Overview

When considering how much house you can afford with a $10,000 down payment, it’s essential to take a close look at your financial situation. We understand how overwhelming this can feel, especially when factoring in your income, expenses, and debt-to-income ratio. Remember, your down payment can significantly influence your mortgage options, opening doors to various loan programs, including FHA loans.

Calculating your maximum home price is crucial. It’s not just about the down payment; you also need to consider your monthly housing costs and additional expenses like property taxes and insurance. By doing this, you can create a sustainable budget that works for you and your family.

We’re here to support you every step of the way as you navigate this process. By assessing your finances and understanding your options, you can make informed decisions that align with your goals. Take a deep breath; you’ve got this!

Introduction

Navigating the path to homeownership can feel overwhelming, especially when considering how much house can be afforded with a $10,000 down payment. This seemingly modest sum can open doors to various financing options. However, understanding its true impact on mortgage choices is crucial. What if this initial investment could not only shape the size of the home but also influence long-term financial stability?

We know how challenging this can be. Exploring the intricacies of budgeting, credit scores, and additional costs associated with homeownership reveals the layers of decision-making that every prospective buyer must face. We’re here to support you every step of the way as you embark on this important journey.

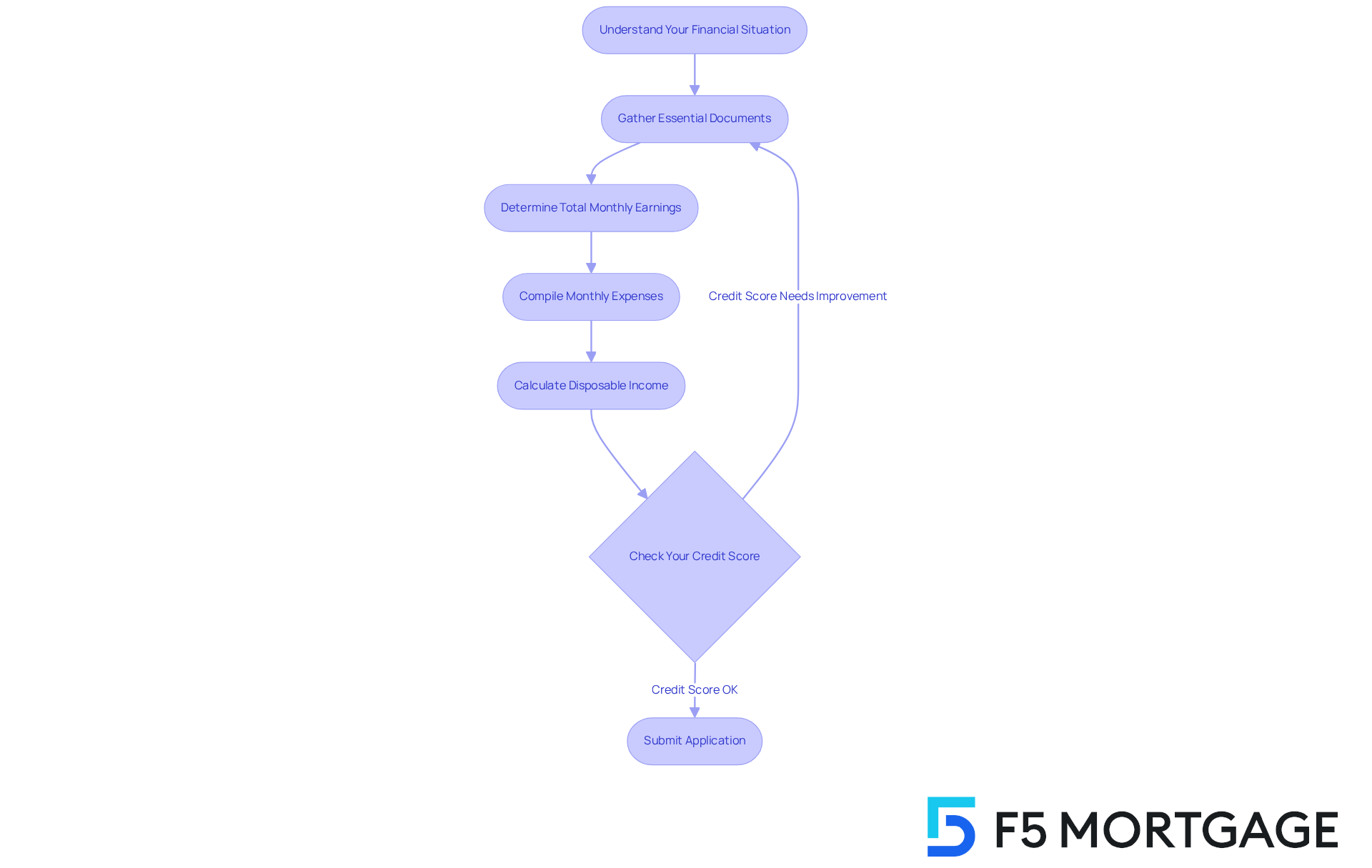

Understand Your Financial Situation

Embarking on your journey toward homeownership can feel overwhelming, but gathering essential financial documents is a great first step. Start by collecting:

- Pay stubs

- Tax returns

- Bank statements

If you’re self-employed, remember to include the last two years of:

- Personal tax returns

- Business tax returns

- K1s

- 1099s

- W2s

For salaried borrowers, just the last year’s W2 and two recent pay stubs from the last 30 days will suffice. Begin by determining your total monthly earnings, ensuring you account for bonuses or extra revenue streams. Next, compile a list of your monthly expenses, such as:

- Rent

- Utilities

- Groceries

- Debt payments

By deducting your total expenses from your earnings, you can clearly see your disposable funds, which is crucial for understanding how much house you can afford with $10,000 down.

Understanding your is vital; it provides a clear view of your financial well-being and helps you create a practical budget for your property acquisition. Financial advisors often emphasize the importance of gathering these documents early in the process to streamline your mortgage application. As one advisor wisely noted, “Having your financial documents organized can significantly speed up the approval process.”

Moreover, checking your credit score is essential, as it directly impacts your mortgage options and interest rates. In 2025, a credit score above 700 is generally seen as favorable, while scores below 620 may limit your choices. By thoroughly evaluating these factors and submitting a refinancing application with your chosen lender, you can confidently navigate the property purchasing process and make informed decisions. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

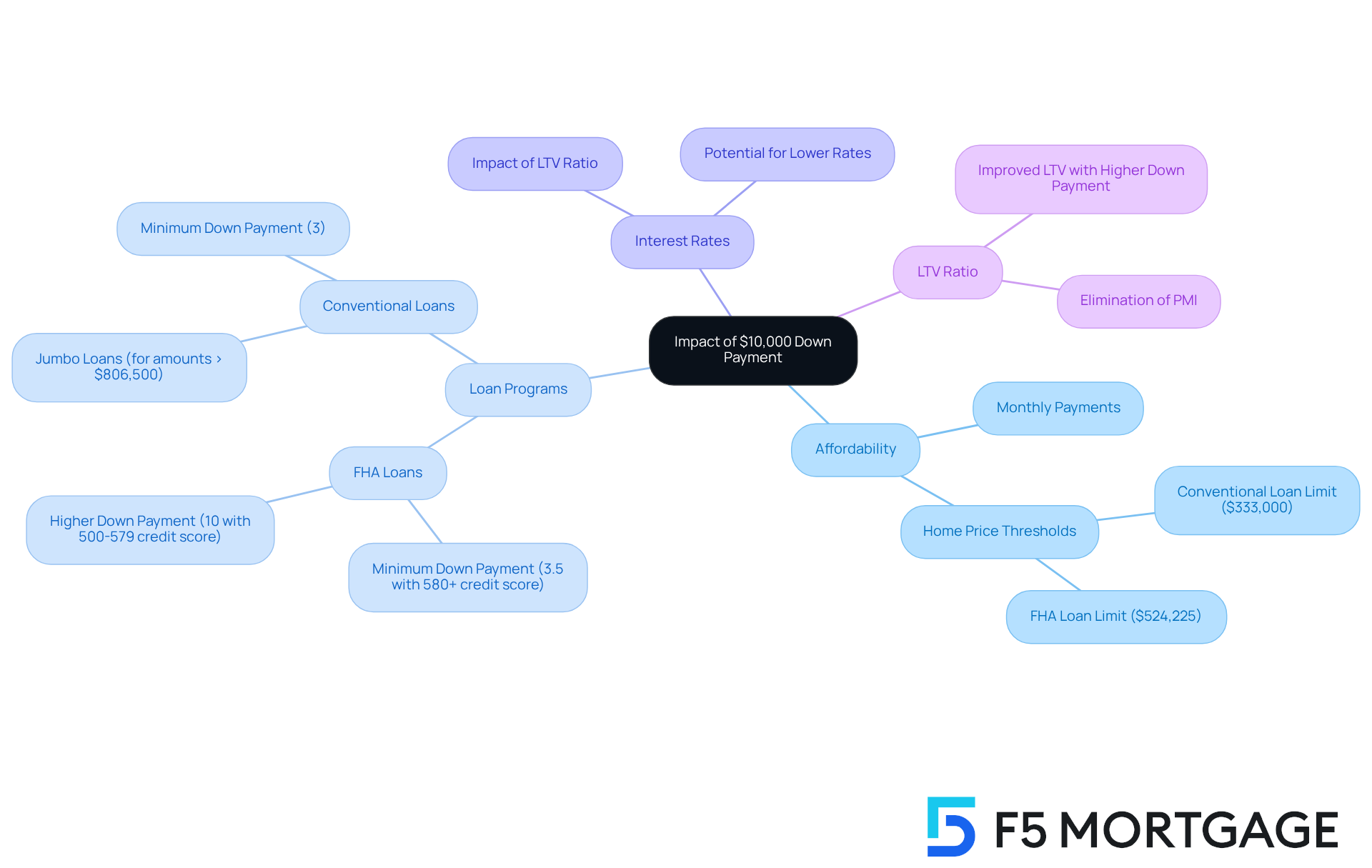

Assess the Impact of a $10,000 Down Payment

A $10,000 down deposit can significantly impact your mortgage choices, leading many to wonder how much house can I afford with $10,000 down. For instance, if you’re looking at a home valued at $200,000, you may want to calculate how much house can I afford with $10,000 down, which represents 5% of the purchase cost. This could open the door to various loan programs, including FHA loans, which allow for smaller deposits. FHA loans require a minimum deposit of 3.5% for borrowers with a credit score of 580 or higher, making them an appealing option for many first-time homebuyers.

Additionally, a larger upfront contribution can enhance your loan-to-value (LTV) ratio. This improvement may lead to better interest rates and even the possibility of eliminating private mortgage insurance (PMI). In 2025, FHA loan limits allow borrowing up to $524,225 in most areas, providing substantial opportunities for buyers with lower initial costs.

Using a can help you understand how much house can I afford with $10,000 down and how different down deposit amounts affect your monthly payments and overall loan costs. Understanding these factors is crucial for making an informed decision about your down payment strategy when purchasing a new home. Remember, we’re here to support you every step of the way.

Calculate Your Maximum Home Price

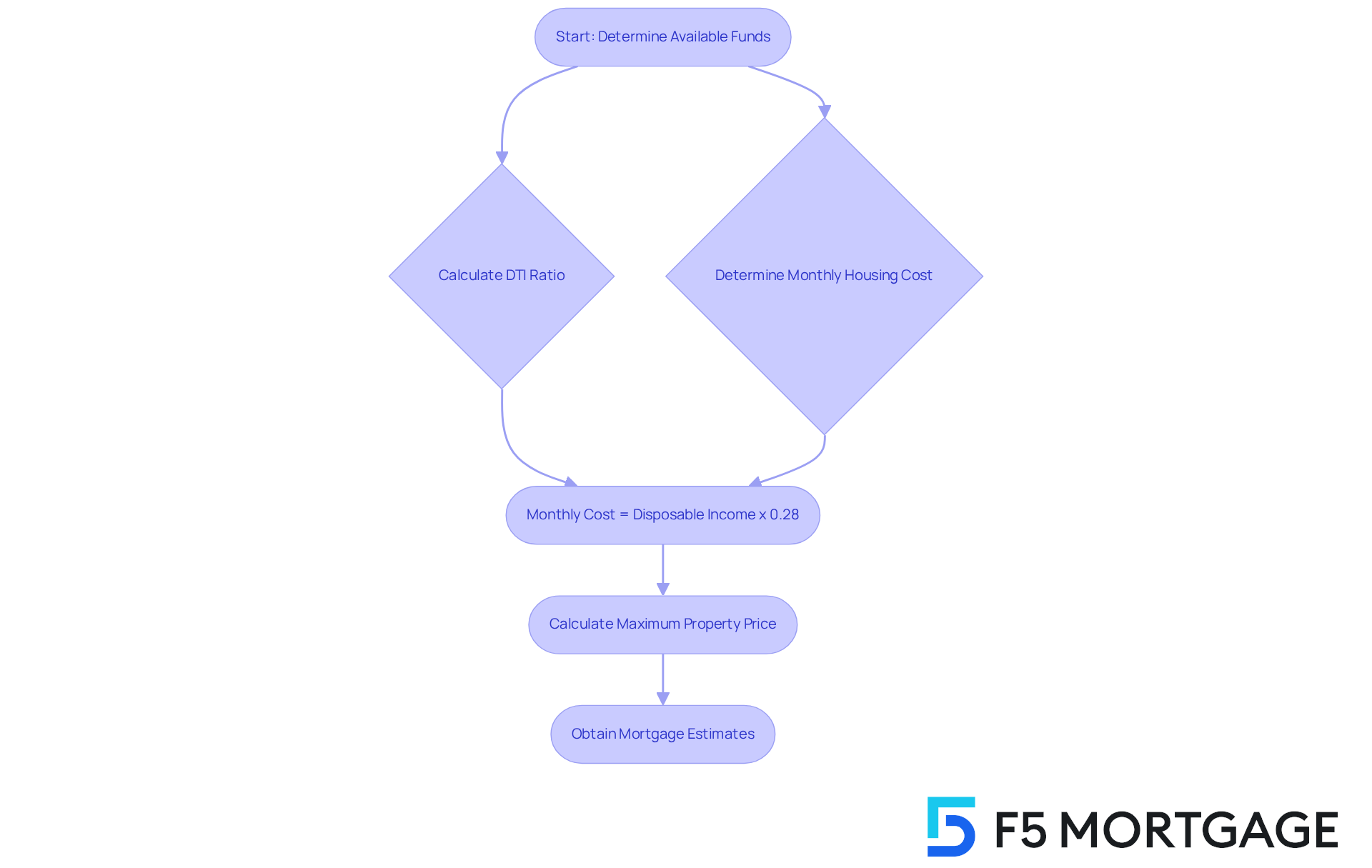

Determining your maximum home price can feel overwhelming, but starting with your available funds is a great first step. We understand how important it is to align this with your debt-to-earnings ratio (DTI). A commonly recognized guideline suggests that your total monthly housing expenses should ideally not exceed 28% of your gross monthly earnings. For example, if your disposable income is $3,000, multiplying it by 0.28 shows that your maximum monthly housing cost should be around $840.

Next, let’s talk about your initial contribution. If you plan to contribute $10,000 down, you can determine how much house you can afford with $10,000 down using this formula:

Maximum Property Price = (Monthly Housing Cost x 12) / Mortgage Factor + Down Payment

This method can help clarify the price range to focus on while you search for your new home.

As we look ahead to 2025, it’s essential to remember that the average monthly payment for first-time property buyers is about $3,240, which represents roughly 42% of their average before-tax monthly earnings. Additionally, many lenders require property owners to maintain a minimum 80% loan-to-value ratio. This means you should aim to have at least 20% of your original loan amount paid down, or your property must have appreciated in value. Keeping your housing expenses within these suggested limits can help ensure your financial stability and affordability.

We recommend obtaining multiple mortgage estimates to explore different options and potentially lower your mortgage costs. Remember, a maximum DTI ratio of 43% is generally necessary for residential loans. We’re here to support you every step of the way as you .

Factor in Additional Homeownership Costs

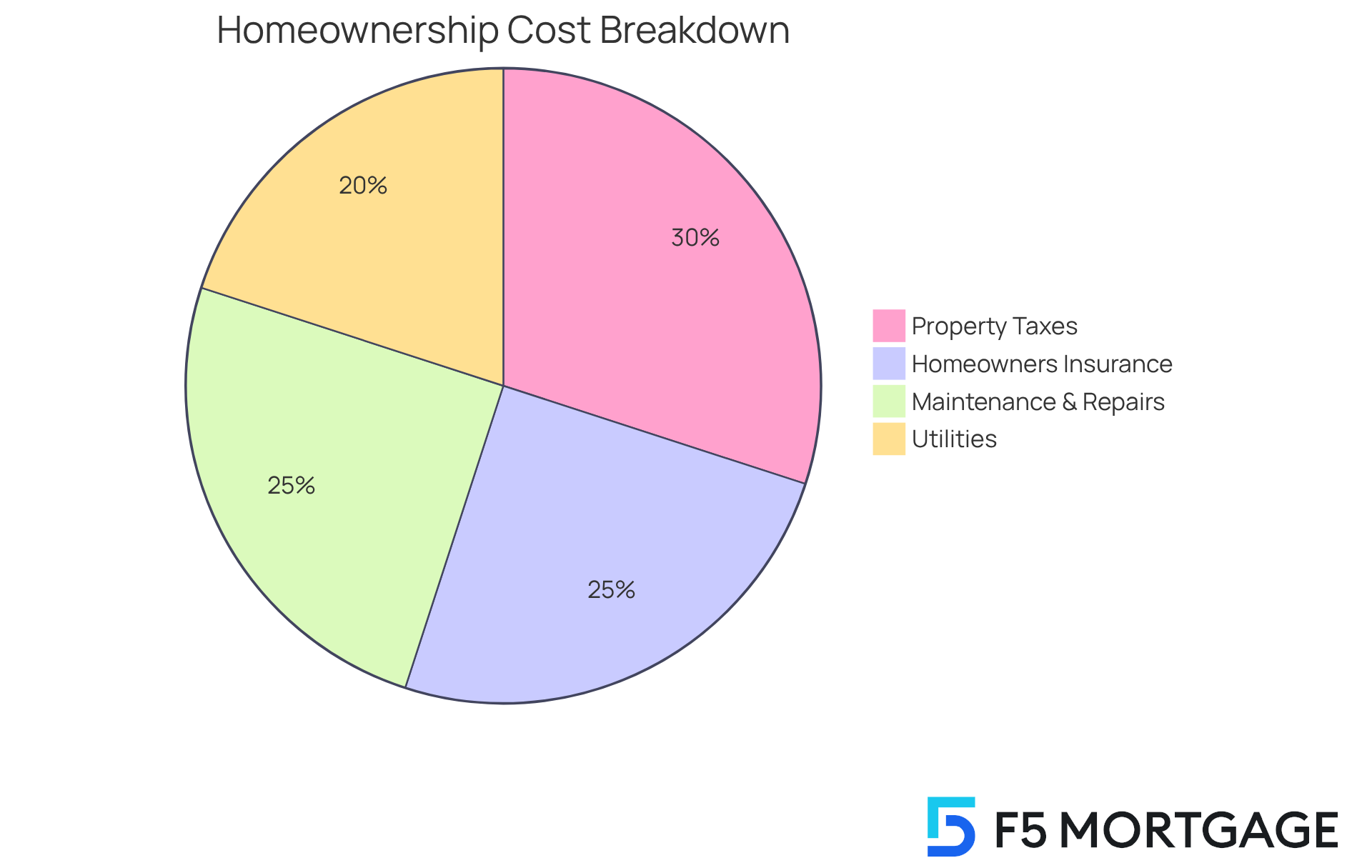

Planning your finances for a new home can feel overwhelming, but we’re here to support you every step of the way. It’s essential to consider extra expenses beyond just your mortgage payment. These may include:

- Property taxes

- Homeowners insurance

- Maintenance and repairs

- Utilities

A good rule of thumb is to set aside about 1% of your property’s value each year for maintenance. For example, if your home is valued at $200,000, you should plan to allocate approximately $2,000 annually for upkeep. This proactive approach helps ensure your home remains a safe and comfortable space for you and your family.

Additionally, property taxes can vary significantly depending on your location, so it’s wise to investigate local rates to understand this expense better. Homeowners insurance is another crucial cost, typically ranging from $800 to $1,500 each year.

By factoring in these additional costs, you can create a realistic and sustainable budget. This way, you can enjoy your new home without the burden of financial stress, knowing that you’ve .

Conclusion

Embarking on the journey to homeownership with a $10,000 down payment can be a truly transformative experience. We understand how challenging this can be, and with careful planning and understanding, you can navigate this process with confidence. This guide highlights the importance of assessing your financial situation—considering your income, expenses, and credit score—to determine how much house you can realistically afford. By organizing your financial documents and grasping the implications of your down payment, you can tackle the complexities of mortgage options more effectively.

Key insights reveal that a $10,000 down payment can significantly influence your mortgage choices. For instance, it may help you qualify for FHA loans or improve your loan-to-value ratio. When calculating the maximum home price, it’s essential to factor in monthly housing costs along with additional expenses like property taxes and maintenance. Utilizing tools like mortgage calculators can clarify your potential financial commitments, ensuring you remain within your budget.

Ultimately, the journey toward homeownership is about more than just the initial down payment; it encompasses a holistic view of your financial health and future planning. By taking the time to understand all associated costs and preparing adequately, you can make informed decisions that lead to sustainable homeownership. Embracing this proactive approach not only fosters financial stability but also paves the way for a fulfilling and secure living environment. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What financial documents should I gather when preparing for homeownership?

You should collect pay stubs, tax returns, and bank statements. If self-employed, include the last two years of personal tax returns, business tax returns, K1s, 1099s, and W2s. For salaried borrowers, the last year’s W2 and two recent pay stubs from the last 30 days are sufficient.

How do I determine my disposable income?

To determine your disposable income, calculate your total monthly earnings, including bonuses or extra revenue streams. Then, compile a list of your monthly expenses, such as rent, utilities, groceries, and debt payments. Deduct your total expenses from your earnings to see your disposable funds.

Why is understanding my disposable income important?

Understanding your disposable income is vital as it provides a clear view of your financial well-being and helps you create a practical budget for purchasing a property.

How can gathering financial documents early in the process help?

Gathering financial documents early can streamline your mortgage application process, significantly speeding up the approval process according to financial advisors.

Why is checking my credit score important when buying a home?

Checking your credit score is essential because it directly impacts your mortgage options and interest rates. A score above 700 is generally favorable, while scores below 620 may limit your choices.

What steps should I take to navigate the property purchasing process confidently?

Evaluate your financial situation by gathering necessary documents, understanding your disposable income, checking your credit score, and submitting a refinancing application with your chosen lender. This will help you make informed decisions throughout the property purchasing process.