Overview

Navigating the FHA loan application process online can feel overwhelming, but we’re here to support you every step of the way. This article serves as your comprehensive guide, detailing the benefits of FHA loans and the required documents, along with easy-to-follow, step-by-step instructions for completing your application.

We know how challenging this can be, which is why we emphasize the importance of preparation and accuracy. By addressing common issues and offering troubleshooting tips, we aim to ensure a smooth application experience. This support is crucial for potential homebuyers like you, helping you navigate the complexities of securing financing with confidence.

Take heart in knowing that with the right guidance, you can master this process. Let’s embark on this journey together, empowering you to achieve your dream of homeownership.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for first-time buyers and those with limited financial resources. We understand how challenging this can be. FHA loans, backed by the Federal Housing Administration, offer a viable solution. They provide lower down payments and flexible credit requirements, making homeownership more accessible.

Yet, the online application process may seem daunting, leaving many potential homeowners unsure of where to begin. What if there was a clear, step-by-step guide to demystify this process? Imagine feeling empowered to take control of your financial future.

In the following sections, we will walk you through the steps involved, ensuring you feel supported every step of the way. Together, we can navigate this journey to homeownership with confidence.

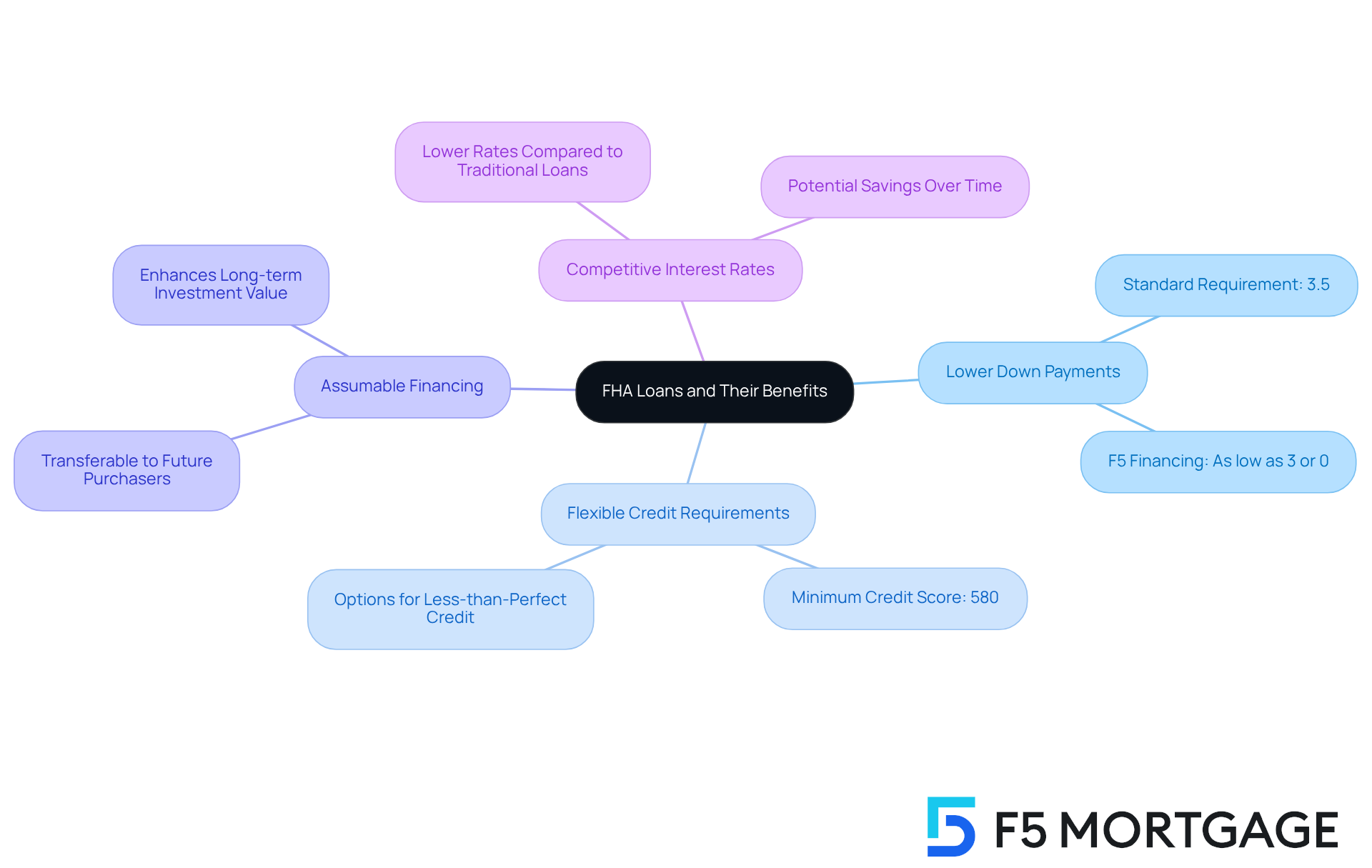

Understand FHA Loans and Their Benefits

FHA mortgages, supported by the Federal Housing Administration, are designed to help lower-income and first-time homebuyers secure financing. We know how challenging this can be, and we’re here to support you every step of the way. Here are some key benefits:

- Lower Down Payments: FHA loans typically require a down payment of just 3.5%, making homeownership more accessible. With F5 Financing, you can qualify for a home with as little as 3% down, or even 0% down for specific programs. This greatly lowers the barrier to entry for many families.

- Flexible Credit Requirements: If you have a credit score as low as 580, you may still qualify for an FHA loan. This flexibility is part of F5 Mortgage’s commitment to offering a variety of financing programs that cater to different borrower needs, especially for those with less-than-perfect credit histories.

- Assumable Financing: One appealing aspect of FHA mortgages is that they can be taken over by future purchasers. This feature can enhance the long-term value of your investment, making it a wise choice for families.

- Competitive Interest Rates: FHA options often provide lower interest rates compared to traditional financing. This means you could save money over time. By exploring the different financing choices available through F5, you can find a solution that aligns with your financial goals and homeownership dreams.

Understanding these advantages can help you assess whether an is the right fit for your financial objectives and aspirations. Remember, there are numerous financing options available through F5 Mortgage, and we’re here to guide you through this journey.

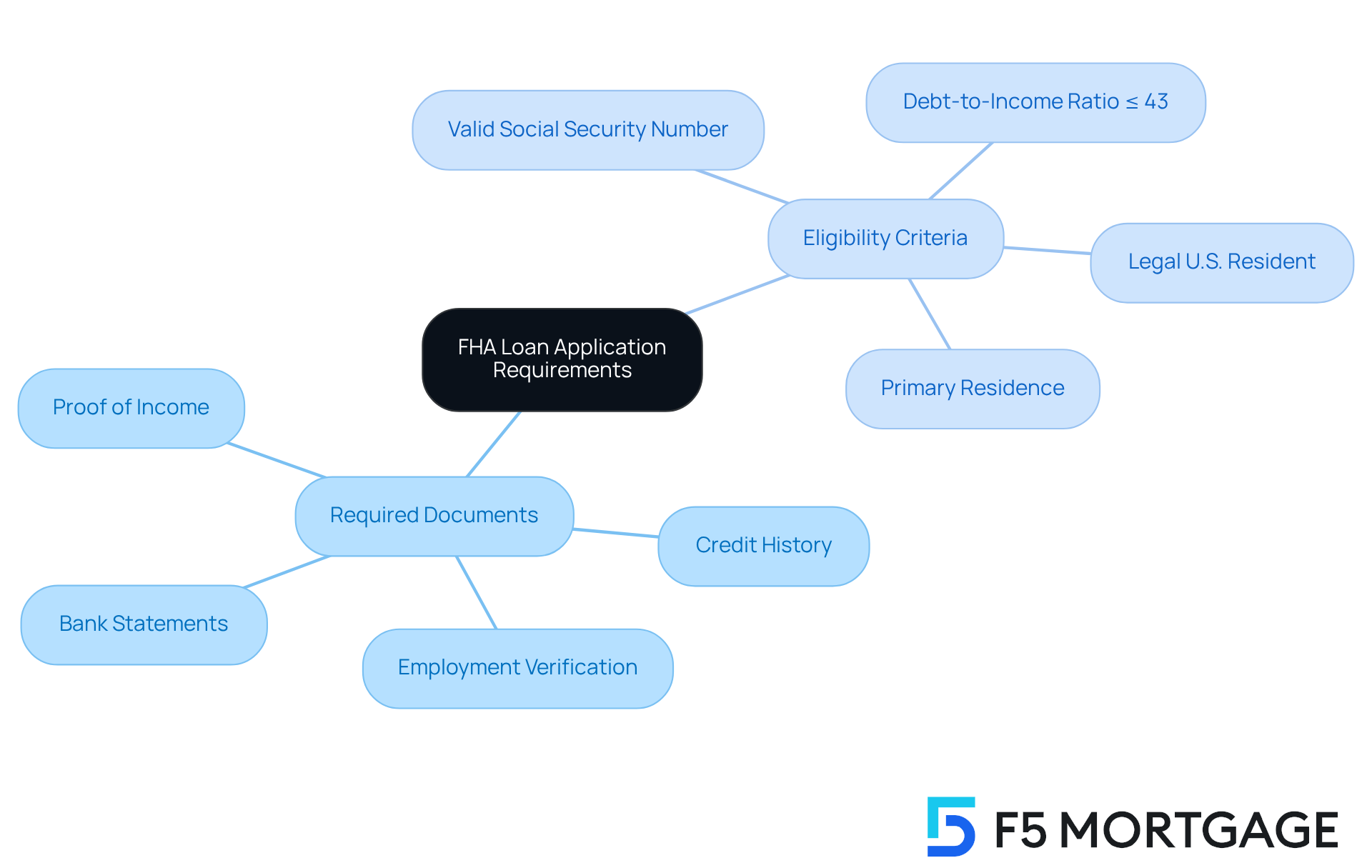

Gather Required Documents and Meet Eligibility Criteria

Before you embark on your fha loan application online journey, we know how important it is to feel prepared. Having the right documents ready can make a significant difference. Here’s what you’ll need:

- Proof of Income: Gather your recent pay stubs, W-2 forms, and tax returns for the last two years. These documents help us understand your financial stability.

- Credit History: A credit report is essential to assess your creditworthiness and determine the best options for you.

- Employment Verification: A letter from your employer confirming your position and salary can provide reassurance about your income.

- Bank Statements: Collect recent statements from all your bank accounts to verify your assets and savings.

Eligibility Criteria:

- You must have a valid Social Security number.

- You should be a legal resident of the U.S.

- Your debt-to-income ratio should not exceed 43%. This is crucial for securing favorable mortgage rates. A better DTI can enhance your chances of approval and lower your monthly payments.

- The property must be your primary residence.

Collecting these documents beforehand will assist you in finalizing your fha loan application online more effectively. At F5 Mortgage, we’re here to support you every step of the way. We use to simplify the process, ensuring a stress-free experience as you prepare for your mortgage approval.

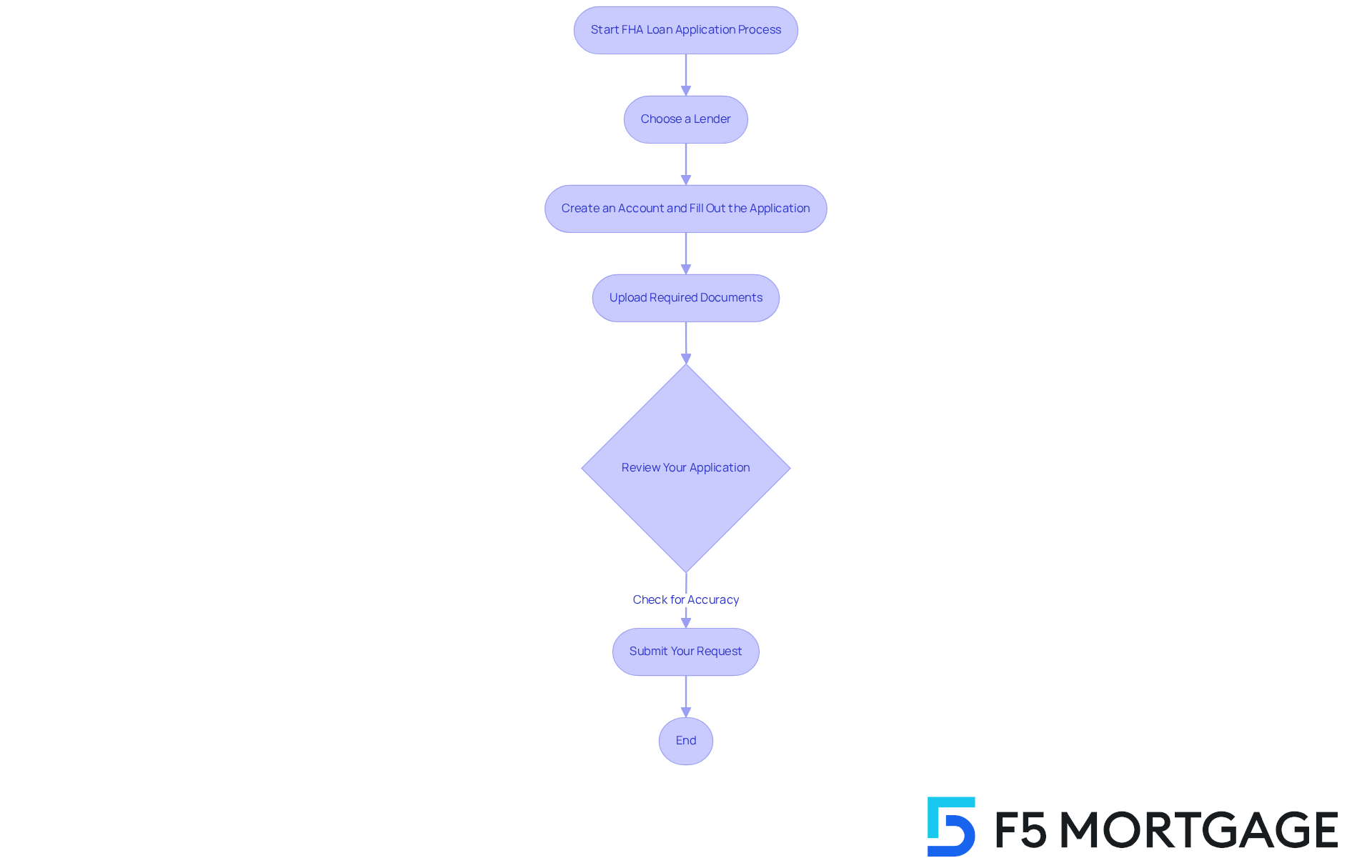

Complete the Online FHA Loan Application Process

Navigating the FHA loan application online can feel overwhelming, but we’re here to support you every step of the way. To help you through this process, please follow these simple steps:

- Choose a Lender: Start by researching FHA-approved lenders. In 2025, there are over 2,500 options available, each offering different terms and services. It’s important to select one that aligns with your financial needs and goals.

- Create an Account and Fill Out the Application: Visit your chosen lender’s website, create an account, and provide your personal information accurately, including your name, address, income, and employment details. Remember, precision is key to avoiding any delays.

- Upload Required Documents: Gather the and ensure they are clear and legible. Common documents include pay stubs, tax returns, and bank statements. This step is crucial for a smooth application process.

- Review Your Application: Before submitting, take a moment to carefully double-check all entries for accuracy. This can help prevent potential issues down the line.

- Submit Your Request: Once you’re satisfied with your application, submit it and await confirmation from your lender. You’ve taken a significant step towards homeownership!

Additionally, F5 Mortgage offers various down payment assistance programs that can ease your journey. For example, the MyHome Assistance Program in California provides up to 3% of the home’s purchase price, while the My Choice Texas Home program offers up to 5% for down payment and closing costs. By following these steps, you can confidently and efficiently navigate the FHA loan application online process.

Troubleshoot Common Issues During Your Application

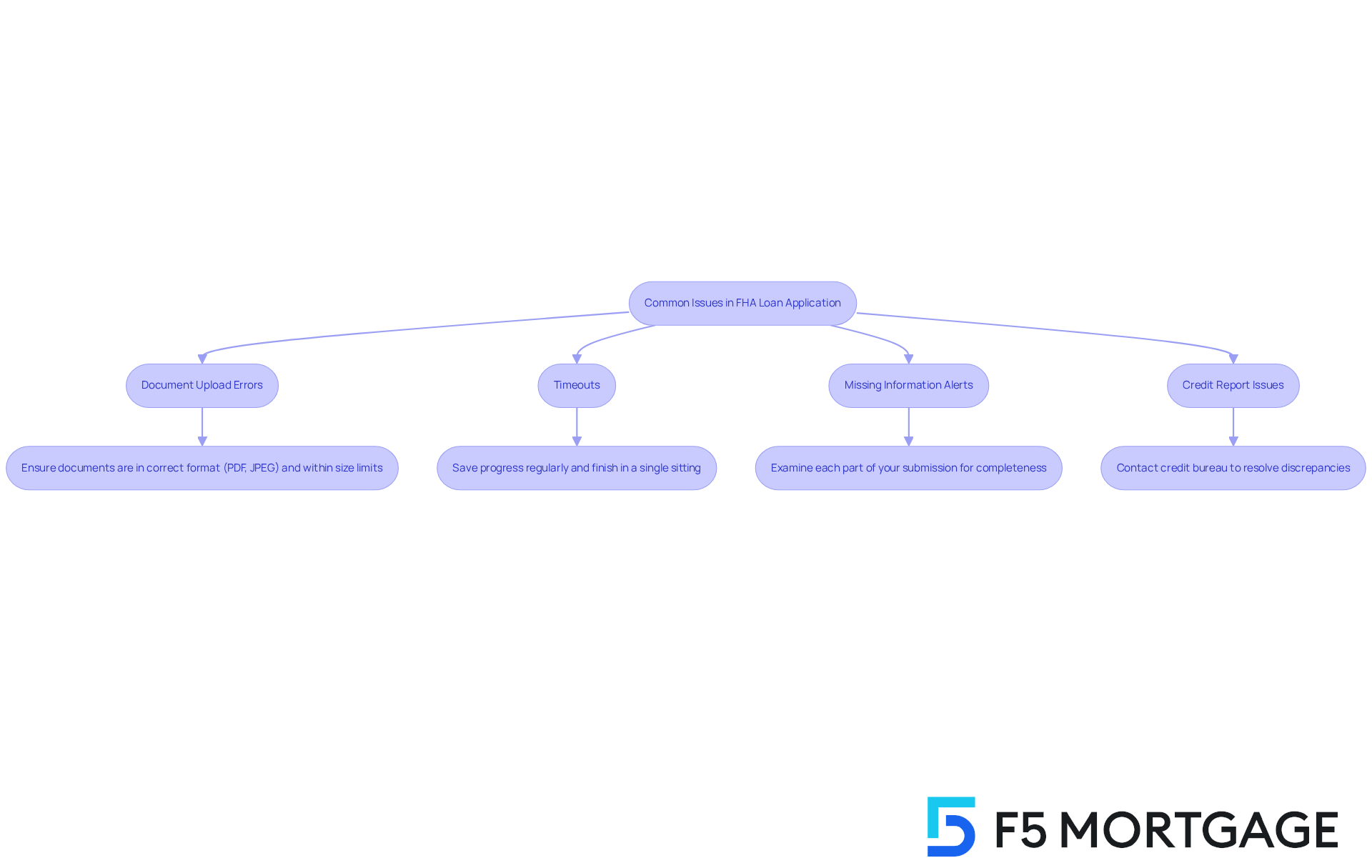

When navigating the , you may face some common challenges. We understand how daunting this process can be, and we’re here to support you every step of the way. Here’s how to troubleshoot these issues:

- Document Upload Errors: If your documents fail to upload, please ensure they are in the correct format (PDF, JPEG) and within the size limits specified by your lender. This small step can save you time and frustration.

- Timeouts: If your session expires, remember to save your progress regularly. It’s a good practice to try and finish the form in a single sitting to avoid interruptions.

- Missing Information Alerts: If you receive notifications about absent details, take a moment to carefully examine each part of your submission. Ensuring all fields are completed accurately can help expedite your application.

- Credit Report Issues: If you notice discrepancies in your credit report, it’s important to contact the credit bureau to resolve them. Addressing these issues early on can make a significant difference in your application outcome.

By being aware of these potential challenges and knowing how to address them, you can navigate the FHA loan application online process more effectively and with greater confidence.

Conclusion

FHA loans offer a welcoming path to homeownership, particularly for those who encounter hurdles with traditional financing options. By recognizing the unique benefits of FHA mortgages—like lower down payments, flexible credit requirements, and competitive interest rates—potential buyers can make informed decisions that resonate with their financial aspirations. Although the process of applying for an FHA loan online may seem daunting, it can be navigated with ease through proper preparation and guidance.

This guide has highlighted the essential steps to successfully complete the FHA loan application online, from gathering necessary documents to troubleshooting common issues that might arise. Key points include:

- The significance of accurate documentation

- Understanding eligibility criteria

- Proactively addressing potential challenges

Each of these elements is vital in ensuring a smooth application experience.

Ultimately, the journey to homeownership is attainable for many, thanks to the supportive framework of FHA loans. By investing time to educate oneself about the application process and utilizing available resources, aspiring homeowners can confidently take steps toward securing their dream home. Embracing this opportunity not only strengthens personal financial stability but also enriches the broader community by promoting homeownership.

Frequently Asked Questions

What are FHA loans?

FHA loans are mortgages supported by the Federal Housing Administration, designed to help lower-income and first-time homebuyers secure financing.

What are the benefits of FHA loans?

Key benefits of FHA loans include lower down payments, flexible credit requirements, assumable financing, and competitive interest rates.

What is the typical down payment required for an FHA loan?

FHA loans typically require a down payment of just 3.5%. Additionally, with certain programs through F5 Financing, you can qualify for a home with as little as 3% down or even 0% down.

What credit score is needed to qualify for an FHA loan?

You may qualify for an FHA loan with a credit score as low as 580, making it accessible for those with less-than-perfect credit histories.

What does “assumable financing” mean in the context of FHA loans?

Assumable financing means that FHA mortgages can be taken over by future purchasers, which can enhance the long-term value of the investment.

How do FHA loans compare to traditional financing in terms of interest rates?

FHA loans often provide lower interest rates compared to traditional financing, potentially saving you money over time.

How can F5 Mortgage assist with FHA loans?

F5 Mortgage offers a variety of financing programs and is committed to guiding borrowers through the process of securing an FHA loan, helping them find solutions that align with their financial goals.