Overview

The main focus of this article is to serve as a caring guide for families seeking to understand and effectively utilize online home equity loans. We know how challenging this can be, and we’re here to support you every step of the way. These loans provide homeowners with the opportunity to access the value of their property for various financial needs.

In this article, we will explore how these loans work, highlighting their advantages and disadvantages. We aim to empower you with the knowledge needed to make informed decisions about leveraging your home equity. The application process can seem daunting, but we will break it down into manageable steps, ensuring you feel confident as you navigate this journey.

By understanding the ins and outs of home equity loans, you can take control of your financial future. We encourage you to read on, as the information provided will help illuminate the path forward, making it easier for you to achieve your financial goals.

Introduction

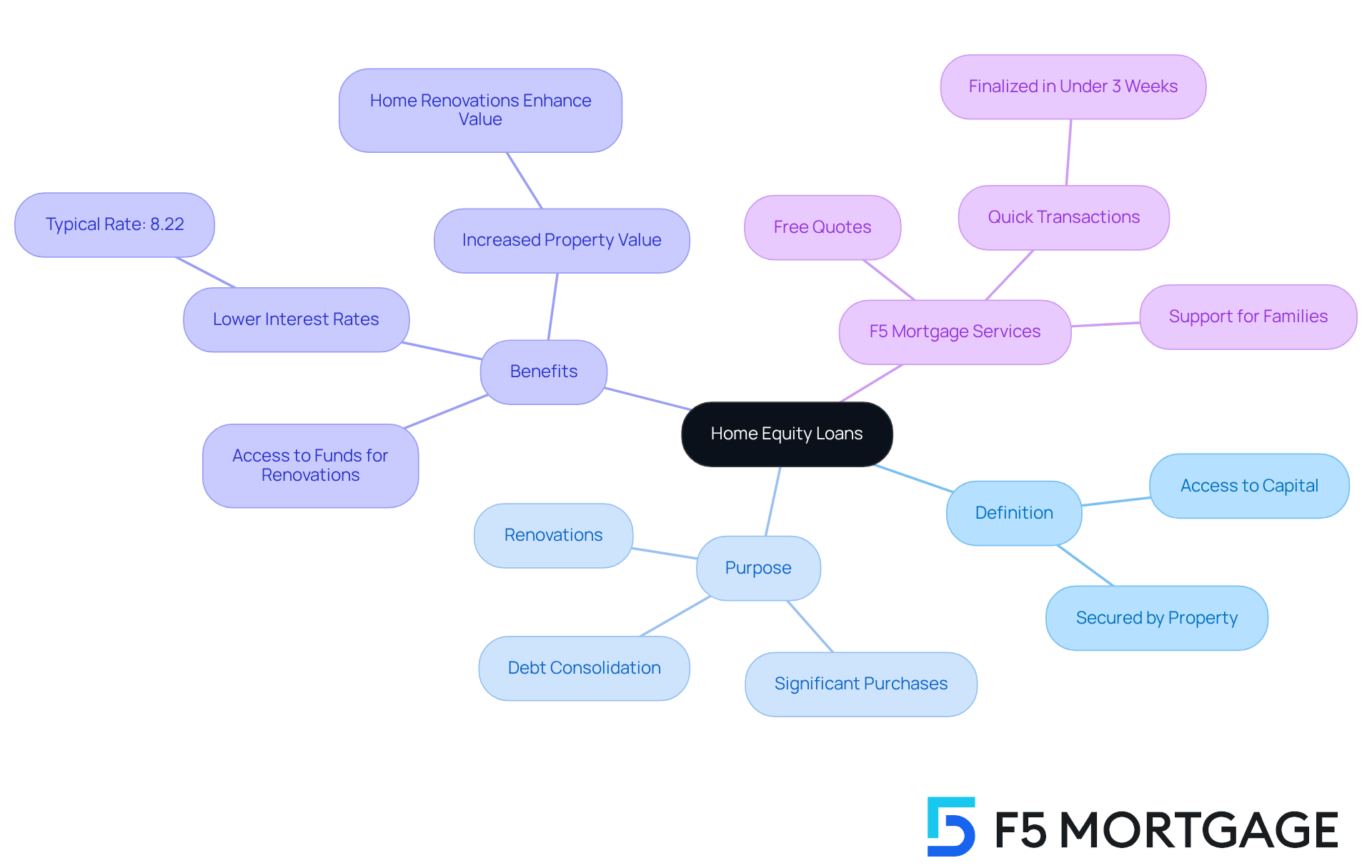

Home equity loans have emerged as a powerful financial tool for homeowners, allowing families to tap into the value of their properties for various needs. We know how challenging it can be to manage finances effectively, and understanding the ins and outs of these loans can unlock opportunities for:

- Home renovations

- Debt consolidation

- Significant purchases

However, with the allure of accessing funds comes the weighty responsibility of potential risks and complexities. How can families navigate this landscape to make informed decisions that secure their financial future? We’re here to support you every step of the way.

Define Home Equity Loans and Their Purpose

An online home equity loan can serve as a lifeline for homeowners, enabling them to access the capital in their home. This capital is the difference between the current market value of the property and the remaining mortgage amount. Often referred to as secondary mortgages, these financial products are secured by the property, much like the primary mortgage.

For many families, an online home equity loan serves as a valuable resource, providing access to funds for various needs—be it renovations, debt consolidation, or significant purchases. We understand how important it is to manage finances effectively, and accessing property value can often mean lower interest rates compared to unsecured loans or credit cards. In 2025, the typical interest rate for property value-based financing is 8.22%, making it an appealing option for those looking to fund home improvements or consolidate debts.

Many families turn to Home Equity Loans (HELs) for residential enhancements, which not only upgrade their living spaces but also increase their property’s value. Financial consultants often highlight the benefits of an online home equity loan, noting that it can serve as a strategic tool for families looking to maximize their home’s worth. With nearly half of U.S. homeowners classified as ” and a significant increase in accessible equity by $5.7 trillion, families have a wealth of options to consider when exploring an online home equity loan for financing.

At F5 Mortgage, we are dedicated to helping families find some of the lowest rates available. We offer a free quote to guide you through the process, ensuring you feel supported every step of the way. Our user-friendly technology simplifies refinancing, and we typically finalize most transactions in under three weeks, allowing families to access the funds they need quickly. F5 Mortgage has proudly assisted over 1,000 families in achieving their dreams of homeownership.

Explain How Home Equity Loans Work

Home equity loans, including online home equity loans, offer property owners a way to access a lump sum of cash based on the value they’ve built up in their homes. We understand that navigating financial options can be daunting, so it’s important to know that lenders typically allow . This equity is calculated by subtracting the outstanding mortgage balance from the current market value of the property. For example, if your home is valued at $500,000 with a mortgage balance of $250,000, you could potentially borrow up to $212,500.

Once you’re approved, you’ll receive the entire amount in one payment, which you’ll then repay over a fixed duration, typically ranging from 5 to 30 years. The fixed interest rates associated with these loans often lead to lower rates compared to unsecured options, making them an attractive choice for families. Monthly payments consist of both principal and interest, providing predictability that can greatly assist in budgeting for your household.

Looking ahead, in 2025, the average borrowing amount for property value loans is projected to be around $46,700, reflecting a slight decline from $48,800 in June 2023. This trend indicates a cautious approach among borrowers, as many aim to avoid over-leveraging their properties. Families have successfully utilized an online home equity loan for various purposes, such as renovations and debt consolidation, showcasing the versatility that these financial products can offer.

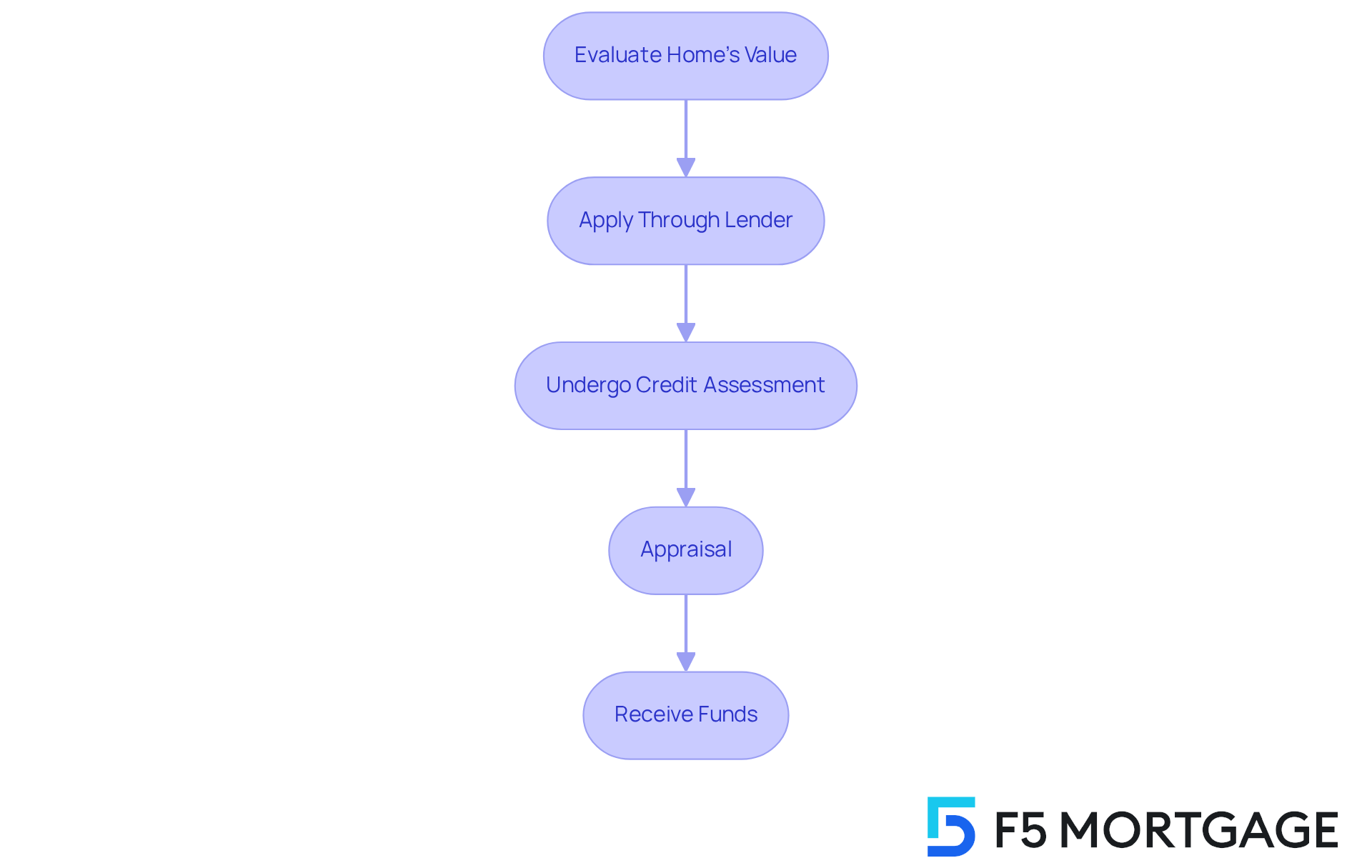

Understanding the property financing process is essential. It typically involves evaluating your home’s current value, applying through a lender, and undergoing a credit assessment. Lenders may require an appraisal to confirm the market worth of your property, ensuring that the financing amount aligns with your available assets. This structured approach not only facilitates access to funds but also empowers families to make informed financial decisions, knowing we’re here to support you every step of the way.

Evaluate the Pros and Cons of Home Equity Loans

Evaluate the Pros and Cons of Home Equity Loans

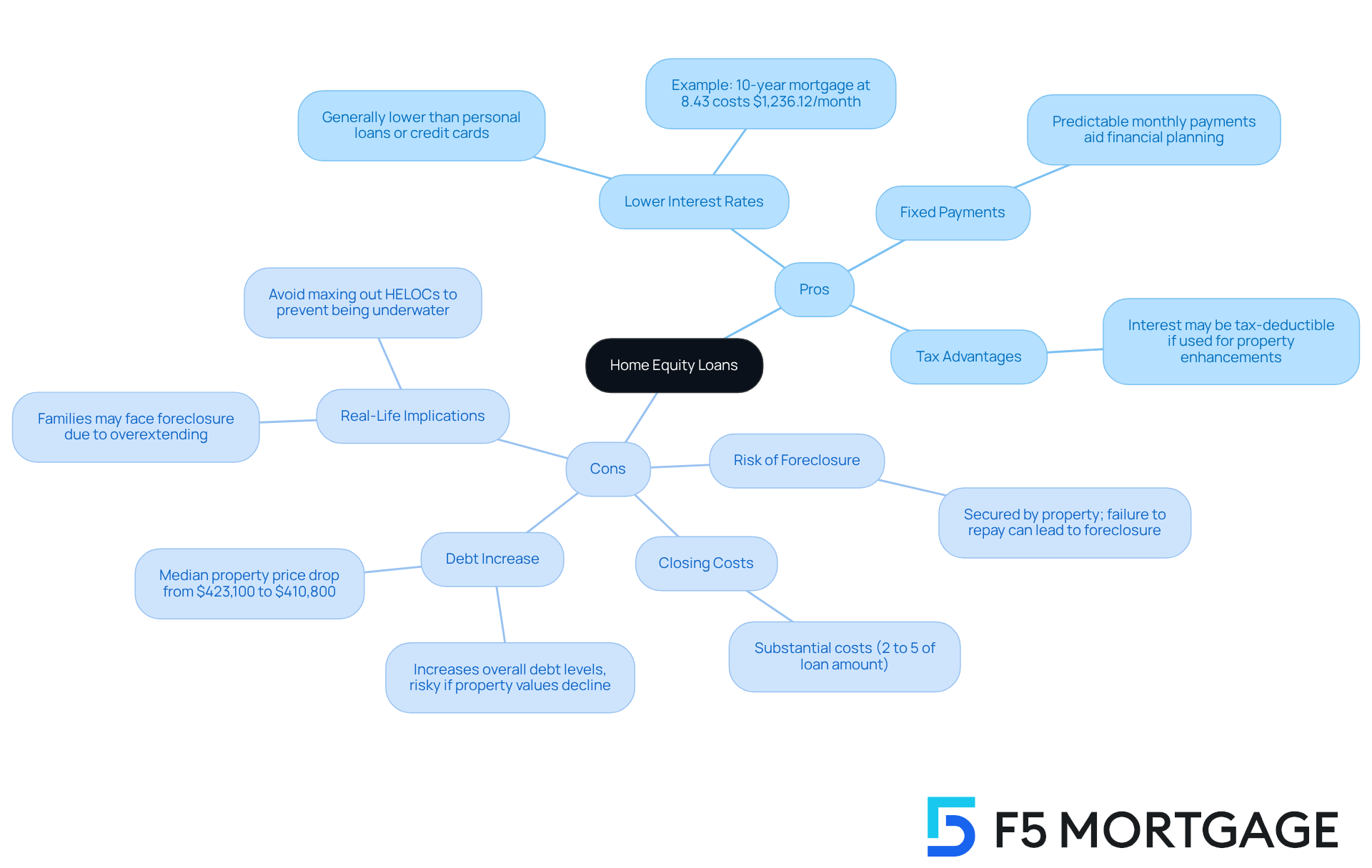

Pros of Home Equity Loans:

- Lower Interest Rates: We understand how important cost-effective options are for families. Homeowners seeking to access funds may find online home equity loans appealing, as they generally offer lower interest rates compared to personal loans or credit cards. For instance, a 10-year mortgage at 8.43% requires a monthly payment of $1,236.12.

- Fixed Payments: These loans come with fixed monthly payments, providing predictability that can greatly aid in financial planning. This stability is crucial for families managing their budgets effectively.

- Tax Advantages: Additionally, the interest paid on property-based financing may be tax-deductible if the funds are used for property enhancements. This potential for savings can be a significant benefit for borrowers seeking an online home equity loan.

Cons of Home Equity Loans:

- Risk of Foreclosure: However, it’s essential to consider the risks involved. Since home equity loans are secured by the property, failure to repay can lead to foreclosure. This is a serious concern that families must weigh carefully. As Tim Maxwell points out, recognizing the potential dangers when utilizing residential assets is vital.

- Closing Costs: Just like primary mortgages, second mortgage loans can come with substantial closing costs, typically ranging from 2% to 5% of the loan amount. These additional expenses can add up, impacting the overall cost of borrowing.

- Debt Increase: Moreover, borrowing against your home increases overall debt levels. This can be particularly risky if property values decline. Recent reports show a median property price drop from $423,100 to $410,800, underscoring the need for caution.

- Real-Life Implications: We know how challenging this can be. There have been instances where families faced foreclosure due to overextending themselves with property equity financing. Specialists often recommend avoiding borrowing the maximum allowed on HELOCs, as it may lead to being underwater if property values continue to fall. This highlights the importance of understanding the long-term financial implications before committing to a debt.

In summary, while home equity loans can provide valuable financial resources, they come with inherent risks that require careful consideration and planning. We’re here to support you every step of the way as you .

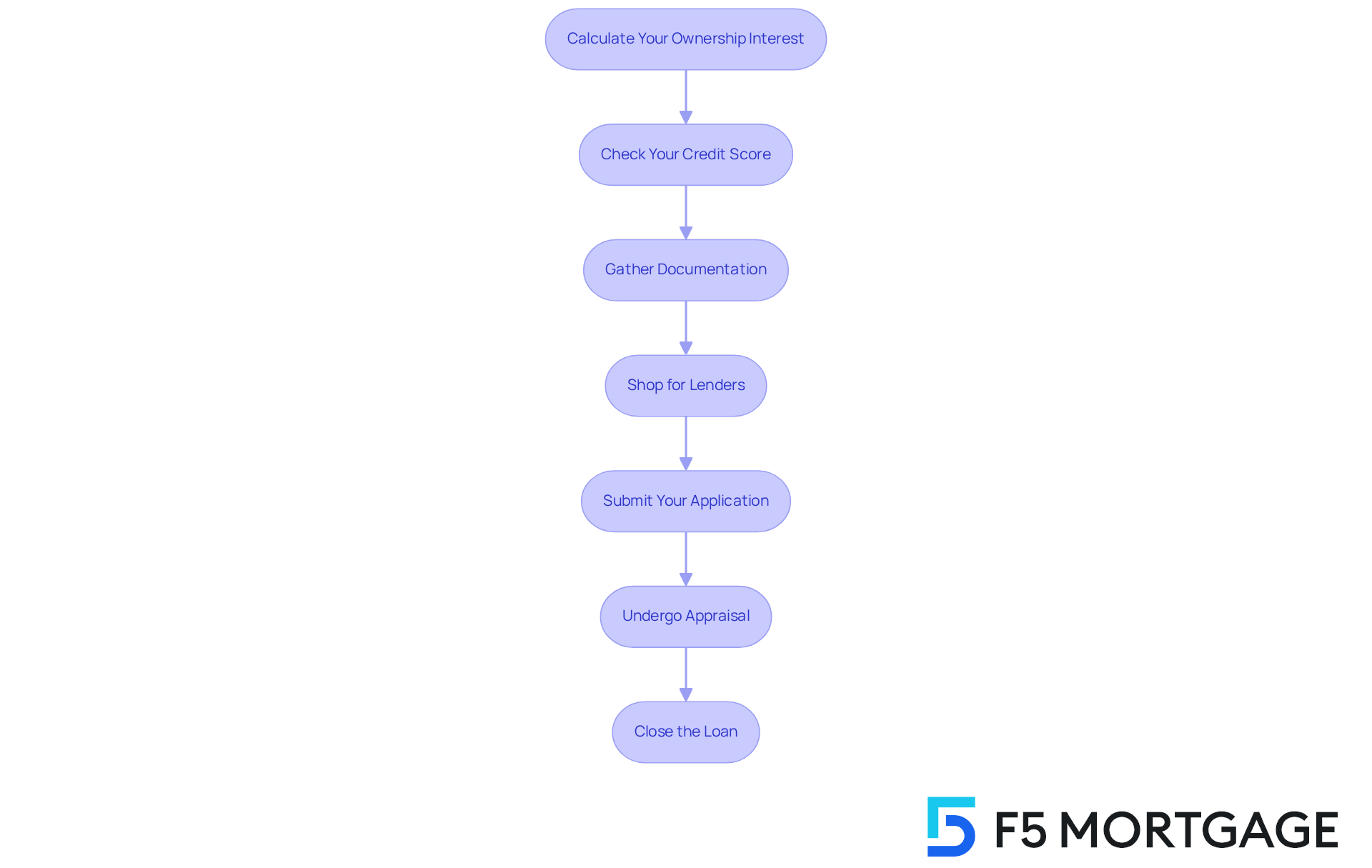

Guide Through the Home Equity Loan Application Process

- Calculate Your Ownership Interest: Begin by evaluating your property value. Deduct your mortgage balance from your home’s current market worth. For instance, if your home is valued at $500,000 and your mortgage balance stands at $300,000, your ownership stake would be $200,000. Understanding this amount is vital as it determines how much you can borrow through an online home equity loan.

- Check Your Credit Score: A solid credit score, typically 620 or above, is crucial for securing favorable financing conditions. We know how important this is—around 41% of property owners review their credit scores before applying for mortgage financing to ensure they meet lender criteria.

- Gather Documentation: Collect essential documents such as proof of income, tax returns, and details about your existing mortgage. This documentation is necessary for lenders to assess your financial situation and determine your eligibility, which can feel overwhelming. But remember, we’re here to support you every step of the way.

- Shop for Lenders: Take the time to compare offers from different lenders to find the best interest rates and terms. With current typical residential equity borrowing percentages below 8.50%, exploring various options for an online home equity loan is essential to secure the best possible agreement for your needs.

- Submit Your Application: Complete the application with your chosen lender, ensuring all required documentation is included. An approval—often referred to as ‘preapproval‘ or ‘prequalification’—indicates that you are a strong candidate for a mortgage based on your financial information. This approval will typically include an estimate of your loan amount, interest rate, and potential monthly payment, which is crucial for understanding your loan options.

- Undergo Appraisal: Your lender will likely require an evaluation to . This step is essential as it influences the amount of resources you can access, and we understand how important this is for your future plans.

- Close the Loan: Once approved, take the time to carefully review the closing documents before signing. After closing, you can expect to receive your funds within a few weeks, allowing you to utilize your property’s value effectively for renovations or other financial needs.

Compare Home Equity Loans with Alternative Financing Options

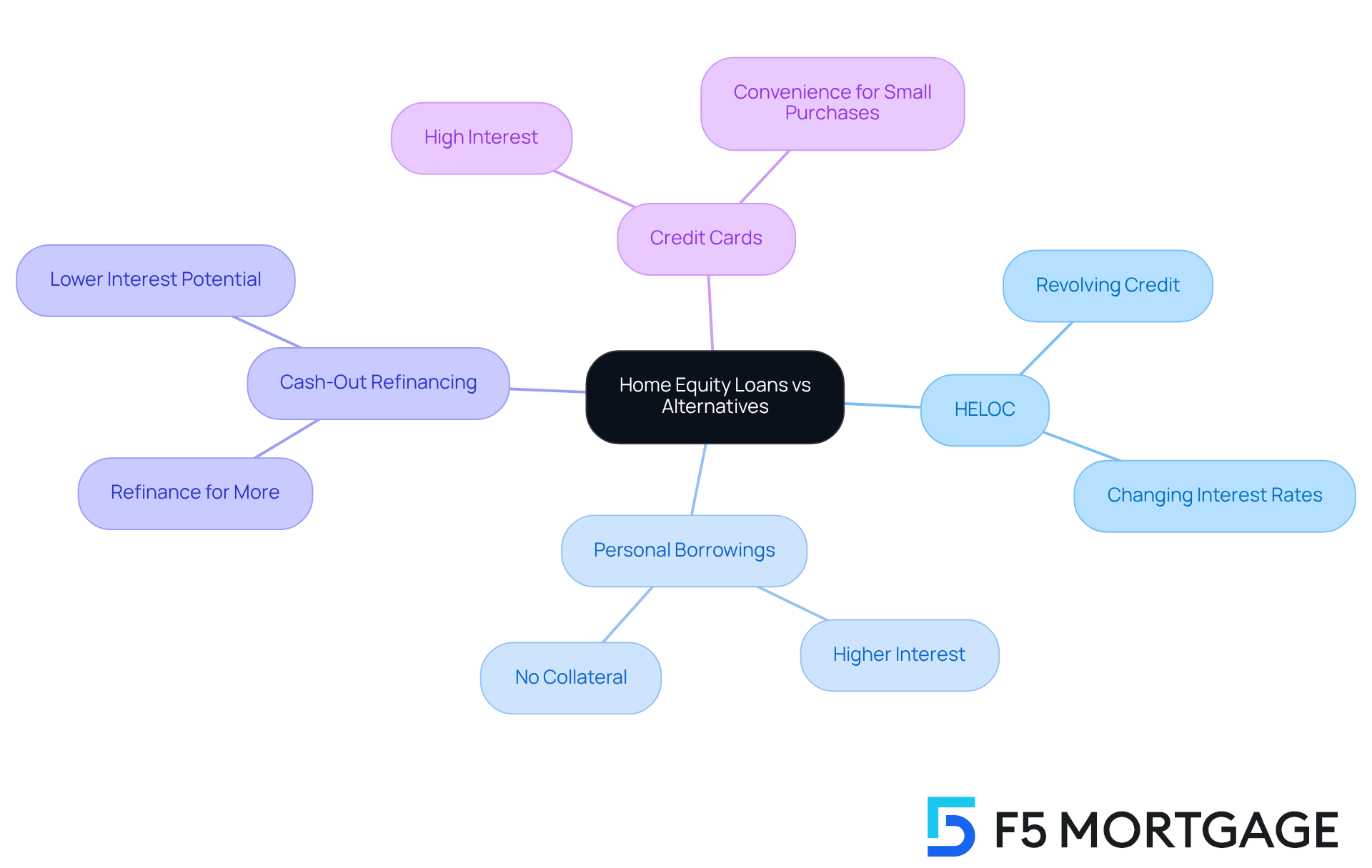

When evaluating financing options, we understand how challenging it can be to navigate the choices available. It’s crucial to compare home equity loans with several alternatives that may better suit your needs:

- Home Equity Lines of Credit (HELOCs): Unlike a home equity loan, a HELOC offers a revolving line of credit that can be accessed as needed. This flexibility is beneficial for ongoing costs, but it usually involves changing interest levels, which can lead to varying monthly payments.

- Personal Borrowings: These unsecured debts typically come with higher interest charges than property-backed loans. While they can be obtained more quickly and without collateral, the is often greater, making them less favorable for larger expenses.

- Cash-Out Refinancing: This option allows homeowners to refinance their existing mortgage for an amount greater than what they owe, receiving the difference in cash. It can be especially advantageous if the new mortgage secures a lower interest percentage, possibly decreasing total borrowing expenses.

- Credit Cards: While credit cards offer convenience for minor purchases, they typically carry considerably higher interest charges compared to residential property financing. This makes them less suitable for larger financial needs, especially if the balance is not paid off quickly.

As we look ahead to 2025, the typical interest for personal loans is about 10%, whereas mortgage loans generally provide percentages closer to 8.25%. Financial analysts emphasize the importance of understanding the differences between these options, particularly regarding interest rates and repayment structures. For families considering their financing choices, an online home equity loan has become increasingly popular, especially among those looking to effectively leverage their home equity. Remember, we’re here to support you every step of the way as you make these important decisions.

Conclusion

Accessing the value of a home through an online home equity loan can be a transformative financial decision for families. We understand how challenging it can be to navigate financial options, and by leveraging the equity built up in their properties, homeowners can obtain funds for various needs, from renovations to debt consolidation. This financial tool not only provides access to lower interest rates but also offers a structured repayment plan that can aid in effective budgeting.

Throughout this guide, we have explored key aspects of home equity loans, including their purpose, how they work, and the essential steps involved in the application process. The advantages of these loans, such as lower interest rates and fixed payments, are balanced against potential risks like foreclosure and increased debt. Understanding these elements is crucial for making informed decisions that align with your long-term financial goals.

Ultimately, the significance of home equity loans lies in their potential to empower families to achieve their financial aspirations. By carefully evaluating options and understanding the implications, homeowners can make strategic choices that enhance their financial well-being. As you consider your financing alternatives, remember that the insights provided here serve as a valuable resource for navigating the complexities of home equity loans and unlocking the full potential of your home investments.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a financial product that allows homeowners to access the capital in their home, which is the difference between the current market value of the property and the remaining mortgage amount. It is often referred to as a secondary mortgage and is secured by the property.

What purposes can a home equity loan serve?

Home equity loans can be used for various needs, such as home renovations, debt consolidation, or significant purchases. They provide access to funds at potentially lower interest rates compared to unsecured loans or credit cards.

How much can homeowners typically borrow with a home equity loan?

Lenders typically allow homeowners to borrow up to 85% of their property’s equity, which is calculated by subtracting the outstanding mortgage balance from the current market value of the property.

How does the repayment process for a home equity loan work?

Once approved, borrowers receive the entire loan amount in one payment and repay it over a fixed duration, typically ranging from 5 to 30 years. Monthly payments consist of both principal and interest.

What is the average borrowing amount for home equity loans projected for 2025?

The average borrowing amount for property value loans in 2025 is projected to be around $46,700, reflecting a slight decline from $48,800 in June 2023.

What steps are involved in obtaining a home equity loan?

The process typically involves evaluating your home’s current value, applying through a lender, and undergoing a credit assessment. Lenders may require an appraisal to confirm the market worth of the property.

How quickly can families expect to finalize a home equity loan transaction?

Many transactions are typically finalized in under three weeks, allowing families to access the funds they need quickly.

How can F5 Mortgage assist families in obtaining a home equity loan?

F5 Mortgage offers low rates and provides free quotes to guide families through the process. Their user-friendly technology simplifies refinancing and they have helped over 1,000 families achieve their homeownership dreams.