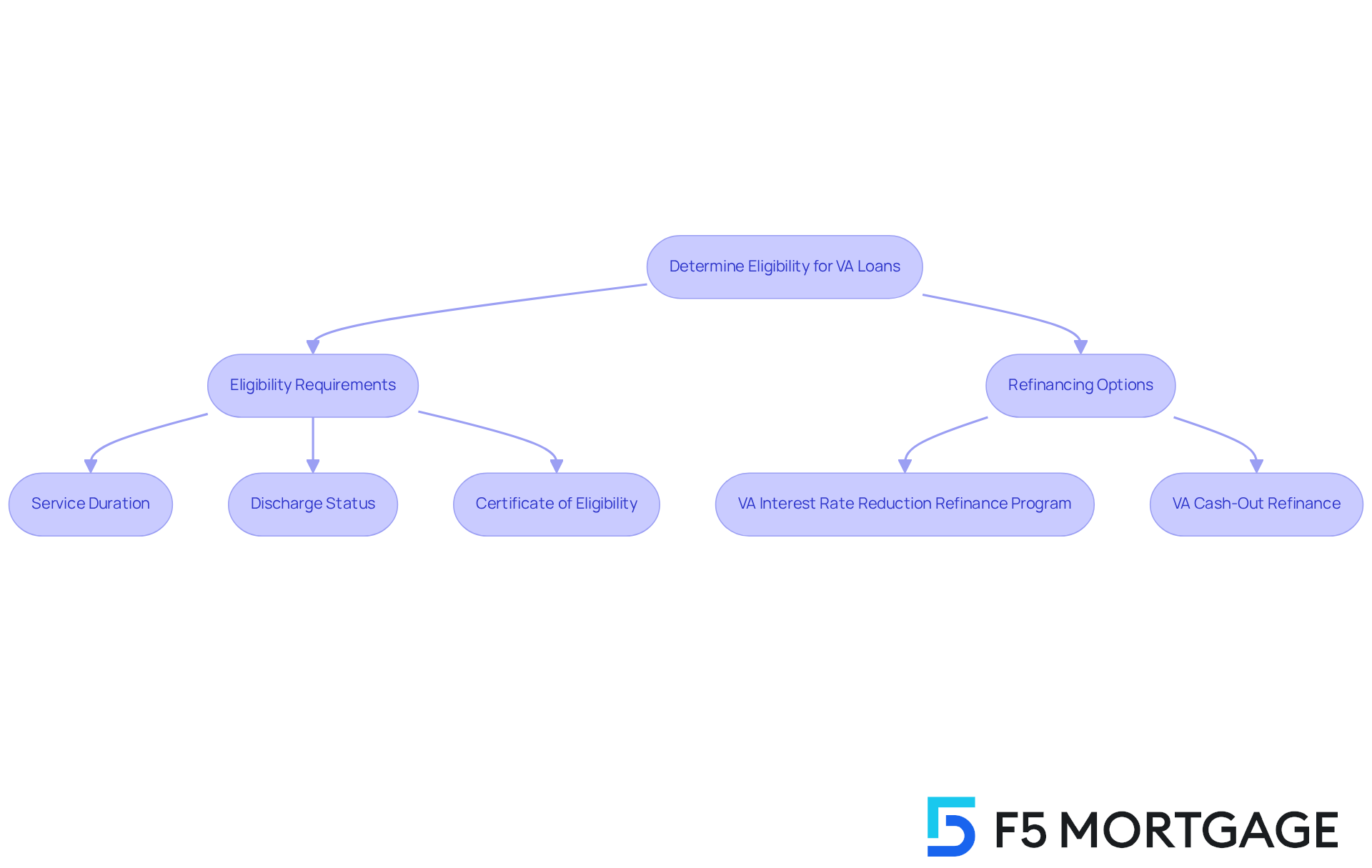

Determine Eligibility for VA Loans

Navigating the world of VA mortgages can feel overwhelming, but we’re here to support you every step of the way. To qualify for a VA mortgage, you must meet specific eligibility requirements set by the Department of Veterans Affairs. Generally, this means you should be a veteran, an active-duty service member, or a member of the National Guard or Reserves. Typically, you need at least:

- 90 continuous days of active duty during wartime

- 181 days during peacetime

Additionally, having a discharge status that is not dishonorable is essential.

To confirm your eligibility, obtaining a Certificate of Eligibility (COE) is necessary. You can request this through the VA or your lender. If you’re considering refinancing in California, there are common mortgage qualification requirements to keep in mind. These include:

- A minimum credit score of 620

- A stable income and employment history

- Sufficient equity in your home

- A debt-to-income ratio of 43% or less

Once you’ve built up some equity in your home, you have two options for refinancing a VA mortgage. The first is the VA Interest Rate Reduction Refinance Program (IRRRL), designed to lower your rate and monthly payment. The second option is the VA cash-out refinance, which can help you meet various financial needs. Understanding these options is crucial for homeowners like you who are looking to while leveraging your VA benefits. Remember, we’re here to help you make the best choice for your family’s future.

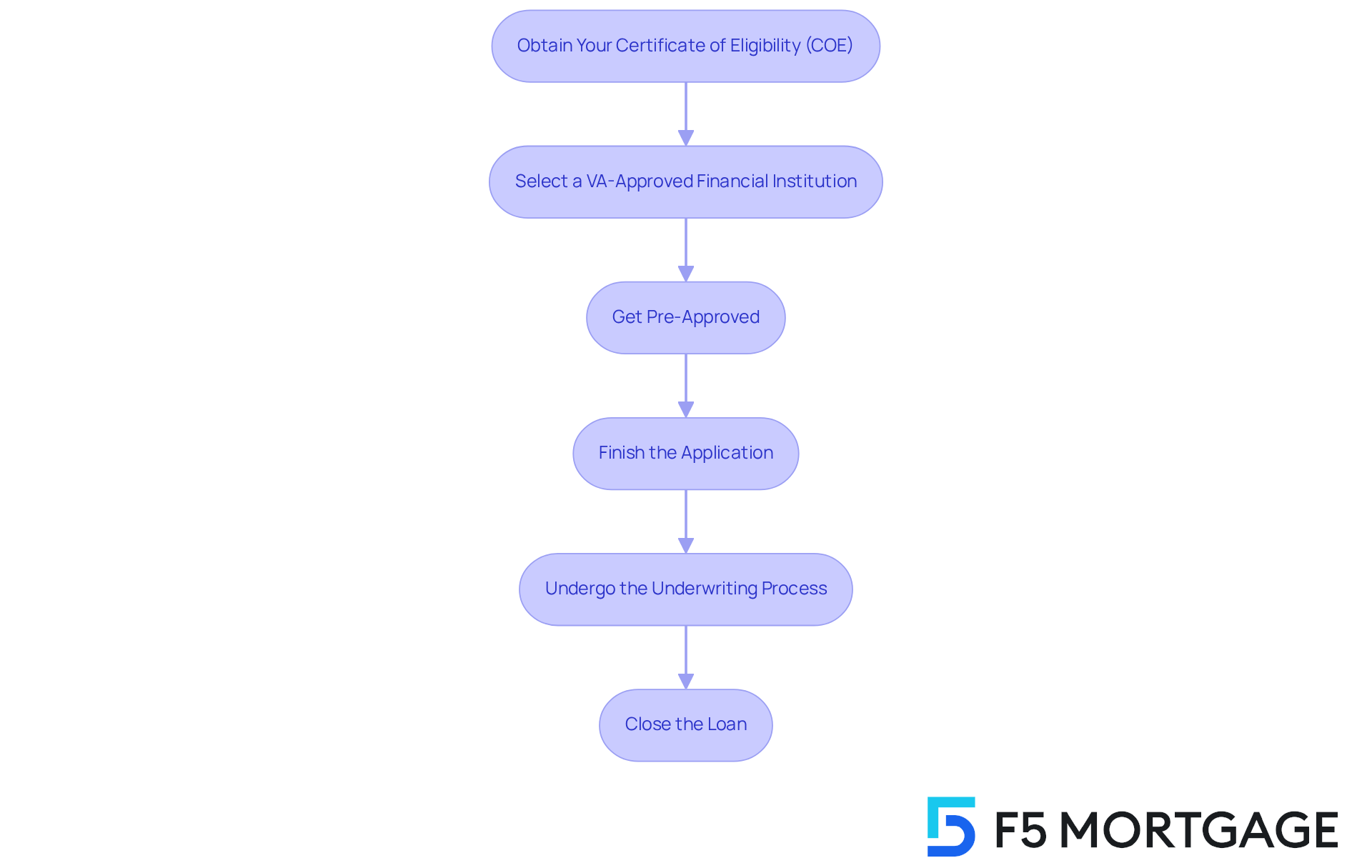

Apply for a VA Loan: Step-by-Step Process

Applying for a VA loan can feel overwhelming, but we’re here to guide you through each step with care and understanding. Here’s how to navigate the process:

- Obtain Your Certificate of Eligibility (COE): This important document confirms your eligibility for a VA mortgage. You can easily apply for it online through the VA’s eBenefits portal or by submitting a paper application.

- Select a VA-Approved Financial Institution: Not every institution offers VA financing, so it’s essential to find one that does. Look for financial institutions experienced in VA loans to ensure a smoother journey.

- Get Pre-Approved: Pre-approval helps you understand how much you can borrow and demonstrates to sellers that you are a serious buyer. During this step, your chosen financial institution will review your financial information. At F5 Mortgage, our caring financing specialists are ready to assist you in finding a product that aligns with your specific goals. You can conveniently apply for pre-approval online, by phone, or through chat.

- Finish the Application: Complete your application with your financial institution, providing all necessary documentation, such as income verification, credit history, and the COE. At F5 Mortgage, we offer flexible application options to make this process as easy as possible for you.

- Undergo the Underwriting Process: The lender will carefully evaluate your application, verify your financial details, and confirm your eligibility for credit. We know how challenging this can be, and we’re here to .

- Close the Loan: Once approved, you’ll sign the final paperwork, and the funds will be distributed for your property acquisition and construction. This is an exciting moment, and we’re thrilled to be part of your journey.

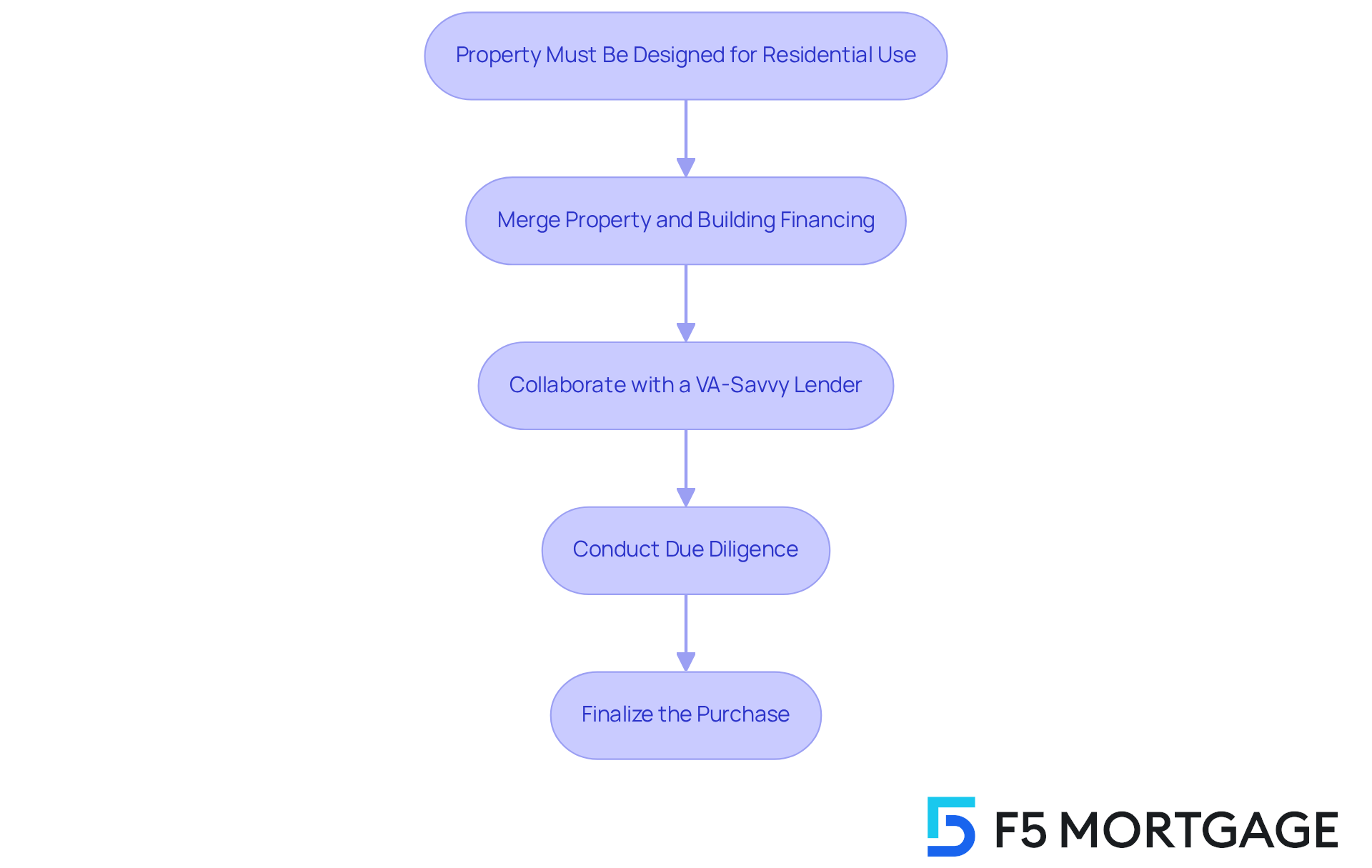

Navigate the Land Purchase Process with a VA Loan

We know how challenging it can be when you ask, can you buy land with a VA loan? It’s essential to keep the following considerations in mind:

- Property Must Be Designed for Residential Use: VA financing can solely be utilized for property meant for constructing a primary dwelling. Ensure that the area meets this requirement to avoid any complications.

- Merge Property and Building Financing: Generally, the question of can you buy land with a VA loan does not permit the acquisition of property alone. You must plan to on the property without delay. This means you will require a VA building financing option that encompasses both the property acquisition and the construction expenses.

- Collaborate with a VA-Savvy Lender: Choosing a lender knowledgeable in VA loans and property acquisitions is crucial. They can guide you through the specific requirements and help you find suitable properties that meet your needs.

- Conduct Due Diligence: Before concluding your acquisition, carry out detailed research on the land. This includes zoning laws, access to utilities, and any restrictions that may apply. Understanding these factors is vital for a successful purchase.

- Finalize the Purchase: Once you have secured financing and completed your due diligence, you can proceed with the purchase. Ensure all paperwork is in order and that you understand the terms of your loan. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the complexities of purchasing land with a VA loan can truly open doors to homeownership for veterans and active-duty service members. The unique benefits of VA financing—such as no down payment and the absence of private mortgage insurance—make it an appealing option for those looking to secure a primary residence. We understand how important it is to grasp the specific eligibility criteria and the steps involved in the application process to maximize these advantages.

Key insights from this article highlight the essential nature of:

- Obtaining a Certificate of Eligibility

- Selecting a knowledgeable lender

- Ensuring that the property is intended for residential use

Additionally, merging the land purchase with construction financing is vital to successfully utilizing a VA loan for land acquisition. Conducting thorough due diligence on the property and understanding the loan terms further solidifies your path to ownership.

Ultimately, leveraging VA loans not only empowers veterans and service members to invest in their futures but also strengthens communities through homeownership. Embracing this opportunity can lead to a fulfilling and stable living environment. We know how challenging this can be, and for those considering this route, taking the first step towards understanding VA loan options can pave the way for a successful land purchase and the realization of your homeownership dreams.

Frequently Asked Questions

Who is eligible for VA loans?

VA loans are available to veterans, active-duty service personnel, and certain members of the National Guard and Reserves.

What is one of the most significant benefits of VA loans?

One of the most remarkable benefits of VA loans is that they typically require no down payment, allowing families to enter the housing market without a large upfront payment.

Is private mortgage insurance (PMI) required for VA loans?

No, VA loans eliminate the need for private mortgage insurance (PMI), which can lead to substantial savings for borrowers.

How do VA loan interest rates compare to conventional loans?

VA loans come with competitive interest rates, making them an appealing option for many families.

What are the credit requirements for VA loans?

VA loans have flexible credit criteria, allowing veterans with lower credit ratings to potentially qualify, as lenders often have less stringent standards compared to traditional financing.

Can you refinance a VA loan?

Yes, once you’ve built up equity in your home, you can refinance a VA mortgage through programs like the VA Interest Rate Reduction Refinance Loan (IRRRL) or a VA cash-out option.

How can VA financing help with homeownership in today’s housing market?

VA financing provides significant advantages such as no down payment, no PMI, competitive interest rates, and flexible credit criteria, which can help families navigate the challenges of affordability in the housing market.