Overview

We understand how challenging it can be to navigate the world of homeownership, especially when it comes to credit scores. To qualify for USDA loans with the lowest possible credit score, applicants typically need to aim for a minimum score of around 600. However, there’s hope! Manual underwriting may consider other financial factors, providing a pathway for those who might feel discouraged.

While the general expectation is a credit score of 640, it’s important to know that flexibility exists in credit requirements. By documenting timely payments and showcasing your financial responsibility, you can still secure financing for your dream home. Remember, we’re here to support you every step of the way, helping you explore the options available to you.

Don’t let a lower credit score deter you from pursuing homeownership. There are alternative paths that can lead you to your goal, and we’re committed to guiding you through this process with compassion and understanding.

Introduction

Navigating the path to homeownership can be particularly challenging for those with low credit scores. We understand how daunting this journey can feel, but USDA loans offer a beacon of hope. These government-backed mortgages are designed to facilitate access to housing in rural and suburban areas, often without the burden of a down payment or high interest rates.

However, a lingering question remains: how can potential borrowers with less-than-ideal credit scores successfully qualify for these advantageous loans? This guide is here to support you every step of the way. We will explore essential steps and strategies to help you overcome credit obstacles and seize the opportunity for homeownership through USDA financing.

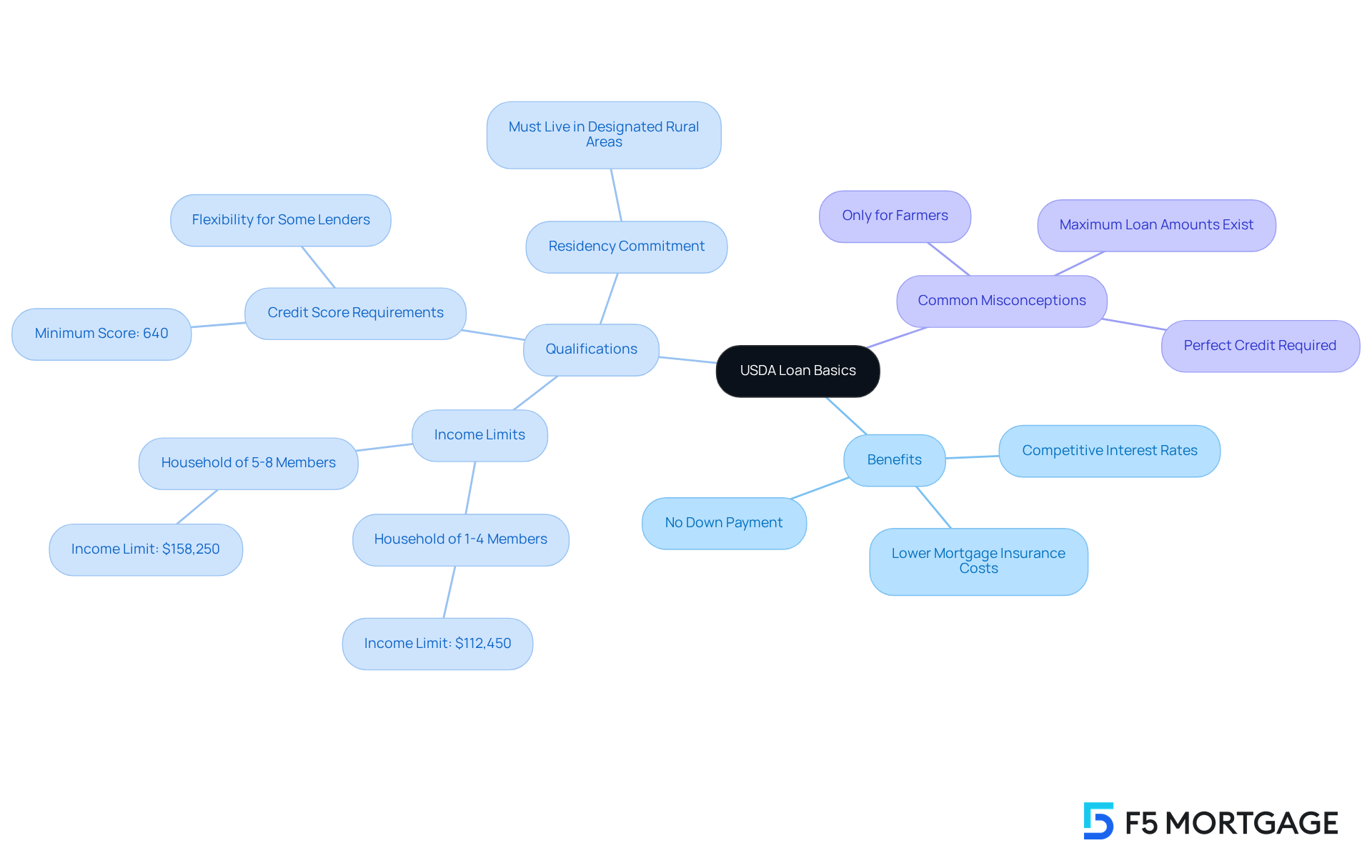

Understand USDA Loan Basics

United States Department of Agriculture mortgages offer government-supported financing options designed to encourage homeownership in rural and suburban areas. These financial products come with several benefits, such as:

- No down payment requirements

- Competitive interest rates

- Lower mortgage insurance costs compared to traditional options

Importantly, these loans do not impose maximum borrowing limits; instead, lending is influenced by factors like debt-to-income ratios and credit ratings. This makes them particularly adaptable for qualified borrowers.

To qualify, applicants need to meet specific income limits that vary based on household size and location. For example, in 2025, the income limit for a household of four in many areas is set at $112,450, while larger households may qualify for limits as high as $158,250. Additionally, candidates must demonstrate a commitment to living in designated rural areas, which can be verified through the eligibility maps provided by the Department of Agriculture.

Understanding these basics is crucial for prospective borrowers, especially those facing challenges with traditional funding options due to credit restrictions. While the Department of Agriculture generally expects a , there isn’t a universal requirement; some lenders may accept the lowest possible credit score under certain conditions. This flexibility, combined with the absence of a down payment, makes these mortgages a practical path to homeownership for many families.

As Jake Vehige, President of Mortgage Lending, emphasizes, “Government-backed mortgages are ideal for individuals wishing to reside in a rural or suburban location but lack additional funds saved for a down payment.” By taking advantage of these financial resources, borrowers can secure favorable conditions that enhance their chances of acquiring a home, even with less-than-perfect financial histories. Furthermore, it’s important to dispel common misconceptions about government-backed financing, such as the belief that they are exclusively for farmers; these funds are accessible to a broader audience than often realized.

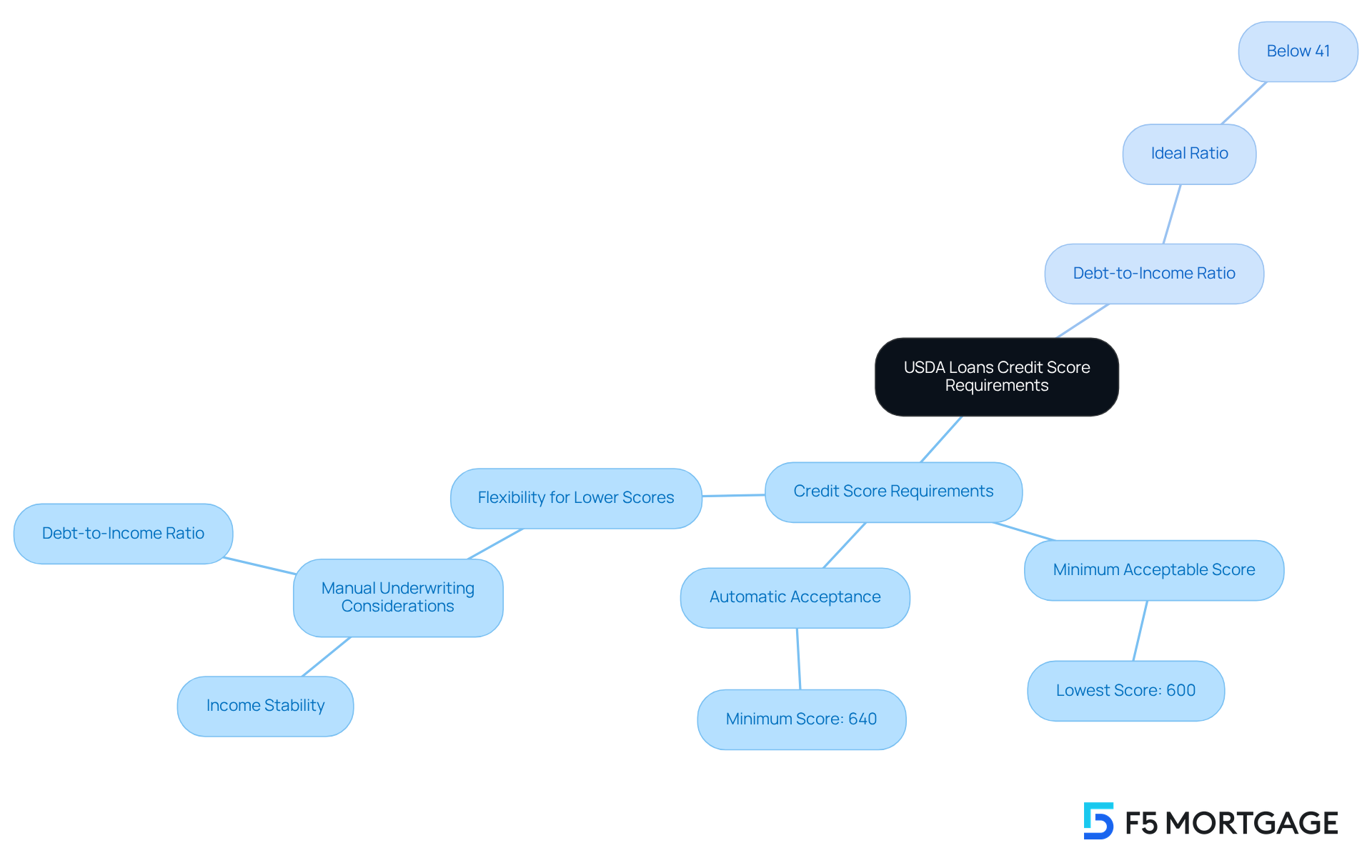

Explore Credit Score Requirements for USDA Loans

We understand that navigating can feel overwhelming. For automatic acceptance through the Guaranteed Financing Program, a minimum rating of 640 is usually required. However, most lenders are willing to consider applicants for agricultural financing with a lowest possible credit score of at least 600. If your rating is lower, don’t lose hope—manual underwriting may still open doors for you. This process considers other important factors like income stability and debt-to-income ratios.

It’s important to recognize that while a higher rating can enhance your chances of approval and secure better terms, this program is specifically designed for individuals who may have the lowest possible credit score. This flexibility is especially vital for first-time homebuyers and those living in rural areas, as it provides access to home financing that might otherwise seem out of reach.

Understanding your debt-to-income (DTI) ratio is also essential. Ideally, this ratio should be below 41%. By knowing where you stand, you can better prepare for the next steps in your application process. Remember, we’re here to support you every step of the way as you work toward achieving your dream of homeownership.

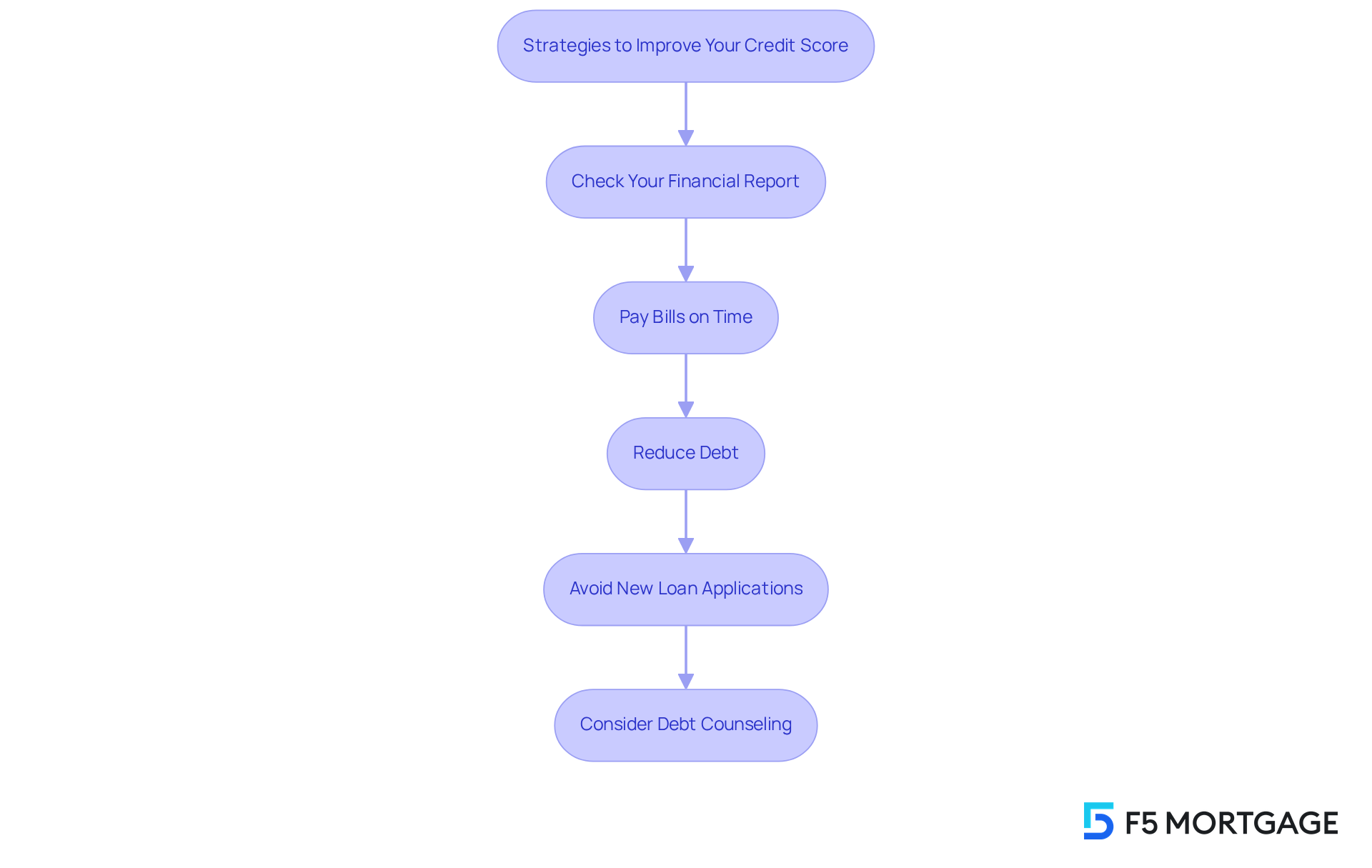

Implement Strategies to Improve Your Credit Score

Enhancing your rating is crucial for qualifying for a USDA loan, especially if your score is the lowest possible credit score. We know how challenging this can be, but there are effective strategies to improve your credit profile:

- Check Your Financial Report: Start by obtaining a complimentary copy of your financial history from the three major credit agencies. Scrutinize it for errors, as inaccuracies can significantly harm your score. In fact, a study found that 44% of participants identified at least one mistake in their reports. If you find any inconsistencies, challenge them to ensure your report accurately reflects your financial history.

- Pay Bills on Time: are essential, making up 35% of your rating. Consider setting up automatic payments or reminders to help you stay on track and avoid late payments, which can negatively impact your score for up to seven years.

- Reduce Debt: Focus on decreasing your card balances and total debt. Aim to keep your utilization ratio below 30%, which means using no more than 30% of your available funds. For optimal financial health, it’s advised to utilize only half to three-fourths of your available limit. Paying down high-interest debts first can lead to quicker improvements in your rating.

- Avoid New Loan Applications: Each new loan application results in a hard inquiry, which can temporarily lower your score. As you work on improving your financial profile, try to limit new applications to maintain stability.

- Consider Debt Counseling: If managing debt feels overwhelming, seeking assistance from a counseling service can be beneficial. These professionals can provide tailored advice and strategies to enhance your financial health, helping you navigate your path to homeownership more effectively.

By applying these strategies, you can take control of your score, which can help you achieve the lowest possible credit score, creating opportunities for better borrowing conditions and increasing your likelihood of qualifying for a government-backed mortgage. Remember, we’re here to support you every step of the way.

Discover Options for Applicants with No Credit History

For applicants who find themselves without a credit history, qualifying for a USDA loan can feel daunting. However, there are several viable options available to help you navigate this journey:

- Manual Underwriting: Lenders may consider alternative financial data, such as payment histories for rent, utilities, and insurance. By documenting these payments, you can effectively showcase your creditworthiness.

- Alternative Financial Sources: Some lenders accept non-traditional financial sources, including utility bills and rental payments, to help establish your financial profile. Be sure to gather evidence of timely payments to support your application.

- Co-Signer: If possible, think about involving a co-signer with a strong financial background. This can significantly enhance your application and improve your chances of approval.

- Credit Builder Financing: Explore the possibility of acquiring a from a local credit union or bank. These products are tailored to help individuals improve their scores through consistent, timely payments.

By utilizing these strategies, you can still strive to obtain a government-backed mortgage and work toward your dream of homeownership. At F5 Mortgage, we understand how challenging this can be; that’s why we have helped over 1,000 families achieve their homeownership dreams, boasting a customer satisfaction rate of 94%. As Sean, a lender, emphasizes, working with USDA-approved lenders is crucial for maximizing the benefits of the USDA loan program. We’re here to support you every step of the way.

Conclusion

Navigating the path to homeownership can indeed be challenging, especially for those grappling with low credit scores. However, USDA loans offer a viable solution, presenting unique benefits such as no down payment and competitive interest rates. By understanding the qualifications and leveraging available resources, individuals can secure financing, even when faced with credit challenges.

This article outlines essential steps for qualifying for USDA loans, emphasizing the importance of credit scores and debt-to-income ratios. While a minimum credit score of around 640 is generally expected, applicants with scores as low as 600 can still find opportunities through manual underwriting and alternative financial documentation. Strategies for improving credit scores, such as timely bill payments and reducing debt, are highlighted as crucial steps in the qualification process.

Ultimately, the USDA loan program serves as a beacon of hope for many aspiring homeowners. By taking proactive measures to enhance credit profiles and exploring available options, individuals can unlock the door to homeownership. The journey may require effort and persistence, but the rewards of owning a home in a rural or suburban area are well worth it. Embracing this opportunity can lead to not just financial stability, but also a fulfilling lifestyle in a community setting. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What are USDA loans?

USDA loans are government-supported financing options offered by the United States Department of Agriculture, designed to encourage homeownership in rural and suburban areas.

What are the key benefits of USDA loans?

Key benefits include no down payment requirements, competitive interest rates, and lower mortgage insurance costs compared to traditional loans.

Are there borrowing limits for USDA loans?

No, USDA loans do not impose maximum borrowing limits; lending is based on factors like debt-to-income ratios and credit ratings.

What are the income limits for qualifying for a USDA loan?

Income limits vary by household size and location. For example, in 2025, the limit for a household of four in many areas is $112,450, while larger households may qualify for limits up to $158,250.

What is required of applicants in terms of residency for USDA loans?

Applicants must demonstrate a commitment to living in designated rural areas, which can be verified through eligibility maps provided by the Department of Agriculture.

What is the minimum credit score required for USDA loans?

The Department of Agriculture generally expects a minimum credit score of around 640, but some lenders may accept lower scores under certain conditions.

Who can benefit from USDA loans?

USDA loans are ideal for individuals wishing to reside in rural or suburban locations but who may lack additional funds saved for a down payment, making them accessible to many families.

Are USDA loans only for farmers?

No, a common misconception is that USDA loans are exclusively for farmers; these loans are accessible to a broader audience.