Overview

Navigating the journey of homeownership can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps to help you determine what price home you can afford.

-

First, it’s crucial to assess your financial situation. Understanding your personal finances is the foundation for making informed decisions.

-

Next, calculating your budgets and debt ratios is key. We know how challenging this can be, but managing your debt-to-income ratios will empower you to make sound financial choices.

-

As you explore mortgage options, consider how each one aligns with your unique needs and circumstances.

-

Lastly, don’t forget to factor in additional homeownership costs. It’s important to consider all expenses associated with owning a home, from maintenance to utilities.

By following these steps, you can approach homeownership with confidence, ensuring that you make choices that are right for you and your family.

Introduction

Understanding the complexities of homeownership can often feel overwhelming. We know how challenging this can be, especially when it comes to determining how much one can afford. As housing prices continue to fluctuate, prospective buyers must navigate a maze of financial assessments. This includes:

- Calculating monthly budgets

- Evaluating different mortgage options

This article serves as a comprehensive guide to help individuals and families demystify the process of home affordability. What are the essential steps to ensure that the dream of owning a home aligns with financial reality? How can one avoid the pitfalls of overextending their budget? We’re here to support you every step of the way.

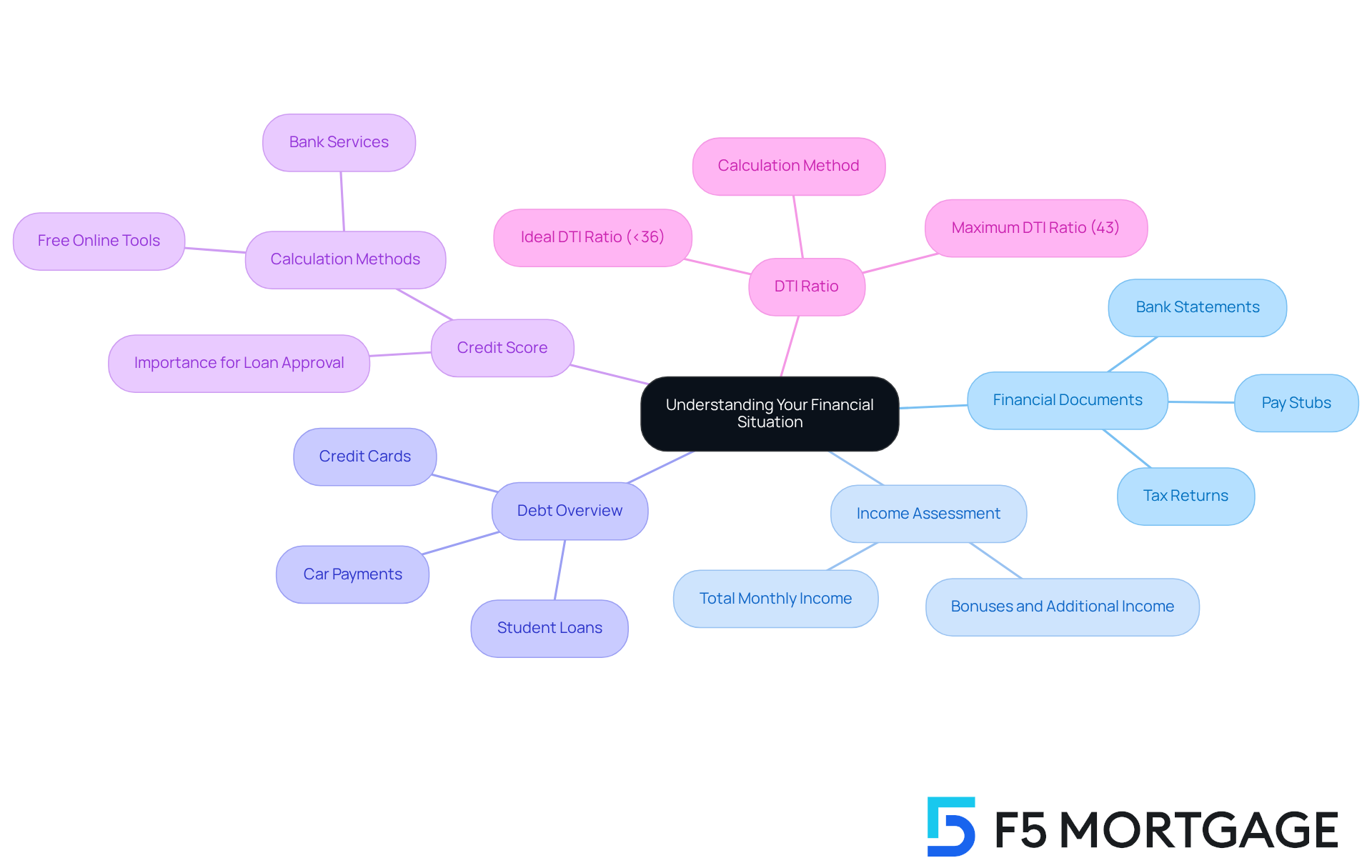

Understand Your Financial Situation

To begin your journey toward homeownership, it’s important to gather essential financial documents such as pay stubs, bank statements, and tax returns. We know how challenging this can be, so take a moment to assess your total monthly income, factoring in any bonuses or additional income sources. Next, compile a list of all your debts, including credit cards, student loans, and car payments. Remember, calculating your credit score is crucial, and you can do this easily using free online tools or through your bank.

Grasping these components is essential. Did you know that the typical American household debt hit roughly $152,653 in 2025, with housing debt making up about 70% of this amount? A strong credit score is vital for loan approval, affecting not only your eligibility but also the interest rates you might obtain. Approval is a lender’s choice, indicating that you are a suitable applicant for a loan based on your financial details. Typically, lenders will offer an estimate of your loan amount, interest rate, and possible recurring charges.

Financial advisors frequently emphasize the significance of assessing your overall income each month in relation to your debts. This will help you calculate your , which should ideally be below 36% for favorable mortgage conditions. Many lenders require a maximum DTI ratio of 43% for home loans, underscoring the importance of managing your debt effectively.

For first-time homebuyers, assessing financial situations can involve practical examples. Consider how much of your income is allocated to debt payments. This holistic view of your finances will empower you to make informed decisions regarding what price home can I afford as you navigate the home buying process. We’re here to support you every step of the way.

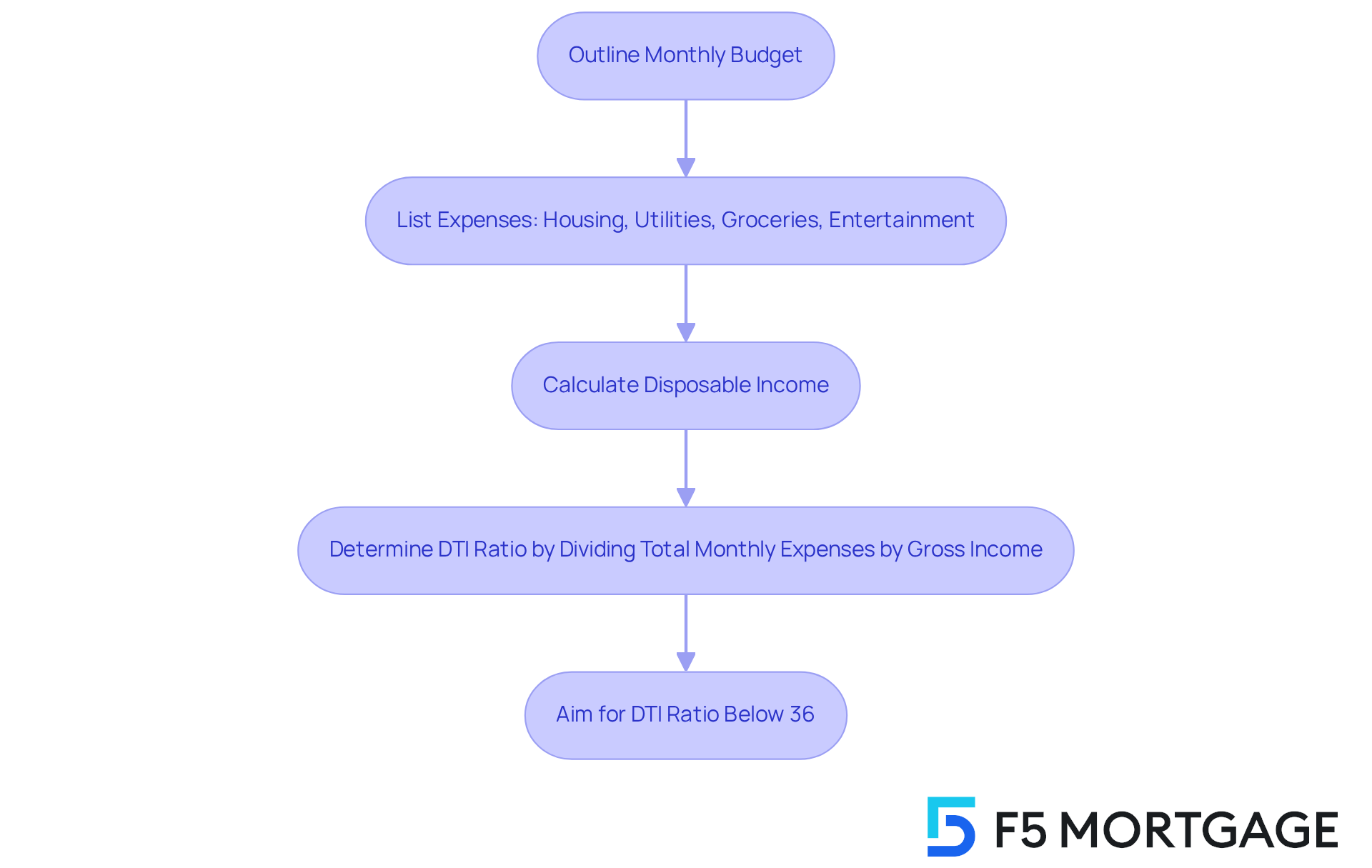

Calculate Your Monthly Budget and Debt Ratios

We understand how important it is to manage your finances, especially when . Start by outlining your budget for the month, which should encompass all your expenses, including:

- Housing

- Utilities

- Groceries

- Entertainment

By deducting these expenses from your total income, you can determine your disposable income, giving you a clearer picture of your financial situation.

Next, let’s look at your debt-to-income (DTI) ratio. This is calculated by dividing your total monthly expenses by your gross income. For optimal mortgage approval chances, aim for a DTI ratio below 36%. In 2025, the average DTI ratio in the U.S. is approximately 36%, highlighting the importance of maintaining a manageable level of debt.

For instance, if your gross monthly income is $5,000 and your total monthly debt payments are $1,500, your DTI would be 30%. This is favorable for lenders and can help you secure the mortgage you need. We encourage you to utilize online calculators to streamline these calculations and ensure accuracy in your financial assessment. Remember, we’re here to support you every step of the way.

Explore Mortgage Options and Their Impact on Affordability

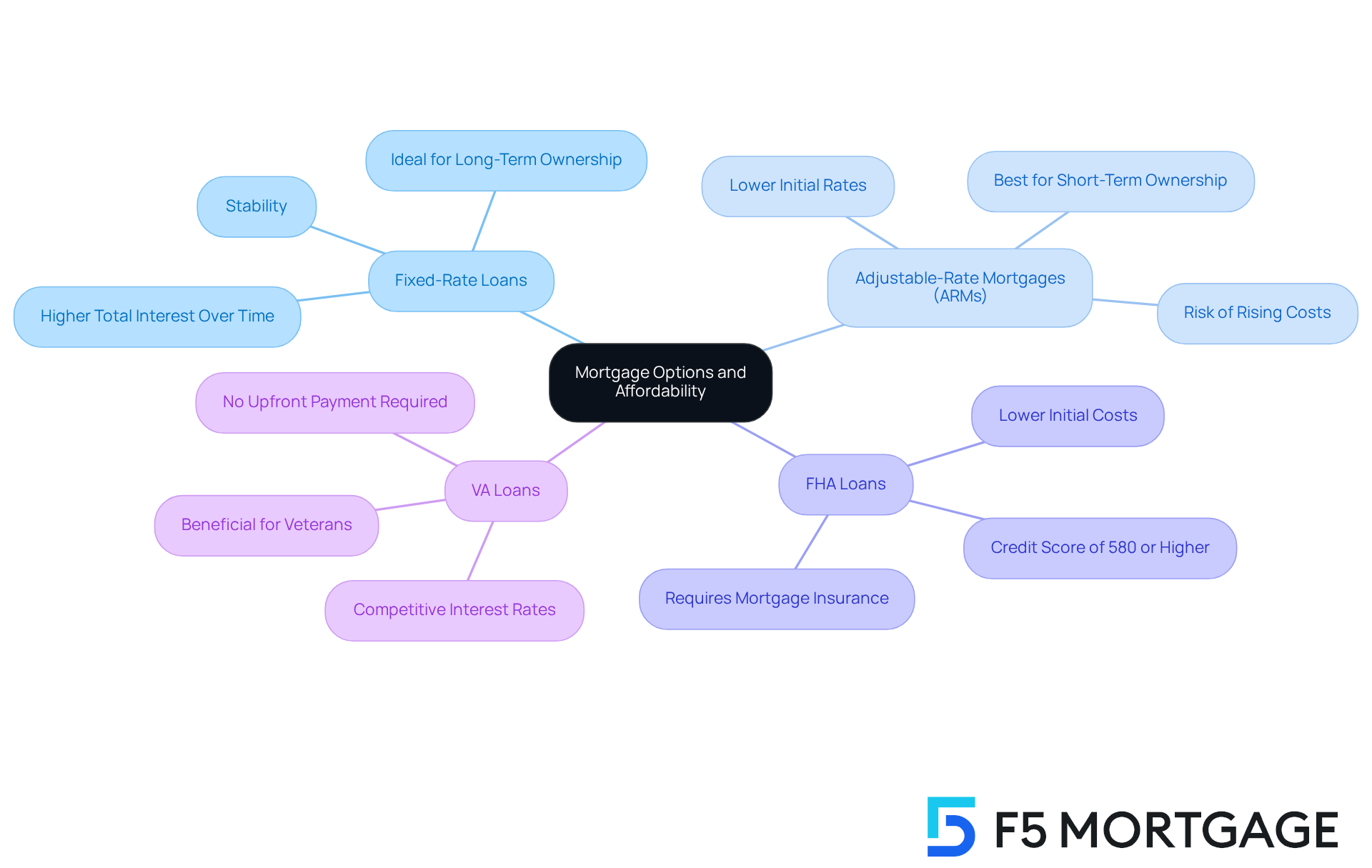

When examining loan options, we understand how overwhelming it can be to navigate the different types available, such as fixed-rate, adjustable-rate, FHA, and VA loans. Each type offers unique advantages and disadvantages that can significantly impact your affordability. For instance, fixed-rate loans provide stability with regular monthly payments, making them ideal for long-term property owners. On the other hand, adjustable-rate mortgages (ARMs) typically start with lower rates, which can be appealing for individuals planning to relocate within a few years, but they do carry the risk of rising costs over time.

Credit scores play a crucial role in determining the loan options available to you. A score of 580 might qualify you for FHA loans, which are particularly favored by first-time homebuyers due to their lower initial costs. , accessible to qualified veterans, also provide beneficial conditions, often without the need for an upfront payment. By understanding these options, families can make informed decisions that align with their financial situations.

Using online loan calculators is a practical way to estimate recurring costs across various borrowing amounts and interest rates. For example, a $400,000 loan at a fixed rate of 6.75% results in approximately $533,981 in total interest over 30 years, while a 15-year fixed rate at 5.75% costs about $207,577 in interest. This highlights the potential savings of shorter loan terms, even if they come with higher monthly payments.

Statistics show that FHA and VA loans are becoming increasingly popular among homebuyers in 2025, reflecting a growing trend towards accessible financing options. By thoughtfully assessing these loan types and utilizing tools like loan calculators, families can understand what price home they can afford. This knowledge empowers them to make decisions that align with their long-term financial goals. Moreover, securing your loan rate can protect you from potential increases, making it an essential step in the home-buying journey.

Factor in Additional Homeownership Costs

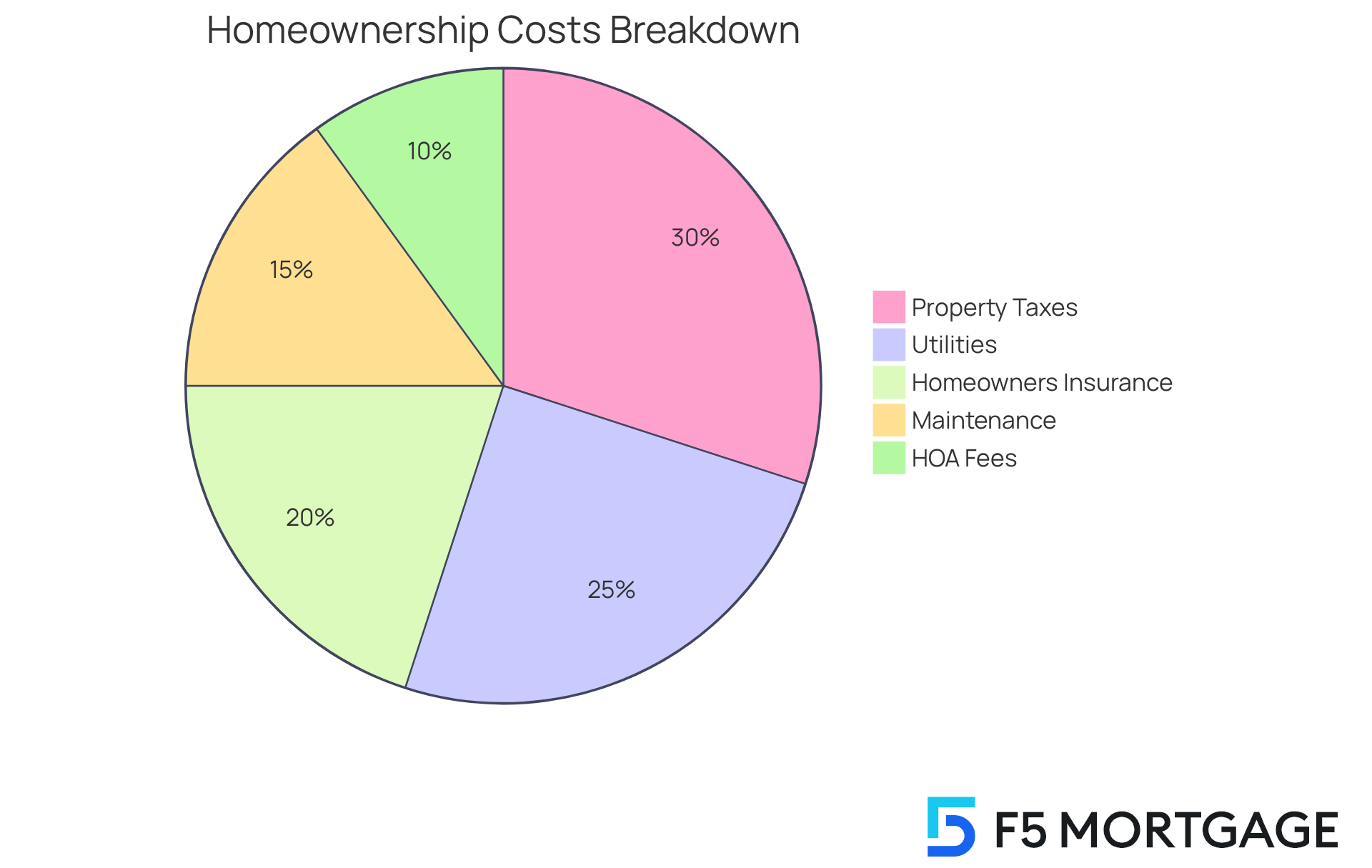

When budgeting for a new home, we often wonder while accounting for more than just your mortgage payment. Property taxes, homeowners insurance, maintenance, and utilities are significant costs that can weigh heavily on your overall economic well-being. For instance, homeowners insurance costs in the U.S. for 2025 are projected to be around $1,500 annually, though this can vary based on your location and coverage levels.

Advisor Suze Orman wisely reminds us, “A significant aspect of monetary independence is having your heart and mind unburdened by concerns over life’s uncertainties.” This highlights the necessity of preparing for these expenses. It’s also wise to allocate 1% to 4% of your home’s value each year for maintenance and repairs. This ensures you are ready for unexpected costs that may arise.

Consider the Johnson family, who recently renovated their residence. They allocated 3% of their home’s worth each year for upkeep, which helped them manage unforeseen repairs without economic pressure. If your property is part of a homeowners association (HOA), don’t forget to include those fees in your budget as well.

Using a detailed budgeting tool or spreadsheet can assist you in tracking these expenses efficiently. This provides a clear view of what price home can I afford regarding your monetary commitments as a homeowner. Financial planners often emphasize that a well-structured budget is essential for managing property taxes and maintenance costs. This allows families to maintain their homes without financial strain, empowering you to navigate this journey with confidence.

Conclusion

Understanding what price home can be afforded requires a comprehensive approach that encompasses financial assessment, budgeting, mortgage options, and additional costs. We know how challenging this can be, but by thoroughly evaluating personal finances, potential homeowners can make informed decisions that align with their financial capabilities and long-term goals.

Let’s break it down into four essential steps:

- Understand your financial situation by gathering key documents and calculating your credit score.

- Calculate your monthly budget and debt ratios to maintain a healthy debt-to-income ratio.

- Explore various mortgage options to find the best fit for your needs.

- Factor in additional costs associated with homeownership, such as property taxes and maintenance.

Each of these steps is crucial in painting a complete picture of affordability and ensuring a successful home-buying experience.

Ultimately, the journey to homeownership is not just about securing a mortgage; it involves a strategic plan that considers all financial aspects. By taking the time to assess personal finances and understand the nuances of home buying, prospective homeowners can confidently navigate the process. Embracing this knowledge empowers you to make decisions that foster financial stability and long-term satisfaction in your new home. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What financial documents should I gather before starting the home buying process?

You should gather essential financial documents such as pay stubs, bank statements, and tax returns.

How can I assess my total monthly income?

Assess your total monthly income by factoring in your regular salary, bonuses, and any additional income sources.

Why is it important to compile a list of debts?

Compiling a list of debts, including credit cards, student loans, and car payments, is important to understand your financial obligations and assess your overall financial health.

How can I calculate my credit score?

You can calculate your credit score easily using free online tools or through your bank.

What is the significance of a strong credit score in the home buying process?

A strong credit score is vital for loan approval as it affects your eligibility for loans and the interest rates you might obtain.

What does loan approval indicate?

Loan approval indicates that you are a suitable applicant for a loan based on your financial details, and lenders will provide an estimate of your loan amount, interest rate, and possible recurring charges.

What is a debt-to-income (DTI) ratio, and why is it important?

The debt-to-income (DTI) ratio is a measure of your monthly debt payments compared to your monthly income. It is important because many lenders require a DTI ratio below 43% for home loans, ideally below 36% for favorable mortgage conditions.

How can first-time homebuyers assess their financial situation?

First-time homebuyers can assess their financial situation by evaluating how much of their income is allocated to debt payments, which helps in determining what price home they can afford.