Overview

Navigating the mortgage loan application process can feel overwhelming, but breaking it down into four manageable steps can make it easier:

- Obtaining pre-approval sets a solid foundation.

- Gathering the required documents is crucial.

- Submitting your application is the key step to take.

- Finalizing the loan through the closing process brings you closer to your goal.

We understand how challenging this can be, and that’s why this article outlines each step in detail. It emphasizes the importance of accurate documentation and effective communication with lenders. By focusing on these aspects, you can enhance your chances of approval and ensure a smooth application experience. Remember, we’re here to support you every step of the way.

Introduction

Navigating the mortgage loan application process can feel overwhelming, filled with complex steps and a multitude of documents to prepare. We know how challenging this can be. However, understanding the essential phases—from pre-approval to closing—can empower potential homeowners to approach this journey with confidence.

What if there was a clear, structured way to simplify this process and increase your chances of securing favorable financing? This guide breaks down the four critical steps needed to successfully complete a mortgage loan application, ensuring that every aspiring homeowner is equipped with the knowledge to turn their dream into reality.

We’re here to support you every step of the way.

Obtain Pre-Approval for Your Mortgage

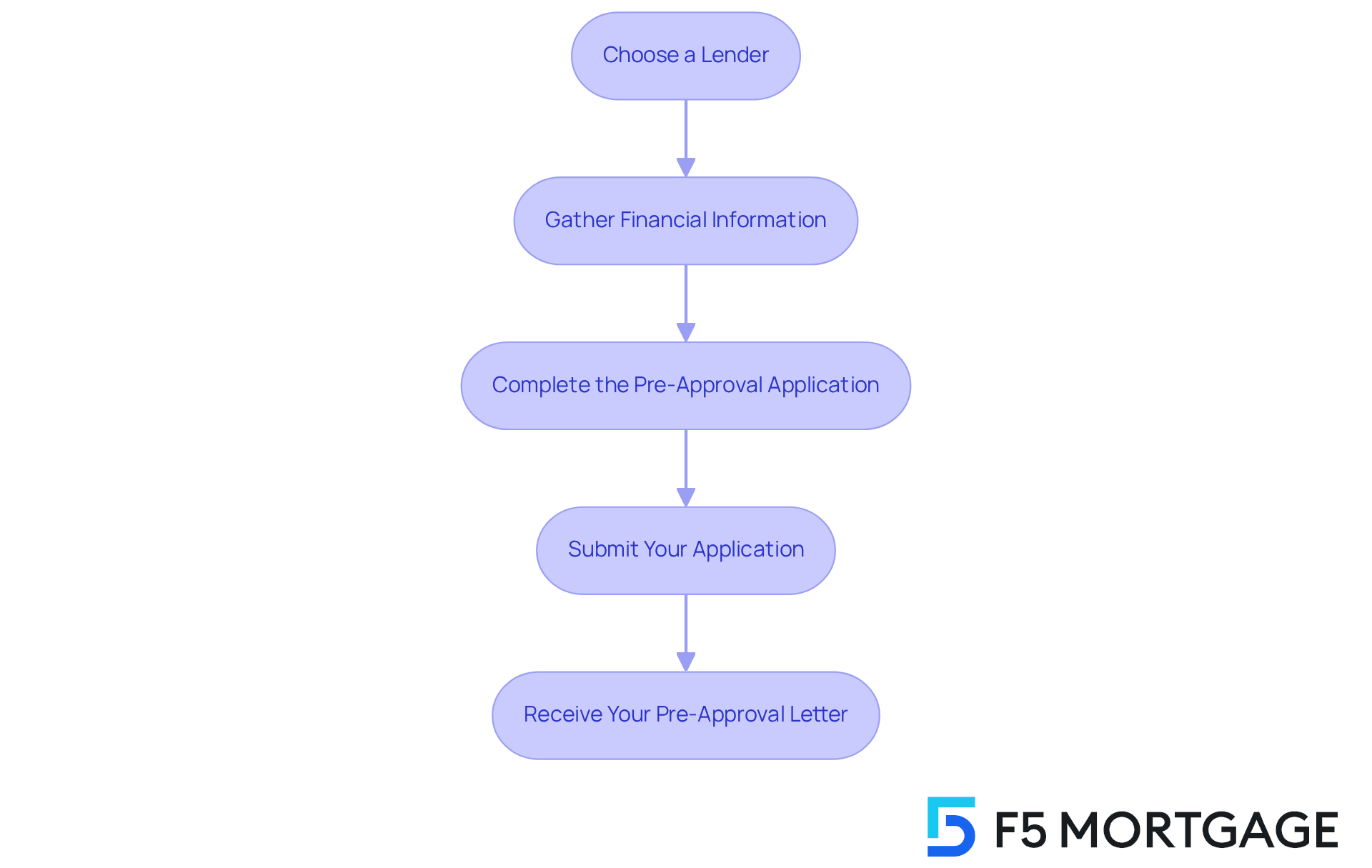

Navigating the mortgage loan application process can feel overwhelming, but we’re here to support you every step of the way. To obtain pre-approval for your mortgage with F5 Mortgage, follow these simple steps:

Choose a Lender: Start by researching and selecting a lender that offers competitive rates and terms. Consider independent brokers like F5 Mortgage, who can provide personalized service and a stress-free experience through user-friendly technology.

Gather Financial Information: Take a moment to prepare your financial documents. You’ll need:

- Recent pay stubs (last 30 days)

- W-2 forms from the last two years

- Bank statements for all accounts

- Tax returns for the last two years

Complete the Pre-Approval Application: Next, fill out F5 Mortgage’s pre-approval application form. Be sure to provide accurate information about your income, debts, and assets. This step is crucial as it helps determine your eligibility for a mortgage.

Submit Your Application: Once your application is complete, send it along with the required documents to F5 Mortgage. They will carefully review your financial situation and perform a credit check.

Receive Your Pre-Approval Letter: If accepted, you will receive a pre-approval letter detailing the amount you are eligible for, along with estimates of your interest rate and monthly payment. This letter is typically valid for 60-90 days and is essential. It shows sellers that you are a serious buyer and helps you understand your loan options.

We know how challenging this can be, but taking these steps will empower you on your .

Gather Required Documents for Application

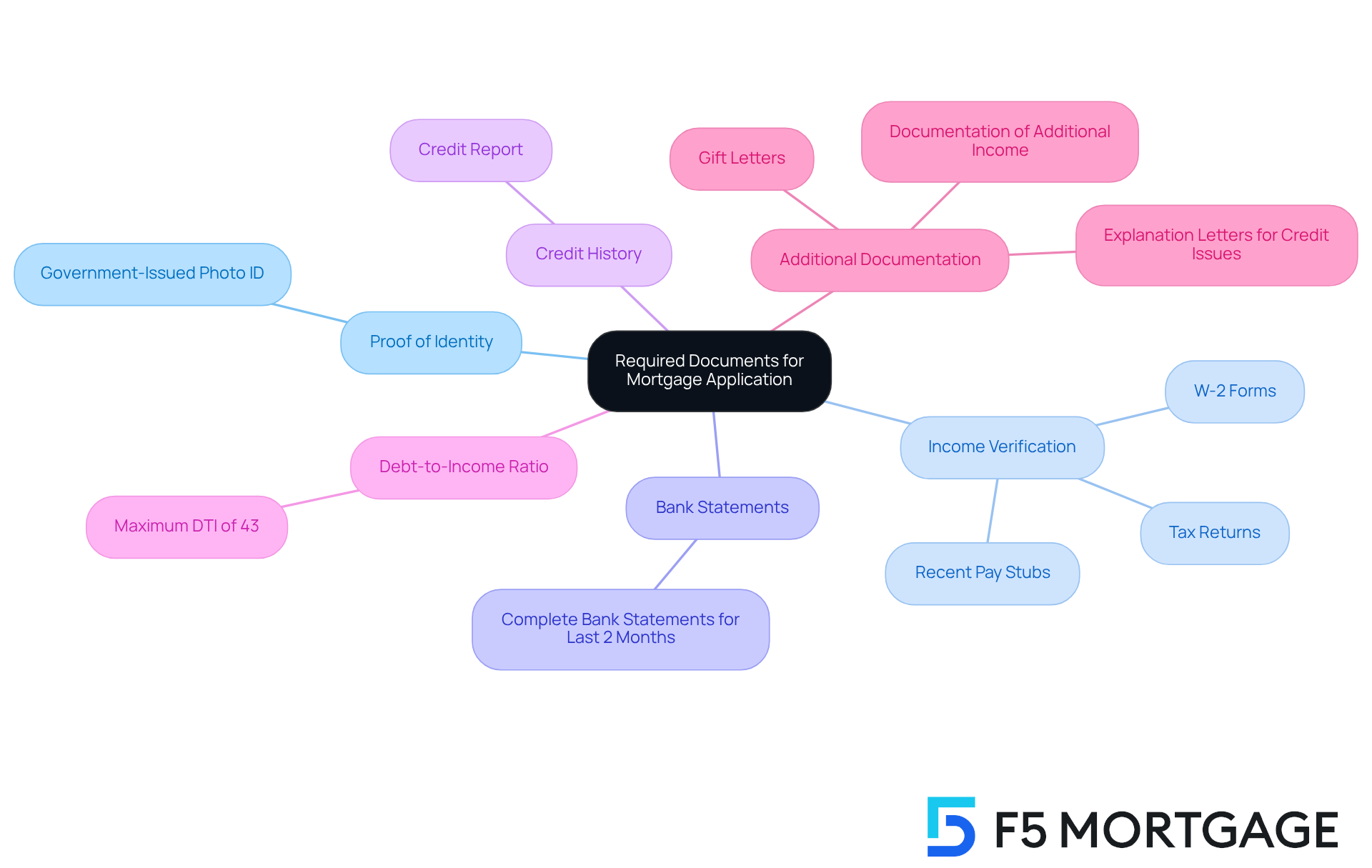

Gathering the required documents for your mortgage loan application can feel overwhelming, but we’re here to help you every step of the way. To make this process smoother, please compile the following essential documents:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is necessary.

- Income Verification: You’ll need to include:

- Recent pay stubs from the last 30 days

- W-2 forms from the last two years

- Tax returns for the last two years, especially if you are self-employed.

- Bank Statements: Please provide complete bank statements for all your financial accounts for the last two months.

- Credit History: Be prepared for your lender to pull your credit report, which will detail your credit history and score.

- Debt-to-Income Ratio (DTI): It’s important to know that a maximum DTI ratio of 43% is generally required for home financing. A lower DTI can lead to more competitive loan rates, so ensure your financial documentation reflects this.

- Additional Documentation: Depending on your unique situation, you may need to provide:

- Gift letters if receiving funds from family for a down payment

- Documentation of any additional income sources, such as rental income

- Explanation letters for any credit issues you may have encountered.

By preparing these documents for your mortgage loan application, you will feel more confident as you explore the refinancing options available through F5 Mortgage. Whether you’re considering conventional loans, FHA loans, or VA loans, having your paperwork ready will ensure a smoother application experience.

Submit Your Application and Undergo Review

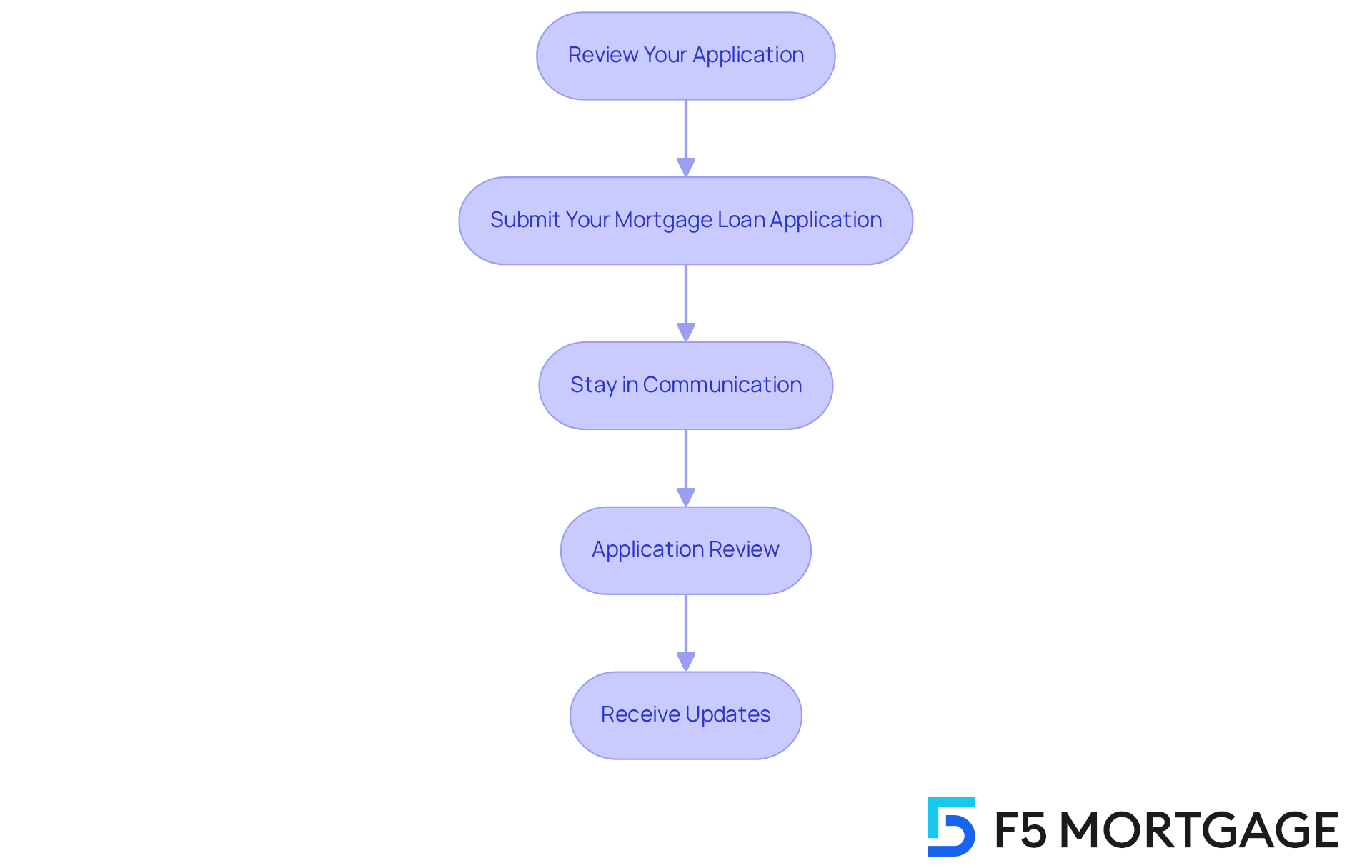

To successfully submit your mortgage application, follow these essential steps:

- Review Your Application: We know how challenging this can be. Ensure that all information is accurate and complete before submission. This initial check can prevent delays later in the process, giving you peace of mind.

- Submit Your Mortgage Loan Application: Send your mortgage loan application and supporting documents to the financial institution, either online or in person, according to their preferred method. Consider comparing rates, costs, and terms from various providers to ensure you find the best deal for your needs. Remember, we’re here to support you every step of the way.

- Stay in Communication: Maintain open lines of communication with your financial institution. Regularly check in and be ready to respond to any inquiries or requests for additional documentation. Studies show that maintaining frequent communication can significantly enhance the application experience and reduce processing times. Your proactive approach can make all the difference.

- Application Review: The financial institution will assess your mortgage loan application, which generally takes anywhere from a few days to a couple of weeks. During this period, they will evaluate your creditworthiness, income stability, and overall financial health. It’s important to note that financial institutions often reserve the with credit scores of 740 or higher, so be mindful of your credit standing. This is a crucial moment in your journey.

The process of submitting a mortgage loan application involves several important steps. Receive updates on your mortgage loan application status from your financial institution. They may reach out for further information or clarification, so be prepared to provide any necessary details promptly. Keep in mind, effective communication can help prevent typical application errors and simplify the procedure. If you’re looking for a realtor, Mortgage can connect you with top agents in your area to help you find the best deal.

Furthermore, according to federal regulations, financial institutions must supply a home financing toolkit booklet from the CFPB within three days of submitting an application for a home loan. This booklet can assist you in grasping the procedure more effectively. Additionally, keep in mind that obtaining quotes from three lenders could potentially save you $1,000 throughout the duration of your financing, making it beneficial to compare options. Lastly, don’t forget to budget for closing costs to avoid unexpected expenses.

By following these steps and maintaining proactive communication, you can navigate the application process more effectively and increase your chances of securing favorable financing terms with Mortgage. Remember, you are not alone in this journey.

Finalize Your Loan: Closing and Funding Process

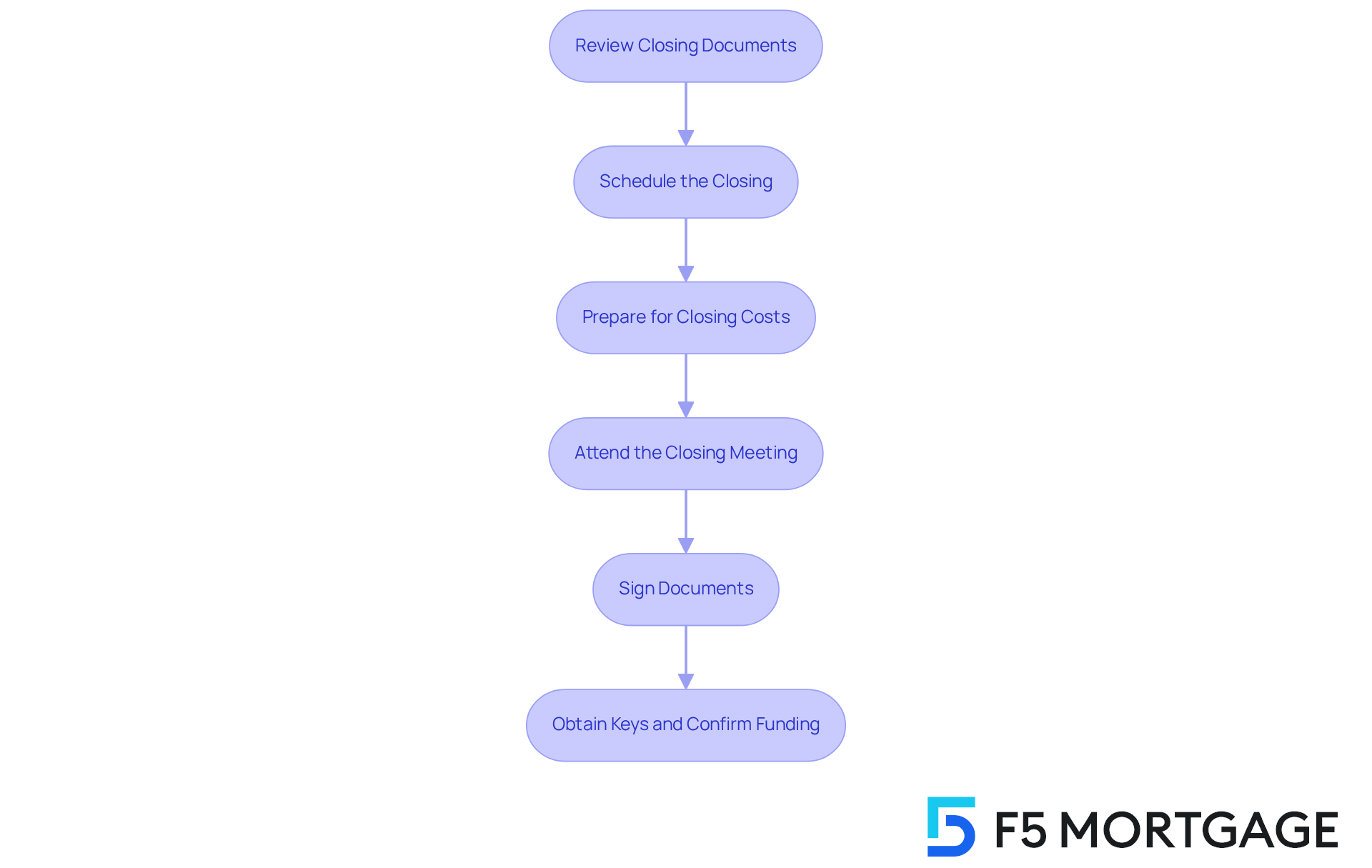

To successfully finalize your mortgage loan, it’s important to follow these essential steps during the closing and funding process:

- Review Closing Documents: We know how overwhelming the paperwork can be. Prior to the closing day, take the time to carefully scrutinize all documents, especially the Closing Disclosure. This document outlines your financing terms and related closing expenses, ensuring transparency about what you will be paying.

- Schedule the Closing: Work closely with your financial institution and real estate agent to establish a convenient closing date and time. Effective communication is key to ensuring all parties are aligned, helping to alleviate any stress you might feel.

- Prepare for Closing Costs: We understand that closing costs can be a concern. Be ready for these costs, which typically range from 2% to 5% of the loan amount. Having these funds readily available will help prevent any last-minute complications and give you peace of mind.

- Attend the Closing Meeting: On the day of closing, attend the meeting with all necessary parties, including your lender, real estate agent, and possibly a lawyer. Bring your identification and any necessary funds to ensure a smooth operation, knowing that you’re not alone in this process.

- Sign Documents: Carefully review and sign all necessary documents, including the loan agreement and promissory note. It’s vital to fully understand your obligations as a borrower to avoid any future issues. Remember, asking questions is always encouraged—this is your journey.

- Obtain Keys and Confirm Funding: Upon signing all paperwork and transferring funds, you will obtain the keys to your new residence. This moment signifies the official conclusion of the financing, a step towards your new beginning.

Statistics indicate that the average closing time for mortgage loan applications has improved, with many transactions now completing in less than 30 days. Real estate professionals emphasize the importance of being well-prepared for closing costs, as these can significantly impact your overall financial commitment. By following these steps and being informed, you can navigate the closing process with confidence and ease, knowing that we’re here to support you every step of the way.

Conclusion

Navigating the mortgage loan application process can feel overwhelming, but it is an essential step toward achieving your dream of homeownership. We know how challenging this can be, yet understanding and following the outlined steps—from obtaining pre-approval to finalizing your loan—can streamline the process and enhance your chances of success. Each phase, whether it involves gathering necessary documents or communicating with your lender, plays a vital role in securing favorable financing.

Key insights throughout this guide highlight the importance of preparation and proactive engagement. From selecting the right lender and compiling essential financial documents to staying in touch during the application review, each action contributes to a smoother experience. Understanding your financial standing, including your credit score and debt-to-income ratio, can significantly impact the terms of your mortgage.

Ultimately, the journey to homeownership is not just about securing a loan; it is about making informed decisions that will benefit you in the long run. Taking the time to prepare thoroughly, communicate effectively, and understand the closing process can lead to a successful outcome. Embrace these steps with confidence, and take your first stride toward owning your dream home. We’re here to support you every step of the way.

Frequently Asked Questions

What is the first step to obtaining pre-approval for a mortgage with F5 Mortgage?

The first step is to choose a lender that offers competitive rates and terms, such as F5 Mortgage, which provides personalized service and a user-friendly experience.

What financial documents do I need to gather for the pre-approval process?

You will need recent pay stubs (from the last 30 days), W-2 forms from the last two years, bank statements for all accounts, and tax returns for the last two years.

How do I complete the pre-approval application?

Fill out F5 Mortgage’s pre-approval application form accurately, providing information about your income, debts, and assets. This information is crucial for determining your eligibility for a mortgage.

What should I do after completing the pre-approval application?

Submit your completed application along with the required financial documents to F5 Mortgage for review.

What happens after I submit my application?

F5 Mortgage will review your financial situation and perform a credit check. If accepted, you will receive a pre-approval letter.

What information does the pre-approval letter contain?

The pre-approval letter details the amount you are eligible for, estimates of your interest rate, and monthly payment. It is typically valid for 60-90 days.

Why is the pre-approval letter important?

The pre-approval letter shows sellers that you are a serious buyer and helps you understand your loan options.