Overview

This article addresses the FHA credit score requirements for successful home financing, highlighting the minimum score of 580 needed for favorable conditions. We understand how challenging this can be, and we want to assure you that borrowers with lower scores can still qualify by making higher down payments. Additionally, we offer strategies to enhance your credit scores, emphasizing the program’s accessibility. It’s important to recognize that financial management plays a crucial role for potential homeowners, and we’re here to support you every step of the way.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for those facing credit challenges. We understand how daunting this journey can be. FHA loans, backed by the Federal Housing Administration, provide a valuable opportunity for many aspiring homeowners. With lower down payment options and more lenient credit score requirements, these loans can be a lifeline.

In this article, we will explore the intricacies of FHA credit score requirements and share strategies that can help you enhance your financial standing. Our goal is to empower you with the knowledge and tools necessary to turn your credit challenges into opportunities for home financing success. How can you transform your situation and take the next step toward your dream of homeownership?

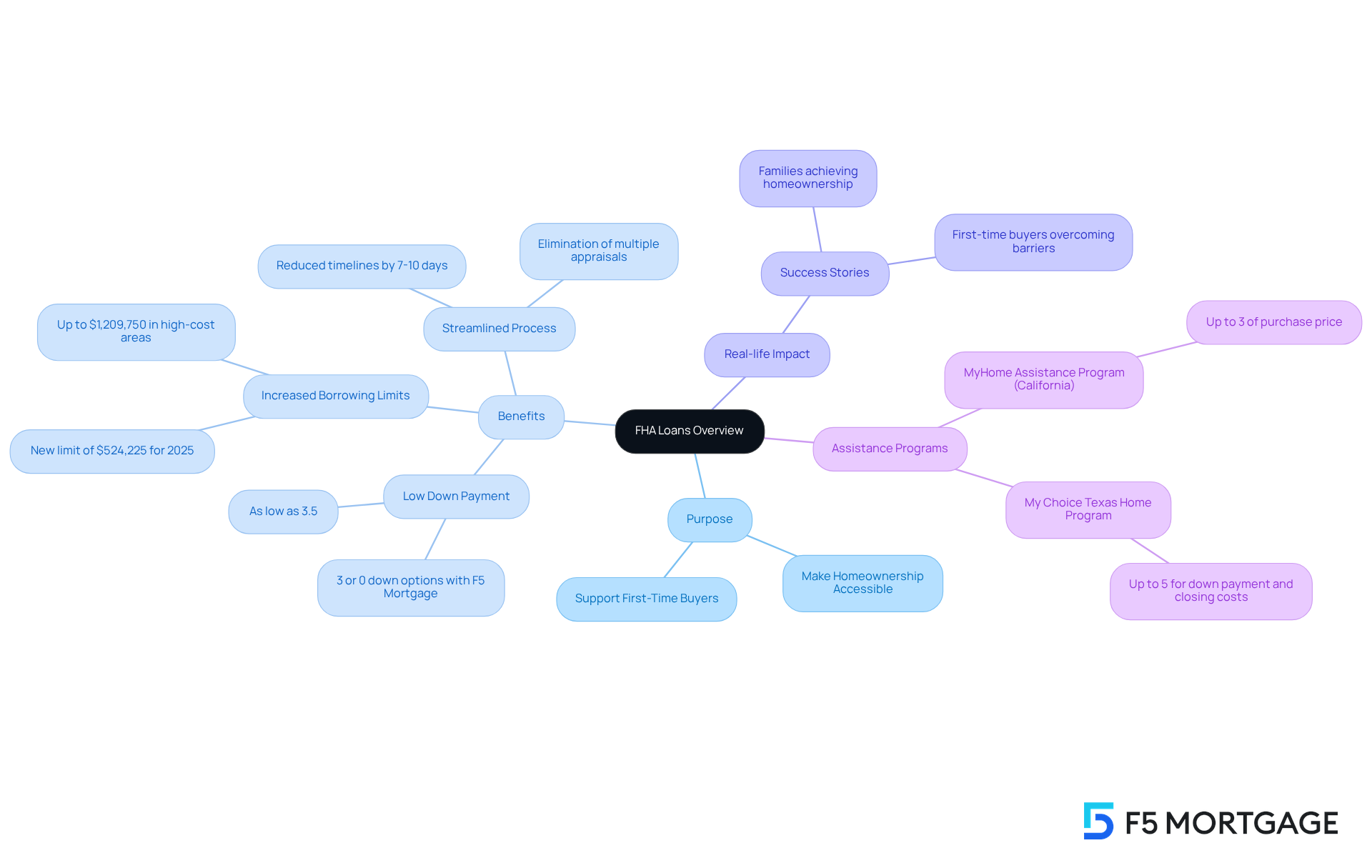

Explore FHA Loans: An Overview of Their Purpose and Benefits

FHA financing, supported by the Federal Housing Administration, is designed to make homeownership more accessible, especially for first-time buyers and those with less-than-perfect financial histories. One of the most appealing aspects of FHA financing is its minimal down payment requirement, which can be as low as 3.5% for borrowers with an FHA credit score of 580 or higher. With F5 Mortgage, you may qualify to purchase a home with just 3% down—or even 0% down for certain financing options. This flexibility allows families to step into the housing market without overwhelming financial pressure.

In 2025, the FHA has increased borrowing limits to $524,225 for single-family homes, reflecting rising home prices and helping families secure larger loans under favorable conditions. Recent regulatory changes have also streamlined the financing process, reducing timelines by an average of 7-10 days. This is especially beneficial for first-time buyers eager to settle into their new homes. These improvements align with F5 Mortgage’s dedication to utilizing technology to enhance the mortgage experience for consumers.

Real-life stories illustrate the impact of FHA financing: families who once thought homeownership was out of reach are now able to buy homes thanks to the program’s low down payment options and the flexibility of the FHA credit score requirements. Approximately 83% of FHA mortgage originations are for first-time buyers, showcasing the program’s success in helping families realize their homeownership dreams.

Additionally, F5 Mortgage provides various down payment assistance programs, such as the MyHome Assistance Program in California, which offers up to 3% of the home’s purchase price, and the My Choice Texas Home program, providing up to 5% for down payment and closing costs. With and lower closing costs, FHA financing remains an attractive option for many families. The recent enhancements in accessibility further solidify FHA financing as a vital resource for those navigating the complexities of home funding. At F5 Mortgage, we are committed to offering personalized support and leveraging technology to ensure a smooth mortgage experience, empowering families to achieve their homeownership goals.

Understand Minimum Credit Score Requirements for FHA Loans

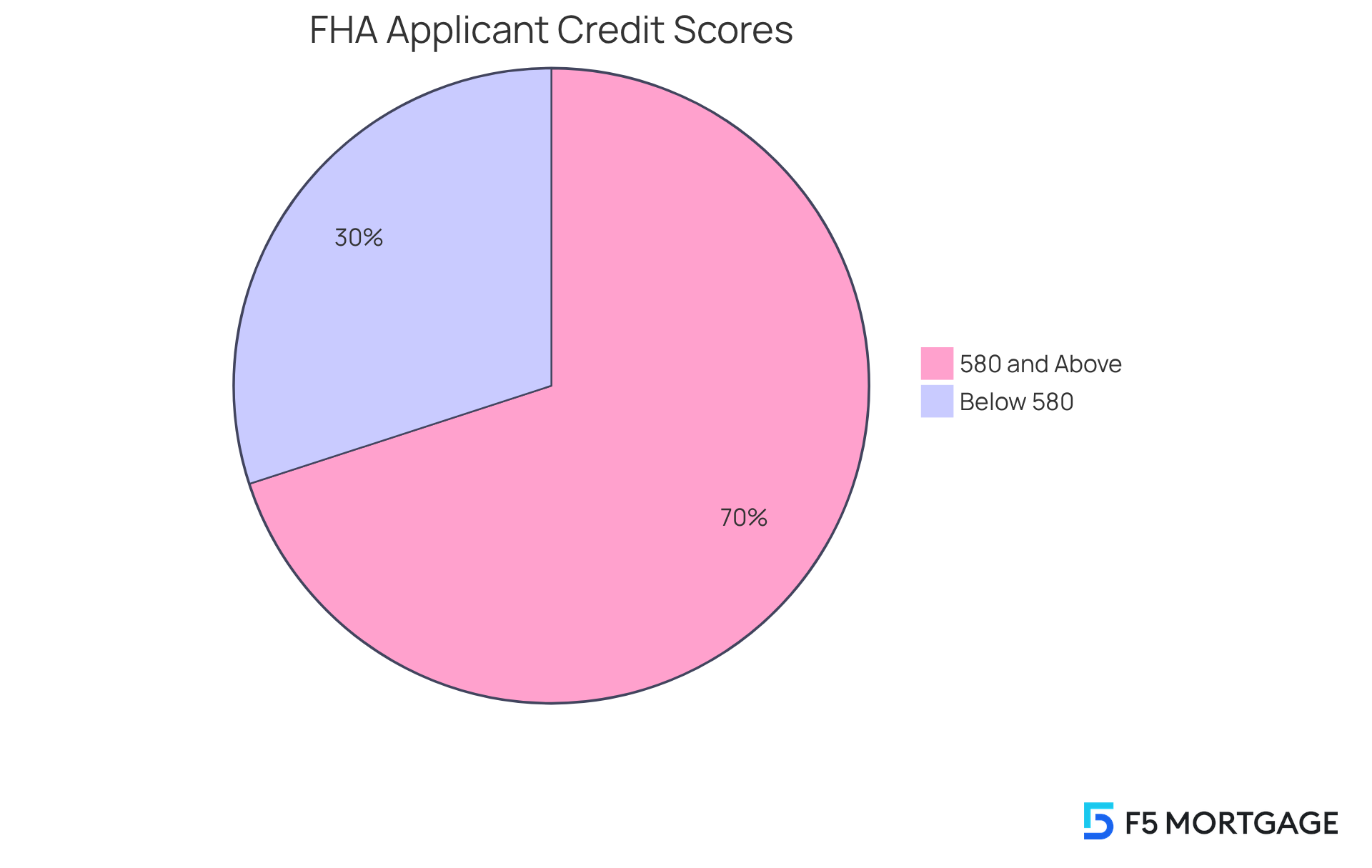

Navigating the world of [FHA mortgages](https://f5mortgage.com/7-essential-fha-loan-florida-insights-for-2025-borrowers) can feel overwhelming, especially when you’re trying to understand the eligibility requirements. To qualify for an FHA mortgage, applicants usually need a minimum credit rating of 580 to take advantage of the low down payment option of just 3.5%. However, we know how challenging this can be—if your rating falls between 500 and 579, you can still qualify, but it will require a higher down payment of at least 10%.

Recent data shows that about 30% of FHA applicants have ratings below 580. This reflects the program’s commitment to being accessible for borrowers who may not have perfect financial histories. While the FHA sets these minimum thresholds, it’s important to note that , especially given the current economic climate. Therefore, we encourage you to reach out to your lender to clarify specific eligibility requirements.

Additionally, understanding the significance of home appraisals is vital in this process. Lenders will order an appraisal to assess the current market value of the property, which directly influences the equity available and the mortgage rates you may receive. By grasping these requirements and utilizing the resources available to you, we believe you can navigate the FHA financing process more effectively and secure favorable terms. Remember, we’re here to support you every step of the way.

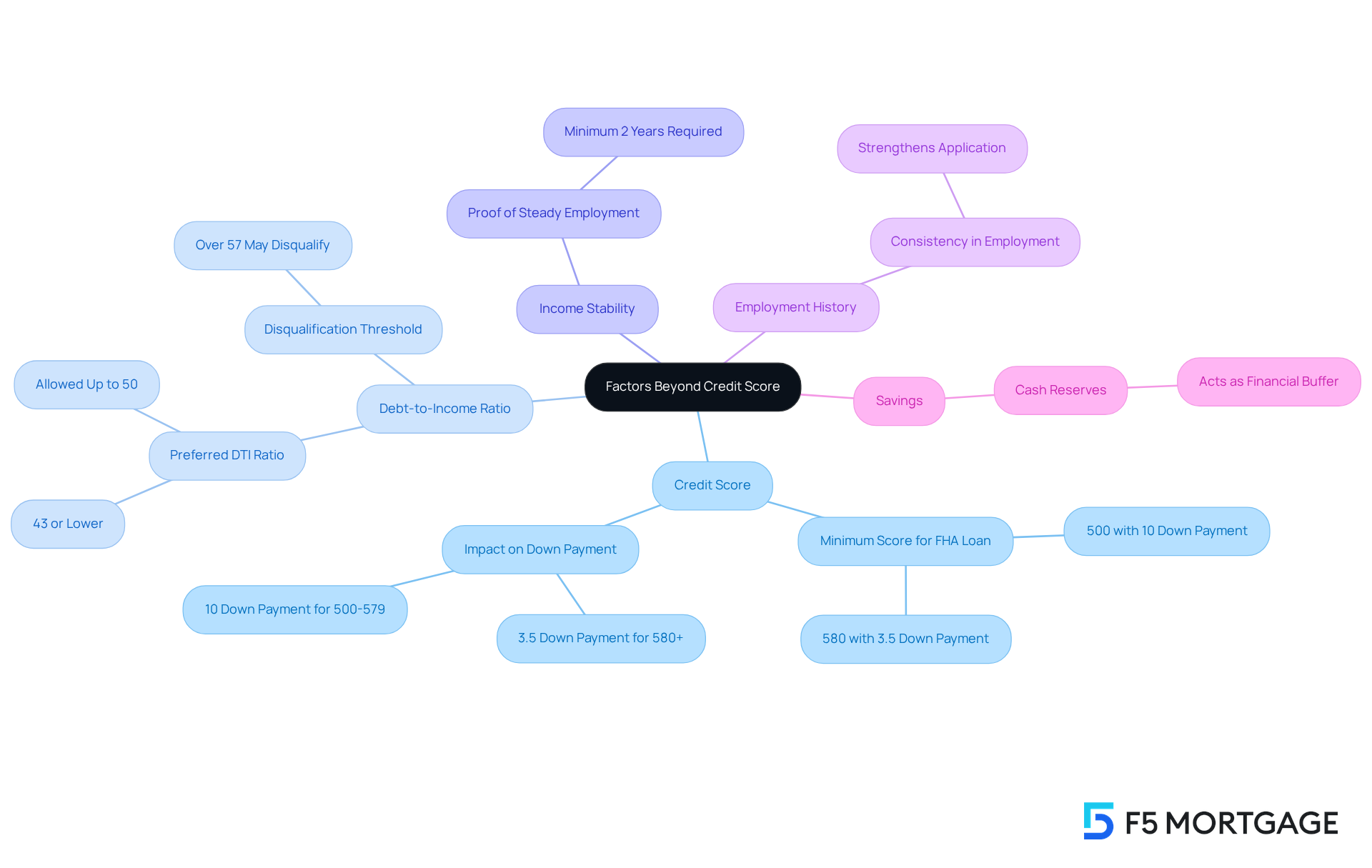

Examine Factors Beyond Credit Score: What Lenders Consider

Navigating the world of FHA mortgages can feel overwhelming, but understanding the role of credit scores and other financial factors can make a significant difference. While credit scores are crucial for FHA mortgage eligibility, lenders also look closely at a borrower’s . A DTI ratio of 43% or lower is generally preferred, as it reflects a borrower’s ability to manage monthly payments effectively. However, it’s reassuring to know that FHA guidelines allow for DTI ratios as high as 50%, offering flexibility for those with unique financial situations. For instance, individuals with steady income and a strong DTI ratio have successfully secured FHA financing, demonstrating that a comprehensive [financial profile can enhance approval chances](https://f5mortgage.com/?p=10455).

Lenders also consider income stability and employment history, typically requiring proof of steady employment for at least two years. This consistency provides lenders with confidence in the borrower’s ability to meet ongoing payment obligations. Additionally, having savings and cash reserves can act as a financial buffer, further strengthening a borrower’s application. By understanding these factors, prospective FHA borrowers can craft a more compelling case for approval, ultimately making their journey toward homeownership smoother and more achievable. Remember, we’re here to support you every step of the way.

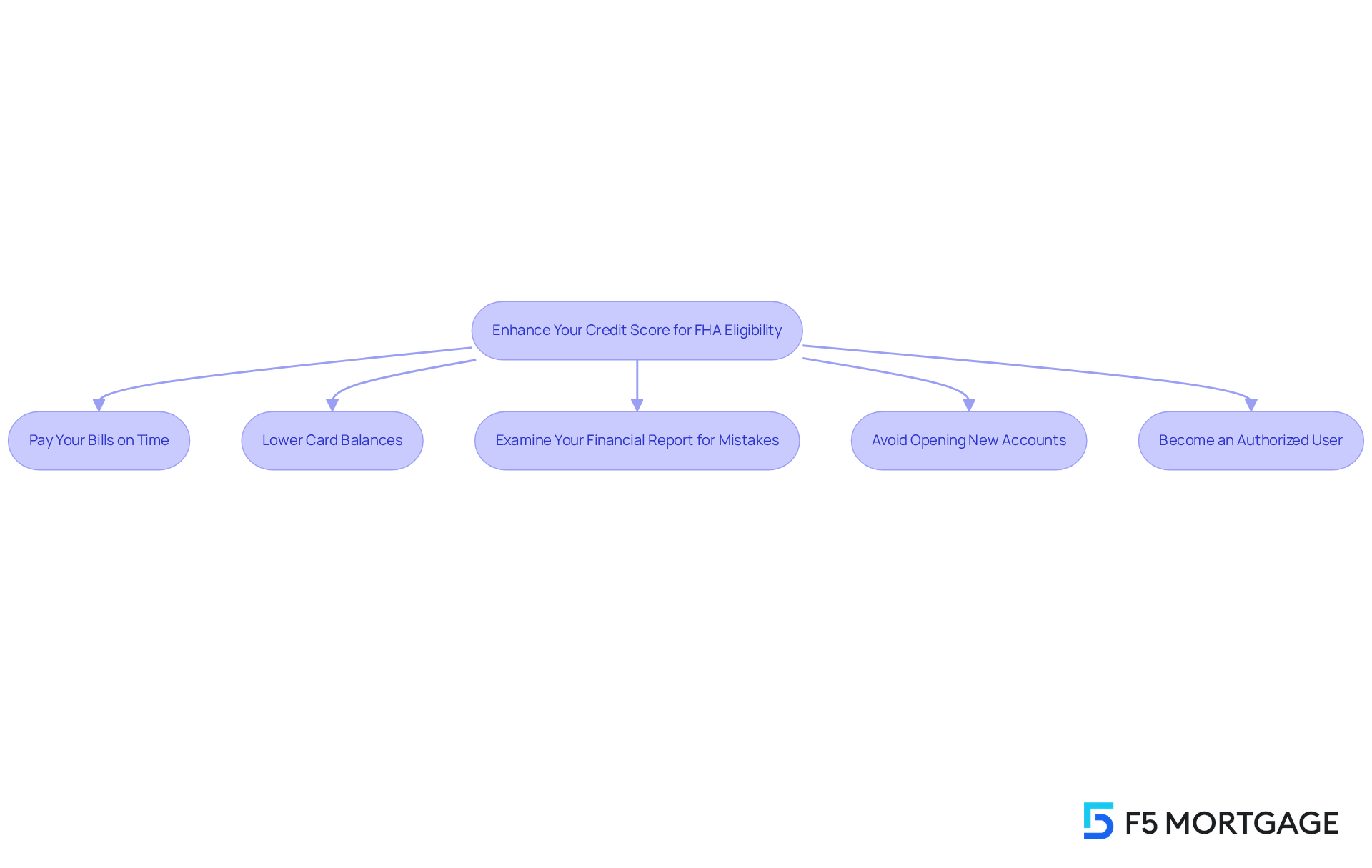

Implement Strategies to Enhance Your Credit Score for FHA Eligibility

Enhancing your FHA credit score is crucial to being eligible for an FHA mortgage. We understand how challenging this can be, and the FHA credit score required for an is 580, or 500 with a 10% down payment. Here are some effective strategies to enhance your creditworthiness:

- Pay Your Bills on Time: Regularly making payments punctually is one of the most important elements influencing your financial rating. Set up reminders or automatic payments to ensure you never miss a due date. As Jon Meyer, a loan specialist, points out, ‘Quick rescoring can be beneficial since your lender can conduct a simulation to inform you of the best approach to improve your ratings.’

- Lower Card Balances: Strive to maintain your utilization ratio under 30%. Reducing current debt can have a beneficial effect on your rating. The typical rating for an individual securing a purchase loan is 737, emphasizing the significance of handling finances efficiently.

- Examine Your Financial Report for Mistakes: Regularly review your financial report for inaccuracies. We’re here to support you every step of the way—challenge any mistakes you discover, as they can adversely impact your results. Fixing mistakes can result in a considerable increase in your rating.

- Avoid Opening New Accounts: Each new inquiry can reduce your rating slightly. Focus on managing your existing accounts rather than opening new ones, which can complicate your financial profile.

- Think About Becoming an Authorized User: If you have a family member or friend with a good financial history, inquire if you can be added as an authorized user on their card. This can assist in enhancing your rating by utilizing their favorable financial background.

By applying these strategies, you can strive towards attaining a rating that meets the FHA credit score criteria, facilitating successful home financing. Real-life examples of families enhancing their credit scores for mortgage eligibility demonstrate that these strategies can lead to tangible results.

Conclusion

FHA loans are a vital pathway to homeownership, especially for first-time buyers and those facing credit challenges. We understand how daunting the financing process can feel, but by grasping the FHA credit score requirements and utilizing available resources, you can navigate these complexities with greater ease. This program not only offers low down payment options but also embraces a variety of financial situations, making homeownership a reality for many families.

It’s important to note that:

- A credit score of 580 is typically needed for favorable terms.

- There is flexibility for those with scores as low as 500.

- Elements like debt-to-income ratios, income stability, and savings significantly influence the approval process.

By taking steps to enhance your credit score—such as making timely bill payments, reducing debt, and correcting inaccuracies—you can improve your standing with lenders.

Ultimately, understanding FHA credit score requirements is crucial. By proactively working to improve your creditworthiness and being aware of eligibility criteria, you can empower yourself on your journey to homeownership. Embracing these strategies not only opens doors to financing but also nurtures a sense of financial stability and achievement in having a home of your own.

Frequently Asked Questions

What is the purpose of FHA loans?

FHA loans, supported by the Federal Housing Administration, are designed to make homeownership more accessible, particularly for first-time buyers and individuals with less-than-perfect financial histories.

What are the benefits of FHA financing?

FHA financing offers minimal down payment requirements, starting as low as 3.5% for borrowers with a credit score of 580 or higher. It also provides flexibility in credit score requirements and has increased borrowing limits to help families secure larger loans.

What is the current down payment requirement for FHA loans?

The down payment requirement for FHA loans can be as low as 3.5%, but with F5 Mortgage, borrowers may qualify for as low as 3% down or even 0% down for certain financing options.

What are the new borrowing limits for FHA loans in 2025?

In 2025, the FHA has increased borrowing limits to $524,225 for single-family homes to reflect rising home prices.

How have recent regulatory changes affected the FHA financing process?

Recent regulatory changes have streamlined the financing process, reducing timelines by an average of 7-10 days, which is particularly beneficial for first-time buyers.

What percentage of FHA mortgage originations are for first-time buyers?

Approximately 83% of FHA mortgage originations are for first-time buyers, highlighting the program’s effectiveness in helping families achieve homeownership.

What down payment assistance programs does F5 Mortgage offer?

F5 Mortgage offers various down payment assistance programs, including the MyHome Assistance Program in California, which provides up to 3% of the home’s purchase price, and the My Choice Texas Home program, offering up to 5% for down payment and closing costs.

How does FHA financing compare in terms of costs?

FHA financing typically features competitive interest rates and lower closing costs, making it an attractive option for many families seeking homeownership.

What is F5 Mortgage’s commitment to borrowers?

F5 Mortgage is dedicated to providing personalized support and leveraging technology to ensure a smooth mortgage experience, empowering families to achieve their homeownership goals.