Overview

We understand how challenging managing a mortgage can be, and we want to help you navigate this journey with confidence. This article outlines four effective strategies for mortgage payoff solutions that can truly make a difference for your financial future. These strategies include:

- Making bi-weekly payments

- Contributing extra funds towards the principal

- Rounding up monthly payments

- Making an annual extra contribution

Research shows that these approaches can significantly reduce both the duration of your loan and the interest costs associated with it. Imagine the financial flexibility you could achieve as a homeowner by implementing these strategies! By taking these steps, you can empower yourself to take control of your mortgage and ultimately find peace of mind.

We’re here to support you every step of the way as you consider these options. Each strategy offers a unique opportunity to enhance your financial well-being, and we encourage you to explore which ones resonate with your situation. Remember, every little bit helps, and your journey towards mortgage freedom starts with informed choices.

Introduction

Navigating the complexities of mortgage repayment can often feel overwhelming for homeowners. We understand how challenging this can be. However, employing effective strategies can lead to significant savings and greater financial freedom. In this article, we explore four powerful methods that not only expedite mortgage payoff but also empower you to make informed decisions about your financial future.

With so many options available, how can you determine the best approach to achieve a swift and cost-effective mortgage payoff? We’re here to support you every step of the way.

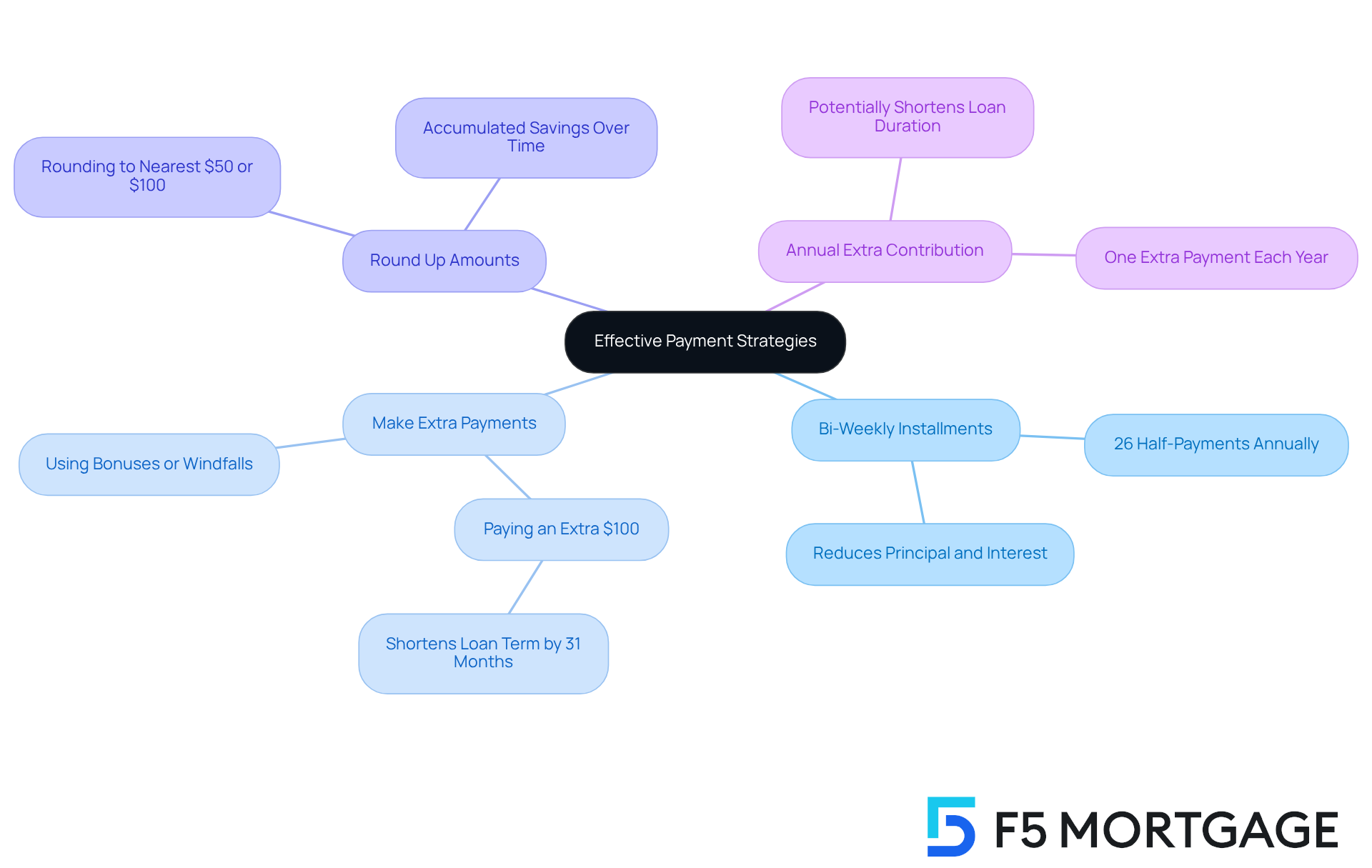

Implement Effective Payment Strategies

To effectively pay off your mortgage, we know how challenging this can be, so consider adopting the following strategies:

- : By switching to bi-weekly installments, you can make 26 half-payments each year. This leads to 13 full contributions instead of the usual 12. This additional sum can significantly decrease both your principal balance and the interest accumulated over time.

- Make Extra Payments: Whenever possible, direct additional funds towards the principal. Using bonuses, tax refunds, or unexpected windfalls for these extra contributions can lead to substantial interest savings. For example, paying an extra $100 per month on a $350,000 mortgage at a 6% interest rate can shorten your loan term by 31 months. You can and build equity more quickly by making these contributions, as shown in the case study titled ‘.’

- Round Up Amounts: If your monthly payment isn’t a round figure, consider rounding it up to the nearest $50 or $100. This small adjustment can accumulate over time, helping to reduce your principal balance more swiftly.

- Annual Extra Contribution: Making one each year can significantly reduce your loan duration and save you thousands in interest. For instance, an additional contribution of $1,000 each year could shorten a 30-year loan term by several years, highlighting the long-term benefits of this approach.

Furthermore, we’re here to support you every step of the way, so it’s recommended to consult a realtor for information on , especially if you’re considering refinancing or making extra contributions. Be sure to check your loan terms to ensure that won’t incur penalties.

By applying these strategies, homeowners can make considerable progress toward their more quickly, thereby achieving enhanced financial flexibility.

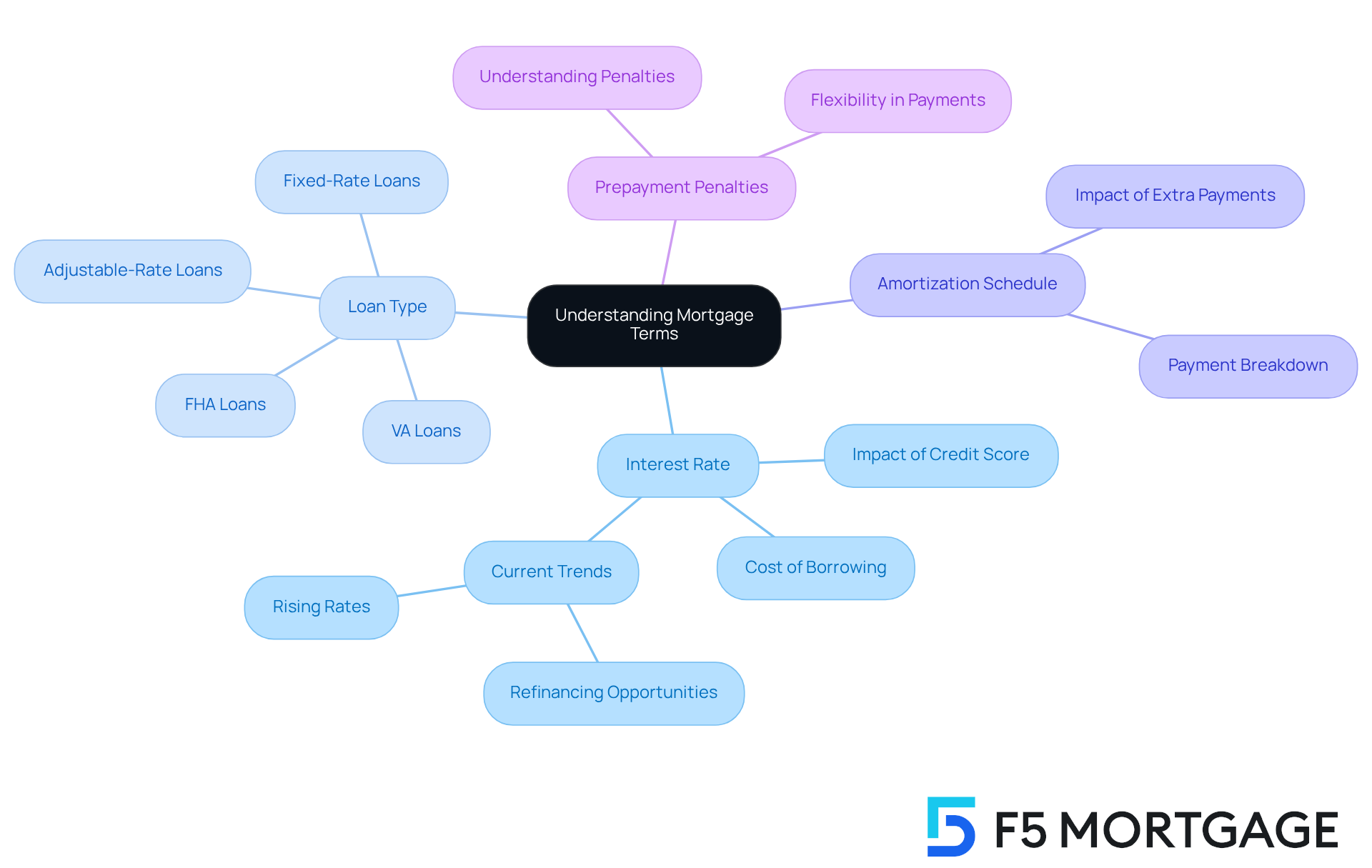

Understand Your Mortgage Terms

Managing your can feel overwhelming, but can make a significant difference. Here’s what you need to know:

- Interest Rate: This is the cost of borrowing money, expressed as a percentage. A lower interest rate can lead to substantial savings over the life of your loan. Currently, , making it crucial for borrowers to secure the best terms possible. With recent drops in in Colorado, now might be an excellent time to consider . If you have a strong credit score, you could benefit from lower rates, saving you thousands in interest costs.

- Loan Type: It’s important to , such as fixed-rate, adjustable-rate, . Each type comes with its own set of advantages and disadvantages tailored to various financial situations. For example, families opting for FHA financing might enjoy , while VA loans offer favorable terms for qualified veterans. Understanding how these loan types affect interest rates can empower families to make informed decisions, especially when thinking about refinancing into a .

- Amortization Schedule: This schedule details each payment throughout the loan, showing how much goes toward interest versus principal reduction. Knowing this can help you assess the impact of making extra payments, which could lead to a faster mortgage payoff and reduce total interest costs. For instance, contributing additional funds can lead to significant savings over time, particularly if you refinance to a lower rate.

- Prepayment Penalties: Some loans may include penalties for early repayment. Understanding this aspect is vital, as it can greatly affect your payment strategy and overall financial planning. Avoiding loans with prepayment penalties can give you more flexibility in managing your finances, enabling a mortgage payoff without incurring extra costs.

By grasping these , families can make informed choices that align with their financial goals and enhance their mortgage management. We know how challenging this can be, and we’re here to support you every step of the way.

Consult Mortgage Professionals for Tailored Advice

Interacting with lending specialists can provide invaluable insights, especially when considering the . Here’s how to make the most of these consultations:

- Prepare Questions: Before meeting with a loan broker or lender, take a moment to compile a list of inquiries about your financing options, interest terms, and potential fees. We know how overwhelming this can be, so aim to ask at least 10-15 questions during these .

- Discuss Financial Goals: Clearly articulate your . Whether you aim for a mortgage payoff or to , a professional can tailor their advice to align with your objectives. As Mr. A, a Partner at a prominent law firm in Hong Kong, shared, ” can greatly influence your financial journey.” At , we’re here to support you through the process, ensuring you choose what feels right for you.

- Explore Multiple Options: Don’t hesitate to . Different brokers may offer unique insights and loan options, allowing you to compare and select the best fit for your needs. For instance, a couple from the UK recently pursued financing to buy and improve a new residence, investing approximately £800,000 in enhancements. They found that consulting various brokers helped them obtain a customized financing solution that suited their specific financial circumstances. F5 Mortgage also provides extensive , enhancing your home purchasing options.

- Stay Informed: Keep abreast of market trends and changes in loan rates. A knowledgeable broker can provide updates and advice on the best times to refinance or adjust your payment strategy. Staying informed empowers you to make timely decisions that align with your financial goals. Our clients have expressed their satisfaction with our services, highlighting the smooth process and .

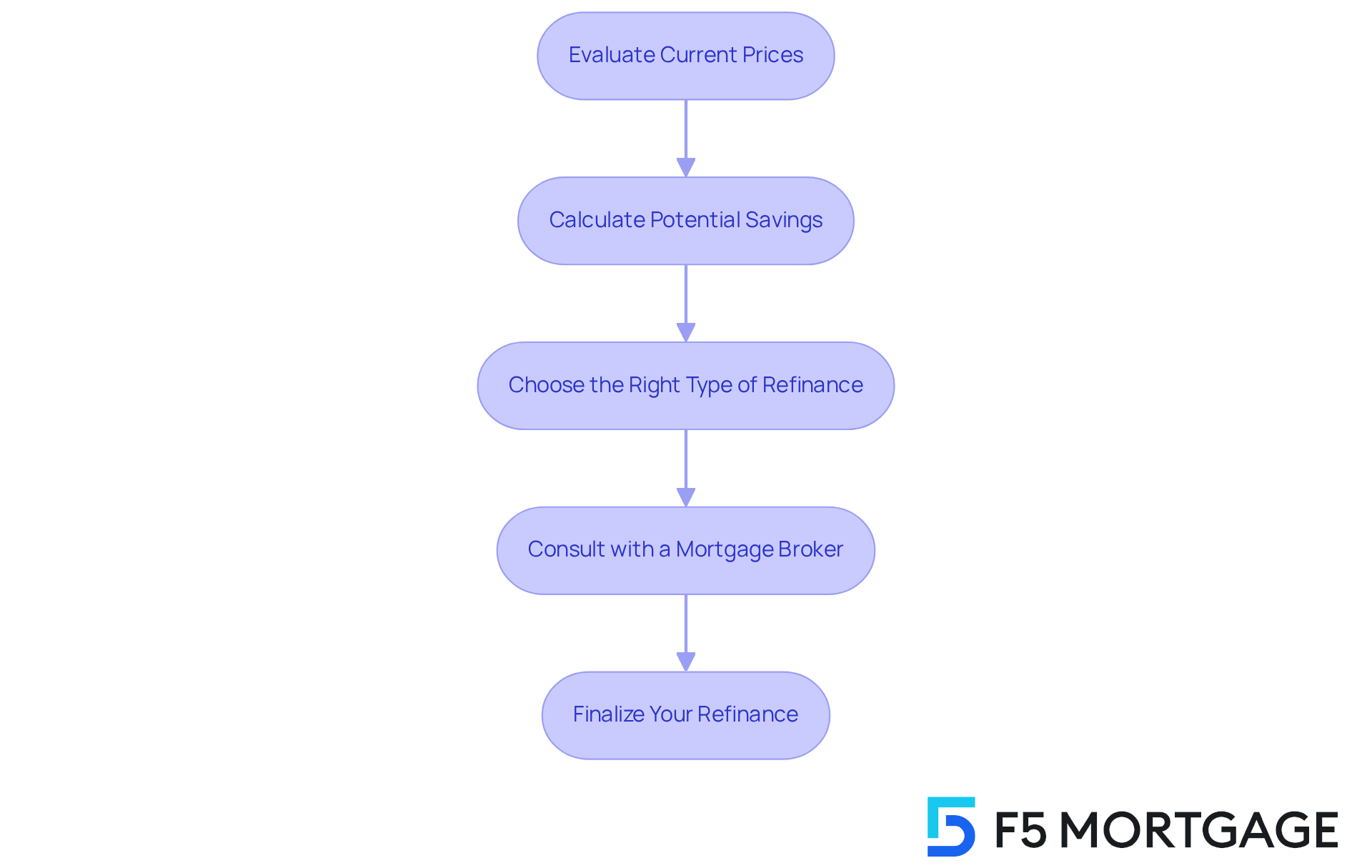

Explore Refinancing Options for Better Rates

can be a strategic move to achieve a better mortgage payoff. We know how challenging this can be, so here are :

- Evaluate Current Prices: Keep updated on present loan costs. With the national average for a currently at 6.744%, homeowners should assess if rates have fallen since their original loan was obtained. This could lead to considerable savings.

- Calculate Potential Savings: Utilize a to estimate potential savings from refinancing. Remember to consider , which usually vary from 2% to 5% of the mortgage amount in Colorado. For instance, refinancing a $500,000 home could incur up to $25,000 in closing costs. However, with , not all homeowners will face such high expenses. This will help you determine if refinancing is financially beneficial.

- Choose the Right Type of Refinance: Explore various , FHA options, VA offerings, and streamline refinancing. Each option caters to different financial objectives, so select one that aligns with your specific needs. For example, are more accessible for those with lower credit scores, while VA loans offer favorable terms for military members.

- : Engaging a mortgage broker can simplify the refinancing journey. They can assist in comparing offers from multiple lenders, ensuring you find the most advantageous deal tailored to your financial situation. F5 Mortgage collaborates with leading lenders to help you compare costs and shop for the most budget-friendly refinance choices. Specialists advise taking initiative and acting swiftly in the current interest environment to take advantage of beneficial refinancing options. As Melissa Cohn, regional vice president of William Raveis Mortgage, advises, “Before you refinance, you want to make sure for you to see real savings.”

By following these steps, homeowners can effectively navigate the refinancing process and potentially unlock substantial savings. We’re here to support you every step of the way.

Conclusion

Adopting effective strategies for mortgage payoff can significantly enhance your financial stability and freedom. We know how challenging this can be, but by implementing methods such as:

- Bi-weekly payments

- Making extra contributions

- Rounding up payments

- Considering annual extra payments

you can accelerate your journey toward full mortgage repayment. These approaches not only reduce your principal balance but also lead to substantial savings in interest over time.

In this article, we outlined several key strategies that can help you feel more in control of your mortgage. Understanding your mortgage terms, consulting professionals for tailored advice, and exploring refinancing options are crucial steps. By familiarizing yourself with interest rates, loan types, and amortization schedules, you can make informed decisions that align with your financial goals. Engaging with mortgage professionals ensures that you receive personalized guidance, enabling you to navigate the complexities of refinancing and payment strategies effectively.

Ultimately, taking proactive steps in managing your mortgage payments is essential for achieving long-term financial goals. Whether through refinancing for better rates or simply adjusting payment strategies, you can unlock significant savings and enjoy increased financial flexibility. It’s imperative to stay informed and utilize available resources to create a sustainable mortgage payoff plan that paves the way for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are some effective payment strategies to pay off a mortgage?

Effective payment strategies include making bi-weekly installments, making extra payments, rounding up monthly payments, and making an annual extra contribution.

How does switching to bi-weekly installments help with mortgage payments?

By switching to bi-weekly installments, you make 26 half-payments each year, resulting in 13 full contributions instead of the usual 12. This can significantly decrease both your principal balance and the interest accumulated over time.

What are the benefits of making extra payments towards the mortgage principal?

Making extra payments can lead to substantial interest savings and help shorten the loan term. For example, paying an extra $100 per month on a $350,000 mortgage at a 6% interest rate can shorten the loan term by 31 months and save you thousands in interest.

How can rounding up monthly payments impact mortgage payoff?

Rounding up your monthly payment to the nearest $50 or $100 can accumulate over time and help reduce your principal balance more quickly.

What is the advantage of making an annual extra contribution to the mortgage?

Making one extra loan installment each year can significantly reduce your loan duration and save you thousands in interest. For instance, an additional contribution of $1,000 each year could shorten a 30-year loan term by several years.

Why is it important to consult a realtor when considering mortgage payment strategies?

Consulting a realtor can provide information on current market trends, which is especially important if you’re considering refinancing or making extra contributions to your mortgage.

What should homeowners check regarding their loan terms before making extra payments?

Homeowners should check their loan terms to ensure that making extra payments won’t incur penalties.