Overview

We understand how challenging navigating home financing can be, especially when it comes to avoiding Private Mortgage Insurance (PMI). Thankfully, there are several strategic steps you can take to ease this burden. Consider:

- Making a larger down payment

- Exploring piggyback loans

- Looking into lender-paid mortgage insurance options

Each of these methods can help you sidestep PMI, which in turn can significantly lower your monthly payments and overall loan costs.

By avoiding PMI, you empower yourself to make informed financial decisions that benefit your family in the long run. We’re here to support you every step of the way, guiding you through these options to find the best fit for your needs. Remember, you have the power to shape your home-buying journey, and with the right strategies, you can achieve your dream of homeownership without the added stress of PMI.

Introduction

Understanding the nuances of Private Mortgage Insurance (PMI) is crucial for homebuyers like you who are navigating the complexities of mortgage financing. We know how challenging this can be. While PMI serves as a safety net for lenders, it can significantly inflate your monthly payments, making homeownership more costly than you might have anticipated.

This article delves into effective strategies to avoid PMI, offering insights that can lead to substantial savings and a more manageable financial future. What if there were simple steps that could help you bypass this added expense and secure your dream home without breaking the bank? We’re here to support you every step of the way.

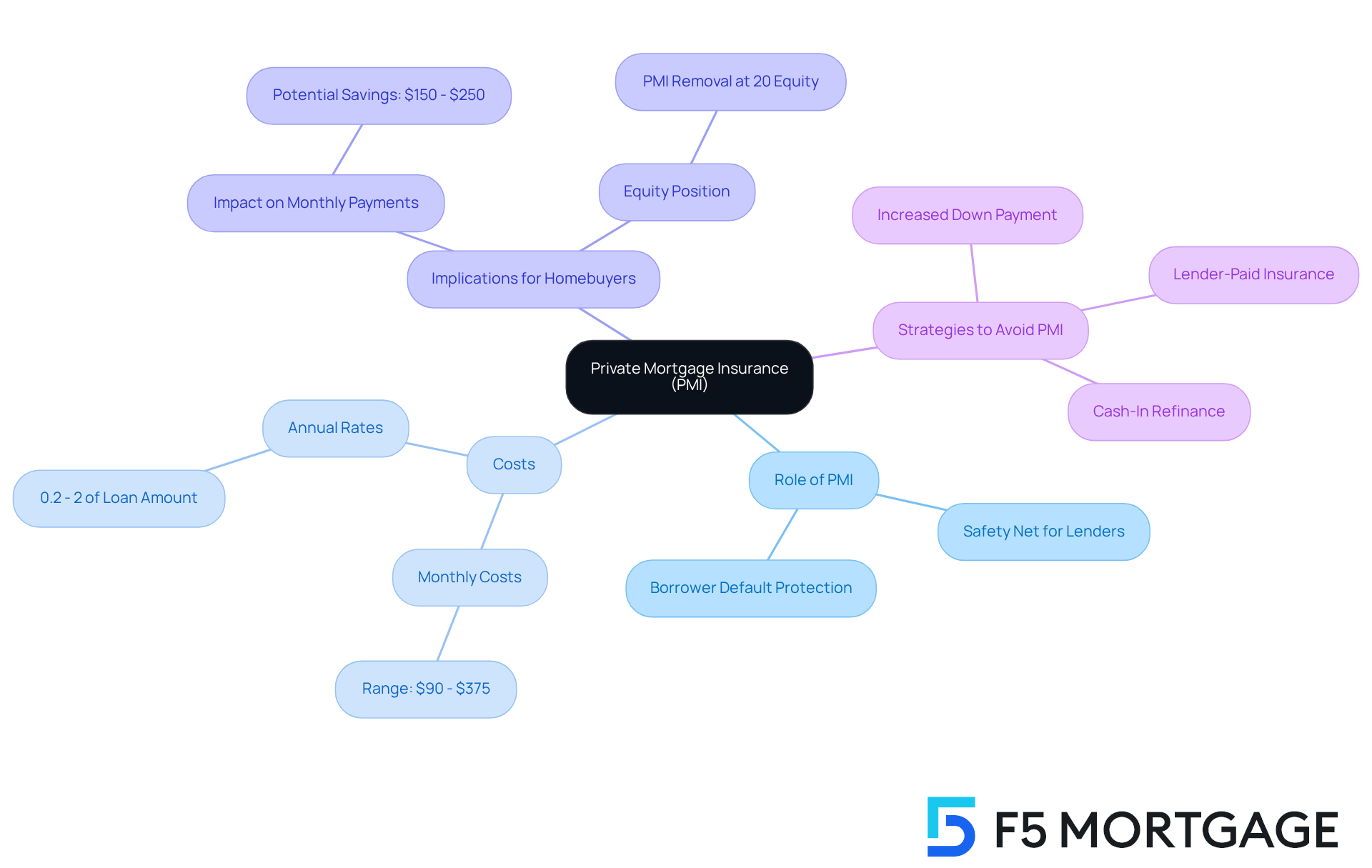

Understand Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) plays a crucial role in the loan landscape, particularly for families who may struggle to provide a down payment of at least 20% of their home’s purchase price. This insurance acts as a safety net for lenders, offering protection in case a borrower defaults. Understanding PMI is vital, as it can significantly , typically ranging from 0.2% to 2% of the total amount borrowed each year. For example, on a $300,000 loan, PMI costs could vary between $90 and $375 each month, depending on the specific rate applied.

Looking ahead to 2025, average PMI rates are expected to remain within this range, reflecting the current market conditions. Financial advisors remind us that while PMI is often a necessary expense for many homebuyers, knowing how to avoid PMI can help manage or even eliminate this cost. For instance, a homeowner with a mortgage balance of $300,000 and a property value of $400,000, who has achieved 25% equity, may qualify for PMI removal, saving between $150 to $250 each month.

PMI primarily protects lenders by addressing the risks associated with smaller initial contributions. If a borrower defaults, the lender can recover some of their losses through the PMI policy. This coverage is particularly relevant in today’s market, where rising property values—like the 50% increase seen in Texas since 2020—can quickly change a borrower’s equity position.

One effective way to learn how to avoid PMI is through cash-in refinance loans. By refinancing while reducing part of the principal, homeowners can improve their loan-to-value ratio, potentially leading to lower interest rates and reduced monthly payments. The lump sum provided at closing can also decrease the remaining installments until the loan is fully paid off, making this option especially appealing for those with extra funds to invest in their equity.

Real-life examples highlight the impact of PMI on homebuyers. Imagine a family purchasing a home for $400,000 with a 10% down payment; they would incur PMI costs that could amount to thousands over the life of the loan. By grasping the implications of PMI and exploring how to avoid PMI—such as increasing the initial contribution, seeking lender-paid mortgage insurance, or considering cash-in refinance loans—homebuyers can make more informed financial choices. For personalized service and competitive rates, we encourage you to reach out to F5 Mortgage. We’re here to support you every step of the way.

Explore Strategies to Avoid PMI

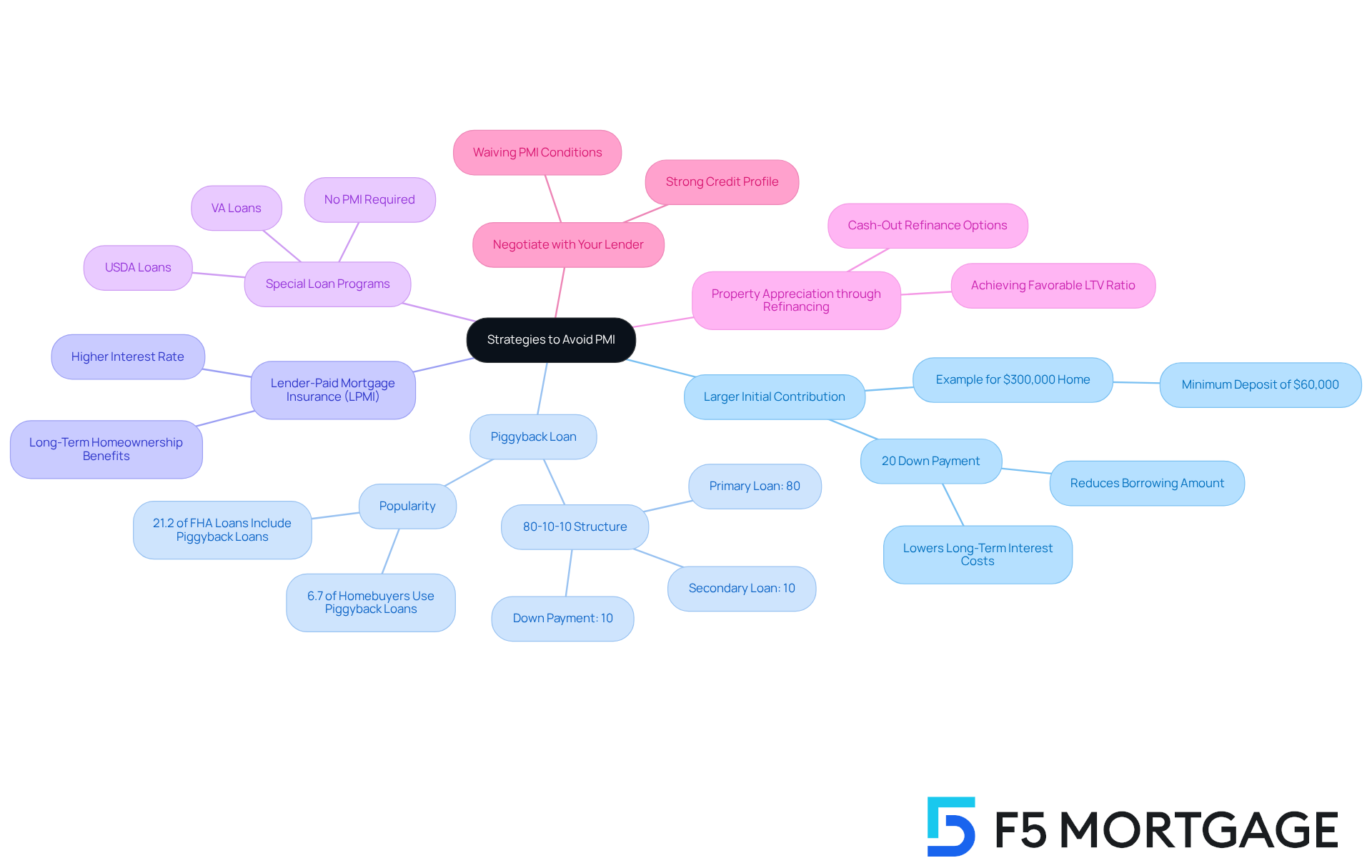

To avoid Private Mortgage Insurance (PMI), we understand how important it is to consider effective strategies that can ease your financial burden:

- Make a Larger Initial Contribution: Striving for a down payment of 20% or more is the most direct method to eliminate PMI. Many homebuyers choose this route, as it not only reduces the amount borrowed but also lowers long-term interest costs. For instance, if you’re looking at a $300,000 home, you would need a minimum initial deposit of $60,000, which is an important factor in learning how to avoid PMI.

- Consider a Piggyback Loan: This financing approach involves obtaining a secondary loan to cover part of the initial cost. A common arrangement is the ’80-10-10′ loan, where the primary loan covers 80% of the property’s value, the secondary loan represents 10%, and you provide a 10% deposit. This option has gained traction, with 6.7% of homebuyers utilizing piggyback loans as of August, reflecting a significant shift in financing strategies.

- Look for Lender-Paid Mortgage Insurance (LPMI): Some lenders offer LPMI, where they cover the PMI cost in exchange for a higher interest rate. This option can be beneficial for those planning to stay in their homes long-term, as it provides a way to learn how to avoid PMI expenses upfront while still securing your mortgage.

- Explore Special Loan Programs: Certain loan programs, such as VA loans for veterans or USDA loans for rural properties, do not require PMI regardless of the down payment amount. These programs can provide substantial savings for eligible borrowers, illustrating how to avoid PMI and helping you to achieve your homeownership dreams.

- Utilize Property Appreciation through Refinancing: If you acquired your home with a conventional loan and put down less than 20%, refinancing may enable you to . High home appreciation rates, especially in places like California, can help you learn how to avoid PMI by achieving a favorable loan-to-value (LTV) ratio, making it easier to eliminate it sooner than expected. Additionally, if you have significant expenses like medical bills or education costs, consider a cash-out refinance to access equity while lowering your LTV ratio. Just ensure that you secure a more affordable interest rate on your new loan.

- Negotiate with Your Lender: If you have a strong credit profile, consider negotiating with your lender to waive PMI under specific conditions related to refinancing. Some lenders may be open to this, particularly if you demonstrate financial stability and a solid repayment history.

By utilizing these strategies, families can effectively navigate the complexities of home financing and potentially save thousands over the duration of their loans. We know how challenging this can be, and we’re here to support you every step of the way.

Evaluate the Financial Impact of PMI

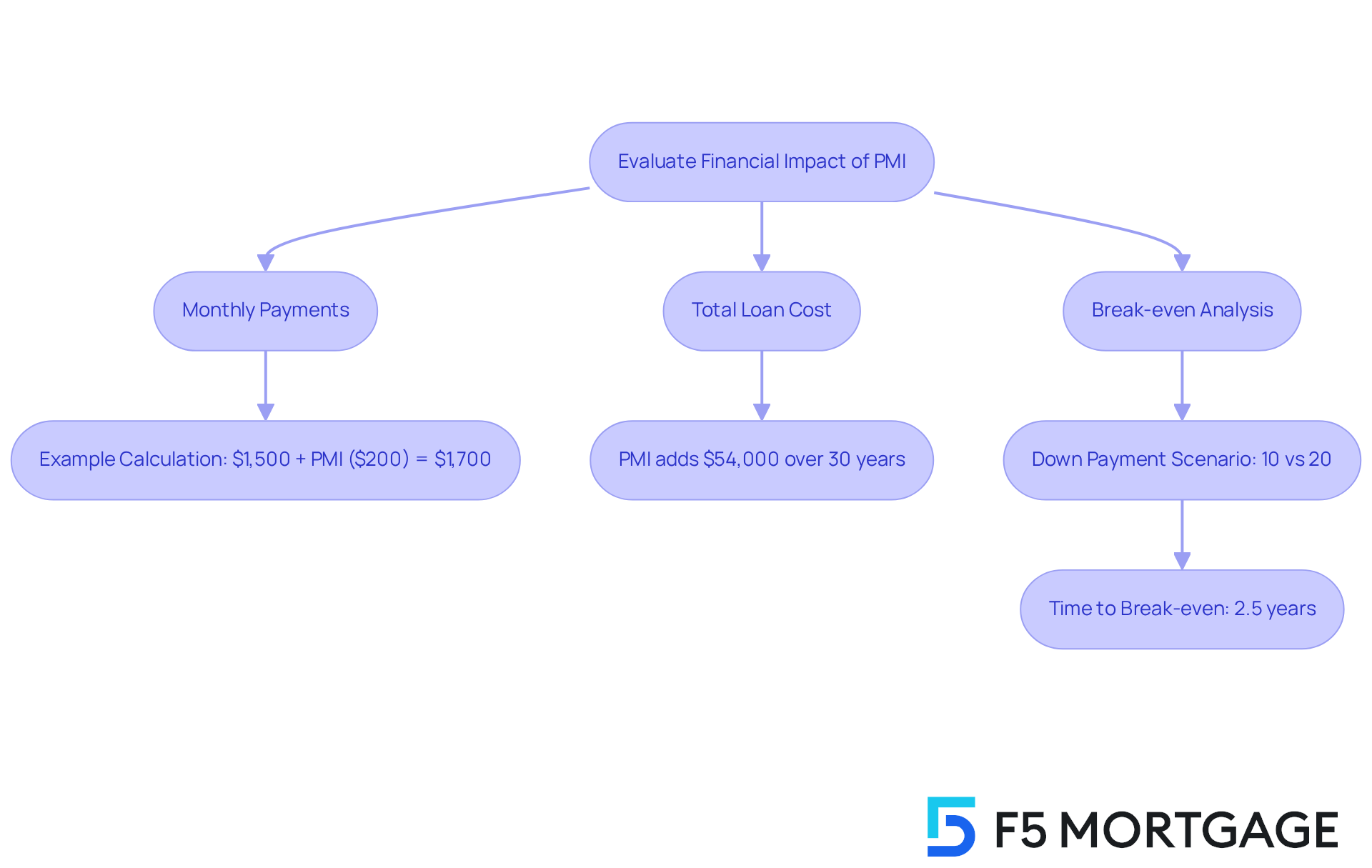

Evaluating the financial impact of Private Mortgage Insurance (PMI) can feel overwhelming, but knowing how to avoid PMI and understanding its key aspects can empower you to make informed decisions.

- Monthly Payments: PMI can significantly increase your monthly mortgage payment. The average monthly cost of PMI typically ranges from 0.46% to 1.5% of the loan amount. For instance, if your loan payment is $1,500 and PMI adds $200, your total monthly payment increases to $1,700. This additional cost can strain your budget, especially for first-time homebuyers who may already be feeling the pressure.

- Total Loan Cost: Over the life of a 30-year loan, PMI can add substantial costs. If PMI costs $150 per month, this translates to an additional $54,000 over 30 years. This figure highlights the importance of understanding how to avoid PMI when evaluating the overall affordability of a mortgage, ensuring you have a clear picture of your long-term financial commitment.

Performing a break-even analysis is essential when evaluating how to avoid PMI or making a larger upfront contribution. For example, if you opt for a $300,000 home and choose to put down 10% instead of 20%, you might pay PMI for several years. If the PMI costs $200 monthly, it would take approximately 2.5 years to reach the break-even point where the savings from learning how to avoid PMI would outweigh the costs incurred from the larger down payment. Additionally, higher credit scores can lead to reduced PMI rates, making it advantageous to enhance your credit prior to applying for a home loan. This analysis can help you determine the most financially sound strategy based on your unique circumstances.

Understanding these factors will empower you to make informed decisions regarding PMI and its . As noted by financial expert Louis DeNicola, “You may request a cancellation a little earlier—once you reach 20% equity based on the home’s original value,” which is an important consideration for long-term planning. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Utilize Resources and Tools for PMI Avoidance

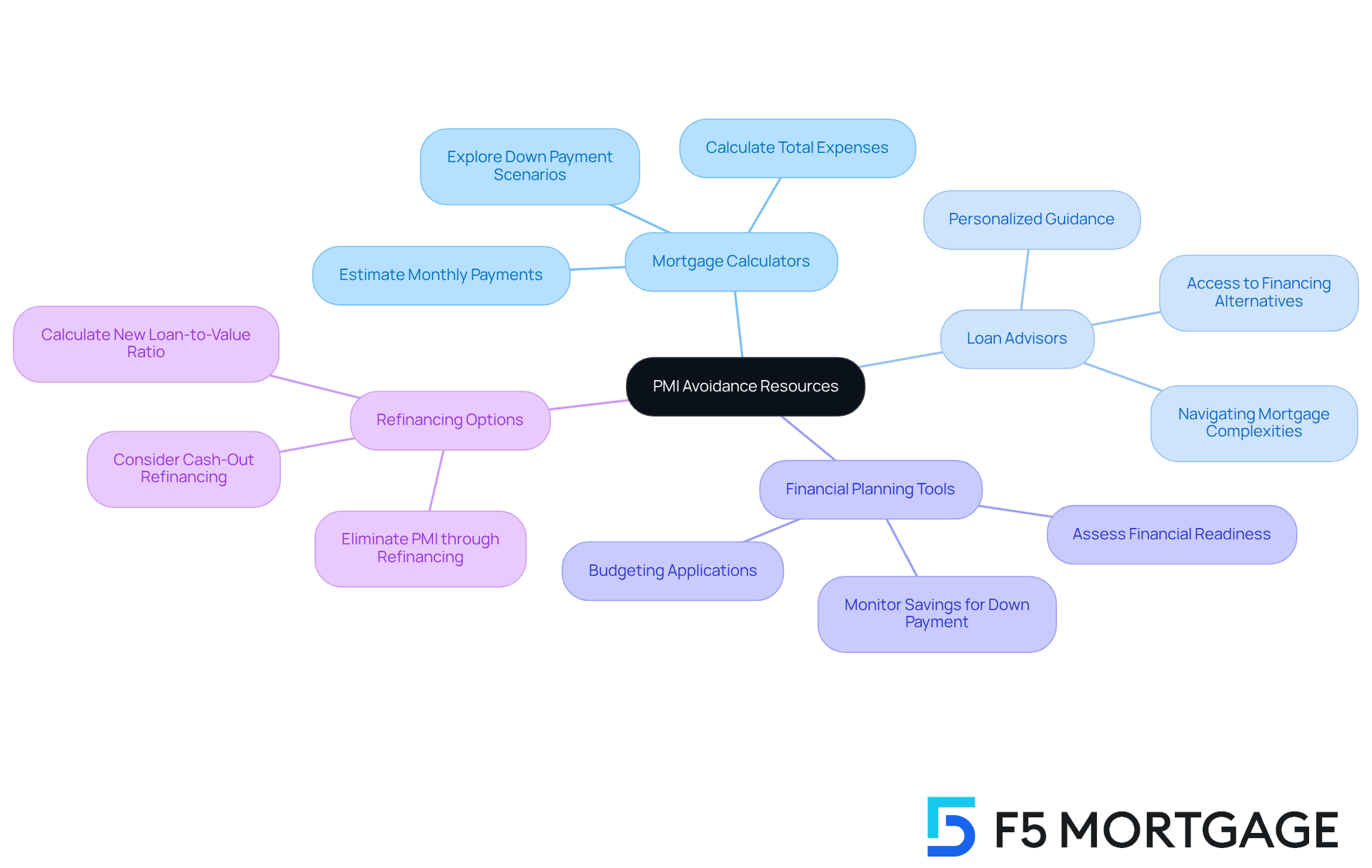

To effectively avoid PMI, we understand how important it is to have the right resources and tools at your disposal:

- Mortgage Calculators: Online mortgage calculators are invaluable for estimating your monthly payments, including PMI. They allow you to explore different down payment scenarios, helping you understand how varying amounts affect your total expenses. For instance, a 20% down payment on a $200,000 property can save you significantly by eliminating PMI altogether.

- Consult with a Loan Advisor: Working with an experienced loan advisor can provide personalized guidance and access to financing alternatives that may not require PMI. Brokers can help you navigate the complexities of mortgage financing and identify programs suited to your financial situation. As Craig Berry wisely notes, “If you want to learn how to avoid PMI but don’t have 20% down, talk to a few lenders about your options.”

- Financial Planning Tools: Utilizing budgeting applications can help you monitor your savings for a down payment and assess your financial readiness for homeownership. By keeping a clear view of your finances, you can learn how to avoid PMI by working towards achieving the 20% down payment threshold. Streamlining your budgeting process can enhance your ability to save effectively.

Furthermore, if you acquired your property through a conventional loan and put down less than 20%, refinancing may allow you to eliminate PMI, especially given the high appreciation rates of properties in California. By calculating your new loan-to-value (LTV) ratio with your home’s increased value, you might be able to eliminate PMI sooner than you think. However, be cautious with cash-out refinancing, as it can lead to higher debt levels and interest rates. If you have significant expenses, consider a cash-out refinance to secure a larger mortgage with a lower LTV ratio, but ensure you can obtain a more affordable interest rate on your new loan.

Current trends indicate that many homebuyers are utilizing these resources, with numerous reports highlighting how to avoid PMI by using effective homebuyer guides. As industry experts emphasize, understanding how to navigate these options is crucial for prospective homeowners aiming to minimize their costs. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how to avoid Private Mortgage Insurance (PMI) is not just a financial strategy; it’s a crucial step for homebuyers who want to manage their commitments effectively. By exploring various approaches—like making a larger down payment, utilizing piggyback loans, or seeking lender-paid mortgage insurance—you can significantly reduce or even eliminate the costs associated with PMI. These methods not only make monthly payments more affordable but also lead to long-term savings that can greatly impact your overall financial health.

As we discuss the financial implications of PMI, it’s important to recognize its effect on monthly payments and total loan costs over time. Evaluating options such as refinancing and negotiating with lenders empowers you to make informed decisions. Additionally, using tools like mortgage calculators and consulting with loan advisors can streamline the process of avoiding PMI, ensuring you feel equipped to navigate your home financing journey.

Ultimately, the significance of understanding and implementing strategies to avoid PMI cannot be overstated. By taking proactive measures, you can save thousands throughout the life of your loan and achieve your homeownership goals with greater financial confidence. As the housing market continues to evolve, staying informed about PMI and its alternatives will remain crucial for anyone looking to make a wise investment in their future. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is insurance that protects lenders in case a borrower defaults on a loan, particularly when the borrower is unable to provide a down payment of at least 20% of the home’s purchase price.

How does PMI affect monthly loan payments?

PMI can significantly impact monthly loan payments, typically ranging from 0.2% to 2% of the total amount borrowed each year. For example, on a $300,000 loan, PMI costs could vary between $90 and $375 each month, depending on the specific rate applied.

Are PMI rates expected to change in the future?

Looking ahead to 2025, average PMI rates are expected to remain within the current range of 0.2% to 2%, reflecting the prevailing market conditions.

How can homeowners avoid PMI?

Homeowners can avoid PMI by increasing their initial down payment to 20% or more, achieving sufficient equity in their property to qualify for PMI removal, or utilizing cash-in refinance loans to improve their loan-to-value ratio.

What is the significance of equity in relation to PMI?

Equity is significant because homeowners with sufficient equity may qualify for PMI removal. For instance, a homeowner with a mortgage balance of $300,000 and a property value of $400,000 who has achieved 25% equity could save between $150 to $250 each month by removing PMI.

How does PMI protect lenders?

PMI protects lenders by addressing the risks associated with smaller initial contributions. If a borrower defaults, the lender can recover some of their losses through the PMI policy.

What are cash-in refinance loans, and how do they relate to PMI?

Cash-in refinance loans allow homeowners to refinance their mortgage while reducing part of the principal. This can improve their loan-to-value ratio, potentially leading to lower interest rates and reduced monthly payments, which may help them avoid PMI.

Can you provide an example of how PMI impacts homebuyers?

For example, a family purchasing a home for $400,000 with a 10% down payment would incur PMI costs that could amount to thousands of dollars over the life of the loan, highlighting the financial implications of PMI for homebuyers.