Overview

Navigating financial challenges can be daunting, and we understand how overwhelming it may feel. The article outlines four essential steps for using a home equity loan for debt consolidation, emphasizing the importance of:

- Understanding home equity

- Qualifying for the loan

- Applying effectively

- Utilizing the funds wisely

First, it’s crucial to recognize the benefits of lower interest rates compared to unsecured debt. These advantages can significantly ease your financial burden. Next, we dive into the necessary qualifications for approval, ensuring you know what to expect.

The application process is structured to guide you smoothly, so you feel confident every step of the way. Finally, we discuss a strategic approach to managing and repaying consolidated debt, all aimed at enhancing your financial stability. Remember, we’re here to support you every step of the way as you embark on this journey towards a more secure financial future.

Introduction

Navigating the complexities of debt management can be overwhelming for homeowners, especially with rising interest rates on credit cards and personal loans making financial stability feel out of reach. We understand how challenging this can be.

A home equity loan might offer a strategic opportunity to consolidate debt, presenting lower interest rates and a more manageable payment structure. However, it’s essential to consider how homeowners can qualify for such loans and what steps they should take to maximize their benefits while minimizing risks.

This guide will explore essential strategies for leveraging home equity loans for debt consolidation, providing clarity and actionable insights for those seeking a fresh start in their financial journey. We’re here to support you every step of the way.

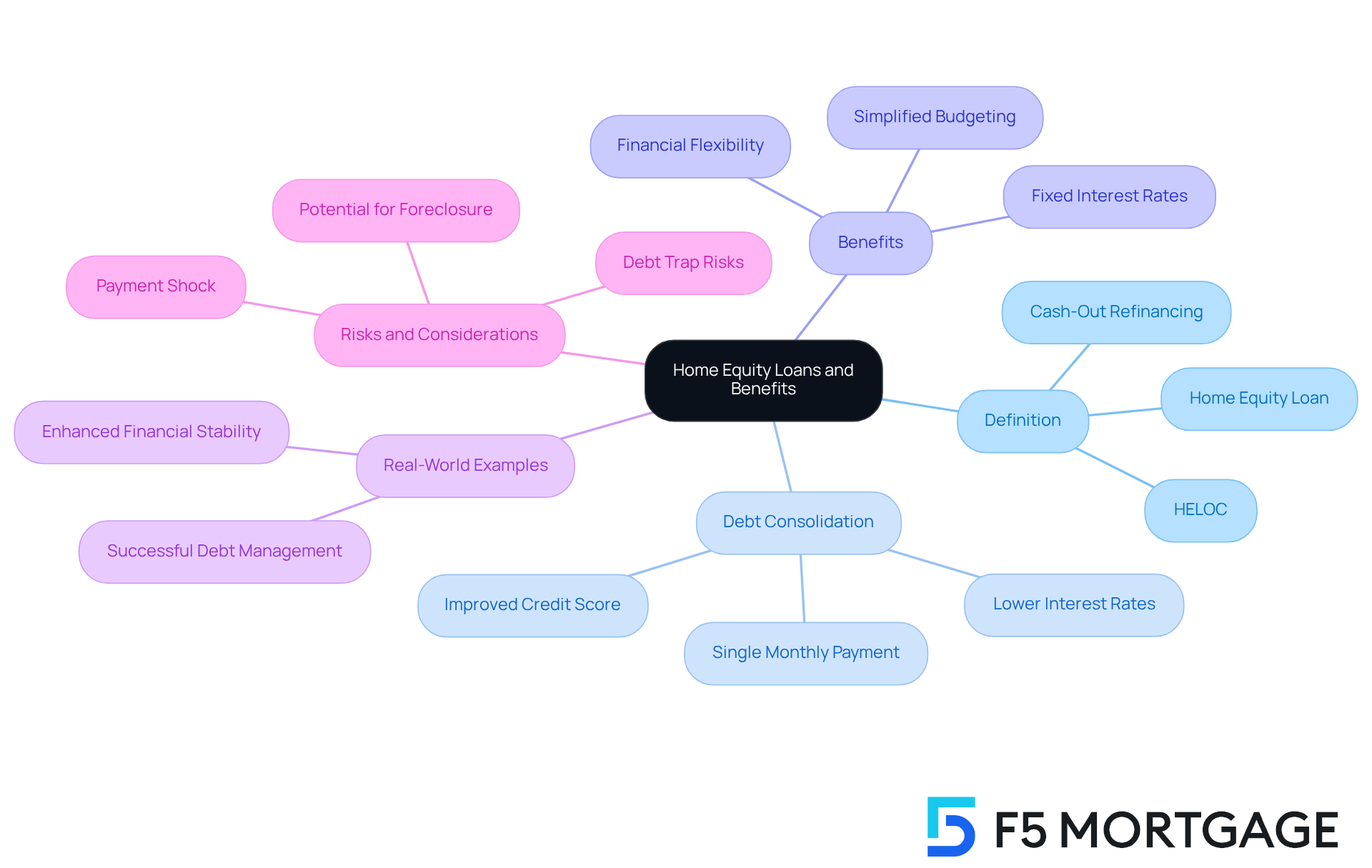

Understand Home Equity Loans and Their Benefits

A property-backed financing option can be a valuable resource for homeowners looking to utilize the equity in their homes. This equity is defined as the difference between the property’s current market value and the remaining mortgage balance. A home equity loan for debt consolidation typically offers lower interest rates compared to unsecured options, making it an appealing choice for those seeking to consolidate debt. With around 8.59%, the contrast with the nearly 22% average for credit cards is striking, allowing borrowers to save significantly over time.

In California, homeowners can also consider cash-out refinancing as a way to access their property value. This process involves refinancing an existing mortgage for a higher amount than what is currently owed, enabling homeowners to receive the difference in cash. This can be particularly beneficial when the new interest rate is lower than the borrower’s existing mortgage rate, providing an additional avenue for consolidation.

The benefits of residential financing are numerous, including fixed interest rates and consistent monthly payments, which simplify budgeting. Homeowners can streamline their finances and potentially reduce their overall interest expenses by using a home equity loan for debt consolidation to combine high-interest obligations, such as credit card balances or personal loans, into a single manageable payment. For instance, using a home equity loan for debt consolidation to merge several credit card debts can lead to significant savings, as borrowers can pay off high-interest liabilities at a lower rate.

Real-world examples highlight the effectiveness of this strategy. Property owners who have utilized a home equity loan for debt consolidation often report enhanced financial stability and a clearer path to achieving their financial goals. Financial consultants emphasize that, when approached thoughtfully, property financing can serve as a strategic tool for simplifying payments and reducing interest costs. As one expert noted, merging debt with a residential financial product can greatly enhance financial management, provided borrowers maintain discipline in their repayment strategies. For families looking to improve their living spaces, these options can offer essential financial flexibility to manage expenses effectively.

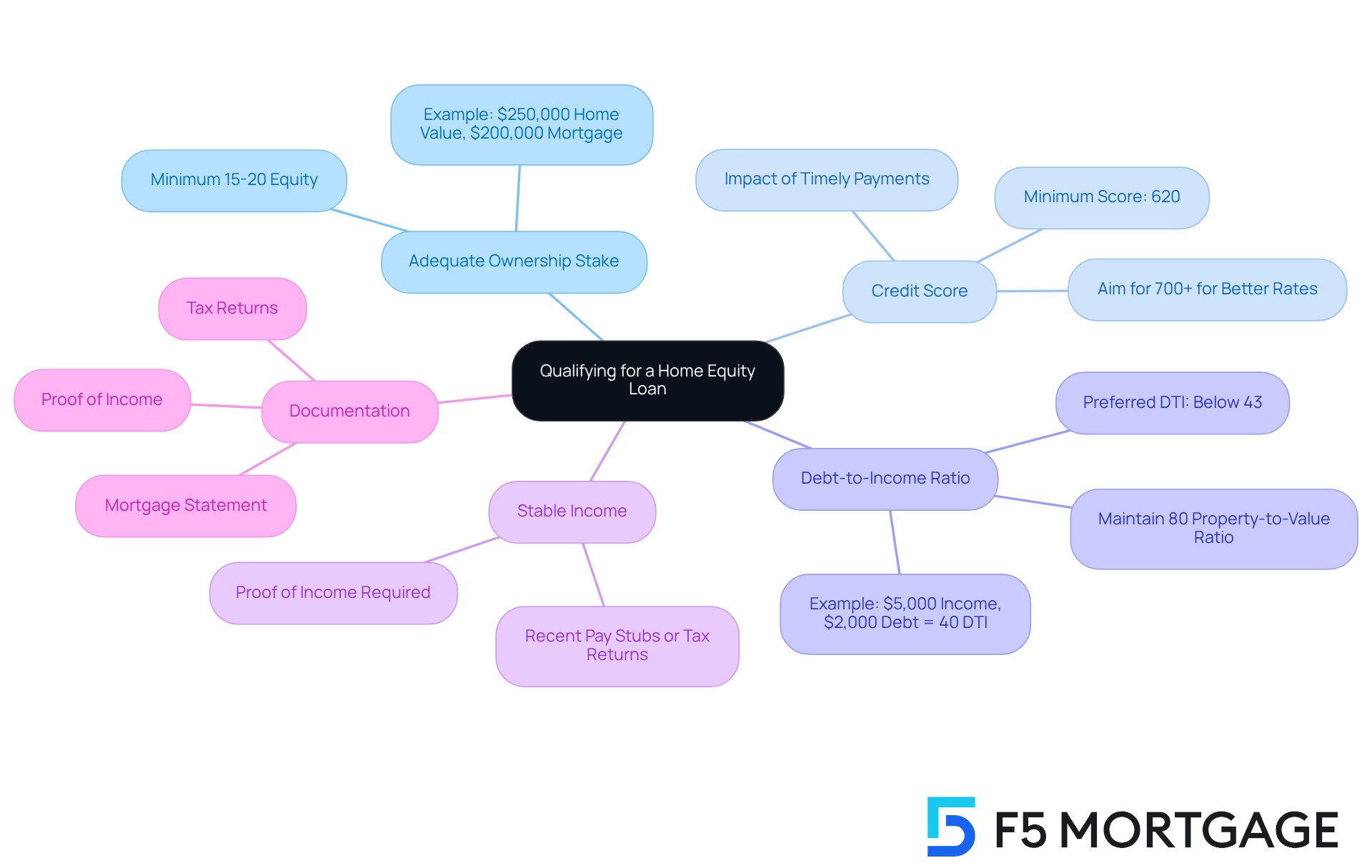

Qualify for a Home Equity Loan

Qualifying for a home equity loan can feel overwhelming, but understanding the key criteria can help you navigate this process with confidence. Here are some essential factors that lenders typically assess:

- Adequate Ownership Stake: Most lenders require homeowners to have at least a 15-20% stake in their property. This means that the market value of your home should exceed your mortgage balance by this percentage. For example, if your residence is valued at $250,000 and your mortgage balance is $200,000, you possess 20% equity, which qualifies you for a home equity line.

- Credit Score: A strong credit score is vital for securing favorable financing terms. Generally, a score of 620 or higher is necessary, but aiming for a score of 700 or above can significantly improve your chances of approval and lower your interest rates. Remember, maintaining a good credit history through timely payments can positively impact your score.

- Debt-to-Income Ratio: Lenders typically prefer a debt-to-income (DTI) ratio below 43%. This ratio assesses your , including the new borrowing, against your gross monthly income. For instance, if your monthly income is $5,000 and your total monthly debts are $2,000, your DTI would be 40%, which is within the acceptable range. Additionally, many creditors require property owners to maintain at least an 80% property-to-value borrowing ratio, meaning they have reduced at least 20% of their initial borrowing amount or their property has appreciated in value.

- Stable Income: Demonstrating a reliable income stream is essential. Lenders will ask for proof of income, such as recent pay stubs or tax returns, to ensure you can manage the repayments. A steady income reassures lenders of your repayment capability.

- Documentation: Be prepared to submit various documents, including your mortgage statement, tax returns, and proof of income. Organizing these documents can streamline the application process and enhance your chances of approval.

By understanding these standards and taking steps to improve your credit score and financial profile, you can increase your eligibility for a home equity loan for debt consolidation. This can be a viable choice for a home equity loan for debt consolidation or other financial needs. We know how challenging this can be, but we’re here to support you every step of the way.

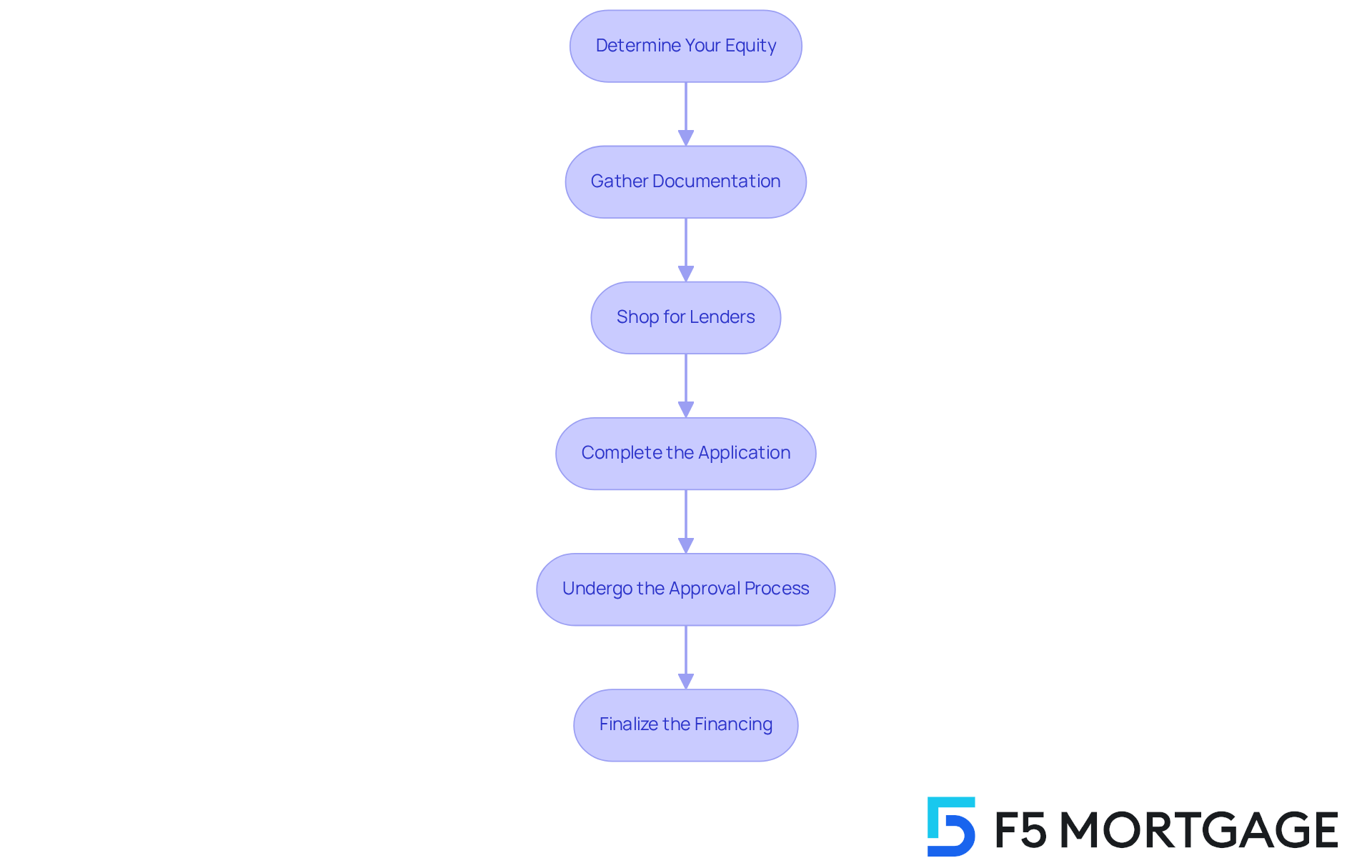

Apply for a Home Equity Loan

Applying for a home equity loan can feel overwhelming, but we’re here to support you every step of the way. By following these key steps, you can ensure a smoother process:

- Determine Your Equity: Start by calculating your property equity. You can do this through a professional appraisal or an online calculator. This figure represents the difference between your property’s current market value and the outstanding balance on your mortgage. We know how challenging this can be, and many creditors, like F5 Mortgage, typically require to maintain a minimum 80% property-to-value ratio. This means you should have reduced at least 20% of your initial borrowing amount or your property has increased in value.

- Gather Documentation: Collect essential application documents, such as proof of income, recent tax returns, and your current mortgage statement. Having these documents ready can expedite the application process and improve your debt-to-income (DTI) ratio, ideally below 43% for competitive mortgage rates.

- Shop for Lenders: Research various lenders to compare interest rates, terms, and fees. Engaging a mortgage broker can provide personalized assistance, helping you navigate the options available. At F5 Mortgage, we leverage user-friendly technology to simplify this process, guiding you without pressure to choose what feels right for you.

- Complete the Application: Fill out the application form accurately, providing detailed information about your financial situation and property. This step is crucial, as lenders rely on this information to assess your eligibility. A well-prepared application can lead to faster approvals, often closing in under three weeks.

- Undergo the Approval Process: After submitting your application, the lender will review your financial information and may require a property appraisal. This process can take anywhere from several days to a few weeks, so be prepared for potential delays. Remember, patience is key during this time.

- Finalize the Financing: Once approved, you will enter the closing phase, where you will sign the financing documents and receive your funds. Typically, finalizing property financing takes about three weeks, making it crucial to remain organized and attentive throughout the procedure.

Successful property financing requests often arise from meticulous preparation and transparent communication with lenders. For instance, applicants who provide comprehensive documentation and maintain a good credit score typically experience smoother approvals. By adhering to these steps, you can effectively utilize your property value through a home equity loan for debt consolidation and reach your financial objectives.

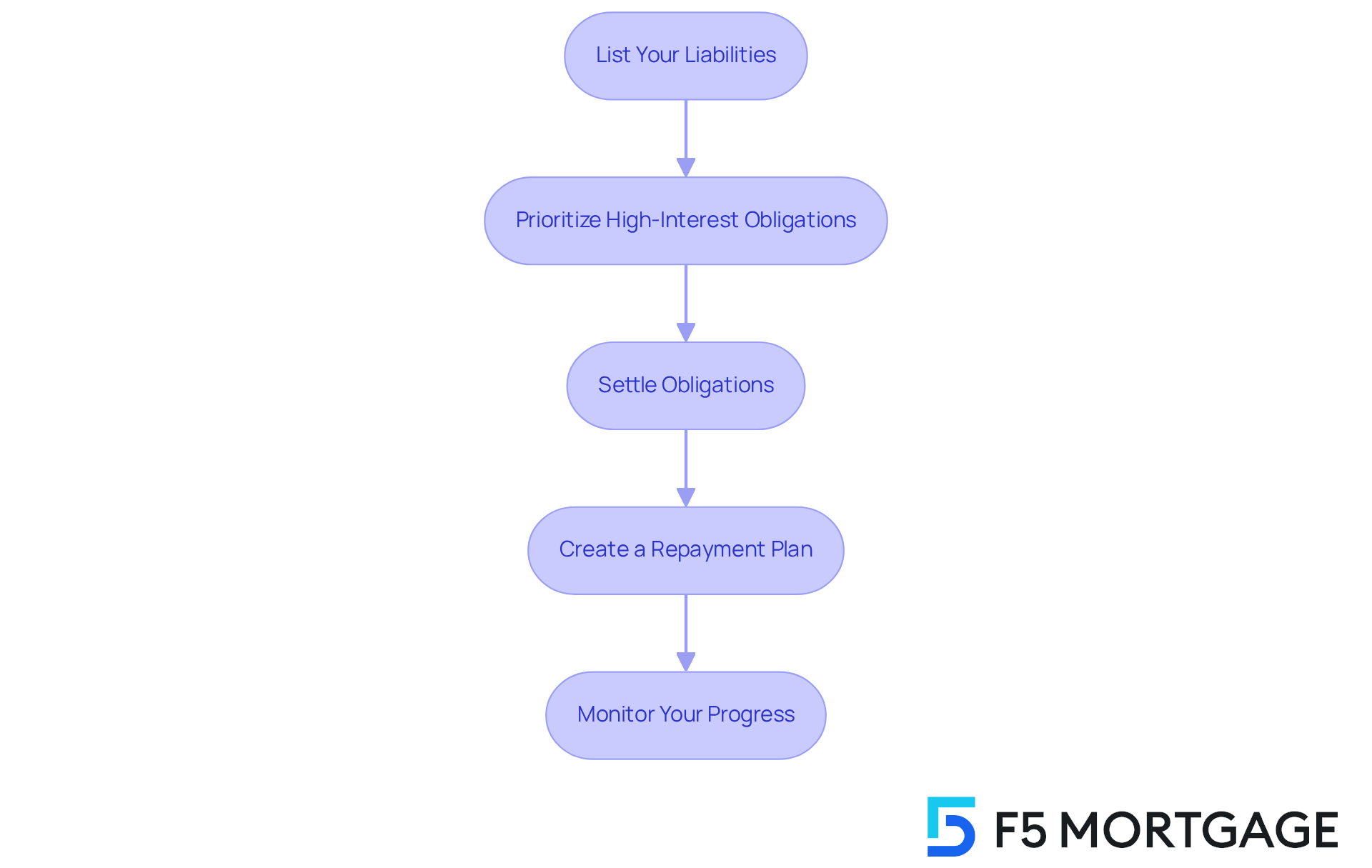

Utilize Your Home Equity Loan for Debt Consolidation

Once you have secured your home equity loan for debt consolidation, we know how important it is to take the right steps to effectively consolidate your debt. Here’s a compassionate guide to help you through the process:

- List Your Liabilities: Begin by cataloging all your current financial obligations, including credit cards, personal loans, and any other high-interest commitments. Did you know the typical American holds approximately $6,730 in credit card obligations? It’s essential to have a clear understanding of your financial responsibilities.

- Prioritize High-Interest Obligations: Concentrate on removing liabilities with the highest interest rates first. This strategy can save you substantial sums in interest payments over time, as can quickly build up. For example, consolidating high-interest credit card balances can lead to reduced overall monthly payments. By emphasizing these obligations, you can maximize the benefits of your property financing.

- Settle Obligations: Use the resources from your property financing to settle these prioritized obligations completely. This action simplifies your finances by reducing the number of monthly payments you need to manage, allowing for better cash flow and financial clarity.

- Create a Repayment Plan: Develop a budget that incorporates your new home equity loan payment. Ensure that you can comfortably make these payments while avoiding the buildup of new financial obligations. A well-structured repayment plan is essential for maintaining financial stability.

- Monitor Your Progress: Regularly review your financial situation to ensure you are on track with your repayment plan. Modify your budget as needed to remain within your limits and prevent returning to high-interest obligations. Keeping a close eye on your progress can help you stay motivated and accountable.

It’s crucial to recognize that while utilizing residential assets can be advantageous for merging obligations, it also carries risks. Borrowing too much can lead to unnecessary interest costs, and hidden fees may impact your total borrowing expenses. Financial advisors frequently highlight the significance of responsible borrowing, mentioning that when utilized wisely, property value can be a powerful resource for accumulating wealth and enhancing financial flexibility. As Debbie Calixto, a sales manager at loanDepot, states, “A home equity loan for debt consolidation can be valuable for funding high-return investments or improving your monthly cash flow.

Conclusion

Utilizing a home equity loan for debt consolidation offers a valuable opportunity for homeowners to tap into their property’s worth while simplifying their financial responsibilities. By transforming high-interest debts into a single, manageable payment, borrowers can save significantly on interest and streamline their budgeting process.

We know how overwhelming financial obligations can feel, and this article highlights essential steps for navigating this journey successfully. Understanding the benefits of home equity loans, qualifying for financing, and executing the application process are crucial. It’s important to assess your equity, maintain a strong credit score, and prioritize high-interest debts to make the most of a home equity loan.

Ultimately, using a home equity loan for debt consolidation can lead to greater financial stability and a clearer path toward your goals. We encourage homeowners to approach this option with diligence and responsibility, ensuring that they keep control over their finances while enjoying the flexibility that home equity can provide. Taking the first step toward debt consolidation not only enhances financial clarity but also empowers you to pave the way for a more secure financial future.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a property-backed financing option that allows homeowners to utilize the equity in their homes, defined as the difference between the property’s current market value and the remaining mortgage balance.

How does a home equity loan help with debt consolidation?

A home equity loan for debt consolidation typically offers lower interest rates compared to unsecured options, making it an appealing choice for consolidating high-interest debts like credit cards.

What are the average interest rates for home equity loans and credit cards?

The average interest rate for residential loans is around 8.59%, while the average rate for credit cards is nearly 22%, allowing borrowers to save significantly over time by consolidating debt with a home equity loan.

What is cash-out refinancing?

Cash-out refinancing involves refinancing an existing mortgage for a higher amount than what is currently owed, enabling homeowners to receive the difference in cash, which can be used for various financial needs.

What are the benefits of using a home equity loan for debt consolidation?

Benefits include fixed interest rates, consistent monthly payments, simplified budgeting, and the potential to reduce overall interest expenses by merging high-interest debts into a single manageable payment.

Can you provide an example of how a home equity loan can save money?

Borrowers can save significantly by using a home equity loan to pay off high-interest liabilities, such as multiple credit card debts, at a lower interest rate.

What do financial consultants say about using home equity loans?

Financial consultants emphasize that, when approached thoughtfully, property financing can serve as a strategic tool for simplifying payments and reducing interest costs, enhancing financial management.

How can home equity loans provide financial flexibility for families?

Home equity loans can offer essential financial flexibility for families looking to improve their living spaces or manage expenses effectively, allowing them to access funds for various needs.