Overview

Navigating home equity rates can be daunting for families looking to upgrade their homes. As of September 2025, these rates average around 8.22%, influenced by various factors such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

We understand how challenging this can be, and it’s crucial to grasp these rates and their determinants.

By doing so, families can make informed borrowing decisions. This knowledge not only empowers them but may also lead to securing better financing terms for home improvements. Remember, we’re here to support you every step of the way as you explore your options.

Introduction

Understanding the dynamics of home equity is crucial for families considering upgrades to their living spaces. We know how challenging this can be, especially as homeowners navigate the complexities of property value and borrowing. The importance of current home equity rates cannot be overstated. With fluctuating interest rates and various factors influencing borrowing costs, families often find themselves pondering: how can they secure the best possible rates to maximize their financial potential? This article delves into the intricacies of home equity, offering insights and strategies to empower families in their pursuit of home improvement while effectively managing their financial future.

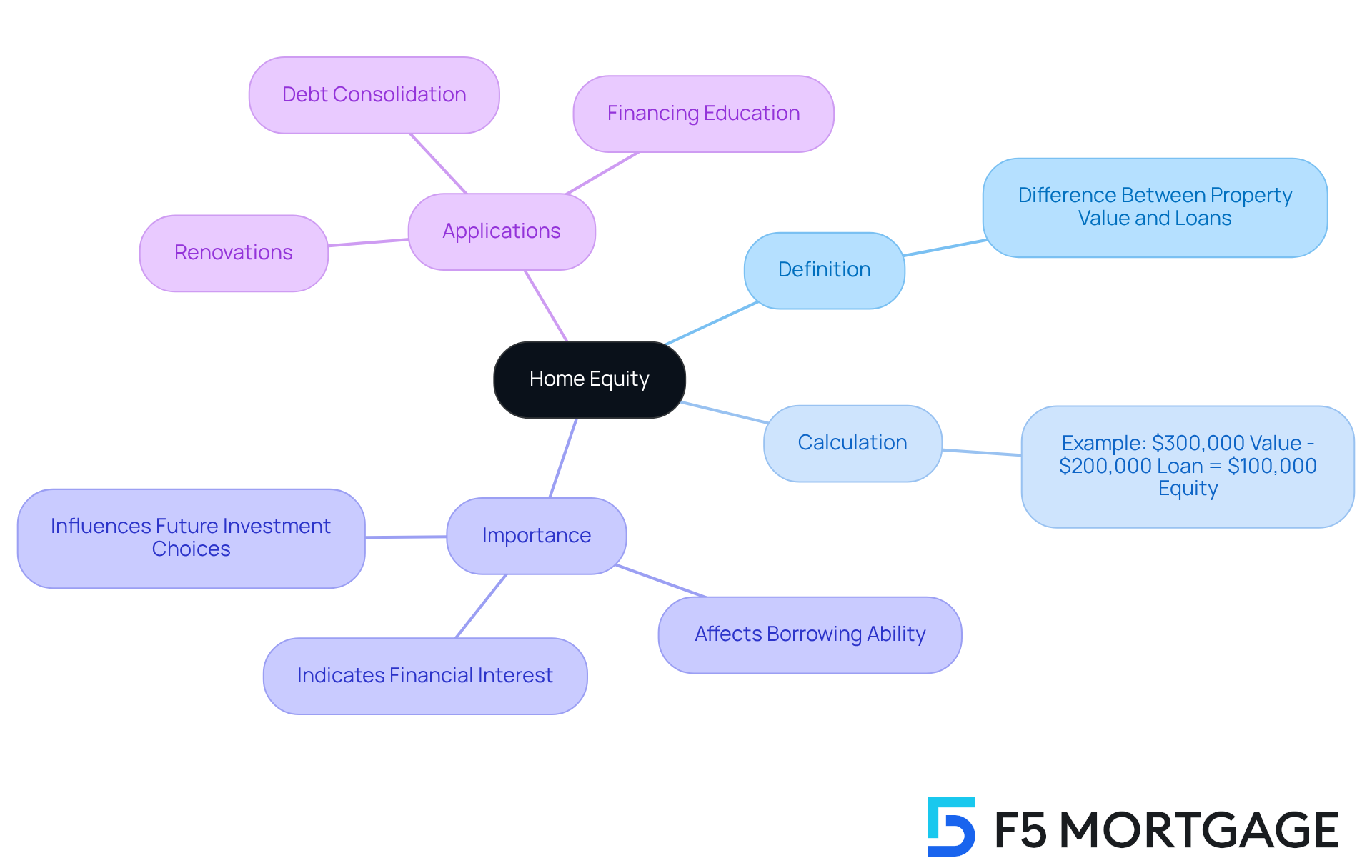

Define Home Equity and Its Importance

Understanding the is essential, especially during times of financial uncertainty. It’s defined as the difference between your home’s current market worth and any outstanding mortgages or loans secured against it. For example, if your residence is valued at $300,000 and you owe $200,000 on your mortgage, your property value minus the loan is $100,000.

This asset is crucial for homeowners like you, particularly if you’re looking to enhance your living space. It can be utilized for various financial needs, such as:

- Renovations

- Debt consolidation

- Financing education

We know how challenging this can be, and understanding your residential value not only indicates your financial interest in your property but also affects your borrowing ability and future investment choices.

By grasping the concept of property value, you empower yourself to make informed decisions that can significantly impact your financial future. Remember, we’re here to support you every step of the way as you navigate these important choices.

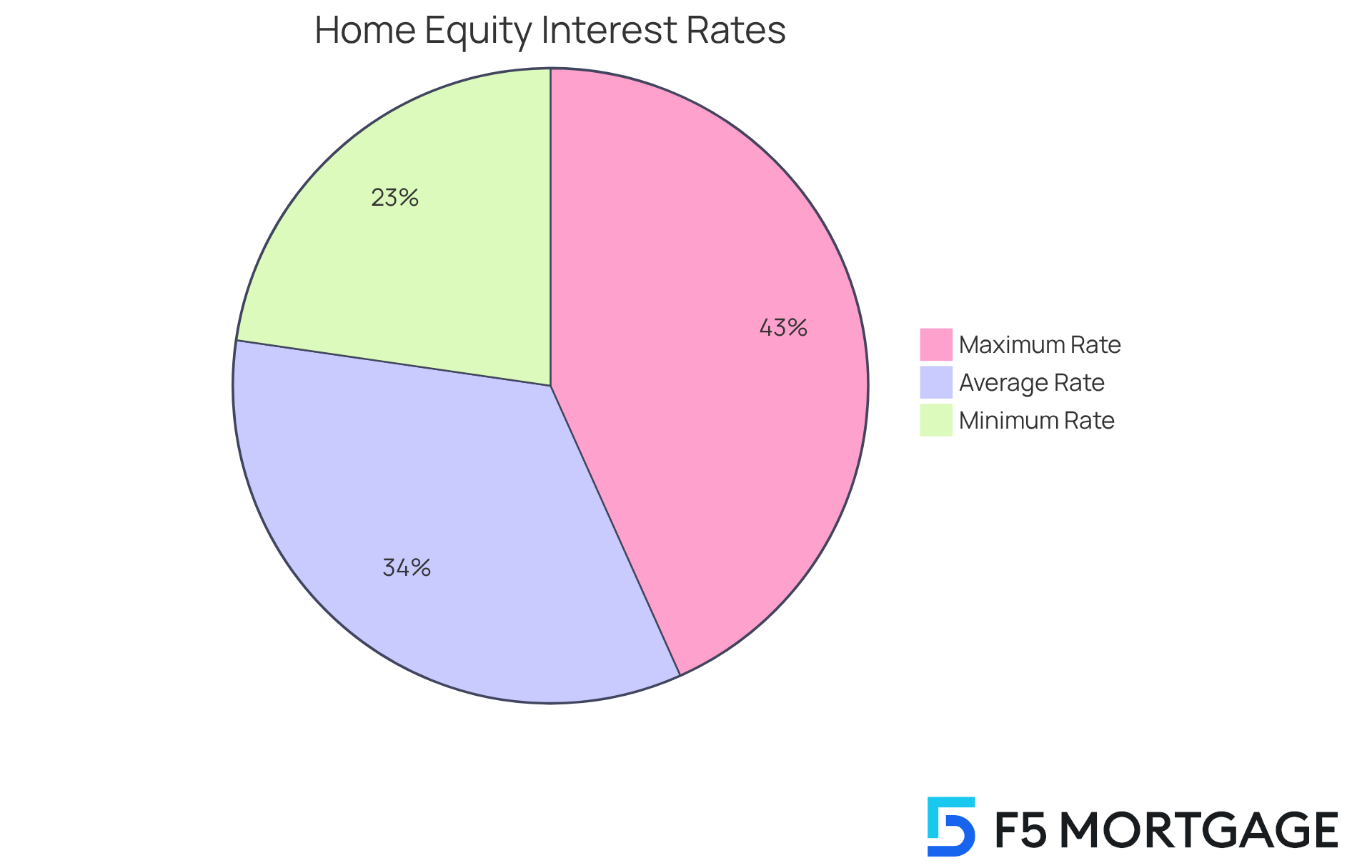

Analyze Current Trends in Home Equity Rates

As of September 3, 2025, we know how challenging navigating property loans can be. The typical interest rate is approximately 8.22%, with values ranging from 5.49% to 10.47%. These variations depend on factors like credit score, loan amount, and term length. Recent trends indicate that current home equity rates have stabilized following fluctuations due to economic conditions and Federal Reserve policies.

For families looking to enhance their residences, staying informed about these trends is crucial. They can significantly influence the cost of borrowing against your property value. For instance, a 10-year mortgage typically averages about 8.37%. Moreover, families can explore refinancing options to adjust their interest rates or borrowing terms. This could allow you to access a lump sum from your home equity for significant expenses or debt consolidation.

It’s also essential to secure your mortgage costs once your application is approved. This step helps protect you from market fluctuations during the processing period. Therefore, assessing your financial situation and timing is vital when considering a loan. We’re here to in this important journey.

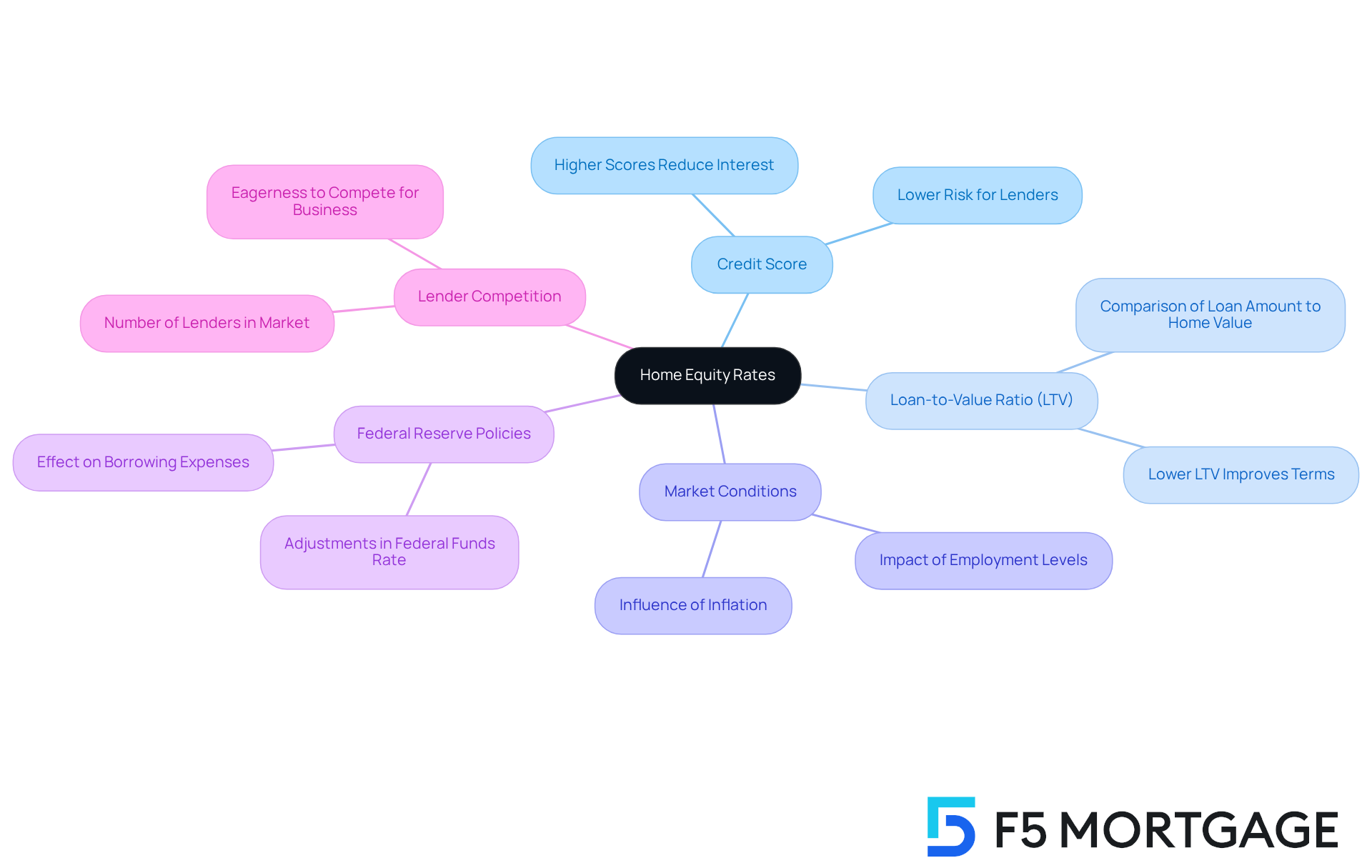

Examine Factors Influencing Home Equity Rates

Understanding current home equity rates can feel overwhelming, but several key factors can help you navigate this process with confidence.

- Credit Score: We know how challenging it can be to maintain a good credit score. However, a higher score generally leads to reduced interest charges, signaling to lenders that you pose less of a risk.

- Loan-to-Value Ratio (LTV): This ratio compares the amount of your loan to the appraised value of your home. A lower LTV can result in improved terms, making it easier for you to secure favorable financing.

- Market Conditions: Economic factors like inflation and employment levels can influence interest levels. Being aware of these conditions can empower you to make informed decisions.

- Federal Reserve Policies: Adjustments in the federal funds interest can affect borrowing expenses universally, including property-backed loans. Staying informed about these changes can be beneficial.

- Lender Competition: The number of lenders in the market and their eagerness to compete for your business can influence costs. Exploring your options can lead to better financial outcomes.

By comprehending these elements, you can enhance your chances of obtaining advantageous property financing terms based on the current home equity rates. We’re here to as you embark on this journey.

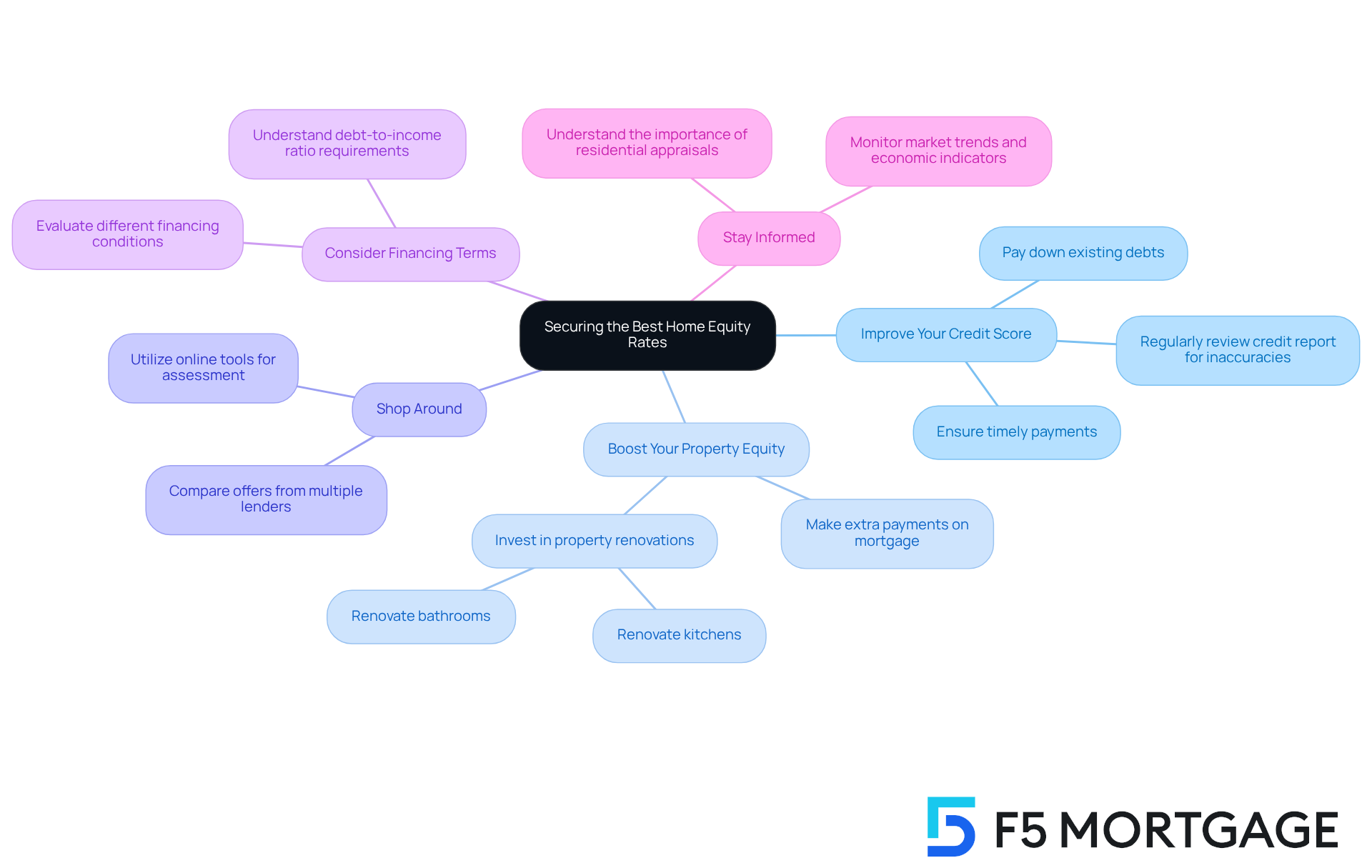

Guide to Securing the Best Home Equity Rates

To secure the best current home equity rates, families can take several thoughtful steps that not only enhance their financial position but also provide peace of mind.

- Improve Your Credit Score: We know how challenging it can be to navigate credit scores. Regularly reviewing your credit report for inaccuracies is essential. By taking proactive steps to enhance your score—such as paying down existing debts and ensuring timely payments—you can significantly boost your creditworthiness. This effort can potentially qualify you for lower rates, making a real difference in your financial journey.

- Boost Your Property Equity: Consider making extra payments on your mortgage or investing in property renovations. Strategic enhancements, like renovating kitchens or bathrooms, can greatly increase your home’s value and your financial stake. Families often see a notable return on investment from these improvements, which can enhance their overall equity position.

- Shop Around: It’s important to remember that rates can vary significantly among lenders, influenced by their risk tolerance and profitability goals. By comparing offers from multiple lenders, you can find the most competitive rate. Utilize online tools to assess various financing options effectively, ensuring you make an informed decision.

- Consider Financing Terms: Evaluating different financing conditions is crucial to finding an option that aligns with your financial objectives. While shorter terms may result in higher monthly payments, they typically incur , which can be beneficial in the long run. Remember, a maximum of a 43% debt-to-income (DTI) ratio is usually required for home loans, whether acquiring a traditional mortgage or refinancing.

- Stay Informed: Keeping an eye on market trends and economic indicators can empower you in your decision-making process. Timing your application thoughtfully can lead to more advantageous terms, especially in a changing market. Additionally, understanding the importance of residential appraisals in assessing property value can further improve your chances of securing favorable terms.

By implementing these strategies, families can significantly enhance their chances of securing the current home equity rates available. We’re here to support you every step of the way.

Conclusion

Understanding home equity rates is crucial for families eager to enhance their homes. Home equity is not just a financial asset; it represents an opportunity for renovations, debt consolidation, or education financing. By grasping the nuances of home equity, homeowners can make informed decisions that positively shape their financial futures.

This article explores the current trends in home equity rates, spotlighting average interest rates and the factors that influence them, like credit scores, loan-to-value ratios, and market conditions. It underscores the importance of securing favorable terms through improved credit scores, comparing lender offers, and staying informed about economic indicators. These insights empower families to navigate the complexities of home equity borrowing with confidence.

Ultimately, understanding and utilizing home equity can provide families with the resources needed to enhance their living spaces and secure their financial well-being. By taking proactive steps to improve creditworthiness and exploring various financing options, families can position themselves for success in the evolving landscape of home equity rates. Embracing this knowledge is essential for making strategic financial decisions that can lead to a brighter future. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is home equity?

Home equity is defined as the difference between your home’s current market value and any outstanding mortgages or loans secured against it.

How is home equity calculated?

Home equity is calculated by subtracting the amount owed on your mortgage from your home’s current market value. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your home equity would be $100,000.

Why is home equity important for homeowners?

Home equity is important because it serves as a financial asset that homeowners can utilize for various needs, such as renovations, debt consolidation, and financing education.

How does understanding home equity affect financial decisions?

Understanding your home equity helps indicate your financial interest in your property, affects your borrowing ability, and influences your future investment choices.

What are some common uses of home equity?

Common uses of home equity include funding home renovations, consolidating debt, and financing educational expenses.