Overview

Mastering home equity interest rates is crucial for families looking to upgrade their homes. We understand how significant these rates can be, as they directly affect borrowing costs for home improvements or refinancing. Factors such as credit scores, loan-to-value ratios, and market conditions play a vital role in determining these rates. By understanding these elements, homeowners can make informed financial decisions that empower them on their journey.

We know how challenging this can be, but you’re not alone. It’s essential to recognize that navigating these factors can lead to better financial outcomes. As you consider your options, remember that being informed is the first step toward making decisions that positively impact your family’s future.

Take the time to explore your credit score and assess your loan-to-value ratio. These steps can significantly influence the interest rates you receive. We’re here to support you every step of the way, ensuring you have the knowledge needed to make the best choices for your home and family.

Introduction

Understanding the intricacies of home equity is crucial for homeowners like you, who are looking to leverage your property for financial gain. We know how challenging this can be, but with the potential to fund significant projects or consolidate debt, mastering home equity interest rates can unlock a world of opportunities.

However, as market conditions fluctuate and personal financial situations vary, how can you ensure that you’re making the best decisions for your family? This article delves into the essential factors influencing home equity interest rates, offering strategies to navigate these complexities and secure the most favorable terms.

We’re here to support you every step of the way.

Define Home Equity and Its Importance

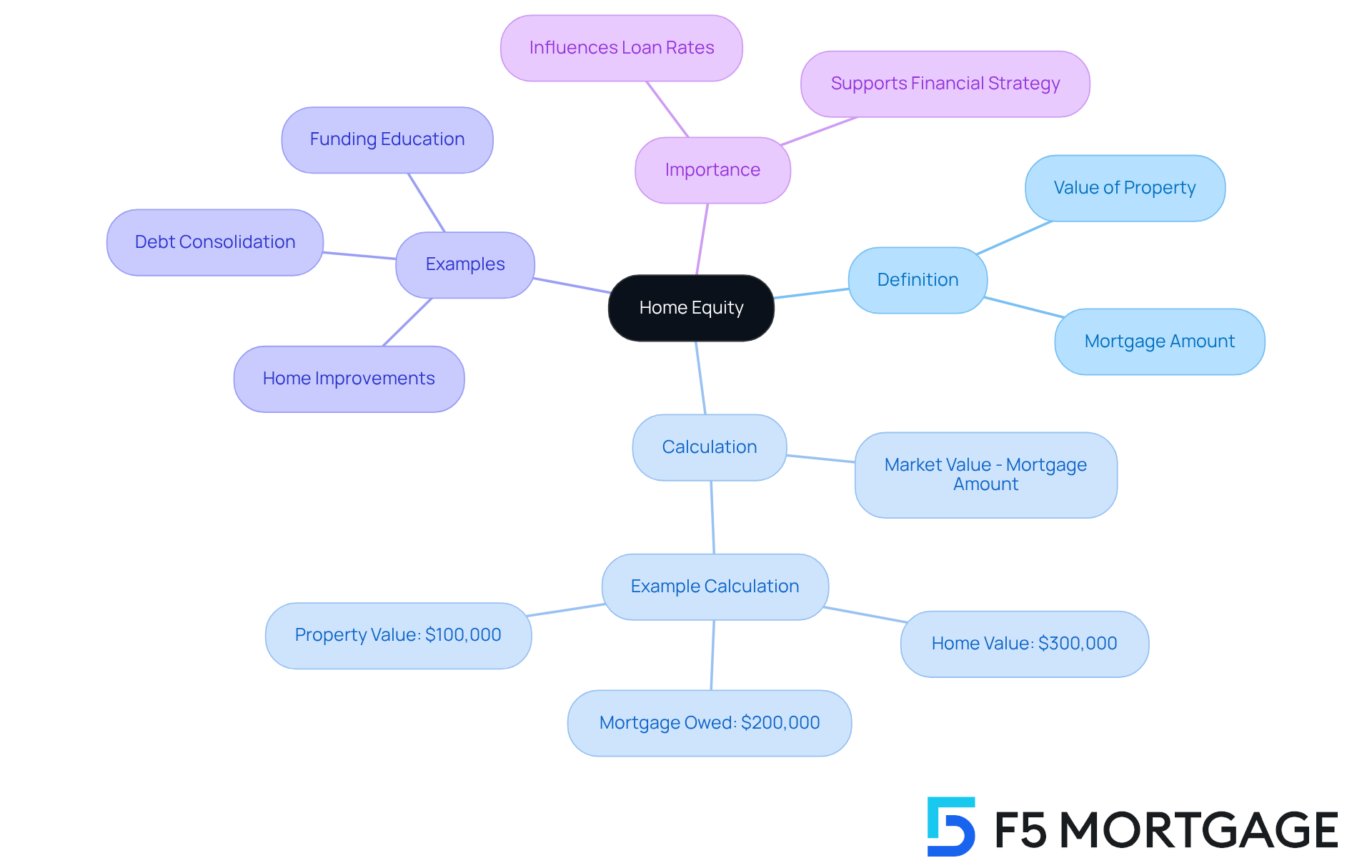

Understanding the value of your property is essential, as it reflects what you truly own. This value is determined by the current market price of your home, minus any remaining mortgage amounts. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your property value stands at $100,000.

We know how challenging navigating finances can be, especially when it comes to making informed decisions about your home. Recognizing your residential value can be a powerful tool for various financial needs, such as:

- Home improvements

- Debt consolidation

- Funding education

This knowledge not only empowers you but also helps you explore your options confidently.

Moreover, the value of your property can significantly influence the home equity interest rate when you are seeking loans or lines of credit. This makes it a vital component of your financial strategy, especially when considering improvements or refinancing. We’re here to support you every step of the way as you .

Examine Factors Affecting Home Equity Interest Rates

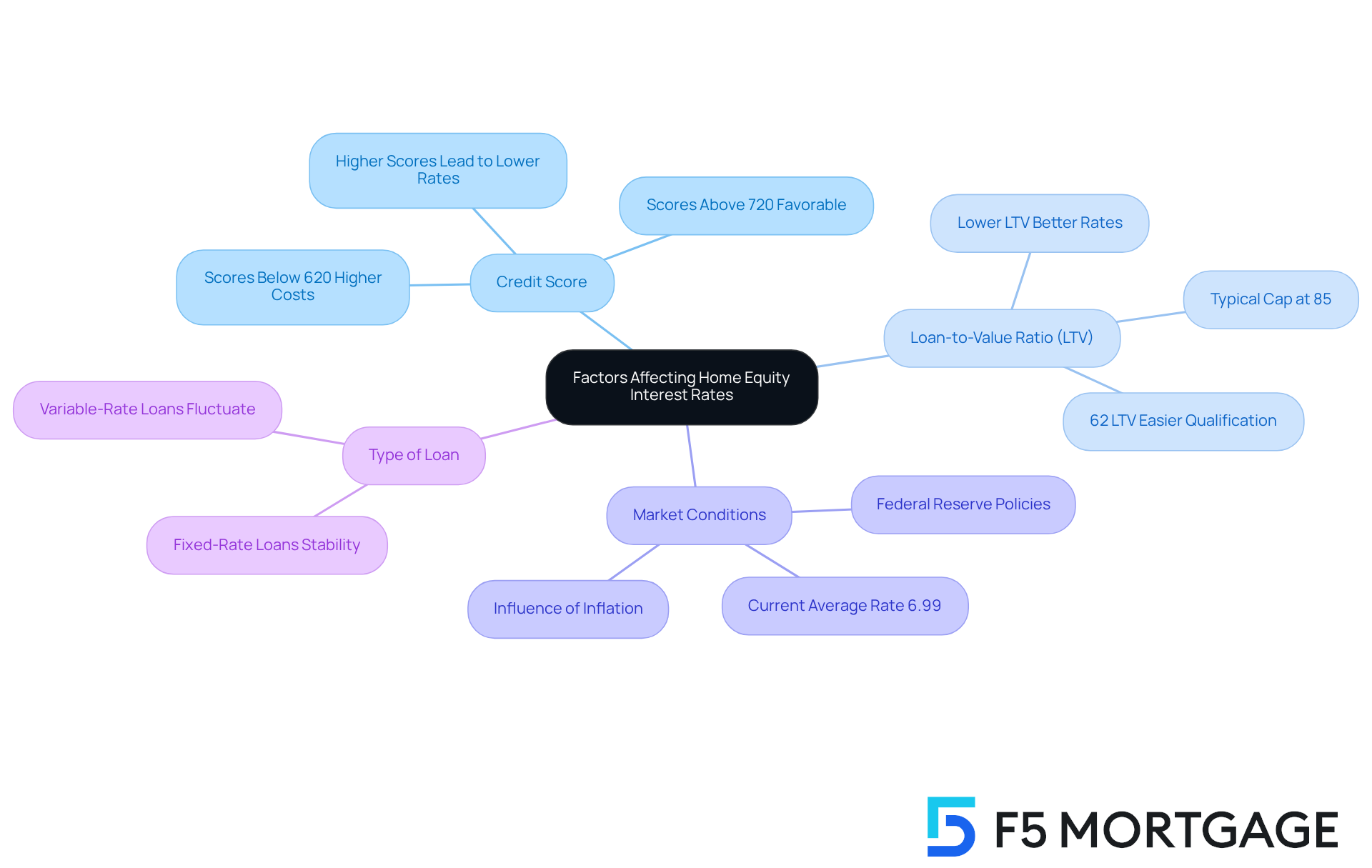

Understanding can feel overwhelming, but several key factors can help you navigate this home equity interest rate process with confidence.

- Credit Score: We know how challenging it can be to manage your credit score. A higher credit score generally leads to lower home equity interest rates, as lenders view borrowers with strong credit histories as lower risk. For instance, borrowers with credit scores of 720 or above often secure more favorable conditions compared to those with scores under 620, who might face higher costs and stricter borrowing limits.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of your home. Most lenders cap the LTV ratio at 85%, which indicates that a lower LTV can result in better borrowing costs and a more advantageous home equity interest rate. Imagine a borrower with a 62% LTV ratio—they may find it easier to qualify for lower costs than someone with a 77% LTV.

- Market Conditions: Economic factors, such as inflation and the Federal Reserve’s monetary policies, significantly influence overall borrowing costs. As we look ahead to 2025, the typical home equity interest rate for a 30-year property loan is around 6.99%, reflecting current market conditions.

- Type of Loan: Different property-backed products, like fixed-rate loans versus variable-rate lines of credit, can have varying interest rates. Fixed-rate loans provide stability, while variable-rate options may change in response to market conditions.

By understanding these factors, you can better assess your financial situation and prepare for the potential costs associated with mortgage financing, including the home equity interest rate. Remember, we’re here to support you every step of the way as you navigate this important journey.

Compare Home Equity Loans and Lines of Credit

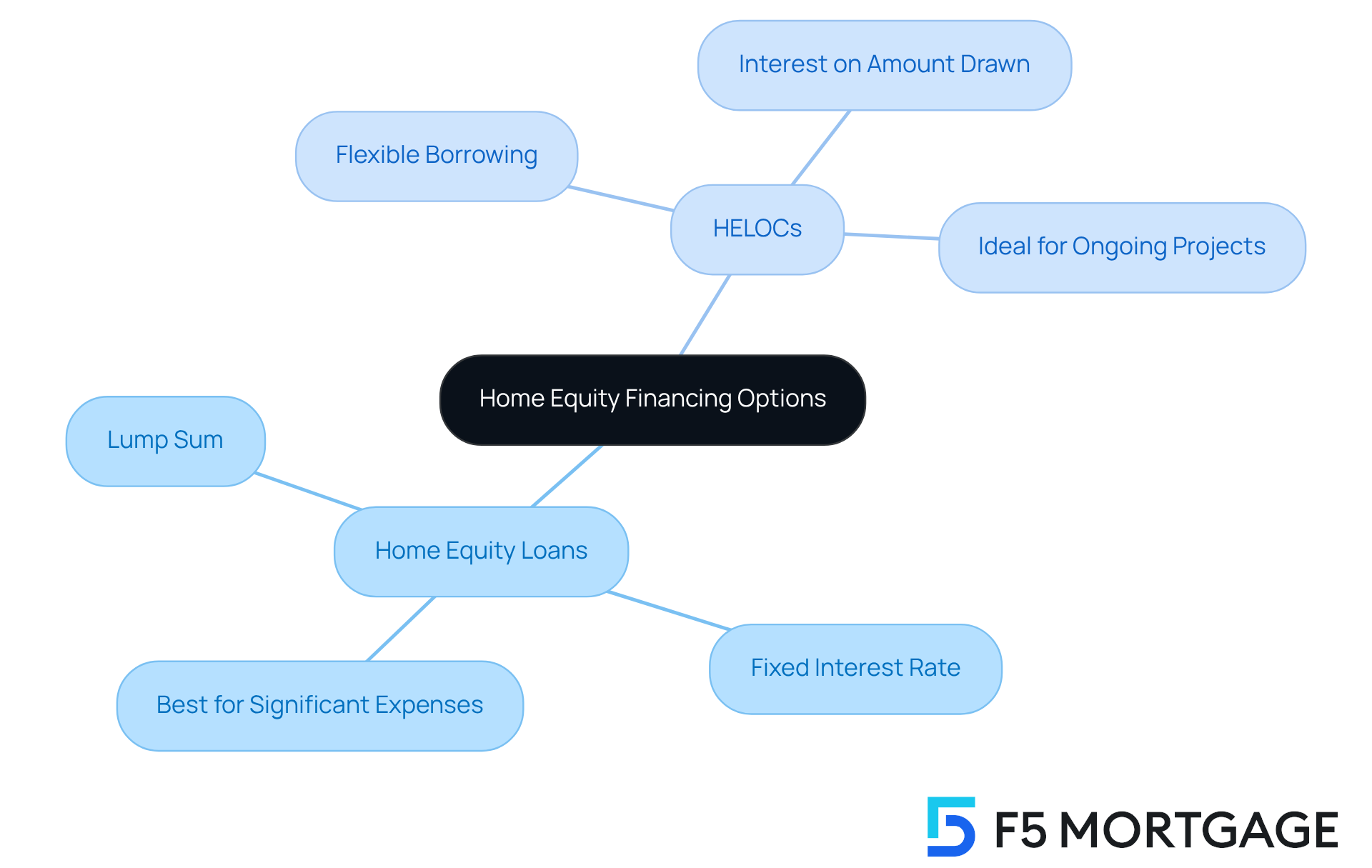

When it comes to property value financing, you have two main options: and home equity lines of credit (HELOCs). Understanding the home equity interest rate can help you navigate your financial decisions with confidence.

Home equity loans can be viewed as a means to receive a lump sum with a home equity interest rate that is fixed. They can be perfect for significant, one-time expenses, like a kitchen renovation. For instance, if you’re planning a project that costs $50,000, you might consider a loan against your property to cover the total cost upfront. This ensures you have consistent monthly payments, allowing you to focus on enjoying your new space.

- Home Equity Lines of Credit (HELOCs): On the other hand, HELOCs are more flexible, functioning like credit cards. They allow you to borrow against your home value up to a predetermined limit, and you only pay interest on the amount you draw. This can be ideal for ongoing projects or gradual improvements, such as landscaping or phased renovations.

When deciding between these options, it’s essential to reflect on your financial situation and specific project needs. Home equity loans can be beneficial for fixed costs due to the home equity interest rate, while HELOCs offer the flexibility you might need for variable expenses. We know how challenging this can be, and recent statistics show that approximately 60% of property owners prefer mortgage loans for significant renovations, while 40% opt for HELOCs for ongoing projects.

Ultimately, your choice should align with your financial goals, the available home equity interest rate options, and your repayment capabilities. If you anticipate needing funds over time, a HELOC could be more advantageous. Conversely, if you have a significant, immediate expense, a home equity loan might be a better fit. We’re here to support you every step of the way as you make this important decision.

Strategies to Obtain Competitive Home Equity Rates

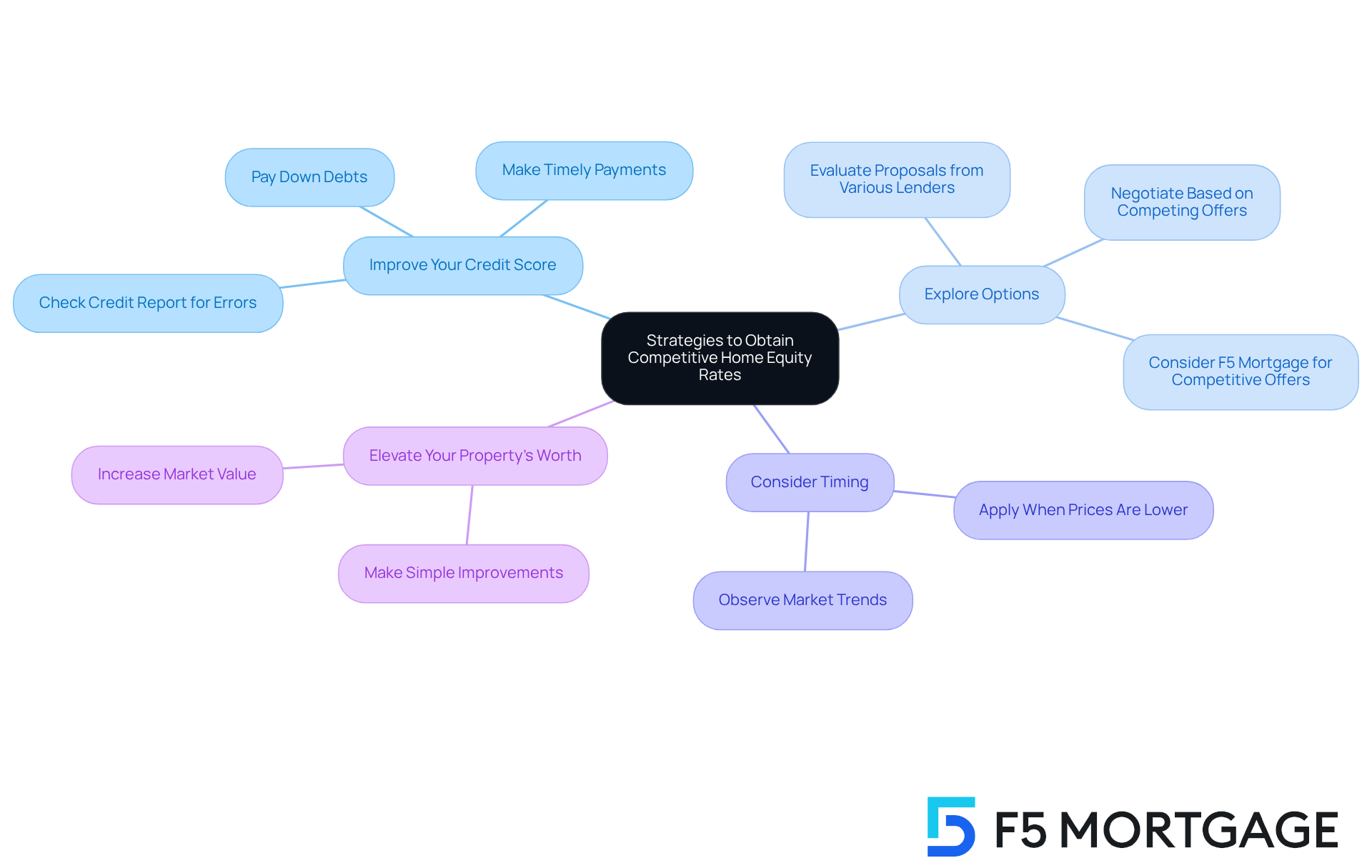

Securing competitive home equity interest rates can feel overwhelming, but we’re here to support you every step of the way. Consider these strategies to help you navigate this process with confidence:

- Improve Your Credit Score: We know how important your creditworthiness is. Paying down debts, making timely payments, and checking your credit report for errors can significantly enhance your score and open up better options for you.

- Explore Options: Take the time to evaluate proposals from various lenders, including F5 Mortgage. They are recognized for their and tailored assistance, which can help you find the most favorable terms and conditions. Remember, don’t hesitate to negotiate with lenders based on competing offers; it’s your right!

- Consider Timing: Interest levels can fluctuate based on market conditions. By observing trends, you can identify the best time to apply, ideally when prices are lower, making your mortgage more affordable.

- Elevate Your Property’s Worth: Enhancing your home can boost its market value. Simple improvements can increase your stake, potentially leading to better loan terms that align with your financial goals.

By implementing these tactics, property owners can position themselves to secure the most advantageous home equity interest rate, making their financial improvements more attainable. Additionally, understanding the home equity interest rate and term refinance options with F5 Mortgage can further maximize your home equity benefits, ensuring you make the most of your investment.

Conclusion

Understanding home equity and its related interest rates is crucial for homeowners looking to make informed financial decisions. We know how challenging this can be, but by grasping the concept of home equity—along with the factors that influence interest rates and the options available for accessing that equity—homeowners can strategically enhance their financial standing. This knowledge empowers them to navigate upgrades or improvements with confidence.

Key insights from this article highlight the importance of:

- Credit scores

- Loan-to-value ratios

- Market conditions

in determining home equity interest rates. Additionally, the comparison between home equity loans and lines of credit provides clarity on which option may best suit individual financial needs. By exploring various lender options and improving credit scores, homeowners can secure competitive rates that align with their financial goals.

Ultimately, taking control of home equity can lead to significant benefits, whether for home improvements, debt consolidation, or other financial endeavors. By staying informed and proactive, homeowners can maximize their investments and secure favorable terms that enhance their financial journey. Embracing these insights and strategies will not only empower individuals today but also pave the way for a more stable financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is home equity?

Home equity is the value of your property that you truly own, calculated by subtracting any remaining mortgage amounts from the current market price of your home.

How is home equity calculated?

Home equity is determined by the formula: current market price of the home minus the remaining mortgage amounts. For example, if a home is valued at $300,000 and the mortgage owed is $200,000, the home equity is $100,000.

Why is understanding home equity important?

Understanding home equity is important because it reflects your true ownership of the property and can be a powerful tool for various financial needs, such as home improvements, debt consolidation, and funding education.

How can home equity influence financial decisions?

The value of your property can significantly influence home equity interest rates when seeking loans or lines of credit, making it a vital component of your financial strategy, especially for improvements or refinancing.

What are some financial needs that home equity can help address?

Home equity can help address financial needs such as home improvements, debt consolidation, and funding education.