Overview

The Loan-to-Value (LTV) ratio in real estate is a vital financial metric that compares the amount of a mortgage to the appraised value of the property, expressed as a percentage.

We understand how challenging navigating the mortgage process can be, and recognizing the importance of LTV can help ease some of that burden.

A lower LTV often leads to better loan conditions, such as:

- Lower interest rates

- Reduced private mortgage insurance

This not only influences lender decisions but also impacts the costs you, as a borrower, may face.

By understanding LTV, you can make informed choices that support your family’s financial well-being.

Introduction

Understanding the intricacies of real estate financing can often feel like navigating a labyrinth. We know how challenging this can be, especially when it comes to crucial metrics such as the Loan-to-Value (LTV) ratio. This essential figure not only reflects the balance between the mortgage amount and the property’s appraised value but also serves as a pivotal indicator for both lenders and borrowers.

As property values fluctuate and lending conditions evolve, how can you effectively leverage LTV to make informed financial decisions? Delving into the definition, significance, and calculation of LTV reveals not just its role in securing favorable loan terms, but also the potential pitfalls of overlooking this vital metric in the home-buying process. We’re here to support you every step of the way as you navigate this important aspect of financing.

Define Loan-to-Value Ratio (LTV) in Real Estate

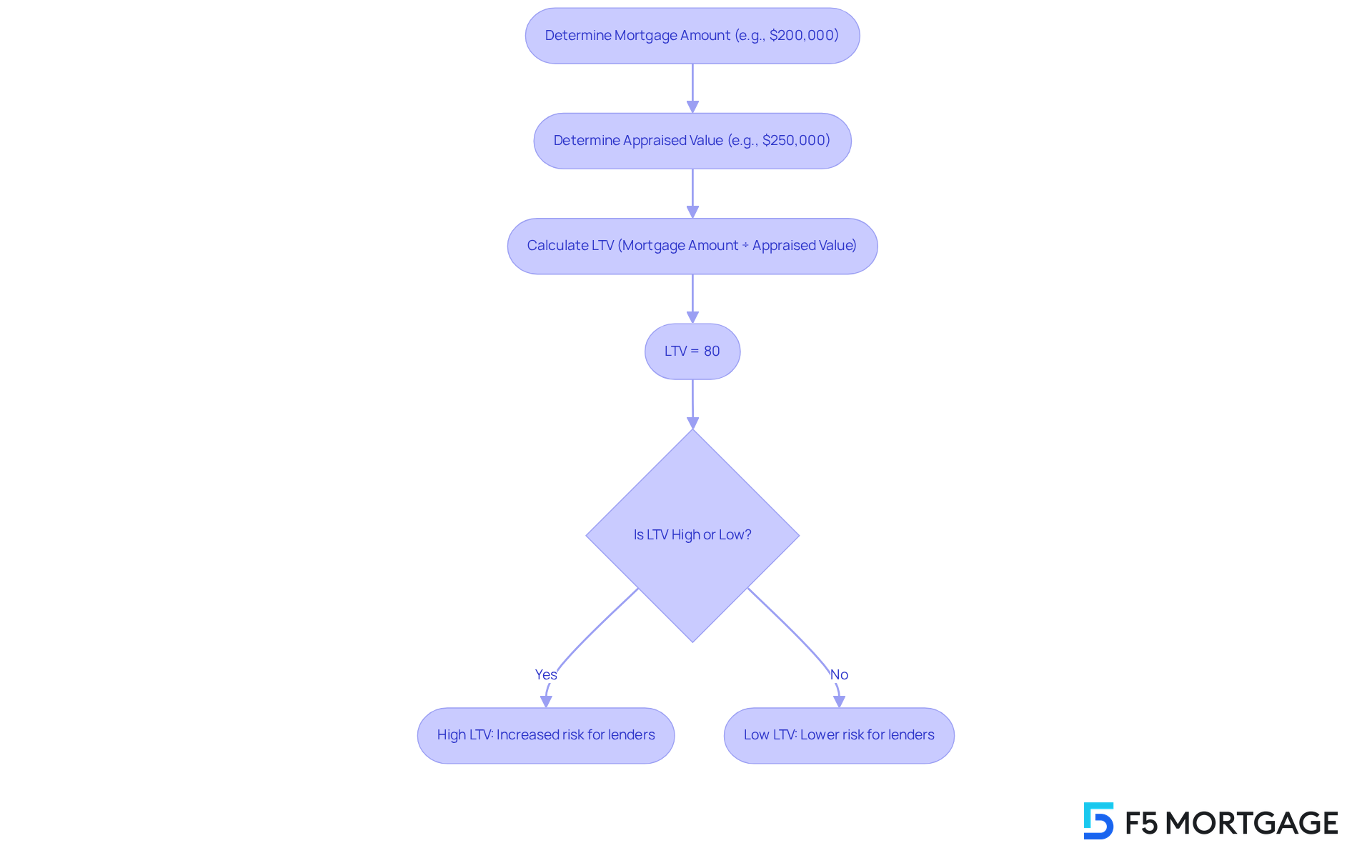

[What is LTV in real estate](https://f5mortgage.com/what-is-a-fixed-rate-mortgage-key-features-and-benefits-explained/)? It is a crucial financial metric that reflects the relationship between a mortgage amount and the appraised value of the property being acquired. We understand how overwhelming this process can be, so let’s break it down. To understand what is LTV in real estate, it is calculated by dividing the amount borrowed by the property’s appraised value, expressed as a percentage. For instance, if someone seeks financing of $200,000 for a property valued at $250,000, the LTV would be 80% (calculated as $200,000 ÷ $250,000).This ratio helps lenders understand what is LTV in real estate as a key indicator to assess risk. A higher what is LTV in real estate indicates that the borrower has less equity in the property, which can increase the lender’s risk exposure. In 2025, the baseline conforming mortgage limit for one-unit properties is set at $806,500, reflecting a 5.2% increase from the previous year. In high-cost areas, the ceiling borrowing limit for one-unit properties reaches $1,209,750, which is 150% of the baseline limit.

We know how important it is to make informed decisions when it comes to borrowing. Prudent borrowing habits involve knowing what is LTV in real estate to guide your choices about funding alternatives. For example, if you have $100,000 in home equity, you could borrow up to $80,000 at an 80% LTV and $90,000 at a 90% LTV. As Angelica Leicht wisely notes, ‘By making informed decisions, you can leverage your home equity effectively to enhance your financial well-being.’

Understanding the implications of rising home values is essential, as it can and overall financial strategy. We’re here to support you every step of the way, ensuring you feel empowered in your financial journey.

Explain the Importance of LTV in Mortgage Financing

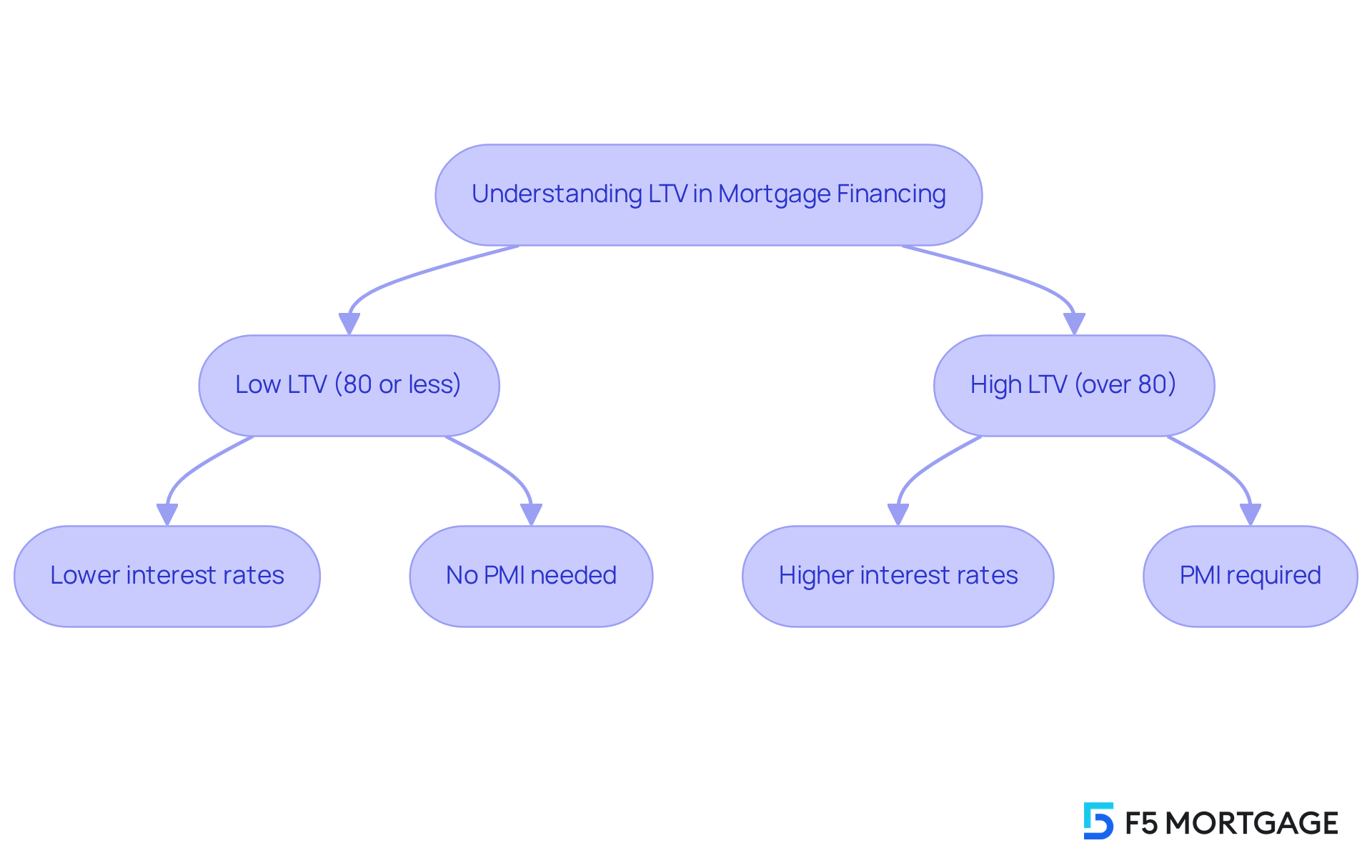

Understanding what is ltv in real estate is essential in mortgage financing, as it plays a crucial role in both lender decisions and borrower costs. We know how challenging this can be, and a often signifies reduced risk for lenders. This can lead to more favorable loan conditions, like lower interest rates and decreased private mortgage insurance (PMI) premiums. For example, maintaining an LTV of 80% or less can eliminate the need for PMI, which can significantly impact your monthly payments.

On the other hand, a higher LTV value typically results in increased interest rates due to the heightened risk perceived by lenders. Additionally, homebuyers with an LTV ratio exceeding 80% must pay PMI when seeking approval for a conventional mortgage. This makes it a significant cost factor for those obtaining loans.

Understanding what is ltv in real estate is vital for anyone seeking loans, as it directly influences financing choices and the total cost of a mortgage. For instance, if someone requests a $250,000 loan on a $300,000 home, the LTV would be calculated at 83.3%. This higher ratio may prompt lenders to adjust rates upward, reflecting the increased risk. Most lenders allow a maximum combined LTV of 85%, with some reaching up to 100%. Understanding these limits is essential when evaluating your options.

Recent updates in the mortgage market, such as Fannie Mae’s expansion of the Value Acceptance program, now enable appraisal waivers at LTVs up to 90%. This change simplifies the process for individuals and highlights the growing reliance on data-driven models for appraisals. As you explore these alternatives, you may find yourself requesting quicker, more efficient processes, which can reshape your mortgage financing experience. Remember, we’re here to support you every step of the way.

Detail How to Calculate LTV and Its Variations

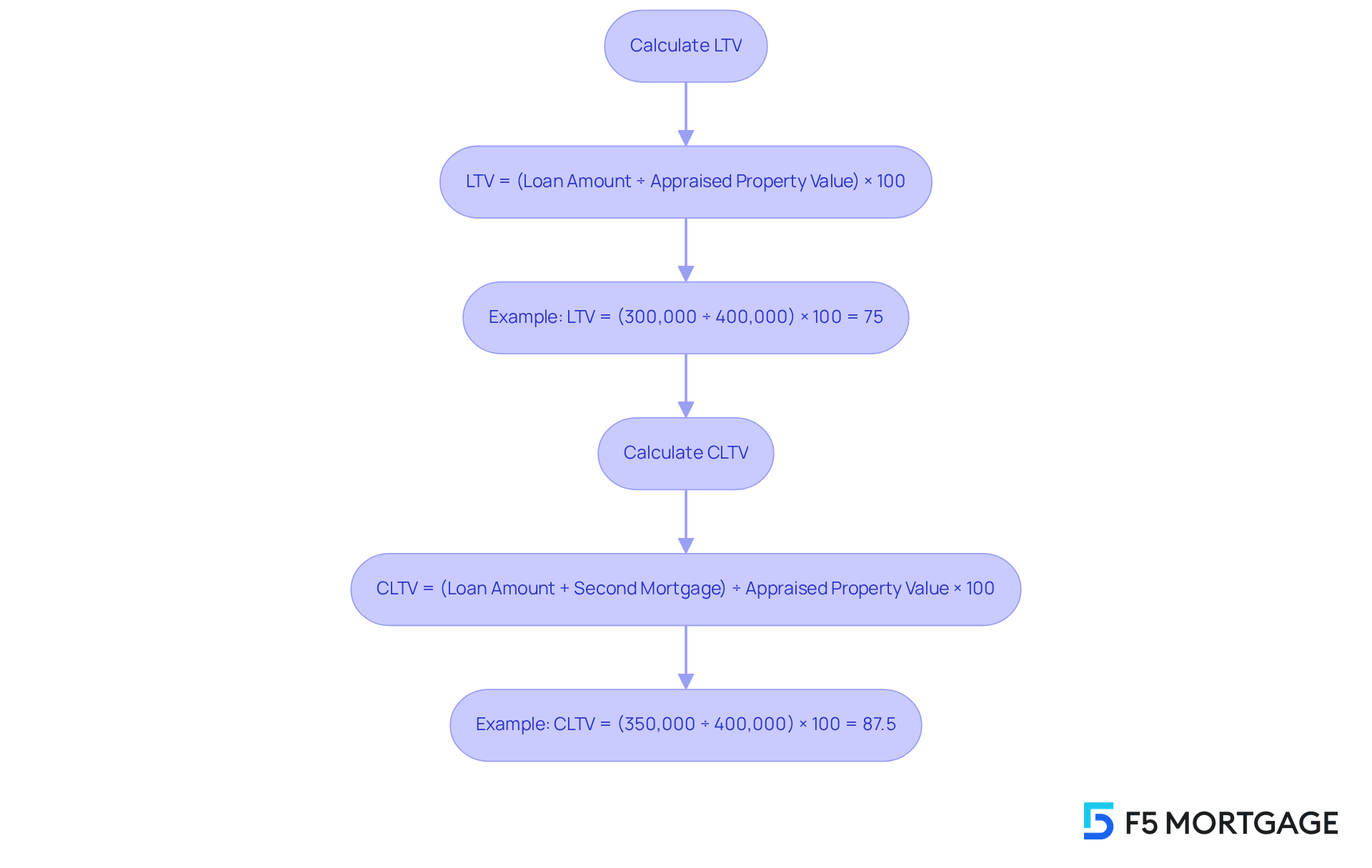

Understanding what is ltv in real estate can feel daunting, but calculating the Loan-to-Value (LTV) proportion is a straightforward process that we can help you with. The formula is simple:

LTV = (Loan Amount ÷ Appraised Property Value) × 100.

For instance, if you’re looking for a $300,000 mortgage on a home valued at $400,000, your LTV would be 75% (300,000 ÷ 400,000 × 100). Lenders generally prefer a lower LTV, and understanding what is LTV in real estate is important as it indicates more equity in your property. This can reduce the risk of default and potentially lead to lower interest rates, which is something we know many borrowers hope for.

In addition to LTV, it’s important to consider the Combined Loan-to-Value (CLTV) ratio, which helps you understand your total borrowing against a property. CLTV includes all debts secured by the property, such as second mortgages. For example, if you have a second mortgage of $50,000, your CLTV would be calculated as follows:

CLTV = (Loan Amount + Second Mortgage) ÷ Appraised Property Value × 100,

leading to a CLTV of 87.5% (350,000 ÷ 400,000 × 100).

Understanding what is ltv in real estate calculations is crucial for both you and your lender, as they significantly impact credit conditions and overall funding strategies. For example, VA and USDA mortgages allow for a 100% LTV level, which means qualified individuals can secure funding without a down payment. FHA mortgages, on the other hand, permit a maximum LTV of 96.5%. The recent increase in the baseline conforming loan limit values (CLLs) for 2025, now set at $806,500 for one-unit properties, highlights the necessity of knowing what is ltv in real estate in today’s market.

By understanding what is ltv in real estate along with CLTV metrics, you can navigate your mortgage options more effectively and secure favorable terms. Reducing your LTV ratio can also lead to lower interest rates and monthly payments, which is vital for enhancing your financial situation. We understand how challenging this can be, and knowing what is ltv in real estate can help empower you to secure better mortgage terms. Utilizing tools like can further assist you in making informed financial decisions, and remember, we’re here to support you every step of the way.

Conclusion

Understanding the Loan-to-Value (LTV) ratio is essential for anyone navigating the real estate financing landscape. We know how challenging this can be. This metric not only reflects the relationship between the mortgage amount and the property’s appraised value but also serves as a critical indicator of risk for lenders. A lower LTV typically leads to more favorable loan conditions, while a higher LTV can result in increased costs and stricter borrowing terms.

Throughout this article, we shared key insights about how LTV impacts mortgage financing. We discussed its role in determining interest rates and the necessity of private mortgage insurance (PMI) for higher ratios. The importance of calculating LTV and understanding its variations, such as Combined Loan-to-Value (CLTV), was emphasized. These figures can significantly influence your financial decisions and borrowing strategies.

Recent market updates, including changes in conforming loan limits and appraisal processes, illustrate the evolving nature of real estate financing. Staying informed is crucial, as it empowers you to adapt to these changes.

Ultimately, comprehending LTV in real estate is not just about numbers; it’s about empowering you to make informed decisions that can significantly affect your financial future. By leveraging this knowledge, you can navigate your mortgage options more effectively, potentially securing better terms and enhancing your overall financial well-being. Engaging with tools like mortgage calculators and keeping up with market trends can further aid in this journey, ensuring that each financial decision aligns with your personal goals and circumstances. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the Loan-to-Value Ratio (LTV) in real estate?

The Loan-to-Value Ratio (LTV) is a financial metric that reflects the relationship between the mortgage amount and the appraised value of the property being acquired. It is calculated by dividing the amount borrowed by the property’s appraised value, expressed as a percentage.

How is LTV calculated?

LTV is calculated by dividing the amount borrowed by the property’s appraised value. For example, if someone seeks financing of $200,000 for a property valued at $250,000, the LTV would be 80% (calculated as $200,000 ÷ $250,000).

Why is LTV important for lenders?

LTV is important for lenders as it serves as a key indicator to assess risk. A higher LTV indicates that the borrower has less equity in the property, which can increase the lender’s risk exposure.

What are the conforming mortgage limits for 2025?

In 2025, the baseline conforming mortgage limit for one-unit properties is set at $806,500, reflecting a 5.2% increase from the previous year. In high-cost areas, the ceiling borrowing limit for one-unit properties reaches $1,209,750, which is 150% of the baseline limit.

How can understanding LTV guide borrowing decisions?

Understanding LTV can guide borrowing decisions by helping individuals assess their funding alternatives. For example, with $100,000 in home equity, one could borrow up to $80,000 at an 80% LTV and $90,000 at a 90% LTV.

What is the significance of rising home values in relation to LTV?

Rising home values can impact borrowing limits and overall financial strategy, making it essential to understand LTV to make informed decisions about leveraging home equity effectively.