Overview

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency, which currently stands at $806,500 for most areas and can reach up to $1,209,750 in high-cost regions. We understand how challenging navigating these financial waters can be, especially when considering upscale properties.

These loans play a crucial role in financing homes that may be beyond the reach of standard mortgages. However, it’s important to know that jumbo loans are not backed by Fannie Mae or Freddie Mac. This means that they come with stricter qualification requirements and potentially higher interest rates. These factors reflect the increased risks that lenders take on, and we’re here to support you every step of the way as you explore your options.

If you’re considering a jumbo loan, take the time to evaluate your financial situation and understand the implications. Remember, we’re here to help you navigate this process with care and compassion.

Introduction

Navigating the complex landscape of real estate financing can be daunting, especially when it comes to understanding jumbo loans. These specialized mortgages exceed the conforming limits set by the Federal Housing Finance Agency, allowing for larger property investments. This is particularly beneficial in high-cost markets where traditional loans may not suffice. However, we know how challenging this can be. The allure of jumbo loans is accompanied by stringent qualifications and potential risks that might leave you wondering: are they truly worth the investment?

In this article, we will explore the key features and significance of jumbo loans. Our goal is to equip you with the knowledge needed to make informed financial decisions in today’s competitive housing market. We’re here to support you every step of the way as you consider your options.

Define Jumbo Loan: Key Characteristics and Thresholds

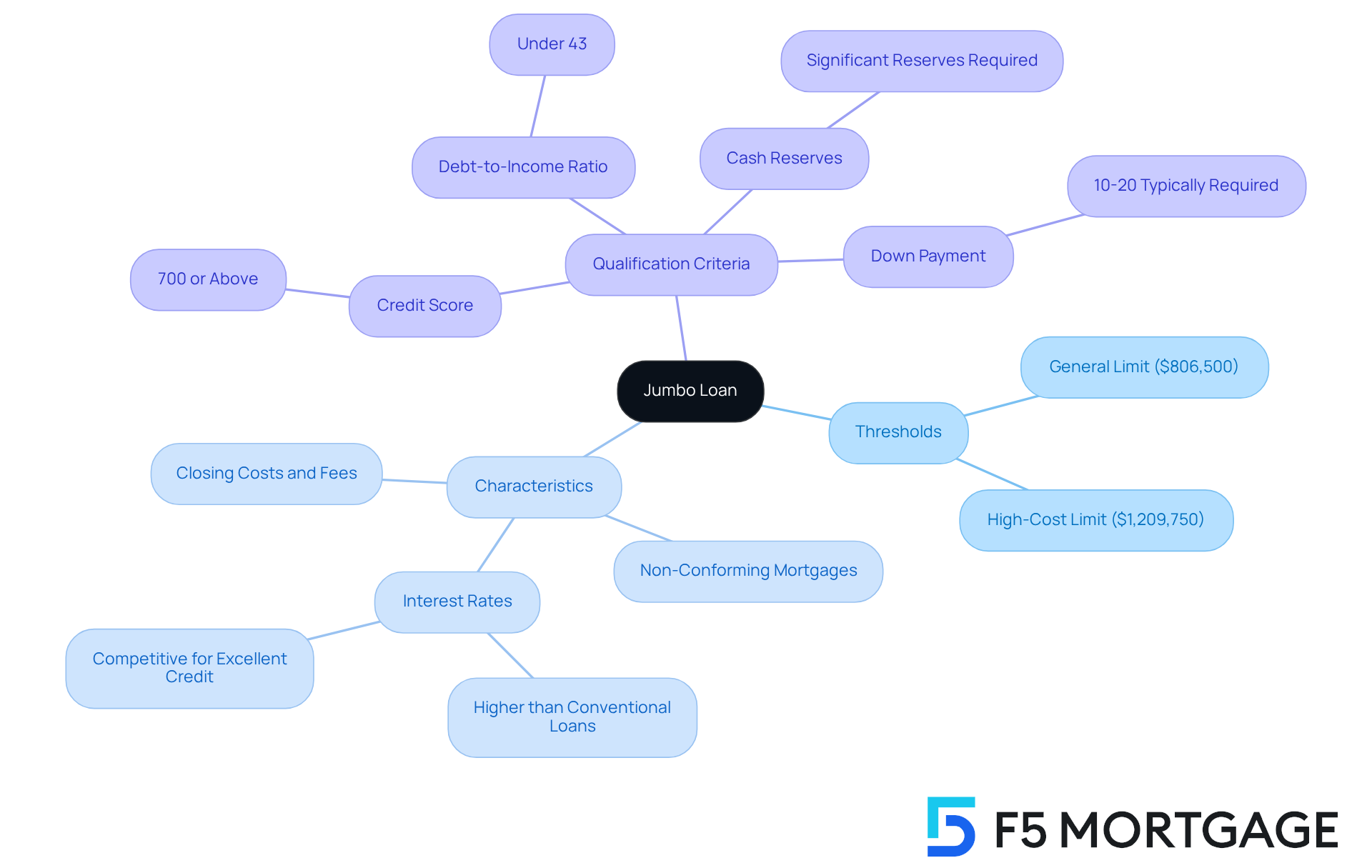

Navigating the world of mortgages can be daunting, especially when it comes to understanding [what is considered a jumbo loan](https://f5mortgage.com/what-is-a-jumbo-loan-in-california). These financial products exceed the conforming thresholds set by the Federal Housing Finance Agency (FHFA), which for 2025, is $806,500 for most areas in the United States. In high-cost regions, this limit can reach as much as $1,209,750. We understand how challenging it can be to grasp these figures, but knowing them is a crucial first step.

Unlike traditional financing options, cannot be bought, guaranteed, or securitized by Fannie Mae or Freddie Mac. This classification as non-conforming mortgages significantly affects the interest rates, terms, and qualification criteria. It’s essential to be aware of these differences as they can impact your financial journey.

Typically, large mortgages are what is considered a jumbo loan, which are used to finance upscale residences or properties in competitive markets where prices exceed traditional thresholds. If you’re considering this path, it’s important to understand what is considered a jumbo loan and the stringent criteria associated with jumbo financing. Generally, a high credit score of 700 or above, a low debt-to-income ratio under 43%, and substantial cash reserves are required. This may seem overwhelming, but it’s designed to ensure that high-income earners can invest confidently in premium real estate.

We’re here to support you every step of the way as you explore your options. Understanding these requirements can empower you to make informed decisions about your future home. Remember, you’re not alone in this process, and with the right guidance, you can find the mortgage solution that best fits your needs.

Context and Importance of Jumbo Loans in Mortgage Financing

In today’s financing landscape, where families navigate high-cost regions with soaring housing prices, it is important to understand what is considered a jumbo loan. As we look ahead to 2025, the baseline conforming mortgage threshold for one-unit properties is set at $806,500, with ceilings in high-cost areas reaching as much as $1,209,750. This creates a significant challenge for many homebuyers who need financing beyond what is considered a jumbo loan. Jumbo mortgages provide a solution by empowering buyers to understand what is considered a jumbo loan and secure larger amounts of financing without the restrictions typically associated with conforming mortgages.

The availability of these larger financing options not only supports personal property purchases but also invigorates the high-end real estate market. Wealthy buyers seeking benefit greatly from jumbo mortgages, allowing them to invest in properties that may have previously seemed financially unattainable. In fact, a substantial number of homebuyers in expensive regions are utilizing jumbo mortgages, highlighting what is considered a jumbo loan and their growing importance in the current market.

Moreover, the flexibility and increased thresholds associated with jumbo mortgages make them an essential choice for investors looking to seize premium real estate opportunities. By facilitating access to larger funding amounts, these mortgages significantly influence the luxury real estate sector, driving demand and shaping property values in these sought-after areas. We understand how challenging this can be, and we’re here to support you every step of the way as you explore your financing options.

Requirements for Securing a Jumbo Loan: Qualifications and Documentation

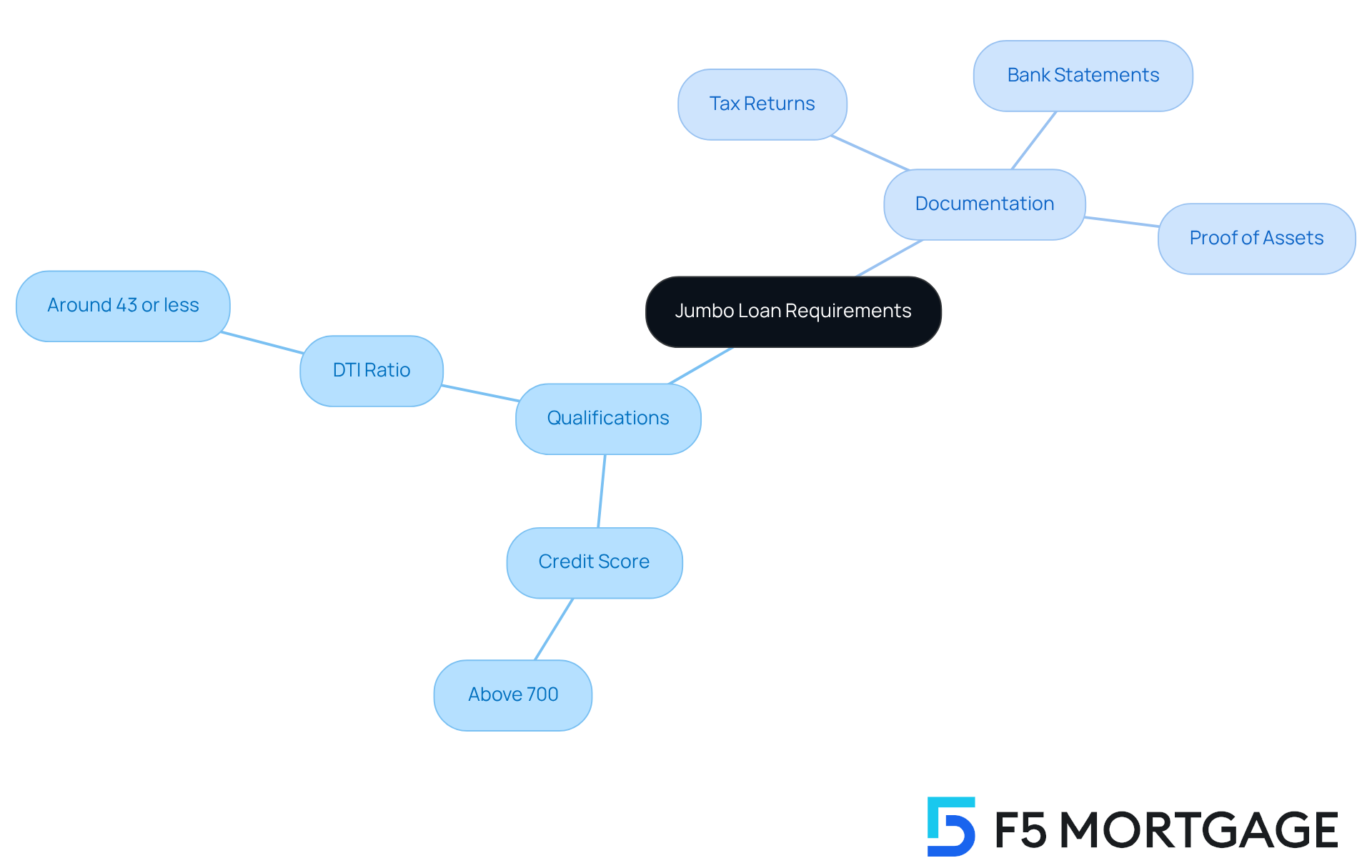

Obtaining large-scale financing can feel daunting, and it’s important to understand that it requires more rigorous criteria than standard mortgages. We know how challenging this can be, and typically, borrowers are expected to have a credit score above 700 and maintain a debt-to-income (DTI) ratio of around 43% or less. In 2025, the average DTI for large-scale borrowing reflects these standards, highlighting the significance of financial stability in the approval process.

Furthermore, lenders often require a considerable down payment, usually ranging from 20% to 30% of the purchase cost. This requirement can greatly influence the of the financing, which is a crucial factor for many families.

The documentation criteria for large-scale financing are also more extensive. Borrowers must provide detailed financial information, including:

- Tax returns

- Bank statements

- Proof of assets

This comprehensive vetting procedure is essential to mitigate the increased risks associated with larger sums, ensuring that borrowers are well-prepared to handle their mortgage payments.

For instance, borrowers with excellent credit ratings have successfully obtained large-scale financing, illustrating that a robust financial profile can ease access to these bigger funding alternatives. Comprehending what is considered a jumbo loan is vital for anyone contemplating a jumbo mortgage, as it prepares them for the demanding application process. Remember, we’re here to support you every step of the way.

Pros and Cons of Jumbo Loans: Weighing the Benefits and Risks

Jumbo financing offers a unique opportunity for homebuyers looking to fund higher-cost real estate. It comes with several benefits, such as the potential for lower interest rates compared to multiple smaller loans. This flexibility makes it an appealing choice for those interested in purchasing luxury homes or investment properties. However, it’s important to recognize the associated risks. Large mortgages typically carry higher interest rates than standard loans, and in 2025, average rates for these large mortgages are expected to be significantly above those for standard ones, reflecting the increased risk that lenders face.

Additionally, since jumbo loans are not backed by government-sponsored entities, lenders often impose stricter conditions, making the borrowing process more complex. We know how challenging this can be, and it’s essential to approach these decisions with care. Specialists emphasize that while jumbo loans can help in acquiring desirable properties, borrowers must thoughtfully assess their financial situations and future goals. For example, a couple aiming to purchase a luxury home encountered hurdles due to their unique financial circumstances, including varied income sources. They successfully navigated these challenges by collaborating with a financial institution willing to accommodate their needs. This illustrates that with thorough research and open communication, borrowers can mitigate potential risks associated with large-scale financing.

Moreover, it’s vital to consider the legal implications of specific property clauses, such as overage clauses, which can complicate lending and impact the strength of lending security. Exploring unconventional lenders might also provide more flexible terms, further assisting borrowers in managing the complexities of jumbo financing. Ultimately, is crucial for making informed decisions about what is considered a jumbo loan. Remember, we’re here to support you every step of the way.

Conclusion

Understanding what constitutes a jumbo loan is essential for anyone navigating the complex world of real estate financing. These loans exceed the conforming limits set by the Federal Housing Finance Agency and play a critical role in enabling homebuyers to secure larger amounts of financing, especially in high-cost markets. By recognizing the unique characteristics and requirements of jumbo loans, potential borrowers can make informed decisions that align with their financial goals.

Throughout this article, we’ve discussed key insights, including the specific thresholds for jumbo loans in 2025, the stringent qualifications needed to secure such financing, and the pros and cons associated with these larger mortgages. It’s important to maintain a strong credit profile and understand the documentation required, as these factors significantly influence the approval process. Moreover, the impact of jumbo loans on the luxury real estate market and overall housing trends highlights their growing significance in today’s economic landscape.

In light of these insights, we know how challenging this can be for prospective homebuyers and investors. Approaching jumbo loans with a well-informed perspective is crucial. By weighing the benefits against the inherent risks and understanding the market dynamics, individuals can navigate their financing options more effectively. The journey to securing a jumbo loan may be complex, but with the right knowledge and support, it offers a pathway to achieving homeownership in desirable locations. We’re here to support you every step of the way.

Frequently Asked Questions

What is a jumbo loan?

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). For 2025, the limit is $806,500 for most areas in the United States, and can reach up to $1,209,750 in high-cost regions.

How do jumbo loans differ from traditional mortgages?

Unlike traditional mortgages, jumbo loans cannot be bought, guaranteed, or securitized by Fannie Mae or Freddie Mac. This classification as non-conforming mortgages affects their interest rates, terms, and qualification criteria.

What are the typical uses for jumbo loans?

Jumbo loans are typically used to finance upscale residences or properties in competitive markets where prices exceed traditional thresholds.

What are the qualification criteria for obtaining a jumbo loan?

To qualify for a jumbo loan, borrowers generally need a high credit score of 700 or above, a low debt-to-income ratio under 43%, and substantial cash reserves.

Why are the requirements for jumbo loans considered stringent?

The stringent requirements are designed to ensure that high-income earners can invest confidently in premium real estate, minimizing the risk for lenders.