Overview

This article offers a caring, step-by-step guide for families earning $45,000 on how to master budgeting effectively. We understand how challenging this can be, and we’re here to support you every step of the way. It highlights the importance of:

- Grasping your financial landscape

- Tracking your income and expenses

- Setting clear financial goals

By creating a budget plan using the 50/30/20 rule, you can take control of your finances. Remember to regularly review and adjust your budget to ensure financial stability and adaptability to changing circumstances. You’re not alone in this journey; together, we can navigate your path to financial well-being.

Introduction

Mastering the art of budgeting can truly transform the financial landscape for families earning around $45,000 a year. Yet, we know how challenging this can be, as many struggle to navigate this essential skill. This comprehensive guide offers a step-by-step approach designed to empower families to take control of their finances. From understanding income and expenses to setting achievable financial goals, we’re here to support you every step of the way. However, the challenge remains: how can families effectively balance their limited resources while planning for both immediate needs and future aspirations?

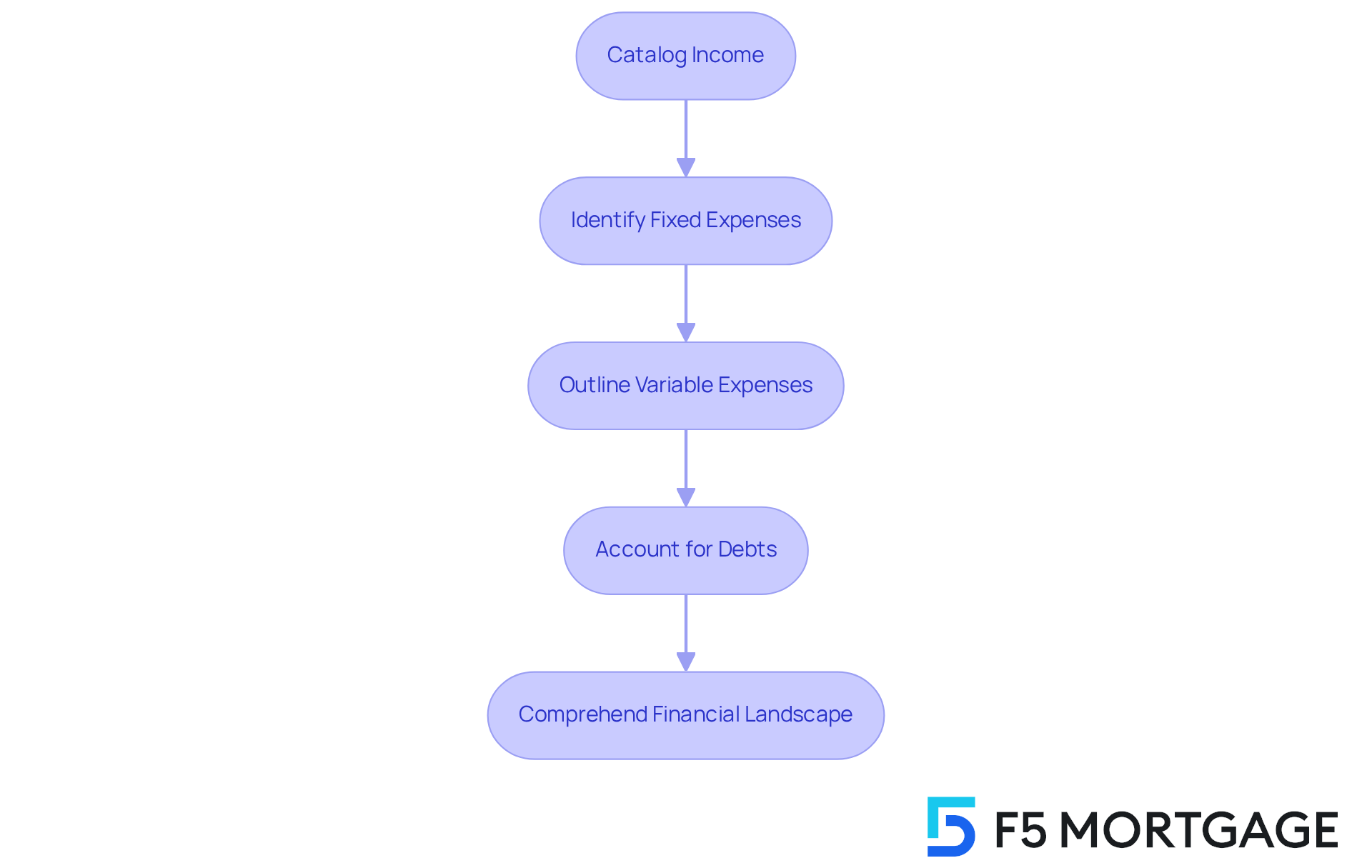

Understand Your Financial Landscape

Begin by cataloging all sources of income, including salaries, side jobs, and any additional earnings. This foundational step is crucial for establishing a complete economic picture, and we know how challenging this can be. Next, identify your fixed expenses, such as rent or mortgage payments, utilities, and insurance. In 2025, families earning approximately 45k can expect that average fixed expenses will consume a significant portion of their income. It’s essential to prioritize these costs in your budget to ensure financial stability.

Following this, outline your variable expenses, which can fluctuate and may include groceries, entertainment, and discretionary spending. Lastly, account for any debts, such as credit card balances or loans, as these obligations can significantly affect your monetary well-being. By compiling this comprehensive overview, you will gain a clearer understanding of your monetary landscape, empowering you to make informed budgeting decisions.

As monetary specialists frequently suggest, ‘A budget is directing your funds to their destination rather than questioning their whereabouts.’ This is crucial for families earning approximately 45k in 2025. Comprehending the economic landscape is not just a task; it’s a behavior-driven aspect of personal finance, and we’re here to support you every step of the way.

Track Your Income and Expenses

Managing your finances can feel overwhelming, but with the right tools, you can take control. We know how challenging this can be, so consider using a or a simple spreadsheet to document all your income and expenses. Start by noting your total income for the month, and then track every expense. It’s helpful to categorize these into fixed expenses, like rent or mortgage, and variable expenses, such as groceries or entertainment.

To gain a comprehensive understanding of your spending habits, track your expenses over the month. This practice reveals where your money goes and empowers you to make informed changes that align with your financial goals. Did you know that the typical American household spent around $77,280 in 2023? This highlights the importance of careful financial planning to avoid overspending.

Many families find success with popular expense management applications like YNAB and GoodBudget. These tools help you track your expenditures and organize your finances, making it easier to stick to your budget and achieve financial stability. YNAB is known for its zero-based budgeting approach, encouraging users to allocate every dollar, while GoodBudget uses the envelope spending method, allowing for effective expense planning.

As you explore these options, it’s crucial to choose applications that prioritize security. Look for features like bank-grade encryption and multi-factor authentication to protect your financial information. Additionally, understanding that financial challenges can differ by gender is important. For instance, women often experience higher levels of worry about unexpected expenses. Recognizing this can help families tailor their financial strategies to meet their unique needs. Remember, we’re here to support you every step of the way.

![]()

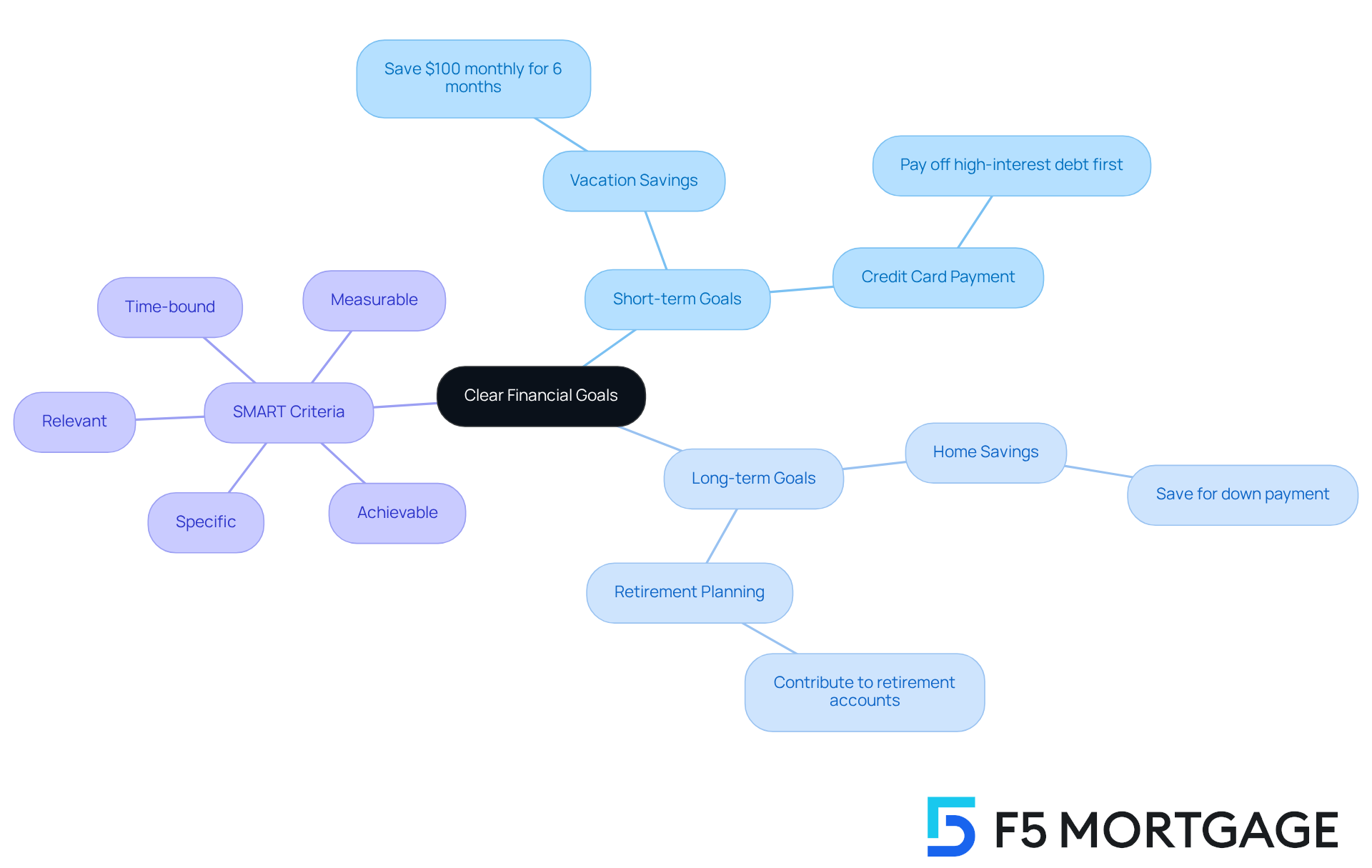

Set Clear Financial Goals

Establishing clear financial goals is essential for effective budgeting, encompassing both short-term and long-term objectives. We know how challenging this can be, but can pave the way for your financial success. Short-term goals may include:

- Saving for a vacation with loved ones

- Paying off a credit card

Meanwhile, long-term aspirations could involve:

- Saving for a home

- Planning for retirement

To enhance the clarity and actionability of these goals, apply the SMART criteria: ensure they are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of vaguely saying, ‘I want to save for a vacation,’ clarify your intention by stating, ‘I will save $100 each month for the next six months to finance our trip to the beach next summer.’ Regularly documenting and reviewing these goals can significantly boost motivation and keep you on track.

In 2025, research suggests that families who establish clear monetary goals are 85% more likely to accomplish their short-term objectives. This statistic emphasizes the efficacy of organized planning. As Manuel Perez Inoa states, ‘A SMART goal transforms abstract desires into concrete objectives, offering clear direction and purpose.’ By aligning your financial aspirations with the SMART framework, you can transform those abstract desires into concrete achievements, paving the way for a secure financial future. Remember, we’re here to support you every step of the way.

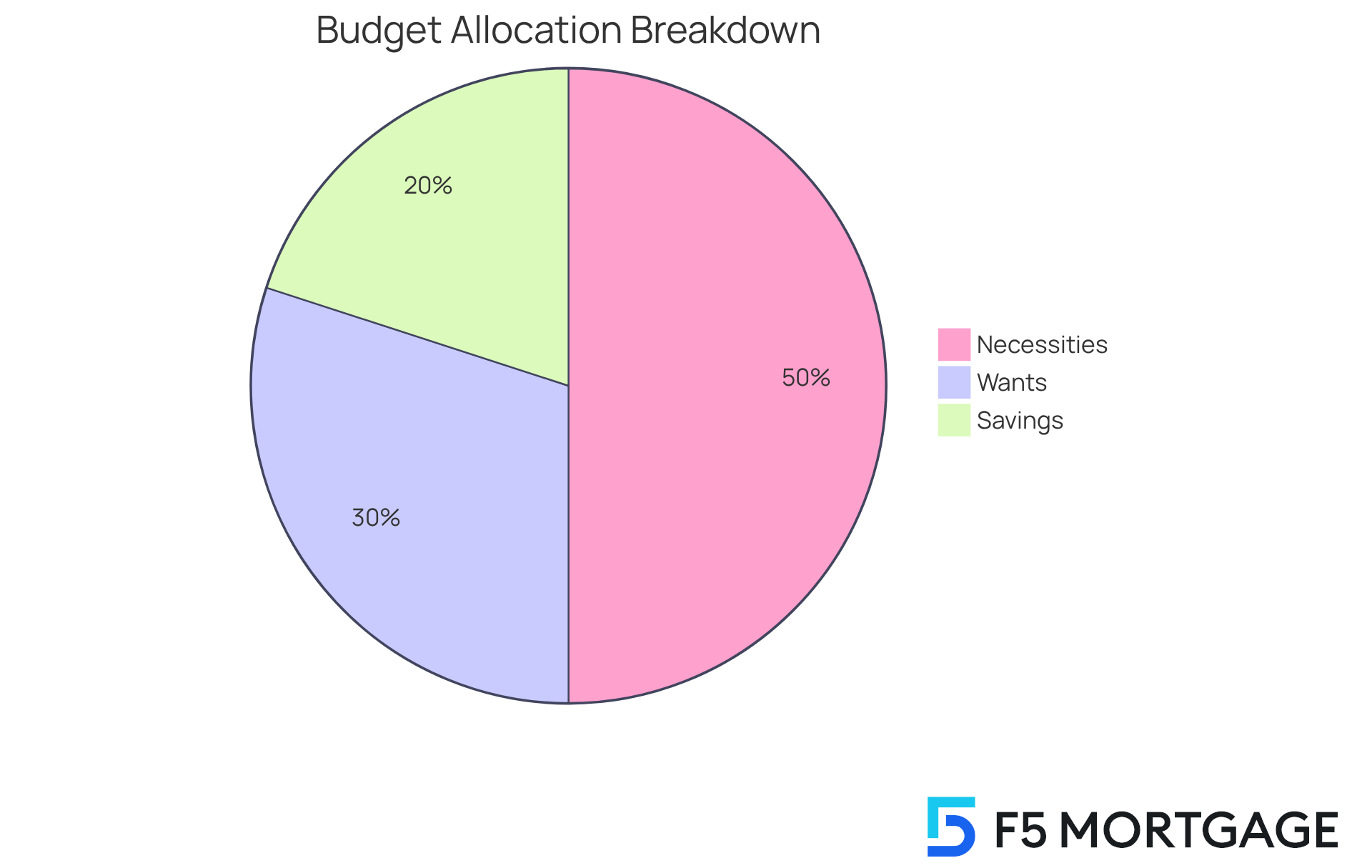

Create Your Budget Plan

Creating an effective budget plan can feel overwhelming, but we’re here to support you every step of the way. Start by allocating your income across essential categories: necessities, savings, and discretionary spending. The 50/30/20 rule serves as a practical framework for this process, suggesting that:

- 50% of your income should be dedicated to needs—such as housing, food, and utilities.

- 30% to wants.

- 20% to savings.

For a household earning 45k in 2025, this amounts to approximately $22,500 for necessities, $13,500 for desires, and $9,000 for savings each year.

This budgeting method not only helps in managing day-to-day expenses but also encourages . Imagine prioritizing essential costs while still allowing for some discretionary spending, like dining out or enjoying entertainment. According to the 50/30/20 rule, the average household financial plan includes spending $72,697 on essential expenditures, highlighting the importance of allocating funds wisely.

It’s essential to ensure that your financial plan remains realistic and flexible to handle unforeseen costs, such as medical bills or car repairs. Consistently examining your expenses is crucial to guarantee they align with your monetary objectives. Adjustments may be necessary as income varies or as household needs change. As U.S. Senator Elizabeth Warren states, “This intuitive and straightforward guideline can assist you in creating a sensible plan that you can adhere to over time to achieve your monetary objectives.” By following the 50/30/20 guideline, households can cultivate a sense of monetary discipline, ultimately leading to enhanced economic well-being and the ability to save for long-term objectives, such as a home down payment or retirement.

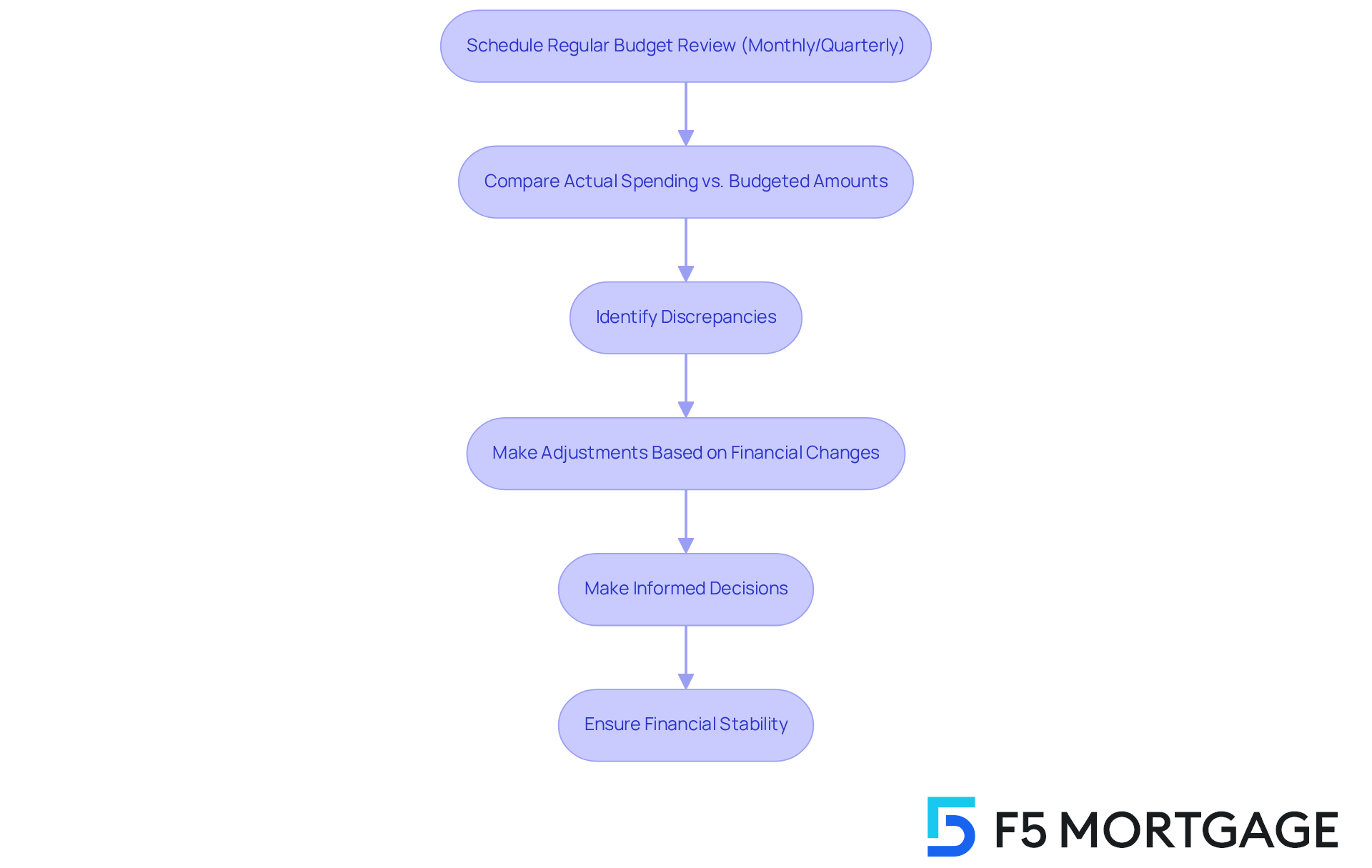

Review and Adjust Your Budget Regularly

Creating a consistent timetable for expense evaluations—whether monthly or quarterly—is essential for sustaining your economic well-being. We know how challenging this can be, but during these reviews, it’s important to compare your actual spending against your to identify discrepancies. For instance, many households that have effectively modified their finances often discover that minor changes can lead to substantial savings over time. This proactive approach allows you to adjust your spending plan based on shifts in earnings, costs, or monetary goals, ensuring that your strategy aligns with your current circumstances.

Financial experts emphasize that regular budget reviews not only help in tracking spending but also empower families to make informed decisions. As Dave Ramsey wisely observes, ‘Your resources reflect your behavior more than your monetary knowledge.’ This highlights the importance of being actively involved in your money management. Additionally, Warren Buffett advises, ‘Do not save what is left after spending, but spend what is left after saving,’ reinforcing the need to prioritize savings in your budgeting process.

Furthermore, adjusting your financial plan to reflect evolving monetary circumstances can reduce stress and improve your ability to achieve your objectives. For example, if unexpected expenses arise, such as medical bills or home repairs, reassessing your budget can help you prioritize essential needs while still working towards your long-term goals. Significantly, around fifty percent of U.S. adults would find it difficult to cover an unforeseen medical expense of $500, highlighting the necessity of planning for such situations. By staying vigilant and flexible, you can navigate the complexities of family budgeting with confidence, avoiding the pitfalls of lifestyle inflation and ensuring your financial stability.

Conclusion

Mastering budgeting is not just a skill; it’s a vital lifeline for families earning around $45,000. It lays the groundwork for financial stability and future growth. By understanding the financial landscape, tracking income and expenses, setting clear goals, creating a structured budget plan, and regularly reviewing progress, families can navigate their financial journey with confidence and clarity.

We know how challenging this can be, which is why this article outlines essential steps to facilitate effective budgeting. It begins with:

- Assessing income and expenses

- Setting SMART financial goals that provide direction

- Introducing the 50/30/20 budgeting method as a practical framework for allocating resources

- Emphasizing the necessity of regular budget reviews to adapt to changing financial circumstances

Each of these components plays a crucial role in ensuring that families can manage their finances effectively, avoid unnecessary stress, and work toward long-term objectives.

Ultimately, the significance of a well-crafted budget transcends mere numbers; it represents a proactive approach to financial well-being. Families are encouraged to take control of their financial destinies by implementing these strategies and utilizing available tools. By doing so, they can not only meet their immediate needs but also build a secure future, paving the way for achieving their dreams and aspirations.

Embracing these budgeting practices can lead to a more empowered and financially literate family, ready to face any challenges that may arise. Remember, we’re here to support you every step of the way as you embark on this important journey.

Frequently Asked Questions

What is the first step in understanding my financial landscape?

The first step is to catalog all sources of income, including salaries, side jobs, and any additional earnings. This helps establish a complete economic picture.

Why is it important to identify fixed expenses?

Identifying fixed expenses, such as rent or mortgage payments, utilities, and insurance, is crucial because these costs consume a significant portion of income, especially for families earning around 45k in 2025. Prioritizing these costs helps ensure financial stability.

What are variable expenses and why should I outline them?

Variable expenses are costs that fluctuate, such as groceries, entertainment, and discretionary spending. Outlining them allows you to understand your spending habits and make informed budgeting decisions.

How should I account for debts in my financial overview?

You should account for any debts, such as credit card balances or loans, as these obligations can significantly affect your monetary well-being.

What tools can I use to track my income and expenses effectively?

You can use financial applications or a simple spreadsheet to document all your income and expenses. Popular expense management applications include YNAB and GoodBudget.

What is the significance of tracking expenses over a month?

Tracking expenses over a month helps reveal where your money goes, empowering you to make informed changes that align with your financial goals.

What budgeting approach does YNAB promote?

YNAB promotes a zero-based budgeting approach, encouraging users to allocate every dollar they earn.

How does GoodBudget help with financial planning?

GoodBudget uses the envelope spending method, allowing users to plan their expenses effectively.

What security features should I look for in financial applications?

Look for features like bank-grade encryption and multi-factor authentication to protect your financial information.

How do financial challenges differ by gender?

Financial challenges can differ by gender, with women often experiencing higher levels of worry about unexpected expenses. Recognizing this can help families tailor their financial strategies to meet their unique needs.