Overview

Navigating the reconveyance deed process after paying off your mortgage can feel overwhelming, but we’re here to support you every step of the way. It’s essential to confirm that your loan has been fully paid. This step not only brings peace of mind but also sets the stage for the next actions you need to take.

Once you’ve confirmed your payment, the next step is to request the reconveyance deed from your lender. This document is crucial as it officially recognizes that you own your home outright. Completing the necessary forms may seem daunting, but remember, you’re not alone in this process. We understand how challenging it can be to navigate these requirements.

Proper documentation is key to avoiding common issues that could affect your ownership rights. By ensuring that all paperwork is in order, you’re not just protecting your current ownership but also facilitating any future property transactions. We know how important it is for you to feel secure in your home, and taking these steps will help you achieve that.

Introduction

Understanding the intricacies of a reconveyance deed can feel overwhelming for many homeowners. We know how challenging this can be, yet it plays a crucial role in confirming property ownership after a mortgage is paid off. This essential legal document not only protects your ownership rights but also facilitates future transactions. It’s vital for anyone looking to sell or refinance their property.

However, many homeowners remain unaware of its importance. So, how can you effectively navigate the reconveyance deed process and avoid potential pitfalls? We’re here to support you every step of the way. Together, we can ensure that you feel confident and informed as you take this important step in your homeownership journey.

Understand the Reconveyance Deed

A reconveyance deed is an essential legal document that signifies the transfer of title from the lender back to the borrower once the mortgage is fully repaid. The reconveyance deed is crucial for resolving any liens related to the mortgage, confirming that the borrower possesses the asset entirely. We know how important it is for homeowners to understand the significance of a reconveyance deed, as it protects their ownership rights and is often necessary for future transactions, such as selling or refinancing the property.

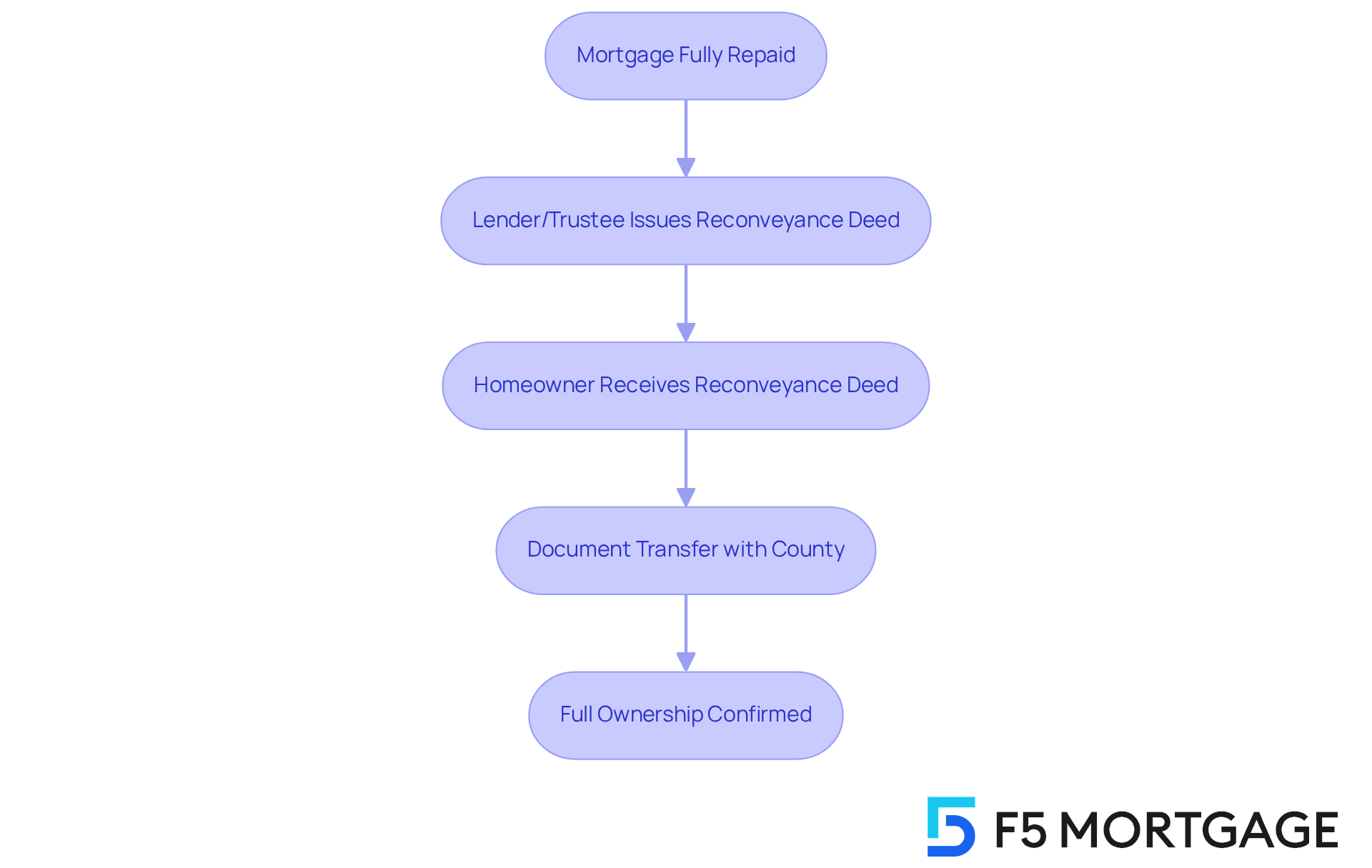

The transfer process typically involves the lender or trustee providing the reconveyance deed after ensuring that all loan responsibilities have been fulfilled. However, many homeowners may not fully grasp the role of the transfer document; studies indicate that around 60% of homeowners are unaware of this crucial paperwork. As we look ahead to 2025, we anticipate that awareness of property transfer documents will improve as more educational materials and programs become available to borrowers.

Real estate lawyers emphasize that a reconveyance deed serves as legal evidence of ownership, safeguarding your rights by confirming that no remaining claims exist against the property. For example, if a homeowner named Sally pays off her $300,000 mortgage, the issuance of a release document verifies her complete ownership and eliminates any related liens, indicating that the lender no longer has any claim on the asset. Without the reconveyance deed, the property may still appear burdened, or refinancing efforts.

Homeowners can generally expect to receive their reconveyance deed within 30 to 60 days after they have settled their mortgage. It is essential to promptly document the transfer agreement with the county to avoid potential issues, such as delays in selling or refinancing the property.

In summary, becoming familiar with the reconveyance deed is vital for successfully navigating the mortgage payoff process and ensuring that your property rights are fully protected. We’re here to support you every step of the way.

Obtain the Reconveyance Deed

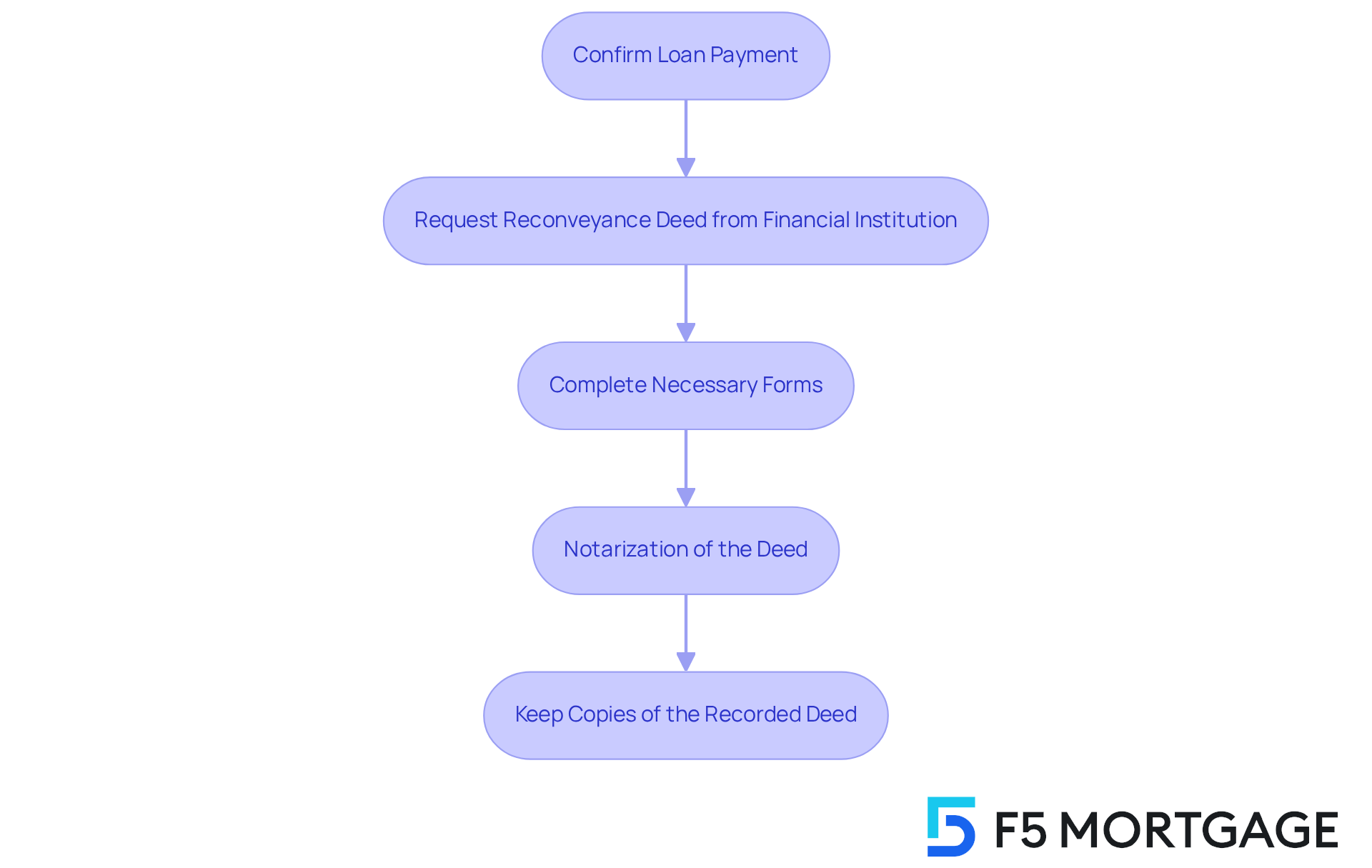

To obtain your reconveyance deed, follow these steps:

- Confirm Loan Payment: We know how challenging this can be, so it’s important to ensure that your mortgage has been paid in full. This includes any final payments or fees that may be due.

- The reconveyance deed is an important legal document. Ask for the reconveyance deed by contacting your financial institution or the trustee mentioned in your trust document. Officially request the reconveyance deed by providing any required paperwork to demonstrate that your loan is settled. We’re here to support you every step of the way.

- Complete Necessary Forms: Some financial institutions may require you to fill out specific forms to begin the transfer process. Make sure that all information is accurate to avoid delays, as we understand how important this is to you.

A reconveyance deed is a legal document that transfers property back to the original owner. Notarization of the reconveyance deed is required once the lender or trustee prepares the transfer document, and it must be signed and notarized. This step is crucial for the document’s legal validity, ensuring everything is in order.

A reconveyance deed is often used to transfer property back to the original owner. Document the Instrument: After notarization, take the reconveyance deed to your local county recorder’s office to have it officially registered. This step ensures that the title is clear and reflects your ownership, giving you .

- Keep Copies: Retain copies of the recorded transfer deed for your records. This document may be needed for future transactions involving the property, and having it on hand can save you time and stress.

Troubleshoot Common Issues in the Reconveyance Process

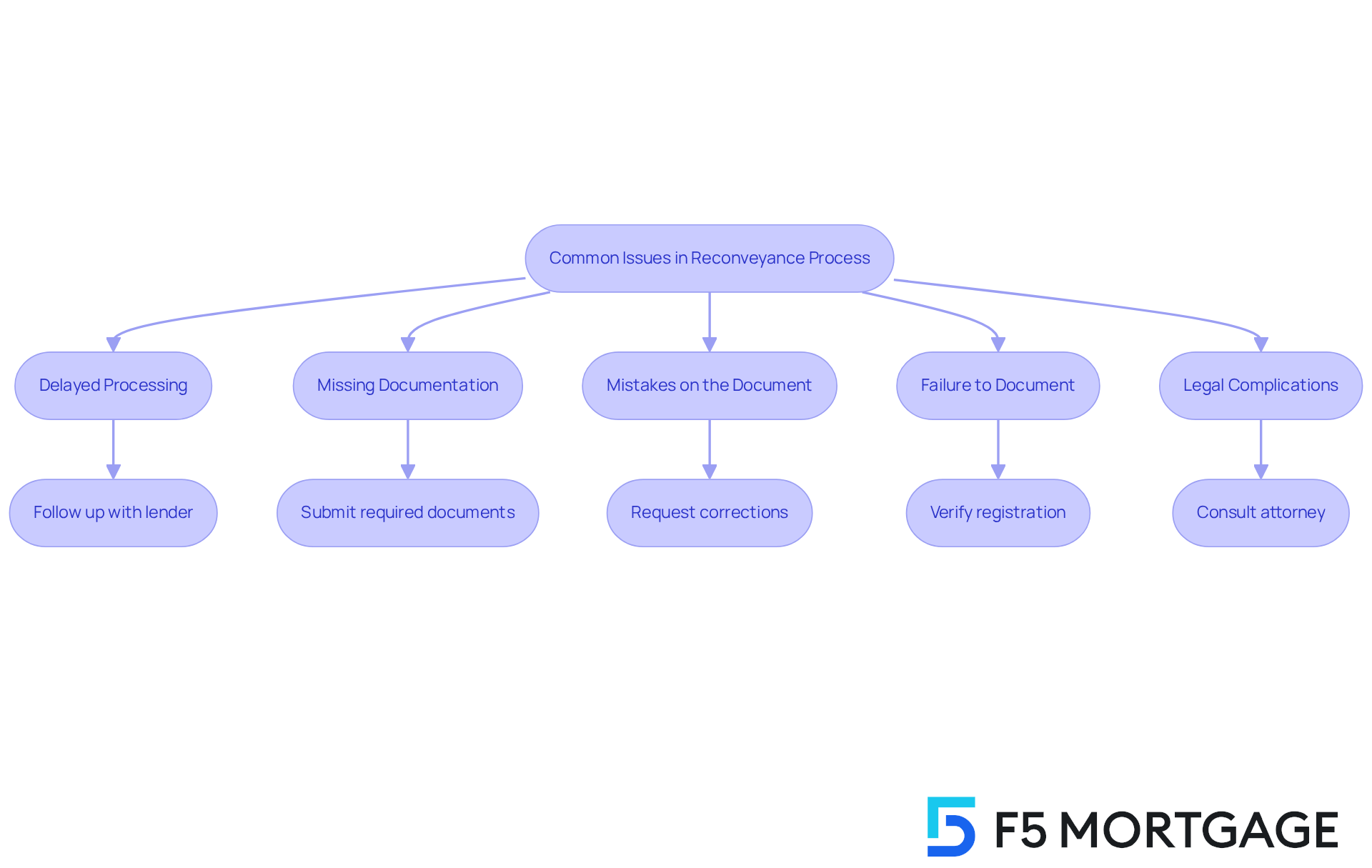

Homeowners often face several common challenges during the reconveyance deed process. While this process is generally straightforward, if these issues are not addressed promptly. Here’s how you can navigate these potential hurdles with confidence:

- Delayed Processing: Sometimes, lenders may take longer than expected to process transfer requests. If you find yourself in this situation, don’t hesitate to follow up with your lender to check the status of your request. We know how frustrating delays can be, and often they stem from absent documentation, a frequent concern in the transfer process.

- Missing Documentation: It’s essential to ensure that all required documents are submitted with your request. Missing paperwork can significantly delay the process, adding to your stress. If you are notified about missing documents, address the issue immediately to prevent further complications.

- Mistakes on the Document: After receiving the transfer document, take the time to thoroughly examine it for any inaccuracies in names, property descriptions, or other essential details. Unfortunately, a significant portion of property transfer documents contain mistakes. If you identify any errors, reach out to your lender without delay to request corrections.

- Failure to Document: If the conveyance instrument is not registered with the county, it may not officially indicate that the mortgage has been paid off. Always verify that the deed has been recorded and obtain a copy for your records. This step is crucial in ensuring clear ownership.

- Legal Complications: Legal issues may arise if the transfer is not handled correctly. As spbickett notes, conflicts of interest can complicate the process. If you encounter significant problems, consulting a real estate attorney can provide the necessary guidance and support.

By being aware of these potential issues and knowing how to address them, you can navigate the property transfer process more effectively. Remember, timely communication with lenders is crucial in mitigating delays and ensuring a smooth reconveyance deed process. We’re here to support you every step of the way.

Conclusion

Understanding the reconveyance deed process is essential for homeowners who have just paid off their mortgage. This important legal document not only confirms the transfer of title from the lender back to you, the borrower, but also eliminates any lingering claims against your property. This ensures a smooth transition into full ownership. By recognizing the significance of this process, you can effectively navigate potential challenges and protect your investment.

Key steps in obtaining a reconveyance deed include:

- Confirming your loan payment

- Officially requesting the deed from your lender

- Completing the necessary forms

- Ensuring notarization and documentation with the county recorder’s office

Being aware of common issues, such as delayed processing or missing documentation, is crucial in preventing complications. By proactively addressing these challenges and maintaining clear communication with your lenders, you can streamline the reconveyance process and safeguard your ownership rights.

Ultimately, being informed about the reconveyance deed process empowers you to take control of your property transactions. As the landscape of real estate continues to evolve, understanding these legal nuances will not only enhance your financial security but also facilitate future endeavors, such as selling or refinancing. Embracing this knowledge is a vital step toward ensuring peace of mind and confidence in your property ownership.

Frequently Asked Questions

What is a reconveyance deed?

A reconveyance deed is a legal document that signifies the transfer of title from the lender back to the borrower once the mortgage is fully repaid.

Why is a reconveyance deed important for homeowners?

It protects homeowners’ ownership rights, resolves any liens related to the mortgage, and is often necessary for future transactions, such as selling or refinancing the property.

What is the process for obtaining a reconveyance deed?

The lender or trustee provides the reconveyance deed after ensuring that all loan responsibilities have been fulfilled, typically within 30 to 60 days after the mortgage is settled.

What percentage of homeowners are unaware of the reconveyance deed?

Studies indicate that around 60% of homeowners are unaware of the reconveyance deed and its significance.

How does a reconveyance deed serve as legal evidence of ownership?

It confirms that no remaining claims exist against the property, safeguarding the homeowner’s rights and verifying complete ownership after the mortgage is paid off.

What could happen if a homeowner does not receive a reconveyance deed?

Without the reconveyance deed, the property may still appear burdened, complicating future transactions or refinancing efforts.

What should homeowners do after receiving their reconveyance deed?

It is essential to promptly document the transfer agreement with the county to avoid potential issues, such as delays in selling or refinancing the property.