Overview

Mortgage loan amortization is the process of repaying a loan through regular payments that cover both principal and interest. This process ultimately reduces the loan balance to zero by the end of the term. Understanding amortization is essential for borrowers, as it influences equity growth and total loan costs. We know how challenging this can be, especially when considering how different repayment strategies and loan durations can significantly affect your financial outcomes.

By recognizing the importance of amortization, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way, helping you navigate through various repayment options that suit your needs. Remember, the choices you make today can have lasting impacts on your future.

Take the time to explore your options and understand how each choice affects your financial journey. Empower yourself with knowledge, and consider reaching out for guidance tailored to your unique situation.

Introduction

Understanding mortgage loan amortization is essential for anyone looking to navigate the complexities of home financing. We know how challenging this can be, and that’s why it’s crucial to grasp this structured repayment method. It not only demystifies how monthly payments are divided between principal and interest but also empowers borrowers to make informed financial decisions that can save them thousands over the life of their loan.

Yet, many still grapple with the implications of different amortization periods. These variations can significantly affect both monthly costs and overall loan expenses. How can homeowners leverage this knowledge to optimize their mortgage strategy and achieve financial stability? We’re here to support you every step of the way as you explore your options.

Define Mortgage Loan Amortization

is a over a set period through regular, scheduled payments. Each installment consists of two parts: the principal and fees. This approach is designed to to zero by the end of the loan term. By using this organized method, you can better manage your debt and see how each payment impacts your loan balance over time.

Amortization plans clearly show how each payment is divided between fees and the reduction of the principal. For instance, if you take out a $400,000 loan at a 6.5% interest rate, you might find that the total cost over 30 years exceeds $900,000, with over $510,177.95 attributed to fees alone. However, by , like an additional $100 each month, you could save $63,917.25 in interest and pay off your mortgage 38 months earlier.

As we look ahead to 2025, the typical repayment period for mortgages remains predominantly 30 years. Yet, many individuals are also opting for shorter terms to build equity more rapidly. Understanding the is crucial. For example, maintaining at least an 80% home-to-value ratio and a maximum debt-to-income (DTI) ratio of 43% can empower you to make informed financial decisions.

These factors are vital as they influence your overall financing management and the potential for . We know how challenging this can be, but we’re here to support you every step of the way in .

Explain How Amortization Works

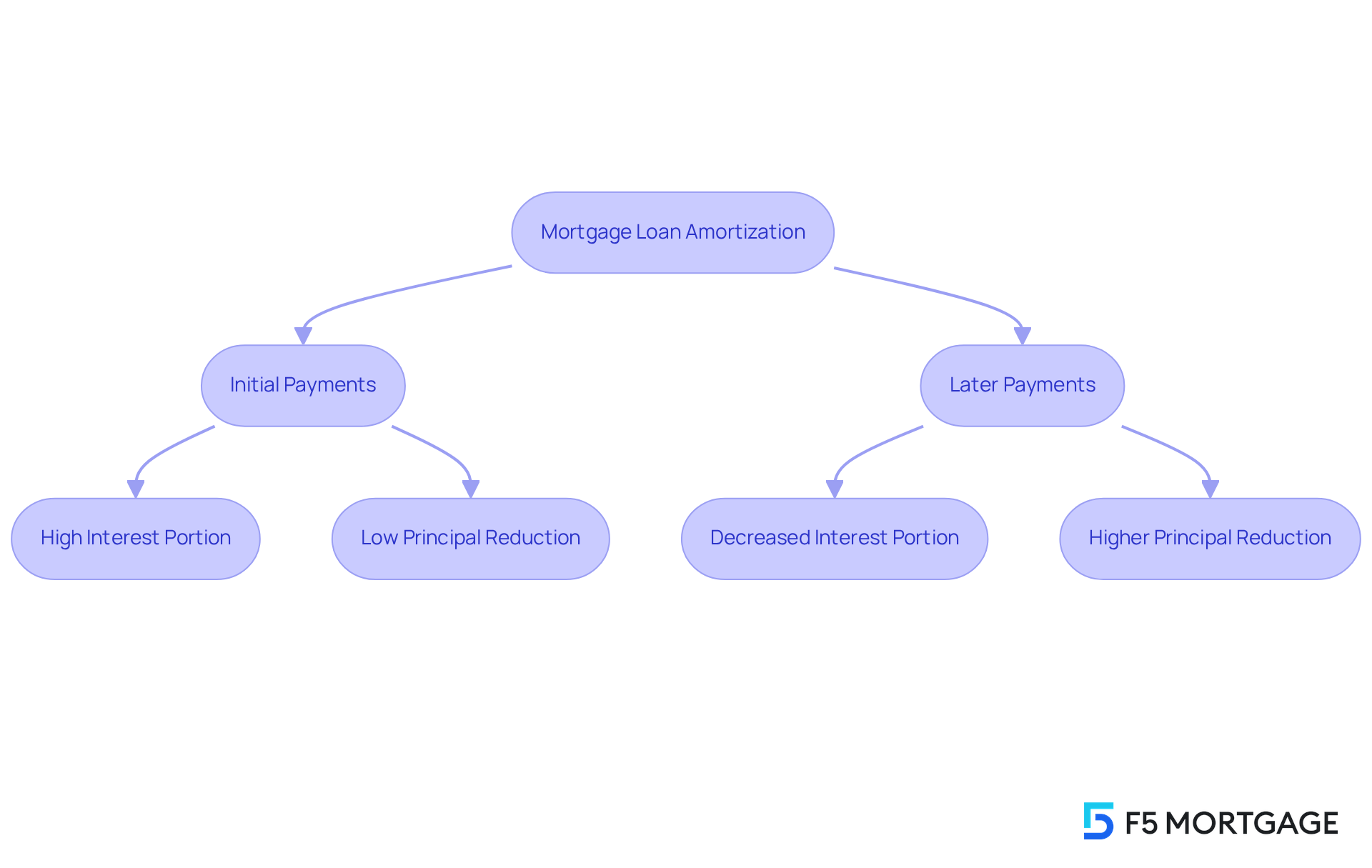

divides the total amount borrowed into equal monthly payments over a set term, typically ranging from 15 to 30 years. Initially, a significant portion of each payment goes toward interest, while a smaller amount reduces the principal. As time goes on, the interest component decreases, allowing more of your payment to be applied to the principal. This shift occurs because interest is calculated on the remaining balance, which decreases over time. is crucial for borrowers, as it directly impacts how quickly they and the total cost of the loan.

For instance, imagine a 30-year of $100,000 at an interest rate of 7.75%. Your monthly payment would be approximately $716.41, with early payments primarily covering the cost of borrowing. However, as the principal balance declines, the equity in your home grows more rapidly. This gradual increase in equity is vital for homeowners, especially in the early years when growth is slower due to higher borrowing costs.

Financial experts emphasize the importance of schedules, which outline how each payment is divided between principal and interest. These schedules not only help you manage your payments effectively but also highlight the long-term . By making or opting for a bi-weekly payment plan, you can significantly reduce your overall costs and shorten the life of the mortgage, enhancing your financial well-being.

In summary, grasping the repayment process is essential for prospective homebuyers. It equips you with the knowledge needed to and repayment strategies. We know how challenging this can be, and we’re here to support you every step of the way.

Analyze the Effects of Amortization Periods

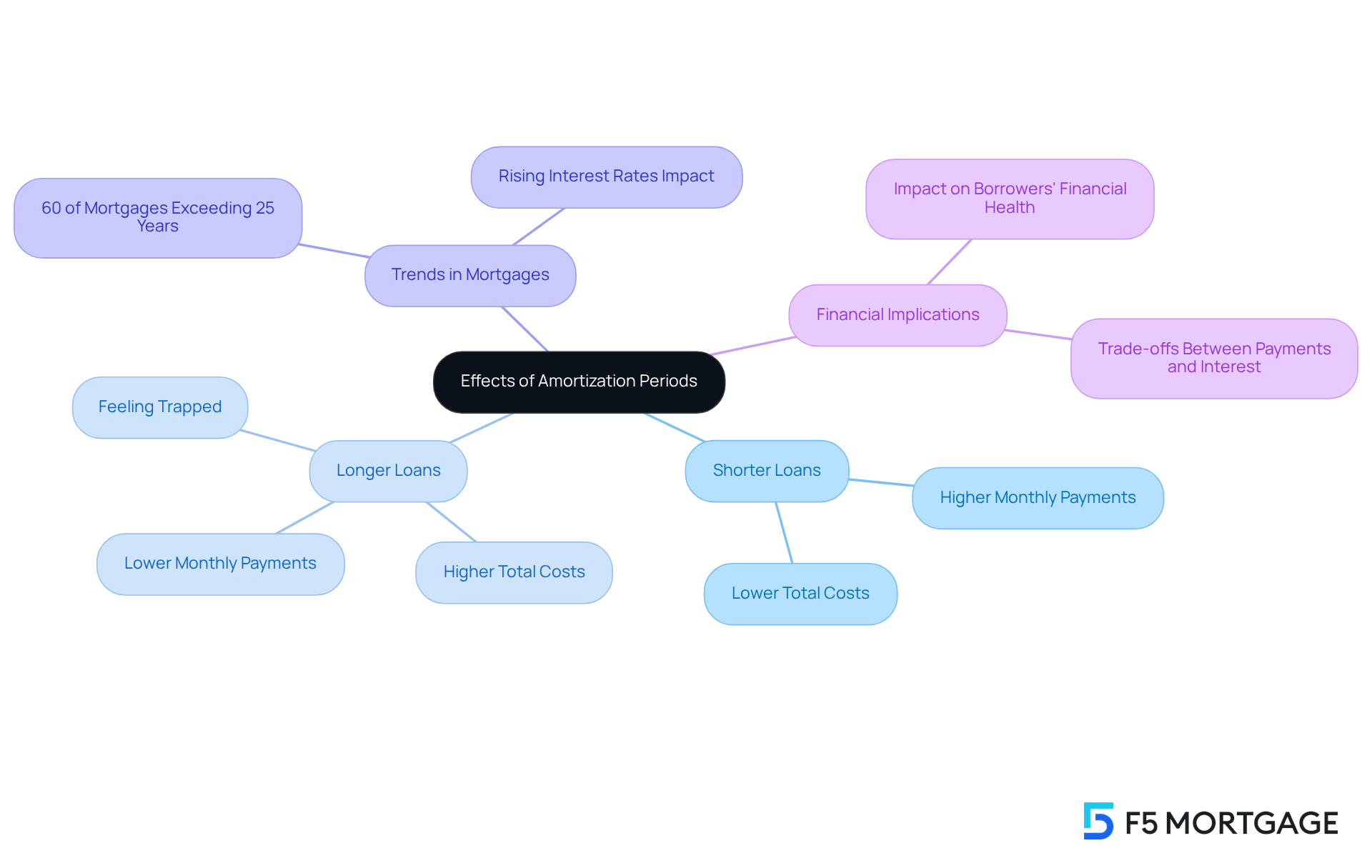

The can significantly impact your monthly costs and the total amount you pay over the life of your loan. If you choose a shorter loan term, like 15 years, you may face higher , but you’ll also benefit from lower overall financing costs because you’ll pay off the loan more quickly. Conversely, opting for a , such as 30 years, can reduce your monthly expenses, but it often leads to a since you remain in debt for a longer period.

For instance, consider a $300,000 . Your monthly payment would be approximately $2,219 over 15 years, compared to about $1,818 over 30 years. Understanding these differences is vital as it can help you choose the that aligns with your and capabilities.

It’s also important to recognize that 60% of mortgages in Canada have repayment durations exceeding 25 years, reflecting a common trend among borrowers. Some loans even offer , allowing you to pay extra towards the principal without incurring fees. This can help you and reduce overall costs.

Financial educator Mark Kalinowski warns that many borrowers might feel ‘trapped’ in lengthy repayment periods, leading to significantly . As interest rates rise, borrowers face a crucial trade-off between initial cost relief and increased overall interest expenses. This makes it essential to carefully evaluate the implications of your repayment choices. We know how challenging this can be, and we’re here to support you every step of the way.

Guide on Selecting an Amortization Schedule

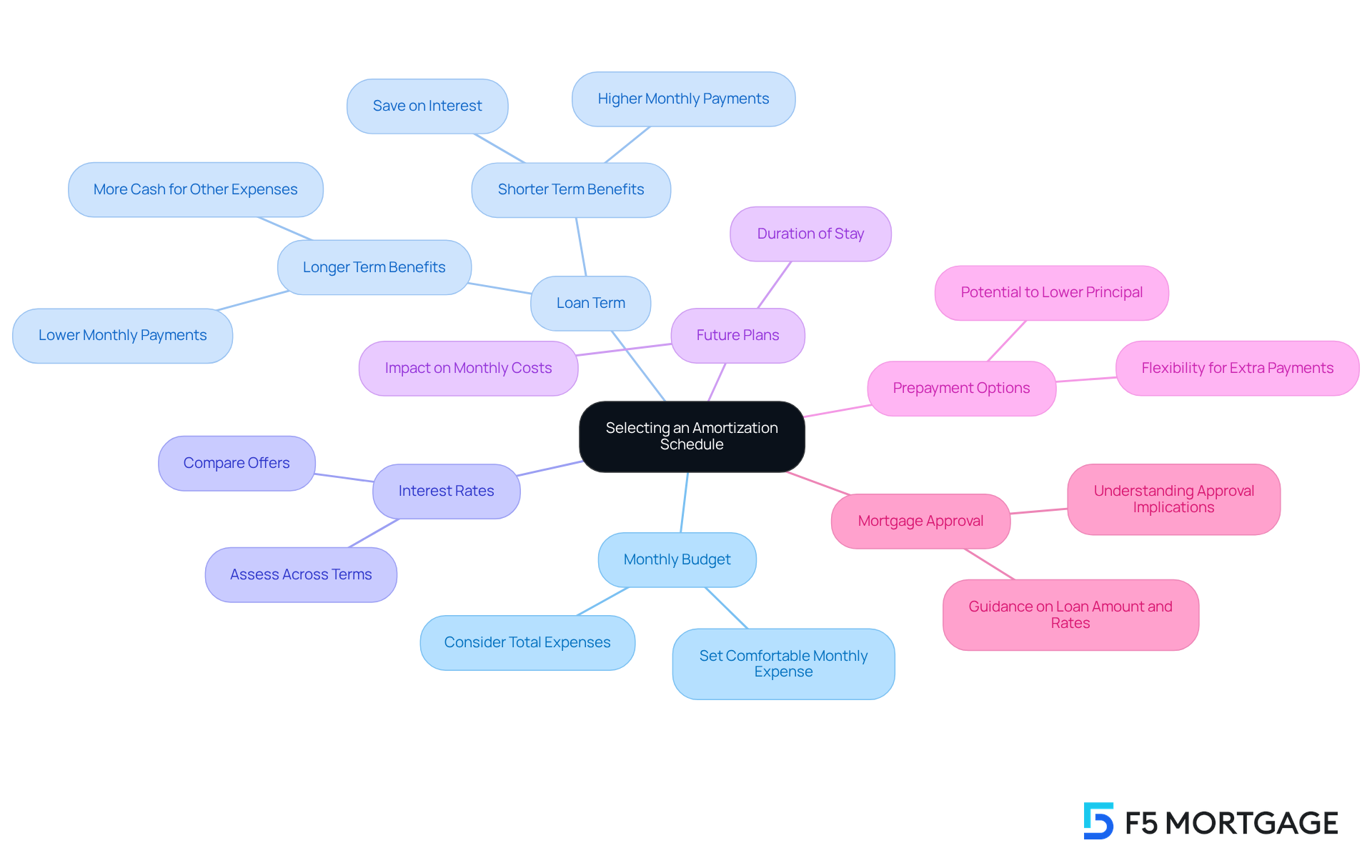

When choosing an , we understand how important it is for you to evaluate your , , and comfort with monthly contributions. Here are some essential factors to consider:

- : Start by setting a comfortable monthly expense that fits within your budget. While may seem appealing, they often lead to greater total expenses due to prolonged charges.

- : Think about whether a shorter or longer loan term aligns with your financial aspirations. For instance, shorter durations, like 15 years, can save you over $250,000 in fees compared to a 30-year mortgage, but they do involve higher monthly costs. An extended duration can help keep your lower, allowing you to allocate more cash for home improvement projects or increase your savings.

- : It’s crucial to assess interest rates across different borrowing terms. A lower rate can significantly reduce your overall cost throughout the life of the loan, making it essential to compare offers for the best arrangement.

- Future Plans: Reflect on how long you plan to stay in your home. If you foresee relocating in a few years, opting for a shorter amortization might not be necessary, as it could lead to increased monthly costs without substantial long-term benefits.

- : Look for financing that allows additional payments without penalties. This flexibility can empower you to reduce the principal more quickly if your financial situation improves, ultimately lowering the total amount paid.

- : Understand what an approval means for your financing options. An approval indicates that, based on your financial information, you’re a strong candidate for a mortgage. It provides estimates of your loan amount, interest rate, and potential monthly payment, guiding your decision-making process.

By thoughtfully evaluating these factors, you can select a mortgage loan amortization schedule that aligns with your financial goals and lifestyle. We’re here to support you every step of the way, ensuring a more manageable and cost-effective mortgage experience.

Conclusion

Understanding mortgage loan amortization is essential for anyone navigating the complexities of home financing. We know how challenging this can be, and this structured repayment method not only helps borrowers manage their debt effectively but also allows them to see the gradual reduction of their loan balance over time. By grasping the nuances of amortization, you can make informed decisions that align with your financial goals, whether you choose a shorter or longer repayment term.

Key insights highlight the importance of evaluating various factors when selecting an amortization schedule. From understanding how monthly payments are divided between principal and interest to recognizing the impact of different loan durations on overall costs, each element plays a critical role in shaping your financial landscape. Additionally, the potential for significant savings through strategies like making extra payments cannot be overstated.

Ultimately, the journey through mortgage loan amortization requires careful consideration and planning. By taking the time to assess your personal financial circumstances, future plans, and available options, you can create a path that not only eases your financial burden but also enhances your investment in your home. Embracing these strategies will empower you to navigate your mortgage journey with confidence, ensuring a more secure financial future.

Frequently Asked Questions

What is mortgage loan amortization?

Mortgage loan amortization is a structured method of repaying debt over a set period through regular, scheduled payments that consist of principal and fees, aimed at reducing the remaining balance to zero by the end of the loan term.

How is each payment in a mortgage loan amortization plan structured?

Each payment in a mortgage loan amortization plan is divided between fees and the reduction of the principal, allowing borrowers to see how each payment impacts their loan balance over time.

What is an example of the total cost of a mortgage loan?

For a $400,000 loan at a 6.5% interest rate over 30 years, the total cost can exceed $900,000, with over $510,177.95 attributed to fees alone.

How can making extra payments affect a mortgage?

Making extra payments, such as an additional $100 each month, can save borrowers significant interest (up to $63,917.25) and allow them to pay off their mortgage 38 months earlier.

What is the typical repayment period for mortgages?

The typical repayment period for mortgages remains predominantly 30 years, but many individuals are opting for shorter terms to build equity more rapidly.

What are important ratios to consider in mortgage loan amortization?

Maintaining at least an 80% home-to-value ratio and a maximum debt-to-income (DTI) ratio of 43% are crucial for making informed financial decisions regarding mortgage loans.

Why is understanding mortgage loan amortization important?

Understanding mortgage loan amortization is vital as it influences overall financing management and the potential for competitive mortgage options.