Overview

When considering how much home you can afford, it’s essential to start by taking a close look at your financial situation. Gather your financial documents, calculate your income and expenses, and understand your debt-to-income ratio. We know how challenging this can be, but these steps are crucial for establishing a realistic housing budget.

Additionally, it’s important to think about the extra costs that come with homeownership and explore potential financing options. By doing so, you can better navigate the challenges present in today’s housing market. Remember, we’re here to support you every step of the way as you embark on this journey.

Introduction

Embarking on the journey to homeownership can often feel overwhelming. We understand how challenging it is to determine how much home you can afford, especially in today’s market with rising property prices and fluctuating interest rates. Prospective buyers are navigating a complex landscape that calls for careful financial evaluation.

This guide is here to support you every step of the way. We offer a structured approach to assessing your personal finances, identifying key metrics, and calculating your affordability. Our aim is to empower you to make informed decisions that align with your aspirations.

How can you effectively balance your dreams of homeownership with the realities of your financial situation? Let’s explore this together, ensuring you feel confident and prepared as you move forward.

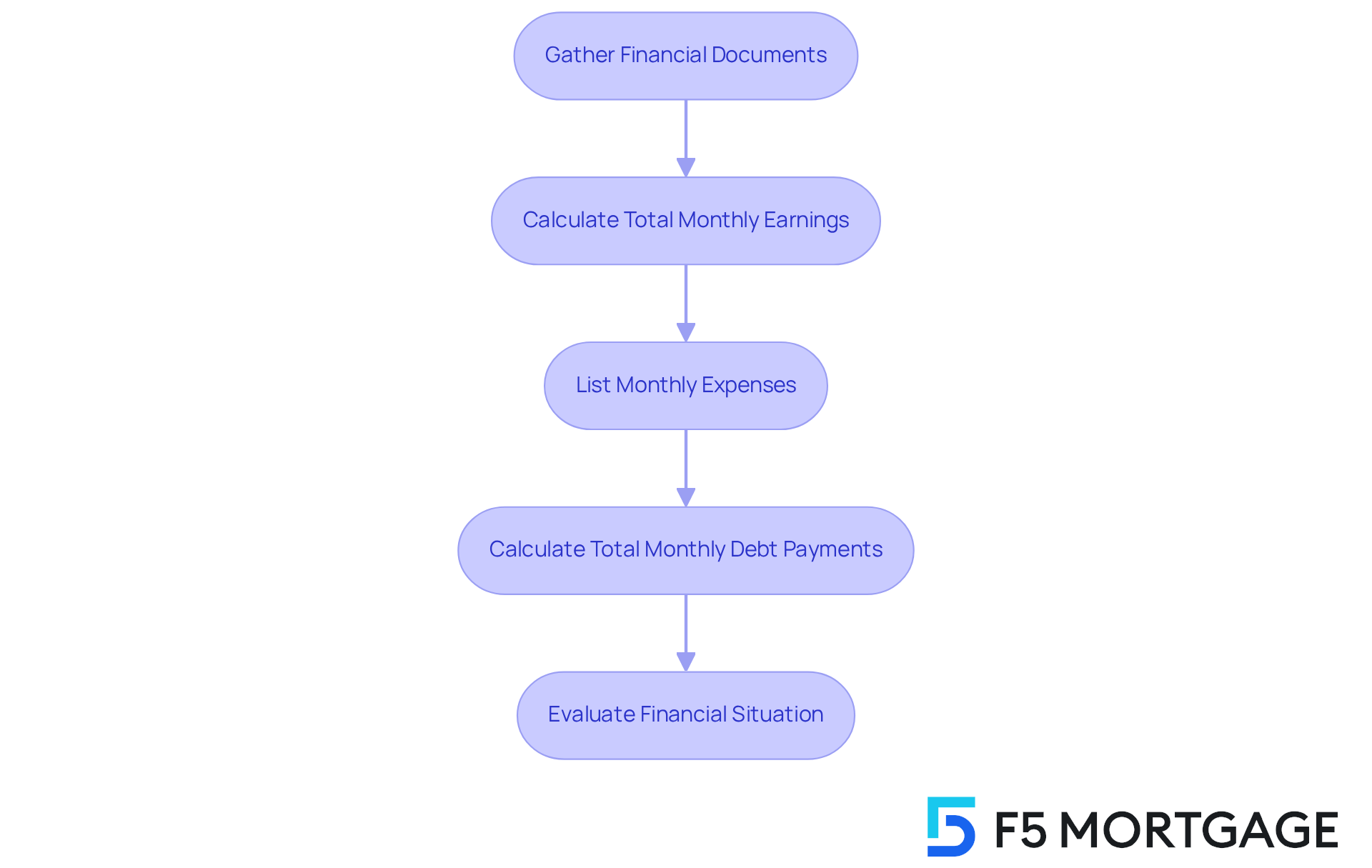

Understand Your Financial Situation

Begin by gathering all essential financial documents, such as pay stubs, bank statements, and records of any existing debts. If you are self-employed, this means including the last two years of personal and business tax returns, K1s, 1099s, and/or W2s. For salaried individuals, just the last year’s W2 and two recent pay stubs from the last 30 days will suffice. To get a clear picture of your finances, calculate your total monthly earnings by adding together all sources, including salaries, bonuses, and side jobs. For example, if a family has a combined income of $5,000 each month, it’s important to consider all earnings to accurately evaluate their financial capacity.

Next, create a list of monthly expenses, which should include utilities, groceries, and other recurring costs. Understanding these ongoing obligations is vital for better budget management. Additionally, calculate your total monthly debt payments, which encompass credit card bills, student loans, and car payments. Generally, lenders prefer that your total monthly debt payments do not exceed 36% of your gross income. So, for a monthly income of $5,000, your total debt obligations should ideally be around $1,800. However, for residential loans, a maximum Debt-to-Income (DTI) ratio of 43% is often required, which can influence your mortgage options and rates. This thorough overview will give you a clearer understanding of your financial situation, empowering you to make informed decisions about how much home can you afford in relation to your mortgage payment.

Financial consultants emphasize the importance of collecting these documents early in the home-buying journey. Doing so simplifies the mortgage application process and helps identify areas for improvement in your financial profile. We understand how challenging this can be, and comprehending your is crucial before moving forward with a property purchase. Remember, we’re here to support you every step of the way.

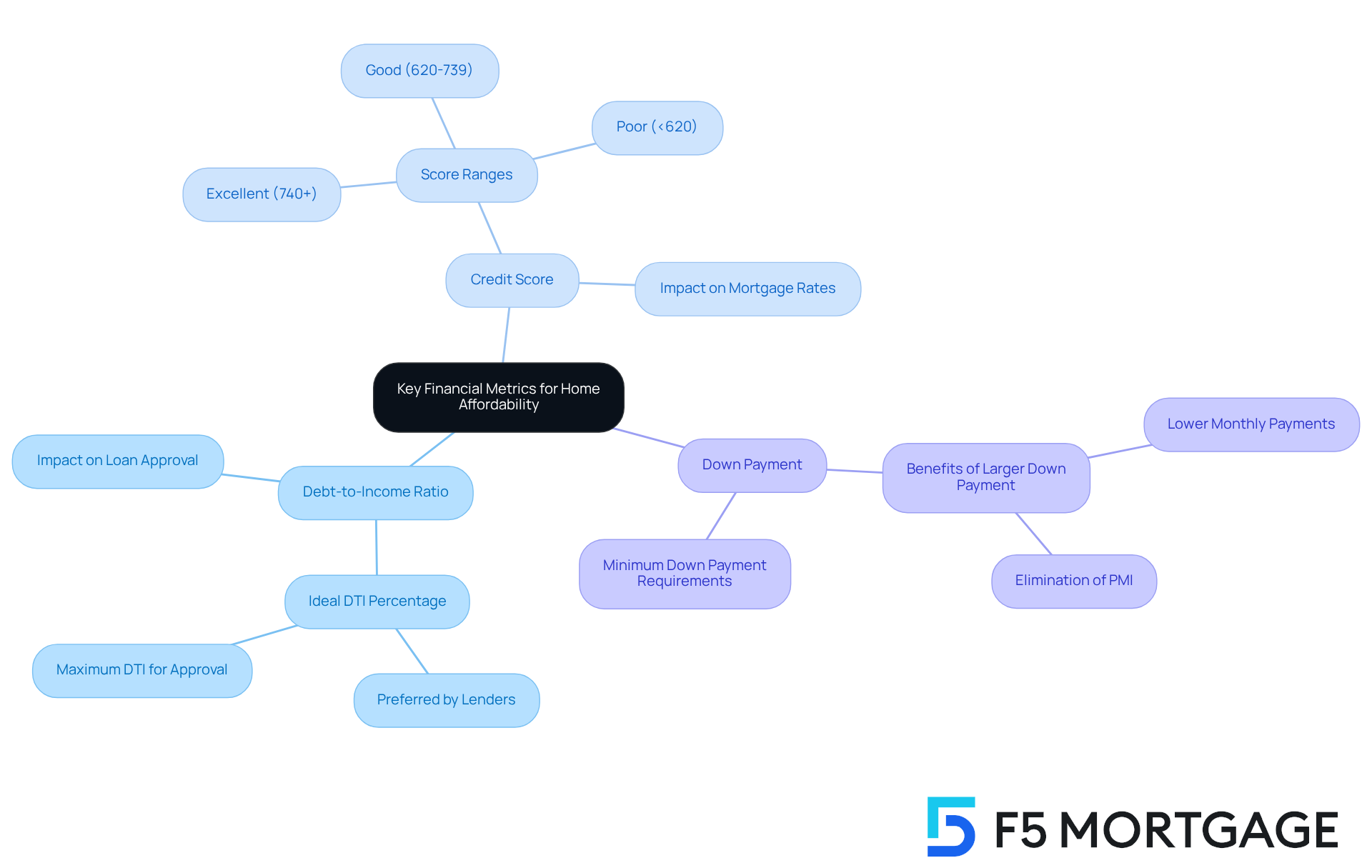

Identify Key Financial Metrics

When considering how much home you can afford, we understand how overwhelming this process can feel. It’s essential to look at several key financial metrics that can guide you. One of the most important factors is your debt-to-income (DTI) ratio. This ratio is calculated by dividing your total monthly debt payments by your gross earnings. Lenders typically prefer a DTI ratio below 36%, as this suggests a healthier balance between your debt and income.

Your also plays a significant role in determining your mortgage interest rate and loan terms. Aiming for a score of 740 or higher can unlock the most competitive rates, while scores below 620 may limit your options and increase costs. We know how challenging it can be to navigate these numbers, but understanding them is key to your success.

Additionally, having sufficient funds for a down payment is crucial. A larger down payment not only reduces your monthly mortgage payments but can also eliminate the need for private mortgage insurance (PMI), which can further enhance your financial situation. By focusing on these metrics, you can take empowered steps toward securing favorable mortgage terms. Remember, we’re here to support you every step of the way.

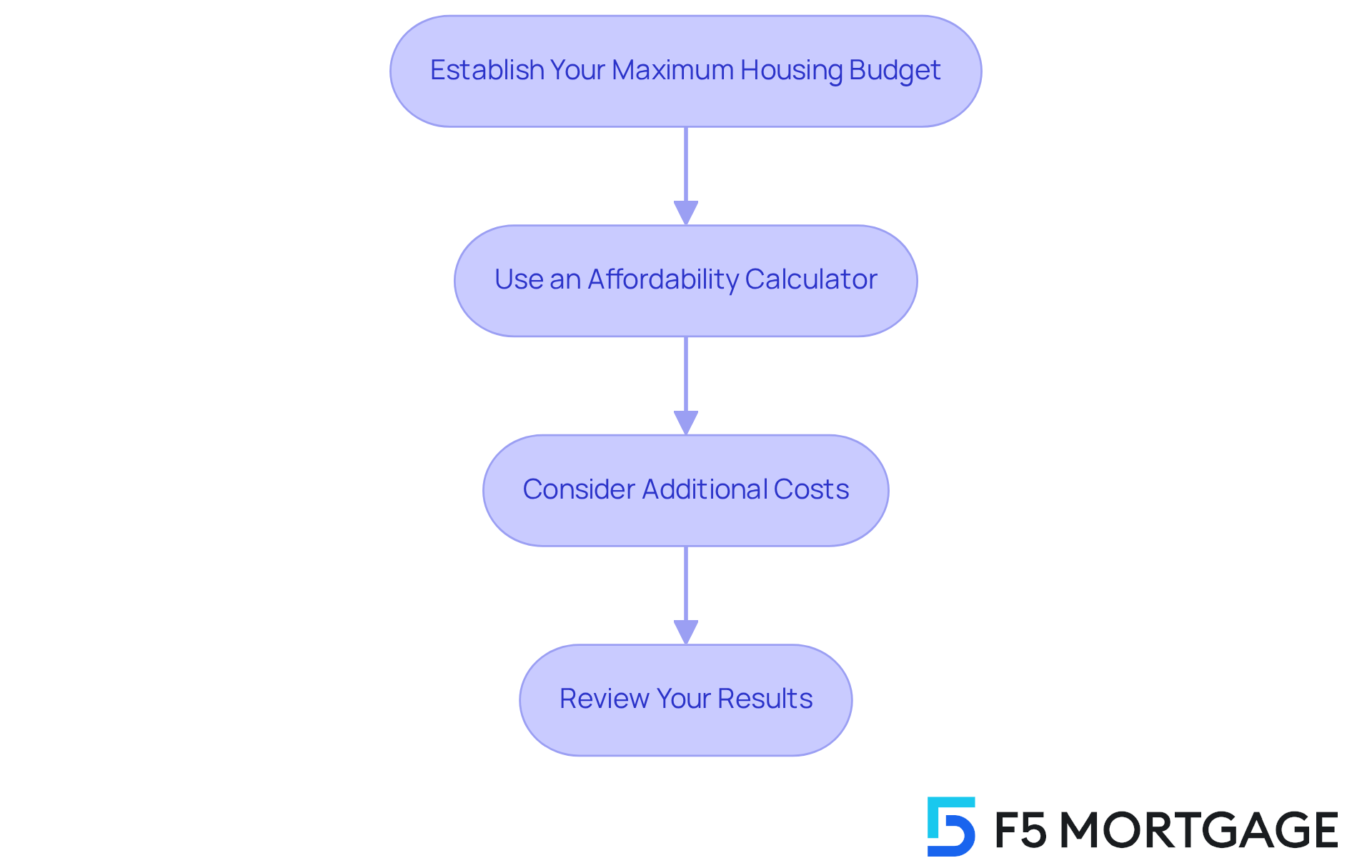

Calculate Your Home Affordability

Calculating how much home you can afford can feel overwhelming, but we’re here to support you every step of the way. To help you navigate this process, follow these simple steps:

- Establish Your Maximum Housing Budget Per Month: We know how challenging it can be to manage finances. Financial specialists suggest that to assess how much home can you afford, your total housing expenses—including mortgage, property taxes, and insurance—should not exceed 28% of your gross earnings. For instance, if your yearly earnings are $150,000, your gross earnings are roughly $12,500, allowing for a maximum housing budget of about $3,500.

- Use an : To simplify your calculations, consider entering your income, monthly debts, and down payment into an online affordability calculator. User-friendly options are available on platforms like NerdWallet and Zillow, which can help streamline this important process.

- Consider Additional Costs: Remember, it’s crucial to factor in closing costs, maintenance, and potential homeowner association (HOA) fees when determining your budget. These expenses can significantly impact your overall affordability, so ensure they are included in your calculations.

- Review Your Results: Once you’ve completed your calculations, you should have a clear price range for properties that fit within your budget. This knowledge will empower you to make informed choices and avoid economic strain during your home-buying journey.

By following these guidelines, you can confidently navigate the complexities of housing affordability and assess how much home can you afford, ensuring your living expenses remain manageable and aligned with your financial goals.

Address Common Affordability Challenges

Determining how much home can you afford can be challenging, especially with fluctuating interest rates, rising property prices, and unexpected costs. We know how daunting this can feel. To help you navigate these challenges, consider the following strategies:

- Stay Informed About Market Trends: Regularly monitor mortgage rates and housing market conditions. As of 2025, with the national median listing price for properties reaching $431,250, it’s important to consider how much home can you afford based on a minimum annual income of $114,000. Keeping abreast of these changes will empower you to make informed decisions.

- Build a Financial Cushion: It’s essential to save for unexpected costs that may arise during the home-buying process, such as repairs or closing costs. This monetary cushion can help reduce the effect of any , providing you with peace of mind.

- Consider Alternative Financing Options: If traditional loans seem out of reach, explore options like FHA or VA loans, which often provide more favorable terms for first-time buyers or veterans. Furthermore, F5 Mortgage offers several down payment assistance initiatives, including the MyHome Assistance Program in California, which provides up to 3% of the property’s purchase price, and the My Choice Texas program, supplying up to 5% for down payment and closing aid. Florida also has programs that can assist buyers, enhancing your purchasing power in a competitive market.

- Consult with a Mortgage Broker: Engaging with a knowledgeable broker at F5 Mortgage can offer personalized advice and access to a variety of loan options tailored to your financial situation. With over 1,000 families helped and a customer satisfaction rate of 94%, F5 Mortgage is here to support you every step of the way. Their user-friendly technology simplifies the process, ensuring that you feel guided and supported throughout.

By implementing these strategies, families can better navigate the current housing market to determine how much home can you afford, which is characterized by increased competition for affordable homes and rising prices. Together, we can make the dream of homeownership more attainable.

Conclusion

Determining how much home you can afford is a crucial step in your home-buying journey. We understand how challenging this can be, and it requires a clear understanding of your financial landscape. By taking the time to evaluate your income, expenses, and key financial metrics, you can set realistic expectations and avoid the pitfalls of overextending financially. This careful assessment not only aids in budgeting but also empowers you to make informed decisions that align with your long-term financial goals.

Throughout this article, we’ve outlined essential steps to guide you through this intricate process. From gathering your financial documents and calculating your debt-to-income ratios to utilizing affordability calculators and considering additional costs, each step plays a vital role in painting a comprehensive picture of what you can afford. Moreover, addressing common challenges—such as fluctuating interest rates and rising property prices—equips you with strategies to navigate the current market effectively.

Ultimately, understanding home affordability is more than just crunching numbers; it’s about establishing a solid foundation for your future financial stability. By staying informed about market trends, building a financial cushion, and exploring various financing options, you can enhance your purchasing power and increase your chances of securing a home that not only meets your needs but also fits within your budget. Taking these proactive measures ensures that the dream of homeownership remains attainable, fostering a sense of security and fulfillment for years to come.

Frequently Asked Questions

What financial documents should I gather to understand my financial situation?

You should gather pay stubs, bank statements, records of existing debts, and if self-employed, the last two years of personal and business tax returns, K1s, 1099s, and/or W2s. Salaried individuals need the last year’s W2 and two recent pay stubs from the last 30 days.

How can I calculate my total monthly earnings?

To calculate your total monthly earnings, add together all sources of income, including salaries, bonuses, and side jobs.

Why is it important to list monthly expenses?

Listing monthly expenses, such as utilities, groceries, and other recurring costs, is vital for better budget management and understanding ongoing financial obligations.

What are total monthly debt payments, and why are they important?

Total monthly debt payments include credit card bills, student loans, and car payments. They are important because lenders prefer that these payments do not exceed 36% of your gross income, which affects your borrowing capacity.

What is the maximum Debt-to-Income (DTI) ratio for residential loans?

For residential loans, a maximum Debt-to-Income (DTI) ratio of 43% is often required, which can influence your mortgage options and rates.

Why is it important to collect financial documents early in the home-buying journey?

Collecting financial documents early simplifies the mortgage application process and helps identify areas for improvement in your financial profile, making it easier to understand how much home you can afford.

How can understanding my financial condition help me in the property purchase process?

Understanding your financial condition empowers you to make informed decisions about your mortgage payment and overall home affordability, which is crucial before moving forward with a property purchase.