Overview

Navigating the process of securing a VA loan for land purchase can feel overwhelming, but we’re here to support you every step of the way. This article outlines five essential steps to help you successfully secure your loan:

- Preparing your application

- Identifying VA-approved land options

- Collaborating with a knowledgeable lender

- Navigating the appraisal and closing process

We know how challenging this can be, which is why we provide detailed guidance on gathering necessary documents and understanding eligibility criteria. Working with experienced financial institutions is crucial to ensure a smooth loan experience, and we’re committed to helping you find the right resources.

By following these steps, you can approach the loan process with confidence and clarity. Remember, you are not alone in this journey; our aim is to empower you with the knowledge and support you need to achieve your goals.

Introduction

Navigating the world of real estate financing can feel overwhelming, particularly for veterans and service members eager to purchase land. We understand how challenging this can be. VA loans present a unique opportunity to acquire property with significant benefits, including no down payment and competitive interest rates, making them an appealing option. However, the journey to securing a VA loan for land purchase involves specific steps and considerations that can lead to confusion.

How can you ensure that you meet all requirements and successfully navigate this process? We’re here to support you every step of the way as you work towards achieving your homeownership dreams.

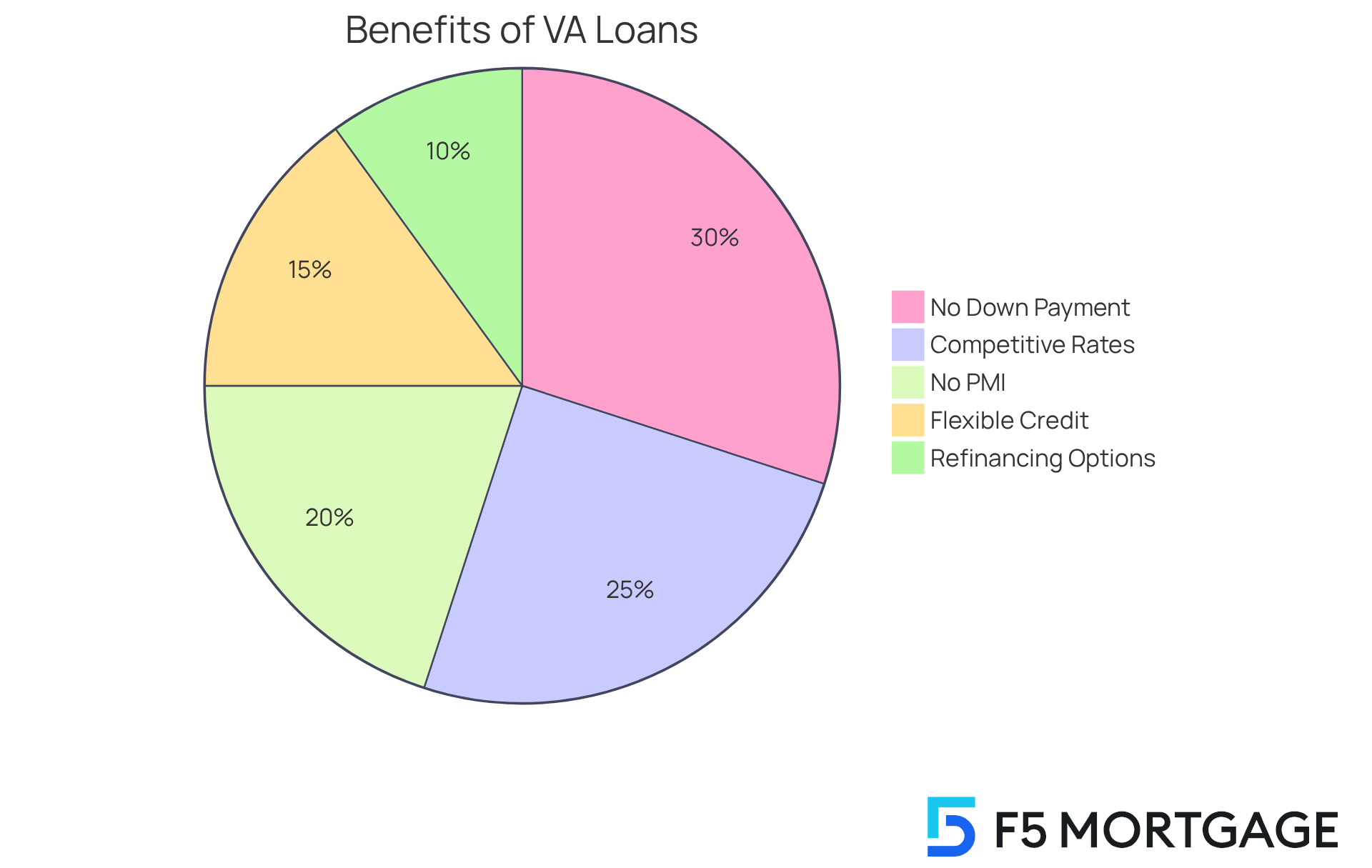

Understand VA Loans and Their Benefits

VA loans for land purchase are a valuable financing option supported by the U.S. Department of Veterans Affairs, designed to assist veterans, active-duty service members, and certain members of the National Guard and Reserves in purchasing homes or property. We know how challenging this can be, and understanding the can make a significant difference for you and your family.

- No Down Payment: One of the most significant advantages is that eligible borrowers can finance 100% of the purchase price. This means you can acquire land with a VA loan for land purchase without the burden of upfront costs, making it easier for families looking to upgrade their homes.

- Competitive Interest Rates: VA financing typically offers reduced interest rates compared to traditional loans. This can lead to substantial savings over time, positively impacting your monthly budget.

- No PMI Requirement: Unlike traditional financing, VA mortgages do not require private mortgage insurance (PMI). This lowers your monthly payments, making homeownership more affordable.

- Flexible Credit Requirements: VA financing often features more lenient credit score criteria, which opens the door for a wider range of borrowers, including first-time homebuyers.

- Refinancing Options: Once you’ve built equity in your home, you can explore refinancing your VA mortgage. Options like the VA Interest Rate Reduction Refinance Program (IRRRL) can help lower your rate and monthly payment, or you might consider a VA cash-out refinance to meet various financial needs.

By grasping these advantages and the refinancing options available, you can make informed decisions as you navigate the home buying process with F5 Mortgage. We’re here to support you every step of the way, ensuring you explore all available options, including FHA and USDA financing, tailored to your financial needs.

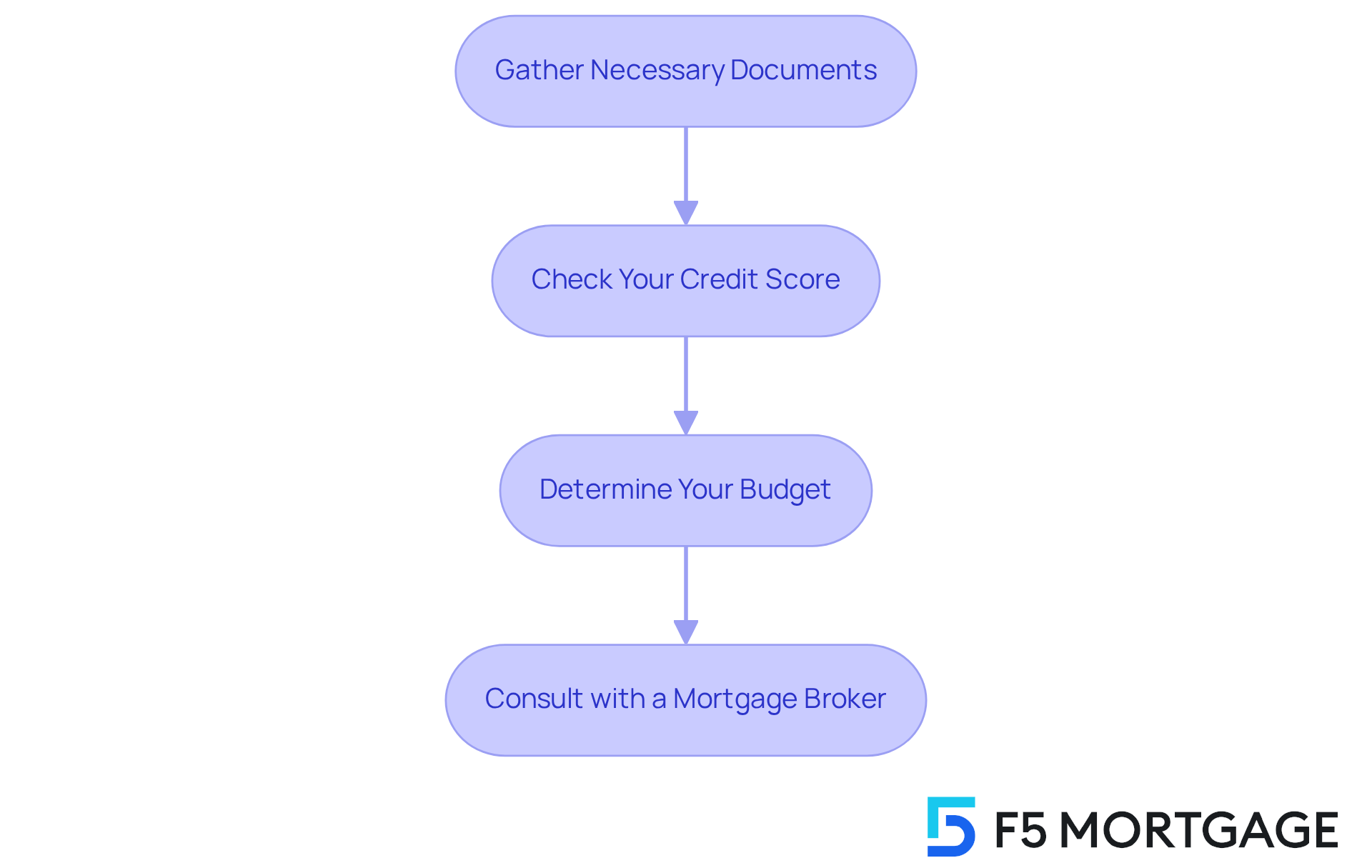

Prepare for Your VA Loan Application

Preparing for your [VA loan application](https://f5mortgage.com/7-key-insights-on-current-va-irrrl-rates-for-veterans) can feel overwhelming, but we’re here to support you every step of the way. Follow these steps to help ease the process:

- Gather Necessary Documents: Start by collecting essential documents like your Certificate of Eligibility (COE), proof of income such as pay stubs and tax returns, and any other financial statements. We know how important it is to have everything in order.

- Check Your Credit Score: Take a moment to review your credit report for any errors. While VA loans offer flexible credit requirements, a higher score can lead to better loan terms. Understanding your credit is a crucial step in this journey.

- Determine Your Budget: Assess your financial situation to see how much you can comfortably afford. Remember to factor in additional costs like property taxes and insurance. This will help you make informed decisions that align with your goals.

- : Engaging with an experienced mortgage broker can provide you with tailored advice and help navigate the application process smoothly. Their expertise can make a significant difference.

By preparing thoroughly, you can enhance your chances of a smooth application, and we’re here to guide you through it all.

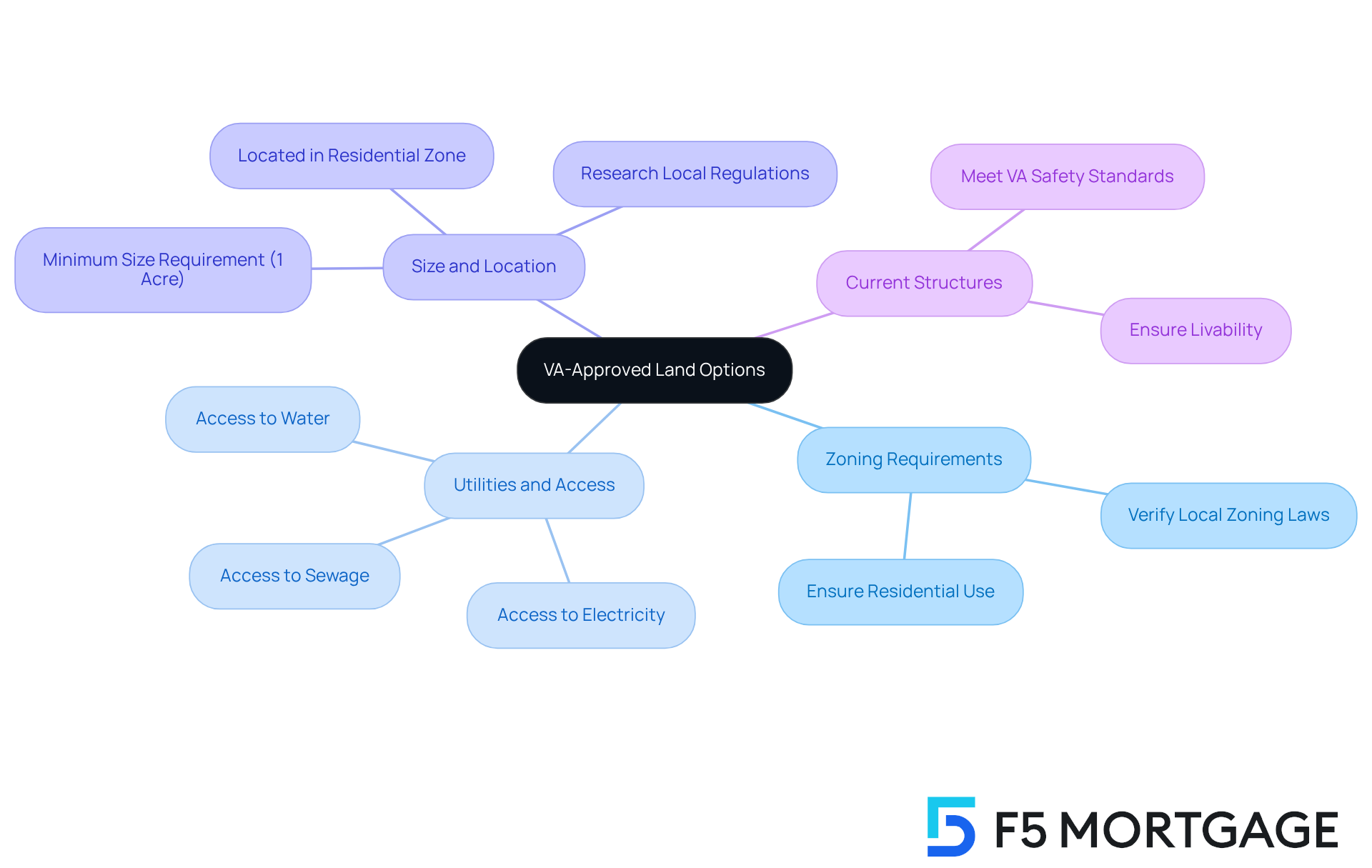

Identify VA-Approved Land Options

When searching for land to purchase with a VA loan, it’s important to consider a few key criteria that can make the process smoother for you and your family:

- Zoning Requirements: We know how crucial it is to find the right fit. The land must be zoned for residential use, so be sure to verify local zoning laws to ensure compliance.

- Utilities and Access: Access to essential utilities like water, electricity, and sewage is vital. If these aren’t available, it could complicate the financing process, and we want to help you avoid any unnecessary hurdles.

- Size and Location: Generally, VA financing requires the property to be a minimum size—often at least one acre—and located in a residential zone. Researching local regulations can confirm this, helping you feel more confident in your decision.

- Current Structures: If there are existing structures on the property, they must meet VA standards for safety and livability. This is important for ensuring a safe environment for you and your loved ones.

By focusing on these criteria, you can identify land options that meet the requirements for a VA loan for land purchase, making your journey toward homeownership a little easier. We’re here to support you every step of the way.

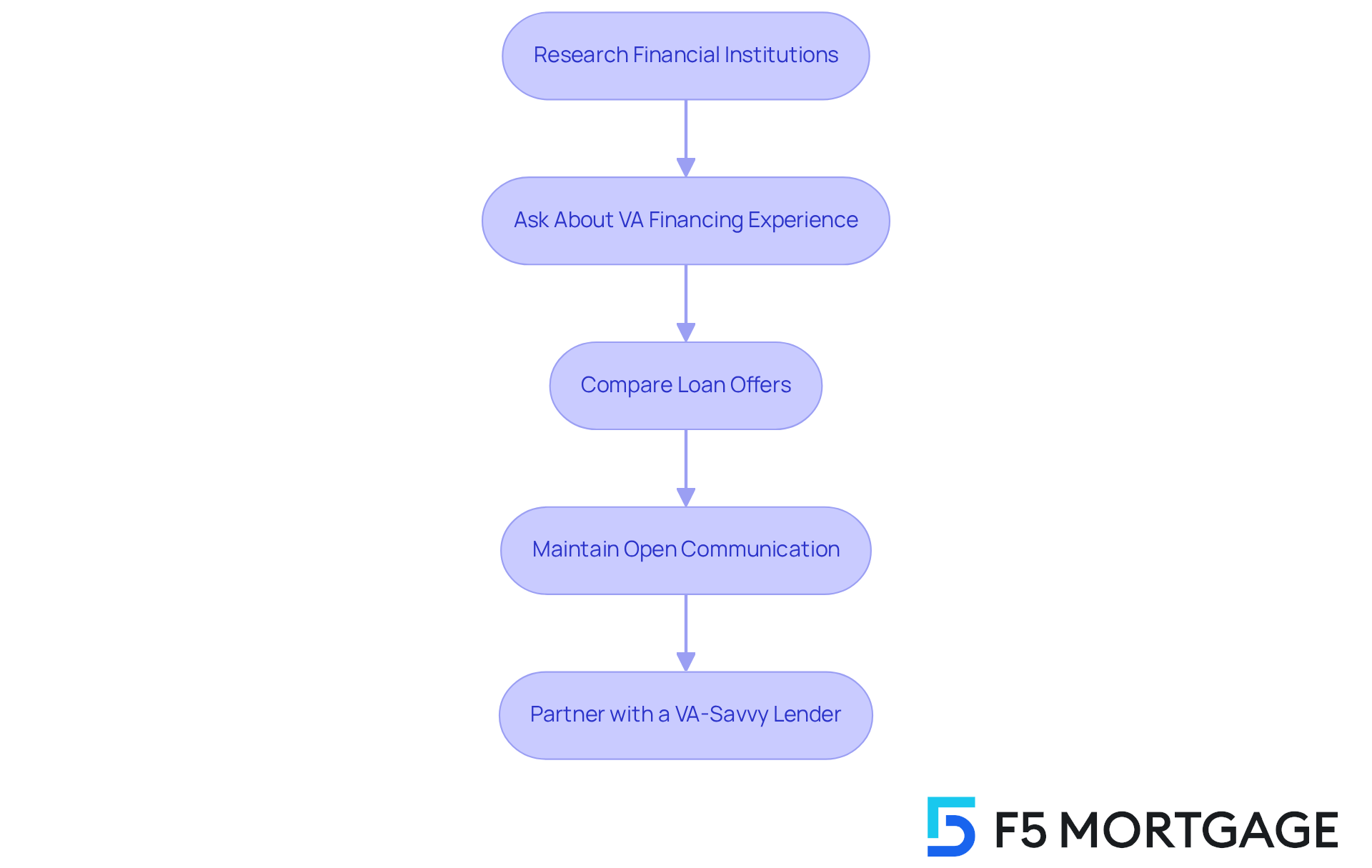

Collaborate with a VA-Savvy Lender

To guarantee a seamless , it’s essential to partner with a provider who specializes in VA mortgages. We understand how challenging this process can be, and we’re here to support you every step of the way. Here’s how you can navigate this journey:

- Research Financial Institutions: Look for providers with a solid history in VA financing. Reading reviews and seeking recommendations from fellow veterans or service members can be incredibly helpful. Many clients have praised F5 Mortgage for their exceptional service, with one stating, “Everything went very smoothly!” Another highlighted the personalized attention they received.

- Ask About VA Financing Experience: During your initial consultations, it’s important to inquire about the provider’s experience with VA financing and their understanding of the specific requirements. Many clients have shared that the team at F5 Mortgage, including loan officers like Jeff and Ryan, provided expert guidance throughout the process, ensuring they understood every step.

- Compare Loan Offers: Don’t hesitate to obtain quotes from various financial institutions to compare interest rates, fees, and terms. This will empower you to find the best deal. F5 Mortgage is recognized for competitive rates and personalized service, making them a strong contender in your search.

- Maintain Open Communication: Establishing a good relationship with your financial institution is key. Clear communication can help address any concerns or inquiries that arise during the process. Clients have expressed appreciation for the patience and support they received from the F5 Mortgage team, which made their experience worry-free.

By collaborating with an experienced financial partner like F5 Mortgage, you can navigate the VA loan for land purchase process more effectively, ensuring a smoother journey toward acquiring your land.

Complete the Appraisal and Closing Process

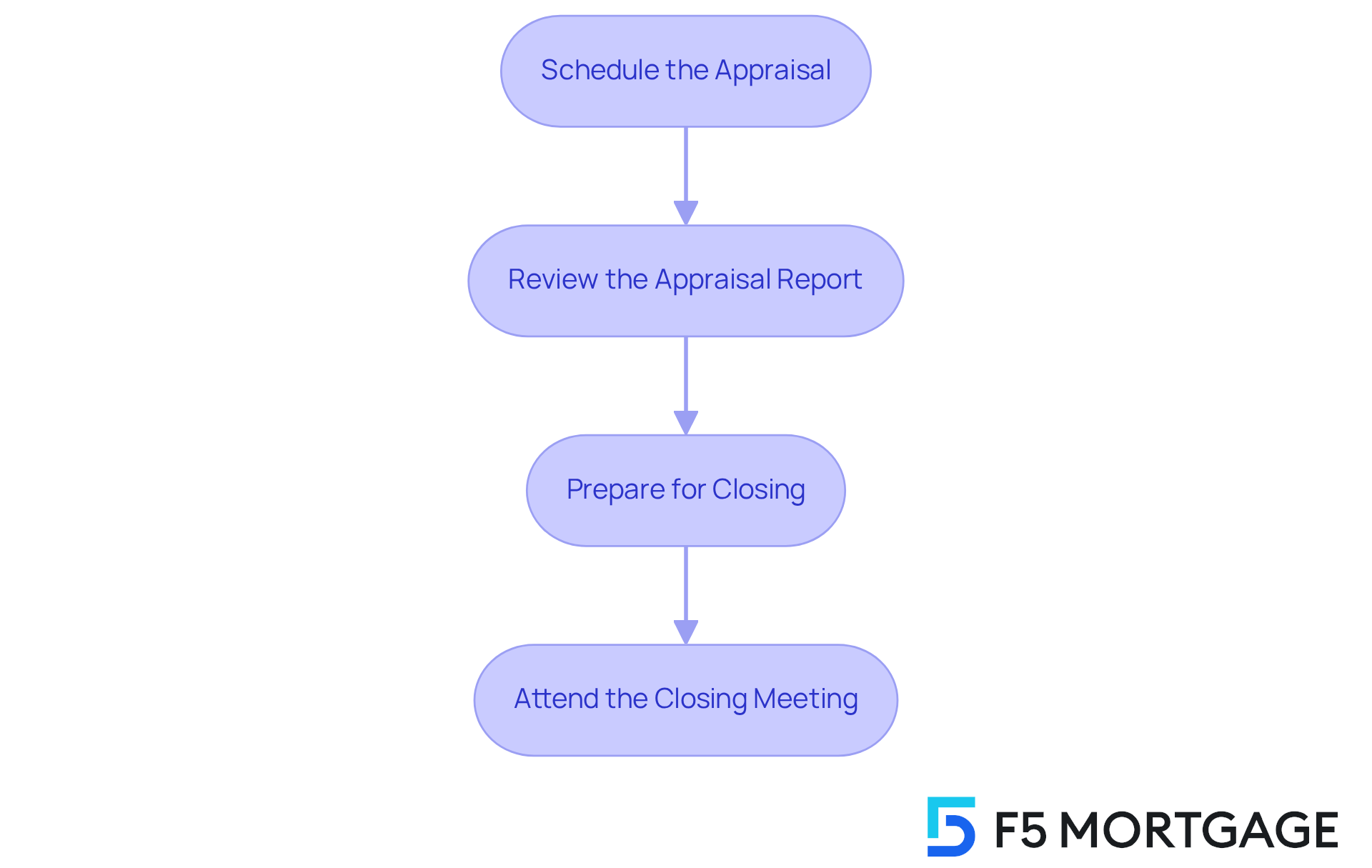

Once your application is approved, it’s time to navigate the appraisal and closing process, and we’re here to support you every step of the way:

- Schedule the Appraisal: Your financial institution will arrange for a VA-approved appraiser to assess the property’s value. This step is crucial because it ensures the property meets VA standards. We know how challenging this can be, and it’s important to note that the financial institution may also request an inspection to verify your property is in good shape. A home needing significant repairs may not be eligible for refinancing options, so understanding this step is vital.

- Review the Appraisal Report: After the appraisal, take the time to review the report carefully. If the property value is lower than expected, don’t hesitate to discuss options with your lender. Remember, you have support available to help you through this.

- Prepare for Closing: Gather the required documents for closing, including your ID, financing documents, and proof of insurance. Ensuring all paperwork is in order can help avoid delays, and we’re here to help if you have any questions.

- Attend the Closing Meeting: During the closing meeting, you will sign the final documents and pay any closing costs. Once everything is completed, you will receive the keys to your new land, marking an exciting new chapter.

By understanding and preparing for the appraisal and closing process, including the importance of inspections, you can secure a successful conclusion to your VA loan for land purchase journey. Remember, since F5 Mortgage acts as a broker, you will make payments to the lender that closes your loan. We are always here to you may have post-closing.

Conclusion

Securing a VA loan for land purchase is not just a strategic move; it’s a heartfelt opportunity for veterans and active-duty service members to invest in their future without the weight of significant upfront costs. By embracing the benefits of VA loans—such as no down payment, competitive interest rates, and flexible credit requirements—eligible borrowers can confidently navigate the path to homeownership.

In this guide, we’ve outlined essential steps to ensure a successful application process. We understand how challenging this can be, so from grasping the advantages of VA loans to preparing necessary documentation, identifying suitable land options, and collaborating with knowledgeable lenders, each phase is vital for a seamless experience. Working with a VA-savvy lender is particularly important, as it provides expert guidance tailored to the unique needs of veterans and service members.

Ultimately, the journey to purchasing land with a VA loan is more than just securing financing; it’s a meaningful step toward establishing a stable and fulfilling future. By taking proactive measures—like thorough preparation and informed decision-making—individuals can unlock the potential of VA loans and make homeownership a reality. We’re here to support you every step of the way, so embrace this opportunity and take the first step toward your dream property today.

Frequently Asked Questions

What are VA loans for land purchase?

VA loans for land purchase are financing options supported by the U.S. Department of Veterans Affairs, designed to assist veterans, active-duty service members, and certain members of the National Guard and Reserves in purchasing homes or property.

What are the main benefits of VA loans?

The main benefits of VA loans include no down payment requirement, competitive interest rates, no private mortgage insurance (PMI) requirement, flexible credit requirements, and refinancing options.

How does the no down payment benefit work?

Eligible borrowers can finance 100% of the purchase price of the land, allowing them to acquire property without any upfront costs.

What are the interest rates like for VA loans?

VA financing typically offers reduced interest rates compared to traditional loans, leading to substantial savings over time.

Do VA loans require private mortgage insurance?

No, VA mortgages do not require private mortgage insurance (PMI), which lowers monthly payments and makes homeownership more affordable.

What are the credit requirements for VA loans?

VA financing often features more lenient credit score criteria, making it accessible for a wider range of borrowers, including first-time homebuyers.

What refinancing options are available for VA loans?

Borrowers can explore refinancing options like the VA Interest Rate Reduction Refinance Program (IRRRL) to lower their rate and monthly payment, or a VA cash-out refinance to meet various financial needs.

What should I do to prepare for my VA loan application?

To prepare, gather necessary documents (like your Certificate of Eligibility, proof of income, and financial statements), check your credit score, determine your budget, and consult with a mortgage broker for tailored advice.

Why is it important to check my credit score before applying for a VA loan?

While VA loans offer flexible credit requirements, having a higher credit score can lead to better loan terms, making it important to review your credit report for any errors before applying.

How can a mortgage broker help with my VA loan application?

An experienced mortgage broker can provide tailored advice and help navigate the application process smoothly, making a significant difference in your experience.