Overview

Local mortgage brokers play a vital role for families, offering personalized support and a deep understanding of the local market. They provide tailored financial solutions that truly enhance the homebuying experience. We know how challenging this can be, and that’s why these brokers are here to simplify the mortgage process for you.

By improving communication and offering competitive rates, local mortgage brokers help families feel more confident in their decisions. This not only leads to higher satisfaction but also empowers families on their homeownership journey. Remember, you’re not alone in this process; we’re here to support you every step of the way.

Introduction

Navigating the complexities of home financing can feel overwhelming for families. We understand how high the stakes are in this journey. Local mortgage brokers, like those at F5 Mortgage, are here to help transform this daunting experience into a personalized and manageable process. By leveraging their deep understanding of the local market and building strong relationships with lenders, these brokers provide tailored solutions that meet unique financial needs. This not only enhances overall satisfaction but also fosters a sense of security during a significant life decision.

But what truly sets local mortgage brokers apart? How can they significantly impact your family’s homebuying experience? We’re here to support you every step of the way.

F5 Mortgage: Personalized Service Tailored to Your Needs

At F5 Financing, we understand the unique that every household faces. We excel in offering tailored consultations that cater to your specific circumstances. By taking the time to comprehend your needs, we ensure that you receive that align perfectly with your financial objectives. This but also fosters long-lasting relationships built on trust and understanding.

For , we know how challenging this journey can be. That’s why F5 provides through each phase of the financing process, ensuring you feel confident and informed. One satisfied client shared, “The group at F5 made my effortless! Their support and expertise were invaluable.” With a commitment to a , we utilize user-friendly technology and personalized guidance to simplify the process, often achieving .

Research shows that overall satisfaction is 41 points higher when lenders engage early with customers. This underscores the . As Bruce Gehrke from J.D. Power highlights, lenders who take an active advisory role earn significantly higher customer satisfaction scores. At F5, we are dedicated to providing that cater to the distinct financial situations of each household. We’re here to support you every step of the way.

In-Depth Local Market Knowledge Enhances Financing Options

At F5, we understand how challenging navigating the can be. Our deep comprehension of the environment empowers individuals with that are not only competitive but also tailored to their unique neighborhoods. This allows us to provide valuable insights into neighborhood trends, , and potential developments that could significantly influence your .

For families contemplating acquisitions in rapidly evolving areas, our knowledge of is invaluable. These developments are known to greatly enhance property values, and we’re here to support you every step of the way. With our , you can make that align with both current market conditions and future growth potential.

We know how important it is to feel confident in your choices. By leveraging our expertise, you can navigate this journey with assurance, knowing that you have the right support to make informed decisions for your family’s future.

Improved Communication and Support for First-Time Homebuyers

At F5 Mortgage, we understand that often experience anxiety and uncertainty when navigating the financing landscape. To help alleviate these concerns, we prioritize , allowing our customers to reach out with questions or issues at any time. This proactive approach not only clarifies the complexities of the but also empowers individuals to .

Moreover, we customize loans to meet personal objectives, ensuring that each person receives a that fits their unique requirements. Our commitment extends to providing a wealth of , including comprehensive homebuyer guides and frequently asked questions. These tools are designed to support first-time buyers in grasping their options and responsibilities.

By fostering a culture of openness and availability, we guarantee that our customers feel assured and knowledgeable throughout their . As one observed, “During one of the most significant of your life, you want to be knowledgeable and comforted at every stage.” We know how challenging this can be, and we’re here to .

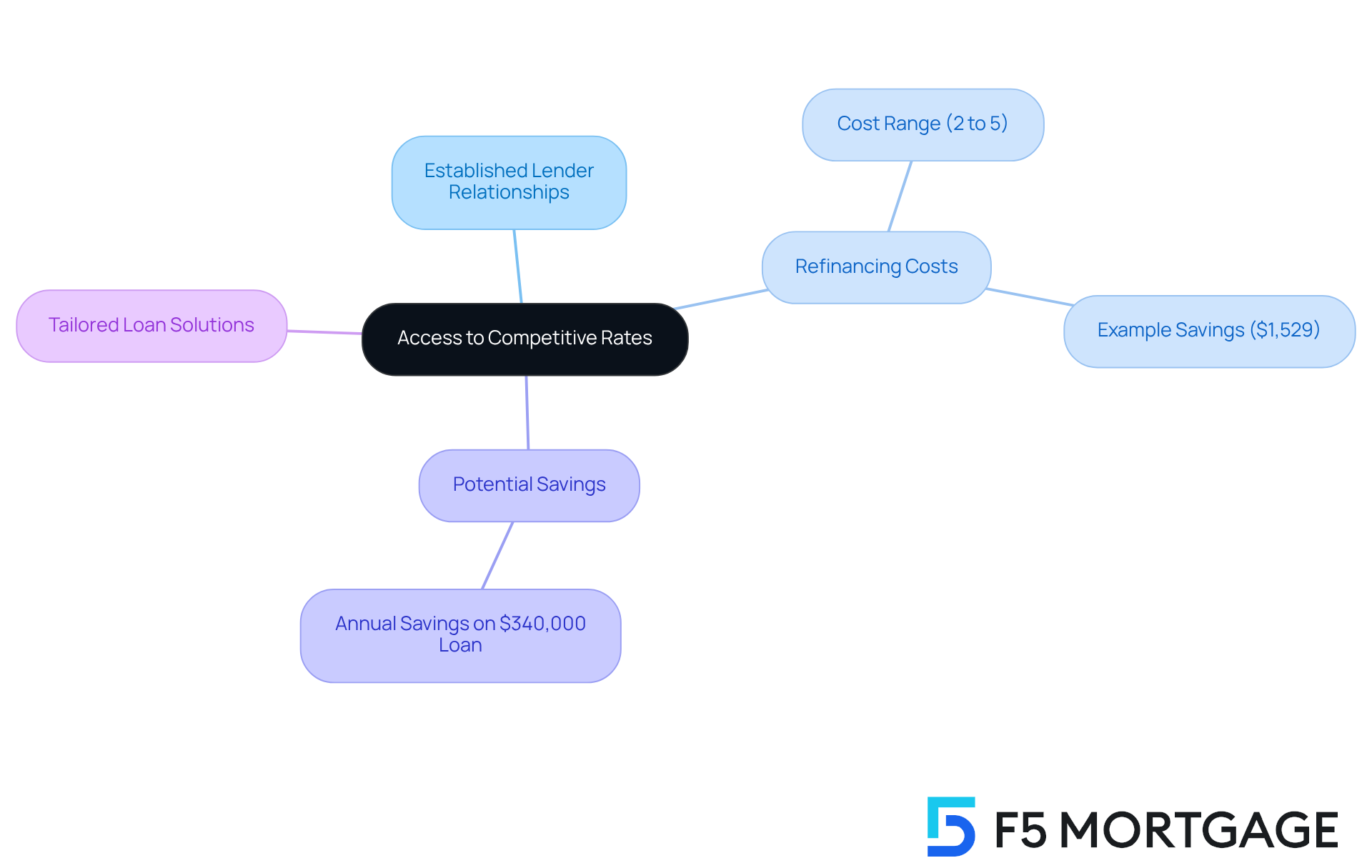

Access to Competitive Rates Through Established Lender Relationships

At F5, we understand how challenging it can be to . With established connections to over twenty leading lenders, we provide our clients access to that may be hard to find through conventional banks. This can be a game-changer for households looking to while keeping expenses in check.

typically comes with costs ranging from 2% to 5% of the overall loan amount, and we know that can be daunting. That’s why F5 is here to guide you through these expenses efficiently. For instance, refinancing a $340,000 loan with a 0.57% lower rate could save your household approximately $1,529 each year.

By comparing rates and terms from various providers, we can . Our goal is to ensure you receive the best possible offer while also considering available . We’re here to support you every step of the way, helping you achieve your .

Personalized Financial Solutions for Unique Client Situations

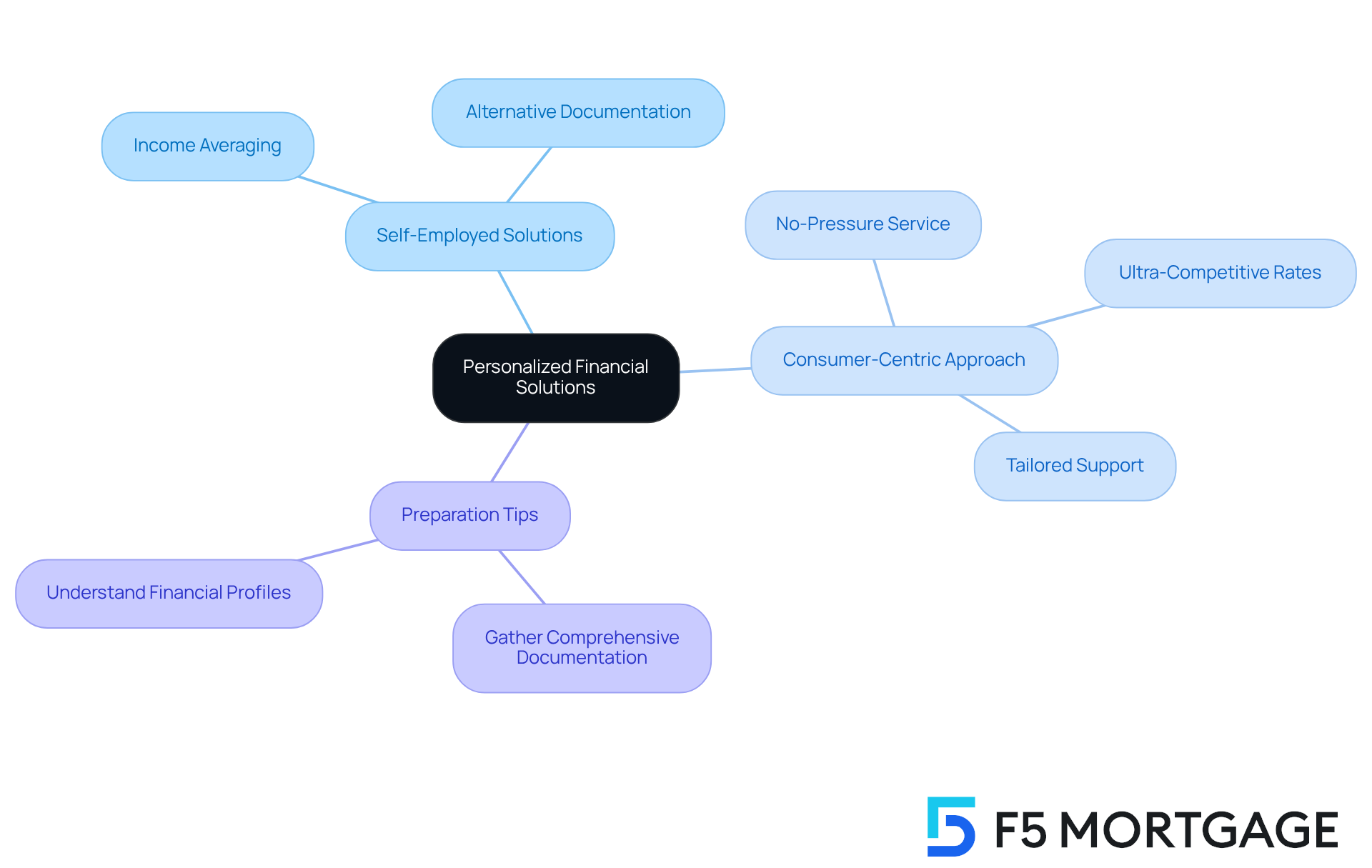

At F5 Mortgage, we understand that families have diverse financial backgrounds and needs that can be best addressed by . For self-employed individuals, we offer designed to accurately represent their , which can often be complex and variable. This customized approach ensures that are not hindered during the loan application process, allowing them to secure the funding they need without unnecessary barriers.

By leveraging industry-leading technology and providing a , . We ensure without the hassle of aggressive sales tactics. Our commitment to a consumer-centric approach addresses the unique challenges faced by or those seeking non-traditional loans, particularly with the help of local mortgage brokers. By focusing on , we simplify the mortgage journey and significantly enhance the likelihood of success for clients navigating the through local mortgage brokers.

F5 Financing also offers specific programs for self-employed individuals, such as income averaging and alternative documentation options. These services help ensure that their financial profiles are accurately represented. This level of customization, coupled with our personal, no-pressure service, assists families in obtaining the funding they require without unnecessary obstacles.

For self-employed borrowers, we recommend gathering comprehensive documentation of income sources and expenses before applying for a mortgage. This preparation can streamline the application process and improve your chances of approval. Remember, we’re here to support you every step of the way.

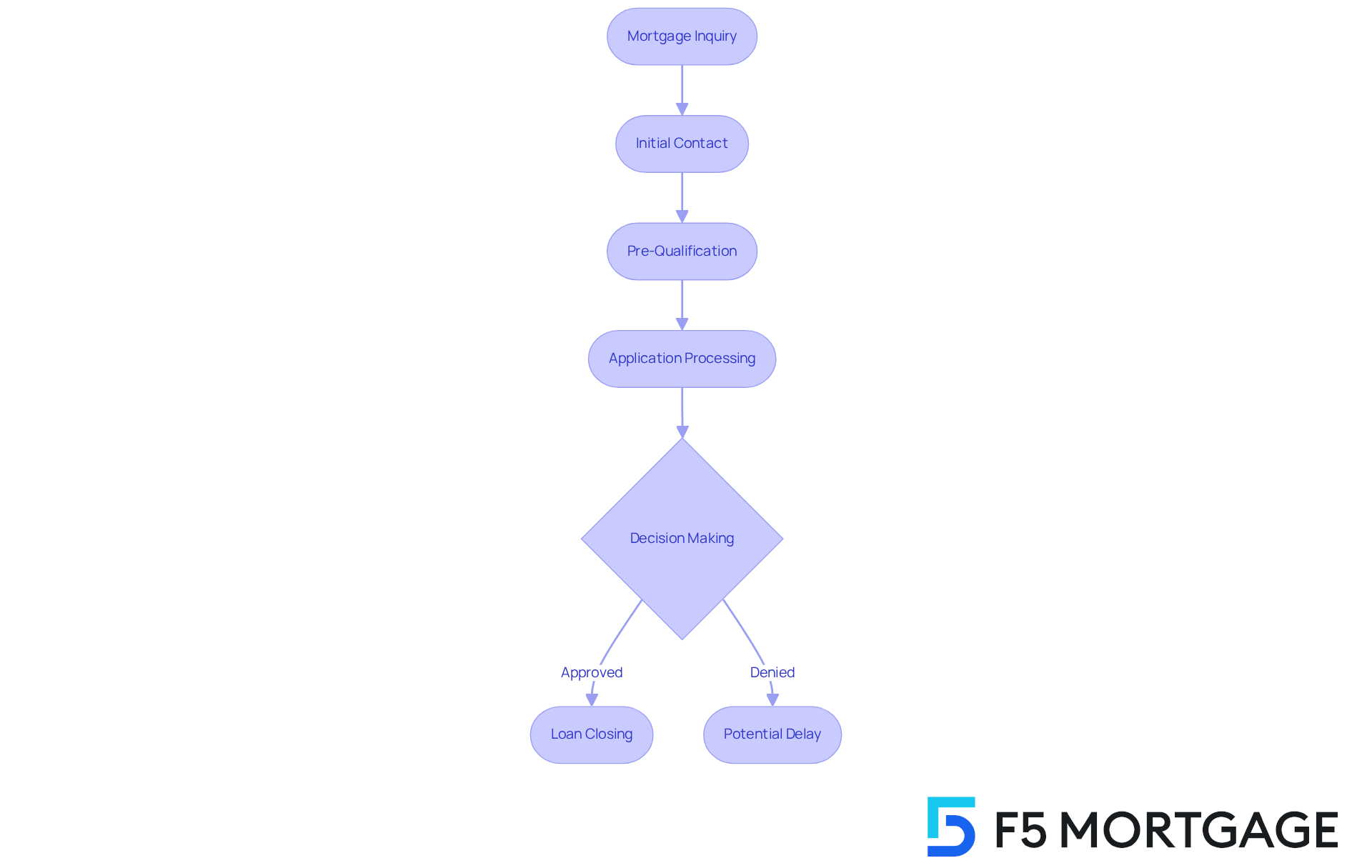

Faster Response Times and Decision-Making Processes

At , we understand how challenging the can be, which is why we stand out for our rapid and . Most loans are finalized in under three weeks, thanks to our dedicated team and effective decision-making focused on your satisfaction. In today’s competitive housing market, where the national median home price has reached a record peak, and fast-tracked application processing can make a significant difference for households.

We know how important it is to stay informed, so we utilize advanced technology and ensure clear communication at every stage. This way, you can capitalize on opportunities as they arise. Industry experts emphasize that being gives buyers a crucial edge, enabling them to make credible offers and avoid bidding wars. In fact, studies show that leads contacted within the first five minutes are five times more likely to convert. This highlights the importance of working with who prioritize , ensuring that families like yours receive the support they need.

We’re here to support you every step of the way, making the mortgage process as as possible. Remember, you deserve a partner who understands your needs and is committed to helping you achieve your .

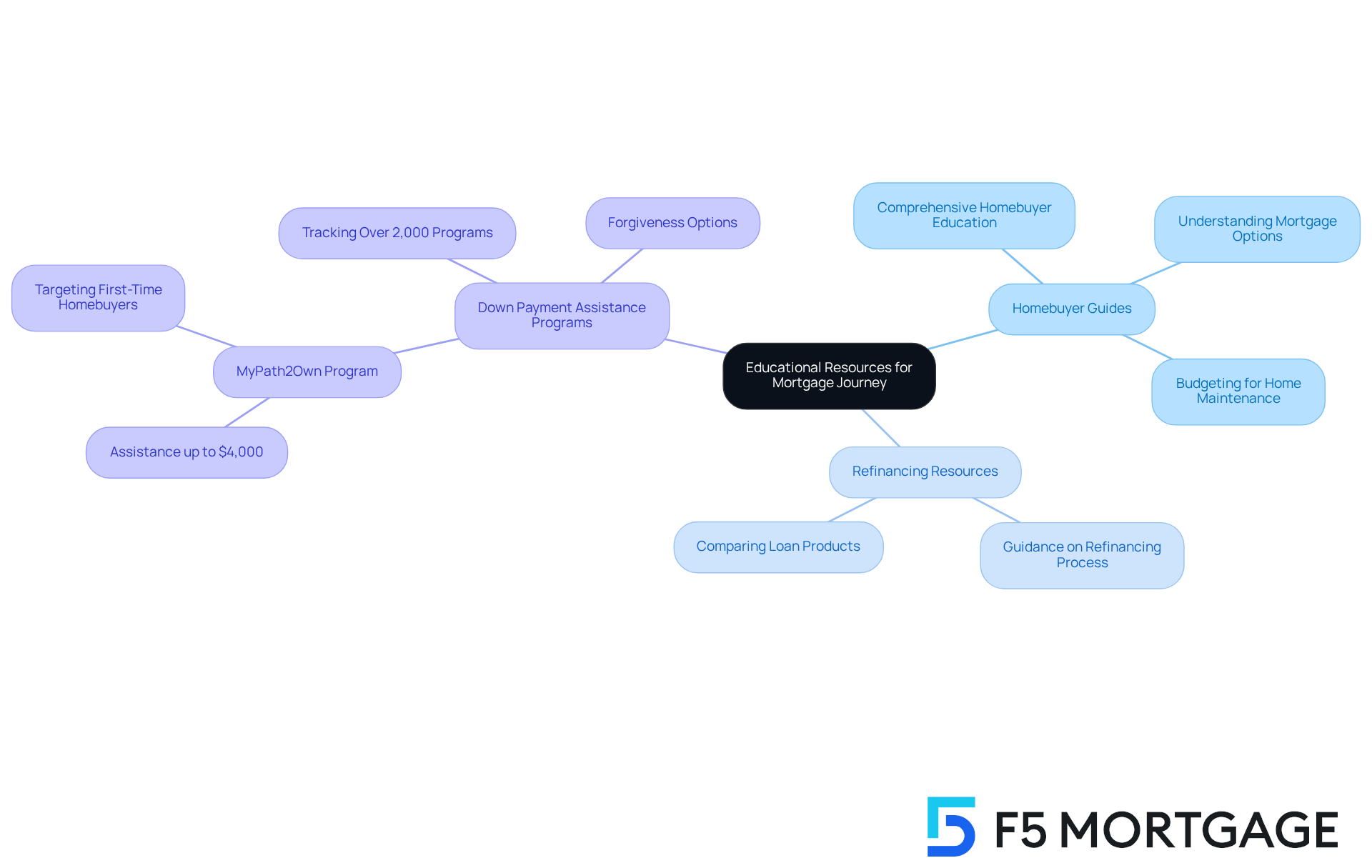

Educational Resources Empower Clients in Their Mortgage Journey

F5 goes beyond traditional brokerage services by providing a wealth of throughout your . With comprehensive , refinancing resources, and tailored , F5 Mortgage ensures you have the information you need to make informed decisions.

These resources are essential in clarifying the financing process, equipping families like yours with the knowledge to understand options, compare products, and choose the best financial path. For instance, have shown a remarkable improvement in participants’ readiness to seek their ideal homes, with many expressing increased confidence in navigating the complexities of financing.

Current trends highlight a growing awareness of the importance of . As industry experts note, are crucial for making sound mortgage decisions. Programs offering personalized guidance not only help you avoid common pitfalls but also empower you to use homeownership as a means of building long-term wealth. This commitment to education positions F5 as a trusted ally in achieving your , fostering a sense of confidence and readiness for families like yours.

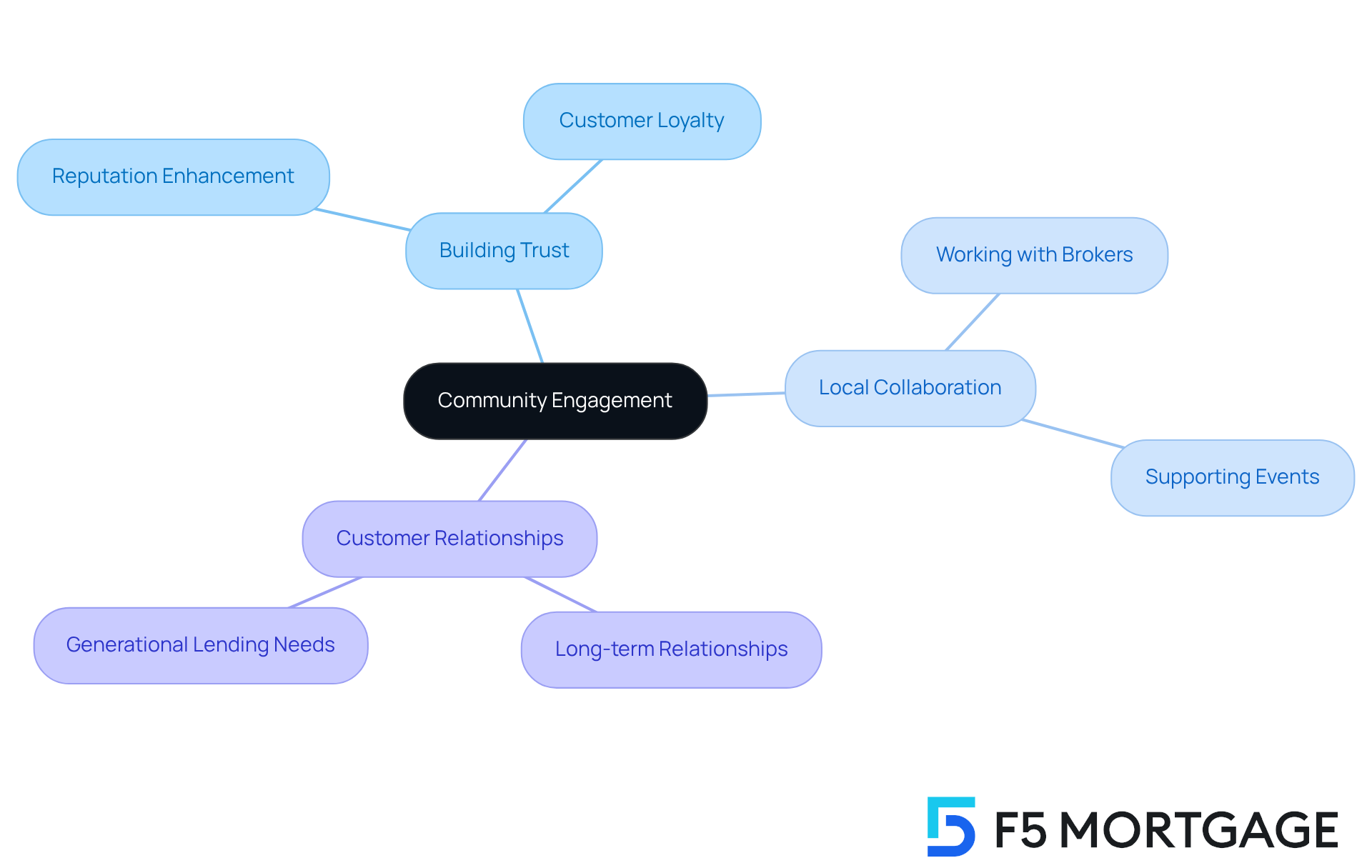

Building Trust and Loyalty Through Community Engagement

At , we truly understand how important community is to families. Our commitment to and supporting initiatives that resonate with residents reflects our dedication to your welfare. This sincere involvement not only enhances our reputation but also fosters trust and loyalty among our customers. We understand how challenging it can be to choose a lending institution, and families are more inclined to select that truly care about their community.

By building , F5 Mortgage collaborates with to position itself as a in the . We are here to support you every step of the way, reinforcing our dedication to your satisfaction and assistance. Research shows that financial professionals who collaborate with local mortgage brokers can significantly . This ultimately leads to lasting and positively impacts generational lending needs. Together, we can with confidence and care.

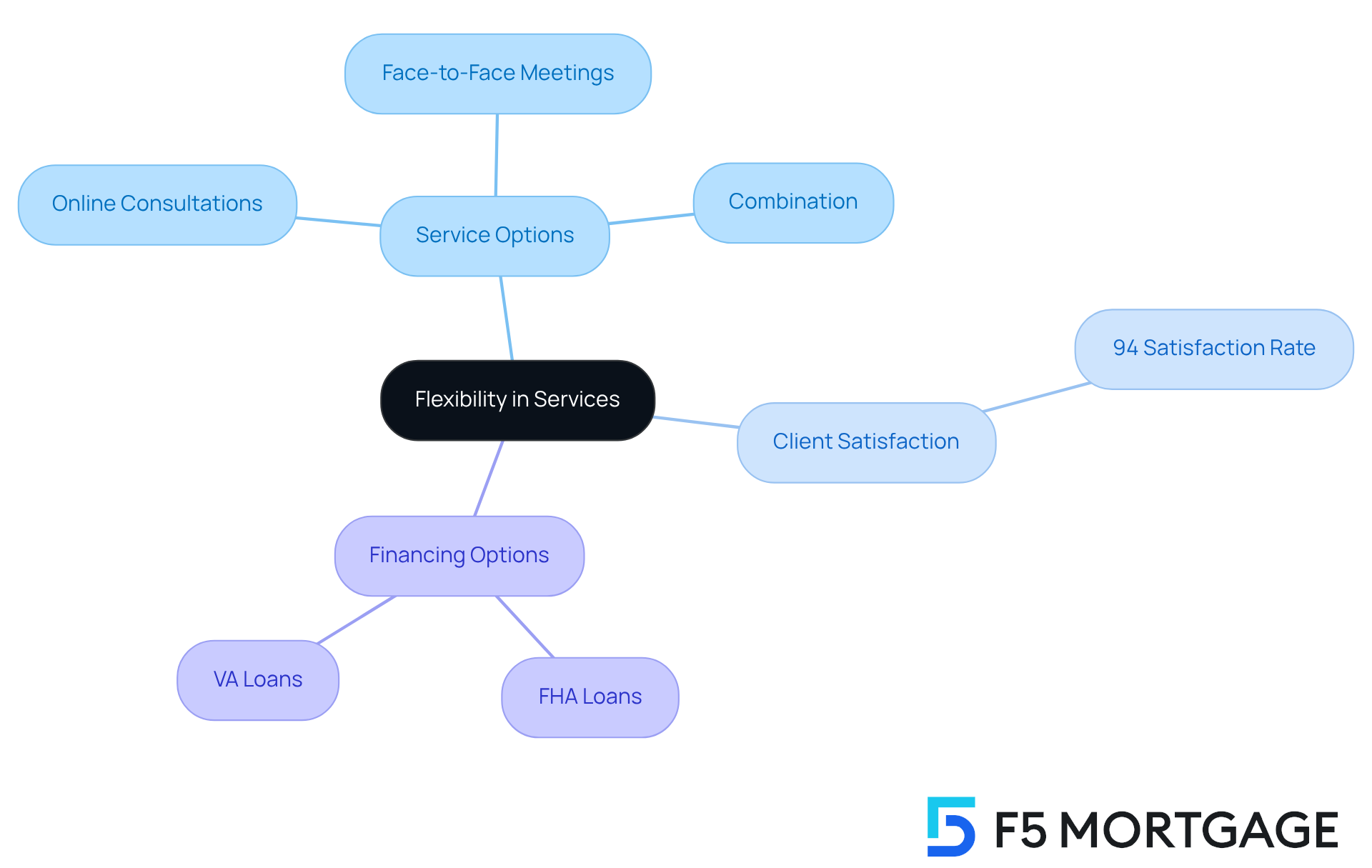

Flexibility in Services to Meet Client Preferences

F5 Home Loans was founded by Ryan McCallister, who recognized the need for a more . We understand how challenging navigating lending services can be, especially when every family has unique preferences and needs. That’s why F5 offers , whether you prefer online consultations, face-to-face meetings, or a combination of both. This flexibility not only enhances your overall experience but also fosters a sense of comfort and support throughout your financing journey.

By leveraging industry-leading technology, F5 provides without the pressure of aggressive sales tactics, which can often feel overwhelming. Our commitment to transparency and client empowerment reflects our dedication to meeting the diverse needs of our clients. With a of 94%, it’s clear that our approach resonates positively with families.

Moreover, F5 Home Loans offers a variety of , including . This further emphasizes our promise to deliver customized solutions tailored to each household’s distinct circumstances. We’re here to , ensuring that your is as smooth and reassuring as possible.

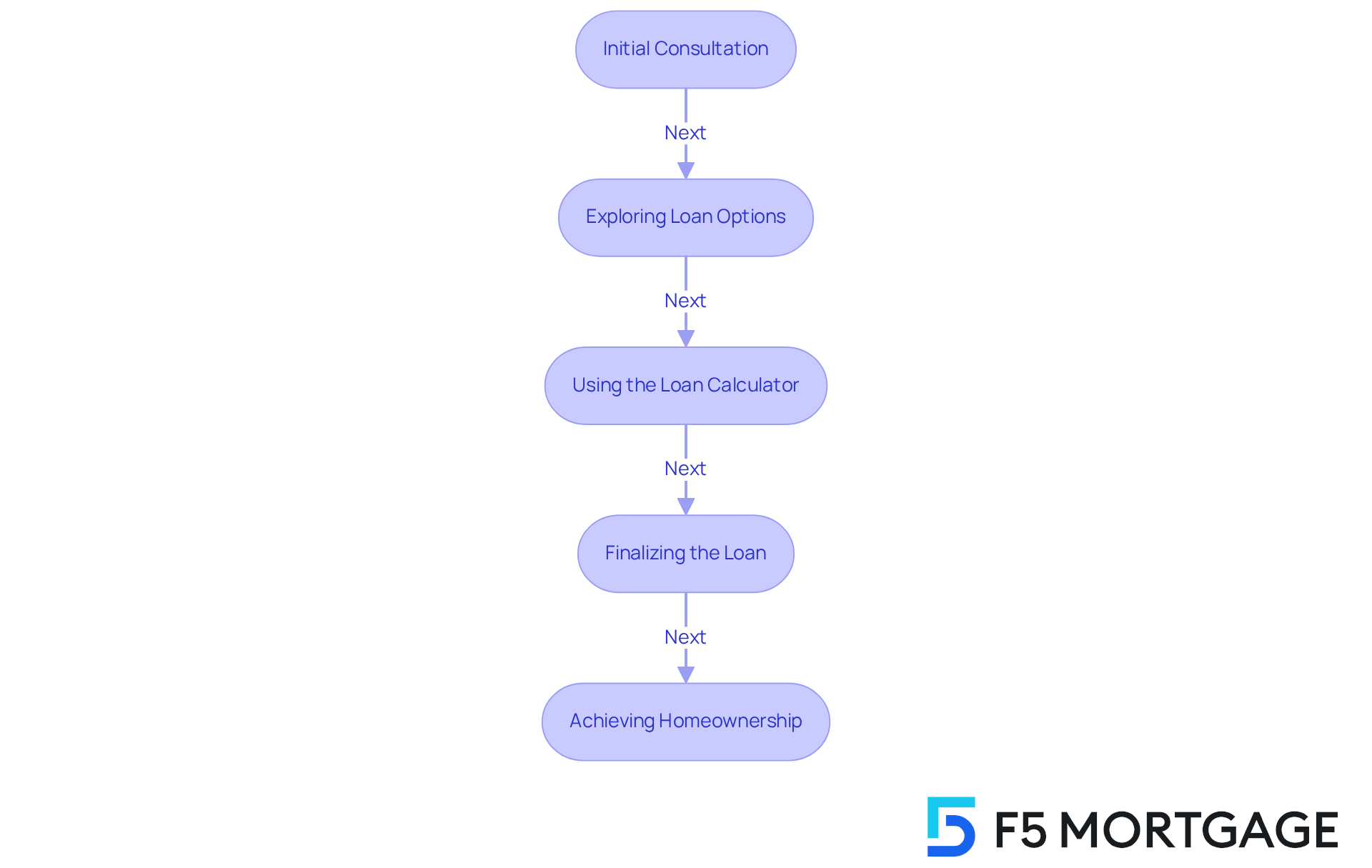

Simplified Mortgage Process with Hands-On Local Assistance

At F5 Mortgage, we understand how challenging the loan process can be for households, and we are dedicated to simplifying it by providing practical support from at every phase. From the first consultation to the finalization of the loan, you will benefit from that clarifies the intricacies of financing. This personalized approach not only reduces stress but also fosters confidence as you make .

By breaking down the into manageable steps and offering clear, concise explanations, F5 Mortgage empowers you to navigate your with ease. For example, our allow families to explore various loan options, ensuring you select the best fit for your unique financial situation. Additionally, our helps you grasp potential payments, further enhancing your decision-making process.

The importance of hands-on assistance cannot be overstated; it transforms what can often be an overwhelming experience into a straightforward and supportive journey. As one mortgage professional noted, ‘Having local mortgage brokers by your side can make all the difference in achieving your .’ This commitment to positions F5 Mortgage as a trusted partner for families seeking to secure their dream homes. We’re here to .

Conclusion

At F5 Mortgage, we understand how overwhelming the process of home financing can be for families. Local mortgage brokers play a crucial role in guiding you through this journey, offering personalized services and in-depth market knowledge. Our commitment to clear communication ensures that you receive tailored solutions that align with your unique financial situation and aspirations. This caring approach not only enhances your satisfaction but also builds trust and loyalty, making your journey to homeownership more manageable and enjoyable.

Key insights from our discussion highlight the importance of local expertise in navigating the mortgage landscape. Families benefit from competitive rates through established lender relationships, while first-time homebuyers receive the necessary support and educational resources to empower their decisions. Additionally, the flexibility in service options and our commitment to community engagement further reinforce the value of working with local mortgage brokers, who prioritize your needs and preferences.

In conclusion, partnering with a local mortgage broker like F5 is not just about securing a loan; it’s about building a supportive relationship that guides you toward your homeownership dreams. As the landscape of mortgage financing continues to evolve, we encourage you to leverage the expertise of local brokers to navigate this journey with confidence and clarity. Remember, the right support can make all the difference, transforming what may seem like a daunting process into an empowering experience.

Frequently Asked Questions

What services does F5 Financing offer?

F5 Financing provides tailored consultations that cater to individual financial circumstances, ensuring clients receive financing solutions aligned with their financial objectives.

How does F5 support first-time homebuyers?

F5 offers dedicated advisors who guide first-time homebuyers through each phase of the financing process, providing support and expertise to ensure they feel confident and informed.

What is the typical timeline for closing a loan with F5?

F5 often achieves quick closings in under three weeks, simplifying the loan process with user-friendly technology and personalized guidance.

Why is early engagement important in the financing process?

Research indicates that overall satisfaction is significantly higher when lenders engage early with customers, leading to better customer satisfaction scores for proactive lenders.

How does F5 leverage local market knowledge?

F5 utilizes its deep understanding of the local real estate market to provide competitive financing options tailored to specific neighborhoods, including insights into property values and neighborhood trends.

What resources does F5 provide for first-time homebuyers?

F5 offers a wealth of educational resources, including comprehensive homebuyer guides and FAQs, to help first-time buyers understand their options and responsibilities.

How does F5 ensure effective communication with customers?

F5 prioritizes open communication, allowing customers to reach out with questions or issues at any time, which helps clarify the complexities of the mortgage process and empowers informed decision-making.

What is the overall goal of F5 Financing in its services?

F5 Financing aims to provide personalized loan solutions that cater to the unique financial situations of each household, fostering long-lasting relationships built on trust and understanding.