Overview

Understanding the factors that influence a home appraisal can feel overwhelming, but we’re here to support you every step of the way. Four surprising elements can significantly impact this process:

- Neighborhood quality

- Home layout

- Cleanliness

- Odors

Each of these factors plays a crucial role in how appraisers perceive and evaluate your property.

By addressing these concerns, you can enhance your home’s perceived value. For instance, ensuring your home is clean and free of unpleasant odors can create a welcoming atmosphere that resonates positively with appraisers. Remember, we’re here to help you navigate these challenges and empower you to take action that can make a difference in your appraisal experience.

Introduction

Understanding the intricacies of home appraisals can often feel like navigating a maze. Hidden factors can dramatically influence a property’s perceived value, and we know how challenging this can be. This article delves into four surprising elements that homeowners may overlook but can significantly sway appraisal outcomes. As the real estate landscape continues to evolve, recognizing these factors empowers homeowners.

It raises critical questions about how to effectively enhance property value. What unexpected influences might be lurking in the shadows of your home appraisal? We’re here to support you every step of the way.

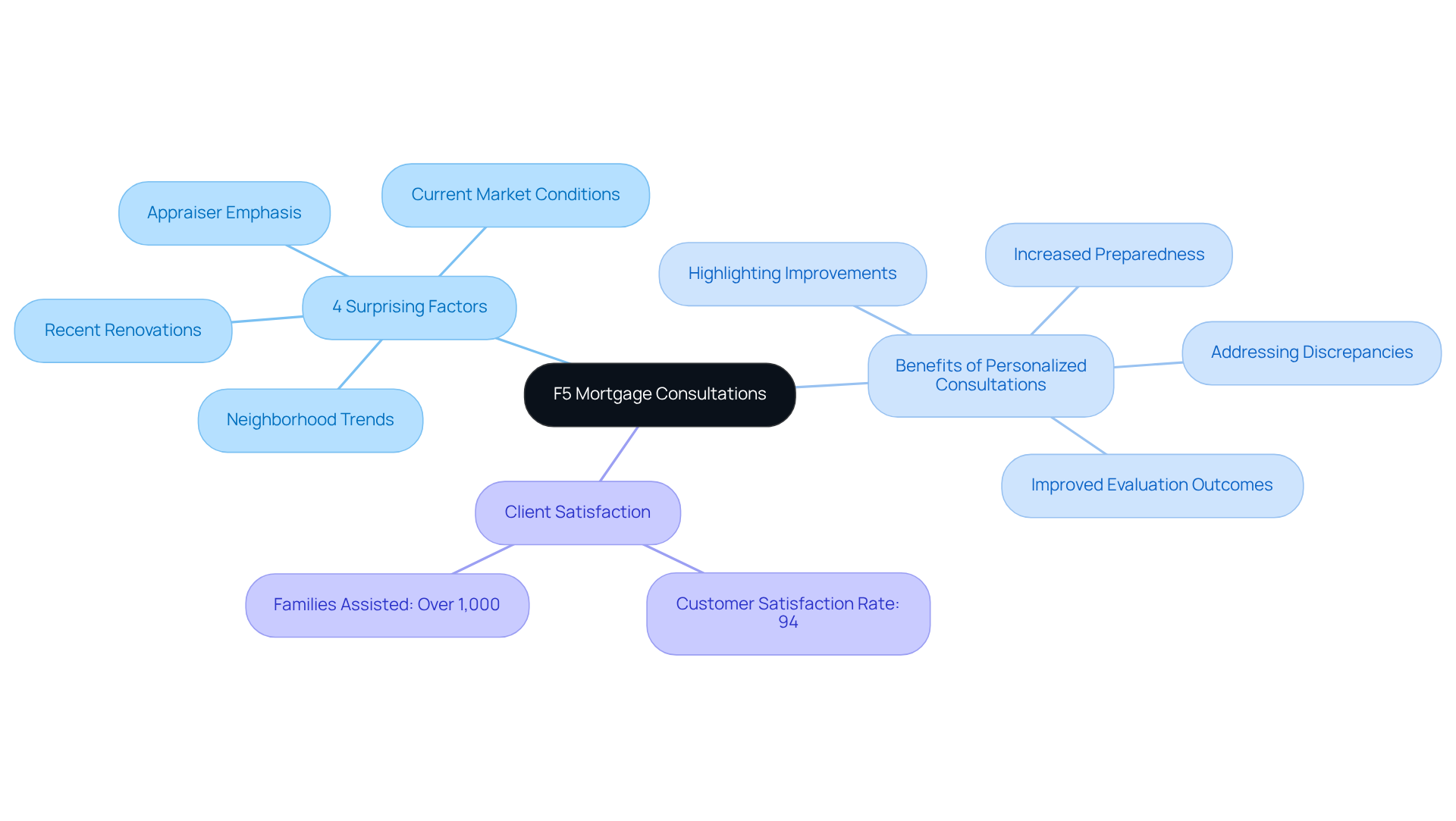

F5 Mortgage: Personalized Consultations to Enhance Home Appraisal Outcomes

At F5 Mortgage, we understand how challenging navigating the appraisal process can be. That’s why we offer personalized consultations designed to empower you with the confidence you need. By discussing recent renovations, neighborhood trends, and current market conditions, you can learn about 4 surprising factors that can affect a home appraisal, which will provide you with valuable insights to significantly enhance your property’s perceived value.

Our customized approach ensures you comprehend what appraisers emphasize, allowing you to showcase your property in the best possible light. Statistics reveal that personalized consultations lead to improved evaluation outcomes, as clients like you feel better prepared to address discrepancies and highlight improvements.

Real estate experts emphasize the importance of preparation. The valuation outcomes of a home can be greatly impacted by the 4 surprising factors that can affect a home appraisal. As one satisfied client shared, ‘The support I got from F5 Mortgage made all the difference in my evaluation.’ By taking advantage of these consultations, homeowners can increase their chances of receiving a positive evaluation, ultimately supporting their homeownership goals.

With a and over 1,000 families assisted, F5 Mortgage is dedicated to providing customized service and expert advice. We are here to ensure a smooth and hassle-free mortgage process, enhancing your evaluation experience every step of the way.

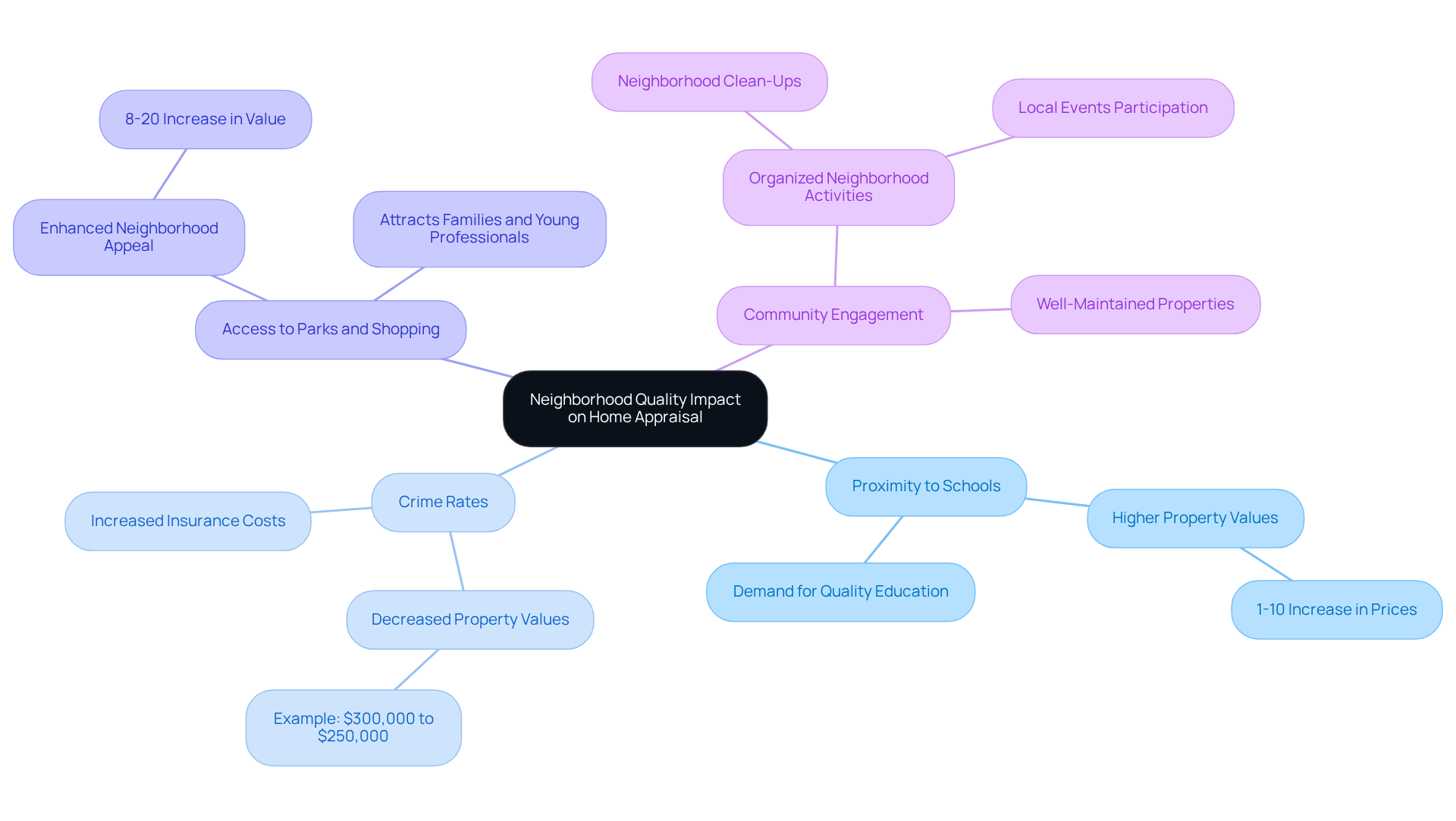

Neighborhood Quality: How Community Conditions Affect Home Appraisal Values

One of the 4 surprising factors that can affect a home appraisal is the quality of the neighborhood. We understand that factors such as:

- Proximity to highly-rated schools

- Low crime rates

- Access to parks and shopping centers

can significantly enhance the appeal of a home. For example, homes located in esteemed school districts often command prices that are 1-10% higher than those in less desirable areas, reflecting the strong demand for quality education. Conversely, areas affected by higher crime rates may see a drop in real estate prices; a home valued at $300,000 in a safe neighborhood might decrease to $250,000 if crime rates rise.

When seeking a mortgage, lenders will request a home assessment to determine the current market value of your property. This assessment helps identify your equity, which directly . Appraisers carefully evaluate these aspects, making it vital for homeowners to stay informed about their community’s reputation. Community factors, such as organized neighborhood events and overall appearance, also impact real estate prices. Well-maintained homes and active community participation can enhance neighborhood desirability, while neglected properties may detract from it.

In summary, understanding the connection between neighborhood quality and the 4 surprising factors that can affect a home appraisal is essential for both homeowners and potential buyers. Engaging in community initiatives, like neighborhood clean-ups or local events, and maintaining your property can help preserve and even increase real estate value over time. We know how challenging this can be, but taking these steps can empower you to navigate the real estate landscape with confidence.

Home Layout: The Surprising Influence of Floor Plan Design on Appraisal Results

When considering refinancing with F5 Mortgage, it’s important to know that the design and arrangement of your home can significantly influence its assessment, as well as . We understand how important this decision is for you. Open floor plans that maximize space and natural light are often more appealing than traditional, compartmentalized layouts. Appraisers evaluate how well the layout meets modern living needs, as this is one of the 4 surprising factors that can affect a home appraisal, which can ultimately impact the refinancing rates you may qualify for.

Furthermore, the evaluation process is crucial. It establishes your asset’s current market worth and how much equity you have, directly affecting your refinancing options. For homeowners contemplating renovations, it is important to focus on creating practical spaces, as there are 4 surprising factors that can affect a home appraisal and attract prospective buyers. This approach can lead to higher evaluations and better mortgage payments through competitive refinancing options and tailored loan conditions offered by F5 Mortgage. Remember, we’re here to support you every step of the way as you navigate these important decisions.

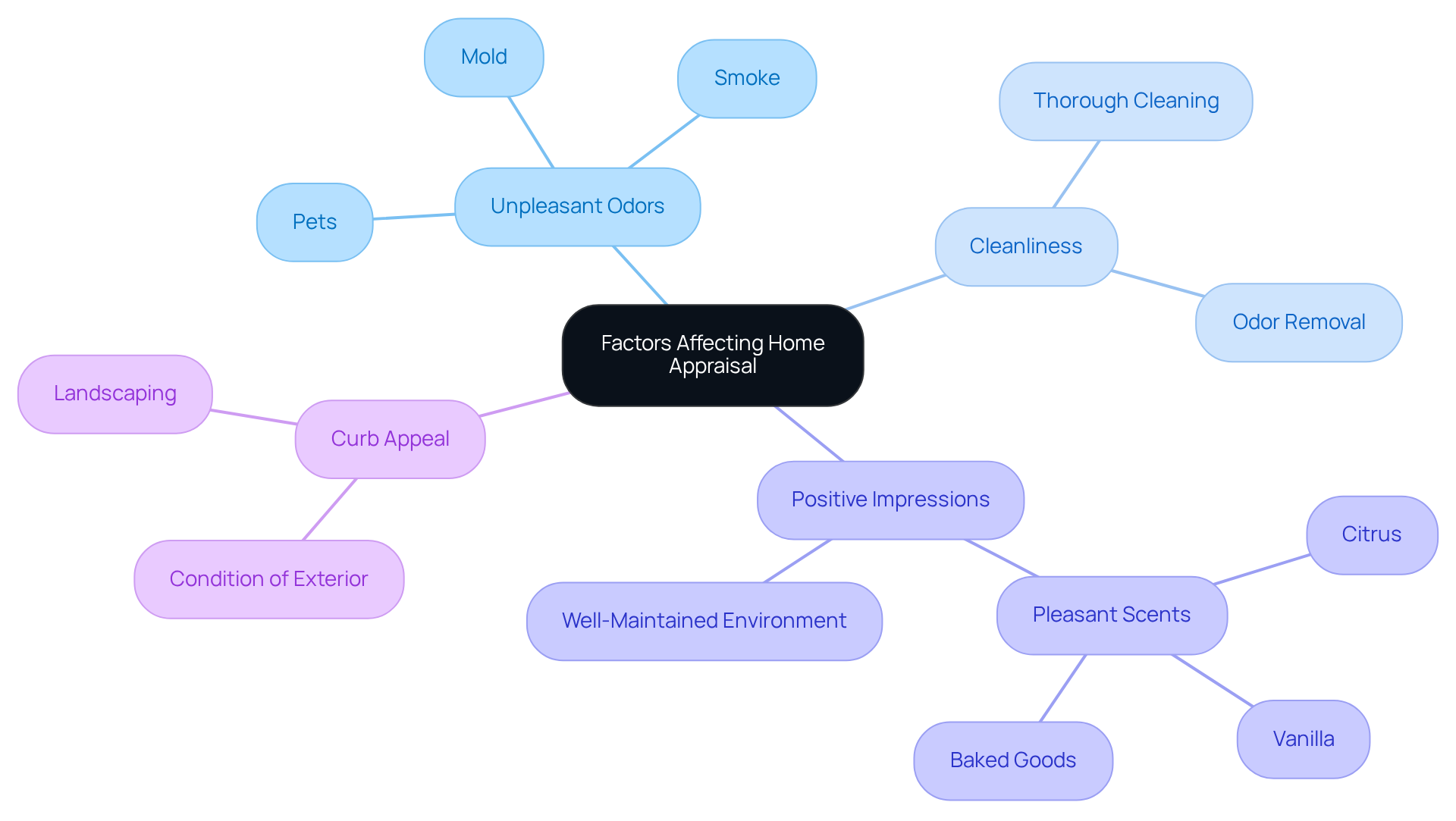

Odors and Cleanliness: The Unexpected Role of Home Smells in Appraisal Assessments

There are 4 surprising factors that can affect a home appraisal, including scents and tidiness. We know how challenging it can be to navigate the atmosphere of a home, as assessors are not immune to its effects. , whether from pets, smoke, or mold, can diminish a property’s overall appeal, often resulting in lower valuation figures. On the other hand, a clean and well-maintained home fosters a positive impression. This allows appraisers to focus on the property’s features instead of being distracted by negative elements.

To maximize your chances of achieving the best possible outcome, homeowners should prioritize thorough cleaning and odor removal before a valuation. We’re here to support you every step of the way. Experienced appraisers note that the overall feel and smell of a home are among the 4 surprising factors that can affect a home appraisal, making it essential to create a welcoming environment. Simple steps, such as using pleasant scents like citrus or vanilla, can enhance the atmosphere and potentially lead to a more favorable appraisal. Remember, a little effort can go a long way in making your home shine.

Conclusion

Understanding the nuanced factors that influence home appraisals can truly empower you as a homeowner to significantly enhance your property’s perceived value. We know how challenging this can be, and the insights shared here highlight how elements such as neighborhood quality, home layout, and even the cleanliness of your property can play unexpected roles in determining appraisal outcomes. By recognizing these surprising influences, you can take proactive steps to ensure your home is positioned favorably in the eyes of appraisers.

Key points discussed include:

- The importance of community conditions, which can elevate or diminish property values.

- The impact of modern home layouts that cater to contemporary living preferences.

- The often-overlooked aspects of odors and cleanliness reveal how sensory experiences can affect appraisals.

Engaging with experts, such as F5 Mortgage, can provide personalized strategies that align these factors with successful appraisal results.

Ultimately, the significance of these insights extends beyond individual appraisals; they underscore the importance of being informed and prepared in the real estate landscape. We encourage you to take action—whether through community involvement, home improvements, or consultations with mortgage experts—to maximize your property’s value. By doing so, you not only enhance your appraisal outcomes but also contribute to your long-term homeownership goals.

Frequently Asked Questions

What services does F5 Mortgage provide regarding home appraisals?

F5 Mortgage offers personalized consultations to help clients navigate the appraisal process, discussing factors like recent renovations, neighborhood trends, and current market conditions to enhance home appraisal outcomes.

What are the benefits of personalized consultations at F5 Mortgage?

Personalized consultations empower clients with knowledge about factors that affect home appraisals, improve preparation for appraisals, and increase the perceived value of their properties.

What are the surprising factors that can affect a home appraisal?

The article mentions that there are four surprising factors that can affect a home appraisal, though it does not specify what they are.

How do personalized consultations impact appraisal outcomes?

Statistics indicate that personalized consultations lead to improved evaluation outcomes, as clients feel better prepared to address discrepancies and highlight property improvements.

What is the customer satisfaction rate of F5 Mortgage?

F5 Mortgage has a customer satisfaction rate of 94%.

How many families has F5 Mortgage assisted?

F5 Mortgage has assisted over 1,000 families.

What is the overall goal of F5 Mortgage’s services?

The goal is to provide customized service and expert advice to ensure a smooth and hassle-free mortgage process, enhancing the home evaluation experience for clients.